Professional Documents

Culture Documents

THIRD OUTLINE Notes

Uploaded by

none0 ratings0% found this document useful (0 votes)

6 views4 pagesOriginal Title

THIRD-OUTLINE-notes.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesTHIRD OUTLINE Notes

Uploaded by

noneCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

THIRD OUTLINE – NEGOTIABLE INSTRUMENTS

III. Form and Interpretation of Negotiable Instruments

A. Requisites of Negotiability

1) Of Negotiable Instruments in General

Section 1. Form of negotiable instruments. — An instrument to be negotiable must conform to the following

requirements:

(a) It must be in writing and signed by the maker or drawer;

(b) Must contain an unconditional promise or order to pay a sum certain in money;

(c) Must be payable on demand, or at a fixed or determinable future time;

(d) Must be payable to order or to bearer; and

(e) Where the instrument is addressed to a drawee, he must be named or otherwise indicated therein with

reasonable certainty.

2) Of a Promissory Note

(a) It must be in writing and signed by the maker;

(b) Must contain an unconditional promise to pay a sum certain in money;

(c) Must be payable on demand, or at a fixed or determinable future time; and

(d) Must be payable to order or to bearer.

3) Of a Bill Exchange

(a) It must be in writing and signed by the drawer;

(b) Must contain an unconditional order to pay a sum certain in money;

(c) Must be payable on demand, or at a fixed or determinable future time;

(d) Must be payable to order or to bearer; and

(e) The drawee must be named or otherwise indicated therein with reasonable certainty.

4) Application of the Requisites

B. Meaning of Particular Requisites

1) Unconditional Promise or Order

Section 3

Instrument payable absolutely. — It is not enough that there be a promise or order. It must be

unconditional, that is, it must not be subject to any condition or contingency except implied conditions

of presentment protests and notice of dishonor as provided in the law. In other words, the note or bill

must be payable absolutely.

Reason for requisite. — The fact that the liability is unconditional greatly enhances the ability of the

instrument to circulate freely from one person to another. No one would accept a paper for debt if the

right to recover were not absolute or unconditional in nature. Instruments which are not to be paid until a

condition has happened or been fulfilled would be of little practical value in business.

Terms not affecting unconditional liability. — The mere indication of the particular fund out of which

reimbursement is to be made, or an indication of particular account to be debited with the amount does

not render a promise or order conditional.

Note:An instrument payable out of a particular fund is non- negotiable (Sec. 3, par. 2.) as it is

not payable "in any event" because the amount to be paid is made to depend upon the adequacy

or existence of the fund designated. It is to be distinguished from an instrument, merely

containing reference to funds fromwhich reimbursement is to be made. Here, the fund specified

is the direct source of payment and the measure of liability.

The test of negotiabilityin every case is said to be whether or not the instrument carries the

general personal credit of the maker or drawer. If it does, the instrument is negotiable; if it

carries only the credit of a particular fund, the instrument is non-negotiable.

Implied promise to pay. — It is not essential that the word "promise" should be used. Any words

equivalent to a promise or assumption of full responsibility for the payment of the note on the face of an

instrument are sufficient to constitute a "promise to pay."

Bare acknowledgment of indebtedness. — A bare admission or acknowledgement of indebtedness (like

"I.O.U.," "due PI,000.00," "for value received," etc.) alone is not a negotiable instrument as it does

not import an express promise to pay orshow that the parties intend the debt to be paid.

Use of words of negotiability. — The language used must be such that the written undertaking to pay may

fairly be deduced therefrom. Thus, if words of negotiability or payment are added as indicating a promise

to pay (like "due P or order" or "due P or bearer," or "due P or demand," or "I.O.U. P10,000.00 to be paid

on June 1."), the instrument is negotiable although it contains no express promissory words.

2) Certainty of Sum

Section 2

The "sum certain" requirement is met ifthe holder can determine from the instrument itself the amount

he is entitled to receive at maturity.

