Professional Documents

Culture Documents

Partnership Q1

Uploaded by

Lorraine Mae Robrido0 ratings0% found this document useful (0 votes)

928 views3 pagesgfgcvg

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgfgcvg

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

928 views3 pagesPartnership Q1

Uploaded by

Lorraine Mae Robridogfgcvg

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

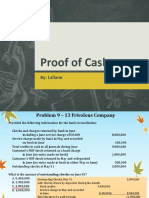

Partnership Formation 5) Under the bonus method,

a. Total partnership capital is equal to the fair value of the

Part 1: True or False net contributions to the partnership.

1) The assets contributed to (and related liabilities assumed by) b. Total partnership capital is less than the fair value of the

the partnership are measured in the partnership books at fair net contributions to the partnership.

value. c. Total partnership capital is greater than the fair value of

2) A bonus exists when the capital account of a partner is credited the net contributions to the partnership.

for an amount greater than or less than the fair value of his d. Total partnership capital is less than the fair value of the

contributions. net contributions to the partnership, if the bonus is given

3) A bonus given to a partner is treated as an adjustment to the to the incoming partner.

capital accounts of the other partners. 6) Under the bonus method, the asset contribution of the partner

4) Partner A contributed cash of P100 and land with carrying receiving the bonus is

amount of P500 and fair value of P700 to a partnership. The a. Debited at an amount greater than the fair value of the

credit to Partner A’s capital account in the partnership books is asset contributed

P600. b. Debited at an amount lesser than the fair value of the

5) Partner B contributed land with carrying amount of P100 and asset contributed

fair value of P200 to a partnership. In the partnership books, land c. Debited at an amount equal to the fair value of the asset

is debited for P200 but Partner B’s capital account is credited for contributed

P100. d. Either a or b

6) Partner C contributed inventory costing P500 and with a net 7) Transactions between and among the partners are

realizable value of P400 to a partnership. The related accounts a. Recorded in the partnership books

payable of P100 will be assumed by the partnership. The net b. Not recorded in the partnership books

credit to Partner C’s capital account in the partnership books is c. Either a or b

P300. d. Neither a nor b

Questions 8 to 10 are based on the following information:

Part 2: Multiple Choice A and B agreed to form a partnership. A contributed cash of

1) When property other than cash is invested in a partnership, at P100,000 while B contributed cash of P200,000. The partnership

what amount should the noncash property be credited to the agreement stipulates that A and B will have equal interest on the

contributing partner’s capital accounts? initial capital of the partnership and in subsequent partnership

a. Fair value at the date of contribution profits and losses.

b. Contributing partner’s original cost 8) Which of the following statements is correct?

c. Assessed valuation for property tax purposes a. A’s contribution will be debited for P150,000.

d. Contributing partner’s tax basis b. The partnership’s capital after recording the contribution

2) You and I formed a partnership. The fair value of my of A but before recording the contribution of B is

contribution is P100,000 while the fair value of your contribution is P150,000.

P50,000. However, since you will be contributing an expertise to c. The partnership’s capital after recording the

the partnership, we have agreed to value that expertise. contributions of both A and B is greater than P300,000.

Accordingly, we have agreed that our respective capital accounts d. None of the these.

will be credited for equal amounts. Which of the following 9) Which of the following statements is correct?

statements is correct? a. The contractual agreement is unfair because A’s

a. Our agreement results to a bonus of P25,000 which contribution is way below the agreed interest of A in the

relates to the valuation of your expertise. Accordingly, partnership. Therefore, the contractual agreement is

we will record goodwill of P25,000. void.

b. Our agreement results to a bonus of P25,000. In b. The capital balances of the partners after the

accordance with our agreement, I shall pay you partnership formation are P100,000 and P200,000,

P25,000. Our asset contributions will be debited at their respectively. Any adjustment on the partners’ capital

fair values of P100,000 and P50,000, respectively. balances to reflect the effects of the contractual

c. Our agreement results to a bonus of P25,000 which is stipulations shall not be made through the partnership

treated as a capital adjustment – an increase to your books.

capital account and a decrease to my capital account. c. A and B shall have capital balances of P150,000 each

My asset contribution will be debited at P75,000 while after the partnership formation.

