Professional Documents

Culture Documents

DCF Guide Example

Uploaded by

Alexander Rios0 ratings0% found this document useful (0 votes)

22 views4 pagesDCF-guide-example

DCF-guide-example

DCF-guide-example

Original Title

DCF-guide-example

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDCF-guide-example

DCF-guide-example

DCF-guide-example

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views4 pagesDCF Guide Example

Uploaded by

Alexander RiosDCF-guide-example

DCF-guide-example

DCF-guide-example

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

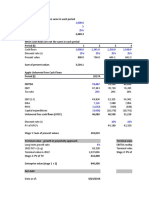

When cash flows are the same in each period

Cash flows 1,000.0

t (periods) 5

r (discount rate) 25%

Present value 2,689.3

When cash flows are not the same in each period

Period (t) 1 2 3 4

Cash flows 1,000.0 1,245.0 1,258.0 1,568.0

Discount rate (r) 25% 25% 25% 25%

Present value 800.0 796.8 644.1 642.3

Sum of present values 3,504.1

Apple Unlevered Free Cash Flows

Period (t) 2017A 2018P 2019P

EBITDA 74,467 78,190 82,099

EBIT 67,343 70,710 74,245

Tax rate 26% 26% 26%

EBIT (1-t) 49,834 52,325 54,941

D&A 7,124 7,480 7,854

NWC (1,032) (929) (836)

Capital expenditures (9,836) (10,278) (10,741)

Unlevered free cash flows (UFCF) 46,089 48,598 51,219

Discount rate (r) 10% 10%

PV of UFCFs 44,180 42,329

Stage 1: Sum of present values 203,010

Terminal value - growth in perpetuity approach Terminal value - EBITDA multi

Long term growth rate 4% EBITDA multiple

2022 FCF x (1+g) 62,220 Terminal value in 2022

Terminal value in 2022 1,037,004 Stage 2: PV of TV

Stage 2: PV of TV 643,898

Enterprise value (stage 1 + 2) 846,908 Enterprise value (stage 1 + 2)

Net debt Shares outstanding

Data as of: 9/24/2016 Basic shares outstanding

Effect of dilutive securities

Commercial paper 8,105 Dilutive shares outstanding

Current portion of long term debt 3,500

Long term debt 75,427 Equity value

Gross debt 87,032

Cash and equivalents 20,484

Short term marketable securities 46,671 Equity value

Long term marketable securities 170,430

Nonoperating assets 237,585

Net debt (150,553.0)

5

1,895.0

25%

621.0

2020P 2021P 2022P

86,204 90,515 95,040

77,957 81,855 85,948

26% 26% 26%

57,689 60,573 63,602

8,247 8,659 9,092

(753) (677) (610)

(11,224) (11,729) (12,257)

53,959 56,826 59,827

10% 10% 10%

40,540 38,813 37,148

rminal value - EBITDA multiple approach

ITDA multiple 9.0x

rminal value in 2022 855,363

age 2: PV of TV 531,113

terprise value (stage 1 + 2) 734,123

ares outstanding

sic shares outstanding 5,332

ect of dilutive securities 50

utive shares outstanding 5,382

Perpetuity EBITDA

approach approach

$185.32 $164.37

You might also like

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- Warren Buffett and Interpretation of Financial Statements - FLAME PDFDocument33 pagesWarren Buffett and Interpretation of Financial Statements - FLAME PDFAlexander Rios67% (3)

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Marriott Restructuring Case AnalysisDocument6 pagesMarriott Restructuring Case AnalysisjaribamNo ratings yet

- Financial Modeling of TCS LockDocument62 pagesFinancial Modeling of TCS LocksharadkulloliNo ratings yet

- New Heritage Doll Company Financial AnalysisDocument31 pagesNew Heritage Doll Company Financial AnalysisSoundarya AbiramiNo ratings yet

- Fundamentals of Automation TechnologyDocument106 pagesFundamentals of Automation Technologyoak2147100% (2)

- Practical Question Accountancy MainDocument22 pagesPractical Question Accountancy MainDubai SheikhNo ratings yet

- New Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionDocument9 pagesNew Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionIleana StirbuNo ratings yet

- AirThread CalcDocument15 pagesAirThread CalcSwati VermaNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Module For AccountingDocument46 pagesModule For AccountingJhefz KhurtzNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- Analysis of AirThread Connection Acquisition Cash Flows and ProjectionsDocument66 pagesAnalysis of AirThread Connection Acquisition Cash Flows and Projectionsbachandas75% (4)

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- SPX MiniDocument2 pagesSPX Minizmcoup100% (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- Ratio Analysis Insights for Business PerformanceDocument30 pagesRatio Analysis Insights for Business PerformanceAayush Agrawal100% (3)

- Printicomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentDocument103 pagesPrinticomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentKunal MehtaNo ratings yet

- Backus Valuation ExcelDocument28 pagesBackus Valuation ExcelAdrian MontoyaNo ratings yet