This is a requisite for the negotiability of the instrument (Sec. l[b];), to assure clarity and certainty in

determining the value of the instrument.

The sum is not rendered uncertain by a clause in the instrument that it is to be paid with interest, by

stated installment, with exchange, with costs of collection, or with attorney's fees. Neither is the certainty

of the sum affected by an acceleration provision in an installment note.

The basic test is whether the holder can determine by calculation or computation the amount payable

when the instrument is due. But a promissory note giving the maker the right to ascertain the amount

rightly payable thereunder is non-negotiable.

a. Acceleration Due to Default

With an acceleration clause. — The sum is still certain although payable by stated installments

with an acceleration clause, i.e., a promise that if any installment or interest is not paid as agreed,

the whole shall become due. Such a clause requires full payment of an instrument immediately

upon default on any installment. It does not make an instrument payable upon contingency (and

so non-negotiable) since the time of payment will surely come and the exact value of the

instrument can be ascertained.

b. Attorney’s Fees

While the law says "costs of collection or an attorney's fee," the word "or" is not material and an

agreement to pay "attorney's fees and all costs of collection" does not impair negotiability,since

the two phrases mean the same thing.

3) In Money

If the instrument calls for an act other than the payment of money, it is not negotiable because a

negotiable instrument is intended as a substitute for money.

If an instrument be for a specified sum of money, and also for the payment of something else, the value of

which is not ascertained but depends upon extrinsic evidence, it would not be negotiable.

4) Payable on Demand

Section 7

Demand instrument – payable anytime

payable on demand not only as between the immediate parties but also as to subsequent parties.

An instrument payable on demand is due and payable immediately after delivery. It is a present debt due

at once.

i. Expressed to be payable on demand.

ii. No time for payment is expressed

iii. Payable on demand as regards the maker. [EXAMPLE:A note dated July 3, 2010 and payable

"thirty days after date" was issued on August 4, 2010 (when it was already overdue).]

iv. Payable on demand as regards the acceptor. [EXAMPLE:A bill payable on July 20,2010 was

accepted by the drawee on July 21,2010.]

v. Payable on demand as regards the indorser. [EXAMPLE:A note payable "thirty days" after July

1,2010 and indorsed on August 1,2010. The indorsement after maturity, in legal effect, creates a

new instrument payable on demand.]

5) Determinable Future Time

Section 4

Term or Time instrument - payable only upon the arrival of the time for payment

EXAMPLES:

(1) Payable at a fixed time; "I promise to pay P or order the sum of P10,000.00 on September 10,2010."

Here, the future date specified is a fixed time.

(2) Payable at a fixed period after date: "Sixty (60) days after date, I promise to pay P or order the sum of

P10,000.00."

The date of maturity may be determined beforehand by counting sixty (60) days from the date of

its issuance.

But an instrument payable "at the earliest possible time after date" is not payable at a definite

time.

(3) Payable at a fixed period after sight: "Sixty (60) days after sight, pay to the order of P the sum of

P10,000.00."

After sight means after the instrument is seen by the drawee upon presentment for acceptance or

accepted by the drawee. Hence, the date of maturity may be determined beforehand by counting

sixty (60) days from the date it is presented to the drawee.

(4) Payable on or before a fixed time.

i. "On or before September 10,2010,1 promise to pay P or order P10,000.00."

ii. "On demand or at the end of the year, I promise to pay P or order P10,000.00."

(5) Payable on or before a determinable future time: "On or before the start of the next school semester, I

promised to pay P or order P10,000.00."

(6) Payable on the occurence of a specified event: "I promised to pay P or order the sum of P10,000.00

upon the death of his father.""I promised to pay P or order the sum of P10,000.00 upon the death of his

father."

(7) Payable after the occurrence of a specified event: "Thirty (30) days after the death of his father, I

promise to pay P or order the sum of P10,000.00”

Note: But a bill or note payable several days before the occurrence of the specified event is

not negotiable, since the date of maturity of the instrument can only be ascertained after

it has become overdue and, therefore, the time for payment is uncertain.

