Professional Documents

Culture Documents

Trans Union Fraud Deeds Memo

Uploaded by

izraul hidashiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trans Union Fraud Deeds Memo

Uploaded by

izraul hidashiCopyright:

Available Formats

TransUnion Title Insurance

16700 Valley View, Suite 275

La Mirada, CA 90638

Tel 714.452.1300

Fax 714.452.1301

UNDERWRITING BULLETIN

Bulletin No.: CA10-002 –

More fraud variations.

In the previous bulletin, deeds from beneficiaries that acquired by foreclosure were discussed.

There are two new related situations which have now surfaced.

1. A Trustee’s deed recorded in favor of a third party bidder. The only problem is that the sale was

never held and the trustee did not execute the deed. A very alert agent noticed subtle irregularities in

the deed and called the (nationally active) trustee to verify. They verified all right. They verified that

the sale had not been held and the deed is a forgery.

This means that a trustee’s deed into a third party bidder can no longer be automatically assumed to be

a good transfer. Such a deed should not be used to vest title in your Title Report. Show the effect of

the deed in Schedule B and call for some form of proof that the deed is valid. It’s hard to imagine any

form of proof that doesn’t involve the foreclosing trustee. Be cautious if the foreclosing trustee is an

unknown entity. Most foreclosures are being handled by the national arms of major title insurers.

Consider inspecting the property for possession. If the foreclosed out owner is still in possession, do

not insure.

2. A local title company, not underwritten by TransUnion, had objected to a deed from a beneficiary.

Very much in the pattern of the deeds discussed in the previous bulletin, with the exception that the

grantee in this case is an individual. That individual responded with a copy of a title insurance policy

insuring his ownership, prepared on a TransUnion form. There were significant errors in the policy,

so that Title Company contacted this office to determine the validity of the policy. Needless to say,

the policy is a forgery, and actually not a very good one. If you are presented with a title policy as

“proof” in any of these scenarios, you must verify its validity by contacting either the issuing agent or

the underwriter.

Intentional disregard of the matters contained in this Bulletin may cause any loss sustained under the terms of a policy

to be allocated entirely to the Agent.

You might also like

- Cancel DeedDocument13 pagesCancel DeedMIke Lopez100% (3)

- CHANGE IN OWNERSHIP Handbook PDFDocument179 pagesCHANGE IN OWNERSHIP Handbook PDFJoe Long100% (2)

- BAUSERMAN V UNEMPLOYMENT INSURANCE AGENCYDocument95 pagesBAUSERMAN V UNEMPLOYMENT INSURANCE AGENCYBrandon Michael ChewNo ratings yet

- Advanced Hacking Techniques:: Implications For A Mobile WorkforceDocument10 pagesAdvanced Hacking Techniques:: Implications For A Mobile WorkforceDevesh100% (1)

- 2008 City of Tacoma Purchase OrdersDocument2,732 pages2008 City of Tacoma Purchase OrdersAndrew Charles HendricksNo ratings yet

- Dealers ComplaintDocument70 pagesDealers ComplaintGMG EditorialNo ratings yet

- Samsung Galaxy A13 5G English User ManualDocument143 pagesSamsung Galaxy A13 5G English User ManualAb BossNo ratings yet

- Wisconsin Circuit Judge BiographiesDocument249 pagesWisconsin Circuit Judge BiographiesWisconsin Election WatchNo ratings yet

- A Study On Frauds & Developments in Plastic MoneyDocument84 pagesA Study On Frauds & Developments in Plastic Money7644 Ujala GuptaNo ratings yet

- Course Syllabus - ObliconDocument12 pagesCourse Syllabus - ObliconjorgepayasayNo ratings yet

- (With Scripts All-In-One) CHOP 24th-29th OCT, 2022Document39 pages(With Scripts All-In-One) CHOP 24th-29th OCT, 2022Dolido EnterprisesNo ratings yet

- Ahmer Payroll Sheet 2019..Document50 pagesAhmer Payroll Sheet 2019..Ib RarNo ratings yet

- Philippine Laws Related To Child ProtectionDocument15 pagesPhilippine Laws Related To Child ProtectionMaria Fiona Duran Merquita100% (1)

- Driver Handbook 2022 2023Document78 pagesDriver Handbook 2022 2023Samuel AdamsNo ratings yet

- The Telecheckinternet Check Acceptance and Checks by Phone ServiceDocument1 pageThe Telecheckinternet Check Acceptance and Checks by Phone Serviceaaes2No ratings yet

- Notice of Transfer and Release of Liability - ReceiptDocument1 pageNotice of Transfer and Release of Liability - ReceiptDrew HardinNo ratings yet

- Danny Ghazal 10/8/20 NTS330 Mike Vasquez ReconDocument9 pagesDanny Ghazal 10/8/20 NTS330 Mike Vasquez Reconapi-541446689No ratings yet

- NOTARIZE WimberlyLienFinalPreNotaryDocument4 pagesNOTARIZE WimberlyLienFinalPreNotaryDaniel MontesNo ratings yet

- TCL 30 5G - T776O - UM - EnglishDocument73 pagesTCL 30 5G - T776O - UM - EnglishJasson BornNo ratings yet

- 15 Motion To AmendDocument3 pages15 Motion To AmendN.S. Fuller, Esq.No ratings yet

- Outline - FRAUDDocument4 pagesOutline - FRAUDPAULYN MARIE BATHANNo ratings yet

- Stingray Project To ShareDocument18 pagesStingray Project To ShareTina EvansNo ratings yet

- Notice of Dispute of Alleged Debt2Document4 pagesNotice of Dispute of Alleged Debt2Armond TrakarianNo ratings yet

- Call Center Student's Manual A2Document100 pagesCall Center Student's Manual A2J. ArevaloNo ratings yet

- Pre Need Plans PPT NotesDocument3 pagesPre Need Plans PPT NotesReyniere AloNo ratings yet

- UntitledDocument8 pagesUntitledAntonella DiSatanaNo ratings yet

- Revised UP Credits SyllabusDocument13 pagesRevised UP Credits SyllabusJul A.No ratings yet

- 404 ThePegasusFileDocument5 pages404 ThePegasusFileAntonella DiSatanaNo ratings yet

- Commercial Law Review 1 - Corporation Law QuestionsDocument3 pagesCommercial Law Review 1 - Corporation Law QuestionsVictoria EscobalNo ratings yet

- Luzon Brokerage v. Maritime BuildingDocument15 pagesLuzon Brokerage v. Maritime BuildingJoycee ArmilloNo ratings yet

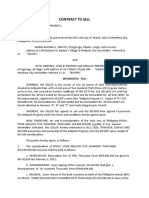

- Contract To Sell - AuDocument4 pagesContract To Sell - AuMARIA SANDRA SalvadorNo ratings yet

- Revealing The Impotence of The Black Nobility at The Center of The Banking CartelDocument6 pagesRevealing The Impotence of The Black Nobility at The Center of The Banking CartelAnonymous CdKFSJPGFNo ratings yet

- Not Applicable Not Applicable Not ApplicableDocument5 pagesNot Applicable Not Applicable Not Applicabledirty thizzNo ratings yet

- Residential Lease or Rental AgreementDocument2 pagesResidential Lease or Rental Agreementaya mikageNo ratings yet

- Case Digest-Substitution of Heirs, Legacies and Devises, Legal or Intestate SuccessionDocument4 pagesCase Digest-Substitution of Heirs, Legacies and Devises, Legal or Intestate SuccessionDarwin Dionisio ClementeNo ratings yet

- Rental AgreementDocument3 pagesRental AgreementCarl TomlinsonNo ratings yet

- Emergency Motion Rechnitz Response-8!29!14Document75 pagesEmergency Motion Rechnitz Response-8!29!14Linda GonzalesNo ratings yet

- Microsoft Outlook - Kim Triplett Kolerich Shares May Day 2013 Events OlympiaDocument3 pagesMicrosoft Outlook - Kim Triplett Kolerich Shares May Day 2013 Events OlympiaAndrew Charles HendricksNo ratings yet

- Ohio Attorney General v. CLE Door Co LLC ComplaintDocument7 pagesOhio Attorney General v. CLE Door Co LLC ComplaintWKYC.comNo ratings yet

- Chrome Operating SystemDocument29 pagesChrome Operating SystemSai SruthiNo ratings yet

- Inf1125 REQ FOR YOUR OWN DL CARD OR VEHICLE REG INFO RECORD PDFDocument1 pageInf1125 REQ FOR YOUR OWN DL CARD OR VEHICLE REG INFO RECORD PDFSteve SmithNo ratings yet

- Washington Mutual (WMI) - Project Fillmore (Decapitalization of WMB FSB)Document50 pagesWashington Mutual (WMI) - Project Fillmore (Decapitalization of WMB FSB)meischer100% (1)

- Transunion Offering DocumentDocument440 pagesTransunion Offering DocumentWHRNo ratings yet

- Revised Final Agenda For Nevada Covid Vax MandateDocument10 pagesRevised Final Agenda For Nevada Covid Vax MandateSarah Ashton CirilloNo ratings yet

- SolutionsDocument23 pagesSolutionsapi-3817072No ratings yet

- Best DNS: Best DNS: The Best Free DNS Servers / Free DNS 2015Document10 pagesBest DNS: Best DNS: The Best Free DNS Servers / Free DNS 2015osama OsNo ratings yet

- Convert Demo Software To Full version-OllyDbg - PDFDocument7 pagesConvert Demo Software To Full version-OllyDbg - PDFSreekanth KrishnamurthyNo ratings yet

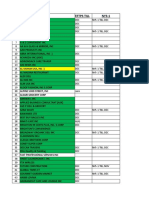

- Track Race # Horse Barrier Map Position TrainerDocument28 pagesTrack Race # Horse Barrier Map Position TrainerSherwin LingatingNo ratings yet

- SeriousShopper10 02 14Document20 pagesSeriousShopper10 02 14Serious ShopperNo ratings yet

- 2011 NRLCA Mail Count Guide Support Docs 8-4-2011Document122 pages2011 NRLCA Mail Count Guide Support Docs 8-4-2011postaltexanNo ratings yet

- Spam LawsuitDocument21 pagesSpam LawsuitmaustermuhleNo ratings yet

- Mobile Network Performance Dataset DefinitionsDocument19 pagesMobile Network Performance Dataset DefinitionsrazafarhanNo ratings yet

- Keyboard Layouts WindowsDocument6 pagesKeyboard Layouts WindowsMulugeta AbebawNo ratings yet

- South Carolinians Lose $42 Million To Cyber Crime in 2021Document33 pagesSouth Carolinians Lose $42 Million To Cyber Crime in 2021Briasia RussNo ratings yet

- Imerys Disclosure Statement 1/28/21Document602 pagesImerys Disclosure Statement 1/28/21Kirk HartleyNo ratings yet

- Florida MedicaidDocument31 pagesFlorida MedicaidJonathan OffenbergNo ratings yet

- An Experienced and Empowered Team: - TextDocument22 pagesAn Experienced and Empowered Team: - TextSoumya RanjanNo ratings yet

- BLP Presentaion Group 4Document24 pagesBLP Presentaion Group 4Bhavya UdiniaNo ratings yet

- ThePurpleLotus - Wattigney InformationDocument6 pagesThePurpleLotus - Wattigney InformationDeepDotWeb.comNo ratings yet

- Galaxy S22 Ultra S-BOOT StringsDocument432 pagesGalaxy S22 Ultra S-BOOT StringsJayNo ratings yet

- GVerifier - ComplaintDocument33 pagesGVerifier - ComplaintJonathan Greig100% (1)

- Censure Rebuttal SpeechDocument11 pagesCensure Rebuttal SpeechKateNo ratings yet

- Current LogDocument6 pagesCurrent LogDominic Isaac AcelajadoNo ratings yet

- Selfcare Payment ReceiptDocument1 pageSelfcare Payment Receiptvicky007sterNo ratings yet

- Alee Dutell Periodontist Observation ReportDocument4 pagesAlee Dutell Periodontist Observation Reportapi-672620289No ratings yet

- Ohio Supreme Court OneOhioDocument5 pagesOhio Supreme Court OneOhioTitus WuNo ratings yet

