Professional Documents

Culture Documents

Co-Operative Accounting Assignment and Case Analysis

Uploaded by

Titus ClementOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Co-Operative Accounting Assignment and Case Analysis

Uploaded by

Titus ClementCopyright:

Available Formats

Course Code: CO 1661.

2

Title: Co-operative Accounting

Assignment Code: CO. 1661.2/SDE-C/2019-20

Assignment Coverage: All Modules

Maximum Marks: 10

Attempt any 5 questions, each in 2-3 pages (2 marks each)

1. Explain the meaning, features and procedure of co-operative accounting.

2. Explain the various types of the books and registers kept by co-operative societies.

3. Discuss the various sources of owned and borrowed funds of co-operative societies.

4. Explain the provisions of the Act relating to state aid to co-operatives.

5. Discuss the powers, duties and responsibilities of co-operative auditors.

6. Explain the features, significance and method of preparation of the balance sheet of a

co-operative society and draft the specimen form of the co-operative balance sheet.

7. From the following details prepare the Receipts and disbursement statement of a Milk

Marketing Co-operative society for the year ended 31st March, 2020.

Receipt: Rs. Payments: Rs.

Share capital (members) 525000 Loan to member 411000

Sales of Branch 425000 Share capital 12560

Loan repayment by 235000 Sales tax 59000

members

Sale of Cattle feed 35000 Office rent 3800

Bank withdrawals 123000 Transportation charge 8400

Interest on loan 48500 Electricity charges 8400

Staff security deposit 11300 Contingency expense 12000

Miscellaneous receipt 6300 Postage 325

Member’s deposit 4320 Rent of yard 7600

Interest on fixed deposit 4320 Advance payment 11800

Milk supplies account 132500 Stationery 350

Manure sales 4250 Milk supplies account 65800

Furniture purchased 22500

Opening Balance 38600

Course Code: CO 1661.2

Title: Co-operative Accounting

Case Analysis Code: CO. 1661.2/SDE-C/2019-20

Case Analysis Coverage: All Modules

Maximum Marks: 10

Attempt any two cases

1. Assume that you are the auditor of a credit cooperative society in Kerala. You have

completed your work and now you are ready for awarding audit classification, according to

the Act and Rules. Explain the procedure that you will adopt for audit classification with

special reference to the tests that you will apply for audit classification and the principles to

be followed in this connection. Prepare a statement showing audit classification of credit co-

operative societies in Kerala.

2. “Earning of profit is not the basic objective of a cooperative society. But this does not

simply that cooperatives are run on no profit or no loss basis. It is the mode of disposal of

surplus, that imparts a peculiar status to the cooperatives in comparison to other forms of

business organization. The cooperatives dispose off their surplus as per the cooperative

societies Act Rules and bye laws”. Critically analyze the above statements and state the

relevant Section of the Cooperative Societies Act which deals with the disposal of surplus and

explain the manner in which surplus is to be distributed.

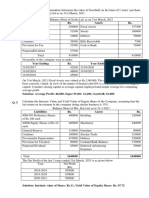

3. From the information given below prepare final accounts of an Agricultural Credit

Society for the year ending 31st March 2020.

Balance Sheet as on 31.3.2019

Liabilities Amount Assets Amount

Share capital 275500 Cash in hand 9500

Deposits 140000 Cash at Bank 58000

Borrowing from DCB 410000 Loan to members 610000

Reserve Fund Invested 54000 Shares in DCB 55000

Reserve Fund Un invested 20000 Advance due to 115000

Common Good Fund 6000 Interest accrued 55000

Establishment 10000 Interest on over dues 24500

Advance due by 40000 Reserve fund invested 54000

Interest payable 30000 Miscellaneous income 4000

Reserve for over due interest 24500 Furniture 30000

Reserve for bad debt 10000 Land & Building 50000

Undistributed profit 10000

Net Profit 35000

Total 1065000 Total 1065000

Receipts and Disbursement Account for the year ended 31st March 2020

Receipts Amount Payments Amount

To Share capital 20000 By Share capital 5000

Deposits 60000 Deposits 10000

Borrowings from DCB 600000 Borrowings from DCB 615000

Repayment by members 549000 Loan to members 600000

Advance due by 100000 Advance due by 110000

Advance due to 150000 Advance due to 50000

Miscellaneous income 64500 Interest on over dues 45000

Interest on loan 100000 Furniture 2000

Bank withdrawals 950000 Establishment 80000

Opening cash 9500 Investment in bank 1050000

Cash in hand (closing) 36000

Total 2603000 Total 2603000

The following adjustments are to be made:

1.Depreciate furniture at 10%.