Note: Payable "when able," etc.; within reasonable time, NON-NEGOTIABLE

6) Payable to Order

Section 8

An instrument is payable to order where it is drawn payable: (1) to the order of a specified or (2) to him or

his order.

Any subsequent purchaser thereof will not enjoy the advantages of being a holder of a negotiable

instrument but will merely"step into the shoes of the person designated in the instrument” and will thus

be open to all the defenses available against the latter.

It is not essential, however, that the words "to the order of" or "or order" be used. The words "to P and

assigns," have been held to be equivalent words which will render the instrument negotiable.

EXAMPLES:

(1) to order of payee who is notthe maker.

"I promise to pay PI,000.00 to the order of P (or to pay P or order PI,000.00).

(Sgd.) M"

(2) to order of payee who is not the drawer.

"Pay to the order of P P1,000.00.

(Sgd.) R6"

(3) to order of payee who is not the drawee.

"Pay to the order of P PI,000.00

(Sgd.) R

To W, Manila"

(4) to order of drawer.

"Pay to the order of myself PI,000.00.

(Sgd.) R

ToW, Manila"

NOTE: When a depositor wishes to get cash from his bank over the counter, the practice

is to draw a check in the form of "Pay to cash."

(5) to order of maker.

"I promise to pay to the order of myself PI,000.00.

(Sgd.)M"

NOTE: But a note payable to the order of the maker is not complete, until indorsed by

him. (Sec. 184.)

(6) to order of drawee.

"Pay to the order of yourself P1,000.00.

(Sgd.) R

ToW, Manila"

(7) to order of two or more payees jointly: "Pay to the order of P and A PI,000.00."

(8) to order of one or some of several payees: "Pay to the order of P, A, or B PI,000.00" or "Pay to the

order of P, A and B, or any of them or any two of them."

NOTE: In this case, the instrument is payable to either one of them, and the

indorsement of any one is sufficient to pass title.

(9) to order of holder of an office for the time being: "Pay to the order of the Commissioner of Internal

Revenue" or "Pay to the order of the Treasurer, Philippine National Bank."

7) Payable to Bearer

Section 9

Bearer means the person in possession of a bill or note which is payable to bearer.

An instrument payable to bearer may be transferred by delivery without indorsement.

Payable to order of a fictitious person. – A fictitious person is meant to be one who, though named or

specified as payee in an instrument, has no right to it because the maker or drawer so intended and it

matters not, therefore, whether the name of the payee used by him be that one living or dead, or one who

never existed.

8) Samples of Negotiable Instruments

9) Rules as to Dates

If the instrument bears a date, it is presumed that said date is the date when it was made or drawn.

He who claims that some other date is the true date has the burden to establish such claim.

Generally, a date is not essential to make an instrument negotiable.

i. When essential:

(1) Where instrument is payable at a fixed period after date.

(2) Where instrument is payable at a fixed period after sight or presentment

an instrument payable on demand need not be dated since it is demandable at any time

BUT! date of issue of the promissory note or the date of the last negotiation of the bill of exchange is

essential for the purpose of determining whether a party has acted within a reasonable time (see Sec. 144.)

but not to make the instrument negotiable.

ANTE-DATED and POST-DATED

i. An instrument is ante-dated when it contains a date earlier that the true date of its issuance.

Thus, an instrument issued on July 30,2010 but is dated July 15,2010 is antedated.

ii. An instrument is post-dated when it contains a date later than the true date of its issuance. It is

just the reverse of an antedated instrument. In the example given, if the instrument was issued on

July 15,2010, but bears a date of July 30,2010, it is postdated.

iii. If the ante-dating or post-dating is done for an illegal or fraudulent purpose, the instrument is

rendered invalid.

iv. An example of illegal ante-dating is that done to conceal the charge of usurious interest. An

example of illegal post-dating is to issue a post-dated check in payment of an obligation because

of insufficiency of funds without bona fide intention to cover the amount of the check.

