Professional Documents

Culture Documents

FM Assignment

Uploaded by

Anuran BordoloiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM Assignment

Uploaded by

Anuran BordoloiCopyright:

Available Formats

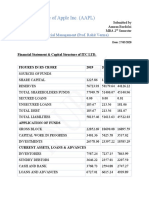

ITC LIMITED

SOURCES OF FUNDS 19-Mar 18-Mar 17-Mar

Total Share Capital 1,225.86 1,220.43 1,214.74

Equity Share Capital 1,225.86 1,220.43 1,214.74

Reserves 54,725.99 50,179.64 44,126.22

NETWORTH 57,949.79 51,400.07 45,340.96

Secured Loans 7.89 0 0.01

Unsecured Loans 0 11.13 17.99

TOTAL DEBT 7.89 11.13 18

TOTAL LIABILITIES 57,957.68 51,411.20 45,358.96

Gross Block 22,717.26 18,595.00 16,843.67

Less: Accum. Depreciation 4,230.86 3,029.01 1,963.43

NET BLOCK 18,486.40 15,565.99 14,880.24

Capital Work in Progress 3,401.36 5,025.58 3,537.02

INVESTMENTS 26,578.00 23,397.22 18,585.29

Inventories 7,587.24 7,237.15 7,863.99

Sundry Debtors 3,646.22 2,357.01 2,207.50

Cash and Bank Balance 3,768.73 2,594.88 2,747.27

Total Current Assets 15,002.19 12,189.04 12,818.76

Loans and Advances 6,329.97 6,203.48 4,394.64

Total CA, Loans & Advances 21,332.16 18,392.52 17,213.40

Current Liabilities 11,682.36 10,808.96 8,683.79

Provisions 157.88 161.15 173.2

Total CL & Provisions 11,840.24 10,970.11 8,856.99

NET CURRENT ASSETS 9,491.92 7,422.41 8,356.41

TOTAL ASSETS 57,957.68 51,411.20 45,358.96

Contingent Liabilities 2,491.31 2,257.52 2,148.64

Book Value (Rs) 45.64 42.12 37.33

AMAN KAYAL MBA 2nd SEMESTER

ANSWER 1-

ITC's capital structure mostly consists of mostly equity share capital and the company has a

minimum amount of debt.

The capital structure of the company has not changed in any major way as debt has always

been at negligible levels for the company is the past 3 years

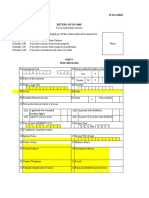

Weighted Average Cost of Capital under Book Value Approach:

Market Price of Share-156.8 as on 26th March

Growth Rate of Dividend for the past 3 years%-10%(Approx)

Tax Rate-30%

Dividend Paid as at 13.05.2019=5.75

Cost of Equity Share Capital(Ke)

Ke(=D1/P0)+G

Ke=(5.75/156.8)%+10%

Ke=(5.75/156.8)%+10%

Ke=3.66%+10%

Ke=13.66%

Cost of Debt=Kd

Kd=I(1-Tax Rate)/Face Value

Kd=.1(1-.3)/1

Kd=7%

Now,

Sources Amount Cost of Capital Cost

Equity Sh

1,225.86 13.66% 167.4525

Capital

Debt 7.89 7% 0.5523

Total 168.0048

WACC= Total Cost/Total Amount

0.13617

WACC=13.61%

ANSWER 2-

I think Net Income apprach is the most applicable approach as the cost of debt is lower than

the cost of equity and also the benefit of deductible expenditure i.e. tax is availed in this

approach.

Short Note on Net Income Approach:

Net income approach was developed by Durand, In this approach, the cost of debt is

identified as cheaper source of financing than equity share capital. The more application of

debt in the capital structure brings down the overall capital, more particularly 100%

application of debt finance leads to resemble the over all cost of capital as cost of debt. The

weighted average cost of capital will come down due to more application of leverage in the

capital structure, only with reference to cheaper cost of raising than the equity share capital

cost. The value of the firm is more in the case of lesser overall cost of capital due to more

application of leverage in the capital structure. The optimum capital structure is that at when

the value of the firm is highest and the overall cost of capital is lowest. This approach

highlights that the application of leverage influences the overall cost of capital and that affects

the value of the firm.

