Professional Documents

Culture Documents

Daily Edible Oil Analysis Dt.22112019 PDF

Daily Edible Oil Analysis Dt.22112019 PDF

Uploaded by

Riksan RiksanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Edible Oil Analysis Dt.22112019 PDF

Daily Edible Oil Analysis Dt.22112019 PDF

Uploaded by

Riksan RiksanCopyright:

Available Formats

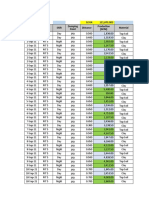

Daily Edible oil Analysis Date: Friday, November 22, 2019 Time: 08.

45 AM IST

Market watch

% Volume Open Int

Close Change Open High Low Open Int Curr/Unit

change (In Tons) change

NCDEX Soy

Oil

Dec 803.85 -4.70 -0.58 811.50 811.50 800.70 17920 49240 2130 INR/10Kg

Jan 806.50 -4.45 -0.55 814.90 814.90 803.10 9300 29460 3100 INR/10Kg

Feb INR/10Kg

807.25 -4.55 -0.56 816.00 816.50 807.25 500 510 260

MCX CPO

Nov 654.50 -2.60 -0.40 658.00 661.50 651.20 7440 25490 -490 INR/10Kg

Dec 660.50 -2.40 -0.36 661.20 667.40 657.40 16020 44000 470 INR/10Kg

Jan 660.20 -2.30 -0.35 659.60 665.90 658.10 2470 8240 580 INR/10Kg

Commentary Dec Jan Feb REFIEND SOY OIL IMPORT PARITY

NCDEX Soy Oil Calendar Spreads Particulars Argentina

Soy oil futures on NCDEX settled lower on 803.85 806.50 807.25 FOB ($/ Ton) of Soy Degum oil (Dec) 703

profit taking tracking weakness in CBO Toy Dec 0 2.65 3.4 Freight + Insurance + Landed weight 58

oil futures and easing Argentina CDSBO FOB Jan -2.65 0 0.75 CIF Value (incl. shortage) 761.00

prices. Feb Custom Duty (INR Import ref rate 72.75)

-3.4 -0.75 0 21315

MCX CPO Calendar Spreads Dollar conversion to INR @ 72.10 76183

CPO futures on MCX settled lower on profit

taking triggered by weakness in BMD CPO 654.50 660.50 660.20 Landing Charges & All expenses 1000

futures and CBOT soy oil futures. Basis -5 1 0.7 Landed cost at WC Indian / ton 77183

Nov 0 6 5.7 Landed cost at WC India /10 kg 772

CPO-SOY OIL spread is currently at -149 for

Dec -6 0 -0.3 Refining cost 28

Nov-Dec and -152 for Nov-Jan, while. For

Dec-Dec it is at -143 and for Dec-Jan -146. Jan -5.7 0.3 0 Soy Oil Refined @ Kandla +GST 800

Soy Oil-CPO Spreads (Futures) Freight to Indore 27

Argentina Soy oil basis surge higher but Refined Soy Oil Soy Oil Refined @ Indore +GST 827

could not fully compensate losses in CPO IMPORT PARITY

CPO Dec Jan Feb

underlying futures. CDSBO FOB offer prices

go down by $7 to $703/MT for Dec loadings. Nov -149 -152 -153

Dec -143 -146 -147 Particulars Indo/Mal

CPO futures on MCX trading Rs. 17 per 10 Kg Jan -144 -146 -147 C&F Value ($/Ton) of CPO(Dec) 645.00

lower, while, while, Soy oil futures on NCDEX India Import Tariffs on Veg Oils($/MT) 19622

Custom Duty (INR Import ref rate 72.75)

trading Rs. 4 per 10kg higher from landing

prices at Kandla. Rev Date CPO RBD CDSBO Dollar Conversion to INR @ 72.10 66127

15/11/2019 613 661 761 Landing Charges (incl. shortage) 1000

31/10/2019 560 586 743 Landed cost at WC India / ton 67127

15/10/2019 534 566 730 Landed cost at WC India /10 kgs 671

www.sunvingroup.com Sunvin Research Report Page 1 of 7

Daily Edible oil Analysis Date: Friday, November 22, 2019 Time: 08.45 AM IST

Physical market check (Previous day closing) (in Rs/10Kg, *-USD/Ton)

Soy Oil

CDSBO Soy Oil Solvent Crude Refined Soy oil Del CDSBO Spot HS CDSBO Spot CDSBO CIF

Date CDSBO Brazil FOB*

Argentina Fob* Indore+ Indore+ JNPT HS Kandla West Coast*

21Nov 703(D) 714(J) 765 800 770 756 763(D)

