Professional Documents

Culture Documents

BDO Background

Uploaded by

Katherine Fernandez0 ratings0% found this document useful (0 votes)

66 views4 pagesBDO is a full-service universal bank in the Philippines that provides lending, deposit-taking, foreign exchange, and other services. It was established in 1968 as a thrift bank and was later acquired and expanded, becoming a commercial bank in 1994 and universal bank in 1996. BDO has over 1,300 branches and 4,000 ATMs nationwide, offering insurance, investment banking, private banking and other financial services through subsidiaries.

Original Description:

A brief history on the banking company established in the Philippines.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBDO is a full-service universal bank in the Philippines that provides lending, deposit-taking, foreign exchange, and other services. It was established in 1968 as a thrift bank and was later acquired and expanded, becoming a commercial bank in 1994 and universal bank in 1996. BDO has over 1,300 branches and 4,000 ATMs nationwide, offering insurance, investment banking, private banking and other financial services through subsidiaries.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views4 pagesBDO Background

Uploaded by

Katherine FernandezBDO is a full-service universal bank in the Philippines that provides lending, deposit-taking, foreign exchange, and other services. It was established in 1968 as a thrift bank and was later acquired and expanded, becoming a commercial bank in 1994 and universal bank in 1996. BDO has over 1,300 branches and 4,000 ATMs nationwide, offering insurance, investment banking, private banking and other financial services through subsidiaries.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

BANCO DE ORO (BDO)

COMPANY PROFILE

BDO is a full-service universal

bank in the Philippines. It provides a

complete array of industry-leading

products and services including Lending

(corporate and consumer), Deposit-

taking, Foreign Exchange, Brokering,

Trust and Investments, Credit Cards,

Corporate Cash Management and

Remittances in the Philippines. Through its

local subsidiaries, the Bank offers

Investment Banking, Private Banking,

Leasing and Finance, Rural Banking, Life

Insurance, Insurance Brokerage and

Stock Brokerage services.

BDO’s institutional strengths and value-added products and services hold

the key to its successful business relationships with customers. On the

front line, its branches remain at the forefront of setting high standards as

a sales and service-oriented, customer focused force. BDO has the largest

distribution network with over 1,300 operating branches and more than

4,000 BDO Unibank was established on January 2, 1968, as Acme Savings

Bank, a thrift bank with just two branches in Metro Manila. In November

1976, Acme was acquired by the Sy Group, the group of companies

currently owned by retail magnate Henry Sy, and renamed Banco de Oro

Savings and Mortgage Bank.

In December 1994, BDO became a commercial bank and was renamed

Banco de Oro Commercial Bank. In September 1996, BDO became a

universal bank, which led to the bank's name being changed to the

current Banco de Oro Universal Bank (BDO Unibank). It is one of the many

banks owned by a Chinese-Filipino in the Philippines (others include

Metrobank and Chinabank).

BDO Unibank eventually became involved in insurance services in 1997

(it is a bancassurance firm) by establishing a subsidiary called BDO

Insurance Brokers. In 1999, BDO Unibank expanded its insurance services

through partnerships with Zamora Assurance and Assicurazoni Generali

s.p.a., one of the world's largest insurance firms, and Jerneh Asia Berhad,

a member of Malaysia's Kuok Group. Later, BDO Unibank. partnered up

with its insurance affiliates, which are Generali Pilipinas Life Assurance

Company and Generali Pilipinas Insurance Company, in March 2000.ATMs

nationwide.

Sources:

