Professional Documents

Culture Documents

Pension Fund Transfer Rules

Uploaded by

santoshkumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pension Fund Transfer Rules

Uploaded by

santoshkumarCopyright:

Available Formats

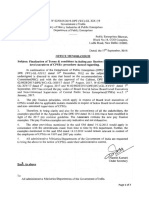

PENSION FUND REGULATORY

AND DEVELOPMENT AUTHORITY

B-14A,Chhartrapati Shivaji Bhavan,

Qutab Industrial Area,

Katwaria Sarai, New Delhi-11016.

Ph:011-26517501,26517503,26133730

Fax:011-26517507

VENKATESWARALU PERI Website:www.pfrda.org.in

General Manager

PFRDA/24/EXIT/11 Dated:21st March,2020

Subject: Accounting Procedure for crediting the amount withdrawn by the pensioner

from PFRDA and interest thereon in to Government Account for availing

benefit of Additional Relief on Death/Disability of the Govt. Servant covered

under NPS-reg.

Shri. K.Praveen Kumar

Chairman & Board of Directors,

A.P.Grameena Vikas Bank

Head Office :: Wranagal.

Dear Sir,

This has reference Letter no. PFRDA/2020/CGRO/30 Dated. 14-03-2020 from Shri.

G.V.S.Santosh Kumar, reference the OM.No.38/41/06/P&PW(A) , Governement of India Dated 5 th

May,2009 on the subject cited above.

Attention is invited to DP&PW OM. No. 38/41 /06/P&FW(A) dated 05.05.2009 to be read with OM

No.28/03/2018-P&PW(13) dated 02.04.2018 wherein it is stated the “The Exit and Withdrawals under

NPS regulations 2015 provides in para 6(e) that if the subscriber or the family members of the deceased

subscriber, upon his death / disability , avails the option of additional relief on death or disability provided

by the Government, the Government shall have right to adjust or seek transfer of the entire accumulated

pension wealth of the subscriber to itself. The subscriber or family members of the subscriber availing

such benefit shall specifically and unconditionally agree and undertake to transfer the entire accumulated

pension wealth to the Government, In lieu of enjoying or obtaining such additional reliefs like family

pension or disability pension or any other pensionary benefits from such Government authority.” It is also

stated in the OM dated 02.04.2018 that the family of the deceased Govt. servant is entitled to family

pension / Disability Pension under old pension scheme, if they want to avail the benefits under old

pension scheme. In this case the entire accumulated funds under NPS may be recovered from the family

with interest However, the possibility to adjust the recovery of accumulated wealth from arrears of family

pension may also be explored.”

2. For any further clarification on the DPPW OM dated 05th May 2009, Bank may kindly get in touch with

the DPPW itself.

3. This issues with approval of Joint Secretary, Department of Financial services, Ministry of Finance.

Yours Sincerely,

VENKATESWARALU PERI

General Manager

You might also like

- Letter-3 To Chairman From PFRDADocument2 pagesLetter-3 To Chairman From PFRDAsantoshkumarNo ratings yet

- Letter-3 To Chairman From PFRDA PDFDocument2 pagesLetter-3 To Chairman From PFRDA PDFsantoshkumarNo ratings yet

- Calculation of FPP in PensionDocument3 pagesCalculation of FPP in PensionchakriskzrdNo ratings yet

- G.O.No.171, Dated 10 June 2015.: Government of Tamil Nadu 2015Document3 pagesG.O.No.171, Dated 10 June 2015.: Government of Tamil Nadu 2015Gowtham RajNo ratings yet

- Epf Joint Declaration - RajeshDocument3 pagesEpf Joint Declaration - Rajeshravikoriveda123No ratings yet

- Go 35 16 03 2024Document3 pagesGo 35 16 03 2024Kiran kumarNo ratings yet

- FD (SPL) 209PEN2012 - 21FEB2015 Nps Contribution by Self BothDocument2 pagesFD (SPL) 209PEN2012 - 21FEB2015 Nps Contribution by Self BothbalrajsNo ratings yet