You might also like

- "Accounting For Managers": Assignment No.-01Document25 pages"Accounting For Managers": Assignment No.-01Faeyaz FatehNo ratings yet

- Capital Structure Analysis of ITC LTDDocument4 pagesCapital Structure Analysis of ITC LTDAnuran Bordoloi0% (1)

- ACCM CA1pdfDocument15 pagesACCM CA1pdfTabrej AnsariNo ratings yet

- MyreportDocument22 pagesMyreportHaseena ShameemNo ratings yet

- Oka Corporation BHDDocument3 pagesOka Corporation BHDFagbile TomiwaNo ratings yet

- Accounting Presentation (Beximco Pharma)Document18 pagesAccounting Presentation (Beximco Pharma)asifonikNo ratings yet

- Sun Pharma Ratio LALITDocument6 pagesSun Pharma Ratio LALITLalit RoyNo ratings yet

- Lecture Common Size and Comparative AnalysisDocument28 pagesLecture Common Size and Comparative AnalysissumitsgagreelNo ratings yet

- Lecture-3 & 4 - Common Size and Comparative AnalysisDocument28 pagesLecture-3 & 4 - Common Size and Comparative AnalysissanyaNo ratings yet

- Financial Statements - TATA - MotorsDocument6 pagesFinancial Statements - TATA - MotorsSANDHALI JOSHI PGP 2021-23 BatchNo ratings yet

- ITC Financial AnalysisDocument21 pagesITC Financial AnalysisDeepak ChandekarNo ratings yet

- Ma Term Paper 20192mba0328Document8 pagesMa Term Paper 20192mba0328Dileepkumar K DiliNo ratings yet

- FM Group 03Document25 pagesFM Group 03Mohammad IslamNo ratings yet

- Egyptian Tourism Resorts-Mohamed Ahmed AbdelateyDocument19 pagesEgyptian Tourism Resorts-Mohamed Ahmed AbdelateyMohamed Ahmed AbdelatyNo ratings yet

- Comprehensive Income (2017-2018)Document12 pagesComprehensive Income (2017-2018)Lee SuarezNo ratings yet

- Bajaj Finance Limited Fra ProjectDocument12 pagesBajaj Finance Limited Fra ProjectSUBASH S 2019No ratings yet

- FMA Project (ITC Valuation DCF)Document40 pagesFMA Project (ITC Valuation DCF)Vishal NigamNo ratings yet

- Financial Analysis of Perpetual Help Community Cooperative (PHCCI)Document17 pagesFinancial Analysis of Perpetual Help Community Cooperative (PHCCI)Jasmine Lilang ColladoNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- FM Group 03Document25 pagesFM Group 03Mohammad IslamNo ratings yet

- Shinansh TiwariDocument11 pagesShinansh TiwariAnuj VermaNo ratings yet

- CF Project - GP 13Document8 pagesCF Project - GP 13hjiyoNo ratings yet

- Dion Global Solutions Limited: SourceDocument15 pagesDion Global Solutions Limited: SourceAnish DalmiaNo ratings yet

- Analysis of Working CapitalDocument7 pagesAnalysis of Working CapitalAzfar KawosaNo ratings yet

- Ratio Analysis of L&T InfotechDocument36 pagesRatio Analysis of L&T Infotechrajwindernijjar1100% (1)

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- Deven Rawat (FM)Document7 pagesDeven Rawat (FM)devenrawat.03No ratings yet

- Balance Sheet of Itc LTDDocument7 pagesBalance Sheet of Itc LTDMarri Sushma Swaraj ReddyNo ratings yet

- FA of ItcDocument18 pagesFA of ItcSriya GuptaNo ratings yet

- Industry OverviewDocument7 pagesIndustry OverviewBathula JayadeekshaNo ratings yet

