Professional Documents

Culture Documents

Environmental Risk and Opportunities Register

Uploaded by

Armand LiviuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Environmental Risk and Opportunities Register

Uploaded by

Armand LiviuCopyright:

Available Formats

V1

Hoddesdon Environmental Risk

and Opportunities Register

Risk Assessment Title Pharmaron UK Hoddesdon's Environmental Site Risk and Opportunities Register

Location Hoddesdon Site

Initial assessment team and date

Associated documents SOP Environmental Management System Hoddesdon

SOP Hoddesdon Change Control Process

FRM

SPT RA-Hoddesdon Environmental Aspects and Impacts

EXT

Other

Purpose of this assessment To effectively assess the risks and opportunities from Interested Parties relevant to the site's

Environmental Management System

Definitions Interested Parties relevant to the EMS - Person or organisation can affect or be affected by

or perceive themselves to be affected by a decision or activity. These may be internal or

external.

Environmental conditions: climate, air quality, water quality, land use, existing

contamination, natural resource availability and biodiversity, that can affect the organisations

purpose, or be affected by it's environmental aspects

External Issues : external cultural, social, political, legal, regulatory, financial, technological,

economic, natural and competitive circumstances, whether international, national, regional or

local.

Internal Issues : internal characteristics or conditions of the organisation, such as its

activities, products and services, strategic direction, culture and capabilities (ie. people,

knowledge, processes, systems)

Date Printed: 04/11/2020 Page 1 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

The purpose of this tab is to record changes made to this risk assessment following review.

Any supporting information can be placed onto additional tabs.

Version 1 New Document

Date Printed: 04/11/2020 Page 2 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

Assumptions made prior to and during the risk assessment

###

SWOT and STEEPLE analyses has identified all Interested Parties relevant to the EMS for the business and its context.

###

Context of the business is understood

###

Definitions are understood

###

Following each review and/or change, a new version of the register is published and publicised via the site brief .

Date Printed: 04/11/2020 Page 3 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

Criteria - Risk

Likelihood Score Severity Score

Improbable - extremely unlikely 1 Negligible 1

Remote – but conceivable 2 Marginal 5

Occasional – even chance of occurring 5 Serious 15

Probable – no surprise 10 Critical 30

Highly probable - to be expected 20 Catastrophic 50

RISK = Probable Likelihood X Severity of Outcome

Severity

1 5 15 30 50

Likelihood 1 1 5 15 30 50

2 2 10 30 60 100

5 5 25 75 150 250

10 10 50 150 300 500

20 20 100 300 600 1000

LOW MEDIUM HIGH

Priority Action

1 1-20 Risk is as low as reasonably practicable

2 21 – 50 No immediate action – keep under review

3 51-100 Action within next year - Keep under review

4 101-150 Action within 3 months

5 151 – 201 Action within next month

6 201-300 Action within a week

7 > 300 Immediate action - Risk cannot be tolerated

Note: The scoring can sit between numbers if the hazard does not meet the criteria.

Date Printed: 04/11/2020 Page 4 of 15

V1 Hoddesdon Environmental Risk

and Opportunities Register

STEEPLE Analysis

Social Technology Economic Environment Political Legal Ethical

Education Rate of technology obsolesce(up grades) Exchange rate Threats from natural causes Government changes EPR 2016 bribery, all levels

Income Mobile technology Economic growth Waste recycling International trade regulations Employment laws IP

Attitudes IT changes Inflation rates Sustainable energy sources Union Health and safety laws Reputation

Demographic (age) Alternative technology Government funding Site infrastructure Government policy on research funding IP Business ethics

Mobile work force Data security international trade Gaseous discharges Exit from EU Data Security Customer confidentiality

Site location Raw material - sole supplier Company change API emissions Protestors

Public opinion TD process to protect raw material supply Utilities costs CFC Emissions

Raw material costs Releases to water

Challenge with type of work available. 1/3 Fixed overhead costs for site Transfer of waste

pharma is biological molecules.

