Professional Documents

Culture Documents

Chapter 7-Ibt

Uploaded by

Jannefah Irish Saglayan0 ratings0% found this document useful (0 votes)

85 views1 pageaaa

Original Title

chapter 7-ibt

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaaa

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

85 views1 pageChapter 7-Ibt

Uploaded by

Jannefah Irish Saglayanaaa

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Free Trade — refers to a situation in which — is by far the oldest economic argument for

a government does not attempt to restrict government intervention

what its citizens can buy from or sell to — Alexander Hamilton proposed it in 1792

another country — according to this argument, many developing

countries have a potential comparative

advantage in manufacturing, but new

Tariff — is a tax levied on imports (or

manufacturing industries cannot initially

exports) compete with established industries in

two categories of tariffs: developed countries

• Specific tariffs — are levied as a fixed

charge for each unit of a good imported 2. Strategic Trade Policy — argument has

(for example, $3 per barrel of oil) two components:

• Ad valorem tariffs — are levied as a (1) it is argued that by appropriate actions, a

government can help raise national income if it

proportion of the value of the imported

can somehow ensure that the firm or firms that

good gain first-mover advantages in an industry are

domestic rather than foreign enterprises

Subsidy (2) it might pay a government to intervene in an

— is a government payment to a domestic industry by helping domestic firms overcome the

producer barriers to entry created by foreign firms that

— take many forms, including cash grants, have already reaped first-mover advantages

low-interest loans, tax breaks, and

government equity participation in

domestic firms

— by lowering production costs, subsidies

help domestic producers in two ways:

(1) competing against foreign imports

(2) gaining export markets

Import Quota — is a direct restriction on

the quantity of some good that may be

imported into a country

Tariff Rate Quota — a lower tariff rate is

applied to imports within the quota than

those over the quota

Voluntary Export Restraint (VER) — is a

quota on trade imposed by the exporting

country, typically at the request of the

importing country's government

Quota Rent — the extra profit that

producers make when supply is artificially

limited by an import quota

Local Content Requirement — is a

requirement that some specific fraction of

a good be produced domestically

Administrative Trade Policies — are

bureaucratic rules designed to make it

difficult for imports to enter a country

Dumping — is variously defined as selling

goods in a foreign market at below their

costs of production or as selling goods in a

foreign market at below their "fair" market

value

Antidumping Policies

— are designed to punish foreign firms that

engage in dumping

— the ultimate objective is to protect

domestic producers from unfair foreign

competition

* antidumping duties are often called

countervailing duties

Political Arguments for Intervention:

1. Protecting Jobs and Industries

2. National Security

3. Retaliation

4. Protecting Consumers

Economic Arguments for Intervention:

5. Furthering Foreign Policy Objectives

1. Infant Industry Argument

6. Protecting Human Rights

7. Protecting the Environment

You might also like

- Taxation ReviewerDocument145 pagesTaxation ReviewerJingJing Romero95% (95)

- Cooperative Code of The PhilippinesDocument13 pagesCooperative Code of The PhilippinesTyra Joyce Revadavia67% (6)

- Tariff & Non-Tariff BarriersDocument29 pagesTariff & Non-Tariff BarriersSanjivSIngh0% (1)

- ITLP - Notes2Document9 pagesITLP - Notes2Louis MalaybalayNo ratings yet

- Import Vs Export: Refers To The Exchange of Products and Services From One Country To AnotherDocument35 pagesImport Vs Export: Refers To The Exchange of Products and Services From One Country To AnotherMark Christian AlteradoNo ratings yet

- Chapter 5 Global Marketing StrategyDocument31 pagesChapter 5 Global Marketing StrategyAddi100% (1)

- Trade barriers explainedDocument35 pagesTrade barriers explainedMahesh DesaiNo ratings yet

- Customs Reviewer 2018 (Final)Document25 pagesCustoms Reviewer 2018 (Final)Mamerto Egargo Jr.No ratings yet

- Tamil Nadu's Chemical Industries Now LaggingDocument102 pagesTamil Nadu's Chemical Industries Now LaggingtechkasambaNo ratings yet