- Note Payable and Debt Restructuring ProblemsDocument8 pagesNote Payable and Debt Restructuring Problemschamie143No ratings yet

- MBBcurrent 564548147990 2022-01-31 PDFDocument4 pagesMBBcurrent 564548147990 2022-01-31 PDFAdeela fazlinNo ratings yet

- DCF Guide Example2020Document6 pagesDCF Guide Example2020jam manNo ratings yet

- AssignmentDocument6 pagesAssignmentAnkita KumariNo ratings yet

- Análise HCB 260323Document4 pagesAnálise HCB 260323IlidiomozNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- FMO M5 Soln.sDocument16 pagesFMO M5 Soln.sVishwas ParakkaNo ratings yet

- Contoh Simple FCFFDocument5 pagesContoh Simple FCFFFANNY KRISTIANTINo ratings yet

- Financial Management ProjectDocument59 pagesFinancial Management ProjectFaizan MoazzamNo ratings yet

- Mayes 8e CH05 SolutionsDocument36 pagesMayes 8e CH05 SolutionsRamez AhmedNo ratings yet

- Nike Inc Cost of Capital Blaine KitchenwDocument11 pagesNike Inc Cost of Capital Blaine KitchenwAlvaro Gallardo FernandezNo ratings yet

- 6.+Energy+and+Other+revenue BeforeDocument37 pages6.+Energy+and+Other+revenue BeforeThe SturdyTubersNo ratings yet

- .+Energy+and+Other+gross+profit AfterDocument41 pages.+Energy+and+Other+gross+profit AfterAkash ChauhanNo ratings yet

- 8.+opex BeforeDocument45 pages8.+opex BeforeThe SturdyTubersNo ratings yet

- 6.+Energy+and+Other+Revenue AfterDocument37 pages6.+Energy+and+Other+Revenue AftervictoriaNo ratings yet

- 2.+average+of+price+models BeforeDocument23 pages2.+average+of+price+models BeforeMuskan AroraNo ratings yet

- Corprate FinanceDocument14 pagesCorprate Financeramisha tasnuvaNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Pepsico DCF Valuation SolutionDocument45 pagesPepsico DCF Valuation SolutionSuryapratap KhuntiaNo ratings yet

- Ratio Modeling & Pymamid of Ratios - CompleteDocument28 pagesRatio Modeling & Pymamid of Ratios - CompleteShreya ChakrabortyNo ratings yet

- Asian Paints (Autosaved) 2Document32,767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240No ratings yet

- Cpa 8Document13 pagesCpa 8justinorchidsNo ratings yet

- Calculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Document1 pageCalculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Prachi NavghareNo ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- Final AnalyticsDocument10 pagesFinal AnalyticsAries BautistaNo ratings yet

- Tata Power DCF valuationDocument6 pagesTata Power DCF valuationpriyal batraNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Alk Bird1Document5 pagesAlk Bird1evel streetNo ratings yet

- UltraTech Cements and Jaiprakash AssociatesDocument8 pagesUltraTech Cements and Jaiprakash AssociatesanushaNo ratings yet

- Smic - DCF - de Asis - Gomez - TriviñoDocument36 pagesSmic - DCF - de Asis - Gomez - TriviñoDiana De AsisNo ratings yet

- Smic - DCF & Computations - de Asis - Gomez - TriviñoDocument47 pagesSmic - DCF & Computations - de Asis - Gomez - TriviñoDiana De AsisNo ratings yet

- Presentation Group F Update T6Document21 pagesPresentation Group F Update T6Phạm Hồng SơnNo ratings yet

- Research Needed For Question 5Document4 pagesResearch Needed For Question 5Ahmed MahmoudNo ratings yet

- Motives For Merger: 1. Horizontal 2. Vertical 3. Conglomerate 4. ConcentricDocument41 pagesMotives For Merger: 1. Horizontal 2. Vertical 3. Conglomerate 4. ConcentricWasif HossainNo ratings yet

- Star River Electronics Ltd.Document10 pagesStar River Electronics Ltd.jack stauberNo ratings yet

- Suumary of Key Drivers 1.1Document6 pagesSuumary of Key Drivers 1.1Matthew SiagianNo ratings yet

- answer Data Tugas Kelompok 2 DoneDocument58 pagesanswer Data Tugas Kelompok 2 DoneAndriansyah RasyidNo ratings yet

- Yates Case Study - LT 11Document23 pagesYates Case Study - LT 11JerryJoshuaDiazNo ratings yet

- Tesla Income Statement and Financial Ratios 2016Document5 pagesTesla Income Statement and Financial Ratios 2016Mary JoyNo ratings yet

- TSE's 5 Year Projection Key Drivers SummaryDocument6 pagesTSE's 5 Year Projection Key Drivers SummaryMatthew SiagianNo ratings yet

- Consolidated Financial Statements - FY23Document59 pagesConsolidated Financial Statements - FY23Bhuvaneshwari .ANo ratings yet

- AbuDhabi Hotels - Case ExhibitsDocument14 pagesAbuDhabi Hotels - Case ExhibitsNandini RayNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsSudhanshu Kumar SinghNo ratings yet