your asset contribution will be debited at P75,000. d. The partnership formation will result to a debit to an

d. Our agreement results to a bonus of P25,000 which is unidentifiable asset called “good wheel.”

treated as a capital adjustment – an increase to your 10) Which of the following statements is incorrect?

capital account and a decrease to my capital account. a. The total partnership assets after the partnership

Our asset contributions will be debited at their fair values formation is P300,000.

of P100,000 and P50,000, respectively. b. The effect of the contractual stipulation is a decrease in

3) Under the bonus method, any increase or decrease in the B’s capital balance and a corresponding increase in A’s

capital credit of a partner is capital balance.

a. Deducted from or added to the capital credits of the c. The contractual stipulation does not affect the debit

other partners recording of the partner’s respective asset contributions.

b. Recognized as goodwill d. B’s asset contribution will be debited at a decreased

c. Recognized as expense amount of P150,000.

d. Deferred and amortized to profit or loss

4) Partnership capital and drawings accounts are similar to the Part 3: Problems

corporate 1) On January 1, 2020, Mr. A and Ms. B agreed to form a

a. Paid in capital, retained earnings, and dividends partnership contributing their respective assets and equities

accounts subject to adjustments. On that date, the following were provided:

b. Retained earnings account Mr. A Ms. B

c. Paid in capital and retained earnings accounts Cash 28,000 62,000

d. Preferred and common stock accounts Accounts 200,000 600,000

Receivable partnership. Compute for the adjusted capital balances of the

Inventories 120,000 200,000 partners on January 1, 2020.

Land 600,000

Building 500,000 7) A and B drafted a partnership agreement that lists the following

Furniture & Fixtures 50,000 35,000 assets contributed at the partnership’s formation:

Intangible Assets 2,000 3,000 A B

Accounts Payable 180,000 250,000 Cash 20,000 30,000

Other Liabilities 200,000 350,000 Inventory 15,000

Capital 620,000 800,000 Building 40,000

The following adjustments were agreed upon: Furniture & 15,000

Accounts receivable of P20,000 and P40,000 are Equipment

uncollectible in A’s and B’s respective books. The building is subject to a mortgage of P10,000 which the

Inventories of P6,000 and P7,000 are worthless in A’s and partnership has assumed. The partnership agreement also

B’s respective books. specified that profits and losses are to be distributed evenly. What

Intangible assets are to be written off in both books. amounts should be recorded as capital for A and B at the

Requirement: Provide one compound journal entry in the formation of the partnership?

partnership’s books.

8) On April 30, 2020, A, B and C formed a partnership by

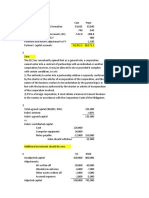

Questions 2 to 4 are based on the following information: combining their separate business proprietorships. A contributed

Mr. A and Ms. B formed a partnership and agreed to divide the cash of P50,000. B contributed property with a P36,000 carrying

initial capital equally even though Mr. A contributed P100,000 and amount, a P40,000 original cost, and P80,000 fair value. The

Ms. B contributed P84,000 in identifiable assets. partnership accepted responsibility for the P35,000 mortgage

2) The partners agree that the difference in the amount of attached to the property. C contributed equipment with a P30,000

contribution and the amount of credit to the partner’s capital shall carrying amount, a P75,000 original cost, and P55,000 fair value.

be treated as compensation for the expertise that the partner will The partnership agreement specifies that profits and losses are to

be bringing to the partnership. Provide the entry to be made in the be shared equally but is silent regarding capital contributions.

partnership books. Which partner has the largest April 30, 2020 capital account

3) The partners agree that the difference in the amount of balance and how much is it?

contribution and the amount of credit to the partner’s capital shall

be treated as cash settlement between the partners. Provide the Questions 9 and 10 are based on the following information:

entry to be made in the partnership books. A and B formed a partnership. The partnership agreement

4) The partners agree that the difference in the amount of stipulates the following:

contribution and the amount of credit to the partner’s capital shall A shall contribute noncash assets with carrying amount of

be treated as compensation for the expertise that the partner will P60,000 and fair value of P100,000.

be bringing to the partnership. How much is the unidentifiable B shall contribute cash of P200,000.

asset to be recognized in the books for Ms. B’s expertise? A and B shall have interests of 80% and 20%, respectively,

on both the initial partnership capital and in subsequent

5) On January 1, 2020, Mr. A and Ms. B agreed to form a partnership profits and losses.

partnership. The partners’ contributions are listed below: No outside cash settlements shall be made between and

Mr. A Ms. B among the partners.

