Professional Documents

Culture Documents

Part-A For Goods

Uploaded by

GROUPV AUDIT0 ratings0% found this document useful (0 votes)

42 views1 pageGST

Original Title

Part-A for Goods

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGST

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

42 views1 pagePart-A For Goods

Uploaded by

GROUPV AUDITGST

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

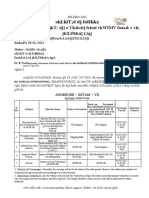

ANNEXURE – GSTAM - VII

GST AUDIT PLAN

Part-A for Goods

M/s. Loghorn Industries Private Limited

Note: As per DGARM report Flag score is 5 and the unit is flagged as G1 and J4 as

per Risk parameters

Sl. Subject Specific Issue Source Back-up Coverage Selection

No. Document Document Period Criteria

(Records/Registe

rs/Accounts

maintained U/S

35 CGST Act read

with rule 56 of

CGST Rules)

1. Classification Verification of Invoice/GST 1. R M For the All documents

(HSN) eligibility of returns Procurement months:

exemption. Register August,

September

Classification of 2. Sale register

and October,

goods 2017

Rate of tax for

the different

products

2. Valuation Value addition, GST Invoice 1. Commerci Entire Audit All invoice

related party al invoice period serial

transaction 2. General ledger numbers

3. Credit/ Debit

ending with 5.

notes

3. ITC Ratio of ITC to 1 Input invoices 1. Material Entire Audit All invoice

the total tax paid 2 Credit receipt note/ period

ITC availment availment register

and reversal register 2. Insurance claim

ITC on exempted

goods documents for

transit losses

3. Stores ledger

4. Filing of GST Whether returns GSTR-1, GSTR-3B GSTR-1, GSTR-3B , Entire Audit All returns

returns are filed in time , GSTR-9 and GSTR-9 and GSTR- period

GSTR-9C 9C

5. Verification of Reconciliation of GSTR-9C and P&L GSTR-9C and P&L Entire Audit GSTR-9C and

GSTR-9C with GSTR-9C and account account period P&L account

P&L account P&L account

Inspector Superintendent DD(Cost) AC ADC

(Sachin Chahal) (Sudhanshu Shekhar) (K.N.Hari Hara Prasad) (GVSR Sarma) (A.Shyam Sundar)

You might also like

- Annual Return - Salem BranchDocument23 pagesAnnual Return - Salem BranchSureshkumarNo ratings yet

- Audit Plan: Note # 1Document6 pagesAudit Plan: Note # 1Audit Circle IV BhavnagarNo ratings yet

- GST Annual Return and AuditDocument10 pagesGST Annual Return and AuditRachit ChhedaNo ratings yet

- GST Audit Checklist 1560016510Document2 pagesGST Audit Checklist 1560016510Ravina Rohira100% (1)

- GST Audit PowerpointDocument62 pagesGST Audit PowerpointBiswakesh PatiNo ratings yet

- Supply of Documents On PriorityDocument15 pagesSupply of Documents On PriorityManoj Kumar TanwarNo ratings yet

- 5 Audit PlanDocument2 pages5 Audit PlanTradingideas2456No ratings yet

- Latest Updation in GSTN PortalDocument47 pagesLatest Updation in GSTN PortalVenkat BalaNo ratings yet

- GST Audit Amendment Notes by Pankaj GargDocument12 pagesGST Audit Amendment Notes by Pankaj GargGopal Airan100% (2)

- To RSA - ERDB AOM 2019-06 (2018) Non-Submission of ReportsDocument5 pagesTo RSA - ERDB AOM 2019-06 (2018) Non-Submission of ReportsJean Monique Oabel-TolentinoNo ratings yet

- A. Ipi"L: Lnformal Tendering Quotation (Rfa)Document72 pagesA. Ipi"L: Lnformal Tendering Quotation (Rfa)Liberty MunyatiNo ratings yet

- CaroDocument10 pagesCaroAneek JainNo ratings yet

- Goods & Service Tax (OFI) White Paper On AccountingDocument9 pagesGoods & Service Tax (OFI) White Paper On AccountingRahul JainNo ratings yet

- ReturnsDocument12 pagesReturnsPriya DasNo ratings yet

- New Stock Statement FormatDocument7 pagesNew Stock Statement FormatdeexithNo ratings yet

- Tender - ICF - 02 08 2018Document4 pagesTender - ICF - 02 08 2018Sadashiva sahooNo ratings yet

- PERC SEC 17 Q 2nd Quarter Ended June 30 2020 Finalr2Document78 pagesPERC SEC 17 Q 2nd Quarter Ended June 30 2020 Finalr2redevils86No ratings yet

- Lesson Plan AccSept 2018Document4 pagesLesson Plan AccSept 2018Anissa E.No ratings yet

- Hindustan Unilever GST ReturnsDocument136 pagesHindustan Unilever GST Returnsyoyorikee0% (1)

- Return Formats (Sugam Return - FORM GST RET-3) (Quarterly) (Including Amendment)Document32 pagesReturn Formats (Sugam Return - FORM GST RET-3) (Quarterly) (Including Amendment)Puneet PrajapatiNo ratings yet

- 1ZVN926000-796 - RevA - SPT Revenue Record & Invoice IssuanceDocument7 pages1ZVN926000-796 - RevA - SPT Revenue Record & Invoice IssuanceNguyễn Thành TrungNo ratings yet