20Nov 710(D) 728(J) 748 788 765 756 768(D)

19Nov 702(D) 722(J) 748 788 765 753 759(D)

18Nov 697(D) 712(J) 748 787 765 750 752(D)

Physical market check (Previous day closing) (in Rs/10Kg, *-USD/Ton)

Palm Oil

CPO Spot C&F CPO Spot HS RBD Olein Spot C&F RBD Olein Spot RBD Olein Spot

Date CPO Spot FOB* RBD Olein Spot FOB*

West Coast* Kandla West Coast * HS Kandla+ HS Mumbai+

21Nov 610.00 645.00(D) 653 670.00(D) 652.50(D) 716 730

20Nov 611.25 645.00(D) 665 675.00(D) 655.00(D) 710 723

19Nov 598.75 635.00(D) 642 660.00(D) 642.50(D) 710 723

18Nov 595.00 630.00(D) 637 655.00(D) 635.00(D) 708 718

Physical market check (Previous day closing) (in Rs/10Kg., *-USD/Ton)

Sun Oil

Sun Oil Russia Sun Oil Ukraine Sun Oil CSFO CIF Sun Oil Exp Ref Crude Sun Oil Sun Oil Exp Sun Oil Ref

Date

FOB* FOB* Argentina FOB* West Coast* Mumbai+ Mumbai+ Mumbai+ Chennai+

21Nov 708(D) 728.0(D) 710(ND) 775.00(D) 830 777 785 840

20Nov 700(D) 720.0(D) 710(ND) 772.50(D) 840 780 785 845

19Nov 695(D) 717.0(D) 710(ND) 760.00(D) 840 765 785 845

18Nov 690(D) 709.0(D) 710(ND) 755.00(D) 840 760 790 845

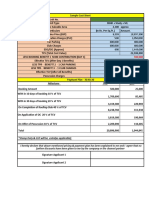

Soybeans (Indore) INR +128, +$1.8 Rape Mustard Seed (Jaipur) INR -119 -$1.7 INR -36 +$0.5

Net Crush Margins (Previous day) Spot prices Net Crush Margins (Previous day) Expeller Kacchi Ghani

(A)Bean For Plant/ ton 39200 (A)Mustard Seed For plant/ton 44900 44900

(B) Crush cost/ton 1200 (B)Crushing Charges/ton 850 1100

(C) Total cost to crusher/ton (A+B) 40400 (C) Lab Tolerance @ 1% of A 449 449

(D) Refined oil Excluding GST/10kgs 800 (D)Discount @ 1% of (A) 449 449

(E) Refining expenses/10kgs 29 (E) Cost/ton (A+B-C-D) 44852 45102

(F) Solvent Oil/10kgs 771 (F) Mustard oil/10kgs 854 863

(G) Oil share @18% /ton (18% of F) 13878 (G) Oil Realization/ton 37% of F 31598 31931

(H) DOC-Ex Indore/ton 32500 (H) Oil Cake/ton 20850 20850

(I) DOC-Ex Kandla/ton 33800 (I) Meal Realization/ton 63% of H 13135.5 13135.5

(J) Meal Share @ 82% /ton (82% of H) 26650 (J)Total Realization/ton (G+I) 44733.5 45066.5

(K) Net Realization/ton (G+J) 40528 (K) Net Crush Margins/ton (J-E) -118.5 -35.5

(L) Net Crush Margins/ton (K-C) 128 (L)Net Crush Margins/ton ($)with INR@71.7 -1.65 -0.50