- Types of Trade BarriersDocument4 pagesTypes of Trade BarrierssumitdangNo ratings yet

- Heirs of Jose Lim Dispute Ownership of Partnership PropertiesDocument2 pagesHeirs of Jose Lim Dispute Ownership of Partnership PropertiesSharon G. BalingitNo ratings yet

- Heirs of Jose Lim Dispute Ownership of Partnership PropertiesDocument2 pagesHeirs of Jose Lim Dispute Ownership of Partnership PropertiesSharon G. BalingitNo ratings yet

- G.R. No. L-3146Document1 pageG.R. No. L-3146Jannefah Irish SaglayanNo ratings yet

- Working Capital Management PDFDocument6 pagesWorking Capital Management PDFLeviNo ratings yet

- Coal Gasification PDFDocument39 pagesCoal Gasification PDFSanat KumarNo ratings yet

- A Barangay Ordinance (Amalia Pilar)Document4 pagesA Barangay Ordinance (Amalia Pilar)don cong100% (1)

- International Trade and Agreement ReviewerDocument12 pagesInternational Trade and Agreement ReviewerJohn Rey Ominga EsperanzaNo ratings yet

- Policy instruments guide for imports and exportsDocument2 pagesPolicy instruments guide for imports and exportsRaven Cristal OlegarioNo ratings yet

- Government interventions in international tradeDocument3 pagesGovernment interventions in international tradeTCNo ratings yet

- Ibt ReviewerDocument9 pagesIbt ReviewerCatherine AntineroNo ratings yet

- Chapter 6 7 ReviewerDocument4 pagesChapter 6 7 ReviewerMachi KomacineNo ratings yet

- Tacn3 - Nhom Fire - Unit 1Document10 pagesTacn3 - Nhom Fire - Unit 1Nguyễn Quốc VươngNo ratings yet

- Tariffs and Quotas: Pros, Cons, and DefinitionsDocument9 pagesTariffs and Quotas: Pros, Cons, and DefinitionsAbby NavarroNo ratings yet

- International Business: Governmental Influence On TradeDocument18 pagesInternational Business: Governmental Influence On TradeUrstruly ChakriNo ratings yet

- Module 3 - Part 2 - Business Government RelationsDocument20 pagesModule 3 - Part 2 - Business Government RelationsKareem RasmyNo ratings yet

- 7 Types Trade Barriers ExplainedDocument2 pages7 Types Trade Barriers ExplainedChoo YieNo ratings yet

- Trade Barriers ExplainedDocument21 pagesTrade Barriers Explainedneelu_ch143078No ratings yet

- ECN 138. Chapter 11Document3 pagesECN 138. Chapter 11Louren Pabria C. PanganoronNo ratings yet

- Angelyn Lucido Dailine Gequillo: ReportersDocument42 pagesAngelyn Lucido Dailine Gequillo: ReportersPhero MorsNo ratings yet

- Tariff: Negative Consequences of TarrifDocument8 pagesTariff: Negative Consequences of TarrifAbby NavarroNo ratings yet

- Unit 1 - International Trade - Part 2Document23 pagesUnit 1 - International Trade - Part 2phươngNo ratings yet

- Lund University - Introduction To International Business - Lecture 3Document11 pagesLund University - Introduction To International Business - Lecture 3Jarste BeumerNo ratings yet

- Political Economy of International Trade Chapter - 5Document22 pagesPolitical Economy of International Trade Chapter - 5Suman BhandariNo ratings yet

- CHAPTER V. INTERNATIONAL BUSINESS AND TRADE POLICIESDocument16 pagesCHAPTER V. INTERNATIONAL BUSINESS AND TRADE POLICIESくど しにちNo ratings yet

- Bus 302 - CH 06 (F01)Document19 pagesBus 302 - CH 06 (F01)Hasnat nahid HimelNo ratings yet

- Events that Increased International Trade VolumeDocument1 pageEvents that Increased International Trade VolumeMARYROSE REGIONo ratings yet