https://www.bdo.com.ph/about-bdo/business-operation ,

https://en.wikipedia.org/wiki/Banco_de_Oro#/media/File:BDO_Unibank_(logo).svg

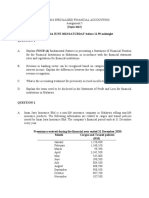

INVESTMENT AND GRAPH

AMOUNT SHARE NO. OF

DATE IN PESOS COMPA AMOUN INCOM SHARES

NY T CLOSE E

%

Aug. 9, 2,010.5 BDO 2.45 N/A 14

2019

Aug. 13, 1,977.46 BDO 0.84 -1.61 N/A

2019

Aug. 19, 2,002.94 BDO 2.66 1.82 N/A

2019

Aug. 23, 2,016.66 BDO 3.64 0.98 N/A

2019

Aug. 30, 2,024.50 BDO 4.20 0.56 N/A

2019

Sept. 5, 1,985.30 BDO 1.40 -2.8 N/A

2019

Sept. 10, 1,965.70 BDO 0 -1.40 N/A

2019

Sept. 16, 1,971.58 BDO 0.42 0.42 N/A

2019

Sept. 20, 1,991.18 BDO 1.82 1.40 N/A

2019

Sept. 26, 1,995.10 BDO 2.10 0.28 N/A

2019

INVESTMENT AND GRAPH

You might also like

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Strategic Management BDODocument33 pagesStrategic Management BDOKapoy-eeh Lazan82% (11)

- Strama 2015Document72 pagesStrama 2015Millicent Matienzo100% (5)

- Narrative Report - Chema C. PacionesDocument9 pagesNarrative Report - Chema C. PacionesMeach CallejoNo ratings yet

- BDO-Strategic PlanDocument37 pagesBDO-Strategic PlanJENNIFER MORANTENo ratings yet

- BDO UnfinishedDocument3 pagesBDO UnfinishedPaolo Nico P HermoNo ratings yet

- Banco de Oro or Bdo Unibank IncDocument4 pagesBanco de Oro or Bdo Unibank IncJcel JcelNo ratings yet

- BDO UnibankDocument2 pagesBDO Unibanklitac baresNo ratings yet

- Group 7 Strategic ManagementDocument25 pagesGroup 7 Strategic ManagementPduys16No ratings yet

- Investment Theory and AnalysisDocument8 pagesInvestment Theory and AnalysisJinky Bago AcapuyanNo ratings yet

- Final StramaDocument75 pagesFinal StramaChristian Jay Patiño Orpano100% (1)

- Bus. Fin. PatricioDocument11 pagesBus. Fin. PatricioRosana PatricioNo ratings yet

- Banco de Oro: Corporate ProfileDocument6 pagesBanco de Oro: Corporate ProfileNilo Palsic CampoNo ratings yet

- Final StramaDocument74 pagesFinal StramaRalphDesiEscueta94% (36)

- Summary For Number 4: BDO Unibank, IncDocument1 pageSummary For Number 4: BDO Unibank, Incpamela dequillamorteNo ratings yet

- Insurance Awareness 2019 PDF (Jan - Dec 13)Document79 pagesInsurance Awareness 2019 PDF (Jan - Dec 13)Rajaram RNo ratings yet

- Research Paper: St. Nicholas Senior High SchoolDocument11 pagesResearch Paper: St. Nicholas Senior High SchoolDominic Dalton CalingNo ratings yet

- Banco de Oro Universal Bank: A Brief StudyDocument22 pagesBanco de Oro Universal Bank: A Brief StudyLileth ViduyaNo ratings yet

- Tutorial PFPDocument20 pagesTutorial PFPGAW KAH YAN KITTYNo ratings yet

- HistoryDocument3 pagesHistoryPia Angela ElemosNo ratings yet

- BP InsuranceDocument18 pagesBP InsurancehimanshiNo ratings yet

- Presentation On Financial Performance Evaluation of Meghna Lif Insurance LimitedDocument10 pagesPresentation On Financial Performance Evaluation of Meghna Lif Insurance LimitedMurshid IqbalNo ratings yet

- PT Bank Bukopin TBK: June 11, 2020Document2 pagesPT Bank Bukopin TBK: June 11, 2020Az CheNo ratings yet

- Financial Management Project ReportDocument14 pagesFinancial Management Project ReportApoorva Pattnaik0% (1)

- History: BeginningsDocument3 pagesHistory: Beginningsrobloxian MobiNo ratings yet

- Strama Sem Project PDFDocument6 pagesStrama Sem Project PDFIvy PeraltaNo ratings yet

- Service That Transforms Uncertainty To Security.: 2019 Annual ReportDocument23 pagesService That Transforms Uncertainty To Security.: 2019 Annual ReportAnonymous ReyesNo ratings yet

- BFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Document14 pagesBFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Tabrej AlamNo ratings yet