Cash 50,000 120,000 9) How much is the total partnership capital after formation?

Accounts 360,000 1,080,000 10) How much is the adjusted capital account of B after the

Receivable formation?

Inventories 216,000 360,000

Land 1,080,000 11) A, B and C formed a partnership. Their contributions are as

Building 900,000 follows:

Equipment 90,000 90,000 A B C

Accounts Payable 336,000 450,000 Cash 50,000 40,000 140,000

Capital 1,460,000 2,100,000 Equipmen 150,000

The partners agreed to the following: t

The recoverable amounts of the partners’ respective Additional information:

accounts receivable are P400,000 and P760,000 for Mr. A Although C has contributed the most cash to the partnership,

and Ms. B, respectively. he did not have the full amount of P140,000 available and

The inventory contributed by Ms. B includes obsolete items was forced to borrow P40,000. The partners agreed that half

with a recorded cost of P20,000. of the amount borrowed shall be assumed by the

partnership.

The land contributed by Mr. A has an attached mortgage of

P180,000. The partnership shall assume the mortgage. The equipment contributed by B has an unpaid mortgage of

P20,000, the repayment of which is not assumed by the

The equipment contributed by Ms. B has a fair value of

partnership.

P130,000.

The partners agreed to equalize their interest. Cash

Mr. A has an unrecorded accounts payable of P100,000. The

settlements among the partners are to be made outside the

partnership assumes the obligation of settling that account.

partnership.

Requirement: Provide one compound journal entry in the

Which partner shall receive cash payment from the other

partnership’s books.

partner(s) and how much?

6) On January 1, 2020, Mr. A and Ms. B agreed to form a

12) A and B agreed to form a partnership. The partnership

partnership and share profits and losses in the ratio of 3:7,

stipulates the following:

respectively. Mr. A contributed a parcel of land that cost him

P10,000. Ms. B contributed P40,000 cash. The land was sold for Initial capital of P300,000.

P18,000 on January 1, 2020, immediately after formation of the A 25:75 interest in the equity of the partnership.

A contributed P100,000 cash while B contributed P200,000 cash.

Which partner should provide additional investment (or withdraw

part of his investment) in order to bring the partners’ capital

credits equal to their respective interests in the equity of the

partnership and how much?

-JMR

You might also like

- Meet Your STRAWMANDocument7 pagesMeet Your STRAWMANBigGator93100% (10)

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneGianJoshuaDayrit100% (1)

- Oregon Child CustodyDocument7 pagesOregon Child CustodyGracie AllenNo ratings yet

- AnnuitiesDocument39 pagesAnnuitiesRaymart BulagsacNo ratings yet

- Partnership FormationDocument4 pagesPartnership FormationDesiree Dawn GabalesNo ratings yet

- Grade 6.alexander Graham Bell. PhiliriDocument3 pagesGrade 6.alexander Graham Bell. PhiliriRhodora A. Borja100% (2)

- (Exercise) WaccDocument3 pages(Exercise) Waccclary frayNo ratings yet

- Finance Lease: Demo Teaching PresentationDocument52 pagesFinance Lease: Demo Teaching PresentationFaye Reyes100% (2)

- Capital StructureDocument41 pagesCapital StructureRAJASHRI SNo ratings yet

- PFRS 3 - Business Combination PDFDocument2 pagesPFRS 3 - Business Combination PDFMaria LopezNo ratings yet

- Dang Thuy Huong - 1704040049 - HW Tut 6Document19 pagesDang Thuy Huong - 1704040049 - HW Tut 6Đặng Thuỳ HươngNo ratings yet

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- FAQ (Flexi) PDFDocument4 pagesFAQ (Flexi) PDFDivyansh Chand BansalNo ratings yet

- Reg CC Funds Availability ChartDocument1 pageReg CC Funds Availability Chartslade1jeNo ratings yet

- Handouts PartnershipDocument9 pagesHandouts PartnershipCPANo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- AFAR-01 PartnershipDocument6 pagesAFAR-01 PartnershipRamainne Ronquillo0% (1)