(M) Net Crush Margins/ton ($) with INR@71.7 1.79

www.sunvingroup.com Sunvin Research Report Page 2 of 7

Daily Edible oil Analysis Date: Friday, November 22, 2019 Time: 08.45 AM IST

International Futures

CBOT Soy Oil Close Chg Open High Low Volume

Dec 30.69 -0.51 31.20 31.25 30.57 58458

Jan 30.88 -0.53 31.41 31.45 30.75 78680

Mar 31.16 -0.53 31.71 31.71 31.03 27839

E-CBOT Soy oil LTP Chg %Chg Open High Low

Dec 30.71 0.02 0.07 30.69 30.73 30.64

Jan 30.88 0.00 0.00 30.88 30.91 30.82

Mar 31.13 -0.03 -0.10 31.13 31.18 31.10

BMD CPO LTP Chg %Chg Open High Low

Dec 2558 -14 -0.54 2558 2558 2558

Jan 2626 3 0.11 2608 2633 2607

Feb 2666 -1 -0.04 2650 2678 2650

Mar 2686 -2 -0.07 2670 2696 2670

DCE Soy oil LTP Chg %Chg Open High Low

Jan 2020 6336 -54 -0.85 6338 6384 6304

May 2020 6336 -62 -0.97 6368 6402 6304

DCE RBD Olein LTP Chg %Chg Open High Low

Jan 2020 5556 -42 -0.75 5544 5580 5516

May 2020 5776 -42 -0.72 5780 5806 5740

CBOT Soy Oil Calendar Spread

Month Dec Jan Mar May

Spot Basis (Illinois) 31.19 30.71 30.89 31.13 31.48

-0.48 -0.3 -0.06 0.29

Dec 0 0.18 0.42 0.77

Jan -0.18 0 0.24 0.59

Mar -0.42 -0.24 0 0.35

May -0.77 -0.59 -0.35 0

BMD CPO Calendar spreads

Month Dec Jan Feb Mar

Spot Malaysia CPO MYR 2610 2558 2626 2667 2686

Basis -52 16 57 76

Dec 0 68 109 128

Jan -68 0 41 60

Feb -109 -41 0 19

Mar -128 -60 -19 0

www.sunvingroup.com Sunvin Research Report Page 3 of 7

Daily Edible oil Analysis Date: Friday, November 22, 2019 Time: 08.45 AM IST

Commodity Pairs Spreads Gas Oil & Bio-diesel LTP

CPO-SOY -37 ICE EU Low Sulphur Gas Oil ($/MT) 584

PALM OIL-GAS OIL(POGO) +56 PME South East Asia($/MT) 725

BEAN OIL-GAS OIL(BOGO) +93 SME Argentina FOB ($/MT) 760

Imported Veg Oil Spreads (Dec Shipments) At Indian Ports (21 Nov 2019)

CPO RBD SUN SOY CANOLA

BASIS

645 670 775 763 795

CPO(CNF)

0 -25 -130 -118 -150

RBD(CNF)

25 0 -105 -93 -125

SUN(CIF)

130 105 0 12 -20

SOY(CNF)

118 93 -12 0 -32

CANOLA(CNF)

150 125 20 32 0

Veg Oil Market Related Currencies and Index

Currency Last Change Currency Last Change Index Last Change

Argentine Peso Indian Rupee US Dollar

59.73 -0.06 71.74 -0.003 Index 97.951 -0.042

Brazilian Real Indonesia Rupiah CRB Index

4.193 -0.0025 14095 15 180.7277 1.7637

British Pound Malaysia Ringgit GOLD 1464.65 1.05

1.2914 0.0001 4.166 -0.002

Canadian Dollar Philippine Piso SILVER 17.047 -0.018

1.3277 -0.0008 50.78 -0.04

Chinese Yuan Russia Rouble Brent Crude 63.59 -0.38

7.0304 0.0019 63.694 -0.001 Oil

Euro Ukraine Hryvinia WTI Crude 58.19 -0.39

1.1061 0.0004 24.16 0.02 Oil

www.sunvingroup.com Sunvin Research Report Page 4 of 7

Daily Edible oil Analysis Date: Friday, November 22, 2019 Time: 08.45 AM IST

Weather & Impact on Oil crops

(Source: Refinitiv Eikon)

ARGENTINA/PARAGUAY 10-DAY: A strong frontal passage in the next several days will be the key feature of the Argentina/Paraguay 10-day

forecast. The front will hit the major crop regions of Argentina around Buenos Aires first, dropping temperatures down to 1-3 °C below normal

already averaged across the next 5 days. Meanwhile, northern Argentina and Paraguay will hang on to warmth 1-2 °C above normal during the

same period. The cold front will have swept across the entire region by the 6-10 day outlook, with temperatures 3-5 °C cooler than normal over

Argentina/Paraguay. The powerful cold front will bring near to above normal rainfall through 28-November across nearly all of

Argentina/Paraguay. The heaviest totals will hit Argentina in a fairly widespread manner, with surpluses of 30-60 mm (1.2-2.4 in). There will be

pockets of near to slightly drier than normal conditions around Buenos Aires and western Paraguay, but all regions will receive either modest or

heavy rainfall. The rainfall distribution is perfect for making a positive impact on all crops, as Argentina high rainfall benefits wheat while more

modest totals in Paraguay will facilitate corn/soybean plantings.