2.Interest payable on borrowings as on 31/03/2020 is Rs.20,000.

3.Overdue interest on the previous year were realized in the current year.

4.Interest on overdue on 31/03/2020 is Rs.15,000

You might also like

- 7 - Co-Operative AccountingDocument4 pages7 - Co-Operative AccountingGaurav Chandrakant100% (1)

- Baf Sem Vi Sample Multiple Choice QuestionsDocument26 pagesBaf Sem Vi Sample Multiple Choice Questionsharesh100% (1)

- Chapter 3 Ethiopian Govt AcctingDocument19 pagesChapter 3 Ethiopian Govt AcctingwubeNo ratings yet

- MCQ Co-Operative Final AccountDocument12 pagesMCQ Co-Operative Final AccountAdi100% (1)

- Loan Conditions 23-02-04Document96 pagesLoan Conditions 23-02-04strength, courage, and wisdom100% (1)

- Associate Co. QuestionsDocument3 pagesAssociate Co. QuestionsSigei Leonard100% (2)

- Assume XYZ Company Is A Merchandising Business and Registered For VAT WhichDocument6 pagesAssume XYZ Company Is A Merchandising Business and Registered For VAT WhichKen LatiNo ratings yet

- Elias ResearchDocument56 pagesElias Researchtamrat lisanwork100% (2)

- Valuation of Goodwill and SharesDocument15 pagesValuation of Goodwill and SharesJuhi PunmiyaNo ratings yet

- Monthly Reports: Figure 1.1: Revenue/Assistance/Loan Report Me/He 21Document13 pagesMonthly Reports: Figure 1.1: Revenue/Assistance/Loan Report Me/He 21GedionNo ratings yet

- Stephen Das A 4022183 Research Proposal-IfRSDocument25 pagesStephen Das A 4022183 Research Proposal-IfRSStephen Das100% (1)

- File 3Document77 pagesFile 3Othow Cham AballaNo ratings yet

- Solved Problems: OlutionDocument5 pagesSolved Problems: OlutionSavoir PenNo ratings yet

- Worksheet For Mathematics For ManagementDocument3 pagesWorksheet For Mathematics For Managementabel shimeles100% (1)

- Consignment and Joint Venture Question and SolutionDocument4 pagesConsignment and Joint Venture Question and SolutionAnonymous duzV27Mx3100% (1)

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- Domestic Tax Electronic Payment Instruction Penality TaxDocument1 pageDomestic Tax Electronic Payment Instruction Penality TaxRad Biomedical Engineering PLCNo ratings yet

- Internship Summary Report Week1Document2 pagesInternship Summary Report Week1Ayalkibet AbrihamNo ratings yet

- Introduction 3Document24 pagesIntroduction 3Zinashbizu LemmaNo ratings yet

- Tax Accounting AssignmentDocument10 pagesTax Accounting Assignmentsamuel debebeNo ratings yet

- Unit 4Document21 pagesUnit 4Yonas0% (1)

- ACFN 631 Self - Test Question No 1Document3 pagesACFN 631 Self - Test Question No 1Esubalew Ginbar100% (2)

- Investment Incentives in EthiopiaDocument2 pagesInvestment Incentives in EthiopiaErmias SimeNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- New Road Map Accounting and Finance CurricullumDocument166 pagesNew Road Map Accounting and Finance CurricullumAbdulakim Zenu100% (2)

- Final EXIT 2015Document110 pagesFinal EXIT 2015naolmeseret22No ratings yet

- HRM AssignmentDocument21 pagesHRM AssignmenttotiNo ratings yet

- 3chapter Three FM ExtDocument19 pages3chapter Three FM ExtTIZITAW MASRESHANo ratings yet