C. Rules on Interpretation of Instruments

(Section 17, Act 2031)

1) Sums expressed in words and in figures different. — When there is a discrepancy between the sum

expressed in words and the sum expressed in figures, the former controls.

2) Words ambiguous or uncertain. — Words outweigh figures. However, when the words are ambiguous or

uncertain, reference may be had to the figures to determine the true amount.

3) Date when stipulated interest to run not specified. — If the date when the stipulated interest is to run is

not specified, theinterest runs from the date of the instrument or if undated, from the date of issue.

4) Instrument undated. — An undated instrument is considered dated as of the date of its issue.

NOTE: Issue means the first delivery of the instrument complete in form, to a person who takes

it as holder.

5) Written and printed provisions in conflict. — In case of conflict between the written and printed

provisions, the former prevail.

6) Whether instrument bill or note in doubt. — In case of doubt as to whether an instrument is a bill or note,

the holder may treat either at his election.

7) Capacity in which person signed in doubt.—In case of doubt as to what capacity the person making the

instrument intended to sign, he is to be deemed an indorser.

Signature of maker: lower right-hand

Drawee’s name: lower left-hand

The holder negotiates the instrument by signing on the back thereof.

Section 17(f) applies only when there is 'doubt due to the ambiguous location of the signature.

One who signed in the place of the maker's name is not an indorser.

(Section [17]g, Negotiable Instruments Law; Article 1216, Civil Code)

1) Instrument signed by two or more persons. — An instrument with the words "I promise to pay" signed by

two or more persons gives rise to solidary liability.

Anyone of the signers may be held liable for the whole amount of the instrument. The reason is

that each of them is deemed to utter the words "I promise to pay."

"I, we, or either or us promise to pay." – SOLIDARY LIABILITY

"we promise to pay" – JOINT LIABILITY ONLY

You might also like

- Negotiable InstrumentsDocument9 pagesNegotiable InstrumentsAndrolf CaparasNo ratings yet

- General Rules of Negotional InstrumentsDocument2 pagesGeneral Rules of Negotional InstrumentsRae SlaughterNo ratings yet

- Negotiable Instruments Law 1-3 Lecture NotesDocument8 pagesNegotiable Instruments Law 1-3 Lecture Notesleyla watsonNo ratings yet

- Basic Principles of Negotiable InstrumentsDocument37 pagesBasic Principles of Negotiable InstrumentsAndrea IvanneNo ratings yet

- Negotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Document14 pagesNegotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Gennelyn Grace PenaredondoNo ratings yet

- Negotiable Instrument Law ReviewerDocument8 pagesNegotiable Instrument Law ReviewerJerwel De PerioNo ratings yet

- Negotiable Instruments Law (NOTES)Document3 pagesNegotiable Instruments Law (NOTES)FbarrsNo ratings yet

- Commercial Law ReviewDocument22 pagesCommercial Law ReviewKatrine ManaoNo ratings yet

- Negotiable InstrumentsDocument4 pagesNegotiable InstrumentsAndrolf CaparasNo ratings yet

- Negotiable Instruments 1st SessionDocument50 pagesNegotiable Instruments 1st SessionRM Mallorca100% (3)

- RFBT Negotiable Instruments LawDocument8 pagesRFBT Negotiable Instruments LawKatzkie Montemayor Godinez100% (1)

- Negotiable Instruments NotesDocument14 pagesNegotiable Instruments NotesGennelyn Grace PenaredondoNo ratings yet

- Law On Negotiable Instruments ReviewerDocument7 pagesLaw On Negotiable Instruments ReviewerLourdes May Flores ParmanNo ratings yet

- NegoIn Section 1-10Document13 pagesNegoIn Section 1-10Aries James67% (3)

- Law On Negotiable InstrumentsDocument9 pagesLaw On Negotiable InstrumentsMikaerika AlcantaraNo ratings yet