Date Printed: 04/11/2020 Page 5 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

SWOT Analysis

Helpful to achieving objectives Harmful to achieving objectives

Strengths Weaknesses

Hoddesdon Site Internal Origin

Highly experienced, skilled staff High running costs

Respected heritage and reputation Raw material costs and supply

Strong relationship with customers Variability of order demand

Well presented refurbished facility Technological changes/advancements

Location of facility Loss of experienced staff

Responsiveness to enquiries Loss of knowledge and technical expertise

High levels of customer satisfaction Training burden

Succession Planning Discharge limits

Supportive Management Different legislation across the world

Technical expertise Facility maintenance costs

EHS activities Controlled temperature storage monitoring

Back catalogue of work Data management

Investment opportunities from wider Company Uneven flow of work affecting waste disposal levels

Limited number of experienced staff

Opportunities Threats

Collaborative work with customers Competitors

Loyal customers Pricing

External Origin

Linking sales with capabilities on other sites Specialist market

Exhibiting at industry events Cost of materials

Hosting industry events Shipping

Promotion by publishing work Data security

Links with university chemistry departments Technological changes/advancements

Funding from government Alternative technologies

Part of a bigger company Customer budget restrictions

Chemical Industry Association (CIA), promotional body Cost of utilities

Technological changes and advancements EHS licences

Strategic acquisitions made by Company Financing

Expansion of other areas of site Exchange rates

Customer EHS Audits Customer demands

High degree of risk, pricing based on estimates

Resource stretched supporting other sites

Change of client perception following Company change

Equipment wear and tear

Customer EHS Audits

Regulatory Inspections

Date Printed: 04/11/2020 Page 6 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

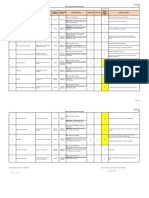

Risk Analysis

Groups at risk: A = Customers, B = Staff, C = Facility/ Equipment, D = Process, E = Technology, F = Suppliers G= Environment, H = Stakeholders/Regulators, I = Business

LOW = GREEN MEDIUM = YELLOW HIGH = RED

Ref Risk Identified Source Potential Harm Groups L1 S1 R1 Existing Controls L2 S2 R2 Additional Actions/Controls Required L3 S3 R3 Action Responsibility

at Risk Priority

R1 Failure of EMS Internal and Maintain compliance A, H, I 20 50 1000 20 50 1000 Permit compliance document (line by 1 30 30 2 Top Management

could result in external against Permit line review) ensures that resources

Permit breaches conditions and limits are adequate and

and regulatory equipment/processes are in place

non-compliance. Staff awareness of the permit limits

and importance of remaining

compliant maintained through training

against SOPs, RPS training, EHS

committee meetings, etc

Management lines and accountability.

Good communication - site

meetings/production meetings.

Controlled documentation in place.

Effectiveness of processes is audited

and change is controlled.

Management review.

Internal EHS inspection programme

R2 Management of Internal Business H, I 20 50 1000 Optimising operational efficiency by 5 30 150 Monitoring costs and continual 1 30 30 3 Top Management

costs and profitability, budget eliminating unnecessary costs/waste improvement of processes.

overheads compliance

R3 Fulfilment of Internal and Failure of EMS I, G, H 20 50 1000 20 50 1000 Terms of licences understood. 1 30 30 3 EHS Manager

licensing details External could breach

licensing rights

Control and monitoring of processes

that could impact on our adherence to

licence conditions

Management review,

Internal EHS monitoring programme.

External audits by agencies and

customers

Maintain open dialogue with agencies.

R4 Protection of Internal and IP, Customers, Staff A, B, 10 50 500 2 50 100 Data security committee. 2 50 100 3 QA Department

Company owned External D, E, Competitive pay and conditions for staff IT Department

IP, customer base H, I

and staff, custody Investment in appropriate

of customer data software/hardware to reduce risk.

Competitive pay and conditions for

staff

Data encryption.

USB ports control.

Management review.

