Professional Documents

Culture Documents

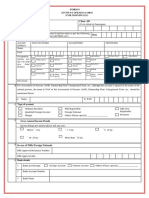

Customer Due Diligence - 2018-07-20 - 18-19-17

Uploaded by

wakhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Due Diligence - 2018-07-20 - 18-19-17

Uploaded by

wakhanCopyright:

Available Formats

Customer Due Diligence

Pakistan The content in the Customer Due Diligence section is valid for

the following calendar year:

#N/A

15) Are there minimum transaction thresholds, under which

customer due diligence is not required?

If Yes, what are the various thresholds in place?Are there

minimum transaction thresholds, under which customer due

diligence is not required?

Contact If Yes, what are the various thresholds in place?

Syed Faraz Anwer The AML/CFT regulations

(http://www.sbp.org.pk/l_frame/Revised-AML-CFT-Regulations.pdf)

+92 21 32426711 specify monetary thresholds for transactions executed by occasional

syed.faraz.anwer@pk.pwc.co customers/ walk-in customers and online transactions. Organisations,

m however, have defined their own internal monetary thresholds.

State Life Building, 16) What are the high level requirements for verification of

1-C; I.I.Chundrigar Road, customer identification information (individuals and legal

Karachi entities)?

As per the State Bank of Pakistan's AML/CFT Regulations (para 3 of

Regulation 1: Customer Due Diligence), for identity and due diligence

purposes, at a minimum, the following information shall also be obtained,

verified and recorded on the relevant KYC/CDD form or account opening

form:

a) full name as per identity document;

b) CNIC/Passport/NICOP/POC/ARC number or where the customer is

not a natural person, the registration/incorporation number or business

registration number (as applicable);

c) existing residential address, registered or business address (as

necessary), contact telephone number(s) and e-mail (as applicable);

d) date of birth, incorporation or registration (as applicable);

e) nationality or place of birth, incorporation or registration (as

applicable);

f) nature of business, geographies involved and expected type of counter-

parties (as applicable);

g) purpose of account;

h) type of account;

i) source of earnings;

j) expected monthly credit turnover (amount and no. of transactions); and

k) normal or expected modes of transactions.

Verification of the identity of the customers shall be completed before

business relations are established including verification from the National

Database & Registration Authority (NADRA), wherever required. In

addition, there are defined documentation requirements to be fulfilled in

relation to different categories of customers. For further details, please

refer to the revised Annexure I of the AML/CFT Regulations which can be

accessed at: http://www.sbp.org.pk/bprd/2017/CL29-Annex.pdf

17) Where copies of identification documentation are provided,

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 1

Customer Due Diligence

Pakistan what are the requirements around independent verification or

authentication?

As per paragraph 4 of Regulation 1 of the State Bank of Pakistan's

AML/CFT Regulations, the bank/development finance institution shall

verify identity documents of the customer(s) from relevant

authorities/document issuing bodies or where necessary using other

reliable, independent sources and retain on record, copies of all reference

documents used for identification and verification. The particulars/CNIC

Contact of such persons must be verified from the National Database Registration

Authority (NADRA) through VeriSys or bio-metric technology.

Syed Faraz Anwer Verification of the identity of the customers and beneficial owners shall be

completed before business relations are established including verification

+92 21 32426711

of a Computerized National Identity Card/National Identity Card for

syed.faraz.anwer@pk.pwc.co Overseas Pakistanis/Pakistan Origin Card from NADRA, where required

m for customers under these regulations.

State Life Building, For further details, please refer to the AML/CFT Regulations which can be

1-C; I.I.Chundrigar Road, accessed at: http://www.sbp.org.pk/l_frame/Revised-

Karachi AML-CFT-Regulations.pdf.

18) What are the high level requirements around beneficial

ownership (identification and verification)?

As per paragraphs 7 and 8 of Regulation 1 of the State Bank of Pakistan's

AML/CFT Regulations, banks/development finance institutions (DFIs)

shall take reasonable measures to obtain information to identify and verify

the identities of the beneficial owner(s). Where the customer is not a

natural person, the bank/DFI shall (i) take reasonable measures to

understand the ownership and control structure of the customer in order

to understand the purpose and intended nature of the business relations

and (ii) determine the natural person(s) who ultimately own or control the

customer. Verification of the identity of the beneficial owner(s) shall be

completed before business relations are established including verification

from the National Database Registration Authority (NADRA), where

required.

For further details, please refer to the AML/CFT Regulations which can be

accessed at: http://www.sbp.org.pk/l_frame/Revised-

AML-CFT-Regulations.pdf.

19) In what circumstances are reduced/simplified due diligence

arrangements available?

Detailed guidelines on general low risk scenarios/factors and their

disposition are available in section 'F' (paragraphs 7-9) of the State Bank

of Pakistan's 'AML/CFT Guidelines on Risk Based Approach for Banks &

DFIs'. The guidelines can be accessed at:

http://www.sbp.org.pk/l_frame/AML-CFT-Guidelines-

RiskBasedApproach.pdf.

