Professional Documents

Culture Documents

Introduction of Transaction Failure Fees - Effective 1st April 2020 PDF

Uploaded by

Seema Joshi0 ratings0% found this document useful (0 votes)

15 views1 pageOriginal Title

Introduction of Transaction Failure Fees_effective 1st April 2020.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageIntroduction of Transaction Failure Fees - Effective 1st April 2020 PDF

Uploaded by

Seema JoshiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

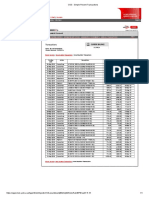

Axis Bank|Internal

IMPORTANT NOTICE FOR SAVINGS CUSTOMERS

Introduction of Fee on Negative behaviour with effect from 1st April 2020:

a) ATM Transaction failure charge – Extending charge to Axis Bank ATMs

It is now proposed to extend the charge to failure transactions performed at own ATMs as

well.

Fee Existing Proposed

On-us ATM cash withdrawal

transaction failure charges due Nil Rs 25/txn

to insufficient funds

b) Additional transaction failure fee for accounts not maintaining balance

Proposed for accounts not

Transaction Failure Type Existing maintaining desired

(In Rs per txn) balances*

(In Rs per txn)

NACH 500 650

SI 250 300

Inward Cheque/ECS 500 650

Outward Cheque 200 250

Auto debit 250 300

ATM 25 50

POS 25 50

* Accounts not maintaining balances in Month M-1 and M wherein the transaction incidence is in

month M will be eligible for the higher rate structure

c) Fair usage fees on branch transactions

It is proposed to introduce Fair usage fees for branch transactions which include branch

Cash, Outward clearing, Fund transfer, RTGS/NEFT & Remittances.

Fee Existing Proposed

15 txn free/month would be permitted

and charge of Rs 75/txn would be

Fair Usage Fees Nil levied 16th transaction onwards.

This is over and above the existing fee

structure.

d) Free limit rationalization on Cheque book facility for Easy and equivalent schemes

It is proposed to rationalise the cheque book rate structure in line with market practice

as under

Fee Existing Proposed

One multicity Cheque Book One multicity Cheque Book

per quarter (20 leaves). Rs. 60 per year (20 leaves). Rs. 100

Cheque Book

per chequebook (20 leaves). per chequebook (20 leaves).

Per Cheque/Leaf Rs. 3 Per Cheque/Leaf Rs. 5

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Tarot Voice of The Inner Light PDFDocument275 pagesTarot Voice of The Inner Light PDFSeema Joshi100% (8)

- Tarot Voice of The Inner Light PDFDocument275 pagesTarot Voice of The Inner Light PDFSeema Joshi100% (8)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Chapter 6 Suspense Practice Q HDocument5 pagesChapter 6 Suspense Practice Q HSuy YanghearNo ratings yet

- Clydesdale Bank Nov20 Lukasik UkDocument1 pageClydesdale Bank Nov20 Lukasik Ukjulien feuillet100% (1)

- MR Mandlakayise A Mabizela PO BOX 13029 The Tramshed 0126: Page 1 of 2Document2 pagesMR Mandlakayise A Mabizela PO BOX 13029 The Tramshed 0126: Page 1 of 2Mandlakayise MabizelaNo ratings yet

- Talking With Your AngelsDocument42 pagesTalking With Your AngelsSeema JoshiNo ratings yet

- Police Verification of PropertyDocument2 pagesPolice Verification of PropertySeema JoshiNo ratings yet

- Ather Bank StatementDocument12 pagesAther Bank StatementsksaudNo ratings yet

- OSS - Simple Recent Transactions PDFDocument1 pageOSS - Simple Recent Transactions PDFjair2018No ratings yet

- Semifinals Set ADocument9 pagesSemifinals Set AAnn GGNo ratings yet

- Cs610-Lab 3Document6 pagesCs610-Lab 3mayashamaim72002No ratings yet

- Implementing Arubaos CX Switching Rev 20 21Document5 pagesImplementing Arubaos CX Switching Rev 20 21Muhammed AKYUZNo ratings yet

- WIRESHARKDocument30 pagesWIRESHARKMylavarapu SriprithamNo ratings yet

- Optical Network Seminar on Light Tree ArchitectureDocument30 pagesOptical Network Seminar on Light Tree ArchitectureVasanth Vasu33% (3)

- Online Service Sector in IndiaDocument40 pagesOnline Service Sector in IndiaNishtha KapoorNo ratings yet

- Dental Education For The 21st CenturyDocument3 pagesDental Education For The 21st CenturymaldosarNo ratings yet

- Proactive Outbound Contact CapabilitiesDocument23 pagesProactive Outbound Contact Capabilitiesing.nizarNo ratings yet

- Comparison Between OCI & AWSDocument12 pagesComparison Between OCI & AWSHamzeh Wael ShaheenNo ratings yet

- Lecture 025 SBB Super Breaker Block BullishDocument22 pagesLecture 025 SBB Super Breaker Block BullishkaitongjiangNo ratings yet

- SIBA Testing Services FormDocument1 pageSIBA Testing Services FormMujeeb Rehman PanhwarNo ratings yet

- TA TCNH FormatDocument3 pagesTA TCNH FormatNhựt Nguyễn MinhNo ratings yet

- Transaction StatementDocument2 pagesTransaction StatementSatya GopalNo ratings yet

- Internet BillDocument4 pagesInternet BillKanchan Asnani0% (1)

- Vouching - Verification PPT Sem IIIDocument10 pagesVouching - Verification PPT Sem IIIRohini UbaleNo ratings yet

- Submitted By: Bhawana Chawla MBA-2CDocument11 pagesSubmitted By: Bhawana Chawla MBA-2CBHAWANACHAWLANo ratings yet

- UNIT 4 - Front Office AccountingDocument45 pagesUNIT 4 - Front Office AccountingHigneh FantahunNo ratings yet

- RgiptulluDocument25 pagesRgiptulluHelloNo ratings yet

- M2M IOT TECHNOLOGIES FUNDAMENTALSDocument18 pagesM2M IOT TECHNOLOGIES FUNDAMENTALSDenifer Deep100% (2)

- GoZiyarah-Umrah-2020 PackagesDocument1 pageGoZiyarah-Umrah-2020 PackagesPlanagement BDNo ratings yet

- Network Engineer Résumé Seeking New OpportunitiesDocument4 pagesNetwork Engineer Résumé Seeking New OpportunitiesMinhaj KhanNo ratings yet

- Market Outlook SD-WAN - 2018-2023 - WorldwideDocument27 pagesMarket Outlook SD-WAN - 2018-2023 - Worldwidemasterlinh2008No ratings yet

- Missouri Do Not Resuscitate FormDocument1 pageMissouri Do Not Resuscitate Formitargeting0% (1)

- National Municipal Accounting Manual PDFDocument722 pagesNational Municipal Accounting Manual PDFpravin100% (1)

- Canara - Epassbook - 2023-10-10 202024.654466Document49 pagesCanara - Epassbook - 2023-10-10 202024.654466Kamal Hossain MondalNo ratings yet