Professional Documents

Culture Documents

Semi-Annual Interest, Journal Entries)

Uploaded by

Jazehl Joy ValdezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Semi-Annual Interest, Journal Entries)

Uploaded by

Jazehl Joy ValdezCopyright:

Available Formats

CLASSROOM EXERCISES ON INVESTMENT IN DEBT SECURITIES

Problem 1 (FA-FVPL, FA-AC, FA-FVOCI, Discount, Annual Interest, Journal entries)

On January 1, 2019, Aldridge Co. purchased P2,000,000 face value 9% bonds for P1,924,184.26, to

yield 10%. The bonds mature on December 31, 2023 and pay interest annually every December 31.

On December 31, 2019, the bonds have a fair value of 99. On December 31, 2020, the bonds have a

yield of 12%. On July 1, 2021, the bonds were sold at 104 plus accrued interest.

Prepare the necessary journal entries from 2019 to 2021, assuming the bonds were classified as follows:

1. Financial asset at fair value through profit or loss

2. Financial asset at amortized cost

3. Financial asset at fair value through other comprehensive income

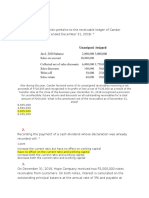

Problem 2 (FA-AC, Premium, Transaction Cost, Purchased in between interest payment dates,

semi-annual interest, Journal Entries)

On June 30, 2019, Christensen Inc. purchased 5-year, 12% bonds with a face value of P1,000,000 to

yield 10%. The bonds pay interest every July 1 and January 1, and was dated January 1. Broker’s fee

paid by Christensen on the bonds amounted to P37,953.64. This adjusted the effective rate of the bonds

to 9%. The bonds were classified as financial assets at amortized cost.

1. Compute for the total cash payment made by Christensen on June 30, 2019.

2. How much should Christensen initially recognize the investment?

3. How much should be recognized by Christensen as interest receivable on December 31, 2019?

4. Determine the investment’s carrying amount at the end of 2020.

5. Determine the interest income recognized by Christensen in 2020.

Problem 3 (FA-AC, Discount, Annual Interest, Serial Bonds, Journal Entries)

On January 1, 2019, Daniela Co. purchased a bond investment with a face value of P4,000,000 and a

stated rate of 10% payable annually every December 31. The bonds were classified as financial assets

at amortized cost with a 12% effective yield. The bonds mature at an annual instalment of P1,000,000

every December 31.

Prepare the journal entries in 2019 as well as the amortization table for the whole duration of the bonds.

Problem 4 (FA-AC, Discount, Semi-annual Interest)

On January 1, 2019, Cambodia Corp. purchased 3-year bonds with a face value of P5,000,000 and a

stated interest rate of 12% per year payable semi-annually every June 30 and December 31. The bonds

were acquired to yield 16%. These were recorded as financial assets at amortized cost. On June 30,

2021, the bonds were sold at par.

1. How much is the purchase price of the bonds?

2. How much in the interest recognized by Cambodia in 2020?

3. How much is the carrying amount of the asset at the end of 2020?

4. How much was the gain or loss recognized by Cambodia when the bonds were sold?

Problem 5 (FA-FVOCI, Premium, Annual Interest)

Cameroon Co. designates purchased debt securities as FAFVOCI. On December 31, 2018, the entity

purchased 5-year, 7% bonds at a yield of 5%. The following schedule presents the fair value of the

bonds at yearend:

December 31, 2019 P1,065,000

December 31, 2020 1,075,000

December 31, 2021 1,056,500

December 31, 2022 1,030,000

December 31, 2023 1,000,000

1. How much should be reported as FAFVOCI in the statement of financial position of Cameroon on

December 31, 2020?

2. How much unrealized gain (loss) should be shown in the 2020 statement of comprehensive income?

3. How much unrealized gain (loss) should be shown in the 2020 statement of financial position?

4. How much unrealized gain (loss) should be shown in the 2021 statement of comprehensive income?

5. How much unrealized gain (loss) should be shown in the 2021 statement of financial position?

6. How much unrealized gain (loss) should be shown in the 2022 statement of comprehensive income?

7. How much unrealized gain (loss) should be shown in the 2022 statement of financial position?

Problem 6 (FA-FVOCI, Premium, Semi-annual Interest)

On January 1, 2019, Grenada Inc. purchased 15%, P1,500,000 face value bonds of Maldives Inc. at a

price to yield 12%. The bonds mature on December 31, 2023. It pays interest semi-annually every June

30 and December 31. The securities at the date of acquisition were designated by Grenada as FA-

FVOCI. On December 31, 2019, the bonds are quoted in the market at 110, while on December 31,

2020, the bonds are quoted at 109.

1. How much is the purchase price of the bonds?

2. How much is the balance of Unrealized Gain (Loss) – OCI as of December 31, 2019?

3. How much is the balance of Unrealized Gain (Loss) – OCI as of December 31, 2020?

Problem 7 (FA-FVOCI, Premium, Annual Interest, Serial Bonds)

On January 1, 2019, Jamaica Co. purchased a bond investment with a face value of P3,000,000 and

stated 12% interest payable annually every December 31. The bonds are classified as FAFVOCI with a

10% effective yield. The bonds mature at an annual instalment of P1,000,000 every December 31. At the

end of 2019 and 2020, the bonds were quoted in the market at 104 and 105, respectively.

1. How much is the purchase price of the bonds?

2. How much is the interest income recognized by Jamaica in 2019?

3. Determine the balance of Unrealized Gain (Loss) – OCI as of December 31, 2019.

4. Determine the balance of Unrealized Gain (Loss) – OCI as of December 31, 2020.

Problem 8 (FA-FVPL, FA-FVOCI, Face Value, Annual Interest, Reclassification to FA-AC, Journal

Entries)

Banks Corp. acquired P3,000,000, 12% bonds at face value on January 1, 2019, and classified them as

FA-FVPL. The bond mature on December 31, 2024, and pay interest every December 31. At the end of

the year, the bonds have a fair value of P3,100,000. On December 31, 2020, due to a change in the

entity’s business model, the bonds were reclassified to financial asset at amortized cost. On this date,

the bonds have a fair value of P3,190,191.93 (interpolated at an effective interest rate of 10%)

1. Prepare the journal entries from 2019 to 2021.

2. Assume that instead of initially recognizing the financial assets at FVPL, Banks recognized them as

financial assets at fair value through other comprehensive income. Prepare the necessary journal

entries from 2019 to 2021.

Problem 9 (FA-AC, Discount, Annual Interest, Reclassification to FA-FVOCI, FA-FVPL)

On January 1, 2019, Cayman Corp. purchased P1,000,000, 10%, 5-year bonds which it classified as FA-

AC. The bonds were purchased to yield 12%. Interest is payable every December 31. The bonds were

quoted at 99 at the end of 2019.

At the end of 2020, Cayman Corp. decided to change its business model and reclassified the instrument

as FA-FVOCI. On this date, the effective rate applicable on the bonds was 11%. The bonds were quoted

at 101 at the end of 2021.

1. Prepare the journal entries from 2019 to 2021.

2. Assuming that the instrument was reclassified to FA-FVOCI (instead of FA-FVPL), prepare the

necessary journal entries from 2019 to 2021.

Problem 10 (FA-FVPL, FA-FVOCI, Discount, Annual Interest, Reclassification)

On January 1, 2019, Joy Corp. purchased P2,000,000, 8%, 5-year bonds which it classified as FA-FVPL.

The bonds were purchased to yield 10%. Interest is payable every December 31. The bonds were

quoted at 101 at the end of 2019.

At the end of 2020, Joy Corp. changed its business model and reclassified the instrument as FA-FVOCI.

On this date, the bonds have a fair value of P 1,807,853.50 (interpolated at an effective interest rate of

12%). The bonds were quoted at 99 at the end of 2021.