Moreover, detailed guidelines regarding reduced / simplified due diligence

arrangements for branchless banking accounts are discussed in the '

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 2

Customer Due Diligence

Pakistan Paragraph 4' of the State Bank of Pakistan's Branchless Banking

Regulations. The regulations can be accessed at:

http://www.sbp.org.pk/bprd/2016/C9-Annx-A.pdf.

Furthermore, detailed guidelines on Simplified Due Diligence of on Low

Risk Bank Accounts (Asaan Account) has also been published by the State

Bank of Pakistan under BPRD Circular No. 11 dated June 22, 2015. The

guidelines can be accessed at:

Contact http://www.sbp.org.pk/bprd/2015/C11-Guidelines.pdf

Syed Faraz Anwer 20) In what circumstances are enhanced customer due

diligence measures required?

+92 21 32426711 Section 'D' (paragraphs 4-6) of the State Bank of Pakistan's 'AML/CFT

syed.faraz.anwer@pk.pwc.co Guidelines on Risk Based Approach for Banks & DFIs' provides specific

m high risk elements and recommendations for enhanced due diligence for

certain customer types (e.g. NPOs, NGOs, charities, associations, house

State Life Building, wife accounts, landlords, proprietorships, self-employed professionals, on-

1-C; I.I.Chundrigar Road, line transactions, cash, wire transfers, etc). Paragraph 5 provides high risk

Karachi elements/factors categorised into customers, products and delivery

channels and geography or locations.

For further details, please refer to the guidelines which can be accessed at:

http://www.sbp.org.pk/l_frame/AML-CFT-Guidelines-

RiskBasedApproach.pdf.

21) In what circumstances are additional due diligence required

for Politically Exposed Persons (‘PEPs’)?

Paragraph 29 of Regulation 1 of the State Bank of Pakistan's (SBP)

AML/CFT Regulations covers in detail the due diligence measures

required for PEPs.

In relation to PEPs and their close associates or family members,

banks/development finance institutions (DFIs) shall:

a) implement appropriate internal policies, procedures and controls to

determine if a customer or beneficial owner is a PEP;

b) obtain approval from the bank's senior management to establish or

continue business relations where the customer or a beneficial owner is a

PEP or subsequently becomes a PEP;

c) establish, by appropriate means, the sources of wealth or beneficial

ownership of funds, as appropriate, including the bank/ DFI's own

assessment to this effect; and

d) conduct during the course of the business relationship, enhanced

monitoring of business relations with the customer.

For further details, please refer to the AML/CFT Regulations which can be

accessed at: http://www.sbp.org.pk/l_frame/Revised-

AML-CFT-Regulations.pdf.

22) What enhanced due diligence must be performed for

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 3

Customer Due Diligence

Pakistan correspondent banking relationships (cross-border banking

and similar relationships)?

Regulation 2 (Correspondent Banking) of the State Bank of Pakistan's

(SBP) AML/CFT Regulations cover this area in detail.

For further details, please refer to the AML/CFT Regulations which can be

accessed at: http://www.sbp.org.pk/l_frame/Revised-

AML-CFT-Regulations.pdf.

Contact 23) Are relationships with shell banks specifically prohibited?

Syed Faraz Anwer Yes. As per paragraph 4 of Regulation 2 of the State Bank of Pakistan's

(SBP) AML/CFT Regulations, no bank/development finance institution

+92 21 32426711 (DFI) shall enter into or continue correspondent banking relations with a

syed.faraz.anwer@pk.pwc.co shell bank and shall take appropriate measures when establishing

m correspondent banking relations, to satisfy them that their respondent

banks do not permit their accounts to be used by shell banks.

State Life Building,

1-C; I.I.Chundrigar Road, For further details, please refer to the AML/CFT Regulations which can be

Karachi accessed at: http://www.sbp.org.pk/l_frame/Revised-

AML-CFT-Regulations.pdf.

24) In which circumstances are additional due diligence

required for non face-to-face transactions and/or

relationships?

In dealing with non face-to-face transactions and/or relationships,

adequate measures have been adopted by organisations. Additional due

diligence may be required when:

a) transactions do not make economic sense or are inconsistent with the

customer's business or profile;

b) transactions involving locations of concern & wire transfer(s); and

c) transactions involving unidentified parties.

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 4

Customer Due Diligence

India The content in the Customer Due Diligence section is valid for

the following calendar year:

#N/A

15) Are there minimum transaction thresholds, under which

customer due diligence is not required?

If Yes, what are the various thresholds in place?Are there

minimum transaction thresholds, under which customer due

diligence is not required?

Contact If Yes, what are the various thresholds in place?

