Professional Documents

Culture Documents

FA of Itc

Uploaded by

Sriya GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FA of Itc

Uploaded by

Sriya GuptaCopyright:

Available Formats

Financial Statement Analysis of ITC Limited

Neha Rawat

Student, Symbiosis College of Arts and Commerce, Pune, India

Abstract

Financial statements can say a lot about a company’s financial health and earning potential. These

statements are analyzed and reviewed for decision making purposes, this process is known as financial

analysis. Financial analysis help the stakeholders to assess the financial performance of an organization

which helps them in making good investment decisions. This paper provides a detailed financial analysis

of ITC Ltd with an attempt to assess the company’s efficiency and performance. The study has focused

on past and present performance of ITC Ltd over the period of 5years for analyzing the trends.

ITC Ltd. Overview

ITC was incorporated on August 24, 1910 under the name of Imperial Tobacco Company of India

Limited and is currently headquartered in Kolkata, India. The company was renamed, ‘Indian Tobacco

Company’ in 1970 and later to ‘ITC Limited’ in 1974. ITC has a diversified business, with its

products/businesses ranging from Consumer goods to Hotel, IT, Apparel, Cigarettes, Agri-business,

Paperboard and Packaging. It is one of the prominent FMCG Company in India, with an annual turnover

of US$7.3 billion (2019).

Objectives

1. To analyze the financial strength and weaknesses of ITC Ltd.

2. Comparative study of Two year Annual reports

3. To provide a statement of financial health of ITC Ltd.

Research Methodology

This is a descriptive case study of the ITC’s financial performance. The analysis is based on Secondary

data collected from the company’s annual reports from the FY 2015-16 to FY 2018 -2019, newspaper

articles, and websites.

Tools used for data analysis:

The data is compiled and tabulated with the help of MS Excel. Besides charts are also used to present the

data using Excel. The techniques used in analysis are:

1. Comparative Study of Balance sheet and Income Statement

2. Common size Balance sheet and Income Statement

3. Ratio Analysis

4. Trend Analysis

5. Du Pont Analysis

Electronic copy available at: https://ssrn.com/abstract=3630917

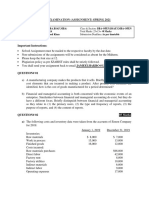

COMPARATIVE BALANCESHEET in cr.

2019 2018 Amount Change Change %

SHAREHOLDER'S FUNDS

Equity Share Capital 1,225.86 1,220.43 5.43 0%

TOTAL SHARE CAPITAL 1,225.86 1,220.43 5.43 0%

Reserves and Surplus 55,917.07 51,289.68 4,627.39 9%

TOTAL RESERVES AND SURPLUS 55,917.07 51,289.68 4,627.39 9%

TOTAL SHAREHOLDERS FUNDS 59,140.87 52,510.11 6,630.76 13%

Minority Interest 343.47 334.47 9.00 3%

NON-CURRENT LIABILITIES

Long Term Borrowings 8.15 11.50 -3.35 -29%

Deferred Tax Liabilities [Net] 2,052.06 1,923.02 129.04 7%

Other Long Term Liabilities 79.92 109.98 -30.06 -27%

Long Term Provisions 161.95 149.63 12.32 8%

TOTAL NON-CURRENT LIABILITIES 2,302.08 2,194.13 107.95 5%

CURRENT LIABILITIES

Short Term Borrowings 1.86 17.35 -15.49 -89%

Trade Payables 3,509.58 3,496.18 13.40 0%

Other Current Liabilities 6,449.17 5,672.82 776.35 14%

Short Term Provisions 51.38 63.8 -12.42 -19%

TOTAL CURRENT LIABILITIES 10,011.99 9,250.15 761.84 8%

TOTAL CAPITAL AND LIABILITIES 71,798.41 64,288.86 7,509.55 12%

ASSETS

NON-CURRENT ASSETS

Tangible Assets 18,625.74 15,863.68 2,762.06 17%

Intangible Assets 545.92 457.75 88.17 19%

Capital Work-In-Progress 4,126.18 5,499.60 -1,373.42 -25%

FIXED ASSETS 23,308.08 21,829.76 1,478.32 7%

Non-Current Investments 11,695.99 11,483.79 212.20 2%

Deferred Tax Assets [Net] 59.37 47.98 11.39 24%

Long Term Loans And Advances 8.34 9.69 -1.35 -14%

Other Non-Current Assets 4,776.83 4,321.49 455.34 11%

TOTAL NON-CURRENT ASSETS 40,051.14 37,895.24 2,155.90 6%

CURRENT ASSETS

Current Investments 13,347.50 10,569.07 2,778.43 26%

Inventories 7,943.97 7,584.53 359.44 5%

Trade Receivables 4,035.28 2,682.29 1,352.99 50%

Cash And Cash Equivalents 4,152.03 2,899.60 1,252.43 43%

Short Term Loans And Advances 6.75 5.84 0.91 16%

OtherCurrentAssets 2,261.74 2,652.29 -390.55 -15%

TOTAL CURRENT ASSETS 31,747.27 26,393.62 5,353.65 20%

TOTAL ASSETS 71,798.41 64,288.86 7,509.55 12%

Electronic copy available at: https://ssrn.com/abstract=3630917

COMMON SIZE BALANCE SHEET

Electronic copy available at: https://ssrn.com/abstract=3630917

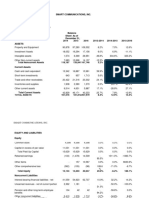

COMPARATIVE INCOME STATEMENT in cr.