- Trash - CPDocument74 pagesTrash - CPgroup3 cgstauditNo ratings yet

- GSTV70P4 November 27 December 3 (PG 144) SamplechapterDocument2 pagesGSTV70P4 November 27 December 3 (PG 144) SamplechapterSatyakanth SunkaraNo ratings yet

- Annexure Viii Neon Cable - 26!04!2021Document12 pagesAnnexure Viii Neon Cable - 26!04!2021group3 cgstauditNo ratings yet

- Asset Purchase Request Form QF-790 Rev 10Document1 pageAsset Purchase Request Form QF-790 Rev 10ahmadtaiyabiNo ratings yet

- Second Hand Empty Gunny Bags Bid for 10000 PiecesDocument5 pagesSecond Hand Empty Gunny Bags Bid for 10000 PiecesRahul RawatNo ratings yet

- Return Formats (Sahaj Return - FORM GST RET-2) (Quarterly) (Including Amendment)Document30 pagesReturn Formats (Sahaj Return - FORM GST RET-2) (Quarterly) (Including Amendment)ch7utiyapa9No ratings yet

- 00 - Checklist - Past Audit Reports - TransmissionDocument4 pages00 - Checklist - Past Audit Reports - Transmissionpave.scgroupNo ratings yet

- Certification DraftDocument47 pagesCertification DraftndNo ratings yet

- Document 1Document2 pagesDocument 1gstceraslmNo ratings yet

- CA Vishal Poddar - GST Audit JalgaonDocument40 pagesCA Vishal Poddar - GST Audit JalgaonshahtaralsNo ratings yet

- Stock Statement Register-FSM-3Document4 pagesStock Statement Register-FSM-3Sanjay Khan0% (1)

- Complete GST Book PDFDocument351 pagesComplete GST Book PDFAGNIHOTRAM RAM NARAYANANo ratings yet

- GST Annual Return Filing DeadlineDocument61 pagesGST Annual Return Filing DeadlineRishav AnandNo ratings yet

- Accounting Ledgers and Entries in GST: CMA Bhogavalli Mallikarjuna GuptaDocument6 pagesAccounting Ledgers and Entries in GST: CMA Bhogavalli Mallikarjuna GuptaRohan KulkarniNo ratings yet

- Inspection 2020-21 CGST Audit RajkotDocument2 pagesInspection 2020-21 CGST Audit Rajkotgroup6 cgstauditNo ratings yet

- GR - IR Account ClearingDocument8 pagesGR - IR Account Clearingabhijeetp7No ratings yet

- APO_2023_0331_sec17q_1st_quarter_a-1Document47 pagesAPO_2023_0331_sec17q_1st_quarter_a-1Don Michaelangelo BesabellaNo ratings yet

- Circular CGST 131 NewDocument5 pagesCircular CGST 131 NewSanjeev BorgohainNo ratings yet

- Record Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Document16 pagesRecord Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Sha dowNo ratings yet

- Job Aid On How To Accomplish Bir Invty ReportDocument7 pagesJob Aid On How To Accomplish Bir Invty ReportKezza Marie LuengoNo ratings yet

- GST ASMT Form Dispute ReplyDocument2 pagesGST ASMT Form Dispute ReplyStock PsychologistNo ratings yet

- Project Chanakya Configuration Design Document Cin - Excise ModuleDocument6 pagesProject Chanakya Configuration Design Document Cin - Excise ModuleAkhilesh ShuklaNo ratings yet

- GST Returns and FormsDocument46 pagesGST Returns and FormsSachin KhapareNo ratings yet

- Basic Information Sr. No: Prepared by PH 9993035180Document14 pagesBasic Information Sr. No: Prepared by PH 9993035180zakir hussainNo ratings yet

- Chem Process-Skoda 03.06.2019Document9 pagesChem Process-Skoda 03.06.2019Mayank GandhiNo ratings yet

- GeM Bidding 3891560Document9 pagesGeM Bidding 3891560Tumbin DilseNo ratings yet

- Protective Cover TenderDocument5 pagesProtective Cover TenderAMM GSD JODHPURNo ratings yet

- Basics of Accounting in Simlified MannerDocument15 pagesBasics of Accounting in Simlified Mannerricky gargNo ratings yet

- Annexure Gstam-ViiiDocument17 pagesAnnexure Gstam-ViiiHarsh ManiNo ratings yet

- GeM Bidding 3970612Document9 pagesGeM Bidding 3970612KARMVIR KUMARNo ratings yet

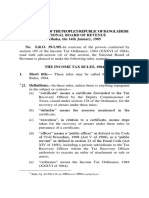

- Government of The People'S Republic of Bangladesh National Board of Revenue Dhaka, The 14th January, 1985Document253 pagesGovernment of The People'S Republic of Bangladesh National Board of Revenue Dhaka, The 14th January, 1985Pujan Shaci DuttaNo ratings yet

- GFR Forms for Financial RulesDocument48 pagesGFR Forms for Financial RulesPatrickNo ratings yet

- Draft ReportDocument11 pagesDraft Reportmohuyadas555No ratings yet

- AIIMS Mangalagiri Blood Gas Analyser CartridgesDocument6 pagesAIIMS Mangalagiri Blood Gas Analyser CartridgesVikas PatidarNo ratings yet

- GeM Bidding 3482736Document4 pagesGeM Bidding 3482736mogijo11dffdfgdfgNo ratings yet

- Guide de SAP 1697127495Document9 pagesGuide de SAP 1697127495facillenegoce.alaouiNo ratings yet

- Regulatory Compliance Report - Sample ReportDocument4 pagesRegulatory Compliance Report - Sample ReportNesley ComendadorNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet