Professional Documents

Culture Documents

Journal - Mangayarkkarasi 4may15mrr PDF

Journal - Mangayarkkarasi 4may15mrr PDF

Uploaded by

Shiva Charan ßennyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Journal - Mangayarkkarasi 4may15mrr PDF

Journal - Mangayarkkarasi 4may15mrr PDF

Uploaded by

Shiva Charan ßennyCopyright:

Available Formats

ISSN: 2249-7196

IJMRR/May 2015/ Volume 5/Issue 5/Article No-4/315-320

Mangayarkkarasi Muthuvelan / International Journal of Management Research & Review

A STUDY ON CASH FLOW ANALYSIS IN M/S. PANTALOON RETAIL (INDIA)

LIMITED

Mangayarkkarasi Muthuvelan*1

1

Asst. Prof, Dept. of Electronics and Communication Engineering, Sri Muthukumaran

Institute of Technology, Mangadu, India.

ABSTRACT

Cash flow analysis is highly useful for financial planning in the firm. This analysis is used to

determine what transactions caused the cash balance to change during a particular period.

Many users give preference to direct method few only considering the indirect method. Here,

two statements are to be prepared one is calculation of cash from operations and another one

is cash flow statement. In this work the basic tool used to understand the cash flow analysis

of previous consecutive five year’s data collected from M/s. Pantaloon Retail (India) Limited.

The company involves retail operations in Fabric Materials, Food Materials, Electronic

Goods, Home Needs and Logistics. But all these operations are focused on retail markets in

India. The cash from business operations increases gradually from the year 2006-2010. Here,

the sources and applications of cash for the year 2010 is increased compared to other years.

So the financial position of the firm is good at the year 2010.

Keywords: Current assets, Current liabilities, cash inflow and cash outflow, sources of cash,

application of cash

1. INTRODUCTION

Cash flow is the changes in firm’s cash during a particular period by indicating the firm’s

sources and uses of cash during that period. To determine what transactions caused the cash

balance to change during a particular period [8].

Pantaloon Retail (India) Limited, is India’s leading retail company with presence across

multiple lines of businesses.

Cash flow as the actual movement of money in and out of a business. Money flowing into a

business is termed as positive cash flow and is credited as cash received. Monies paid out are

termed as negative cash flow and are debited to the business. The difference between the

positive and negative cash flows is termed as net cash flow [2].

The researchers have estimated cash received from customers and cash paid to suppliers and

employees for firms reporting using the indirect method for self-selection problem. This

method is based on adjusting income statement items for the movement in the relevant

balance sheet account(s). A much larger sample was obtained using this approach. Although

the results appear robust, the predictive power of the method using estimated data is lower

*Corresponding Author www.ijmrr.com 315

Mangayarkkarasi Muthuvelan / International Journal of Management Research & Review

than the method that uses the firm’s own reported direct cash flow data only. This process id

directly affected the distinct possibility of an errors-in-sample problem [7].

The need for financial plan is cash flow management. This would normally represent the

planned position throughout a work and as such would be concerned with the income,

expenditure and net cash flow. This enables the cash flow situation to be monitored using

approaches such as forecast, project phase monitoring/updating and monthly cost/value

reconciliation [1].

The ability of reveal operating cash flow and indirect accrual components can be used to

explain Australian firm’s annual returns. They found affirmation of significant explanatory

power for revealed operating cash flow components after aggregate operating cash flows.

This could be done when they also have significant incremental predictive power for future

(one year ahead) operating cash flows. Accrual components also have incremental

explanatory power for returns[2].

To disclose cash from operations using both the direct and indirect method, Australian data is

not subject to the limitations faced by United States data for cash flow requirements.

Components of CFO and reconciling items (non-cash items, non-operating items and changes

in accruals) can be taken directly from the financial statements instead of being estimated.