BRAZIL 10-DAY: A divided weather pattern will prevail across most of Brazil through 10 days, as it will not miss out on regional impacts from a

cold front passing through. Northeast Brazil will be the only area with persistent warmth, featuring temperatures 2-4 °C above normal through

10 days. South Brazil will be 1-2 °C warmer than normal through 5 days, while Central-West and Southeast Brazil will be near normal. During

the 6-10 day outlook, South Brazil will flip to temperatures 1-3 °C cooler than normal while Central-West and Southeast Brazil will remain near

normal along the frontal boundary. Rainfall totals through 28-November will be near to above normal in most areas of Brazil, with surpluses as

high as 50 mm (~2 in) in some localized areas. This widespread uptick in rainfall is mostly due to the advancing cold front in the forecast, which

will create precipitation everywhere in its vicinity. Pockets of slight dryness could remain in Mato Grosso and Bahia, but even those regions will

receive some rains. Though cool/wet weather could slow corn/soybean planting progress in Brazil temporarily, the soil moisture boost will be

well received and supports upside for the crops.

International News & Events

CBOT soybean futures fell to their lowest level in almost two months on Thursday as uncertainty about progress in U.S-China trade talks

overshadowed support from stronger-than-expected weekly U.S. export sales.

CBOT Soybean oil futures settled sharply lower and funds started to book profits amid weakness in soybean futures and easing palm oil prices

from higher range. Soy oil basis in Argentina and Brazil remained firm but CDSBO FOB prices goes down due to sharply lower underlying futures.

According to CFTC report, On CBOT Thursday, funds were net sellers in Soybean (-7,500), Soy Oil (-7,000), and net buyers in Soy Meal (+3,000).

US Weekly sales and exports: Soybeans: Net sales of 1,516,700 MT, up 22% from the previous week and 39% from the prior 4-week average,

Exports 1,707,400 MT, up 35% from the previous week and 18% from the prior 4-week average, Soymeal: Net sales 196,400 MT, down 43%

from the previous week and 12% from the prior 4-week average. Exports 159,900 MT. Soy Oil: Net sales 39,100 MT and exports 2,400 MT.

USDA said, China agreed to buy 568,573 MT of US soybeans in the week ended Nov. 14, down from 760,527 MT a week earlier. US soybean

shipments headed to China during the week rose to 873,573 MT from 693,527 MT.

Basis bids for corn shipped by barge to the U.S. Gulf Coast were mostly flat on Thursday, underpinned by moderate demand for export-grade

grain but capped by sluggish export demand. Spot basis offers for U.S. soymeal held steady at most processors in the rail and truck markets.

As per Bolsa De Cereales, by Nov 20, Argentina 2019/20 soybean planting 46.8% completed in compare to 29.6% last week, 43% last year and

45% 5-year average. While, Sunflower planting 88.5% completed in compare to 78.1% last week, 91.6% last year and 83.2% 5-year average.

Argentina govt estimated 2019/20 soy planting area at 17.7 mln Ha (43.7 mln Acr), up slightly from its previous 17.6 mln Ha forecast.

ICE canola futures dipped on Thursday, ending a five-day winning streak, pressured by a broader fall in global veg oil futures.

SPPOMA South Malaysian palm oil Nov 1-20 v/s Oct 1-20: Production: -11.55%, Yields: -14.02%, OER: +0.47%.

Growth in palm oil production will slow in the next few years, helping reduce stockpiles and boost prices, James Fry from LMC Intl said.

Crude oil prices were toppled from their highest in nearly two months on Friday by doubts over future demand for crude as uncertainty

continues to shroud a potential U.S.-China trade deal, and along with it the health of the global economy.

www.sunvingroup.com Sunvin Research Report Page 5 of 7

Daily Edible oil Analysis Date: Friday, November 22, 2019 Time: 08.45 AM IST

Sunvin Market Outlook

Market Commentary

Tracking weakness in CBOT soy oil futures overnight and DCE RBD palm olein futures in Asian hours, BMD CPO futures open gap lower in continuation

of the downside correction triggered Thursday. However, prices seen bouncing back from key technical support level (For details, see page number 7)

and moving sideways amidst lack of fresh bullish support. On production front Malaysia Nov palm oil production is said to be -5-7%, while export is

likely to be 4-5% up. If it realized, Nov end stocks would be seen going lower. Indonesia PTP tender traded further higher by $3 per MT Thursday, while,

APEX CPO futures continued to stay at premium over BMD CPO futures indication a supply issue at Indonesian side. On destination front, China looking

to buy more veg oils ahead of Luna new year holidays but the weakness in DCE RBD palm olein futures may not give a profitable hedging opportunity

now and market would wait for a further upside resumption in the futures. Further, China has seen buying Old and new Brazilian soybean crop as Us-

China trade agreement is unlikely to happen anytime soon. The resumption of South American soybean buying could pressure the veg oil import as