- Dagohoy Q1Document4 pagesDagohoy Q1belinda dagohoyNo ratings yet

- Use The Fact Pattern Below For The Next Three Independent CasesDocument5 pagesUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- PartnershipDocument3 pagesPartnershipMark Edgar De Guzman0% (1)

- Chapter 12 - Practice SetDocument2 pagesChapter 12 - Practice SetKrystal shaneNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationShane NayahNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementLeanah TorioNo ratings yet

- CHAPTER 14 Business Combination PFRS 3Document3 pagesCHAPTER 14 Business Combination PFRS 3Richard DuranNo ratings yet

- Worksheet No. 3 Describing Data: Applying The ConceptsDocument2 pagesWorksheet No. 3 Describing Data: Applying The ConceptsKeneth Joe Cabungcal100% (1)

- Problem 44Document2 pagesProblem 44Arian AmuraoNo ratings yet

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- Partnership Accounting Comprehensive ProblemDocument10 pagesPartnership Accounting Comprehensive ProblemNikki GarciaNo ratings yet

- Illustration: Formation of Partnership Valuation of Capital A BDocument2 pagesIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoNo ratings yet

- Cup - Basic ParcorDocument8 pagesCup - Basic ParcorJerauld BucolNo ratings yet

- Partnership Accounting QuestionsDocument15 pagesPartnership Accounting QuestionsNhel AlvaroNo ratings yet

- Additional ProblemsDocument3 pagesAdditional Problems가 푸 레멜 린 메No ratings yet

- 2ND Online Quiz Level 2 Set B (Answers)Document7 pages2ND Online Quiz Level 2 Set B (Answers)Vincent Larrie MoldezNo ratings yet

- PUNZALANDocument16 pagesPUNZALANAngelique Kate Tanding DuguiangNo ratings yet

- Pure ProblemsDocument7 pagesPure Problemschristine anglaNo ratings yet

- Partnership FormationDocument2 pagesPartnership Formationlouise carinoNo ratings yet

- Ac 16 MidtermDocument20 pagesAc 16 MidtermMarjorie AmpongNo ratings yet

- Business Policy Activity 2Document3 pagesBusiness Policy Activity 2Motopatz BrionesNo ratings yet

- Bank of The Philippine Islands Balanced Scorecard Group 2Document5 pagesBank of The Philippine Islands Balanced Scorecard Group 2Jasper TabernillaNo ratings yet

- Audit of Investments - Equity Securities Supplementary ProblemsDocument2 pagesAudit of Investments - Equity Securities Supplementary ProblemsNIMOTHI LASE0% (1)

- Partnership Dissolution 4Document6 pagesPartnership Dissolution 4Karl Wilson GonzalesNo ratings yet

- Balbin, Ma. Margarette P. Assignment #1Document7 pagesBalbin, Ma. Margarette P. Assignment #1Margaveth P. BalbinNo ratings yet

- AdvaccDocument3 pagesAdvaccMontessa GuelasNo ratings yet

- Receivable ManagementDocument2 pagesReceivable ManagementJoey WassigNo ratings yet

- Business Combination Q4Document2 pagesBusiness Combination Q4Sweet EmmeNo ratings yet

- Partnersip Operation Short QuizDocument3 pagesPartnersip Operation Short QuizToni Marquez50% (2)

- If The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnDocument2 pagesIf The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnJoana TrinidadNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- ACCOUNTING FOR INVESTMENT PROPERTY AND EQUIPMENTDocument20 pagesACCOUNTING FOR INVESTMENT PROPERTY AND EQUIPMENTAhmadnur JulNo ratings yet

- AFAR - 4 Construction Accounting and Franchise AccountingDocument3 pagesAFAR - 4 Construction Accounting and Franchise AccountingalyssaNo ratings yet

- Partnership Liquidation DistributionDocument2 pagesPartnership Liquidation DistributionIvy BautistaNo ratings yet

- Chapter 12-14Document18 pagesChapter 12-14Serena Van Der WoodsenNo ratings yet

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocument2 pagesConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- Seatwork - Advacc1Document2 pagesSeatwork - Advacc1David DavidNo ratings yet

- Partnership Operation 004Document2 pagesPartnership Operation 004John GacumoNo ratings yet