- NIL Essential RequisitesDocument8 pagesNIL Essential Requisitesjohn nestor cabusNo ratings yet

- REQUISITES OF NEGOTIABILITY (Autosaved)Document34 pagesREQUISITES OF NEGOTIABILITY (Autosaved)Narz SabangNo ratings yet

- Negotiable Instrument NotesDocument5 pagesNegotiable Instrument NotesJoshua UmaliNo ratings yet

- Negotiable Instrument: Prama MukhopadhyayDocument44 pagesNegotiable Instrument: Prama MukhopadhyayManjeev Singh SahniNo ratings yet

- Requisites of NegotiabilityDocument5 pagesRequisites of NegotiabilityRikki Joy C MagcuhaNo ratings yet

- Sec 152-165Document3 pagesSec 152-165Let it beNo ratings yet

- Business Law Negotiable Instruments Philippines3Document41 pagesBusiness Law Negotiable Instruments Philippines3Ace BautistaNo ratings yet

- Concept of Future or Determinable Future TimeDocument3 pagesConcept of Future or Determinable Future TimeShazna SendicoNo ratings yet

- Quiz - Negotiable InstrumentsDocument9 pagesQuiz - Negotiable InstrumentsGabrielle Ann SeguiranNo ratings yet

- X'Chapter I SECTION 1: Form of Negotiable InstrumentsDocument13 pagesX'Chapter I SECTION 1: Form of Negotiable InstrumentsKloie SanoriaNo ratings yet

- Negotiable Instruments NotesDocument11 pagesNegotiable Instruments NotesWilliam TabuenaNo ratings yet

- Negotiable Instrument LawDocument78 pagesNegotiable Instrument LawjaneNo ratings yet

- Notes On Negotiable Intruments Law Part 1Document13 pagesNotes On Negotiable Intruments Law Part 1JurilBrokaPatiño100% (1)

- Law On Negotiable Instruments Sections 1-10Document3 pagesLaw On Negotiable Instruments Sections 1-10Santi ArroyoNo ratings yet

- Nego SylabusDocument44 pagesNego SylabusRose Mae GullaNo ratings yet

- Handout No. 04 - Negotiable Instruments Law - Atty. de JesusDocument27 pagesHandout No. 04 - Negotiable Instruments Law - Atty. de JesusDaniel Torres AtaydeNo ratings yet

- Ateneo 2007 Commercial Law (Negotiable Instruments Law)Document16 pagesAteneo 2007 Commercial Law (Negotiable Instruments Law)Maria Jessica Franco Balancio100% (2)

- Chapter 1 NegoDocument27 pagesChapter 1 Negojhaeus enaj100% (1)

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsJeaner AckermanNo ratings yet

- Negotiable Instruments Law: Section 1. Form of Negotiable InstrumentDocument4 pagesNegotiable Instruments Law: Section 1. Form of Negotiable InstrumentJed CaraigNo ratings yet

- The Negotiable Instruments ActDocument38 pagesThe Negotiable Instruments ActPJr MilleteNo ratings yet

- Negotiable Instruments LawDocument23 pagesNegotiable Instruments LawPhilippe AmbasNo ratings yet

- JilaaDocument6 pagesJilaaSanji VinsmokeNo ratings yet

- Negotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Document1 pageNegotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Mark Hiro NakagawaNo ratings yet

- Negotiable IntstrumentDocument2 pagesNegotiable IntstrumentJayson AbadNo ratings yet

- ABALOS, Ruth Anne Negotiable Instruments (Sec. 1 To Sec. 100)Document8 pagesABALOS, Ruth Anne Negotiable Instruments (Sec. 1 To Sec. 100)Lyannhe DilaoNo ratings yet

- 3-Vol-V-NI-BR-IT Acts-Page Nos-1-34Document34 pages3-Vol-V-NI-BR-IT Acts-Page Nos-1-34pashamharikareddyNo ratings yet