China’s oilseed crush margins have improved recently due to high oil share. In India, buyers are mostly absent in palm oil as the net payable import

duties are again pushed higher after Indian govt revised the fortnightly import tariffs and USDINR ref rate for import at higher side. The RBD palm olein

discount over soybean oil and Sunflower oil has converged significantly, while, negative import margins continued to caution the buyers from taking

larger interest in palm oil. On biodiesel front, the unfavorable POGO spread for a longer period of time has started to show the effects now and palm oil

may find difficult to continue to hold the bullish momentum without remain attractive for discretionary blending. In external markets, Soy oil futures on

CBOT drops sharply lower Thursday and hence CDSBO FOB prices at South American origins also came down despite the basis remained firm. At Black

sea markets, sun oil prices continue to find buying support as the premium oil being offered at attractive spread over the competition. However, the

larger export availability at Ukraine and Russia is continued to cap the recovery in sun oil prices. Rapeseed oil prices at European markets seen

correcting lower as Canola futures on ICE and Rapeseed futures on Euronext exchange closed lower. Next key data to watch: MPOA Malaysia Nov 1-20

Palm oil production, Malaysia Nov 1-25 palm oil exports and SPPOMA Nov 1-25 South Malaysian palm oil production. Happy Weekend.

Technical Commentary

BMD CPO FEB (MYR/MT): After resisting at upper Bollinger Band, prices have corrected up to the rising trend line support. A bounce back from 2650

levels is being witnessed so far. It seems a distribution pattern is taking place in daily chart and it would take some time before heading lower for a

more intense retracement of the entire rise from 2140 – 2709. Resistance is at 2685 – 2700. Support is at 2650 – 2637.

CBOT Soy Oil DEC (Cents/lb): In line with our expectations, prices corrected lower up to 30.57 so far. Now resistance is at 30.94 – 31.10 and support is

at 30.45 – 30.25. A volatile price movement in 30.25 – 31.10 is likely scenario for some time.

APEX CPO FEB (USD/MT): The trend is up and high registered of $663.25 so far. Price is correcting lower now and trend line support is at $649. A

correction towards $649-647 area is likely to be seen before market again attempts to continue the bullish trend and break the high of $663.25 and

try to test the upper Bollinger Band at $671.

DCE RBD Palm Olein JAN (CNY/MT): The trend is up but anticipated profit taking is being witnessed. Key support of 5566 has broken and it could be the

first warning that a correction of the entire rise is started to unfold. Now as long as high of 5644 is intact, expect lower levels of 5460 – 5370 to be

tested coming sessions.

USDINR: Resistance is at 72 and support is at 71.50. Either side break of these levels would indicate the future course of prices act ion.

CPO MCX NOV: The trend still remains up. Support is at 650 – 645 and resistance is at 658 – 662. Expect a dual side momentum for the time-being.

www.sunvingroup.com Sunvin Research Report Page 6 of 7

Daily Edible oil Analysis Date: Friday, November 22, 2019 Time: 08.45 AM IST

SOY OIL NCDEX DEC: Resistance is at 813 and key support is at 797. Expect a range-bound momentum in 797-813 area for some time now.

SOYBEAN NCDEX DEC: The trend is up. High registered of 4065 after a mini breakout above 4003 but market could not close above it. Another

attempt to move higher is likely to be seen. Expect higher range of 4060 – 4095 in coming sessions. Support is at 3958 – 3930.

Laughter Cartoons & Disclaimer

Analysis by

Anilkumar Bagani

Research Head – Sunvin Group

With invaluable insights by

Mr. Sandeep Bajoria

CEO - Sunvin Group

Disclaimer: This Document has been prepared by Sunvin Research (A Division of Sunvin Group). The information, analysis and estimates

contained herein are based on Sunvin Research assessment and have been obtained from sources believed to be reliable. This document

is meant for the use of the intended recipient only. This document, at best, represents Sunvin Research opinion and is meant for general

information only. Sunvin Research, its directors, officers or employees shall not in any way be responsible for the contents stated herein.

Sunvin Research expressly disclaims any and all liabilities that may arise from information, errors or omissions in this connection. This

document is not to be considered as an offer to sell or a solicitation to buy any securities. Sunvin Research, its affiliates and their

employees may from time to time hold positions in securities referred to herein. Sunvin Research or its affiliates may from time to time solicit

from or perform investment banking or other services for any company mentioned in this document.