Internal EHS inspection programme

Date Printed: 04/11/2020 Page 7 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

R5 Failure of aspects Internal and Flow of A, B,C, 20 50 1000 Defined responsibilities for processes. 2 50 100 Defined responsibilities for processes. 1 50 50 2 Top Management

of the EMS could External information/samples D, F, I Management lines and accountability.

bring about a between processes.

failure between Failure of Good communication - site

processes communication meetings/production meetings.

(Effective could delay or Controlled documentation in place.

communication prevent product Processes are understood by staff and

between realisation , responsibilities are well defined

departments challenge the site Effectiveness of processes is audited

(interface between permit limits, place and change is controlled.

BD/Quotations/Pla staff in danger of Management review.

nning. receiving exposure Internal EHS inspection programme

Production/QC/Shi to radiochemicals or

pping. EHS & chemicals

Waste ))

R6 Failure by external External Fulfilment of A, D, I, 10 30 300 Supplier approval and review process. 2 30 60 Internal EHS inspection programme 1 30 30 1 EHS Manager

suppliers could be contract. C, B Investigation of non conformances.

detrimental to us Availability of Records that support equipment

fulfilling our products/services conformity are formally accepted by the

environmental and Company (stamped - sign and date by

regulatory Facilities)

responsibilities

R7 Environmental Internal and Minimise A, B, 20 50 1000 Compliance with NRW permits. 2 50 100 Management review, Internal EHS 1 30 30 1 EHS Manager

management External environmental G, I Pessimistic approach to ensure stringent monitoring programme. Constructive

impact for local control dialogue with agencies

community.

Changes to

interpretation of the

permit conditions by

agencies

R8 Retention of Internal Business capability. A, B, 20 50 1000 Succession planning. 2 50 100 Management review of skills of 1 30 30 1 Top Management

specialist skills Time taken to train, C, D, Staff training - multiskilling in small teams workers

and knowledge gain experience. H, I to ensure suitable knowledge and cover

at all times.

Recruitment/succession planning.

R9 Maintaining of External Harm from pricing A, H, I 10 50 500 Discussions and service review of 5 50 250 Support for staff to attend symposiums 2 50 100 3 Top Management

efficient and cost increases, changes suppliers and other industry events

effective systems in service provision, Awareness of market pricing Membership of industry committees

that ensure efficiency of Keeping abreast of technology Secure and appropriate waste routes

compliance processes Regular duty of care and service and contractors

suitability audits

R10 Risk to staff, data, External and IP, customer A, B, 5 50 250 Site security. 2 50 100 Management review. 2 50 100 3 Top Management

equipment, site Internal confidentiality, D, E, Internal EHS inspection programme

specialist skills and H, I Staff training. ICT security committee

techniques

Business values and Code of conduct

R11 Risk to business External Pricing, lead-times A, H, I 10 50 500 Skills and specialist nature of work. 5 30 150 Business Development support 2 50 100 3 Top Management

from competitors

Competitive pricing.

Date Printed: 04/11/2020 Page 8 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

R12 Technological Internal and Specialist E, B, 20 30 600 Planning and budgeting. 10 15 150 Management review. 5 15 75 3 Top Management

Changes / External equipment, A, C, I Internal EHS inspection programme

Advancements technologies, IT Staff training Change control process

software and New staff bring their

hardware knowledge/experiences and new ideas

R13 Changes following External Potential for A, B, 10 50 500 Risk is currently unknown, any impact

UK decision to uncertainty with C, D, will affect our UK based competitors too

leave EU. Risk to trading rules and E, F,

trade links, regulations. G, H, I

inflation and

exchange rates,

European funding.