They examine the relevance of direct and indirect method disclosures is one of the few

Australian papers to take advantage of this data. They provide evidence supporting the

proposition that the cash flow components disclosed using the direct method are superior to

the net) CFO figure in explaining stock returns. Consistent with the United States research,

accrual information provided via the indirect method also adds explanatory power to their

model. In addition to cash flow and accrual information, the length of the firm’s operating

cycle (measured using current asset turnover ratios) was also found to be associated with

stock returns [4].

Most of the financial users give preference to the direct method, only few of them considered

the indirect method. Here, they found direct method cash flow this reflected in stock prices

indication. The direct method information is economically important that provides recurring

benefits than many firms which derives from providing direct method information likely

exceed recurring costs [6].

Success of every business depends on its cash management. The supply of cash is frequently

a limitation on the successful execution of many policies and programs. So it is necessary to

study the composition of cash of a firm to know the impact of its cash flow decision on its

liquidity, profitability and solvency [3].

A firm would enter into trouble when it spends more cash than it’s able to generate. The

adequate capital for it survival was generated by the firm. To know the firm is generating

adequate cash we can look into the cash flow statement, cannot look into the balance sheet or

the profit and loss account.

The cash flow enables the effective planning and coordination of financial operations. This

also enables the proper allocation of cash among the various activities of the firm. The

investment decisions of the management is aided by only the cash flow. The firm must

Copyright © 2012 Published by IJMRR. All rights reserved 316

Mangayarkkarasi Muthuvelan / International Journal of Management Research & Review

properly analyzing the past business activities and plan for the future. The liquidity picture of

the firm is shown by the cash flow of the firm.

In this paper cash from operation and cash flow statement was calculated. The data taken to

this analysis for the period 2005-2010 from the annual report of Pantaloon Retail (India) Ltd

[9].

This paper is organized as follows: Section 2 describes the cash flow management

approaches. In Section 3, Data analysis and Interpretation was analyzed. The Section 4

concludes the paper.

2. CASH FLOW MANAGEMENT APPROACHES

A cash flow statement is the part of a financial statements prepared by the firm. The cash

flow can be classified as Operating activities, investing activities and Financing activities.

This classification is essential to analyze the cash flow [8].

1. Operating Activities

This involves manufacturing and selling of goods and services. The cash inflow find out from

the sale and the cash outflow from the payment of all expenses relating to selling the product.

This activity can be described as the cash flow from operations is the difference between the

cash inflow and outflow from operations.

2. Investing Activities

The cash flows related to the purchase and sale of fixed assets, buying and selling of financial

securities, borrowing and lending money. The cash flow from investing activities are the

difference between cash inflow and outflow from investing activities.

3. Financing Activities

Here, the cash inflow is the raising of capital either as debt or as equity and cash outflow is

the payment of dividend. This can be described as the difference between cash inflow and

outflow from financing activities.

From these three activities we are going to use only operating activities. For this we can

calculate the cash from operations and cash flow statement.

A. Changes of balance sheet in terms impact on cash

Table 1: Flow of Cash

Outflow of Cash Inflow of Cash

Increase in current asset other than cash Decrease in current asset other than cash

Increase in non-current assets Decrease in non-current assets

Decrease in current liabilities Increase in current liabilities

Decrease in long term liabilities Increase in long term liabilities

The above table 1 shows the inflow and outflow of cash of any firm’s. The inflow of cash

denotes the decrease in current and non - current assets, increase in current and long term

liabilities. The outflow of cash denotes the increase in current and non - current assets and

decrease in current and long term liabilities.

Copyright © 2012 Published by IJMRR. All rights reserved 317

Mangayarkkarasi Muthuvelan / International Journal of Management Research & Review

B. Sources and applications of cash

Table 2: Sources and Applications of Cash

Sources of Cash Applications of Cash

Issue of shares Redemption (Repayment) of capital

Issue of long term debts such as debentures Purchase of fixed assets

Sale of assets Repayment of long term debt

Cash Cash lost in operations

Decrease in current assets Increase in current assets

Increase in current liabilities Decrease in current liabilities

The sources and applications of cash of a firm is shown in table 2.