2019 2018 Amount Change Change %

INCOME

REVENUE FROM OPERATIONS [GROSS] 49,348.43 47,362.51 1,985.92 4%

Less: Excise/Sevice Tax/Other Levies 1,509.43 4,239.61 -2,730.18 -64%

REVENUE FROM OPERATIONS [NET] 47,839.00 43,122.90 4,716.10 11%

TOTAL OPERATING REVENUES 48,352.68 43,448.94 4,903.74 11%

Other Income 2,173.79 1,831.86 341.93 19%

TOTAL REVENUE 50,526.47 45,280.80 5,245.67 12%

EXPENSES

Cost Of Materials Consumed 13,403.01 11,943.75 1,459.26 12%

Operating And Direct Expenses 0.00 0.00 0.00

Employee Benefit Expenses 4,177.88 3,760.90 416.98 11%

Finance Costs 45.42 89.91 -44.49 -49%

Depreciation And Amortisation Expenses 1,396.61 1,236.28 160.33 13%

Other Expenses 8,348.11 7,349.60 998.51 14%

TOTAL EXPENSES 31,388.35 28,292.17 3,096.18 11%

PROFIT/LOSS BEFORE EXCEPTIONAL, EXTRAORDINARY ITEMS AND TAX 19,138.12 16,988.63 2,149.49 13%

Exceptional Items 0.00 412.90 -412.90 -100%

PROFIT/LOSS BEFORE TAX 19,138.12 17,401.53 1,736.59 10%

TAX EXPENSES-CONTINUED OPERATIONS

Current Tax 6,191.62 5,893.19 298.43 5%

Less: MAT Credit Entitlement 0.00 0.00 0.00

Deferred Tax 122.30 23.24 99.06 426%

Other Direct Taxes 0 0 0.00

TOTAL TAX EXPENSES 6,313.92 5,916.43 397.49 7%

PROFIT/LOSS AFTER TAX AND BEFORE EXTRAORDINARY ITEMS 12,824.20 11,485.10 1,339.10 12%

PROFIT/LOSS FROM CONTINUING OPERATIONS 12,824.20 11,485.10 1,339.10 12%

PROFIT/LOSS FOR THE PERIOD 12,824.20 11,485.10 1,339.10 12%

Minority Interest -243.57 -221.48 -22.09 10%

CONSOLIDATED PROFIT/LOSS AFTER MI AND ASSOCIATES 12,592.33 11,271.20 1,321.13 12%

OTHER ADDITIONAL INFORMATION

EARNINGS PER SHARE

Basic EPS (Rs.) 10 9 1.00 11%

Diluted EPS (Rs.) 10 9 1.00 11%

DIVIDEND AND DIVIDEND PERCENTAGE

Equity Share Dividend 6,285.21 5,770.01 515.20 9%

Tax On Dividend 1,213.60 1,136.83 76.77 7%

Electronic copy available at: https://ssrn.com/abstract=3630917

COMMON SIZE INCOME STATEMENT

Electronic copy available at: https://ssrn.com/abstract=3630917

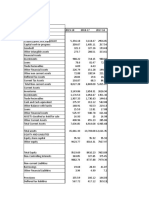

TREND ANALYSIS

2019 2018 2017 2016 2015

Net Profit/ loss 131% 118% 107% 97% 100%

EPS 83% 75% 75% 67% 100%

Total Assets and Liabilities 156% 140% 122% 112% 100%

2019 2018 2017 2016 2015

Income 126% 113% 111% 102% 100%

Expenditure 122% 110% 111% 101% 100%

Electronic copy available at: https://ssrn.com/abstract=3630917

INTERPRETATION

It is found that Income and Expenditure, both show increasing trend at almost same trend rate, with revenue being

slightly above the expenditure. Eventually, profits also increase at an increasing rate. But among all the other factors

total assets shows the significant increase over the past five years (this is justifiable, since, ITC is a well diversified

company, and is not just restricted to FMCG sector)

INTERPERATING FINANCIAL STATEMENTS

BALANCE SHEET

ITC’s Total assets increased by 12% in 2019, current assets showed an increase of 20% while non-current assets

increased by 6% only. A comparative analysis of balance sheet shows that CWIP decreased by 50%, which justifies

the increase in fixed assets by 7% , which eventually leads to decrease in the proportion of non-current assets to Total

assets from 59% to 56%. Other assets declined by 15% the decrease was mainly due to decrease in other Advances by

42% (including advances with statutory authorities, prepaid expenses, employees, etc.).