- RTI Letter From F&ADocument1 pageRTI Letter From F&AacervrockNo ratings yet

- AP Govt Revises Dearness Relief Rates for Pensioners from Jan 2013Document4 pagesAP Govt Revises Dearness Relief Rates for Pensioners from Jan 2013Billa Naganath0% (1)

- Fin e 299 2015Document3 pagesFin e 299 2015Gowtham RajNo ratings yet

- P Bhattacharya Pay FixationDocument1 pageP Bhattacharya Pay FixationMohamed AnsarNo ratings yet

- West Bengal Govt Raises DA to 6Document3 pagesWest Bengal Govt Raises DA to 6Paras SinhaNo ratings yet

- Finance (PGC) Department, Secretariat, Chennai-600 009Document3 pagesFinance (PGC) Department, Secretariat, Chennai-600 009Arumugam ManickavasagamNo ratings yet

- PRC 2010 D.A. On PensionDocument3 pagesPRC 2010 D.A. On PensionSEKHARNo ratings yet

- Fin e 138 2016Document3 pagesFin e 138 2016velxerox4123No ratings yet

- Government Sanctions 27% Interim Relief for PensionersDocument4 pagesGovernment Sanctions 27% Interim Relief for PensionersThappetla SrinivasNo ratings yet

- Grevience LetterDocument6 pagesGrevience LettersantoshkumarNo ratings yet

- FINANCE (Allowances) DEPARTMENT Secretariat, Chennai-600 009. Letter No.1074/FS/Fin. (Allowances) /2020, Dated:05-06-2020Document2 pagesFINANCE (Allowances) DEPARTMENT Secretariat, Chennai-600 009. Letter No.1074/FS/Fin. (Allowances) /2020, Dated:05-06-2020kmtharan.mca@gmail.comNo ratings yet

- Finance (PGC) Department, Secretariat, Chennai-600 009Document2 pagesFinance (PGC) Department, Secretariat, Chennai-600 009Gowtham RajNo ratings yet

- Rythu Sadhikara SamsthaDocument5 pagesRythu Sadhikara SamsthaChinnaBabuNo ratings yet

- MS56FINDocument2 pagesMS56FINBalu Mahendra SusarlaNo ratings yet

- Fin e 48 2013Document3 pagesFin e 48 2013Bernadette RajNo ratings yet

- 1481-F (P2)Document2 pages1481-F (P2)dd.dpscfinanceNo ratings yet

- Department Nati Nal Health Missi N: Family WelfarDocument8 pagesDepartment Nati Nal Health Missi N: Family WelfarAnil KumarNo ratings yet

- Ad-Hoc Bonus 2023-2024Document2 pagesAd-Hoc Bonus 2023-2024Aditya NandiNo ratings yet

- Employee's Provident Fund (EPF) at Times of India News PaperDocument100 pagesEmployee's Provident Fund (EPF) at Times of India News PaperAshok KumarNo ratings yet

- E Ashram Infotech - Profile and Project NotesDocument4 pagesE Ashram Infotech - Profile and Project NotesJR LifeNo ratings yet

- Fin e 474 2009Document4 pagesFin e 474 2009iniyarajNo ratings yet

- Telangana govt extends contract worker pay till Sept 2021Document2 pagesTelangana govt extends contract worker pay till Sept 2021mohanNo ratings yet

- Telangana Pension DR HikeDocument4 pagesTelangana Pension DR Hikeindhra sena reddyNo ratings yet

- 26.01.2016 Eps Will Apply Only Epf MembersDocument2 pages26.01.2016 Eps Will Apply Only Epf Membersd kumarNo ratings yet

- 6th Annual Report 2016-17-17014092761851082664Document278 pages6th Annual Report 2016-17-17014092761851082664Abdul NoufalNo ratings yet

- Policy DocumentDocument9 pagesPolicy DocumentMahesh ShindeNo ratings yet

- FIN Nance (HR.V) DepartmentDocument4 pagesFIN Nance (HR.V) DepartmentQC&ISD1 LMD COLONYNo ratings yet

- Malasakit Program OfficeDocument1 pageMalasakit Program OfficeTor YulsNo ratings yet