Dhruv Chawla Where a transaction is carried out by a non-account based customer (e.g.

walk-in customer) and the amount of the transaction is lower than

+91 (0) 8130166550 INR50,000 (approx. USD735), the customer's identity and address do not

dhruv.chawla@in.pwc.com require verification. However, if a bank has reason to believe that a

customer is intentionally structuring a transaction into a series of

PricewaterhouseCoopers Pvt. transactions below the threshold of INR50,000 (approx. USD735) to

Ltd. avoid detection, the bank should verify the identity and address of the

The Millenia, Tower D, 7th customer and also consider filling in a suspicious transaction report.

Floor, 1&2 Murphy Road, Verification of identity must be conducted in respect of all cross-border

Ulsoor, Bangalore - 560008 payments.

India

16) What are the high level requirements for verification of

customer identification information (individuals and legal

entities)?

The banking entity, financial institution (FI) or intermediary must verify

and maintain the records in respect of the identity and the current address

of the customer. The documents required are:

Individuals:

For opening accounts of individuals, banks/FIs should obtain one certified

copy of an 'officially valid document' (e.g. passport, driving licence,

Permanent Account Number (PAN) Card, Voter's Identity Card issued by

the Election Commission of India, job card issued by NREGA duly signed

by an officer of the State Government, letter issued by the Unique

Identification Authority of India containing details of name, address and

Aadhaar number or any other document as notified by the Central

Government) and one recent photograph.

Corporates:

a) Certificate of incorporation;

b) Memorandum and Articles of Association;

c) a resolution from the Board of Directors and Power of Attorney granted

to its managers, officers or employees to transact on its behalf; and

d) an officially valid document in respect of managers, officers or

employees holding legal authority to transact on its behalf.

Partnership firm:

a) registration certificate;

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 5

Customer Due Diligence

India b) partnership deed; and

c) an officially valid document in respect of the person holding legal

authority to transact on its behalf.

Trust:

a) registration certificate;

b) trust deed; and

Contact c) an officially valid document in respect of the person holding a power of

attorney to transact on its behalf.

Dhruv Chawla

Unincorporated association or a body of individuals:

+91 (0) 8130166550

dhruv.chawla@in.pwc.com a) resolution of the managing body of such association or body of

individuals;

PricewaterhouseCoopers Pvt. b) power of attorney granted to transact on its behalf;

Ltd. c) an officially valid document in respect of the person holding legal

The Millenia, Tower D, 7th authority to transact on its behalf; and

Floor, 1&2 Murphy Road, d) such information as may be required by the bank/FI to collectively

Ulsoor, Bangalore - 560008 establish the legal existence of such an association or body of individuals.

India

17) Where copies of identification documentation are provided,

what are the requirements around independent verification or

authentication?

Certified copies of an official valid document(s) may be used. The copies

need to be verified by seeing the original document(s) and stamped as

'original(s) seen and verified'.

18) What are the high level requirements around beneficial

ownership (identification and verification)?

The banking entity, financial institution (FI) or intermediary should take

reasonable measures to identify the beneficial owner(s) and verify

his/her/their identity in a manner so that it is satisfied that it knows who

the ultimate beneficial owner(s) is/are.

a) If the client is a company, the beneficial owner is the natural person(s),

who, whether acting alone or together, or through one or more juridical

person(s), has/have a controlling ownership interest or who exercises

control through other means.

b) Where the client is a partnership firm, the beneficial owner is the

natural person(s), who, whether acting alone or together, or through one

or more juridical person(s), has/have ownership of/entitlement to more

than 15% of capital or profits of the partnership.

c) Where the client is an unincorporated association or body of

individuals, the beneficial owner is the natural person(s), who, whether

acting alone or together, or through one or more juridical person(s),

has/have ownership of/entitlement to more than 15% of the property or

capital

or profits of the unincorporated association or body of individuals.

d) Where the client is a trust, the identification of beneficial owner(s) shall

include identification of the author of the trust, the trustee(s), the

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 6

Customer Due Diligence

India beneficiaries with 15% or more interest in the trust and any other natural

person(s) exercising ultimate effective control over the trust through a

chain of control or ownership.

e) Where the client or the owner of the controlling interest is a company

listed on a stock exchange or is a subsidiary of such a company, it is not

necessary to identify and verify the identity of any shareholder(s) or

beneficial owner(s) of such companies.

19) In what circumstances are reduced/simplified due diligence

Contact arrangements available?

Dhruv Chawla If an individual customer does not have any of the 'officially valid

documents' (see below) as proof of identity, then banks/financial

+91 (0) 8130166550 institutions are allowed to adopt 'simplified measures' in respect of 'low

dhruv.chawla@in.pwc.com risk' customers, taking into consideration the type of customer, business

relationship, nature and value of transactions based on the overall money

PricewaterhouseCoopers Pvt. laundering and terrorist financing risks involved.

Ltd.