Cash & Cash equivalents were 6% of total assets, however they increased by 43% in 2019, growing cash reserves

signal strong company performance as it offers protection during business slowdowns and provides options for future

growth.

Long term borrowings and short term borrowing are 0% of total assets over the two – year period. Generally a ratio

result of less than 0.5 is considered good. Therefore ITC has more assets than debts, indicating that they’re in a better

financial position. The reason for decline in long term debt to assets ratio is either that numerator is declining or the

Electronic copy available at: https://ssrn.com/abstract=3630917

denominator is getting bigger or both the scenarios hold true. When we look at ITC’s balance sheet it is evident that

long terms debts are being paid off and the assets are also increasing, so there is not a much problem here.

Looking at the asset turnover ratio which is below 1, can be cause of concern (its competitor HUL has good ratio of

2.14). ITC’s revenue has increased over the past 5 years but the asset turnover is low which could be a sign of

overinvestment in assets.

INCOME STATEMENT

Earnings after tax and interest represents 25% of total revenue. ITC’s Net profit margin (25.38%) was significantly

higher than HUL and Godfrey Philips (15% and 10% respectively). Cost of material consumed represents 27% of total

revenues, which is highest when compared to the remaining expenses, for example, operating and direct expenses

were 0% of total revenues while other expenses like (Power and fuel, Consumption of stores and spare parts, Contract

processing charges, etc.) constituted 17% of total revenues.

Both PAT and Total Revenue increased by 12% in 2019. Finance cost reduced by 49%, while depreciation and

amortization expenses increased by 13%. Operating profit margin was 40% approx. which was comparatively higher

than Godfrey Philips (19%) and lower than HUL whose operating profit margin was around 47%.

CASH FLOW ANALYSIS

CASH FLOW OF ITC (in Rs. Cr.)

2019 2018 2017 2016 2015

NET PROFIT/LOSS BEFORE EXTRAORDINARY ITEMS AND TAX 19,149.82 17,409.11 16,026.32 14,859.07 14,362.05

Net CashFlow From Operating Activities 12,583.41 13,169.40 10,627.31 9,799.04 9,843.20

Net Cash Used In Investing Activities -5,545.68 -7,113.89 -3,250.93 -3,920.81 -5,275.43

Net Cash Used From Financing Activities -6,868.64 -6,221.13 -7,301.03 -5,612.52 -4,661.03

Foreign Exchange Gains / Losses 0 0 0 0 0

Adjustments On Amalgamation Merger Demerger Others 0 0 0 0.08 0

NET INC/DEC IN CASH AND CASH EQUIVALENTS 169.09 -165.62 75.35 265.79 -93.26

Cash And Cash Equivalents Begin of Year 173.79 339.41 264.06 -1.73 276.48

Cash And Cash Equivalents End Of Year 342.88 173.79 339.41 264.06 183.22

Electronic copy available at: https://ssrn.com/abstract=3630917

TRENDS

2019 2018 2017 2016 2015

Net CashFlow From Operating Activities 128% 134% 108% 100% 100%

Net Cash Used In Investing Activities 105% 135% 62% 74% 100%

Net Cash Used From Financing Activities 147% 133% 157% 120% 100%

Cash And Cash Equivalents Begin of Year 63% 123% 96% -1% 100%

Cash And Cash Equivalents End Of Year 187% 95% 185% 144% 100%

Electronic copy available at: https://ssrn.com/abstract=3630917

INTERPRETATION

Net Cash outflow from investing activities has significantly declined in 2019, the outflow was highest in 2018 and

lowest in 2017, over the past 5 years

ITC’s investments in purchase of fixed assets and intangibles increased in 2019 by 10% and sale receipts from

property, plant and equipment reduced from 79.72 crores to 27.82 crores. Purchase of non-current investments also

reduced by 26%.

ITC raised capital by issuing shares, which increased by 6% in 2019. Interest payments also increased significantly

(101% increase), there was also an increase in dividend payments.

The Cash & Cash equivalents has also increased by 187% over the past few years.

