Professional Documents

Culture Documents

Case Study (Finance)

Uploaded by

Manu B0 ratings0% found this document useful (0 votes)

33 views1 pageIncome tax is levied on individuals who were in India for at least 182 days in the previous tax year or at least 60 days in the previous tax year and 365 days in the preceding 4 years. The definition of 'salary' for income tax purposes is broader than normal usage and includes both monetary payments like basic salary and bonuses as well as non-monetary benefits like housing and interest-free loans from an employer. For an income to be considered salary, an employer-employee relationship must exist between the payer and payee such that payments received directly from an employer would constitute salary while payments received directly from clients while working independently would constitute professional income.

Original Description:

Original Title

case study(Finance)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIncome tax is levied on individuals who were in India for at least 182 days in the previous tax year or at least 60 days in the previous tax year and 365 days in the preceding 4 years. The definition of 'salary' for income tax purposes is broader than normal usage and includes both monetary payments like basic salary and bonuses as well as non-monetary benefits like housing and interest-free loans from an employer. For an income to be considered salary, an employer-employee relationship must exist between the payer and payee such that payments received directly from an employer would constitute salary while payments received directly from clients while working independently would constitute professional income.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views1 pageCase Study (Finance)

Uploaded by

Manu BIncome tax is levied on individuals who were in India for at least 182 days in the previous tax year or at least 60 days in the previous tax year and 365 days in the preceding 4 years. The definition of 'salary' for income tax purposes is broader than normal usage and includes both monetary payments like basic salary and bonuses as well as non-monetary benefits like housing and interest-free loans from an employer. For an income to be considered salary, an employer-employee relationship must exist between the payer and payee such that payments received directly from an employer would constitute salary while payments received directly from clients while working independently would constitute professional income.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Income tax is the tax you pay on your income.

Income Tax is levied on a person who was in

India for 182 days during the previous tax year or the person who was in India for at least 60

days during the previous tax year and for at least 365 days during the preceding 4 years will be

taxed.

The meaning of the term ‘s alary’ for purpos es of income tax is much w ider

than w hat is normally unders tood. Every payment made by an employer to his

employee for s ervice rendered w ould be chargeabl e to tax as income from

s alaries . The term ‘s alary’ for the purpos es of Income- tax A ct, 1961 w ill

include both monetary payments (e.g. bas ic salary, bonus , commis s ion,

allow ances etc.) as w ell as non-monetary faciliti es (e.g. hous ing,

accommoda tion, medical facili ty, interes t free loans etc.

Employer-employee relationship:

Before an income can become chargeable under the head ‘salaries’, it is vital that there

should exist between the payer and the payee, therelationship of an employer and an employee.

Consider the following examples:

a) Sujatha, an actress, is employed in Chopra Films, where she is paid a monthly

remunerat ion of 2 lakh. S he acts in various films produced by various

producers . The remuneration for acting in such films is directly paid to Chopra Films

by the different producers . In this cas e, 2 lakh w ill cons titut e s alary in the

hands of S ujatha, s ince there relations hip of employer and employee

exis ts betw een Chopra F ilms and S ujatha.

b) In the above example, if Sujatha acts in various films and gets fees from different

producers , the s ame income w ill be chargeable as income from

profes s ion s ince the relationship of employer and employee does not exist between

Sujatha and the film producers .