- Concept of Negotiable InstrumentsDocument6 pagesConcept of Negotiable InstrumentsJemmieNo ratings yet

- Negotiable Instrument - Lecture in UstDocument2 pagesNegotiable Instrument - Lecture in UstRaymondBelgicaNo ratings yet

- The Negotiable Instruments Law CodalDocument12 pagesThe Negotiable Instruments Law CodalAleezah Gertrude RaymundoNo ratings yet

- 00 Nego Lecture NotesDocument18 pages00 Nego Lecture NotesChaNo ratings yet

- Nego Sec 1 - 52 Print!!Document4 pagesNego Sec 1 - 52 Print!!azizNo ratings yet

- Assignment - 1Document13 pagesAssignment - 1Mohd shakeeb HashmiNo ratings yet

- The Negotiable Instruments ActDocument63 pagesThe Negotiable Instruments ActRavi KumarNo ratings yet

- Negotiable InstrumentsDocument9 pagesNegotiable InstrumentsMary May NavarreteNo ratings yet

- Negotiable Instruments Act 1881Document11 pagesNegotiable Instruments Act 1881kallasanjay100% (1)

- Business Law 4: (Negotiable Instrument) MidtermDocument14 pagesBusiness Law 4: (Negotiable Instrument) MidtermJayson ResurreccionNo ratings yet

- Act 2031Document32 pagesAct 2031popbiloNo ratings yet

- Negotiable Instruments LawDocument39 pagesNegotiable Instruments LawHei Nah MontanaNo ratings yet

- Negotiable Instrument Act, 1881Document25 pagesNegotiable Instrument Act, 1881Viney VermaNo ratings yet

- Negotiable Instruments Law ReviewerDocument18 pagesNegotiable Instruments Law Reviewernoorlaw100% (2)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Second Division G.R. No. 221815, November 29, 2017 Glynna Foronda-Crystal, Petitioner, V. Aniana Lawas SON, Respondent. Decision REYES, JR., J.Document8 pagesSecond Division G.R. No. 221815, November 29, 2017 Glynna Foronda-Crystal, Petitioner, V. Aniana Lawas SON, Respondent. Decision REYES, JR., J.noneNo ratings yet

- The Stubborn Little Girl by Ok ChanDocument9 pagesThe Stubborn Little Girl by Ok ChannoneNo ratings yet

- Allahu La Ilaha Illa Huwa, Al-Haiyul-Qaiyum LaDocument1 pageAllahu La Ilaha Illa Huwa, Al-Haiyul-Qaiyum LanoneNo ratings yet

- Let It GoDocument1 pageLet It GononeNo ratings yet

- Notes in CIVIL PROCEDUREDocument1 pageNotes in CIVIL PROCEDUREnoneNo ratings yet

- Application Letter Sample 1Document3 pagesApplication Letter Sample 1noneNo ratings yet

- (A.M. No. MTJ-00-1282. March 1, 2001) : Gonzaga-Reyes, J.Document3 pages(A.M. No. MTJ-00-1282. March 1, 2001) : Gonzaga-Reyes, J.noneNo ratings yet

- Operation ManagementDocument13 pagesOperation ManagementnoneNo ratings yet

- G.R. No. 196870 PDFDocument56 pagesG.R. No. 196870 PDFnoneNo ratings yet

- Practice Set: Audit of Cash and Cash EquivalentsDocument2 pagesPractice Set: Audit of Cash and Cash EquivalentsANGELU RANE BAGARES INTOLNo ratings yet

- Yuchico vs. Atty. Gutierrez, A.C. No. 8391, Nov. 23, 2010Document5 pagesYuchico vs. Atty. Gutierrez, A.C. No. 8391, Nov. 23, 2010Tim SangalangNo ratings yet

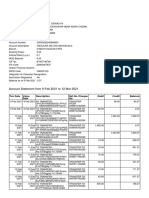

- Account Statement From 9 Feb 2021 To 12 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 9 Feb 2021 To 12 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceABHINAV DEWALIYANo ratings yet