The Millenia, Tower D, 7th Examples of 'officially valid documents' include: passport, driving licence,

Floor, 1&2 Murphy Road, Permanent Account Number (PAN) Card, Voter's Identity Card issued by

Ulsoor, Bangalore - 560008 the Election Commission of India, job card issued by NREGA duly signed

India by an officer of the State Government, letter issued by the Unique

Identification Authority of India containing details of name, address and

Aadhaar number or any other document as notified by the Central

Government, etc.

20) In what circumstances are enhanced customer due

diligence measures required?

Customers that are likely to pose a higher than average risk to the bank

may be categorised as medium or high risk depending on the customer's

background, nature and location of activity, country of origin, source of

funds and client profile, etc. Banks may apply enhanced due diligence

measures based on the risk assessment, thereby requiring intensive due

diligence for higher risk customers, especially those for whom the sources

of funds is not clear. Examples of customers requiring enhanced due

diligence measures may include:

a) non-resident customers;

b) high net worth individuals;

c) trusts, charities, NGOs and organisations receiving donations;

d) companies having a close family shareholding or beneficial ownership;

e) firms with 'sleeping partners';

f) politically exposed persons of foreign origin;

g) non face-to-face customers;

h) those with a high risk reputation (based on publicly available

information); and

i) correspondent banking relationships.

21) In what circumstances are additional due diligence required

for Politically Exposed Persons (‘PEPs’)?

Banks should gather sufficient information on any person/customer of

this category intending to establish a relationship and check all the

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 7

Customer Due Diligence

India information available on the person in the public domain. Banks should

verify the identity of the person and seek information about their source of

funds before accepting the PEP as a customer. The decision to open an

account for a PEP should be taken at a senior level and this procedures

should be clearly stipulated in the bank's customer acceptance policy.

Banks should also subject such accounts to enhanced monitoring on an

ongoing basis. The above may also be applied to the accounts of the family

Contact members or close relatives of PEPs. In the case of an existing customer or

the beneficial owner(s) of an existing account subsequently becoming a

Dhruv Chawla PEP, banks should obtain senior management approval to continue the

business relationship and subject the account to the customer due

+91 (0) 8130166550

diligence measures as applicable to the customers of a PEP category

dhruv.chawla@in.pwc.com including enhanced monitoring on an ongoing basis. These instructions

are also applicable to accounts where a PEP is the ultimate beneficial

PricewaterhouseCoopers Pvt. owner. Furthermore, banks should have appropriate ongoing risk

Ltd. management procedures for identifying and applying enhanced customer

The Millenia, Tower D, 7th due diligence to PEPs, customers who are close relatives of PEPs and

Floor, 1&2 Murphy Road, accounts of which a PEP is the ultimate beneficial owner.

Ulsoor, Bangalore - 560008

India 22) What enhanced due diligence must be performed for

correspondent banking relationships (cross-border banking

and similar relationships)?

a) banks should gather sufficient information to fully understand the

nature of the business of the respondent bank. Banks should try to

ascertain, from publicly available information, whether the respondent

bank has been subject to any money laundering or terrorist financing

investigation or regulatory action.

b) the bank should also be satisfied that the respondent bank has verified

the identity of all customers having direct access to its accounts and is

undertaking ongoing due diligence on them. The bank should also ensure

that the respondent bank is able to provide the relevant customer

identification data immediately upon request.

c) additionally, in order to monitor and review 'at par' cheque facilities

extended to walk-in-customers of cooperative banks through

correspondent banking arrangements and to assess the risks including

credit risk and reputation risk arising associated with such arrangements,

banks should retain the right to verify the records maintained by these

cooperative banks/societies for compliance with the existing instructions

on KYC and AML under such arrangements.

23) Are relationships with shell banks specifically prohibited?

Yes. Guidance issued by the local regulator prohibits entering into a

correspondent relationship with shell banks. Shell banks are not

permitted to operate in India. Banks should also guard against

establishing relationships with respondent foreign financial institutions

that permit their accounts to be used by shell banks.

24) In which circumstances are additional due diligence

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 8

Customer Due Diligence

India required for non face-to-face transactions and/or

relationships?

a) in the case of non face-to-face customers, banks must adopt specific and

adequate procedures to mitigate the higher risk involved in addition to

applying the usual customer identification procedures.

b) certification of all the documents presented should be insisted upon

and additional documents may be called for in such cases. In the case of

Contact cross-border customers, there is the additional difficulty of matching the

customer with the documentation and the bank may have to rely on third

Dhruv Chawla party certification/ introduction. In such cases, it must be ensured that the

third party is a regulated and supervised entity and has adequate KYC

+91 (0) 8130166550

systems and controls in place. Additionally, the first transaction should be

dhruv.chawla@in.pwc.com through a cheque issued from an existing bank account.

PricewaterhouseCoopers Pvt.

Ltd.

The Millenia, Tower D, 7th

Floor, 1&2 Murphy Road,

Ulsoor, Bangalore - 560008

India

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 9

Customer Due Diligence

Malaysia The content in the Customer Due Diligence section is valid for

the following calendar year:

#N/A

15) Are there minimum transaction thresholds, under which

customer due diligence is not required?