- Unit 4: Capital Project FundsDocument20 pagesUnit 4: Capital Project FundsMuktar jiboNo ratings yet

- Acc AssignmentDocument2 pagesAcc Assignmentwossen gebremariam0% (1)

- Accounting Assignment (100) : A. B. C. The Journal EntryDocument2 pagesAccounting Assignment (100) : A. B. C. The Journal EntryFaiaz ShahreearNo ratings yet

- AnswerDocument8 pagesAnswerMelese AyenNo ratings yet

- Financial Accounting and Accounting Standards: Intermediate Accounting, 12th Edition Kieso, Weygandt, and WarfieldDocument31 pagesFinancial Accounting and Accounting Standards: Intermediate Accounting, 12th Edition Kieso, Weygandt, and WarfieldKarunia Utami100% (1)

- Micro Economics AssignmentDocument9 pagesMicro Economics AssignmentYosef MitikuNo ratings yet

- Capital BudgetingDocument26 pagesCapital BudgetingAshenafi AbdurkadirNo ratings yet

- Awash Bank Exam Question and Entrance TestDocument17 pagesAwash Bank Exam Question and Entrance TestAderajew Dagim GonderewNo ratings yet

- Rift Valley University Bole Special Campus Department of Business ManagementDocument76 pagesRift Valley University Bole Special Campus Department of Business ManagementSusniose FikremariamNo ratings yet

- Profits and Gains From Business and ProfessionDocument4 pagesProfits and Gains From Business and ProfessionAyaan AhmedNo ratings yet

- Dire Dawa University: College of Business and Economic Department of ManagementDocument20 pagesDire Dawa University: College of Business and Economic Department of ManagementEng-Mukhtaar CatooshNo ratings yet

- Nse Fact Book 2015Document90 pagesNse Fact Book 2015computer30No ratings yet

- Group 5 ProposalDocument26 pagesGroup 5 ProposalSelamawit Ephrem0% (1)

- Unit 10 SECP (Complete)Document21 pagesUnit 10 SECP (Complete)Zaheer Ahmed SwatiNo ratings yet

- AcFn 1031 Chapter 3-1Document16 pagesAcFn 1031 Chapter 3-1bro50% (2)

- Auditing and Assurance Services - Past Exam QuestionsDocument5 pagesAuditing and Assurance Services - Past Exam QuestionsHelena Thomas0% (1)

- Ias 20 - Gov't GrantDocument19 pagesIas 20 - Gov't GrantGail Bermudez100% (1)

- Examples & Practice Questions For Income From PropertyDocument8 pagesExamples & Practice Questions For Income From PropertyAbdulAzeemNo ratings yet

- Meaning of Branch AccountingDocument10 pagesMeaning of Branch Accountingabubeker abduNo ratings yet

- Aisha Zuber Final ResearchDocument48 pagesAisha Zuber Final ResearchAmaril MogaNo ratings yet

- Ethiopia D3S4 Income TaxesDocument19 pagesEthiopia D3S4 Income TaxesEshetie Mekonene AmareNo ratings yet

- AssignmentDocument11 pagesAssignmentLaury Phillips100% (1)

- Ethiopian Code of Ethics For Professional Accountants PDFDocument67 pagesEthiopian Code of Ethics For Professional Accountants PDFjoooking100% (1)

- Asfaw AberaDocument90 pagesAsfaw Aberaanteneh mekonen100% (1)

- Acc ch-4 Lecture NoteDocument18 pagesAcc ch-4 Lecture NoteBlen tesfayeNo ratings yet

- Project Analysis (Acct 422)Document193 pagesProject Analysis (Acct 422)cosmic cowboyNo ratings yet

- Valuation of BusinessDocument2 pagesValuation of BusinessLAKHAN TRIVEDINo ratings yet

- Model Question PaperDocument3 pagesModel Question Paperi.am.dheeraj8463No ratings yet

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocument3 pagesInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNo ratings yet

- Final Ac P2Document5 pagesFinal Ac P2SudeepNo ratings yet

- Accounts ProblemsDocument30 pagesAccounts ProblemsBalasaranyasiddhuNo ratings yet