UK government

changes

R14 Couriers used to External Fulfilment of A, G, 20 50 1000 Technical Agreement sets out 5 50 250 Shipping documentation produced on 2 50 100 2 QA Department

ship products to contract to deliver H, I expectations with Courier. site.

the customer product as agreed, Shipping checks conducted at

both in terms of time handover to Courier.

and conditions to Internal QA inspection programme

preserve product On site DGSA

R15 Site Internal Specialist site and A, C, 20 50 1000 Maintenance schedule for quality and 5 50 250 CAPEX plan and review. 2 50 100 2 QA Department

equipment, wear H, I safety critical equipment. Prioritisation of work needed. EHS Manager

and tear Failure to Maintenance contracts with approved Internal QA inspection programme

adequately maintain service providers. Training of staff

the facility could

result in equipment

breakdowns which

in turn could

compromise our

ability to meet the

EMS requirements

R16 Site - interaction Internal Lack of knowledge A, H, I 20 50 1000 BD and Technical meetings with new 5 50 250 Systems and structure for the new Top Management

with wider on how we may Pharmaron sites. Outcome will help company across all sites is needed

Company support new assess any gaps we may have

Company

acquisitions

.Potential for

uncertainty when

quoting to

customers, could

lead to delays with

providing customers

with information

R17 Environment External Potential for the A, H, I 20 50 1000 Maintain compliance against EPR 2016 1 50 50

Agency breaching of the site Permit conditions and limits

permit due to lack of Dedicated EHS Manager to audit the

understanding about disposal of waste and discharges from

the permit site

conditions

Date Printed: 04/11/2020 Page 9 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

R18 Health and Safety External Potential for being A, H, I 20 50 1000 Dedicated EHS Manager to ensure to 1 50 50

Executive non-compliant ensure compliance health and safety

against Health and legislation

Safety Regulations EHS committee meetings to highlight any

trends and potential problems

Occupational hygiene monitoring to

ensure staff exposures the API and

chemicals is minimised

R19 Health and Safety External Potential for being A, H, I 20 50 1000 Maintain compliance with ADR2017 and 1 50 50

Executive non-compliant CDG2009 when transporting fproducts

against CDG2009 and waste

when transporting On-site DGSA to ensure compliance

materias

R20 Home Office External Potential for non A, H, I 20 50 1000 Maintain compliance with the sites drug 1 50 50

compliance with the precursor and controlled drug licenses

Misuse of Drugs Act Staff with key roles in the controlled drug

1971and Misuse of process based on site and ensure

Drugs regulations compliance though the control and

2001 documented use of substances and

regular auditing and annual returns

Chemical database and planning teams

highlight any new substances

R21 The Department External Potential for non A, H, I 20 50 1000 Maintain compliance with the Chemical 1 50 50 Consider a chemical database Top Management

for Business, compliance with Weapons Convention by having a highlights which highlights any new

energy and CWC responsible member of staff on site who substances which have compliance

industrial strategy maintains records, carries out audits and conditions and/or restrictions

(BEIS) completes the annual returns annual

returns

Date Printed: 04/11/2020 Page 10 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

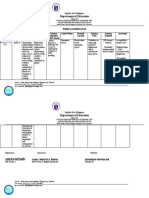

Opportunity Analysis

Interested Groups: A = Customers, B = Staff, C = Facility/ Equipment, D = Process, E = Technology, F = Suppliers G= Environment, H =

Stakeholders/Regulators,

Opportunity I =Opportunity

Business Risk Source Potential Opportunity Interested Existing Controls to Additional Responsibility

Ref Groups manage opportunity Actions/Controls

Required

O1 Customers Early discussion External Potential for repeat A, I, H Quotations, BD and Promotional

with customers to business, operations literature, exhibiting

ensure their recommendations to interaction and at consortium

requirements are others. feedback events to ensure

met and the Protects Company's that we provide a

chmicals used and reputation service rather than

waste created is Minimises make a product

minimised discharges and

reduces costs

Allows for more

projects to be

carried out with

current Permit limits

O2 Potential Reaching new External Potential to grow the A, I, H Promote our as O1 Business

Customers customers business, increase capabilities, Development

market share advertising,

publishing work,

attending industry

events

O3 Employees Company's Internal Loyalty, flexibility as B, I, H Provision of a Top management Top

biggest asset: business develops working environment supportive of Management

professional, and conditions innovation,

highly skilled and which supports the investment in

motivated staff. facilitation of training, rewards

customer

requirements.