*The Copyright for this report is being applied for.

www.sunvingroup.com Sunvin Research Report Page 7 of 7

You might also like

- Fcpo-Bmd News: Futures Tumble Dragging Cash Prices Lower To Compete With Us$80 Reduction in Indonesian LevyDocument4 pagesFcpo-Bmd News: Futures Tumble Dragging Cash Prices Lower To Compete With Us$80 Reduction in Indonesian Levykunal singhNo ratings yet

- Estimasi Cost Produksi 2020Document17 pagesEstimasi Cost Produksi 2020AnggaVaiNo ratings yet

- Sales Performance Report of August 2010Document8 pagesSales Performance Report of August 2010Amit JhaNo ratings yet

- Diesel Vs PetrolDocument21 pagesDiesel Vs PetrolShyam NettathNo ratings yet

- 2023 02 07 Margin Statements HB6596Document3 pages2023 02 07 Margin Statements HB6596Nageswara Rao VemulaNo ratings yet

- Oil Price Its Effects On Indian Economy FinalDocument39 pagesOil Price Its Effects On Indian Economy Finalparmeshwar mahatoNo ratings yet

- Daily Control Hauling Coal Mei-1Document3 pagesDaily Control Hauling Coal Mei-1Ipan SulaimanNo ratings yet

- Daily Mas Ppo 092022Document1 pageDaily Mas Ppo 092022Mike LeganosNo ratings yet

- Regarding Export of Bottled WaterDocument3 pagesRegarding Export of Bottled WaterDinesh YelureNo ratings yet

- Forex Rates 10 12 2021Document2 pagesForex Rates 10 12 2021MSFNo ratings yet

- IpoDocument25 pagesIpovinaydhage5No ratings yet

- Argus Biofuels (2023!08!08)Document11 pagesArgus Biofuels (2023!08!08)Pitipat LeeNo ratings yet

- Argus Coalindo Indonesian Coal Index ReportDocument3 pagesArgus Coalindo Indonesian Coal Index ReportAbdi PratamaNo ratings yet

- Petrosilicon Petroleum ReportDocument14 pagesPetrosilicon Petroleum Reportvishi.segalNo ratings yet

- WeldingDocument2 pagesWeldingtammam shamiNo ratings yet

- Carbu RantsDocument1 pageCarbu RantsRéunion la 1ère WebNo ratings yet

- Calculation Sheet For ReferenceDocument10 pagesCalculation Sheet For ReferenceLL.B. ClassmateNo ratings yet

- PP 7 A PS Oil Prices (C)Document1 pagePP 7 A PS Oil Prices (C)Sushant KoulNo ratings yet

- Cbtllll2O2O: Goreng: Customer'S Po No: Date 23-April-?02S Supermi Mie 4.50Document3 pagesCbtllll2O2O: Goreng: Customer'S Po No: Date 23-April-?02S Supermi Mie 4.50Procopio DoysabasNo ratings yet

- Indonesian Coal Index Report (2021-12-24)Document3 pagesIndonesian Coal Index Report (2021-12-24)Noel RybNo ratings yet

- ICI Period 07092010Document2 pagesICI Period 07092010Pusaka LogisticsNo ratings yet

- Wr19uhso9 CoalMonthlyReviewMar2411Document14 pagesWr19uhso9 CoalMonthlyReviewMar2411raviarya.ismNo ratings yet

- UPB Pickup Summary 2019Document909 pagesUPB Pickup Summary 2019ANDYKANo ratings yet

- Asia Naphtha Report SampleDocument9 pagesAsia Naphtha Report SampleSunil NagarNo ratings yet

- Be CHK260Document2 pagesBe CHK260Yogini ManeNo ratings yet

- Kharain PoDocument1 pageKharain PoZohaib hassanNo ratings yet

- Forex Rate 15 Jan 2024Document3 pagesForex Rate 15 Jan 2024junniklNo ratings yet

- Distance OBDocument28 pagesDistance OBNankNo ratings yet

- Proposal Trading CpoDocument7 pagesProposal Trading CpoMichael Christian RasmanNo ratings yet

- Checklist Shipping BillDocument2 pagesChecklist Shipping BillSunil NaigaonkarNo ratings yet

- Sales Report 2020Document27 pagesSales Report 2020Endri GinantakaNo ratings yet

- Food Corporation of India - GujaratDocument47 pagesFood Corporation of India - Gujaratmanager contractNo ratings yet

- Travel Expense Report: Aian Carl O. Pableo Analyzer Engineer IED SingaporeDocument8 pagesTravel Expense Report: Aian Carl O. Pableo Analyzer Engineer IED SingaporeAian Carl O. PableoNo ratings yet

- Morning Brief - October 07, 2022Document1 pageMorning Brief - October 07, 2022ANKUR KIMTANINo ratings yet

- Currency Futures at NSE Currency Futures at NSE 08 November November 2010Document4 pagesCurrency Futures at NSE Currency Futures at NSE 08 November November 2010Mayank SaxenaNo ratings yet

- Indonesian Coal Index Report (2023-05-12)Document3 pagesIndonesian Coal Index Report (2023-05-12)Nerv KeanNo ratings yet