- G.O.Ms - No.164, Dated 07 July 2021.: Government of Tamil Nadu 2021Document4 pagesG.O.Ms - No.164, Dated 07 July 2021.: Government of Tamil Nadu 2021Monika AnnaduraiNo ratings yet

- GOs of All Kinds Leave PDFDocument16 pagesGOs of All Kinds Leave PDFchinthalapani jayapalreddyNo ratings yet

- Go RT No 740 Dated 28-4-2020 Extenstion of Term PRC PDFDocument1 pageGo RT No 740 Dated 28-4-2020 Extenstion of Term PRC PDFG.pradeep ReddyNo ratings yet

- YDocument4 pagesYBernadette RajNo ratings yet

- AP Leave Rules-Special LeavesDocument16 pagesAP Leave Rules-Special LeavesRamachandra Rao100% (11)

- AP govt order on 1-day salary contribution to CM Relief FundDocument2 pagesAP govt order on 1-day salary contribution to CM Relief FundPamela RomeroNo ratings yet

- Finance (Pension) Department: G.O.No.42, Dated 14 February, 2014Document3 pagesFinance (Pension) Department: G.O.No.42, Dated 14 February, 2014Papu KuttyNo ratings yet

- Computer Course Par e 130 2008Document5 pagesComputer Course Par e 130 2008chozhaganNo ratings yet

- Order Final MO Posting 05.02 .2020Document107 pagesOrder Final MO Posting 05.02 .2020scNo ratings yet

- PFDocument18 pagesPFPredhivrajNo ratings yet

- G.O. - M.S - 162 - Enhancement of QuotaDocument2 pagesG.O. - M.S - 162 - Enhancement of Quotasukesh sNo ratings yet

- PEZA V COADocument12 pagesPEZA V COARyan Christian LuposNo ratings yet

- Government Clarifies Family Pension RulesDocument3 pagesGovernment Clarifies Family Pension Ruleschandra shekharNo ratings yet

- Revision Authority For Central Civil PensionDocument1 pageRevision Authority For Central Civil PensionImages BazarNo ratings yet

- Moon Light Icecream ParlorDocument5 pagesMoon Light Icecream ParlorsrikanthNo ratings yet

- Guidelines for CPS Number AllotmentDocument3 pagesGuidelines for CPS Number AllotmentArumugam ManickavasagamNo ratings yet

- DA GoDocument6 pagesDA GoBalu Mahendra SusarlaNo ratings yet

- Sabbatical Leave Clarification 13092021Document2 pagesSabbatical Leave Clarification 13092021greggtldivisionNo ratings yet

- Procedure For Implementation of TDPS 2021 26 pdf1957Document98 pagesProcedure For Implementation of TDPS 2021 26 pdf1957Subhash VermaNo ratings yet

- G.O 7 6 1 2012 Pensioner FSF SubnDocument3 pagesG.O 7 6 1 2012 Pensioner FSF SubnCEO THENINo ratings yet

- Compassionte AppointmentDocument1 pageCompassionte Appointmentmuralisearching4No ratings yet

- By Order and in The Name of The Governor of Andhra PradeshDocument1 pageBy Order and in The Name of The Governor of Andhra Pradeshdevi priyankaNo ratings yet

- Contributory PensionDocument2 pagesContributory PensionvenkatasubramaniyanNo ratings yet

- Adobe Scan Sep 06, 2023Document1 pageAdobe Scan Sep 06, 2023ANkit Singh MaanNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Citizen Charter of Labour DepartmentDocument3 pagesCitizen Charter of Labour DepartmentsantoshkumarNo ratings yet

- GVS Doc GGG Doc 7Document28 pagesGVS Doc GGG Doc 7santoshkumarNo ratings yet

- GVSAADHARiiiDocument1 pageGVSAADHARiiisantoshkumarNo ratings yet

- Joint Circularby Aibea Ncbe Nobw Inbef DT 9 11 20 PDFDocument5 pagesJoint Circularby Aibea Ncbe Nobw Inbef DT 9 11 20 PDFjava javaNo ratings yet