Competitive rates of

pay and conditions

O4 Potential Ensuring business External Competitive terms B, I, H Succession Links with STEM, Top

employees continuity. and conditions of planning, local school and Management

Specialist skills employment requirement to universities.

employ best skilled Opportunities for

candidates promotion at

available, career graduate fairs

progression.

Competitive rates of

pay and conditions

O5 Technological Enable to compete External More competitive in A, B, E, Sharing knowledge Attending industry Top

Changes and in marketplace. marketplace. H, I across Pharmaron events and Management

Advancement Further A more sites seminars

improvements in environmentally (Chemistry, IT,

environmental sound and less risky EHS, Quality).

performance and place for customers CAPEX reviews

reduction of costs, to send their

liabilities and business

business risks Further enhance our

offering to our

customers

O6 Site - Expansion of Internal Ensuring best A, B, D, Informing clients of Company wide Top

interaction capability. practice and E, H, I acquisition, linking meetings of Senior Management

with wider Business common approach our known brand Management.

Company development use to environmental with Pharmaron. BD and Technical

of CRM to exploit management Managing customer meetings with other

opportunities. Strategic concerns with Sites to assess any

Potential for acquisitions by change and with gaps we may have.

investment from Company environmental Clear lines of

the wider management communication,

Company reporting lines and

responsibilities

across the UK sites

O7 Stakeholders Allow for greater External External funding A, B, C Contacts with Top

investment to from Government, Government and Management

enable Research and RDEC

development. Development

Opportunity to (RDEC) grants

advertise business

and its capabilities

Date Printed: 04/11/2020 Page 11 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

O8 Site More production Internal Expansion of A, B, F, Scope of this Top

capacity to allow production capability E, G, H, I opportunity has yet Management

growth and to be fully defined.

development of Controls will be

the site detailed

documented plan of

project . CAPEX

funding

O9 Regulators Opportunity to External Competitive A, B, F, EHS Manager

influence what is advantage over E, G, H, I

regarded as being business opponents

best practice Reduced regulatory

across the industry interaction and

costs

O10 Customer Opportunity to External Competitive A, B, F, Top

Auditors confirm to advantage over E, G, H, I Management

customers that business opponents

their IP, and Increased amount

projects will not be and value of work

at risk when

Pharmaron carries

out their business

Date Printed: 04/11/2020 Page 12 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

Interested Parties and Business Context relevant to the EMS

Risks/

Interested Party/ External/ Risks/

Opportunity Needs /Expectations/Details Why

Business Context Internal Opportunity

Ref.

Failure of EMS could result in Permit

R1 Regulatory Interested Party External Maintain compliance against Permit conditions and limits Risk

breaches and regulatory non-compliance.

Management of costs, inventory and overheads to ensure Optimising operational efficiency by

R2 Stakeholders Interested Party Internal Risk

profitability eliminating unnecessary costs/waste

Fulfilment of licensing details

Terms of licences understood.

R3 Regulatory Interested Party External Risk Failure of EMS could breach licensing rights

Control and monitoring of processes that could impact on

our adherence to licence conditions

Protection of Company owned IP, customer

R4 Competitors Interested Party External IP, Staff, other customers Risk

base and staff, custody of customer data

Flow of information/samples between processes. Failure of aspects of the EMS could bring

Failure of communication could delay or prevent product about a failure between processes (Effective

R5 Customers Interested Party Internal realisation , challenge the site permit limits, place staff in Risk communication between departments

danger of receiving exposure to radiochemicals or (interface between BD/Quotations/Planning.

chemicals Production/QC/Shipping. EHS & Waste ))

Failure by external suppliers could be

Fulfilment of contract.

R6 Suppliers Interested Party External Risk detrimental to us fulfilling our environmental

Availability of products/services

and regulatory responsibilities

Minimise environmental impact for local

R7 Local community Interested Party External Environmental management Risk

community

Retention of specialist skills and knowledge

Succession planning.

Staff training - multiskilling in small teams to ensure

Time taken to train, gain experience.

suitable knowledge and cover at all times.

R8 Employees Business Context Internal Risk Demographic of workforce is towards an older

population

Recruitment/succession planning.