Electronic copy available at: https://ssrn.com/abstract=3630917

RATIO ANALYSIS – COMPARISION WITH PEERS

Liquidity Ratio

2015 2016 2017 2018 2019

Current Ratio

ITC 2.10 3.73 3.69 2.85 3.17

Godfrey Philips 1.46 2.24 2.34 1.72 1.47

HUL 1.08 1.46 1.32 1.31 1.37

Quick Ratio

ITC 1.40 2.37 2.38 2.03 2.54

Godfrey Philips 0.35 0.61 0.84 0.68 0.60

HUL 0.77 1.08 0.99 1.03 1.08

Electronic copy available at: https://ssrn.com/abstract=3630917

Turnover Ratio 2015 2016 2017 2018 2019

Total Assets Turnover

ITC 0.87 0.79 0.80 0.70 0.70

Godfrey Philips 1.26 1.10 1.11 0.97 0.90

HUL 2.25 2.20 2.13 2.01 2.14

Accounts Receivables Turnover

ITC 20.23 21.24 18.00 16.88 12.52

Godfrey Philips 20.17 21.94 13.69 27.73 37.53

HUL 32.18 25.80 30.90 27.43 21.95

Fixed Asset Turnover

ITC 2.26 2.33 2.29 2.07 2.17

Godfrey Philips 3.56 3.16 3.44 3.56 3.64

HUL 9.99 9.10 7.34 7.32 7.97

Inventory Turnover

ITC 1.72 1.50 1.96 2.09 2.19

Godfrey Philips 1.47 1.42 1.95 2.04 1.67

HUL 5.64 5.82 6.42 6.66 7.18

Accounts Payable Turnover

ITC 7.31 5.80 6.04 4.54 4.96

Godfrey Philips 7.40 8.66 8.09 6.98 3.71

HUL 2.92 2.79 2.64 2.33 2.56

Average Collection Period

ITC 18.05 17.18 20.28 21.62 29.15

Godfrey Philips 18.09 16.64 26.67 13.16 9.72

HUL 11.34 14.15 11.81 13.31 16.63

Average Payment Period

ITC 49.92 62.93 60.48 80.48 73.53

Godfrey Philips 49.30 42.14 45.11 52.26 98.51

HUL 125.11 130.78 138.41 156.43 142.37

Electronic copy available at: https://ssrn.com/abstract=3630917

Profitability Ratio 2015 2016 2017 2018 2019

Gross Profit Margin Ratio

ITC 34.27 35.84 33.77 35.43 35.54

Godfrey Philips 9.96 9.06 6.45 7.01 11.48

HUL 22.33 21.22 19.69 17.72 17.47

Operating Profit Margin Ratio

ITC 38.39 39.11 38.56 40.25 40.64

Godfrey Philips 14.48 14.80 12.11 13.08 18.68

HUL 44.28 45.06 44.76 46.74 47.45

Net Profit Margin Ratio

ITC 24.36 23.31 23.51 25.36 25.38

Godfrey Philips 6.97 7.15 5.58 6.67 10.08

HUL 13.45 12.78 13.43 14.54 15.20

Return on Capital Employed

ITC 30.77 22.24 22.56 21.87 21.68

Godfrey Philips 13.90 10.74 8.23 8.86 12.75

HUL 108.80 63.40 66.76 71.76 77.03

Return on Assets

ITC 21.23 18.36 18.72 17.86 17.86

Godfrey Philips 8.80 7.84 6.18 6.44 9.06

HUL 43.83 40.28 44.26 44.81 50.86

SOLVENCY RATIOS

2015 2016 2017 2018 2019

DEBT TO EQUITY

ITC 0 0 0 0 0

GODFREY PHILIPS 0.16 0.06 0.03 0.02 0.02

HUL 0 0 0 0 0

EFFICIENCY RATIOS

OPERATING RATIO

ITC 0.27 0.30 0.28 0.27 0.28

Electronic copy available at: https://ssrn.com/abstract=3630917

INTERPRETATION

Current Ratio of all the three companies taken for analysis is above 1.00, which means that it can meet its

short- term debt obligations with no stress. ITC's current ratio is highest among the other two companies,

indicating a good financial position.

Higher quick ratios are more favorable for the companies, because it shows there more quick assets than

current liabilities. Here, again ITC has the highest quick ratio amongst the other two CO'S. HUL has quick

ratio of 1.08 means it can pay off her current liabilities with quick assets and still have some quick assets left

over. Godfrey Philips is in a more risky position as its quick ratio is below 1, indicating inadequate current

assets to cover near term debt.

Total Assets Turnover ratio measures how efficiently a firm uses its assets to generate sales, so a higher ratio

is always favorable. Here, HUL has the highest ratio among the other two CO's. ITC and Godfrey Philips has

a ratio which is below 1, which means that the CO'S are not using their assets efficiently and most likely have

mgt. or prod. Problems.

Accounts Receivables Turnover ratio measures the ability of a business to efficiently collect its receivables.

So, higher ratio is more favorable. Here, Godfrey Philips has the highest ratio, while ITC and HUL, are in a

good position.

A high Fixed Asset turnover indicates that assets are being utilized efficiently and a low turnover means the

opposite of what high turnover means. Now, here HUL has the highest turnover as compared to ITC and

Godfrey Philips.

Inventory Turnover measures how efficiently a company can sell the inventory it buys and also control its

merchandise. Therefore, it is important to have a high turnover. HUL, with the 7.18 shows that the company

does not overspend by buying too much inventory and waste resources by storing non-salable inventory. Low

turnover shows that CO's do not have good inventory control.

A higher Accounts Payable shows suppliers that company pays its bills frequently and regularly. ITC has the

highest ratio when compared to HUL &Godfrey Philip.

A lower average collection period is more favorable, indicating that company collects payments faster. Here,

Godfrey Philips has the lowest amongst the other two CO'S, which shows effectiveness of its accounts

receivable mgt. practices.

