Professional Documents

Culture Documents

Chapter 21 Reclassification of Financial Assets PDF

Uploaded by

RonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 21 Reclassification of Financial Assets PDF

Uploaded by

RonCopyright:

Available Formats

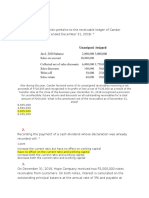

Problem 1.

On January 2019, Royalty Company purchased 9% bonds in the face amount of

P6,000,000. The bonds mature on January 1, 2025 and were purchased for P5,555,000 to yield

11%. The entity classified the bonds as held to maturity and interest is payable annually every

December 31. The entity provided the following information about fair value of the bonds and

effective rate:

Fair Value Effective Rate

December 31, 2019 5,450,000 12%

December 31, 2020 6,155,000 8%

On December 31, 2020, the entity changed the business model for this investment to collect

contractual cash flows composed of principal and interest and to sell the financial asset in the

open market.

On January 1, 2021, the fair value of the bonds did not change.

1. What is the interest income for 2019?

2. What amount of unrealized loss should be recognized in profit or loss for 2019?

3. What amount of unrealized gain should be recognized in profit or loss for 2020?

4. What is the interest income for 2021?

Problem 2. On January 1, 2020, Soledad Company purchased 10% bonds in the face amount of

P3,000,000. The bonds mature on January 1, 2030 and were purchased for P3,405,000 to yield

8%.

The entity used the effective interest method of amortization and interest is payable annually

every December 31.

The business model for this investment is to collect contractual cash flows composed of interest

and principal and to sell the financial asset in the open market.

On December 31, 2020, the entity changed the business model for this investment to realize fair

value changes.

On January 2, 2021, the fair value of the bond was P2,845,000 at an effective rate of 11%.

1. What is the interest income for 2020?

2. What amount in profit or loss should be recognized in 2021 as a result of

reclassification?

3. What is the interest income for 2021?

You might also like

- Module 1 and 3 AssignmentDocument12 pagesModule 1 and 3 AssignmentPrincess Maeca OngNo ratings yet

- Financial Asset at Amortized CostDocument1 pageFinancial Asset at Amortized CostExcelsia Grace A. Parreño25% (12)

- Intermediateaccounting2 Debt Investments - Fafvoci 793 1665904389Document2 pagesIntermediateaccounting2 Debt Investments - Fafvoci 793 1665904389Annie MalinaoNo ratings yet

- InvestmentsDocument5 pagesInvestmentsEdmar HalogNo ratings yet

- ACCTGREV1 - 002 Notes Payable and RestructuringDocument2 pagesACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNo ratings yet

- Quiz 12 (Bonds)Document1 pageQuiz 12 (Bonds)Panda ErarNo ratings yet

- Financial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)Document2 pagesFinancial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)ashleydelmundo14No ratings yet

- SemiDocument7 pagesSemiNanzNo ratings yet

- PROBLEM 1. at December 31, 2019, Sally Company's Notes ReceivableDocument16 pagesPROBLEM 1. at December 31, 2019, Sally Company's Notes ReceivableAccounting 201100% (1)

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- Quiz 10Document1 pageQuiz 10Lalaine BeatrizNo ratings yet

- Ae 211 Solutions-PrelimDocument10 pagesAe 211 Solutions-PrelimNhel AlvaroNo ratings yet

- Semi-Annual Interest, Journal Entries)Document3 pagesSemi-Annual Interest, Journal Entries)Jazehl Joy ValdezNo ratings yet

- Chapter 2Document8 pagesChapter 2cindyNo ratings yet

- A. 65,000 Loss B. 5,000 Loss D. 65,000 GainDocument3 pagesA. 65,000 Loss B. 5,000 Loss D. 65,000 GainLyn AbudaNo ratings yet

- Audprob Diy5 PDFDocument2 pagesAudprob Diy5 PDFFrosterSmile WPNo ratings yet

- Investments Problem 1Document9 pagesInvestments Problem 1Rex AdarmeNo ratings yet

- Exercise For ECLDocument1 pageExercise For ECLJazehl ValdezNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesRonamae RevillaNo ratings yet

- Answer Key - M1L2 PDFDocument4 pagesAnswer Key - M1L2 PDFEricka Mher IsletaNo ratings yet

