Professional Documents

Culture Documents

Similarities Between Capital Budgeting and Security Valuation

Uploaded by

RaffayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Similarities Between Capital Budgeting and Security Valuation

Uploaded by

RaffayCopyright:

Available Formats

Similarities between Capital Budgeting and Security Valuation

Once a potential capital budgeting project has been identified, its evaluation involves the same steps

that security analysts use.

1) First, the cost of the project must be determined. This is similar to finding the price that must be

paid for a stock or bond.

2) Next, management estimates the expected cash flows from the project, including the salvage value

of the asset at the end of its expected life. This is similar to estimating the future dividend or interest

payment stream on a stock or bond, along with the stock's expected sales price or the bond's

maturity value.

3) Third, the risk of the projected cash flows must be estimated. This requires information about the

probability distribution (risk) of the cash flows.

4) Given the project's risk, Management determines the cost of capital at which the cash flows should

be discounted.

5) Next, the expected cash flows are put on a present value basis to obtain an estimate of the asset's

value. This is equivalent to finding the present value of a stock’s expected future dividends.

6) Finally, the present value of the expected cash flows is compared with the required outlay. If the PV

of the cash flows exceeds the cost, the project should be accepted. Otherwise, it should be rejected.

(Alternatively, if the expected rate of return on the project exceeds its cost of capital, the project is

accepted.)

Q. List the six steps in the capital budgeting process, and compare them with the steps in security

valuation.

You might also like

- CH 10.risk and Refinements in Capital BudgetingDocument27 pagesCH 10.risk and Refinements in Capital BudgetingTria_Octaviant_8507100% (1)

- Chapter 6 - The Analysis of Investment ProjectsDocument16 pagesChapter 6 - The Analysis of Investment ProjectsAbdul Fattaah Bakhsh 1837065No ratings yet

- Borrowing CostDocument2 pagesBorrowing CostAlexander Dimalipos100% (1)

- A. The Importance of Capital BudgetingDocument34 pagesA. The Importance of Capital BudgetingMutevu SteveNo ratings yet

- Gitman 0321286618 08Document30 pagesGitman 0321286618 08Adiansyach PatonangiNo ratings yet

- 8 Capital Budgeting - TheoriesDocument25 pages8 Capital Budgeting - TheoriesIamnti domnateNo ratings yet

- Case StudyDocument10 pagesCase StudyAmit Verma100% (1)

- Chapter 02 - Cost of CapitalDocument30 pagesChapter 02 - Cost of Capitalpasan.17No ratings yet

- Corporate Finance Is The Field of Finance Dealing With Financial Decisions That BusinessDocument9 pagesCorporate Finance Is The Field of Finance Dealing With Financial Decisions That Businesssmriti-nNo ratings yet

- Ms-42 em 20-21Document16 pagesMs-42 em 20-21nkNo ratings yet

- MS 42 SolutionDocument16 pagesMS 42 SolutionVimal KumarNo ratings yet

- Gitman 12e 525314 IM ch10rDocument27 pagesGitman 12e 525314 IM ch10rSadaf ZiaNo ratings yet

- Assignment - Project AppraisalDocument25 pagesAssignment - Project Appraisalveenamathew100% (2)

- Assignment (2017 EE 723)Document4 pagesAssignment (2017 EE 723)RafeyTahirNo ratings yet

- 3 Cost of CapitalDocument6 pages3 Cost of CapitalHarris NarbarteNo ratings yet

- Reviewer Borrowing Cost Sec. 1-10Document4 pagesReviewer Borrowing Cost Sec. 1-10imsana minatozakiNo ratings yet

- An Alternative Way To Obtain The Use of Assets Is by LeasingDocument8 pagesAn Alternative Way To Obtain The Use of Assets Is by LeasingWalidahmad AlamNo ratings yet

- Corporate Finance Is An Area of Finance Dealing With The Financial Decisions Corporations Make and The Tools and Analysis Used To Make These DecisionsDocument21 pagesCorporate Finance Is An Area of Finance Dealing With The Financial Decisions Corporations Make and The Tools and Analysis Used To Make These DecisionsPalash JainNo ratings yet

- Kerala Financial Corporation Valuation GuidelinesDocument30 pagesKerala Financial Corporation Valuation GuidelinesriyazNo ratings yet

- Lý Thuyet QTTCDocument2 pagesLý Thuyet QTTCNgọc LêNo ratings yet

- Financial Evaluation of LEASINGDocument7 pagesFinancial Evaluation of LEASINGmba departmentNo ratings yet

- 22 Capital Rationing and Criteria For Investment AnalysisDocument10 pages22 Capital Rationing and Criteria For Investment AnalysisManishKumarRoasanNo ratings yet

- Principles of Capital BudgetingDocument23 pagesPrinciples of Capital BudgetingPrerna BasuNo ratings yet

- Financial ManagementDocument3 pagesFinancial ManagementVjay AbendaNo ratings yet

- Impairment TestDocument30 pagesImpairment TestAstoplNo ratings yet

- Financial Management (Mba)Document38 pagesFinancial Management (Mba)Ajesh Mukundan PNo ratings yet

- Topic 6Document8 pagesTopic 6Руслана ЛуцівNo ratings yet

- 5.IAS 23 .Borrowing Cost Q&ADocument12 pages5.IAS 23 .Borrowing Cost Q&AAbdulkarim Hamisi KufakunogaNo ratings yet

- Module 10 Capital Investment Decisions SolutionDocument19 pagesModule 10 Capital Investment Decisions SolutionChiran AdhikariNo ratings yet

- Key Steps in Project AppraisalDocument4 pagesKey Steps in Project Appraisaljaydeep5008No ratings yet

- Cost of CapitalDocument6 pagesCost of CapitalhiyajNo ratings yet

- SFM Ch.3 Long Term Strategic Financial DecisionDocument10 pagesSFM Ch.3 Long Term Strategic Financial Decision141. Siddiqui RizwanNo ratings yet

- A. The Importance of Capital BudgetingDocument34 pagesA. The Importance of Capital BudgetingRusty SodomizerNo ratings yet

- CAPMDocument40 pagesCAPMkrishnendu maji100% (2)

- Chapter 29 Capital Budgeting PDFDocument28 pagesChapter 29 Capital Budgeting PDFlalita pargaiNo ratings yet

- MAS 10 Capital BudgetingDocument9 pagesMAS 10 Capital BudgetingZEEKIRA100% (1)

- Security Analysis and Portfolio Management LBBLBC603Document19 pagesSecurity Analysis and Portfolio Management LBBLBC603Ayush Kumar GuptaNo ratings yet

- Long-Term Assets I: Property Plant, and EquipmentDocument13 pagesLong-Term Assets I: Property Plant, and EquipmentErjan BhaehakiNo ratings yet

- Types of Decisions Made by A Finance ManagerDocument3 pagesTypes of Decisions Made by A Finance ManagerAadil HanifNo ratings yet

- Chapter-01 An Overview of Corporate Finance NotesDocument19 pagesChapter-01 An Overview of Corporate Finance NotesShuvo ExceptionNo ratings yet

- Chapter 12Document34 pagesChapter 12LBL_Lowkee100% (1)

- Chapter 9Document11 pagesChapter 9ydinaNo ratings yet

- Asset Valuation: Basic Bond Andstock Valuation ModelsDocument23 pagesAsset Valuation: Basic Bond Andstock Valuation ModelsMa Via Bordon SalemNo ratings yet

- Capital Budgeting - THEORYDocument9 pagesCapital Budgeting - THEORYAarti PandeyNo ratings yet

- Mba3 Fin b1p3Document103 pagesMba3 Fin b1p3Divya JainNo ratings yet

- Funds: Recognition of Borrowing Costs - Borrowing Costs That Are Directly Applicable To TheDocument2 pagesFunds: Recognition of Borrowing Costs - Borrowing Costs That Are Directly Applicable To TheOm JogiNo ratings yet

- (C) There Is Certainly A Relationship Between The Weighted AverageDocument9 pages(C) There Is Certainly A Relationship Between The Weighted AverageikrooNo ratings yet

- Investment Appraisal and Real OptionsDocument6 pagesInvestment Appraisal and Real OptionsAmunigun MaryamNo ratings yet

- Assets Securitization: An OverviewDocument13 pagesAssets Securitization: An OverviewJonahJuniorNo ratings yet

- Key Decision Areas of FinanceDocument19 pagesKey Decision Areas of FinanceShivani RawatNo ratings yet

- Accounting Standard 16Document7 pagesAccounting Standard 16Gaurav JadhavNo ratings yet

- Exam 4Document13 pagesExam 4Faheem ManzoorNo ratings yet

- UntitledDocument3 pagesUntitledhena_hasina100% (1)

- IAS 23 Borrowing CostsDocument11 pagesIAS 23 Borrowing Costsksmuthupandian2098No ratings yet

- Unit 3 ID - CBDocument62 pagesUnit 3 ID - CBASHISH KUMARNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Independence TestDocument10 pagesIndependence TestRaffayNo ratings yet

- Lecture 6 Sony Case StudyDocument57 pagesLecture 6 Sony Case StudyRaffayNo ratings yet

- Samplin DistnDocument37 pagesSamplin DistnRaffayNo ratings yet

- Use Venn Diagrams To Solve The Following ProblemsDocument2 pagesUse Venn Diagrams To Solve The Following ProblemsRaffayNo ratings yet

- Central Limit Theorem: Academic CoordinatorDocument15 pagesCentral Limit Theorem: Academic CoordinatorRaffayNo ratings yet

- Marketing Management: MKT 402 Section O Credit Hours 3Document49 pagesMarketing Management: MKT 402 Section O Credit Hours 3RaffayNo ratings yet

- Marketing Management: MKT 402 Section O Credit Hours 3Document44 pagesMarketing Management: MKT 402 Section O Credit Hours 3RaffayNo ratings yet

- Solution (Accounting)Document12 pagesSolution (Accounting)RaffayNo ratings yet

- Marketing Management: MKT 402 Section O Credit Hours 3Document27 pagesMarketing Management: MKT 402 Section O Credit Hours 3RaffayNo ratings yet

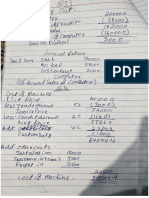

- Cost of Machine CalculationDocument1 pageCost of Machine CalculationRaffayNo ratings yet

- Financial Accounting Practice Questions of DepreciationDocument3 pagesFinancial Accounting Practice Questions of DepreciationRaffayNo ratings yet

- Company Acc PracticeDocument9 pagesCompany Acc PracticeRaffayNo ratings yet

- Cost of Machine QuestionDocument1 pageCost of Machine QuestionRaffayNo ratings yet

- 3-HBR Value Innovation SLIDESDocument19 pages3-HBR Value Innovation SLIDESRaffayNo ratings yet

- 3-How Strategy Shape Structure SLIDESDocument19 pages3-How Strategy Shape Structure SLIDESRaffayNo ratings yet

- Active and Passive Voices Worksheet PDFDocument3 pagesActive and Passive Voices Worksheet PDFRaffayNo ratings yet

- Cultivating Relationships Ahead of Building Brands: Rethinking MarketingDocument12 pagesCultivating Relationships Ahead of Building Brands: Rethinking MarketingRaffayNo ratings yet

- IX EnglishDocument1 pageIX EnglishRaffayNo ratings yet

- 2-Charting Your Company Future SLIDESDocument11 pages2-Charting Your Company Future SLIDESRaffayNo ratings yet

- TOT Training of TrainersDocument27 pagesTOT Training of TrainersRaffayNo ratings yet

- 1-Reach Beyond Existing Demand SLIDES PDFDocument23 pages1-Reach Beyond Existing Demand SLIDES PDFRaffayNo ratings yet

- X Hali 1 Oct Mcqs PDFDocument1 pageX Hali 1 Oct Mcqs PDFRaffayNo ratings yet

- X-Allama/Quaid Mathematics: I. + Sec Ii.Document1 pageX-Allama/Quaid Mathematics: I. + Sec Ii.RaffayNo ratings yet

- Worksheet Direct and Indirect NarrationDocument4 pagesWorksheet Direct and Indirect NarrationRaffay100% (1)

- Max. Marks: 15 Time: 30 Min Date: 26 Aug, 2016: IX-Shaheed-Millat EnglishDocument1 pageMax. Marks: 15 Time: 30 Min Date: 26 Aug, 2016: IX-Shaheed-Millat EnglishRaffayNo ratings yet

- XI Ss 21 Jan 2017 Thory PDFDocument1 pageXI Ss 21 Jan 2017 Thory PDFRaffayNo ratings yet

- X Hali 1 Feb. 2017Document2 pagesX Hali 1 Feb. 2017RaffayNo ratings yet

- Active and Passive Voices Worksheet PDFDocument3 pagesActive and Passive Voices Worksheet PDFRaffayNo ratings yet

- IX-Shaheed (English) Max. Marks: 15 Time: 35 Min Date: 13 Oct, 2016Document1 pageIX-Shaheed (English) Max. Marks: 15 Time: 35 Min Date: 13 Oct, 2016RaffayNo ratings yet