Average Payment Period measures the avg. number of days it takes a business to pay its vendors for purchases

made on credit. Prompt payments can help business in availing discount offered by suppliers. Here, ITC tales

less number of days as compared to the other two CO's in making payments.

Higher Gross Profit Margin ratio is more favorable. ITC has the higher ratio of 35.54, indicating that Co. is

selling their inventory at a higher profit percentage. A high gross margin would also mean that Co. will have

more money to pay operating expenses.

Electronic copy available at: https://ssrn.com/abstract=3630917

A higher operating margin is more favorable compared with a lower ratio. HUL with operating margin of

47.45, shows that it is making enough money from its ongoing operations to pay its variable costs as well as

its fixed cost.

ITC’s, net profit margin of 25% indicates that every $1 sale contributes 25 cents towards the net profits of the

business.

ROCE measures how much profit each rupee of employed capital generates. A higher ratio is favorable. HUL

has the highest return of 77.03, which indicates that for every rupee invested in capital employed, the

company made 20 paisa’s profit.

ROA shows the percentage of how profitable a company's assets are in generating revenue. Therefore a higher

ratio is more favorable to investors. HUL has a higher ratio of 50.86, indicating that company effectively

manages its assets to produce greater amounts of net income.

DU PONT ANALYSIS

Three-Step DuPont:

ROE= NPM×Asset Turnover×Financial Leverage

2019 2018

PROFIT MARGIN 0.38 0.38

ASSET TURNOVER 0.70 0.70

EQUITY MULTIPLIER 1.29 2.45

ROE 34% 65%

Electronic copy available at: https://ssrn.com/abstract=3630917

EXTENDED DuPont / Five-Step DuPont:

ROE= {(EBIT/S) ×(S/A) − (IE/A)} × A/E× (1−TR)

2019 2018

PROFIT MARGIN 0.38 0.38

ASSET TURNOVER 0.70 0.70

EQUITY MULTIPLIER 1.29 2.45

TAX RATE 0.33 0.34

Interest expense / Assets 0.00 0.00

ROE 23% 43%

= Net Income (After Tax)/Shareholders Equity

INTERPRETATION

The five-step, or extended, DuPont equation breaks down net profit margin further. From the three-step

equation we saw that, in general, rises in the net profit margin, asset turnover and leverage will increase ROE.

The five-step equation shows that increases in leverage don't always indicate an increase in ROE.

In this case, ROE after including interest and tax rate aspects declined from 34% to 23%. ITC’s competitors

like HUL, has ROE of 77%, we should also keep in mind that high ROE can also be due to excessive debt,

therefore it’s better to examine all the ratios and not just ROE.

HUL has no debts in its books, therefore higher ROE here suggests that the company’s management team is

more efficient when it comes to utilizing investment financing to grow their business (and is more likely to

provide better returns to investors). A rising ROE suggests that a company is increasing its profit generation

without needing as much capital. It also indicates how well a company's management deploys shareholder

capital.

ITC’s ROE is less when compared to its peers, due to low asset turnover which indicates that the company

may be mismanaged and could be reinvesting earnings into unproductive assets.

A good margin will vary considerably by industry, but as a general rule of thumb, a 10% net profit margin is

considered average, a 20% margin is considered high (or “good”), and a 5% margin is low. Again, these

guidelines vary widely by industry and company size, and can be impacted by a variety of other factors. ITC’s

profit margin is 38% which is quite good when compared with other companies in the same sector (e.g. HUL

and Godfrey Philips, their Net profit margin was 13% and 6% respectively).

Electronic copy available at: https://ssrn.com/abstract=3630917

An asset turnover of 0.70 means that every $1 worth of assets generated $0.70 worth of revenue. In general,

the higher the ratio – the more "turns" – the better. ITC has a ratio which is below 1, which might indicate that

they are not using their assets efficiently and most likely have mgt. or production problems. As stated earlier,

ITC’s revenue has increased over the past 5 years but the asset turnover is low which could be a sign of

overinvestment in assets. It might mean they've added capacity in fixed assets – more equipment or vehicles –

that isn't being used. Or perhaps the company have assets that are doing nothing, such as cash sitting in the

bank or inventory that isn't selling.

The equity multiplier is a financial leverage ratio that measures the portion of company’s assets that are

financed by stockholder's equity. High equity multiplier could indicate that the company may be overly

dependent on debt for its financing which would make it a potentially risky investment. Low equity multiplier

reveals a company that is mostly funded by stockholders and that the debt financing is low making it a fairly

conservative investment. ITC’s equity multiplier has reduced from 2.45 to 1.29, which shows that it used less

debt to finance its assets in 2019 as compared to the previous year (as we can see that ITC’s long term

borrowing declined from 11.50 in 2018 to 8.15 in 2019).

CONCLUSION: STATEMENT OF FINANCIAL HEALTH

The main areas to determine financial health of a company would be its liquidity, solvency, profitability and

operating efficiency. Out of these four the best measurement of a company’s health is the level of

profitability.