- Prelim PartnershipDissolutionSampleProblemDocument12 pagesPrelim PartnershipDissolutionSampleProblemLee SuarezNo ratings yet

- Partnership Formation Activity 2Document4 pagesPartnership Formation Activity 2Shaira Untalan100% (1)

- Retirement of A Partner 1Document1 pageRetirement of A Partner 1Vonna TerribleNo ratings yet

- AdvDocument2 pagesAdvJhaNo ratings yet

- SAMPLEDocument3 pagesSAMPLEkrizzmaaaayNo ratings yet

- CH 005Document2 pagesCH 005Joana TrinidadNo ratings yet

- Quiz 1 Answers and Solutions (Partnership Formation and Operation)Document6 pagesQuiz 1 Answers and Solutions (Partnership Formation and Operation)cpacpacpaNo ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- editedQUIZ CHAPTER-6 FINANCIAL-ASSETSDocument3 pageseditedQUIZ CHAPTER-6 FINANCIAL-ASSETSanna mariaNo ratings yet

- Special TransactionsDocument5 pagesSpecial TransactionsJehannahBarat100% (1)

- Accounting For Special TransactionDocument5 pagesAccounting For Special TransactionNicole Gole CruzNo ratings yet

- ProblemsDocument12 pagesProblemsJoy MarieNo ratings yet

- Local Media509401656681363485Document10 pagesLocal Media509401656681363485Amethyst ClaireNo ratings yet

- MC Questions For FOA IIDocument9 pagesMC Questions For FOA IIGrace SustiguerNo ratings yet

- PARTNERSHIP FORMATION ACCOUNTINGDocument10 pagesPARTNERSHIP FORMATION ACCOUNTINGSapphire AliasNo ratings yet

- Orca Share Media1583315619577Document13 pagesOrca Share Media1583315619577Sebastian Vincent Pulga PedrosaNo ratings yet

- Deed of Absolute SaleDocument1 pageDeed of Absolute SaleLorraine Mae RobridoNo ratings yet

- Robrido, Lorraine Mae Diongzon: This Document Was Generated by The Student From The SPSPS Online Student PortalDocument1 pageRobrido, Lorraine Mae Diongzon: This Document Was Generated by The Student From The SPSPS Online Student PortalLorraine Mae RobridoNo ratings yet

- Robrido, Lorraine Mae DiongzonDocument2 pagesRobrido, Lorraine Mae DiongzonLorraine Mae RobridoNo ratings yet

- Meaning of Business: Art. 1767, New Civil Code of The Philippines Sec.2 B.P. 68 or Corporation Code of The PhilippinesDocument25 pagesMeaning of Business: Art. 1767, New Civil Code of The Philippines Sec.2 B.P. 68 or Corporation Code of The PhilippinesAnali BarbonNo ratings yet

- Confrasshowday 1Document25 pagesConfrasshowday 1Lorraine Mae RobridoNo ratings yet

- Partnership Q5 SolutionDocument4 pagesPartnership Q5 SolutionLorraine Mae RobridoNo ratings yet

- Partnership Q5Document2 pagesPartnership Q5Lorraine Mae RobridoNo ratings yet

- Agreement To Buy and SellDocument2 pagesAgreement To Buy and SellLorraine Mae RobridoNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Partnership Q3 SolutionDocument2 pagesPartnership Q3 SolutionLorraine Mae RobridoNo ratings yet

- Capital Balances and Profit DistributionDocument4 pagesCapital Balances and Profit DistributionLorraine Mae RobridoNo ratings yet

- Partnership Q2Document1 pagePartnership Q2Lorraine Mae RobridoNo ratings yet

- Partnership Q4Document2 pagesPartnership Q4Lorraine Mae Robrido100% (1)

- Partnership Q2 SolutionDocument4 pagesPartnership Q2 SolutionLorraine Mae RobridoNo ratings yet

- Photography BasicsDocument3 pagesPhotography BasicsGeoffrey Miles100% (3)

- 5 Operating Segments PDFDocument14 pages5 Operating Segments PDFLorraine Mae RobridoNo ratings yet

- Partnership Formation Adjustments and Capital AccountsDocument2 pagesPartnership Formation Adjustments and Capital AccountsLorraine Mae RobridoNo ratings yet