- Demanletter MabutinDocument6 pagesDemanletter MabutinMikko AcubaNo ratings yet

- SkriptaKompanijsko Pravo Privredno PravoDocument343 pagesSkriptaKompanijsko Pravo Privredno PravogrcevicNo ratings yet

- 28 Pco Inc: Lecturer Resource Pack - QuestionsDocument2 pages28 Pco Inc: Lecturer Resource Pack - QuestionsCollen Takudzwa MuguyoNo ratings yet

- Addendum Sheet - CA Final May'23Document54 pagesAddendum Sheet - CA Final May'23Utkarsh GuptaNo ratings yet

- Episode 3 of The Ascent of Money Focuses On The Place Where Shares of Public Listed Companies Are TradedDocument1 pageEpisode 3 of The Ascent of Money Focuses On The Place Where Shares of Public Listed Companies Are Tradeddani qintharaNo ratings yet

- Ef1a2 HDT Rbi Monetary Policy Pcb5Document40 pagesEf1a2 HDT Rbi Monetary Policy Pcb5satish kumarNo ratings yet

- Intermediate Financial Accounting II 1 1Document146 pagesIntermediate Financial Accounting II 1 1natinaelbahiru74No ratings yet

- Portal - Bsnl.in Cdma Aspxfiles PrintReceiptDocument1 pagePortal - Bsnl.in Cdma Aspxfiles PrintReceiptBinu KaaniNo ratings yet

- IB QuestionnaireDocument8 pagesIB QuestionnaireWasi Akhtar33% (3)

- 1-4846226637066 857 93130XXXXX 10 2023Document6 pages1-4846226637066 857 93130XXXXX 10 2023dangarmehul02No ratings yet

- Security AnalysisDocument41 pagesSecurity Analysishadassah VillarNo ratings yet

- 062852Document2 pages062852Jiten KarmakarNo ratings yet

- Financial LiteracyDocument2 pagesFinancial LiteracyLeocila EdangNo ratings yet

- 2 Ceng 6108Document49 pages2 Ceng 6108addisu SissayNo ratings yet

- Praktikum Myob 1 (Membuat Nama Akun Dan Neraca Saldo)Document3 pagesPraktikum Myob 1 (Membuat Nama Akun Dan Neraca Saldo)Narda MufarrihahNo ratings yet

- Chapter 4Document3 pagesChapter 4Duy Anh NguyễnNo ratings yet

- Fact Sheet Fha 203bDocument10 pagesFact Sheet Fha 203bmptacly9152No ratings yet

- Actg 4 Lease AccountingDocument9 pagesActg 4 Lease AccountingScrunchies AvenueNo ratings yet

- University of Ghana: Detailed OutlineDocument34 pagesUniversity of Ghana: Detailed OutlinewdwdkwNo ratings yet

- Cap3 Problems ContDocument1 pageCap3 Problems ContProf. LUIS BENITEZNo ratings yet

- National Stock Exchange of IndiaDocument22 pagesNational Stock Exchange of IndiaParesh Narayan BagweNo ratings yet

- Camp Price-List 2014 inDocument1 pageCamp Price-List 2014 inGjuro14No ratings yet

- Power of Attorney RevocationDocument2 pagesPower of Attorney RevocationRoberto Monterrosa100% (2)

- ReillyBrown IAPM 11e PPT Ch12Document68 pagesReillyBrown IAPM 11e PPT Ch12rocky wongNo ratings yet

- Anglo Irish Case PRINTDocument5 pagesAnglo Irish Case PRINTAlyza C ArellanoNo ratings yet

- Audit of Cash and Cash EquivalentsDocument4 pagesAudit of Cash and Cash EquivalentsstillwinmsNo ratings yet

- Chapter Far-10......Document36 pagesChapter Far-10......ClaNo ratings yet