Liquidity factor

Liquidity of a firm can be measured by current ratio and quick ratio. ITC’s current ratio and quick ratio was

highest amongst the other two companies taken for analysis. The high liquidity ratios are considered favorable

as it shows the company’s abilities to manage short-term obligations. Therefore, to prosper in the long term a

company must first be able to survive in the short term and ITC, when compared to its peers does quite well in

this aspect.

Solvency factor

ITC has 0 debt to equity ratio, which is a very good sign because a lower D/E ratio means more of a

company's operations are being financed by shareholders rather than by creditors. This is a plus for a company

since shareholders do not charge interest on the financing they provide. HUL, also has D/E ratio of 0, while

Godfrey Philips stands at 0.02.

Operating efficiency

We measured the operating efficiency of ITC by calculating operating expense ratio, which was 0.28 for the

year 2019, a low operating margin is considered positive as it shows how efficient a company’s management

is at keeping costs low while generating revenue or sales.

Profitability factor

Electronic copy available at: https://ssrn.com/abstract=3630917

ITC’s Net profit margin, Gross profit margin and operating profit margin is better than HUL and Godfrey

Philips this shows ITC, especially as compared to industry peers, has a greater margin of financial safety, and

is in a better financial position to commit capital to growth and expansion.

ITC’S assets have grown over past few years, its profit increased by 12%, long term and short term borrowing

were 0% of total assets, cash and cash equivalents also increased in the year 2019 apart from that all the four

critical factors which can be considered to determine company’s financial health showed positive results.

Although there is no single perfect method identify the overall financial and operational health of a company,

but if all these measures are used together, they can provide us with a complete and holistic view of a

company's stability. In brief, ITC is in a good position financially, however its ROE was low when compared

to HUL, this mainly due to low asset turnover ratio, which could also signal towards overinvestment in assets

(which can also be a company’s strategy or perhaps the company have assets that are doing nothing). Overall,

the company is doing quite well.

As of June 2020 ITC’s current P/E ratio (calculated as, Market price per share/EPS) stands at 15.62(industry

P/E- 19). While that of HUL is 74.52 (industry P/E – 64.49). A P/E ratio higher than industry average could

mean that a company's stock is over-valued, or else that investors are expecting high growth rates in the

future, on the other hand a P/E ratio lower than the industry average could mean that stock may be

undervalued.

References

https://www.itcportal.com/about-itc/shareholder-value/annual-reports/itc-annual-report-2019/pdf/ITC-Report-

and-Accounts-2019.pdf

https://www.investopedia.com/

https://www.moneycontrol.com/

https://en.wikipedia.org/wiki/ITC_Limited

Electronic copy available at: https://ssrn.com/abstract=3630917

You might also like

- AirAsia's Social Responsibility and CSR ProgramsDocument4 pagesAirAsia's Social Responsibility and CSR ProgramsPrivate TitaniumNo ratings yet

- Final Payment Certificate DomesticDocument1 pageFinal Payment Certificate DomesticDen OghangsombanNo ratings yet

- FM FS For GlobeDocument5 pagesFM FS For GlobeIngrid garingNo ratings yet

- Transactions: The Barclays Bank A/C 20-77-85 43223280Document2 pagesTransactions: The Barclays Bank A/C 20-77-85 43223280Doris Zhao100% (2)

- FsaDocument13 pagesFsaday6 favorite, loveNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- ITC Financial AnalysisDocument21 pagesITC Financial AnalysisDeepak ChandekarNo ratings yet

- Credit Memo For Gas Authority of IndiaDocument15 pagesCredit Memo For Gas Authority of IndiaKrina ShahNo ratings yet

- BANK OF BARODADocument22 pagesBANK OF BARODAShivane SivakumarNo ratings yet

- Pilipinas Shell Vertical and Horizontal AnalysisDocument7 pagesPilipinas Shell Vertical and Horizontal Analysismaica G.No ratings yet

- DG Khan Cement Financial StatementsDocument8 pagesDG Khan Cement Financial StatementsAsad BumbiaNo ratings yet

- HORIZON Analytical Procedure AppendixDocument5 pagesHORIZON Analytical Procedure AppendixWinny PoeNo ratings yet

- ONGC Consolidated Balance Sheet and Profit & Loss AnalysisDocument43 pagesONGC Consolidated Balance Sheet and Profit & Loss AnalysisNishant SharmaNo ratings yet

- Daniel John Gabriel FarDocument9 pagesDaniel John Gabriel FarJohn Gabriel DanielNo ratings yet

- Assingment SCM SEM4 - 1Document17 pagesAssingment SCM SEM4 - 1KARTHIYAENI VNo ratings yet

- Company Financial Analysis and Ratio Comparison Over 5 YearsDocument6 pagesCompany Financial Analysis and Ratio Comparison Over 5 YearsAanchal MahajanNo ratings yet

- Ratios and AnalDocument38 pagesRatios and AnalAbhishekKothiaJainNo ratings yet

- PHILEX - V and H AnalysisDocument8 pagesPHILEX - V and H AnalysisHilario, Jana Rizzette C.No ratings yet