- 10-Year Consolidated Financial Statements Summary (2001-2010Document12 pages10-Year Consolidated Financial Statements Summary (2001-2010anshu sinhaNo ratings yet

- Fm-Nov-Dec 2012Document14 pagesFm-Nov-Dec 2012banglauserNo ratings yet

- Financial PerformanceDocument16 pagesFinancial PerformanceADEEL SAITHNo ratings yet

- Tugas Valuasi Asii An Juni AstriandariDocument8 pagesTugas Valuasi Asii An Juni AstriandarigunawanwiyogosNo ratings yet

- Kotak - Investor Presentation Q1fy21Document38 pagesKotak - Investor Presentation Q1fy21Divya MukherjeeNo ratings yet

- Bayer Annual Report 2020Document265 pagesBayer Annual Report 2020Kaushal RajoraNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceAlexander RiosNo ratings yet

- Performance Attribution White PaperDocument5 pagesPerformance Attribution White Papermario rossiNo ratings yet

- Industry Brochure Arc Welding enDocument11 pagesIndustry Brochure Arc Welding enLeonardo CruzNo ratings yet

- Short Description + Scheme: Eur/Usd Gbp/Usd Xau/Usd Gbp/JpyDocument2 pagesShort Description + Scheme: Eur/Usd Gbp/Usd Xau/Usd Gbp/JpyAlexander RiosNo ratings yet

- Covid 19 PDFDocument123 pagesCovid 19 PDFAlexander Rios100% (1)

- Controlador VDocument78 pagesControlador VAlexander RiosNo ratings yet

- Install KUKA - Sim 2.1 enDocument11 pagesInstall KUKA - Sim 2.1 enrx7000No ratings yet

- PROFIBUS Guideline AssemblingDocument132 pagesPROFIBUS Guideline AssemblingSrikala VenkatesanNo ratings yet

- Ron Beaufort Training, LLC Hands-On Technical WorkshopsDocument17 pagesRon Beaufort Training, LLC Hands-On Technical WorkshopsAlexander RiosNo ratings yet

- Libro 1Document4 pagesLibro 1Alexander RiosNo ratings yet

- FatekServerDDEInterface EnuDocument4 pagesFatekServerDDEInterface EnuRui CaçoeteNo ratings yet

- CX200 Microprocessor Preset Timer-CounterDocument2 pagesCX200 Microprocessor Preset Timer-CounterAlexander RiosNo ratings yet

- ACAD Elec 2012 UserGuideDocument2,814 pagesACAD Elec 2012 UserGuideingluislongoNo ratings yet

- IAS 38 - Intangible Assets PDFDocument7 pagesIAS 38 - Intangible Assets PDFADNo ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationAung Zaw HtweNo ratings yet

- Uv0052 XLS EngDocument14 pagesUv0052 XLS EngAngel ThomasNo ratings yet

- Isca Illustrative Financial Statements 2019Document112 pagesIsca Illustrative Financial Statements 2019Grand OverallNo ratings yet

- Ratio (1) FDocument4 pagesRatio (1) FKathryn Bianca Acance100% (1)

- Lembar JawabDocument9 pagesLembar JawabRita CahyaniNo ratings yet

- Mutual Funds and Other Investment Companies (Lecture Notes) PDFDocument8 pagesMutual Funds and Other Investment Companies (Lecture Notes) PDFNgọc Phan Thị BíchNo ratings yet

- Payslip AlvinDocument5 pagesPayslip AlvinRoniever SubaanNo ratings yet

- Business Ethics and Corporate GovernanceDocument19 pagesBusiness Ethics and Corporate Governancepratima770No ratings yet

- Business Applications - FractionsDocument1 pageBusiness Applications - FractionsShiny NatividadNo ratings yet

- Financial Derivatives Question BankDocument5 pagesFinancial Derivatives Question Bankruchi agrawalNo ratings yet

- Company Law 13.04Document2 pagesCompany Law 13.04Vishesh GuptaNo ratings yet

- Chapter 16Document17 pagesChapter 16Punit SharmaNo ratings yet

- Forms of Business Org. CSRDocument9 pagesForms of Business Org. CSRBryan YaquitenNo ratings yet

- CV SofianingsihDocument5 pagesCV SofianingsihPrilianNo ratings yet

- Ventura, Mary Mickaella R Chapter 3 - MinicaseDocument6 pagesVentura, Mary Mickaella R Chapter 3 - MinicaseMary VenturaNo ratings yet

- Audit Entry Sheet 2Document43 pagesAudit Entry Sheet 2Charles MarkeyNo ratings yet

- The Role of Accounting in The BusinessDocument2 pagesThe Role of Accounting in The BusinessMuslim HabibieNo ratings yet

- FINMAN NotesDocument11 pagesFINMAN NotesIris FenelleNo ratings yet

- Cost of Capital-ProblemsDocument6 pagesCost of Capital-ProblemsUday GowdaNo ratings yet