Levels of authority - accountability.

Retention of customer base, promote

R9 Customers Business Context External Competitors, pricing, changes in customers Risk

business

Risk to staff, data, equipment, site, physical

R10 Security Business Context Internal IP, customer confidentiality, specialist skills and techniques Risk

security

R11 Competitors Business Context External Pricing, lead-times Risk Risk to business

Technological

R12 Business Context Internal Specialist equipment, IT software and hardware Risk Risk to business

Changes

Changes following UK decision to leave EU. Risk to trade

Potential for uncertainty with trading rules,

R13 Stakeholders Business Context External links, inflation and exchange rates, European funding. UK Risk

regulation. Risk is currently unknown

government changes

Failure by the Courier could be detrimental to

Fulfilment of contract to deliver product as agreed, both in us fulfilling our responsibilities to customers.

R14 Courier Business Context External terms of time, conditions to preserve product and to ensure Risk Product could be compromised.

compliance with the transportation of dangerous goods Potential for breach of regulations prompting

regulatory intervention

Failure to adequately maintain the facility

could result in equipment breakdowns which

R15 Stakeholders Business Context Internal Specialist site and equipment, wear and tear Risk

in turn could compromise our ability to meet

the EMS requirements

Potential for uncertainty when quoting to

Stakeholders Lack of knowledge on how we may support new Company

R16 Business Context Internal Risk customers, could lead to delays with providing

Regulators acquisitions

customers with information

Potential for the breaching of the site permit

Maintain compliance against EPR 2016 Permit conditions

R17 Environment Agency Interested Party External Risk due to lack of understanding about the permit

and limits

conditions

Health and Safety

R18 Interested Party External Maintain compliance with Health and safety legislation Risk Potential for being non-compliant

Executive

Health and Safety Maintain compliance with ADR2017 and CDG2009 when Potential for being non-compliant against

R19 Interested Party External Risk

Executive transporting final products and waste materials CDG2009 when transporting materials

Potential for non compliance with the Misuse

Maintain compliance with the sites drug precursor and

R20 Home Office Interested Party External Risk of Drugs Act 1971and Misuse of Drugs

controlled drug licenses

regulations 2001

The Department for

Maintain compliance with the Chemical Weapons

Business, energy

R21 Interested Party External Convention by maintaining records and performing annual Risk Potential for non compliance with CWC

and industrial

returns

strategy (BEIS)

Potential for repeat business, recommendations to others.

Early discussion with customers to ensure

Protects Company's reputation

their requirements are met and the

O1 Customers Interested Party External Minimises discharges and reduces costs Opportunity

radioactivity used and waste created is

Allows for more projects to be carried out with current

minimised

Permit limits

Potential to grow the business, increase

O2 Potential Customers Interested Party External Need to forge links and promote our capabilities Opportunity

market share

Provision of a working environment and conditions which

Company's biggest asset: professional, highly

O3 Employees Interested Party Internal supports the facilitation of customer requirements. Location Opportunity

skilled and motivated staff.

of the facility

succession planning, requirement to employ

O4 Potential employees Interested Party External Competitive terms and conditions of employment Opportunity best skilled candidates available, career

progression

More competitive in marketplace.

Technological

A more environmentally sound and less risky place for Enable to compete in marketplace. Further

O5 Changes and Business Context External Opportunity

customers to send their business enhance our offering to our customers.

Advancement

Further enhance our offering to our customers

Expansion of capability.

Informing clients of acquisition, linking our

Ensuring best practice and common approach to

Site - interaction with known brand with Pharmaron.

O6 Business Context Internal environmental management Opportunity

wider Company Managing customer concerns with change

Strategic acquisitions by Company.

and with environmental management

Potential for investment from the wider Company.

Allow for greater investment to enable

External funding from Government, Research and development.