- Leverage RatioDocument3 pagesLeverage RatioAbhrajit KarNo ratings yet

- Ratio Analysis Memo and Presentation: ACCA 500Document8 pagesRatio Analysis Memo and Presentation: ACCA 500Awrangzeb AwrangNo ratings yet

- Ratio Analysis of TATA MOTORSDocument8 pagesRatio Analysis of TATA MOTORSmr_anderson47100% (8)

- Student Name Regd No Roll No: Tabrej AnsariDocument7 pagesStudent Name Regd No Roll No: Tabrej AnsariTabrej AnsariNo ratings yet

- JFHFFDocument18 pagesJFHFFUjjwal SharmaNo ratings yet

- Fundamental Analysis of PNB Ltd.Document19 pagesFundamental Analysis of PNB Ltd.Ashutosh Gupta100% (1)

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- FINANCIAL ANALYSIS of ONGCDocument13 pagesFINANCIAL ANALYSIS of ONGCdipshi92No ratings yet

- STD Balance Sheet 3Document2 pagesSTD Balance Sheet 3AbhijeetBhiseNo ratings yet

- Sub: Financial Accounting Sub: Financial AccountingDocument14 pagesSub: Financial Accounting Sub: Financial AccountingMilan PateliyaNo ratings yet

- Assignment On Ratio Analysis of Tata Motors For 2007 and 2008Document8 pagesAssignment On Ratio Analysis of Tata Motors For 2007 and 2008Chetan AgrawalNo ratings yet

- Bv-Cia 1.2 526 - 646 - 674Document20 pagesBv-Cia 1.2 526 - 646 - 674Pevin KumarNo ratings yet

- 5 Cs of Credit - Caskey Trucking FinancialsDocument3 pages5 Cs of Credit - Caskey Trucking FinancialsViky VyasNo ratings yet

- Institute of Management Development and Research (Imdr) : Pune Post Graduation Diploma in Management (PGDM)Document9 pagesInstitute of Management Development and Research (Imdr) : Pune Post Graduation Diploma in Management (PGDM)hitesh rathodNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisMohammad Abid MiahNo ratings yet

- Reliance FSA PrachiDocument16 pagesReliance FSA PrachiPrachi SrivastavaNo ratings yet

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princeNo ratings yet

- MaricoDocument13 pagesMaricoRitesh KhobragadeNo ratings yet

- BF1 Package Ratios ForecastingDocument16 pagesBF1 Package Ratios ForecastingBilal Javed JafraniNo ratings yet

- Equity Research Is The Study of A Business and ItsDocument32 pagesEquity Research Is The Study of A Business and ItsSanju JageNo ratings yet

- Particulars 2018-19 2017-18 Liquidity AnalysisDocument10 pagesParticulars 2018-19 2017-18 Liquidity AnalysisIvy MajiNo ratings yet

- Punjab and Sind BankDocument13 pagesPunjab and Sind Banksimran jeetNo ratings yet

- Trent Westside DeepakDocument8 pagesTrent Westside DeepakDeepakNo ratings yet

- Accounts AssignDocument9 pagesAccounts AssigngauravdangeNo ratings yet

- DU Pont AnalysisDocument9 pagesDU Pont Analysisshani2010No ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Models of Change: Unit 1 OdcDocument11 pagesModels of Change: Unit 1 OdcAnuran BordoloiNo ratings yet

- 2forces of ChangeDocument9 pages2forces of ChangeAnuran BordoloiNo ratings yet

- Unit 1: Corporate CultureDocument12 pagesUnit 1: Corporate CultureAnuran BordoloiNo ratings yet

- Organizational Culture and Change: Chapter 10, Nancy Langton and Stephen P. Robbins, Fundamentals of OrganizationalDocument45 pagesOrganizational Culture and Change: Chapter 10, Nancy Langton and Stephen P. Robbins, Fundamentals of OrganizationalAnuran BordoloiNo ratings yet