- relianceDocument2 pagesrelianceAADHYA KHANNANo ratings yet

- Ginebra San Miguel Inc. Financial Position 2020-2019Document1 pageGinebra San Miguel Inc. Financial Position 2020-2019Venus PalmencoNo ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- Hexaware Technologies Financial Statements and ProjectionsDocument50 pagesHexaware Technologies Financial Statements and ProjectionsRahulTiwariNo ratings yet

- FinShiksha Maruti Suzuki UnsolvedDocument12 pagesFinShiksha Maruti Suzuki UnsolvedGANESH JAINNo ratings yet

- MaricoDocument13 pagesMaricoRitesh KhobragadeNo ratings yet

- Horizontal AnalysisDocument6 pagesHorizontal AnalysisjohhanaNo ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- UBL Analysis 2018Document4 pagesUBL Analysis 2018Zara ImranNo ratings yet

- sw-1662556454-TANZANIA INSURANCE QUARTERLY PERFORMANCE STATISTICSDocument12 pagessw-1662556454-TANZANIA INSURANCE QUARTERLY PERFORMANCE STATISTICSGEAT MWAISWELONo ratings yet

- New Microsoft Office Excel WorksheetDocument1 pageNew Microsoft Office Excel WorksheetManan SuchakNo ratings yet

- Tata Steel Valuation by BKMNDocument12 pagesTata Steel Valuation by BKMNKp PatelNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- NilkamalDocument14 pagesNilkamalNandish KothariNo ratings yet

- Wipro Annual Report SummaryDocument17 pagesWipro Annual Report SummaryApoorv SrivastavaNo ratings yet

- Asian PaintsDocument14 pagesAsian PaintsBiswajit BNo ratings yet

- Balance Sheet ParticularsDocument17 pagesBalance Sheet Particularspranav sarawagiNo ratings yet

- Financial Statement: Statement of Cash FlowsDocument6 pagesFinancial Statement: Statement of Cash FlowsdanyalNo ratings yet

- Swot Analysis I. Strenghts: WeaknessesDocument5 pagesSwot Analysis I. Strenghts: WeaknessesNiveditha MNo ratings yet

- Class Work Outs - FSA - MBF2Document67 pagesClass Work Outs - FSA - MBF2Shubham MukherjeeNo ratings yet

- Balance Sheet and Income Statement AnalysisDocument52 pagesBalance Sheet and Income Statement AnalysisM43CherryAroraNo ratings yet

- RIL Financial Statement Analysis (CIA-1BDocument10 pagesRIL Financial Statement Analysis (CIA-1Bprince chaudharyNo ratings yet

- Illustration Acc FMDocument22 pagesIllustration Acc FMHEMACNo ratings yet

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- Emperador Inc. and Subsidiaries 2016 and 2015 Financial StatementsDocument25 pagesEmperador Inc. and Subsidiaries 2016 and 2015 Financial StatementschenlyNo ratings yet

- Oka Corporation BHDDocument3 pagesOka Corporation BHDFagbile TomiwaNo ratings yet

- Financial Performance AnalysisDocument17 pagesFinancial Performance AnalysisIzza Felisilda100% (1)

- 1Document1 page1Saray MorenoNo ratings yet

- Three Statement ModelDocument9 pagesThree Statement ModelAnkit SharmaNo ratings yet

- BF1 Package Ratios ForecastingDocument16 pagesBF1 Package Ratios ForecastingBilal Javed JafraniNo ratings yet

- Comparative Income Statement for Reliance Industries LtdDocument23 pagesComparative Income Statement for Reliance Industries LtdManan Suchak100% (1)

- Accounts Cia: Submitted By: RISHIKESH DHIR (1923649) PARKHI GUPTA (1923643)Document12 pagesAccounts Cia: Submitted By: RISHIKESH DHIR (1923649) PARKHI GUPTA (1923643)RISHIKESH DHIR 1923649No ratings yet

- Mohammed Ameen PG23174 (Britannia Financial Modelling Assignment)Document20 pagesMohammed Ameen PG23174 (Britannia Financial Modelling Assignment)mameen2906No ratings yet

- Hero Motocorp Consolidated Balance Sheet and Profit & Loss Data for FY22Document32 pagesHero Motocorp Consolidated Balance Sheet and Profit & Loss Data for FY22DebayanNo ratings yet

- Jothikrishna AFD ProjectDocument34 pagesJothikrishna AFD ProjectDebayanNo ratings yet

- Balance Sheet (Crore)Document10 pagesBalance Sheet (Crore)MOHAMMED ARBAZ ABBASNo ratings yet

- Titan Company TemplateDocument18 pagesTitan Company Templatesejal aroraNo ratings yet

- Rs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37Document6 pagesRs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37priyanshu14No ratings yet

- Ambuja Cements: Profit & Loss AccountDocument15 pagesAmbuja Cements: Profit & Loss Accountwritik sahaNo ratings yet

- Financial AnalysisDocument9 pagesFinancial Analysisgem paolo lagranaNo ratings yet