O7 Stakeholders Business context External Opportunity

Development grants Opportunity to advertise business and its

capabilities

Date Printed: 04/11/2020 Page 13 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

Stakeholders

Regulators External More production capacity to allow growth and

O8 Business Context Expansion of production capability Opportunity

Customers & Internal development of the site

Staff

Opportunity to influence what is regarded as being best Competitive advantage over business

O9 Regulators Interested Party External practice across the industry Opportunity opponents

Reduced regulatory interaction and costs

Opportunity to confirm to customers that their IP, and Competitive advantage over business

O10 Customer Auditors Interested Party External projects will not be at risk when Pharmaron carries out their Opportunity opponents

business Increased amount and value of work

Date Printed: 04/11/2020 Page 14 of 15

V1

Hoddesdon Environmental Risk

and Opportunities Register

Risk Ref. Actions or Recommendations Action owner

R1 Permit compliance document (line by line review) ensures that resources are adequate and equipment/processes are in M Goodwin

place

R1 Good communication - site meetings/production meetings M Goodwin

R1 Controlled documentation in place. QA Dept

R1 Effectiveness of processes is audited and change is controlled. QA Dept

R1, R6, R7 Internal EHS inspection programme

R2 Monitoring costs and continuous improvement of processes Top

Management

R3 Terms of licenses understood M Goodwin

R4, R10 Data and IP security should be considered by the Pharmaron UK ICT security committee IT Dept

QA Dept

R5 Defined responsibilities for processes. Management lines and accountability. Top

Processes are understood by staff and responsibilities are well defined Management

Effectiveness of processes is audited and change is controlled.

R8 Management review of skills of workers Top

Management

R9 Support for staff to attend symposiums and other industry events Top

Membership of industry committees Management

R11 Business Development support to ensure products and services are competitive and targeted Business

Development

R12 Management review of the best practices including technology for the business sector and ensuring improvements and Top

changes are considered in the change control process so that changes are made efficiently, safely and with no negative Management

compliance impacts

R14 The shipping process should be audited on a regular basis to ensure compliance QA

Department

R15 Prioroities for investment such as CAPEX projects should be prioritised to meet the present and future needs of business Top

whilst considering compliance obligations Management

R16 Systems and structure for effective communication and sharing of best practice across all Pharmaron UK sites required Top

Management

R21 Consider a chemical database highlights which highlights any new substances which have compliance conditions and/or

restrictions

Opportunity

Actions or Recommendations Action owner

Ref

Date Printed: 04/11/2020 Page 15 of 15

You might also like

- 2015 Risk and Opportunities Register PDFDocument3 pages2015 Risk and Opportunities Register PDFdachoko8782% (11)

- Risk Assessment Interested PartiesDocument8 pagesRisk Assessment Interested PartiesAnbu0% (1)

- Risk and Opportunity Assessment 1564904566Document6 pagesRisk and Opportunity Assessment 1564904566Ssnovita31100% (1)

- QSF 1 - RISK AND OPPORTUNITIES REGISTER-compilation by ClauseDocument26 pagesQSF 1 - RISK AND OPPORTUNITIES REGISTER-compilation by Clausemeth nawog100% (3)

- Environmental Aspects and ImpactsDocument15 pagesEnvironmental Aspects and ImpactsCristina Coceasu100% (4)

- Aspects and Impacts Register 160415Document1 pageAspects and Impacts Register 160415Roselyn SharronNo ratings yet

- Environmental Aspects and Impact Register TemplateDocument5 pagesEnvironmental Aspects and Impact Register TemplateCarlosNo ratings yet

- Iso RISK AND OPPORTUNITY ASSESSMENT RECORDDocument5 pagesIso RISK AND OPPORTUNITY ASSESSMENT RECORDMuhammad Awais89% (19)

- Risk & Opportunity Assessment Worksheet: Amang' Rodriguez Memorial Medical CenterDocument4 pagesRisk & Opportunity Assessment Worksheet: Amang' Rodriguez Memorial Medical CenterNylamor LicayNo ratings yet

- Risk and Opportunities Register Bulacan State UniversityDocument58 pagesRisk and Opportunities Register Bulacan State UniversityNiezel Sabrido100% (1)

- Interested Parties Needs ExpectationsDocument4 pagesInterested Parties Needs Expectationsvishvendan100% (7)