1. Prepare the journal entries from 2019 to 2021.

2. Assuming that the instrument was initially classified at FA-FVOCI and it was reclassified to FA-FVPL,

prepare the necessary journal entries from 2019 to 2021.

You might also like

- 13 Impairment of AssetsDocument44 pages13 Impairment of Assetsfordan Zodorovic56% (9)

- 13 Impairment of AssetsDocument44 pages13 Impairment of Assetsfordan Zodorovic56% (9)

- Deed of Sale SharesDocument2 pagesDeed of Sale SharesAlarice L. Yang68% (19)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Bond Problems Journal EntriesDocument1 pageBond Problems Journal EntriesExcelsia Grace A. Parreño25% (12)

- Investment in Debt Securities Qualifying Exam Review Sample QuestionsDocument7 pagesInvestment in Debt Securities Qualifying Exam Review Sample QuestionsHannah Jane Umbay100% (1)

- Customer Relationship Management: CRM Strategy and OrganizationDocument7 pagesCustomer Relationship Management: CRM Strategy and OrganizationMasrur Mustavi OmiNo ratings yet

- Marketing Paytm Wallet - Group5DDocument23 pagesMarketing Paytm Wallet - Group5DAdwait Deshpande100% (1)

- L'oreal ProjectDocument6 pagesL'oreal ProjectRita E. RadyNo ratings yet

- Basel II CheatsheetDocument8 pagesBasel II CheatsheetBhabaniParidaNo ratings yet

- FXKeys Trading Systems & Examples V4.3 PDFDocument120 pagesFXKeys Trading Systems & Examples V4.3 PDFvictorNo ratings yet

- CE and HW On Debt SecuritiesDocument3 pagesCE and HW On Debt SecuritiesAmy SpencerNo ratings yet

- INVESTMENTS IN DEBT SECURITIES-ExercisesDocument4 pagesINVESTMENTS IN DEBT SECURITIES-ExercisesJazmine Arianne DalayNo ratings yet

- Unit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Document9 pagesUnit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Alyna JNo ratings yet

- FA2 03 Bonds Payable PDFDocument3 pagesFA2 03 Bonds Payable PDFdasdsadsadasdasdNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesRonamae RevillaNo ratings yet

- Debt Securities PDFDocument7 pagesDebt Securities PDFChin-Chin Alvarez SabinianoNo ratings yet

- Chapter 21 Reclassification of Financial Assets PDFDocument1 pageChapter 21 Reclassification of Financial Assets PDFRonNo ratings yet

- BN001240323Document5 pagesBN001240323Oshin MenNo ratings yet

- Union Christian College Mock Board Exam ReviewDocument5 pagesUnion Christian College Mock Board Exam ReviewEdmar HalogNo ratings yet

- Bond InvestmentDocument24 pagesBond InvestmentPRINCESS ANGELA LABRONo ratings yet

- Module 5 - Assessment ActivitiesDocument4 pagesModule 5 - Assessment Activitiesaj dumpNo ratings yet

- Exercise Chapter 14Document37 pagesExercise Chapter 1421070286 Dương Thùy AnhNo ratings yet

- Problem No. 1Document6 pagesProblem No. 1Jinrikisha TimoteoNo ratings yet

- HANDOUT - Bonds PayableDocument4 pagesHANDOUT - Bonds PayableMarian Augelio PolancoNo ratings yet

- Non-current Liabilities - Bonds Payable Classification and MeasurementDocument4 pagesNon-current Liabilities - Bonds Payable Classification and MeasurementhIgh QuaLIty SVTNo ratings yet

- AUD.2024-5.-Substantive-Tests-of-InvestmentsDocument4 pagesAUD.2024-5.-Substantive-Tests-of-InvestmentskrizmyrelatadoNo ratings yet

- Audit of InvestmentsDocument3 pagesAudit of InvestmentsJasmine Marie Ng Cheong50% (2)

- ACC 211 - Seventh QuizzerDocument1 pageACC 211 - Seventh QuizzerKate FernandezNo ratings yet

