Professional Documents

Culture Documents

Department of Commerce and Management

Uploaded by

Astitav chauhan0 ratings0% found this document useful (0 votes)

10 views3 pagesDEPARTMENT OF COMMERCE AND MANAGEMENT & its importances

Original Title

DEPARTMENT OF COMMERCE AND MANAGEMENT

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDEPARTMENT OF COMMERCE AND MANAGEMENT & its importances

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesDepartment of Commerce and Management

Uploaded by

Astitav chauhanDEPARTMENT OF COMMERCE AND MANAGEMENT & its importances

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

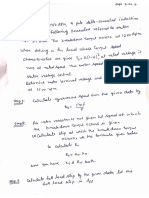

Assignment for 2nd Periodical

CASE 13

Q1 Identify the type of investment decision taken by Manoj by deciding to set

up a separate manufacturing unit for producing jute products?

Ans The type of decision taken by Manoj is “Capital Budgeting”.

Capital Budgeting means Capital budgeting means deciding in advance how

much capital will be invested in long term project which will bring maximum

profit to the firm.

Q2 State any four factors that he is likely to consider while taking this decision?

No of Share = 100,000 Income Tax Rate = 30%

EBIT = $200,000 Price Per Share = $4.20

Long term debt = $1 million Coupon rate on Bound = 8%

Find its (A) P/E ratio, (B) Interest coverage ratio, and (C) Debt ratio

Ans Factor affecting capital Budgeting Decision

Cash flow of the project: If anticipated cash flows are more than the cost

involved then such project are considered.

The rate of return: The investment proposal which ensures highest rate of

return is finally selected.

Risk involved: While investing in long term project we always check how

much. risk involved in this project

Scale of operation: A large scale organisation requires higher investment

in plant and machinery as compared to small scale organisation.

Interest on Bond = $1 Million × 8%

= 10,00,000 × 0.08

= $80,000

EBIT = $200,000

(-) Interest = $80,000

EBT = $1,20,000

(-)Tax = ($36,000) (0.3 × 1,20,000)

EAT = $84,000

Earnings per share = EAT / No. of share

= 84,000 / 1,00,000

= $0.84

A)P/E Ratio = Market Price Per Share / Earning Per

Share

= $4.20 / $0.84

= 5Times

B) Interest Coverage = EBIT / Interest

Ration

= 200,000 / 80,000

= 2.5

Total Assets of firm = Total Debt + Total Equity

= 10,0,00000 + 4.2 × 100,00

= 14,20,000

C) Debt Rate = Total Debt / Total Assets

= 10,00,000 / 14,20,000

= 70.42%

You might also like

- Solution Problem3 CA3Document3 pagesSolution Problem3 CA3Astitav chauhanNo ratings yet

- RE1908A16 - Online Assignment 1 - ELE411 - 12000803 E1908 A16 ELE411Document9 pagesRE1908A16 - Online Assignment 1 - ELE411 - 12000803 E1908 A16 ELE411Astitav chauhanNo ratings yet

- Unit 6Document50 pagesUnit 6Astitav chauhanNo ratings yet

- Specialization Program - Full Detailed Main Brochure 90 PagesDocument92 pagesSpecialization Program - Full Detailed Main Brochure 90 PagesAstitav chauhanNo ratings yet

- Assignment 2Document16 pagesAssignment 2Astitav chauhanNo ratings yet

- Counters: Digital Logic Design LabDocument19 pagesCounters: Digital Logic Design LabAstitav chauhanNo ratings yet

- Flip Flops: Digital Logic Design LabDocument23 pagesFlip Flops: Digital Logic Design LabAstitav chauhanNo ratings yet

- Internal Assignment Computer Practcal Ii 40marks A. Assignment 1 InstructionsDocument1 pageInternal Assignment Computer Practcal Ii 40marks A. Assignment 1 InstructionsAstitav chauhanNo ratings yet

- Mec AssignmentDocument11 pagesMec AssignmentAstitav chauhanNo ratings yet

- Loksangrah Nishkaam Karm Boschee's Matrix: Better Model For WesternDocument3 pagesLoksangrah Nishkaam Karm Boschee's Matrix: Better Model For WesternAstitav chauhanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)