- Weekly Report - 3 Aug 2007Document5 pagesWeekly Report - 3 Aug 2007api-3840085No ratings yet

- Daily Cocoon Transaction Details 020223Document1 pageDaily Cocoon Transaction Details 020223ranjithramesh555No ratings yet

- Exchange RateDocument1 pageExchange RateBRTA SCSNo ratings yet

- RFQ WORKING FormatDocument23 pagesRFQ WORKING Formatravinder_699997291No ratings yet

- ABRO v4.5Document8 pagesABRO v4.5reza imadian azasiNo ratings yet

- Semi-Annual: 2016/2017 BUDGET YEAR Export Performance ReportDocument8 pagesSemi-Annual: 2016/2017 BUDGET YEAR Export Performance ReportSisay TesfayeNo ratings yet

- MunlocalchargesDocument2 pagesMunlocalchargesrezakurnwNo ratings yet

- Caps TrendDocument5 pagesCaps TrendNiraj KumarNo ratings yet

- WEEKLY - MEETING 51 - 52 IP - KAI Hauling PDFDocument27 pagesWEEKLY - MEETING 51 - 52 IP - KAI Hauling PDFMcc KaruniaNo ratings yet

- MIS Slide SKH Metals - 10.05.23Document5 pagesMIS Slide SKH Metals - 10.05.23kainthamandeep127No ratings yet

- Jagmohan Saini Exchange: Pan: Ucc: SEBI Registration: INZ000031633 Phone: 080 4718 1888 Compliance Officer DetailsDocument3 pagesJagmohan Saini Exchange: Pan: Ucc: SEBI Registration: INZ000031633 Phone: 080 4718 1888 Compliance Officer DetailsRaju SainiNo ratings yet

- RAW CASHEW COST - DocxfinalDocument4 pagesRAW CASHEW COST - DocxfinalBrijesh Panchal100% (1)

- Daily Stock Market Report 26 November 2019 by Indira SecuritiesDocument10 pagesDaily Stock Market Report 26 November 2019 by Indira SecuritiesIndiaSecuritiesNo ratings yet

- Khushboo JainDocument21 pagesKhushboo JainhardzoneNo ratings yet

- Nabors Drilling International LTD 0195616 Rev 1Document1 pageNabors Drilling International LTD 0195616 Rev 1sherinNo ratings yet

- Tugas Ringkasan ICI Period 06182010Document2 pagesTugas Ringkasan ICI Period 06182010Pusaka LogisticsNo ratings yet

- Forex Rate 15 Jan 2023Document2 pagesForex Rate 15 Jan 2023junniklNo ratings yet

- Sample: Global BiodieselDocument5 pagesSample: Global BiodieselWiriyan JordyNo ratings yet

- Estimate No - 2022 - 363078Document4 pagesEstimate No - 2022 - 363078Aadil LoneNo ratings yet

- SBM Ta 2023Document1 pageSBM Ta 2023ISBI zhidan saputraNo ratings yet

- SQ 00309 20 21Document1 pageSQ 00309 20 21Mohammed AsherNo ratings yet

- Abhishek Bhootna ACC ModelDocument15 pagesAbhishek Bhootna ACC Modelabhishek bhOoTnANo ratings yet

- Market Report - 26 April 2019Document3 pagesMarket Report - 26 April 2019GSBhullar1971No ratings yet

- Agritrade DefaultDocument3 pagesAgritrade DefaultRiksan Riksan100% (1)

- Daily Global Palm Price Outlook and Strategy - 2020-03-27Document4 pagesDaily Global Palm Price Outlook and Strategy - 2020-03-27Riksan RiksanNo ratings yet

- Fkli & Fcpo: Technical AnalyzerDocument5 pagesFkli & Fcpo: Technical AnalyzerRiksan RiksanNo ratings yet

- Plantation - Feb 18 - Inventory Declines Mom On Lower CPO ProductionDocument4 pagesPlantation - Feb 18 - Inventory Declines Mom On Lower CPO ProductionRiksan RiksanNo ratings yet

- Palm Kernel ShellsDocument13 pagesPalm Kernel ShellsRiksan RiksanNo ratings yet

- Coding For KidsDocument148 pagesCoding For KidsRiksan Riksan100% (6)

- Magic Valley Dairies 11x17-2Document1 pageMagic Valley Dairies 11x17-2Riksan RiksanNo ratings yet

- Coffee BeanDocument3 pagesCoffee BeanRiksan RiksanNo ratings yet

- Mycophenolate Mofetil (Cellcept) and Mycophenolate Sodium (Myfortic)Document3 pagesMycophenolate Mofetil (Cellcept) and Mycophenolate Sodium (Myfortic)Riksan RiksanNo ratings yet

