Professional Documents

Culture Documents

Five Threat of Audit PDF

Uploaded by

Sally NguyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Five Threat of Audit PDF

Uploaded by

Sally NguyenCopyright:

Available Formats

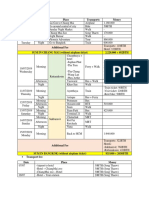

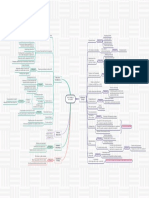

Obtaining a quality control review

Safeguard Recent service with an audit client Disposing interest

Discussing with audit commitee

Eliminated auditor

Setting policies and strategic direction Financial interest Safeguard

Independent partner

Directing and taking responsibility for

the action of the entity's employees Client's audit commitee

Authorising transactions Lose auditor's

Close business relationship Safeguard Eliminated auditor

Provision of non-audit services in general professional skepticism

Deciding which recommendations of the

firm or other third parties to implements Modifying audit plan

Preparation and fair preparation of the FS Employment with Independent professional

an audit client Safeguard accountant review

Designing, implementing and maintaining internal control

(Làm việc với KH) Cooling off period

Using staff member

Independent partner

Independent partner or senior staff

Safeguard Preparing accounting records and FS Additional review

member (not in audit team) to review

Obtaining client approval Temporary staff assignment Not giving function or activity on the audit

Safeguard

(Nhân viên tạm thời của KH) that loaned staff during temporary period

Second partner review Self-review

Eliminated

Confirming the client understands the (Tự kiểm tra)

valuation and the assumptions used Partner on client board

Safeguard Valuation services (Là thành viên HĐQT của cty KH)

Ensuring client acknowledges

responsibility for the valuation Disclose relationship

Use separate personnel Family and personal relationship Safeguard Undertaking quality control review

and discussing the matter with audit

Tax return preparation commitee of the client

Tax calculations FIVE THREAT Self-interest

Use personnel not in audit Compensation and Removing the member

Guidance OF AUDIT (Tư lợi) Safeguard

Safeguard Tax planning Taxation services evaluation policies

Obtaining advice from external tax in respect Reviewing by a professional accountant

Assistance in the Trivial

resolution of tax disputes Gifts and hospitality

Inconsequential

Use personnel not involved in the audit

Safeguard Internal audit services Loans and guarantees

Ensuring client approves all the work of IA

Overdue fee

Corporate finance Safeguard Dicussing with charged governance

(Phí trả chậm)

Significant part of the internal control Charged by the firm expressing on the

IT system services FS, is material or expected to be material

Information significant to accounting records or FS

Contingent fees Charged by the network firm that participates in a significant NOT BE ACCEPTED

part of the audit, is material or expected to be material

Legal service

Advocacy Outcome of non-assurance service

Corporate finance

(Biện minh) Reducing dependency

Contingency fee

Safeguard External quality control review

High percentage Consulting a third party

Rotating senior personnel of fees

Familiarity Total fees from client represent Disclose with governance

Professional accountant review Safeguard For public interest entities more than 15% of the audit firm's Safeguard

(Thân thuộc)

total fees for 2 consecutive years Arrange for a review to be conducted

Regular internal or external quality review

Lowballing Maintaining record

Safeguard

(Hạ giá phí) Complying with all applicable auditing standards,...

Disclosing to audit commitee

Intimidation Recruitment

Removing specific affected inviduals Safeguard MUST NOT MAKE MANAGEMENT DECISION FOR CLIENT

(Đe dọa) (Tuyển dụng nhân sự cấp cao cho KH)

Involving an additional professional accountant

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Promissory Notes - Legal Issues - Foreclosure DefenseDocument21 pagesPromissory Notes - Legal Issues - Foreclosure Defense83jjmack100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Subcontract AgreementDocument3 pagesSubcontract AgreementGryswolf100% (3)

- Reply To Position Paper Revised1Document9 pagesReply To Position Paper Revised1Gladys Kaye Chua100% (6)

- SECRETARY CERTIFICATE For LandBankDocument3 pagesSECRETARY CERTIFICATE For LandBankWilliam Smith100% (5)

- Joint Development Agreement - DraftDocument52 pagesJoint Development Agreement - Draftkoshy75% (4)

- E ContractDocument3 pagesE Contractاحمد مهنىNo ratings yet

- CLJ 2 Exam QuestionerDocument2 pagesCLJ 2 Exam QuestionerKenneth AlatanNo ratings yet

- Facts:: Reyes vs. MosquedaDocument1 pageFacts:: Reyes vs. MosquedaJakie CruzNo ratings yet

- K174040466 Suong NguyenNgoc IncotermDocument4 pagesK174040466 Suong NguyenNgoc IncotermSally NguyenNo ratings yet