- March 2023Document2 pagesMarch 2023Jemmiah NelmidaNo ratings yet

- Banking & Economy PDF - November 2019 by AffairsCloudDocument51 pagesBanking & Economy PDF - November 2019 by AffairsCloudSurbhi KulkarniNo ratings yet

- Bdo - Industryanalysis PaperDocument12 pagesBdo - Industryanalysis PaperJohn Michael Dela CruzNo ratings yet

- Bajaj Finance BRR 230621 Revised BDocument42 pagesBajaj Finance BRR 230621 Revised BGOURAV DEYNo ratings yet

- Econ BdoDocument9 pagesEcon Bdocamille marie brionesNo ratings yet

- 21BSP0094 Nakul DubeyDocument22 pages21BSP0094 Nakul Dubeysanket rasamNo ratings yet

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Document5 pagesLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganNo ratings yet

- Banco de Oro or BDO Unibank, Inc. Is The Largest Bank Based in Makati CityDocument7 pagesBanco de Oro or BDO Unibank, Inc. Is The Largest Bank Based in Makati CityErfan TanhaeiNo ratings yet

- Suncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingDocument6 pagesSuncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingolaNo ratings yet

- Financial Markets: Finals Project Banco de OroDocument11 pagesFinancial Markets: Finals Project Banco de OroJessa EvangelioNo ratings yet

- ACTA1Document3 pagesACTA1Dom PaciaNo ratings yet

- Loan Details Charges: Customer Portal ExperiaDocument4 pagesLoan Details Charges: Customer Portal ExperiaAlpesh KuleNo ratings yet

- Case StudyDocument9 pagesCase Studymarian obagNo ratings yet

- Albay InsurancecompanyDocument15 pagesAlbay InsurancecompanyJay Ann Belen AlbayNo ratings yet

- Bdo Unibank CASE STUDY 1Document18 pagesBdo Unibank CASE STUDY 1marian obag0% (1)

- Zurich Australian Insurance Limited: Annual ReportDocument58 pagesZurich Australian Insurance Limited: Annual ReportSriram Vasumathy SurendranNo ratings yet

- BDO (Banco de Oro) - We Find WaysDocument6 pagesBDO (Banco de Oro) - We Find WaysAivan NovichNo ratings yet

- BKAR 3063 Assignment 5-A222Document4 pagesBKAR 3063 Assignment 5-A2221M1 OCRNo ratings yet

- PestelDocument3 pagesPestelMary Abigail Lapuz0% (1)

- Albay InsurancecompanyDocument15 pagesAlbay InsurancecompanyJay Ann Belen AlbayNo ratings yet

- 0630 BankCom 2022 AR v3Document269 pages0630 BankCom 2022 AR v3devy mar topiaNo ratings yet

- Berjaya Media BHD CS - Term PaperDocument15 pagesBerjaya Media BHD CS - Term PaperReshwin RajNo ratings yet

- I S B A C K: An Immersive ExperienceDocument11 pagesI S B A C K: An Immersive ExperienceRahul KediaNo ratings yet

- BDO 2020 Sustainability ReportDocument100 pagesBDO 2020 Sustainability Reportiyay lopezNo ratings yet

- BDO 2020 Sustainability ReportDocument100 pagesBDO 2020 Sustainability Reportiyay lopezNo ratings yet

- Rekening Pasif Februari 2020Document97 pagesRekening Pasif Februari 2020Bayu Dwi AnantaNo ratings yet

- Article 3Document3 pagesArticle 32022828078No ratings yet

- NBFC Role in Wealth Managment: Nimisha Rai Parth Mehta Pooja Verma Pargya Dwivedi Pratik TanwaniDocument21 pagesNBFC Role in Wealth Managment: Nimisha Rai Parth Mehta Pooja Verma Pargya Dwivedi Pratik TanwaniNimisha RaiNo ratings yet

- Future and Growth of Life InsuranceDocument4 pagesFuture and Growth of Life InsuranceRENUKA THOTENo ratings yet