- IA 2 Quiz #1 - Investment in BondsDocument2 pagesIA 2 Quiz #1 - Investment in BondsSkeeter Britney CostaNo ratings yet

- Homework 6 - Long-Term Financial LiabilitiesDocument2 pagesHomework 6 - Long-Term Financial LiabilitiesCha PampolinaNo ratings yet

- ACCTGREV1 - 002 Notes Payable and RestructuringDocument2 pagesACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNo ratings yet

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Document5 pagesLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- DEBT SECURITIES With Answer For Uploading 1Document7 pagesDEBT SECURITIES With Answer For Uploading 1Ryan Malanum AbrioNo ratings yet

- Topic 3 Bonds Payable and Other ConceptsDocument2 pagesTopic 3 Bonds Payable and Other ConceptsDustinEarth Buyo MontebonNo ratings yet

- A. 65,000 Loss B. 5,000 Loss D. 65,000 GainDocument3 pagesA. 65,000 Loss B. 5,000 Loss D. 65,000 GainLyn AbudaNo ratings yet

- Answer Key - M1L2 PDFDocument4 pagesAnswer Key - M1L2 PDFEricka Mher IsletaNo ratings yet

- Afar FCDocument2 pagesAfar FCRyan Julius RullanNo ratings yet

- Chapter 4Document31 pagesChapter 4Kristina Kitty100% (1)

- Microsoft Word - FAR02 - Accounting For Debt InvestmentsDocument4 pagesMicrosoft Word - FAR02 - Accounting For Debt InvestmentsDisguised owl0% (1)

- Module 1 and 3 AssignmentDocument12 pagesModule 1 and 3 AssignmentPrincess Maeca OngNo ratings yet

- Quiz 3 UploadDocument6 pagesQuiz 3 UploadandreamrieNo ratings yet

- PRELIM EXAM SOLUTIONS AE211Document10 pagesPRELIM EXAM SOLUTIONS AE211Nhel AlvaroNo ratings yet

- Fadm / Group Case Study/ Joyo IncDocument3 pagesFadm / Group Case Study/ Joyo IncS GuptaNo ratings yet

- Test Advance Financial AccountingDocument2 pagesTest Advance Financial AccountingSaadullah ChannaNo ratings yet

- HW On Bonds Payable T1 2020-2021Document2 pagesHW On Bonds Payable T1 2020-2021Luna MeowNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- Tugas - InvestmentDocument2 pagesTugas - InvestmenthakujaNo ratings yet

- Audit of Liabilities - Set ADocument5 pagesAudit of Liabilities - Set AZyrah Mae SaezNo ratings yet

- 9.3 Debt InvestmentsDocument7 pages9.3 Debt InvestmentsJorufel PapasinNo ratings yet

- Investment Income and GainsDocument9 pagesInvestment Income and GainsRex AdarmeNo ratings yet

- QUIZ 1 Part 1Document2 pagesQUIZ 1 Part 1Jerah Marie PepitoNo ratings yet

- Financial Instruments CASE STUDIES FRDocument5 pagesFinancial Instruments CASE STUDIES FRDaniel AdegboyeNo ratings yet

- IAS 32, IFRS7,9 Financial InstrumentsDocument6 pagesIAS 32, IFRS7,9 Financial InstrumentsMazni Hanisah100% (2)

- Bonds Payable 4docx PDF FreeDocument6 pagesBonds Payable 4docx PDF FreeKurumi KunNo ratings yet

- Acctg405 Q6Document2 pagesAcctg405 Q6Baron MirandaNo ratings yet

- Bonds Payable 4Document6 pagesBonds Payable 4charlene kate bunaoNo ratings yet

- Assignment 2Document1 pageAssignment 2mallarijhoana21No ratings yet

- Sample IA QuestionDocument3 pagesSample IA QuestionElisa Ferrer RamosNo ratings yet

- Drills Notes Receivable To Discounting of ReceivableDocument3 pagesDrills Notes Receivable To Discounting of ReceivableVincent AbellaNo ratings yet