- Unit 1 Managing Change and Models of ChangeDocument13 pagesUnit 1 Managing Change and Models of ChangeAnuran BordoloiNo ratings yet

- (Anuran Bordoloi) OD Intervention & TechniquesDocument31 pages(Anuran Bordoloi) OD Intervention & TechniquesAnuran BordoloiNo ratings yet

- 1introduction To ChangeDocument22 pages1introduction To ChangeAnuran BordoloiNo ratings yet

- Unit 2 Odc Structure of Organization and Strategy ImplementationDocument63 pagesUnit 2 Odc Structure of Organization and Strategy ImplementationAnuran BordoloiNo ratings yet

- PDFDocument128 pagesPDFNisar A.No ratings yet

- Project TopicsDocument1 pageProject TopicsAnuran BordoloiNo ratings yet

- ODC (26.04.2021) Organizational Culture ApproachDocument2 pagesODC (26.04.2021) Organizational Culture ApproachAnuran BordoloiNo ratings yet

- Odc (28.04.2021)Document1 pageOdc (28.04.2021)Anuran BordoloiNo ratings yet

- Export Marketing PDFDocument33 pagesExport Marketing PDFAnuran BordoloiNo ratings yet

- Revised JD For Jaro Education-1Document2 pagesRevised JD For Jaro Education-1Anuran BordoloiNo ratings yet

- Course Structure: Royal School of Business (RSB)Document3 pagesCourse Structure: Royal School of Business (RSB)Anuran BordoloiNo ratings yet

- RGU SyllabusDocument3 pagesRGU SyllabusAnuran BordoloiNo ratings yet

- A. Distinguish Between Road Transport and Air Transport.: Export Marketing 2017 Ans 2Document25 pagesA. Distinguish Between Road Transport and Air Transport.: Export Marketing 2017 Ans 2Anuran BordoloiNo ratings yet

- Rural MarketingDocument79 pagesRural MarketingAnuran BordoloiNo ratings yet

- Entrepreneurship PDFDocument61 pagesEntrepreneurship PDFAnuran BordoloiNo ratings yet

- Concept of EntrepreneurshipDocument61 pagesConcept of EntrepreneurshipAnuran BordoloiNo ratings yet

- PM Assignment 2 (Anuran Bordoloi)Document1 pagePM Assignment 2 (Anuran Bordoloi)Anuran BordoloiNo ratings yet

- SDM 2018 Long Answers A. Functions of Sales Management 1.sales PlanningDocument13 pagesSDM 2018 Long Answers A. Functions of Sales Management 1.sales PlanningAnuran BordoloiNo ratings yet

- (Anuran) Taxation LawsDocument35 pages(Anuran) Taxation LawsAnuran BordoloiNo ratings yet

- PM Assignment 2 (Anuran Bordoloi)Document1 pagePM Assignment 2 (Anuran Bordoloi)Anuran BordoloiNo ratings yet

- HRM As Per SyllabusDocument41 pagesHRM As Per SyllabusAnuran BordoloiNo ratings yet

- (Anuran) Sales & Distribution ManagementDocument33 pages(Anuran) Sales & Distribution ManagementAnuran BordoloiNo ratings yet

- (Anuran Bordoloi) SM Assignment - 27.08.2020Document3 pages(Anuran Bordoloi) SM Assignment - 27.08.2020Anuran BordoloiNo ratings yet

- Prajwalita Baruah - Assignment 2Document1 pagePrajwalita Baruah - Assignment 2Anuran BordoloiNo ratings yet

- (Anuran Bordoloi) Solved Question Bank - HRM PDFDocument111 pages(Anuran Bordoloi) Solved Question Bank - HRM PDFAnuran BordoloiNo ratings yet

- Question Bank For Human Resource Management (MBA 2) - 1Document4 pagesQuestion Bank For Human Resource Management (MBA 2) - 1Anuran BordoloiNo ratings yet

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionAjaxNo ratings yet

- Capital Market Questions BankDocument11 pagesCapital Market Questions Bankdev12_lokesh100% (1)