- BDO AnnualreportDocument66 pagesBDO AnnualreportJm ╭∩╮⎝⎲⎵⎲⎠╭∩╮No ratings yet

- BDO UnibankDocument7 pagesBDO UnibankJana Kryzl DibdibNo ratings yet

- Banco de Oro UnibankDocument7 pagesBanco de Oro UnibankNeth SalvatoreNo ratings yet

- BusinessDocument230 pagesBusinessRobert SonguitanNo ratings yet

- Syllabus ObliDocument13 pagesSyllabus ObliKristine Claire TarNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Paul JonesNo ratings yet

- On-The-Job Traning at Rizal Commercial Banking Corporation (RCBC)Document1 pageOn-The-Job Traning at Rizal Commercial Banking Corporation (RCBC)rodel amorNo ratings yet

- Guest House, Court Rental & Donation Collection From 2016 To 2020 - With BDU RemarksDocument62 pagesGuest House, Court Rental & Donation Collection From 2016 To 2020 - With BDU RemarksJenalyn BihagNo ratings yet

- Bank ListsDocument4 pagesBank ListsMhickLuceroNo ratings yet

- List of Cases For Civil Law Review Class: Obligations and ContractsDocument2 pagesList of Cases For Civil Law Review Class: Obligations and ContractservingabralagbonNo ratings yet

- List of Accredited Banks Account Officers - June 2023Document1 pageList of Accredited Banks Account Officers - June 2023Nicole AtuanNo ratings yet

- BHIDocument17 pagesBHIFranklin PagunsanNo ratings yet

- PESONet Participants PDFDocument1 pagePESONet Participants PDFmaydzNo ratings yet

- Manual Collection Report 2019Document54 pagesManual Collection Report 2019Evo PunzalanNo ratings yet

- BSP and Dof Floor Plan GFDocument1 pageBSP and Dof Floor Plan GFKarl Anton ClementeNo ratings yet

- Instapay ParticipantsDocument2 pagesInstapay ParticipantsDan S BNo ratings yet

- Cases DistributionDocument4 pagesCases DistributionJade Belen ZaragozaNo ratings yet

- Types of Banks in The PhilippinesDocument13 pagesTypes of Banks in The PhilippinesHarka MeeNo ratings yet

- Date Mm/dd/yyyy Name of Customer Bank Check # AmountDocument2 pagesDate Mm/dd/yyyy Name of Customer Bank Check # AmountDerick DalisayNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012srichardequipNo ratings yet

- IndexDocument18 pagesIndexChristine FloreteNo ratings yet

- Nil Syllabus 2022Document3 pagesNil Syllabus 2022Angelica MaquiNo ratings yet

- Disclosure No. 851 2020 List of Stockholders As of March 17 2020Document245 pagesDisclosure No. 851 2020 List of Stockholders As of March 17 2020Karl Anthony Rigoroso MargateNo ratings yet

- Philippine Stock Exchange: Head, Disclosure DepartmentDocument7 pagesPhilippine Stock Exchange: Head, Disclosure DepartmentPaulNo ratings yet

- Group 1 Henry SyDocument11 pagesGroup 1 Henry Syulolmo taekaNo ratings yet

- Banco de Oro Universal Bank: A Brief StudyDocument22 pagesBanco de Oro Universal Bank: A Brief StudyLileth ViduyaNo ratings yet

- List of Blue Chip Companies in The Philippine Stock ExchangeDocument1 pageList of Blue Chip Companies in The Philippine Stock ExchangeSj EclipseNo ratings yet

- 123Document9 pages123Julian DubaNo ratings yet

- MBTC Top100Document3 pagesMBTC Top100ming zhan suNo ratings yet

- April 6, 2020 Philippine Stock ExchangeDocument6 pagesApril 6, 2020 Philippine Stock ExchangeCrhis SimthNo ratings yet

- Assigned Cases For The Coverage of The 4TH ExamDocument9 pagesAssigned Cases For The Coverage of The 4TH ExamNhassie John GONZAGANo ratings yet

- List of Cases-Part III-guarantyDocument3 pagesList of Cases-Part III-guarantyIvy PazNo ratings yet

- CASE LIST Negotiable Instruments Law Under Dean Jose R. SundiangDocument2 pagesCASE LIST Negotiable Instruments Law Under Dean Jose R. SundiangErica Dela CruzNo ratings yet