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- Quiz 10Document1 pageQuiz 10Lalaine BeatrizNo ratings yet

- Handout in Financial Assets 2Document2 pagesHandout in Financial Assets 2Micaella GrandeNo ratings yet

- 1st Compre NR and LR PDFDocument3 pages1st Compre NR and LR PDFHelton Jun M. TuralbaNo ratings yet

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocument6 pages02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- Practical Accounting 1Document32 pagesPractical Accounting 1EdenA.Mata100% (9)

- Accounting Chapter 3Document62 pagesAccounting Chapter 3Chandler SchleifsNo ratings yet

- OceaniaDocument28 pagesOceaniaJazehl Joy ValdezNo ratings yet

- HOMEWORK ON CORRECTION OF ERRORS ZoomDocument26 pagesHOMEWORK ON CORRECTION OF ERRORS ZoomJazehl Joy Valdez100% (1)

- Classroom Exercises on Interim Reporting Key FinancialsDocument2 pagesClassroom Exercises on Interim Reporting Key FinancialsalyssaNo ratings yet

- Unit 7-Income TaxesDocument4 pagesUnit 7-Income TaxesJean Pierre IsipNo ratings yet

- CE On Operating SegmentsDocument3 pagesCE On Operating SegmentsalyssaNo ratings yet

- Practice Problems: Supplement 7, Capacity Planning: Problem 1Document4 pagesPractice Problems: Supplement 7, Capacity Planning: Problem 1Kiruba KaranNo ratings yet

- HW On Operating Segments BDocument3 pagesHW On Operating Segments BJazehl Joy ValdezNo ratings yet

- Homework on Single EntryDocument2 pagesHomework on Single EntryalyssaNo ratings yet

- Operating Segments Comprehensive ProblemDocument2 pagesOperating Segments Comprehensive ProblemJazehl Joy ValdezNo ratings yet

- Financial Statements, Closing Entries, and Reversing EntriesDocument42 pagesFinancial Statements, Closing Entries, and Reversing EntriesJazehl Joy ValdezNo ratings yet

- F Sionil JoseDocument16 pagesF Sionil JoseRaymondBelgicaNo ratings yet

- IAS 24 Quizzer PDFDocument2 pagesIAS 24 Quizzer PDFalyssaNo ratings yet

- 00 Table of ContentsDocument2 pages00 Table of ContentsAl Cariaga VelascoNo ratings yet

- "We're Just Here For Compliance, No Pressure... " Was The Phrase That Kept RunningDocument2 pages"We're Just Here For Compliance, No Pressure... " Was The Phrase That Kept RunningJazehl Joy ValdezNo ratings yet

- Homework On Cash and AccrualDocument2 pagesHomework On Cash and Accruallouise carinoNo ratings yet

- BOYDELL 2011 Pub Ch7 Capacity Planning and ManagementDocument32 pagesBOYDELL 2011 Pub Ch7 Capacity Planning and Managementsheilar_16846886No ratings yet

- Accounting Standard Setting Bodies and ProcessDocument4 pagesAccounting Standard Setting Bodies and ProcessJazehl Joy ValdezNo ratings yet

- Digital Marketing and Sustainability in BusinessDocument4 pagesDigital Marketing and Sustainability in BusinessJazehl Joy ValdezNo ratings yet

- Acccob1 Partnership Operations Additional ExercisesDocument2 pagesAcccob1 Partnership Operations Additional ExercisesJazehl Joy ValdezNo ratings yet

- Reshaping Metro Manila: Gentrification, Displacement, and The Challenge Facing The Urban CapitalDocument25 pagesReshaping Metro Manila: Gentrification, Displacement, and The Challenge Facing The Urban CapitalJazehl Joy ValdezNo ratings yet

- True / False Questions: Chapter 07S Learning CurvesDocument25 pagesTrue / False Questions: Chapter 07S Learning CurvesJazehl Joy ValdezNo ratings yet