- He Political Economy of International TradeDocument13 pagesHe Political Economy of International TradeMd. Mehedi HasanNo ratings yet

- Ita Finals ModuleDocument13 pagesIta Finals ModuleNherwin OstiaNo ratings yet

- International Trade BarriersDocument6 pagesInternational Trade BarriersPraveen K ReddyNo ratings yet

- Chapter 8 Government Intervention in International BusinessDocument6 pagesChapter 8 Government Intervention in International BusinessdivyaNo ratings yet

- 7.government Policy and International TradeDocument16 pages7.government Policy and International Tradechhavi nahataNo ratings yet

- International Trade and Public PolicyDocument3 pagesInternational Trade and Public PolicyCat Valentine100% (1)

- THE INSTRUMENTS AND CASES FOR TRADE POLICYDocument24 pagesTHE INSTRUMENTS AND CASES FOR TRADE POLICYPerlaz Mimi AngconNo ratings yet

- Direct Foreign Investment: Restrictions On ImportsDocument5 pagesDirect Foreign Investment: Restrictions On ImportsVenus Gavino ManaoisNo ratings yet

- International EconomicsDocument461 pagesInternational Economicsmagdalena weglarzNo ratings yet

- Name: - Shailesh Padhariya Roll: - 119069 Sub: - Environment For Business Topic: Assignment in Lieu of Mid-SemDocument32 pagesName: - Shailesh Padhariya Roll: - 119069 Sub: - Environment For Business Topic: Assignment in Lieu of Mid-SemMiral PatelNo ratings yet

- IBM Chap 6Document3 pagesIBM Chap 6dangvietanh63wNo ratings yet

- Kuliah 6 Bisnis InternasionalDocument21 pagesKuliah 6 Bisnis InternasionalWahyu NurlatifahNo ratings yet

- Government Influence on Trade PolicyDocument19 pagesGovernment Influence on Trade PolicyabubakarNo ratings yet

- Princess Eve's Guide to International Business TermsDocument5 pagesPrincess Eve's Guide to International Business TermsPrincess TorralbaNo ratings yet

- Tariffs types and effectsDocument12 pagesTariffs types and effectsPawan SharmaNo ratings yet

- Strategic Trade TheoryDocument5 pagesStrategic Trade Theoryლიკ 'აNo ratings yet

- HST 7 - Trade Policy InstrumentsDocument10 pagesHST 7 - Trade Policy InstrumentsMohammad Irfan Amin TanimNo ratings yet

- The Political Economy of International Trade: Mcgraw-Hill/IrwinDocument24 pagesThe Political Economy of International Trade: Mcgraw-Hill/IrwinGivana GrestyNo ratings yet

- Midterm Study GuideDocument5 pagesMidterm Study GuideRyan ThomasNo ratings yet

- Inbustra - Political EconomyDocument8 pagesInbustra - Political EconomyShinichii KuudoNo ratings yet

- TariffDocument5 pagesTariffSunny RajNo ratings yet

- Advanced Economics ProtectionismDocument24 pagesAdvanced Economics ProtectionismArlan BelenNo ratings yet

- Economic Management in International TradeDocument2 pagesEconomic Management in International TradeSharessa FraserNo ratings yet

- The Political Economy of International Trade: Mcgraw-Hill/IrwinDocument16 pagesThe Political Economy of International Trade: Mcgraw-Hill/IrwinYongSoonNo ratings yet

- Am 1Document4 pagesAm 15zy 555No ratings yet

- Sessions 12-15 Political Economy of International TradeDocument11 pagesSessions 12-15 Political Economy of International TradeMohan MahatoNo ratings yet

- COMMERCIAL POLICY INSTRUMENTSDocument23 pagesCOMMERCIAL POLICY INSTRUMENTSMANAGEMENT QUIZNo ratings yet

- The Political Economy of International Trade: Mcgraw-Hill/IrwinDocument18 pagesThe Political Economy of International Trade: Mcgraw-Hill/IrwinDuong DoNo ratings yet