- Financial ManagementDocument2 pagesFinancial ManagementKimberly Milante0% (1)

- 152276Document73 pages152276Shofiana IfadaNo ratings yet

- SV - DTUE401 - Chapter 1 (Lecture 1+2)Document72 pagesSV - DTUE401 - Chapter 1 (Lecture 1+2)Duong Ha ThuyNo ratings yet

- PR - Order in The Matter of M/s GBC Enterprise LimitedDocument1 pagePR - Order in The Matter of M/s GBC Enterprise LimitedShyam SunderNo ratings yet

- How To Create An Expert Advisor With EA BuilderDocument20 pagesHow To Create An Expert Advisor With EA BuilderGeorge Protonotarios100% (1)

- Employee Stock Option PlanDocument7 pagesEmployee Stock Option Plankrupalee100% (1)

- Jeff Saut Market CommentaryDocument6 pagesJeff Saut Market Commentaryavico510No ratings yet

- International Institute For Special EducationDocument19 pagesInternational Institute For Special EducationashuNo ratings yet

- Department of Computer Science and Engineering: Green University of BangladeshDocument3 pagesDepartment of Computer Science and Engineering: Green University of BangladeshAminul IslamNo ratings yet

- 2017-02-24 Margarita Mares Rescission LetterDocument1 page2017-02-24 Margarita Mares Rescission Letterapi-360769610No ratings yet

- Plant and Machinery Valuation Is Undertaken For Various Reasons: 1. BuyingDocument2 pagesPlant and Machinery Valuation Is Undertaken For Various Reasons: 1. BuyingBrahmpal BhardwajNo ratings yet

- Stock Articles of IncorporationDocument5 pagesStock Articles of IncorporationEdward Raymond B. PalsiwNo ratings yet

- Al Safi PlatformDocument15 pagesAl Safi PlatformbadrishNo ratings yet

- Business Finance (Fin 312) : Spring 2008Document9 pagesBusiness Finance (Fin 312) : Spring 2008southern2011No ratings yet

- 4 All HUD Approved Mortgagees 4330.4 REV-1Document291 pages4 All HUD Approved Mortgagees 4330.4 REV-1MaryUmbrello-Dressler100% (1)

- Satyam: "Sinking Ship or Tip of Iceberg"Document22 pagesSatyam: "Sinking Ship or Tip of Iceberg"sublaxmiNo ratings yet

- PWC Business Combinations Noncontrolling InterestsDocument816 pagesPWC Business Combinations Noncontrolling Interestsafmoroz100% (1)

- Item 75544Document3 pagesItem 75544Dragan KaranovicNo ratings yet

- It 11ga2016Document17 pagesIt 11ga2016shiblu39100% (1)

- Study+guide 16-19Document39 pagesStudy+guide 16-19bakerbjNo ratings yet

- Sample Article of IncorporationDocument15 pagesSample Article of IncorporationMagne Joy Binay - AlcantaraNo ratings yet

- Introduction To Investment Analysis & Portfolio ManagementDocument4 pagesIntroduction To Investment Analysis & Portfolio Managementgaurav parekhNo ratings yet

- IRINEO G. CARLOS vs. MINDORO SUGAR CO. ET ALDocument3 pagesIRINEO G. CARLOS vs. MINDORO SUGAR CO. ET ALRal CaldiNo ratings yet

- The Business PlanDocument3 pagesThe Business PlanRose Ann de JuanNo ratings yet

- National Stock Exchange'S Certification in Financial Markets (NCFM)Document4 pagesNational Stock Exchange'S Certification in Financial Markets (NCFM)hitekshaNo ratings yet

- Questionnaire On Mutual FundsDocument5 pagesQuestionnaire On Mutual Fundsriteshjindal19875008No ratings yet

- Fan-Wong, 2002, Corporate Ownership StructureDocument25 pagesFan-Wong, 2002, Corporate Ownership StructureMade Wira MahiswaraNo ratings yet