- 9 Io Kwy GDocument8 pages9 Io Kwy GsantoshkumarNo ratings yet

- RBI Grade B 2022 Phase II FM Previous Year PaperDocument19 pagesRBI Grade B 2022 Phase II FM Previous Year PapersantoshkumarNo ratings yet

- Chure OPD ExternalDocument8 pagesChure OPD ExternalsantoshkumarNo ratings yet

- GVSAADHARiiiDocument1 pageGVSAADHARiiisantoshkumarNo ratings yet

- SC - 7783oooDocument7 pagesSC - 7783ooosantoshkumarNo ratings yet

- Direct Recruitment Drive 2022-23: Application FormDocument3 pagesDirect Recruitment Drive 2022-23: Application FormsantoshkumarNo ratings yet

- RBI Grade B 2022 Phase II ESI Previous Year Paper AnalysisDocument24 pagesRBI Grade B 2022 Phase II ESI Previous Year Paper AnalysissantoshkumarNo ratings yet

- RBI Grade B 2021 Phase II ESI Previous Year Paper QuestionsDocument15 pagesRBI Grade B 2021 Phase II ESI Previous Year Paper QuestionssantoshkumarNo ratings yet

- RBI Grade B 2018 Phase II ESI Previous Year PaperDocument32 pagesRBI Grade B 2018 Phase II ESI Previous Year PapersantoshkumarNo ratings yet

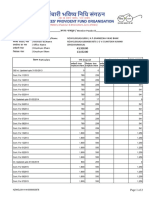

- Gvs EPFStatementDocument2 pagesGvs EPFStatementsantoshkumarNo ratings yet

- Terminal BenefitsDocument63 pagesTerminal BenefitssantoshkumarNo ratings yet

- Gssvsrao EPFStatementDocument4 pagesGssvsrao EPFStatementsantoshkumarNo ratings yet

- Retirement Settelement BenefitsDocument15 pagesRetirement Settelement BenefitssantoshkumarNo ratings yet

- Government of Andhra PradeshDocument3 pagesGovernment of Andhra PradeshsantoshkumarNo ratings yet

- Tsplus Remote Access Documentation: General InformationDocument408 pagesTsplus Remote Access Documentation: General InformationsantoshkumarNo ratings yet

- IjklDocument3 pagesIjklsantoshkumarNo ratings yet

- SantoshDocument42 pagesSantoshsantoshkumarNo ratings yet

- Widows KumarDocument2 pagesWidows KumarsantoshkumarNo ratings yet

- Government of Andhra Pradesh: 'Rzqordgiurpzzzwvhpsor/HhvfrpDocument3 pagesGovernment of Andhra Pradesh: 'Rzqordgiurpzzzwvhpsor/HhvfrpsantoshkumarNo ratings yet

- In The Supreme Court of India Civil Appellate Jurisdiction Civil Appeal No. 59 of 2021Document19 pagesIn The Supreme Court of India Civil Appellate Jurisdiction Civil Appeal No. 59 of 2021santoshkumarNo ratings yet

- Government of Andhra Pradesh: 'Rzqordgiurpzzzwvhpsor/HhvfrpDocument3 pagesGovernment of Andhra Pradesh: 'Rzqordgiurpzzzwvhpsor/HhvfrpsantoshkumarNo ratings yet

- Important Board LetterDocument2 pagesImportant Board LettersantoshkumarNo ratings yet

- Office Memorandum EludingDocument7 pagesOffice Memorandum EludingsantoshkumarNo ratings yet

- The Chairman and Board Members A.P. Grameena Vikas Bank. Head Office:: Warangal Telangana StateDocument3 pagesThe Chairman and Board Members A.P. Grameena Vikas Bank. Head Office:: Warangal Telangana StatesantoshkumarNo ratings yet

- Union Card Corporate Application FormDocument2 pagesUnion Card Corporate Application FormsantoshkumarNo ratings yet

- Nagaland Rural Bank Circular on Pension RegulationsDocument19 pagesNagaland Rural Bank Circular on Pension RegulationssantoshkumarNo ratings yet

- Comparision - Minutes of Meeting 3rd SBC - TNDocument14 pagesComparision - Minutes of Meeting 3rd SBC - TNsrikanth13579No ratings yet