- Axa MKTGDocument2 pagesAxa MKTGJazehl Joy ValdezNo ratings yet

- Homework on Conceptual Framework for Financial ReportingDocument8 pagesHomework on Conceptual Framework for Financial ReportingJazehl Joy ValdezNo ratings yet

- NSTP-CWTS ReflectionDocument1 pageNSTP-CWTS ReflectionJazehl Joy ValdezNo ratings yet

- ProductivityDocument6 pagesProductivityJazehl Joy ValdezNo ratings yet

- Approaches To Calculating Project Hurdle Rates PDFDocument16 pagesApproaches To Calculating Project Hurdle Rates PDFSudipta ChatterjeeNo ratings yet

- Schwab One Account AgreementDocument112 pagesSchwab One Account AgreementcadeadmanNo ratings yet

- Installment Liquidation ExplainedDocument28 pagesInstallment Liquidation Explainedcynthia reyesNo ratings yet

- Muhammad Tahir S/O Muhammad Irshad Scheme No1 Abul Khair: Web Generated BillDocument1 pageMuhammad Tahir S/O Muhammad Irshad Scheme No1 Abul Khair: Web Generated BillUsama Elec15No ratings yet

- EverestDocument7 pagesEverestVivitsa UpastiNo ratings yet

- The Role of Government in Accelerating Industrial Development in Developing CountriesDocument12 pagesThe Role of Government in Accelerating Industrial Development in Developing CountriesTan Tien NguyenNo ratings yet

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument2 pagesBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsFredmar GeminoNo ratings yet

- Advance Tax To Be Collected Through Agents (Section 95 Ka)Document18 pagesAdvance Tax To Be Collected Through Agents (Section 95 Ka)ßïshñü PhüyãlNo ratings yet

- Monopolist's Profit Maximization ProblemDocument4 pagesMonopolist's Profit Maximization ProblemTise TegyNo ratings yet

- Substantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial AssetsDocument3 pagesSubstantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial Assetsdianne caballeroNo ratings yet

- The Platform EconomyDocument14 pagesThe Platform EconomyVincyNo ratings yet

- Custom Jewelry Maker Marketing PlanDocument19 pagesCustom Jewelry Maker Marketing PlanPalo Alto Software100% (13)

- ISB PM Week 2 Required Assignment 2.4 Template - Anishka SachdevDocument3 pagesISB PM Week 2 Required Assignment 2.4 Template - Anishka SachdevMamta SharmaNo ratings yet

- BofA Merrill - QuestionsDocument2 pagesBofA Merrill - QuestionsShubham KumarNo ratings yet

- Company ProfileDocument2 pagesCompany ProfileMonika RockerNo ratings yet

- 8 Steps For The Success of A Marketing PlanDocument2 pages8 Steps For The Success of A Marketing PlanLorena AmayaNo ratings yet

- LNG Export Diversification and Demand Security A Comparative Study of Major ExportersDocument9 pagesLNG Export Diversification and Demand Security A Comparative Study of Major ExportersMypc PersonalNo ratings yet

- WBS and Activity On NodeDocument2 pagesWBS and Activity On NodeSunny WinNo ratings yet

- CORPORATE DEBT LEVELSDocument5 pagesCORPORATE DEBT LEVELSimeldafebrinatNo ratings yet

- The Marketing Plan Market Audit and Competitive Market AnalysisDocument3 pagesThe Marketing Plan Market Audit and Competitive Market AnalysismohsinNo ratings yet

- Put-Call Parity and Binomial Option Pricing ModelsDocument10 pagesPut-Call Parity and Binomial Option Pricing Modelsbassirou ndaoNo ratings yet

- CRM Modules Erp SystemDocument4 pagesCRM Modules Erp SystemSaleemAhmedNo ratings yet

- Test Bank For Selling Building Partnerships 8th Edition by Castleberry PDFDocument29 pagesTest Bank For Selling Building Partnerships 8th Edition by Castleberry PDFa548999052No ratings yet

- (A) When The Options Are Exercised by All The EmployeesDocument2 pages(A) When The Options Are Exercised by All The EmployeesanjaliNo ratings yet