- Schedule PDFDocument2 pagesSchedule PDFSally NguyenNo ratings yet

- Case 1 - The Financial Detective - Nhom4 - K17404CDocument9 pagesCase 1 - The Financial Detective - Nhom4 - K17404CSally NguyenNo ratings yet

- K174040466 Suong NguyenNgoc IncotermDocument4 pagesK174040466 Suong NguyenNgoc IncotermSally NguyenNo ratings yet

- Five Threat of AuditDocument1 pageFive Threat of AuditSally NguyenNo ratings yet

- Research PaperDocument12 pagesResearch PaperSally NguyenNo ratings yet

- Mcduff & Byrd Paul, Weiss, Rifkind, Wharton & Garrison LLP: Attorneys For PlaintiffsDocument10 pagesMcduff & Byrd Paul, Weiss, Rifkind, Wharton & Garrison LLP: Attorneys For PlaintiffstowleroadNo ratings yet

- 07 People vs. Temblor PDFDocument2 pages07 People vs. Temblor PDFjacaringal10% (1)

- Interpretation of Statutes Case LawDocument2 pagesInterpretation of Statutes Case LawSaleha WaqarNo ratings yet

- Customary Law of Succession SlidesDocument22 pagesCustomary Law of Succession SlidesKgaogelo ChueneNo ratings yet

- AAA Assoc Sample Paper 1Document3 pagesAAA Assoc Sample Paper 1Duy Nguyen100% (2)

- TP MainDocument10 pagesTP MainsriNo ratings yet

- The Kenya Gazette Vol - Cxix-No - .175Document80 pagesThe Kenya Gazette Vol - Cxix-No - .175Arnold Tunduli100% (1)

- Intergraph Licensing Release NotesDocument5 pagesIntergraph Licensing Release NotesJose Manuel Lara BernezNo ratings yet

- CroatiaDocument5 pagesCroatiaDalibor MocevicNo ratings yet

- LETTER TO U.S. DISTRICT CLERK KATE BARKMAN Re PETITIONER STAN J. CATERBONE, PRO SE Writ of Habeus Corpus Friday September 1, 2017Document69 pagesLETTER TO U.S. DISTRICT CLERK KATE BARKMAN Re PETITIONER STAN J. CATERBONE, PRO SE Writ of Habeus Corpus Friday September 1, 2017Stan J. CaterboneNo ratings yet

- Lindsworth Brown-Sessay v. Attorney General United States, 3rd Cir. (2013)Document5 pagesLindsworth Brown-Sessay v. Attorney General United States, 3rd Cir. (2013)Scribd Government DocsNo ratings yet

- Special Edition - 6 Mansoor Akbar Kundi - PDF - 42 PDFDocument8 pagesSpecial Edition - 6 Mansoor Akbar Kundi - PDF - 42 PDFKashif KhanNo ratings yet

- Wanzo v. State of Wisconsin - Document No. 3Document3 pagesWanzo v. State of Wisconsin - Document No. 3Justia.comNo ratings yet

- Death Penalty Is Far More Expensive Than ExpectedDocument3 pagesDeath Penalty Is Far More Expensive Than ExpectedCHERRY ANN OLAJAYNo ratings yet

- People v. Quidato (297 SCRA 1 (1998) )Document6 pagesPeople v. Quidato (297 SCRA 1 (1998) )Mara ClaraNo ratings yet

- Republic of The Philippines Manila en BancDocument17 pagesRepublic of The Philippines Manila en BancShey FerriolNo ratings yet

- Child Labour and TraffickingDocument14 pagesChild Labour and TraffickingJanet VargheseNo ratings yet

- Agpalo Chap - VI NatureAndCreationOfAttorney-ClientRelationshipDocument5 pagesAgpalo Chap - VI NatureAndCreationOfAttorney-ClientRelationshipGelo MVNo ratings yet

- Case StudyDocument4 pagesCase StudyKristel Mae BunaganNo ratings yet

- The Decision of The Commonwealth Employment Relations Board in "Town of Dedham and American Federation of State, County and Municipal Employees, Council 93, AFL-CIO,"Document26 pagesThe Decision of The Commonwealth Employment Relations Board in "Town of Dedham and American Federation of State, County and Municipal Employees, Council 93, AFL-CIO,"DedhamTranscriptNo ratings yet

- Review of The Basic Agrarian Law of 1960 (Indonesia)Document108 pagesReview of The Basic Agrarian Law of 1960 (Indonesia)Warren Wright100% (2)

- Code of Corporate GovernanceDocument30 pagesCode of Corporate GovernanceJagrityTalwarNo ratings yet