You might also like

- Salary Income LawDocument25 pagesSalary Income Lawvishal singhNo ratings yet

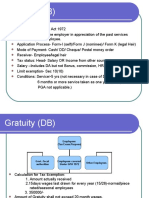

- GratuityDocument3 pagesGratuityTariq MahmoodNo ratings yet

- Success In the Payroll Management Business: How to Start Your Own Payroll Management BusinessFrom EverandSuccess In the Payroll Management Business: How to Start Your Own Payroll Management BusinessRating: 2.5 out of 5 stars2.5/5 (2)

- Tax Law Salary PDFDocument38 pagesTax Law Salary PDFabcNo ratings yet

- Retirement Planning: Iifp - VashiDocument91 pagesRetirement Planning: Iifp - VashiSachin BhoirNo ratings yet

- Income From Salary-FinalDocument42 pagesIncome From Salary-FinalPrathibha TiwariNo ratings yet

- Jamia Millia Islamia: Project On Salaries (Session-2018-2019)Document21 pagesJamia Millia Islamia: Project On Salaries (Session-2018-2019)Harshit AgarwalNo ratings yet

- Salary BasicsDocument14 pagesSalary BasicsAKHIL MANUELNo ratings yet

- Salary BasicsDocument14 pagesSalary BasicsAKHIL MANUELNo ratings yet

- Mission Completed Shubham2Document63 pagesMission Completed Shubham2Ravi SinghNo ratings yet

- SalariesDocument209 pagesSalariesprajeeshNo ratings yet

- Mission Completed Shubham2Document51 pagesMission Completed Shubham2Ravi SinghNo ratings yet

- Income Under The Head Salary2Document142 pagesIncome Under The Head Salary2OnlineNo ratings yet

- Chapter 5 - Income From Salaries - Notes PDFDocument58 pagesChapter 5 - Income From Salaries - Notes PDFRahul TiwariNo ratings yet

- Corporate Project SumitDocument19 pagesCorporate Project SumitBhanupratap Singh ShekhawatNo ratings yet

- Taxable Salary IncomeDocument253 pagesTaxable Salary IncomedjbbuzzzNo ratings yet

- Chapter 4 Income From SalariesDocument106 pagesChapter 4 Income From SalariesYogesh Sahani50% (2)

- DT 5Document83 pagesDT 5AnkitaNo ratings yet

- Meaning of Salary': Condition For Charging Income U/H "Salaries"Document21 pagesMeaning of Salary': Condition For Charging Income U/H "Salaries"kiranshingoteNo ratings yet

- Income Under The Head Salary2 PDFDocument142 pagesIncome Under The Head Salary2 PDFswati0% (1)

- Income From SalariesDocument70 pagesIncome From SalariesPratik AgrawalNo ratings yet

- 1707 - Final Draft of Corporate Law2 RecorrctedDocument18 pages1707 - Final Draft of Corporate Law2 RecorrctedAmarendra AnmolNo ratings yet

- 1707 - Final Draft of Corporate Law2 RecorrctedDocument18 pages1707 - Final Draft of Corporate Law2 RecorrctedAmarendra AnmolNo ratings yet

- 1707 - Final Draft of Corporate LawDocument18 pages1707 - Final Draft of Corporate LawAmarendra AnmolNo ratings yet

- GratuityDocument8 pagesGratuityManish KumarNo ratings yet

- SalaryDocument80 pagesSalarykalyanikamineniNo ratings yet

- The Payment of Gratuity Act, 1972Document6 pagesThe Payment of Gratuity Act, 1972abd VascoNo ratings yet

- Income From Salary Final SEM 3Document49 pagesIncome From Salary Final SEM 3Baleshwar ChauhanNo ratings yet

- Income From SalariesDocument30 pagesIncome From SalariesDeepak Gupta50% (2)

- Bonus and GratuityDocument6 pagesBonus and GratuityYousaf GillaniNo ratings yet

- 23823ipcc It Vol1 Cp4Document231 pages23823ipcc It Vol1 Cp4Joseph SalidoNo ratings yet

- Tax Law UTKARSHDocument20 pagesTax Law UTKARSHrishiraj singhNo ratings yet

- Name: Disha Bcom Hns (Evening) 0332488814Document6 pagesName: Disha Bcom Hns (Evening) 0332488814DishaNo ratings yet

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaNo ratings yet

- SlaaDocument36 pagesSlaaGovind BharathwajNo ratings yet

- Gratuity Law in PakistanDocument6 pagesGratuity Law in PakistanDanish Nawaz100% (1)