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocument6 pages02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNo ratings yet

- Homework 6 - Long-Term Financial LiabilitiesDocument2 pagesHomework 6 - Long-Term Financial LiabilitiesCha PampolinaNo ratings yet

- BONDSDocument3 pagesBONDSjdjdbNo ratings yet

- Problems On Financial AssetsDocument1 pageProblems On Financial AssetsNhajNo ratings yet

- ACC 101 - NR Assignment SolutionDocument6 pagesACC 101 - NR Assignment SolutionAdyangNo ratings yet

- 1st Compre NR and LR PDFDocument3 pages1st Compre NR and LR PDFHelton Jun M. TuralbaNo ratings yet

- Financial Asset Debt Securities Practice QuizDocument3 pagesFinancial Asset Debt Securities Practice QuizMarjorie PalmaNo ratings yet

- Far Quiz 2Document13 pagesFar Quiz 2Shiela Jane CrismundoNo ratings yet

- 9.3 Debt InvestmentsDocument7 pages9.3 Debt InvestmentsJorufel PapasinNo ratings yet

- Allapacan Company Bought 20Document18 pagesAllapacan Company Bought 20Carl Yry BitzNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- Debt Securities PDFDocument7 pagesDebt Securities PDFChin-Chin Alvarez SabinianoNo ratings yet

- Compound Financial Instruments and Note PayableDocument4 pagesCompound Financial Instruments and Note PayablePaula Rodalyn MateoNo ratings yet

- Long Quiz Acct 039 InvestmentDocument1 pageLong Quiz Acct 039 InvestmentMary Louise Manzano RavaloNo ratings yet

- IA 2 Quiz #1 - Investment in BondsDocument2 pagesIA 2 Quiz #1 - Investment in BondsSkeeter Britney CostaNo ratings yet

- Basic Derivatives PDFDocument2 pagesBasic Derivatives PDFlcNo ratings yet

- Module 5 - Assessment ActivitiesDocument4 pagesModule 5 - Assessment Activitiesaj dumpNo ratings yet

- INVESTMENTS IN DEBT SECURITIES-ExercisesDocument4 pagesINVESTMENTS IN DEBT SECURITIES-ExercisesJazmine Arianne DalayNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Assignment 2Document1 pageAssignment 2mallarijhoana21No ratings yet

- Takehome Quiz Ae 121Document3 pagesTakehome Quiz Ae 121Crissette RoslynNo ratings yet

- Investment in Bonds / Financial Assets at Amortized CostDocument1 pageInvestment in Bonds / Financial Assets at Amortized CostSteffanie Olivar0% (1)

- Solutions (Quiz1 &2)Document8 pagesSolutions (Quiz1 &2)Aaron Arellano50% (2)

- Borrowing Cost ProbDocument10 pagesBorrowing Cost ProbYoite MiharuNo ratings yet

- 4 FAR Handout Notes ReceivableDocument2 pages4 FAR Handout Notes Receivablealford sery CammayoNo ratings yet

- Practical Accounting 1Document6 pagesPractical Accounting 1Myiel AngelNo ratings yet

- Bonds Payable Sample ProblemsDocument2 pagesBonds Payable Sample ProblemsErin LumogdangNo ratings yet

- Unit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Document9 pagesUnit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Alyna JNo ratings yet

- INTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Document1 pageINTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Ronn Robby RosalesNo ratings yet

- Chapter 4Document31 pagesChapter 4Kristina Kitty100% (1)

- HANDOUT - Bonds PayableDocument4 pagesHANDOUT - Bonds PayableMarian Augelio PolancoNo ratings yet

- NonesDocument15 pagesNonesMary Rose Nones100% (3)

- FINACC 2 - Quiz 3Document7 pagesFINACC 2 - Quiz 3Kim Ruwen AblazaNo ratings yet

- Handout in Financial Assets 2Document2 pagesHandout in Financial Assets 2Micaella GrandeNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Real Estate Investing: 2 in 1: How to invest in real estate, build credit, raise your credit score, leverage credit lines & achieve financial freedom with commercial, wholesaling, single family homesFrom EverandReal Estate Investing: 2 in 1: How to invest in real estate, build credit, raise your credit score, leverage credit lines & achieve financial freedom with commercial, wholesaling, single family homesNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet