Professional Documents

Culture Documents

1-Reach Beyond Existing Demand SLIDES PDF

Uploaded by

Raffay0 ratings0% found this document useful (0 votes)

33 views23 pagesOriginal Title

1-Reach beyond existing demand SLIDES.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views23 pages1-Reach Beyond Existing Demand SLIDES PDF

Uploaded by

RaffayCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 23

Blue Ocean Strategy:

Reach Beyond Existing Demand

Reach Beyond Existing Demand

Addresses the question: “How do you maximize

the size of the blue ocean you are creating?”

Brings us to the third principle of blue ocean

strategy

REACH BEYOND YOUR EXISTING DEMAND

A key component of achieving value innovation

How To Achieve This?

Companies should challenge two conventional

strategy practices:

1. The focus on existing customers

2. The drive for finer segmentation to accommodate buyer

differences

“As companies compete to embrace preferences

through finer segmentation, they often risk creating

too-small target markets.” (p.101)

Maximizing Their Blue Oceans

“To maximize the size of their blue oceans,

companies need to take a reverse course. Instead of

concentrating on customers, they need to look at

noncustomers. And instead of focusing on customer

differences, they need to build on powerful

commonalities in what buyers value.” (p. 102)

This would allow companies to reach beyond the

existing demand to catch new customers they were

never able to reach before.

Callaway Golf

Instead, Callaway looked at why other sports

enthusiasts and the country club members had not

taken up golf as a sport.

Found a key commonality of its noncustomers:

hitting the golf ball was perceived as too difficult.

“This understanding gave Callaway insight into how

to aggregate new demand for its offering.” (p. 102)

The answer: BIG BERTHA

a golf club with a large head that makes it easier to hit the ball

BIG BERTHA

The Main Point:

This new golf club not only converted noncustomers of the

golfing industry but also pleased existing golf customers

“making it a runaway bestseller across the board”

This new club also made the existing customers realize they

were taking advantage of how the game was actually played and

made them accept the responsibility to improve.

This is a great example of “Reaching Beyond Existing

Demand”

What To Do?

“By looking to noncustomers and focusing on their

key commonalities-not differences…

Callaway saw how to aggregate and offer the mass of

customers and noncustomers a leap in value.” (p. 103)

Figure out what you want. Is it to:

Capture a greater share of existing customers?

Convert noncustomers of the industry into new demand?

“To reach beyond existing demand, think

noncustomers before customers, commonalities

before differences, and desegmentation before

pursuing finer segmentation.”

The Three Tiers of Noncustomers

“There are three tiers of noncustomers that can be

transformed into customers. They differ in their

relative distance from your market.” (p. 103)

We’ll look at each tier to understand how you can

attract them and expand your blue ocean.

The Three Tiers of Noncustomers

First Tier: “Soon-to-be”

noncustomers who are on the

edge of your market, waiting to

jump ship.

Second Tier: “Refusing”

noncustomers who consciously

choose against your market.

Third Tier: “Unexplored”

noncustomers who are in

markets distant from yours.

First-Tier Noncustomers

Closest to your market-they sit on the edge of your

market.

“They are buyers who minimally purchase an

industry’s offering out of necessity but are mentally

noncustomers of the industry. They are waiting to

jump ship and leave the industry as soon as the

opportunity presents itself.” (p. 103)

When offered a leap in value, they would not only

stay, but their purchase frequency would multiply.

First Tier Noncustomers Cont’d

Pret A Manger-fast food company (1988)

Expanded their blue ocean by “tapping into the huge latent

demand of their first-tier noncustomers.”

These first-tier noncustomers were in search for a better

solution for lunch-instead of a nice, expensive sit down meal,

they needed something fast and cheap.

Shared three commonalities

1. They wanted lunch fast

2. They wanted it fresh and healthy

3. They wanted it at a reasonable price

=AN UNTAPPED DEMAND

Pret A Manger

In addition to offering healthy alternatives, Pret A

Manger speeds up the customer ordering experience.

On average, customers spend 90 seconds from the time they

get in line to the time they leave the restaurant.

These three commonalities were a huge hit for lunchers on the

go

Over 25 million sandwiches a year from its 130

stores in the U.K.