- Taxation of Employment IncomeDocument14 pagesTaxation of Employment Incomeomoding benjaminNo ratings yet

- Calculation of Gratuity A) For Employees Covered Under The ActDocument2 pagesCalculation of Gratuity A) For Employees Covered Under The ActdheerajdorlikarNo ratings yet

- Salient Features of The Payment of Bonus ActDocument5 pagesSalient Features of The Payment of Bonus ActbudhnabamNo ratings yet

- Salary TheoryDocument53 pagesSalary TheorymohammedimranukNo ratings yet

- Gratuity ActDocument9 pagesGratuity ActMonil DesaiNo ratings yet

- Tax SyllabusDocument196 pagesTax SyllabusSaurabh SagarNo ratings yet

- HhytyDocument51 pagesHhytyNitin gNo ratings yet

- The Payment of Bonus & Gratuity Act. Bonus Act-1965 & Gratuity Act-1972Document34 pagesThe Payment of Bonus & Gratuity Act. Bonus Act-1965 & Gratuity Act-1972Dhruti AthaNo ratings yet

- Sewa Project: Title:Labour LawsDocument16 pagesSewa Project: Title:Labour LawsAlameluLakshmananNo ratings yet

- Income From Salaries: (Sections 15 To 17)Document15 pagesIncome From Salaries: (Sections 15 To 17)Aliakbar SayaniNo ratings yet

- Salaries: After Studying This Chapter, You Would Be Able ToDocument80 pagesSalaries: After Studying This Chapter, You Would Be Able ToSatyam Kumar AryaNo ratings yet

- Notes On SalariesDocument18 pagesNotes On SalariesParul KansariaNo ratings yet

- Taxation Remuneration IncomeDocument10 pagesTaxation Remuneration IncomeDenimNo ratings yet

- The Payment of Gratuity Act 1971Document4 pagesThe Payment of Gratuity Act 1971Babita Nakoti RawatNo ratings yet

- GratuityDocument7 pagesGratuitySandeep TakNo ratings yet

- Salaries: After Studying This Chapter, You Would Be Able ToDocument82 pagesSalaries: After Studying This Chapter, You Would Be Able ToLilyNo ratings yet

- Salary and Perquisites.Document16 pagesSalary and Perquisites.Deeptangshu KarNo ratings yet

- Ir 16Document8 pagesIr 16Uday TejaNo ratings yet

- Income From Salaries: CA Final Paper7 Direct Tax Laws Chapter 4 CA - Rachana KumarDocument65 pagesIncome From Salaries: CA Final Paper7 Direct Tax Laws Chapter 4 CA - Rachana KumarRupaliNo ratings yet

- Labour Assignment AnswersDocument13 pagesLabour Assignment AnswersDevansh SinghNo ratings yet

- Salary Income-Pg DTDocument11 pagesSalary Income-Pg DTOnkar BandichhodeNo ratings yet

- Final Project of TaxDocument26 pagesFinal Project of TaxakshataNo ratings yet

- Corp Hinal AkashDocument17 pagesCorp Hinal AkashAmarendra AnmolNo ratings yet

- Introduction To Reliance RetailDocument14 pagesIntroduction To Reliance RetailManu BNo ratings yet

- Literature Review On A Study of Retail Store Attributes Affecting The Consumer PerceptionDocument18 pagesLiterature Review On A Study of Retail Store Attributes Affecting The Consumer PerceptionManu BNo ratings yet

- A Study of Effectiveness On Advertisement and Promotional Offers at Big Bazaar, BangaloreDocument78 pagesA Study of Effectiveness On Advertisement and Promotional Offers at Big Bazaar, BangaloreManu B100% (1)

- A Project On Marketing Strategy of Big BazaarDocument47 pagesA Project On Marketing Strategy of Big BazaarManu B0% (1)