If Yes, what are the various thresholds in place?Are there

minimum transaction thresholds, under which customer due

diligence is not required?

Contact If Yes, what are the various thresholds in place?

Alex Tan In broad terms, there is no minimum threshold for the following:

+60 3 2173 1338 a) establishing businesses relationships;

alex.tan@my.pwc.com b) wire transfers;

c) if there is suspicion of ML/TF; and

Level 10, 1 Sentral, Jalan d) if there is doubt about the veracity or adequacy of previously obtained

Rakyat, information.

Kuala Lumpur Sentral, PO

Box 10192, Otherwise:

50706 Kuala Lumpur,

Malaysia For banks and deposit taking institutions:

a) money changing and wholesale currency business - RM3,000 (approx.

USD670) and above;

b) occasional transactions - RM50,000 (approx. USD11,146) and above in

a single transaction or several transactions in a day that appear to be

linked; and

c) cash transactions - RM50,000 (approx. USD11,146) and above in a day.

For insurance and takaful:

May perform simplified customer due diligence on customer, beneficial

owner and beneficiary if:

a) all insurance policies are sold with premium amount below RM5,000

(approx. USD1,114); or

b) any single premium insurance policy is below RM10,000 (approx.

USD2,230).

For money service businesses:

a) money changing and wholesale currency business - RM3,000 (approx.

USD670) and above:

a. RM3,000 (approx. USD670) to RM10,000 (approx. USD2,230),

sighting and keying in customer/beneficial owner identification

information; and

b. above RM10,000 (approx. USD2,230), sighting and keying in

customer/beneficial owner identification information and making a copy

of identification document.

For licensed casino:

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 10

Customer Due Diligence

Malaysia

Any transaction involving RM10,000 (approx. USD2,230) and above (e.g.

exchange cash for cash chips, exchange cash/vouchers for chip warrants,

request for cheques or wire transfers for payments of winnings/capital,

use of membership cards/temporary cards in respect of e-cash out facility,

etc.). Customer due diligence is also required on the third party when

customer requests RM10,000 (approx. USD2,230) and above to be paid to

a third party.

Contact

For licensed gaming outlets:

Alex Tan

Appropriate thresholds are decided internally based on their own risk

+60 3 2173 1338

assessment. Thresholds are not publicly disclosed.

alex.tan@my.pwc.com

For dealers in precious metals and stones:

Level 10, 1 Sentral, Jalan

Rakyat, Any cash transaction equivalent to RM50,000 (approx. USD11,146) and

Kuala Lumpur Sentral, PO above, either as a single transaction or multiple transactions on a given

Box 10192, day.

50706 Kuala Lumpur,

Malaysia 16) What are the high level requirements for verification of

customer identification information (individuals and legal

entities)?

Individuals:

Reporting institutions should obtain at least:

a) full name;

b) date of birth;

c) nationality; and

d) permanent and mailing address and NRIC/passport number.

Institutions should verify the identity, representative capacity, domicile,

legal capacity, occupation or business purpose of any person, as well as

other identifying information on that person, whether an occasional or

usual client, through the use of documents such as an identity card,

passport, birth certificate, driving licence, or any other official or private

photograph bearing document.

Where a particular individual is commonly known by two or more

different names, the individuals shall not use one of those names to open

an account with the reporting institution(s), unless he/she has disclosed

the other names to the reporting institution(s). The reporting institution

should make a record of the different names by which the individual is

commonly known as and upon request provide the information to the

competent authority.

Legal Entities:

Reporting institutions should require the company/business to provide

original documentation and copies should be made of each of the

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 11

Customer Due Diligence

Malaysia following documents:

a) Memorandum and Articles of Association/Certificate of

Incorporation/partnership;

b) identification documents of directors/shareholders/partners;

c) authorisation for any person to represent the company/business;

d) identification document(s) of the person authorised to represent the

company/business in its dealing with the reporting institution; and

Contact e) registered office address and principle place of business.

Alex Tan 17) Where copies of identification documentation are provided,

what are the requirements around independent verification or

+60 3 2173 1338 authentication?

alex.tan@my.pwc.com Original documents must be provided and the reporting institution should

make copies, as required. Certified true copies/duly notarised copies may

Level 10, 1 Sentral, Jalan be accepted.

Rakyat,

Kuala Lumpur Sentral, PO 18) What are the high level requirements around beneficial

Box 10192, ownership (identification and verification)?

50706 Kuala Lumpur, The reporting institution must identify and verify the beneficial owner(s).

Malaysia They should conduct customer due diligence on the natural person that

ultimately owns or controls the customer's transaction when they suspect

the transaction is conducted on behalf of a beneficial owner(s) and not the

customer who is conducting such a transaction. The customer due

diligence conducted should be as stringent as that imposed on an

individual customer.

19) In what circumstances are reduced/simplified due diligence

arrangements available?