- Creative drama workshop invitationDocument2 pagesCreative drama workshop invitationGeoffrey MilesNo ratings yet

- Partnership Q1 SolutionDocument3 pagesPartnership Q1 SolutionLorraine Mae RobridoNo ratings yet

- Nkanflkafk Aklcf NalkfcnafmalfmaDocument7 pagesNkanflkafk Aklcf NalkfcnafmalfmaCj BarrettoNo ratings yet

- P1 Day3 RMDocument6 pagesP1 Day3 RMabcdefg0% (2)

- Exercises and Quiz On InvestmentsDocument13 pagesExercises and Quiz On InvestmentsPrince PierreNo ratings yet

- This Is It Last Na To IMPACT OF TRAIN LAW RESEARCH PINAKA FINAL COMPLETEDocument58 pagesThis Is It Last Na To IMPACT OF TRAIN LAW RESEARCH PINAKA FINAL COMPLETELorraine Mae RobridoNo ratings yet

- SF1 - 2019 - Grade 6 - CAMIADocument4 pagesSF1 - 2019 - Grade 6 - CAMIALorraine Mae RobridoNo ratings yet

- Oke Management of Petty Cash FundDocument14 pagesOke Management of Petty Cash FundulaNo ratings yet

- Form A1.1Document2 pagesForm A1.1Mritunjai SinghNo ratings yet

- Corporate Accounting exam questions and entriesDocument4 pagesCorporate Accounting exam questions and entriesRiteshHPatelNo ratings yet

- Absolute Return - Prime Broker RankingsDocument7 pagesAbsolute Return - Prime Broker RankingsB.C. MoonNo ratings yet

- CIR V PALDocument28 pagesCIR V PALReg AnasNo ratings yet

- QBE 2016 Annual Report PDFDocument200 pagesQBE 2016 Annual Report PDFLaurence FabreagNo ratings yet

- Ipcc Advance Accounting Practice Question 2Document5 pagesIpcc Advance Accounting Practice Question 2Shahnawaz Shaikh100% (1)

- Tax invoice for professional servicesDocument1 pageTax invoice for professional servicesPankaj AzadNo ratings yet

- 1.1 Introduction To The Stock MarketDocument4 pages1.1 Introduction To The Stock MarketYesaswiniNo ratings yet

- Exit FormalityDocument7 pagesExit Formalityhr.singlaNo ratings yet

- Chapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsDocument11 pagesChapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsMondy MondyNo ratings yet

- Ch14 Capital BudgetingDocument20 pagesCh14 Capital BudgetingPatrick GoNo ratings yet

- Chapter 3: Analysis of Financial StatementsDocument42 pagesChapter 3: Analysis of Financial StatementsShovan ChowdhuryNo ratings yet

- Term Finance CertificateDocument2 pagesTerm Finance CertificateSohail AnjumNo ratings yet

- Capital vs Revenue ExpenditureDocument5 pagesCapital vs Revenue ExpenditureRonan FerrerNo ratings yet

- Presentation By:: M.Nauman Sher Razaullah Khan Shiraz KhanDocument22 pagesPresentation By:: M.Nauman Sher Razaullah Khan Shiraz KhanM Fani MalikNo ratings yet

- MCS-Nurul Sari-Case 7.1 7.2 7.7Document4 pagesMCS-Nurul Sari-Case 7.1 7.2 7.7Nurul Sari0% (3)

- PF PFi Terms and ConditionsDocument20 pagesPF PFi Terms and ConditionsAzeizulNo ratings yet

- Benevolent Funds Program 2011-09-21 ToolkitDocument22 pagesBenevolent Funds Program 2011-09-21 ToolkitNational Association of REALTORS®100% (1)

- World Bank Group President urges support for COVID-19 responseDocument3 pagesWorld Bank Group President urges support for COVID-19 responseGonzalo Jose Silvestre Quiroga SoriaNo ratings yet

- Legal and Regulatory Aspects of BankingDocument216 pagesLegal and Regulatory Aspects of Bankingeknath2000No ratings yet

- Train Law RecommendationDocument10 pagesTrain Law RecommendationMaria Angelica PanongNo ratings yet

- Agent Compensation Schedule - 16april2020 PDFDocument9 pagesAgent Compensation Schedule - 16april2020 PDFRajat GuptaNo ratings yet