- How To Unlock Airtel E1731 (E173Bu-1) Huawei Customised Firmware Modem?Document2 pagesHow To Unlock Airtel E1731 (E173Bu-1) Huawei Customised Firmware Modem?Prem TNo ratings yet

- Questions Asked On A Credit ReportDocument8 pagesQuestions Asked On A Credit ReportCharlie WhiteNo ratings yet

- Pre Paid FeaturesDocument29 pagesPre Paid FeatureshelloshivaniNo ratings yet

- SamsungDocument21 pagesSamsungArifur RahmanNo ratings yet

- Banking Law Notes LLB 4Document182 pagesBanking Law Notes LLB 4Joshua MorrisNo ratings yet

- Contract CAN Winter 2015 Handel TDocument88 pagesContract CAN Winter 2015 Handel TJjjjmmmmNo ratings yet

- The Wamu Phantoms - Fraud Theft and RobberyDocument20 pagesThe Wamu Phantoms - Fraud Theft and Robberyizraul hidashiNo ratings yet

- Robo-Signing Gems VIIIDocument34 pagesRobo-Signing Gems VIIIizraul hidashiNo ratings yet

- Robo-Signing Gems IVDocument19 pagesRobo-Signing Gems IVizraul hidashiNo ratings yet

- Robo-Signing Gems IIDocument64 pagesRobo-Signing Gems IIizraul hidashiNo ratings yet

- Robo-Signing Gems IIIDocument199 pagesRobo-Signing Gems IIIizraul hidashiNo ratings yet

- ContracttoSell05 30 2017Document3 pagesContracttoSell05 30 2017Golda GapuzNo ratings yet

- Agreement For PropertyDocument3 pagesAgreement For PropertyAshok HegdeNo ratings yet

- Delhi Rent Control Act, 1958Document6 pagesDelhi Rent Control Act, 1958a-468951No ratings yet

- Batch 7B RfEDocument8 pagesBatch 7B RfEAnawin FamadicoNo ratings yet

- Prop Case DigestsDocument142 pagesProp Case DigestsKim Jan Navata BatecanNo ratings yet

- ZOTOMAYOR v. RUBIODocument2 pagesZOTOMAYOR v. RUBIOEmmanuel Princess Zia Salomon0% (1)

- Magno v. FrancisoDocument3 pagesMagno v. FrancisoLance LagmanNo ratings yet

- Celestino Balus vs. Saturnino Balus & Leonarda Balus Vda. de Calunod (2010)Document1 pageCelestino Balus vs. Saturnino Balus & Leonarda Balus Vda. de Calunod (2010)Tin NavarroNo ratings yet

- RFBT02 Law On Contract ReviewerDocument87 pagesRFBT02 Law On Contract ReviewerSufea PosaNo ratings yet

- Rules On Foreign OwnershipDocument8 pagesRules On Foreign Ownershipadelainezernagmail.comNo ratings yet

- Land Form18 Lease or Sub Lease Offer by DLBDocument2 pagesLand Form18 Lease or Sub Lease Offer by DLBSepuuya AlexNo ratings yet

- VERSION-03 AUG 2023-LAND REGISTRATION-04 AUG 2023 (Autosaved) (Autosaved)Document134 pagesVERSION-03 AUG 2023-LAND REGISTRATION-04 AUG 2023 (Autosaved) (Autosaved)bhlequitablepropertyNo ratings yet

- Recissible Contracts Voidable Contracts Unenforceable Contracts Void Contracts WhatDocument3 pagesRecissible Contracts Voidable Contracts Unenforceable Contracts Void Contracts WhatJanalin TatilNo ratings yet

- Statement of BHRPC On The Death of Jagjit SaikiaDocument2 pagesStatement of BHRPC On The Death of Jagjit SaikiaOliullah LaskarNo ratings yet

- Sample of Tenancy AgreementDocument10 pagesSample of Tenancy AgreementckylpyNo ratings yet

- F3 - MCQs Log and Data FileDocument12 pagesF3 - MCQs Log and Data FileAbdulAzeemNo ratings yet

- Power of AttorneyDocument2 pagesPower of AttorneyAdan HoodaNo ratings yet