Simplified due diligence applies to the following:

Reporting institutions are exempted from obtaining a copy of the

Memorandum and Articles of Association or certificate of incorporation

and from identifying and verifying the directors and shareholders of the

legal person which fall under the following categories:

a) public listed companies or corporations listed in Bursa Malaysia;

b) foreign public listed companies:

a. listed in recognised exchanges; and

b. not listed in higher risk countries;

c) foreign financial institutions that are not from higher risk countries;

d) government-linked companies in Malaysia;

e) state-owned corporations and companies in Malaysia;

f) an authorised person, an operator of a designated payment system, a

registered person, as the case may be, under the FSA and the IFSA;

g) persons licensed or registered under the Capital Markets and Services

Act 2007;

h) licensed entities under the Labuan Financial Services and Securities Act

2010 and Labuan Islamic Financial Services and Securities Act 2010; or

i) prescribed institutions under the Development Financial Institutions

Act 2002.

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 12

Customer Due Diligence

Malaysia 20) In what circumstances are enhanced customer due

diligence measures required?

Local AML guidance requires an enhanced customer due diligence process

for higher risk categories of customers, business relationships or

transactions. Enhanced due diligence should include at least obtaining

more detailed information from the customer and through publicly

available information, in particular, on the purpose of the transaction and

source of funds and obtaining approval from the senior management of

Contact the reporting institution before establishing the business relationship with

the customer.

Alex Tan

Examples of higher risk customers are:

+60 3 2173 1338

alex.tan@my.pwc.com a) individuals with high net worth;

b) non-resident customers;

Level 10, 1 Sentral, Jalan c) individuals from locations known for their high rates of crime (e.g. drug

Rakyat, producing, trafficking, smuggling, etc.);

Kuala Lumpur Sentral, PO d) countries or jurisdictions with inadequate AML/CFT laws and

Box 10192, regulations as highlighted by the FATF;

50706 Kuala Lumpur, e) politically exposed persons (PEPs);

Malaysia f) legal arrangements that are complex (e.g. trusts, nominee companies,

etc.); and

g) cash based businesses and businesses/activities identified by the FATF

as of higher money laundering and/or terrorist financing risk.

21) In what circumstances are additional due diligence required

for Politically Exposed Persons (‘PEPs’)?

Once a PEP (local and foreign) is identified, the reporting institution

should take reasonable and appropriate measures to establish the source

of wealth and funds of such a person.

22) What enhanced due diligence must be performed for

correspondent banking relationships (cross-border banking

and similar relationships)?

Section 20 of the sectorial guidelines for banks and financial institutions

deals with correspondent banking:

S. 20.1 "Reporting institutions providing correspondent banking services

to respondent banks are required to take the necessary measures to ensure

that it is not exposed to the threat of ML/TF through the accounts of the

respondent banks such as being used by shell banks".

S. 20.2 "In relation to cross-border correspondent banking and other

similar relationships, reporting institutions are required to:

a) gather sufficient information about a respondent bank to understand

fully the nature of the respondent bank's business and to determine, from

publicly available information, the reputation of the respondent bank and

the quality of supervision exercised on the respondent bank, including

whether it has been subject to a ML/TF investigation or regulatory action;

b) assess the respondent bank's AML/CFT controls against the AML/CFT

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 13

Customer Due Diligence

Malaysia measures of the country or jurisdiction in which the respondent bank

operates;

c) obtain approval from senior management before establishing new

correspondent banking relationships; and

d) clearly understand the respective AML/CFT responsibilities of each

institution".

S. 20.3 "In relation to “payable-through accounts”, reporting institutions

Contact are required to satisfy themselves that the respondent bank:

Alex Tan a) has performed customer due diligence (CDD) obligations on its

customers that have direct access to the accounts of the reporting

+60 3 2173 1338

institution; and

alex.tan@my.pwc.com b) is able to provide relevant CDD information to the reporting institution

upon request".

Level 10, 1 Sentral, Jalan

Rakyat, S. 20.4 "Reporting institutions shall not enter into, or continue,

Kuala Lumpur Sentral, PO correspondent banking relationships with shell banks. Reporting

Box 10192, institutions are required to satisfy themselves that respondent banks do

50706 Kuala Lumpur, not permit their accounts to be used by shell banks".

Malaysia

For the non-financial institution sector, there is no specific guideline for

correspondent banking.

23) Are relationships with shell banks specifically prohibited?

For banks and other financial institutions, the guidelines state that they

should not establish or have any business relationships with shell banks.

There is no such prohibition for the non-financial sector.

24) In which circumstances are additional due diligence

required for non face-to-face transactions and/or

relationships?

Reporting institutions may establish non face-to-face business

relationships with its customers. Non face-to-face relationships can only

be established if the reporting institution has policies and procedures in

place to address any specific risks associated with non face-to-face

business relationships.