C. Statements to be prepared

i. Calculation of cash from operations

It covers fund from operations and also covers the changes in current assets (except cash and

bank balances) and current liabilities. This clubs both the statements of changes in working

capital and calculations of funds from operations.

Here are the steps for calculating the cash flow from operations using the indirect method:

1. Begins with net income.

2. Add back non-cash expenses. (Such as depreciation and

amortization)

3. Adjust for gains and losses on sales on assets. Add back

losses Subtract out gains

4. Account for changes in all non-cash current assets.

5. Account for changes in all current assets and liabilities

except notes payable and dividends payable.

ii. Preparation of cash flow statement

This statement prepared by considering the various changes in the fixed assets and long term

liabilities. This is starts with the opening balance of cash/bank (if positive, on the debit side

and if negative, on the credit side) and ends with the closing balance of cash/bank [8].

3. DATA ANALYSIS AND INTERPRETATION

The research made in this study is analytical research. Analytical research involves analysis

of information to make critical evaluation. It identifies variables and tries to make

relationship between them.

This study covers a period of five years from 2005-2006 to 2009-2010.

This study is purely based on secondary data. The secondary data have been collected from

the published annual reports of the company from 2005-2006 to 2009-2010.The annual

reports were obtained directly from the company website.

Copyright © 2012 Published by IJMRR. All rights reserved 318

Mangayarkkarasi Muthuvelan / International Journal of Management Research & Review

Here, we find out the cash from operations and cash flow statement.

A. Calculation of cash from operations

Table 3: Cash From Operations

Particulars June- June- June- June- June-

2006 2007 2008 2009 2010

Net profit/loss as per the 1960.86 3393.86 5295.88 6661.42 6316.66

profit and loss account (A)

Add: 77.4 129.33 253.98 447.74 456.77

1. Depreciation

2. Decrease in current asset - - - - 1917.80

3. Increase in current - 359.58 637.66 911.86 -

liabilities

(B) 77.4 488.91 891.64 1359.6 2374.57

C=A+B 2038.26 3882.38 6187.52 8021.02 8691.23

Less: - 1749.45 2628.58 3282.74 -

1. Increase in current asset

2. Increase in current

liabilities - - - - 887.63

(D) - 1749.45 2628.58 3282.74 887.63

Cash from business

operations (E=C-D) 2038.26 2132.93 3558.94 4738.28 7803.6

Here, the cash from business operations gradually increases. At the year 2010 the firm has a

good financial position compared to previous years.

B. Cash flow statement

Table 4: Sources of Cash

Sources of cash June June June June June 2010

2006 2007 2008 2009

Balance in the

Beginning: 21.77 162.97 121.10 109.34 100.54

Cash in hand

Cash in Bank

Add:

Decrease in - 790.74 601.05 379.96 1340.71

working capital

21.77 953.71 722.15 489.3 1441.25

Table 5: Applications of Cash

Applications of cash June June June June June

2006 2007 2008 2009 2010

Payment on dividends 6.72 7.54 10.67 11.57 17.13

Payment of long term loans 297.57 633.85 962.32 1202.56 421.68

Increase in working capital 790.74 601.05 379.96 - 130.71

1095.03 1242.44 1352.95 1214.13 1779.52

Here, the sources of cash for the year 2007 is increased compared to other years except 2010.

The sources of cash for the year 2010 is most superior to other years. For the year 2006 is

Copyright © 2012 Published by IJMRR. All rights reserved 319

Mangayarkkarasi Muthuvelan / International Journal of Management Research & Review

least poor compared to other years. The applications of cash for the year 2010 is most

superior compared to other years. At the year 2006 the cash is little poor compared to other

years. From this we can say the sources and applications of cash for the year 2010 is

increased compared to other years. These are shown in Table IV and V. So we conclude the

firm has a good financial position at this year.