Its growth potential even made McDonald’s buy a

33% share of the company.

Second-Tier Noncustomers

Either do not use or cannot afford to use your

offerings because they find the offerings

unacceptable or beyond their means.

“People who refuse to use your industry’s offerings.

These are buyers who have seen your industry’s

offerings as an option to fulfill their needs but have

voted against them.” (p. 103)

In the Callaway example, these would be the sports

enthusiasts who could have chosen golf but had

consciously chose against it.

Second-Tier Noncustomers Cont’d

JCDecaux-Outdoor advertising

Many companies refused to use outdoor advertising

because it offered limited space or they could not

afford it.

So, JCDecaux expanded their advertising from buses

and billboards located only on the outskirts of town

to actual bus stations and billboards located in

downtown cities to convert second-tier customers.

JCDecaux

This gave JCDecaux the idea to expand to

outdoor/street furniture

Increased the average exposure (time)

Richer contents

More complex messages

Rollout campaign time decreased from 15 days to 3 days

Led to a flock in the industry from second-tier noncustomers!

Number one street furniture-based ad space provider

worldwide

283,000 panels in 33 countries

Third-Tier Noncustomers

Farthest from your market

“They are noncustomers who have never thought of

your market’s offerings as an option.” (p. 104)

Typically, these customers have not been targeted or

thought of as your potential customers by any player

in the industry.

Tooth whitening service example

U.S. Defense Aerospace Industry

The inability to control aircraft costs is a key

vulnerability in the long-term military strength of

the U.S. leaving no viable plan to be able to replace

the aging fleet of fighter aircraft.

In Fall 2001, Lockheed Martin was given the $200

billion JSF contract-the largest military contract in

history.

U.S. Defense Aerospace Industry

Needs:

The Navy-durable aircraft that would survive the stress of

landing on carrier decks and maintainability

The Marines-the need for short takeoff vertical landing

(STOVL) and robust countermeasures

The Air Force-fastest and most sophisticated aircraft with

super tactical agility and stealth technology

=three distinct and separate segments needing to be

combined into one aircraft to cut costs

U.S. Defense Aerospace Industry

The Joint Strike Fighter (JSF) program

challenged this industry practice

JSF searched for key commonalities across the three

branches

JSF found that the highest-cost components of the

three branches were the same: avionics (software)

and the engines

JSF is now called the F-35

U.S. Defense Aerospace Industry

“The aim was to build one aircraft for all three

divisions by combining those key factors while

reducing or eliminating everything else.” (p. 111)

The result: ONE aircraft and a dramatic decrease in

costs. This means the price per aircraft was

significantly lower but had a leap in value in

performance for all three branches.

The JSF reduced costs from $190 mil per aircraft to

$33 mil per aircraft

Go for the Biggest Catchment

Even though “the natural strategic orientation of

many companies is toward retaining existing

customers and seeking further segmentation

opportunities” seems the best way to go for

competitive purposes, this will NOT create a blue

ocean that expands the market and creates new

demand.

You should focus on the tier that represents the

biggest catchment at the time for you.

While exploring whether there are overlapping commonalities

across all three tiers of noncustomers.

Go for the Biggest Catchment

To maximize the scale of your blue ocean:

Reach beyond existing demand to noncustomers and

desegmentation opportunities while you formulate future

strategies.

“If no such opportunities can be found, you can then move on to

further exploit differences among existing customers.” (p. 115)

But, be aware:

You might end up landing in a smaller space

You might lose existing customers to other companies that are

willing to offer a leap in value

Takeaways

1. “Noncustomers tend to offer more insight into how

to unlock and grow a blue ocean than do relatively

content existing customers.” (p. 106)

2. Look for commonalities across their responses to

gain insight as to what your company needs to

expand their customer base.

3. “There is no hard-and-fast rule to suggest which

tier of noncustomers you should focus on and

when.” (p. 114) Go for the biggest catchment.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Independence TestDocument10 pagesIndependence TestRaffayNo ratings yet

- Lecture 6 Sony Case StudyDocument57 pagesLecture 6 Sony Case StudyRaffayNo ratings yet

- Samplin DistnDocument37 pagesSamplin DistnRaffayNo ratings yet

- Use Venn Diagrams To Solve The Following ProblemsDocument2 pagesUse Venn Diagrams To Solve The Following ProblemsRaffayNo ratings yet

- Central Limit Theorem: Academic CoordinatorDocument15 pagesCentral Limit Theorem: Academic CoordinatorRaffayNo ratings yet

- Marketing Management: MKT 402 Section O Credit Hours 3Document49 pagesMarketing Management: MKT 402 Section O Credit Hours 3RaffayNo ratings yet

- Marketing Management: MKT 402 Section O Credit Hours 3Document44 pagesMarketing Management: MKT 402 Section O Credit Hours 3RaffayNo ratings yet

- Solution (Accounting)Document12 pagesSolution (Accounting)RaffayNo ratings yet

- Marketing Management: MKT 402 Section O Credit Hours 3Document27 pagesMarketing Management: MKT 402 Section O Credit Hours 3RaffayNo ratings yet

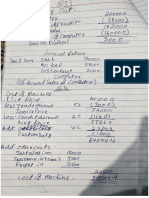

- Cost of Machine CalculationDocument1 pageCost of Machine CalculationRaffayNo ratings yet

- Financial Accounting Practice Questions of DepreciationDocument3 pagesFinancial Accounting Practice Questions of DepreciationRaffayNo ratings yet

- Company Acc PracticeDocument9 pagesCompany Acc PracticeRaffayNo ratings yet

- Cost of Machine QuestionDocument1 pageCost of Machine QuestionRaffayNo ratings yet

- 3-HBR Value Innovation SLIDESDocument19 pages3-HBR Value Innovation SLIDESRaffayNo ratings yet

- 3-How Strategy Shape Structure SLIDESDocument19 pages3-How Strategy Shape Structure SLIDESRaffayNo ratings yet

- Active and Passive Voices Worksheet PDFDocument3 pagesActive and Passive Voices Worksheet PDFRaffayNo ratings yet

- Cultivating Relationships Ahead of Building Brands: Rethinking MarketingDocument12 pagesCultivating Relationships Ahead of Building Brands: Rethinking MarketingRaffayNo ratings yet

- IX EnglishDocument1 pageIX EnglishRaffayNo ratings yet

- 2-Charting Your Company Future SLIDESDocument11 pages2-Charting Your Company Future SLIDESRaffayNo ratings yet

- Similarities Between Capital Budgeting and Security ValuationDocument1 pageSimilarities Between Capital Budgeting and Security ValuationRaffayNo ratings yet

- TOT Training of TrainersDocument27 pagesTOT Training of TrainersRaffayNo ratings yet

- X Hali 1 Oct Mcqs PDFDocument1 pageX Hali 1 Oct Mcqs PDFRaffayNo ratings yet

- X-Allama/Quaid Mathematics: I. + Sec Ii.Document1 pageX-Allama/Quaid Mathematics: I. + Sec Ii.RaffayNo ratings yet

- Worksheet Direct and Indirect NarrationDocument4 pagesWorksheet Direct and Indirect NarrationRaffay100% (1)

- Max. Marks: 15 Time: 30 Min Date: 26 Aug, 2016: IX-Shaheed-Millat EnglishDocument1 pageMax. Marks: 15 Time: 30 Min Date: 26 Aug, 2016: IX-Shaheed-Millat EnglishRaffayNo ratings yet

- XI Ss 21 Jan 2017 Thory PDFDocument1 pageXI Ss 21 Jan 2017 Thory PDFRaffayNo ratings yet

- X Hali 1 Feb. 2017Document2 pagesX Hali 1 Feb. 2017RaffayNo ratings yet

- Active and Passive Voices Worksheet PDFDocument3 pagesActive and Passive Voices Worksheet PDFRaffayNo ratings yet

- IX-Shaheed (English) Max. Marks: 15 Time: 35 Min Date: 13 Oct, 2016Document1 pageIX-Shaheed (English) Max. Marks: 15 Time: 35 Min Date: 13 Oct, 2016RaffayNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lecture 20Document10 pagesLecture 20bilal5202050No ratings yet

- FPAL Product Code GuideDocument53 pagesFPAL Product Code GuideSRARNo ratings yet

- Augocom Micro 768 Battery Tester User ManualDocument29 pagesAugocom Micro 768 Battery Tester User ManualJorge PontonNo ratings yet

- Design A Roller Coaster ProjectDocument4 pagesDesign A Roller Coaster Projectapi-3564628400% (1)

- Vibrations - NptelDocument3 pagesVibrations - NptelMSK65No ratings yet

- Jib Crane Assembly ManualDocument76 pagesJib Crane Assembly ManualRobert Cumpa100% (1)

- Tim Ingold - From The Transmission of Representations To The Education of Attention PDFDocument26 pagesTim Ingold - From The Transmission of Representations To The Education of Attention PDFtomasfeza5210100% (1)

- Ketu in 12th HousesDocument10 pagesKetu in 12th HousesSanket MishraNo ratings yet

- Draft STATCOM Maintenance Schedule (FINAL)Document36 pagesDraft STATCOM Maintenance Schedule (FINAL)Sukanta Parida100% (2)

- Suneet Narayan Singh (Updated CV), NDocument4 pagesSuneet Narayan Singh (Updated CV), Nnishant gajeraNo ratings yet

- AC350 Specs UsDocument18 pagesAC350 Specs Uskloic1980100% (1)

- Age ProblemDocument31 pagesAge ProblemKenny CantilaNo ratings yet

- VAM Must Sumitomo 1209 PDFDocument4 pagesVAM Must Sumitomo 1209 PDFnwohapeterNo ratings yet

- Chemistry Mid Term Exam 2014Document8 pagesChemistry Mid Term Exam 2014Adham TamerNo ratings yet

- Fatigue Consideration in DesignDocument3 pagesFatigue Consideration in DesigngouthamNo ratings yet

- Estimation of Fire Loads For An Educational Building - A Case StudyDocument4 pagesEstimation of Fire Loads For An Educational Building - A Case StudyEditor IJSETNo ratings yet

- EXP1POSTLABDocument13 pagesEXP1POSTLABGiane MagimotNo ratings yet

- BLANCHARD-The Debate Over Laissez Faire, 1880-1914Document304 pagesBLANCHARD-The Debate Over Laissez Faire, 1880-1914fantasmaNo ratings yet

- AnamnezaDocument3 pagesAnamnezaTeodora StevanovicNo ratings yet

- Ra Wah Night Shift - Word Format FiniDocument17 pagesRa Wah Night Shift - Word Format FiniREHOBOTH YAMBO KAHILUNo ratings yet

- The Association Between Eating Disorders and Stress Among Medical Student: A Cross-Sectional StudyDocument11 pagesThe Association Between Eating Disorders and Stress Among Medical Student: A Cross-Sectional StudyIJAR JOURNALNo ratings yet

- Web+Presentation+12+July+2016 EA+-+Eric+LumeDocument57 pagesWeb+Presentation+12+July+2016 EA+-+Eric+LumetranthabinNo ratings yet

- Most Important One Liner Questions and Answers May 2022Document15 pagesMost Important One Liner Questions and Answers May 2022pradeepNo ratings yet

- CADS Revit Scia Engineer Link Best PracticesDocument32 pagesCADS Revit Scia Engineer Link Best PracticestrevorNo ratings yet

- Thesis 1-15Document15 pagesThesis 1-15hewelirNo ratings yet

- Assignment 7 - Cocktail RecipiesDocument20 pagesAssignment 7 - Cocktail RecipiesDebjyoti BanerjeeNo ratings yet

- Welding Research Council: BulletinDocument28 pagesWelding Research Council: BulletinRogerio Tropia GranjaNo ratings yet

- Celly BoostbkDocument15 pagesCelly BoostbknomikabNo ratings yet

- NCERT Solutions For Class 12 Maths Chapter 10 Vector AlgebraDocument51 pagesNCERT Solutions For Class 12 Maths Chapter 10 Vector AlgebraKavin .J.S (KingK)No ratings yet

- Asyb 2020 2Document295 pagesAsyb 2020 2KhangNo ratings yet