- Financial Statement AnalysisDocument28 pagesFinancial Statement AnalysissanyaNo ratings yet

- D489 Abhishek JSWphase 2Document44 pagesD489 Abhishek JSWphase 2Yash KalaNo ratings yet

- Horizontal Vertical Ratio Analysis Problem Soln 16.04.2013Document15 pagesHorizontal Vertical Ratio Analysis Problem Soln 16.04.2013Ojas MaheshwaryNo ratings yet

- Alembic Pharmaceuticals Limited Consolidated Profit & Loss and Balance Sheet AnalysisDocument80 pagesAlembic Pharmaceuticals Limited Consolidated Profit & Loss and Balance Sheet Analysiszorem axoneNo ratings yet

- Unconsolidated Balance Sheet: As at December 31, 2009 Horizontal Analysis Assets Rs. (I/D) %Document4 pagesUnconsolidated Balance Sheet: As at December 31, 2009 Horizontal Analysis Assets Rs. (I/D) %syedaermaNo ratings yet

- Is the US Stock Market in a Bubble? Signs to Watch ForDocument2 pagesIs the US Stock Market in a Bubble? Signs to Watch ForLeslie LammersNo ratings yet

- Dagnachew GetachewDocument91 pagesDagnachew GetachewAhsan HumayunNo ratings yet

- Engineering and Technical Handbooks GuideDocument78 pagesEngineering and Technical Handbooks GuideJohn RoseroNo ratings yet

- Top Agrochemical Suppliers in Tamil NaduDocument6 pagesTop Agrochemical Suppliers in Tamil NadumjmariaantonyrajNo ratings yet

- Consumer Behavior 12th Edition Schiffman Test BankDocument31 pagesConsumer Behavior 12th Edition Schiffman Test Bankrowanbridgetuls3100% (24)

- DGS-2010-001 Design BasisDocument19 pagesDGS-2010-001 Design BasisJose ManjooranNo ratings yet

- International Conference (INAPR) ,: Daftar PustakaDocument4 pagesInternational Conference (INAPR) ,: Daftar PustakakaskusNo ratings yet

- US Navy Foundry Manual 1958Document264 pagesUS Navy Foundry Manual 1958Pop Adrian100% (8)

- MIS Procter & Gamble Q2 AndQ3 by WatieDocument7 pagesMIS Procter & Gamble Q2 AndQ3 by WatieAtielia De SamsNo ratings yet

- The 4 Types of InnovationDocument8 pagesThe 4 Types of InnovationMoncheNo ratings yet

- A Study On Marketing Strategy of Milky Bar ChocolateDocument43 pagesA Study On Marketing Strategy of Milky Bar ChocolateThakur Harshvardhan100% (3)

- The Gold Mine - Field Book For Lean TrainersDocument12 pagesThe Gold Mine - Field Book For Lean TrainersC P ChandrasekaranNo ratings yet

- HR ManagementDocument4 pagesHR ManagementKyrsti DeaneNo ratings yet

- Commercial Invoice Po#6600210291-5057004301 PDFDocument1 pageCommercial Invoice Po#6600210291-5057004301 PDFSandra Lubana Garcia GomezNo ratings yet

- Steel Authority of India LimitedDocument28 pagesSteel Authority of India LimitedAbhishek VishwaNo ratings yet

- Design and Fabrication of Compound DieDocument7 pagesDesign and Fabrication of Compound DieRaj PremrajNo ratings yet

- DOH vs Phillip Morris: SC rules on constitutionality of tobacco promotion banDocument15 pagesDOH vs Phillip Morris: SC rules on constitutionality of tobacco promotion banPaul ToguayNo ratings yet

- Custom Authentication in Oracle APEXDocument19 pagesCustom Authentication in Oracle APEXBala SubramanyamNo ratings yet

- MC CDP - Exam GuideDocument5 pagesMC CDP - Exam GuideArunDagarNo ratings yet

- Abbott Diagnostics Cell Dyn Emerald Operating Manual PDFDocument298 pagesAbbott Diagnostics Cell Dyn Emerald Operating Manual PDFAhmedMoussa0% (1)

- Quiz 1Document3 pagesQuiz 1Russiel DagohoyNo ratings yet

- ZMP19278 - Fragata Uniao - Mil-Tek 102HD PDFDocument6 pagesZMP19278 - Fragata Uniao - Mil-Tek 102HD PDFLeandro_BarjonasNo ratings yet

- Literature @jun-2020 MODIFIEDDocument26 pagesLiterature @jun-2020 MODIFIEDEng-Mukhtaar CatooshNo ratings yet

- Copyright SocietiesDocument3 pagesCopyright SocietiesSayali Gangal100% (1)

- 01-BacarraIN2020 Audit ReportDocument91 pages01-BacarraIN2020 Audit ReportRichard MendezNo ratings yet

- Storage and Ware Housing of Agricultural ProductsDocument14 pagesStorage and Ware Housing of Agricultural ProductsPragyan SarangiNo ratings yet