4. CONCLUSION

This paper has attempted to look into cash flow analysis in Pantaloon Retail (India) Limited.

The paper focuses on the statement of cash flows that recasts the financial statement data

provided by the accrual process. It discusses the use and analysis of the information provided

by the cash flow statement. Many users give preference to direct method few only

considering the indirect method. In this paper I find out the cash from operations and cash

flow statement for the financial years 2006-2010. At the year 2010 the cash from operations

gradually increases compared to other years. The sources of cash for the year 2010 is most

superior to others. At the year 2006 the Applications of cash is little poor than other years.

For the year 2010 the Applications of cash is very high. So we can conclude at the 2010 the

firm has good financial position.

Acknowledgement: The authors would like to thank the anonymous reviewers for their

careful revision and important suggestions which significantly helped to improve the

presentation of this paper.

REFERENCES

[1] Askew W, Mawdesley M, O'Reilly M. Planning and Controlling Construction Projects:

The Best Laid Plans… Addison Wesley Longman and The Chartered Institute of Building,

Essex. 1997; 42-45, 64-67.

[2] Sidhu B, Clinch G, Sin S. A Report on The Usefulness of Direct and Indirect Cash Flow

Disclosures, 2000.

[3] Sidhu B, Clinch G, Sin S. The usefulness of direct and indirect cash flow disclosures.

Review of Accounting Studies 2002; 7(4): 383-404.

[4] Bhavsinh M, Dodiya. A Comparative Study on Cash Flow Statements of ICICI Bank

and AXIS Bank. Indian journal of Applied Research 2014; 4: (4).

[5] Cooke B, Jepson, WB. Cost and Financial Control for Construction Firms, London:

Macmillan Educational Ltd. 1986; 25-26, 41-46.

[6] Hales J. A Review of Academic Research on the Reporting of Cash Flows from

Operations. Social Science Research Network (SSRN), 2012.

[7] Livnat J, Paul Z. The Incremental Information Content of Cash-Flow Components.

Journal of Accounting & Economics 1990; 13 (1): 25-46.

[8] Krishna BY. Accounting for management. CDE Anna University.

[9] www.pantaloonretail.in

Copyright © 2012 Published by IJMRR. All rights reserved 320

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Consumer Goods NoticeDocument3 pagesConsumer Goods NoticeGee Penn100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Mango-Piocalicious Business PlanDocument26 pagesMango-Piocalicious Business PlanJorge UntalanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- WWJ #2 1989Document60 pagesWWJ #2 1989ayamNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Receipt 1010123162 82261428Document2 pagesReceipt 1010123162 82261428Rohan PrajapatiNo ratings yet

- Free Math Worksheets For Kids 100723010006 Phpapp01Document36 pagesFree Math Worksheets For Kids 100723010006 Phpapp01nadinech78100% (3)

- ORFA Jorune: Game MechanicDocument10 pagesORFA Jorune: Game MechanicMarceloNo ratings yet

- S03 Rock Drill H200 HydrastarDocument52 pagesS03 Rock Drill H200 HydrastarCRAC100% (4)

- Eric Priest - Magnetohydrodynamics of The Sun-Cambridge University Press (2014) PDFDocument580 pagesEric Priest - Magnetohydrodynamics of The Sun-Cambridge University Press (2014) PDFLaura Mora100% (1)

- 1 Prefabricated StructuresDocument42 pages1 Prefabricated Structurespooja apteNo ratings yet

- Special Chemistry: Test Name Current Result Previous Result Unit Normal RangeDocument1 pageSpecial Chemistry: Test Name Current Result Previous Result Unit Normal RangeddssNo ratings yet