- Updated FOSFA ContractDocument3 pagesUpdated FOSFA ContractRiksan RiksanNo ratings yet

- JD - Security GuardDocument2 pagesJD - Security GuardRiksan RiksanNo ratings yet

- Inflation ConvexityDocument6 pagesInflation ConvexitysmichelisaliceadslNo ratings yet

- Interactive CH 23 Measuring A Nation's Income 9eDocument45 pagesInteractive CH 23 Measuring A Nation's Income 9eNguyen Quang AnhNo ratings yet

- Conclusion and RecommendationDocument3 pagesConclusion and RecommendationJessica BalganiNo ratings yet

- Jet AirwaysDocument31 pagesJet AirwaysVipul ShettyNo ratings yet

- Paper - Business Model Innovation PDFDocument24 pagesPaper - Business Model Innovation PDFpaula PerezNo ratings yet

- S4HANA1709 BP BB Best Practices Scenerio Guide v1Document6 pagesS4HANA1709 BP BB Best Practices Scenerio Guide v1Habitacion Alquiler SevillaNo ratings yet

- Chapter 4 Game TheoryDocument7 pagesChapter 4 Game TheoryMaria Teresa VillamayorNo ratings yet

- AF201 REVISION PACKAGE s1, 2021Document4 pagesAF201 REVISION PACKAGE s1, 2021Chand DivneshNo ratings yet

- 2) JOSE B. AZNAR Vs RAFAEL YAPDIANGCODocument3 pages2) JOSE B. AZNAR Vs RAFAEL YAPDIANGCOamareia yapNo ratings yet

- Chapter 24 - Teachers Manual - Aa Part 2 PDFDocument13 pagesChapter 24 - Teachers Manual - Aa Part 2 PDFSheed ChiuNo ratings yet

- BA291-1 Basic Food Science Corporation Case StudyDocument9 pagesBA291-1 Basic Food Science Corporation Case StudyJed EstanislaoNo ratings yet

- Is-LM Model With Rational ExpectationsDocument17 pagesIs-LM Model With Rational Expectationssmart__petea9423No ratings yet

- Accell Group: Time To AccelerateDocument52 pagesAccell Group: Time To AccelerateAndi WangNo ratings yet

- Contract of AgencyDocument8 pagesContract of Agencyjerry zaidiNo ratings yet

- Documentary Requirements For Common Government TransactionsDocument74 pagesDocumentary Requirements For Common Government TransactionsChristine Meralpes100% (8)

- Chapter 6 - Review of Capital Budgeting Techniques - Part 1Document10 pagesChapter 6 - Review of Capital Budgeting Techniques - Part 1Abdelrahman Maged0% (1)

- Software AssociatesDocument5 pagesSoftware AssociatesAgrata Pandey77% (13)

- Tackling The European Energy CrisisDocument28 pagesTackling The European Energy CrisisTran Thanh ThaoNo ratings yet

- Monopolistic CompetitionDocument10 pagesMonopolistic CompetitionBhushanNo ratings yet

- CCUS An OpportunityDocument36 pagesCCUS An OpportunityForexliveNo ratings yet

- Types of Replacement Policies:: Classification: InternalDocument4 pagesTypes of Replacement Policies:: Classification: InternalCMNo ratings yet

- Request For Quotation BLANKDocument4 pagesRequest For Quotation BLANKkalawaanelemschoolNo ratings yet

- F-IDS-PERD-010 APPLICATION FOR BOI REGISTRATION (BOI FORM 501) - AttachmentsDocument15 pagesF-IDS-PERD-010 APPLICATION FOR BOI REGISTRATION (BOI FORM 501) - AttachmentsAj IVNo ratings yet

- Business and Income TaxationDocument58 pagesBusiness and Income TaxationFrancisNo ratings yet

- 3.5 Golf Estate 2Document1 page3.5 Golf Estate 2gautam bajajNo ratings yet

- Sample Marketing StrategyDocument8 pagesSample Marketing Strategyprincy4jain-2No ratings yet

- Stratics-2 0Document29 pagesStratics-2 0Manuel YescasNo ratings yet

- Economic Assessment of Hydroponic Lettuce ProductionDocument1 pageEconomic Assessment of Hydroponic Lettuce ProductionMolly ChaseNo ratings yet

- Luxury Car Market in IndiaDocument8 pagesLuxury Car Market in IndiaSuraj SharmaNo ratings yet

- Value Investing - Aswath DamodaranDocument43 pagesValue Investing - Aswath Damodaranapi-3821333100% (1)