- Tax Planning and Compliance for Tax-Exempt Organizations: Rules, Checklists, ProceduresFrom EverandTax Planning and Compliance for Tax-Exempt Organizations: Rules, Checklists, ProceduresNo ratings yet

- Set 1 QP Business StatisticsDocument2 pagesSet 1 QP Business StatisticsTitus ClementNo ratings yet

- 3 Organs of The StateDocument1 page3 Organs of The StateTitus ClementNo ratings yet

- 5 Project Finance Set 1Document7 pages5 Project Finance Set 1Titus ClementNo ratings yet

- Web 2Document2 pagesWeb 2Titus ClementNo ratings yet

- MARKETING MANAGEMENT Qn. PaperDocument2 pagesMARKETING MANAGEMENT Qn. PaperTitus ClementNo ratings yet

- DIGITAL MARKETING SyllabusDocument3 pagesDIGITAL MARKETING SyllabusTitus ClementNo ratings yet

- 4 OjjectivesDocument2 pages4 OjjectivesTitus ClementNo ratings yet

- HRM Short NotesDocument5 pagesHRM Short NotesTitus ClementNo ratings yet

- 3 SignificanceImportance of HRMDocument2 pages3 SignificanceImportance of HRMTitus ClementNo ratings yet

- Collective Bargainning Definition of Collective BargainingDocument11 pagesCollective Bargainning Definition of Collective BargainingTitus ClementNo ratings yet

- Accounting For Specialized InstituitionsDocument4 pagesAccounting For Specialized InstituitionsTitus Clement100% (1)

- Difference Between Personnel Management (PM) and Human Resource ManagementDocument2 pagesDifference Between Personnel Management (PM) and Human Resource ManagementTitus ClementNo ratings yet

- Role of HRM in The Emerging Economic ScenarioDocument2 pagesRole of HRM in The Emerging Economic ScenarioTitus Clement100% (1)

- Difference Between Personnel Management (PM) and Human Resource ManagementDocument2 pagesDifference Between Personnel Management (PM) and Human Resource ManagementTitus ClementNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Synergy and DysergyDocument2 pagesSynergy and DysergyTitus ClementNo ratings yet

- Strategic Choice: 1. Identification of Strategic AlternativesDocument4 pagesStrategic Choice: 1. Identification of Strategic AlternativesTitus Clement100% (2)

- Approaches To SHRMDocument3 pagesApproaches To SHRMTitus Clement100% (1)

- Competitive Advantage Core Competence & RBVDocument2 pagesCompetitive Advantage Core Competence & RBVTitus ClementNo ratings yet

- Devil S AdvocateDocument1 pageDevil S AdvocateTitus ClementNo ratings yet

- Business QuizDocument6 pagesBusiness QuizTitus ClementNo ratings yet

- 7 Role of HRDocument1 page7 Role of HRTitus ClementNo ratings yet

- Collective Bargainning Definition of Collective BargainingDocument11 pagesCollective Bargainning Definition of Collective BargainingTitus ClementNo ratings yet

- Features of SHRMDocument1 pageFeatures of SHRMTitus ClementNo ratings yet

- Prima Facie Case of Misconduct ExistsDocument2 pagesPrima Facie Case of Misconduct ExistsTitus ClementNo ratings yet

- Accounting For Specialized Institution Set 2 Scheme of ValuationDocument19 pagesAccounting For Specialized Institution Set 2 Scheme of ValuationTitus Clement100% (1)

- Accounting For Specialized InstituitionsDocument4 pagesAccounting For Specialized InstituitionsTitus Clement100% (1)

- K.V.Vs College of Science and Technology, Kaithaparambhu: 1. Email AddressDocument16 pagesK.V.Vs College of Science and Technology, Kaithaparambhu: 1. Email AddressTitus ClementNo ratings yet

- Strategic Choice: 1. Identification of Strategic AlternativesDocument4 pagesStrategic Choice: 1. Identification of Strategic AlternativesTitus Clement100% (2)

- 4 OjjectivesDocument2 pages4 OjjectivesTitus ClementNo ratings yet