- Hearing AidsDocument2 pagesHearing AidsHarshad S PatilNo ratings yet

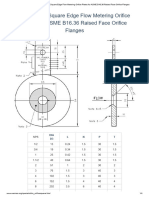

- Wermac - Dimensions of Square Edge Flow Metering Orifice Plates For ASME B16.36 Raised Face Orifice FlangesDocument4 pagesWermac - Dimensions of Square Edge Flow Metering Orifice Plates For ASME B16.36 Raised Face Orifice Flangestechnicalei sulfindoNo ratings yet

- Bidkid Pitch DeckDocument26 pagesBidkid Pitch DeckAoon O MuhammadNo ratings yet

- HUD-1 FormDocument8 pagesHUD-1 FormGarnerRealtyNo ratings yet

- Fundamentals Mock 2 - 1548950645533Document48 pagesFundamentals Mock 2 - 1548950645533Revati RautNo ratings yet

- Managing Your Hamstring Strain - Symptoms & TreatmentDocument2 pagesManaging Your Hamstring Strain - Symptoms & TreatmentAndy Delos ReyesNo ratings yet

- 2012 Virginia Construction CodeDocument156 pages2012 Virginia Construction Codegl1188No ratings yet

- Star Health and Allied Insurance Company Limited: Prospectus - Mediclassic Insurance Policy (Individual)Document8 pagesStar Health and Allied Insurance Company Limited: Prospectus - Mediclassic Insurance Policy (Individual)mfsrajNo ratings yet

- Kajian Tingkat Kebutuhan Dan Penyediaan Es Untuk Operasi Penangkapan Ikan Di Pelabuhan Perikanan Samudera LampuloDocument13 pagesKajian Tingkat Kebutuhan Dan Penyediaan Es Untuk Operasi Penangkapan Ikan Di Pelabuhan Perikanan Samudera LampuloMartonoNo ratings yet

- Comp. Variable Compression Ratio Scfsde With Eddy Current DynamometerDocument25 pagesComp. Variable Compression Ratio Scfsde With Eddy Current DynamometerFrank GandhiNo ratings yet

- Duty Engineer: Grand Mercure & Ibis Yogyakarta Adi SuciptoDocument1 pageDuty Engineer: Grand Mercure & Ibis Yogyakarta Adi Suciptoali maulana yuthiaNo ratings yet

- SquidNet Linux Installation GuideDocument6 pagesSquidNet Linux Installation GuideAtip HamzahNo ratings yet

- Are Obsidian Subsources Meaningful Units of Analysis, Temporal, and Spatial Patterning of Subsources in The Coso Volcanic Field, California - EerkensDocument9 pagesAre Obsidian Subsources Meaningful Units of Analysis, Temporal, and Spatial Patterning of Subsources in The Coso Volcanic Field, California - Eerkenswolfspider1No ratings yet

- Dehydrated Castor Oil SDSDocument5 pagesDehydrated Castor Oil SDSsatishNo ratings yet

- Service Manual: RP12000 E Portable GeneratorsDocument144 pagesService Manual: RP12000 E Portable GeneratorsYonis FrancoNo ratings yet

- Assignment No 2: Q1) A Box in A Certain Supply Room Contains Four 40-W Lightbulbs, Five 60-W Bulbs, and Six 75Document3 pagesAssignment No 2: Q1) A Box in A Certain Supply Room Contains Four 40-W Lightbulbs, Five 60-W Bulbs, and Six 75Aeman NadeemNo ratings yet

- Module 3 Action Research Problem ConceptualizationDocument17 pagesModule 3 Action Research Problem ConceptualizationDora ShaneNo ratings yet

- S.No Date Cust Name Customer Number Model Problem Recvd Amount Repairpayment ModeDocument35 pagesS.No Date Cust Name Customer Number Model Problem Recvd Amount Repairpayment Modejeet meharNo ratings yet

- MPR ProjectDocument57 pagesMPR Projectdivyanshu MNo ratings yet

- 7610 How To Use Multilingual External ModuleDocument3 pages7610 How To Use Multilingual External Modulegogoz50% (2)