Reporting institutions are required to be vigilant in establishing and

conducting non face-to-face business relationships (e.g. through the

internet) and are required to establish appropriate measures for

identification and verification of customer identity that shall be as

effective as that for face-to-face customers and to implement monitoring

and reporting mechanisms to identify potential ML/TF activities.

Reporting institutions may use the following measures to verify the

identity of non face-to-face customer:

a) requesting additional documents to complement those which are

required for face-to-face customer;

b) developing independent contact with the customer; or

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 14

Customer Due Diligence

Malaysia c) verifying the customer's information against any database maintained

by the authorities.

Contact

Alex Tan

+60 3 2173 1338

alex.tan@my.pwc.com

Level 10, 1 Sentral, Jalan

Rakyat,

Kuala Lumpur Sentral, PO

Box 10192,

50706 Kuala Lumpur,

Malaysia

GFC/KYC AML/Customer Due Diligence/2018-07-20 Page 15

Customer Due Diligence

Malaysia

Contact

Alex Tan

+60 3 2173 1338

alex.tan@my.pwc.com

Level 10, 1 Sentral, Jalan

Rakyat,

Kuala Lumpur Sentral, PO

Box 10192,

50706 Kuala Lumpur,

Malaysia

At PwC United Kingdom, our purpose is to build trust in society and solve important problems. We’re a network of firms in 157 countries with more than 208,000

people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at

www.pwc.com/UK.

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the

information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the

accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers LLP, its members,

employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in

reliance on the information contained in this publication or for any decision based on it.

© 2018 PricewaterhouseCoopers LLP. All rights reserved. In this document, “PwC” refers to the UK member firm, and may sometimes refer to the PwC network.

Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details.

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Ownership and Governance of State Owned Enterprises A Compendium of National Practices PDFDocument88 pagesOwnership and Governance of State Owned Enterprises A Compendium of National Practices PDFAmbrozka Ogilvy DamaraNo ratings yet

- Algorithm Trading in Indian Financial MarketsDocument3 pagesAlgorithm Trading in Indian Financial MarketswakhanNo ratings yet

- Re Establishing LegitimacyDocument1 pageRe Establishing LegitimacywakhanNo ratings yet

- 4th Round RatingsDocument8 pages4th Round RatingswakhanNo ratings yet

- APG-Follow-Up-Report-Bangladesh-2019 Partially CompliantDocument10 pagesAPG-Follow-Up-Report-Bangladesh-2019 Partially CompliantwakhanNo ratings yet

- Mongolia-2019 FUR R24LCDocument18 pagesMongolia-2019 FUR R24LCwakhanNo ratings yet

- Corruption and Regulatory StructuresDocument18 pagesCorruption and Regulatory StructureswakhanNo ratings yet

- LL PSC01 V3.0Document5 pagesLL PSC01 V3.0wakhanNo ratings yet

- IdiotsguidetoanonymouscompaniesDocument4 pagesIdiotsguidetoanonymouscompanieswakhanNo ratings yet

- Customer Due Diligence - 2018-07-20 - 18-21-23Document16 pagesCustomer Due Diligence - 2018-07-20 - 18-21-23wakhanNo ratings yet

- Customer Due Diligence - 2018-07-20 - 18-21-23Document16 pagesCustomer Due Diligence - 2018-07-20 - 18-21-23wakhanNo ratings yet

- PrinDocument40 pagesPrinwakhanNo ratings yet

- Blockchain and Public OwnershipDocument34 pagesBlockchain and Public OwnershipwakhanNo ratings yet

- Customer Due Diligence - 2018-07-20 - 18-21-23Document16 pagesCustomer Due Diligence - 2018-07-20 - 18-21-23wakhanNo ratings yet

- Earnings Management and PrivatisationDocument18 pagesEarnings Management and PrivatisationwakhanNo ratings yet

- CPP 4B Albert Ho Notes Online Intellectual Property FraudDocument2 pagesCPP 4B Albert Ho Notes Online Intellectual Property FraudwakhanNo ratings yet

- Public Sector Companies (Corporate Governance Compliance) Guidelines, 2013Document8 pagesPublic Sector Companies (Corporate Governance Compliance) Guidelines, 2013wakhanNo ratings yet

- Cipe Training Resource BookDocument25 pagesCipe Training Resource BookwakhanNo ratings yet

- Where Experts Get It Wrong: Independence vs. Leadership in Corporate GovernanceDocument5 pagesWhere Experts Get It Wrong: Independence vs. Leadership in Corporate GovernanceBrian TayanNo ratings yet

- CG in Emerging MarketsDocument24 pagesCG in Emerging MarketswakhanNo ratings yet

- CipherTrace Cryptocurrency Anti Money Laundering Report 2019 Q3Document37 pagesCipherTrace Cryptocurrency Anti Money Laundering Report 2019 Q3wakhan100% (1)

- Code CorporateGovernance 2012Document42 pagesCode CorporateGovernance 2012araza_962307No ratings yet

- WorkingPaper 57Document87 pagesWorkingPaper 57Shoaib Ahmad KhatanaNo ratings yet