- Sanita, Shaira Mica, V. TOPIC 3Document5 pagesSanita, Shaira Mica, V. TOPIC 3Adan EveNo ratings yet

- Chapter Nine:: Nontariff Trade Barriers and The New ProtectionismDocument26 pagesChapter Nine:: Nontariff Trade Barriers and The New ProtectionismAhmad RonyNo ratings yet

- Instruments or Tools of Commercial PolicyDocument2 pagesInstruments or Tools of Commercial PolicySamad SamNo ratings yet

- International Business: The New Realities: Fifth EditionDocument49 pagesInternational Business: The New Realities: Fifth EditionEswari PerisamyNo ratings yet

- Economics The Global Economy Topic 1 HSCDocument16 pagesEconomics The Global Economy Topic 1 HSCAnna BuiNo ratings yet

- 1, Trade PolicyDocument3 pages1, Trade PolicyNamrata SinghNo ratings yet

- IBT CH15 SummaryDocument2 pagesIBT CH15 SummaryJannefah Irish SaglayanNo ratings yet

- Problem 5-31 (Verna Company)Document7 pagesProblem 5-31 (Verna Company)Jannefah Irish SaglayanNo ratings yet

- IA Terminal OutputDocument5 pagesIA Terminal OutputTakuriNo ratings yet

- THEORIES Business Combination PDFDocument10 pagesTHEORIES Business Combination PDFJannefah Irish SaglayanNo ratings yet

- MCDocument4 pagesMCJannefah Irish SaglayanNo ratings yet

- CH. 7 REV. IBT RecoverDocument3 pagesCH. 7 REV. IBT RecoverJannefah Irish SaglayanNo ratings yet

- AnsDocument1 pageAnsJannefah Irish SaglayanNo ratings yet

- IBT CH15 SummaryDocument2 pagesIBT CH15 SummaryJannefah Irish SaglayanNo ratings yet

- Law221 - SaglayanDocument1 pageLaw221 - SaglayanJannefah Irish SaglayanNo ratings yet

- Rizal Ch. 16 20Document4 pagesRizal Ch. 16 20Jannefah Irish SaglayanNo ratings yet

- Compiled Cases For MidtermDocument36 pagesCompiled Cases For MidtermJannefah Irish SaglayanNo ratings yet

- SWDocument1 pageSWJannefah Irish SaglayanNo ratings yet

- Q and A PartialDocument3 pagesQ and A PartialJannefah Irish SaglayanNo ratings yet

- SeatworkDocument1 pageSeatworkJannefah Irish SaglayanNo ratings yet

- ACFrOgCJsZbltQVe4KHnm5JW xmsOQKPaWmo3kvI5Hufy1OttDnbN9K4cTaAyfDJ0Ub6PsCBurIeKFbeaqO4d7wCiw48QB8VUGwEa3VgoWXx7RZAMkFH3uU2XTeHJbPOcmSEMYVpCV1R8V5ox83rDocument10 pagesACFrOgCJsZbltQVe4KHnm5JW xmsOQKPaWmo3kvI5Hufy1OttDnbN9K4cTaAyfDJ0Ub6PsCBurIeKFbeaqO4d7wCiw48QB8VUGwEa3VgoWXx7RZAMkFH3uU2XTeHJbPOcmSEMYVpCV1R8V5ox83rJannefah Irish SaglayanNo ratings yet

- Chapter 2 - IBTDocument2 pagesChapter 2 - IBTJannefah Irish SaglayanNo ratings yet

- Volleyball Test PDFDocument2 pagesVolleyball Test PDFMar VallNo ratings yet

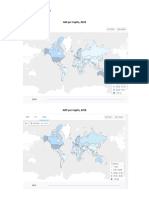

- World Political & Economy MapDocument2 pagesWorld Political & Economy MapJannefah Irish SaglayanNo ratings yet

- What Is The Importance of Studying RizalDocument13 pagesWhat Is The Importance of Studying RizalJobeah D CaballeroNo ratings yet