- Quia - InS 21 Quiz 2 - Session Ins 21 Chapter 2Document5 pagesQuia - InS 21 Quiz 2 - Session Ins 21 Chapter 2toll_meNo ratings yet

- Medical Physical Care PlanDocument1 pageMedical Physical Care PlanAmanda's GardenNo ratings yet

- Banking Resume TempelateDocument3 pagesBanking Resume TempelateTarek HassanNo ratings yet

- Introduction to Syndicated LoansDocument35 pagesIntroduction to Syndicated Loansdivyapillai0201_No ratings yet

- Case Study YellowCabDocument1 pageCase Study YellowCabpymntsNo ratings yet

- Assignment On Insurance Policy Method Abd Sinking Fund MethodsDocument2 pagesAssignment On Insurance Policy Method Abd Sinking Fund Methodsgaurav prajapatiNo ratings yet

- HC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022Document4 pagesHC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022CAIO HENRIQUE FIORDELIZNo ratings yet

- BFSM Unit - 5Document37 pagesBFSM Unit - 5Svijayakanthan SelvarajNo ratings yet

- Table of Contens (2 Files Merged)Document53 pagesTable of Contens (2 Files Merged)Md Khaled NoorNo ratings yet

- SRS Cargo Shipment DetailsDocument1 pageSRS Cargo Shipment DetailsVivek KumatNo ratings yet

- Sno Grank Arno Name Community T.Mark Allotted To CategoryDocument180 pagesSno Grank Arno Name Community T.Mark Allotted To CategorykkalpanaseenuNo ratings yet

- 01 Assignment 13-1 MichelleDocument2 pages01 Assignment 13-1 MichelleMichelle Joy CutamoraNo ratings yet

- 50100500407621_1711954613447Document11 pages50100500407621_1711954613447iblfinserv0No ratings yet

- GP Medi Ins For Club Agts 2009-10Document4 pagesGP Medi Ins For Club Agts 2009-10tsrajanNo ratings yet

- RM Change Request FormDocument2 pagesRM Change Request FormSk Singh0% (1)

- Audit of Inventory Cut-off ProceduresDocument3 pagesAudit of Inventory Cut-off ProceduresDenise RoqueNo ratings yet

- Cindy brigita-PLM-GQPQYZ-CGK-FLIGHT - ORIGINATINGDocument3 pagesCindy brigita-PLM-GQPQYZ-CGK-FLIGHT - ORIGINATINGcindy brigitaNo ratings yet

- Accounting: For AllDocument673 pagesAccounting: For AllSimphiwe NandoNo ratings yet

- Final Project Icici SegmentDocument38 pagesFinal Project Icici SegmentNitinAgnihotriNo ratings yet

- FCB Records Summarized 20-22Document8 pagesFCB Records Summarized 20-22Eric HopkinsNo ratings yet

- Chapter 2Document35 pagesChapter 2Demise WakeNo ratings yet

- Caudit QuizzesDocument13 pagesCaudit QuizzescharlesjoshdanielNo ratings yet

- Istoric Cont: Criterii de CautareDocument4 pagesIstoric Cont: Criterii de CautareRyō Sumy0% (1)

- Tracxn Research Grocery Tech LandscapeDocument104 pagesTracxn Research Grocery Tech LandscapeMOhitNo ratings yet

- AP.2904 - Cash and Cash Equivalents.Document7 pagesAP.2904 - Cash and Cash Equivalents.Eyes Saw0% (1)

- (M2M), Skynet or Internet of EverythingDocument15 pages(M2M), Skynet or Internet of EverythingAdil AhmedNo ratings yet

- This Contract Is Entered Into Effect On July 19th, 2021 BetweenDocument1 pageThis Contract Is Entered Into Effect On July 19th, 2021 BetweenErika GarayoNo ratings yet

- Arens Aas17 PPT 01 PDFDocument38 pagesArens Aas17 PPT 01 PDFSin TungNo ratings yet

- Cash Sales Recording Manual For Merchandising BusinessDocument3 pagesCash Sales Recording Manual For Merchandising BusinessWræn ŸåpNo ratings yet