- Corporate Governance Review 2014Document62 pagesCorporate Governance Review 2014wakhanNo ratings yet

- Ramadan Planning: If You FAIL To You PLAN ToDocument15 pagesRamadan Planning: If You FAIL To You PLAN TowakhanNo ratings yet

- Public Sector Companies (Corporate Governance) Rules 2013Document27 pagesPublic Sector Companies (Corporate Governance) Rules 2013wakhanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fsa Systems ReviewDocument30 pagesFsa Systems ReviewHuyềnNo ratings yet

- AML/CFT Responsibilities and Preventative Measures RegulationDocument32 pagesAML/CFT Responsibilities and Preventative Measures RegulationAbdul Mussawer MoradNo ratings yet

- HDFC Common Application FormDocument3 pagesHDFC Common Application FormTirthGanatraNo ratings yet

- RISK ASSESSMENT GuidelinesDocument34 pagesRISK ASSESSMENT GuidelineszamanbdNo ratings yet

- Main Reviewer For The AML Home Study ProgramDocument43 pagesMain Reviewer For The AML Home Study ProgramMike E DmNo ratings yet

- Acleda Bank Aml 2009Document60 pagesAcleda Bank Aml 2009Jeevann Goldee Shikamaru100% (1)

- Money Laundering Final ThesisDocument119 pagesMoney Laundering Final ThesisashairwaysNo ratings yet

- Customer Due Diligence TemplatesDocument25 pagesCustomer Due Diligence TemplatesFreznel B. Sta. Ana100% (1)

- 05 Circular - ForM 9 - Account Opening Form (Individual)Document4 pages05 Circular - ForM 9 - Account Opening Form (Individual)Sneha bagweNo ratings yet

- Application Form Cross Border Financing Facility December2015Document8 pagesApplication Form Cross Border Financing Facility December2015samdol badigolNo ratings yet

- Fihfc Kyc Aml Policy March 2020Document23 pagesFihfc Kyc Aml Policy March 2020HarpreetNo ratings yet

- Aml CFT Quiz Ans (1) 20211116212832Document205 pagesAml CFT Quiz Ans (1) 20211116212832Uday GopalNo ratings yet

- Addendum Form HDFCDocument2 pagesAddendum Form HDFCmanoj92.hdfcloanNo ratings yet

- Financial Crime Guide For Firms - P2 Financial Crime Thematic Reviews (FCA UK 2015)Document95 pagesFinancial Crime Guide For Firms - P2 Financial Crime Thematic Reviews (FCA UK 2015)ducuhNo ratings yet

- Guidance For Lawyers PDFDocument44 pagesGuidance For Lawyers PDFvanessaNo ratings yet

- PWC Kyc Anti Money Laundering Guide 2013Document292 pagesPWC Kyc Anti Money Laundering Guide 2013Adrian Ilie100% (1)

- KYC, AML and Compliance Basic Module (New)Document15 pagesKYC, AML and Compliance Basic Module (New)Vijay ChallaNo ratings yet

- Politically Exposed Persons (PEPs) - Risks... (PDF Download Available)Document22 pagesPolitically Exposed Persons (PEPs) - Risks... (PDF Download Available)FrankNo ratings yet

- NNJ Chapter Acams Study Guide Review PDFDocument134 pagesNNJ Chapter Acams Study Guide Review PDFSaied Mastan100% (1)

- KYC Checklist SpreadsheetDocument56 pagesKYC Checklist Spreadsheetwilliam medrano100% (1)

- Non Employed Worker GLOBAL Screening Self Certification Letter - 1 Oct 2020Document6 pagesNon Employed Worker GLOBAL Screening Self Certification Letter - 1 Oct 2020nandita sharmaNo ratings yet

- AMLReportDocument33 pagesAMLReportprabu2125No ratings yet

- New Paytime Customer ProfileDocument7 pagesNew Paytime Customer ProfileJy AcctNo ratings yet

- Outline: IFMP AML/CFT Certification: o o o o oDocument6 pagesOutline: IFMP AML/CFT Certification: o o o o oRaza FNo ratings yet

- KYC Norms Full ProjectDocument72 pagesKYC Norms Full ProjectPriyanka Pandit88% (24)

- Individual: Know Your Customer (Kyc) Application FormDocument5 pagesIndividual: Know Your Customer (Kyc) Application FormMuhammad HaseebNo ratings yet

- CAMS Test - 2 (22.2.2020)Document33 pagesCAMS Test - 2 (22.2.2020)vinttt13409No ratings yet

- Farage DossierDocument40 pagesFarage DossierCallum JonesNo ratings yet

- PWC Anti Money Laundering 2016 PDFDocument671 pagesPWC Anti Money Laundering 2016 PDFPraveen KumarNo ratings yet

- MCB AML KYC QuestionnnaireDocument3 pagesMCB AML KYC QuestionnnaireM.Ali HassanNo ratings yet