- Partnership and Corporation Test BankDocument8 pagesPartnership and Corporation Test BankJannefah Irish SaglayanNo ratings yet

- PE Volleyball NotesDocument5 pagesPE Volleyball NotesLeviNo ratings yet

- IBT PrelimDocument6 pagesIBT PrelimJannefah Irish SaglayanNo ratings yet

- Proactive Paper (The Accountant)Document1 pageProactive Paper (The Accountant)Jannefah Irish SaglayanNo ratings yet

- Fashion IndustryDocument2 pagesFashion IndustryKadam BhavsarNo ratings yet

- Quintessentially NickelDocument24 pagesQuintessentially NickelMikhaelNo ratings yet

- Americas Petrochemical Outlook H1 2018: Petrochemicals Special ReportDocument13 pagesAmericas Petrochemical Outlook H1 2018: Petrochemicals Special ReportrubenpeNo ratings yet

- International BusinessDocument52 pagesInternational BusinessBurvie Mei PanlaquiNo ratings yet

- 18 5 KurmaiDocument8 pages18 5 KurmaiMera SamirNo ratings yet

- CA - Cjs Nanda PresentationDocument68 pagesCA - Cjs Nanda PresentationAmit PrajapatiNo ratings yet

- Iii. Trade Policies and Practices by Measure (1) M D A I (I) ProceduresDocument19 pagesIii. Trade Policies and Practices by Measure (1) M D A I (I) ProceduresgghNo ratings yet

- Pospap WTODocument3 pagesPospap WTOnafis1993No ratings yet

- International BusinessDocument14 pagesInternational Businesssaloni singhNo ratings yet

- Trade Agreement RSA - MalawiDocument6 pagesTrade Agreement RSA - MalawiFrontyardservices Uganda limitedNo ratings yet

- Customs Summary Book Nov 20 by CA Yachana Mutha BhuratDocument52 pagesCustoms Summary Book Nov 20 by CA Yachana Mutha BhuratDevyani100% (2)

- Dumping StrategyDocument16 pagesDumping StrategyNehaNo ratings yet

- International Trade TheoryDocument35 pagesInternational Trade TheorySachin MalhotraNo ratings yet

- Export SubsidiesDocument19 pagesExport Subsidiesdj gangster80% (10)

- Board's Report Highlights FY PerformanceDocument263 pagesBoard's Report Highlights FY PerformanceHitansh GuptaNo ratings yet

- US-Colombia Trade Promotion AgreementDocument347 pagesUS-Colombia Trade Promotion AgreementAndersonBerryNo ratings yet

- An International Criminal CourtDocument3 pagesAn International Criminal CourtAllyssa FayeNo ratings yet

- 2019 Banking & Economy Current Affairs PDF in EnglishDocument134 pages2019 Banking & Economy Current Affairs PDF in EnglishRahulNo ratings yet

- Notice: Antidumping: Canned Pineapple Fruit From — Initiation of ReviewsDocument2 pagesNotice: Antidumping: Canned Pineapple Fruit From — Initiation of ReviewsJustia.comNo ratings yet

- Anti-Dumping Measures in the PhilippinesDocument8 pagesAnti-Dumping Measures in the PhilippinesShaina DalidaNo ratings yet

- Berhampur University: SyllabusDocument28 pagesBerhampur University: SyllabusMohit SinhaNo ratings yet

- Nguku Grace D61-75539-20112 PDFDocument66 pagesNguku Grace D61-75539-20112 PDFRS123No ratings yet

- Introduction To Custom Law: Prepared by DR Renu AggarwalDocument13 pagesIntroduction To Custom Law: Prepared by DR Renu AggarwalPramod PrabhasNo ratings yet

- Air Import Clearance - FinalDocument6 pagesAir Import Clearance - FinalNeha SinghNo ratings yet

- Customs Duty Overview: Concepts, Taxpayers, Scope and ExemptionsDocument39 pagesCustoms Duty Overview: Concepts, Taxpayers, Scope and ExemptionsLê Thiên Giang 2KT-19No ratings yet