- HSE-MP-001: Understanding External Contextual Factors Impacting the OrganizationDocument9 pagesHSE-MP-001: Understanding External Contextual Factors Impacting the OrganizationBảo Trần100% (1)

- ISO 14001 2015 Upgrade ChecklistDocument10 pagesISO 14001 2015 Upgrade ChecklistDariush Rumi100% (1)

- Aspects and ImpactsDocument3 pagesAspects and ImpactsrexivyNo ratings yet

- Manage Risks and Seize OpportunitiesDocument5 pagesManage Risks and Seize Opportunitiesamyn_s100% (2)

- Environmental Aspects and ImpactsDocument9 pagesEnvironmental Aspects and Impactssharif khan100% (3)

- Risks and Opportunities ISO14001-2015Document25 pagesRisks and Opportunities ISO14001-2015dauxom100% (2)

- ISO 14001 2015 Environmental Aspects and Impacts Procedure SampleDocument6 pagesISO 14001 2015 Environmental Aspects and Impacts Procedure SampleEndah Yulita67% (3)

- 200-74195 Aspect & Impacts Register RevDocument484 pages200-74195 Aspect & Impacts Register RevCandice100% (2)

- Environmental Impact PrioritiesDocument3 pagesEnvironmental Impact Prioritiespak-ksa lifeNo ratings yet

- Environmental Aspects and ImpactsDocument6 pagesEnvironmental Aspects and ImpactsImtiyaz Akhtar80% (5)

- Environmental Aspects Register (Iso 14001)Document6 pagesEnvironmental Aspects Register (Iso 14001)Naba majeadNo ratings yet

- Environmental Aspects Register and EvaluationDocument6 pagesEnvironmental Aspects Register and EvaluationShrikant UtekarNo ratings yet

- Contextual Issues and Risk Assessment - AfconsDocument3 pagesContextual Issues and Risk Assessment - AfconsAnonymous i3lI9MNo ratings yet

- Register of Environmental Aspects & Impacts: Business Standards SystemDocument4 pagesRegister of Environmental Aspects & Impacts: Business Standards SystemguliNo ratings yet

- Risk and Opportunity RegisterDocument2 pagesRisk and Opportunity RegisterRohith100% (1)

- Msc-Qhsef-22 Risks and Opportunity RegisterDocument3 pagesMsc-Qhsef-22 Risks and Opportunity Registersuhara hussain100% (1)

- Context of Org, Expectation of Interested Parties, Risk and OpporDocument3 pagesContext of Org, Expectation of Interested Parties, Risk and OpporRAHUL SINGHNo ratings yet

- Example of ISO 45001 - 2018 OHSMS Manual - ISO Consultant in KuwaitDocument22 pagesExample of ISO 45001 - 2018 OHSMS Manual - ISO Consultant in KuwaitShengrong Yee100% (1)

- Register Environmental ImpactsDocument7 pagesRegister Environmental ImpactsArmand LiviuNo ratings yet

- Risks in Canteen and Office AreasDocument8 pagesRisks in Canteen and Office Areasjoshisunil2No ratings yet

- Management Review Report 2009-10Document30 pagesManagement Review Report 2009-10テレブリコ ジェファーソンNo ratings yet

- Environmental Aspects Identification and Assessment - ProcDocument9 pagesEnvironmental Aspects Identification and Assessment - ProcAamir MukhtarNo ratings yet

- Risk Register AllLevelsDocument5 pagesRisk Register AllLevelsSam Atia100% (1)

- Environmental Aspect Impact RegisterDocument17 pagesEnvironmental Aspect Impact Registersyahir et0% (1)

- Risk and Opportunity RegisterDocument7 pagesRisk and Opportunity RegisterSandeep B100% (1)

- Ims Manual 2019 FinalDocument58 pagesIms Manual 2019 Finalaneesh awasthi100% (7)

- Environmental Aspect Impact RegisterDocument10 pagesEnvironmental Aspect Impact Registernikhilearat100% (7)

- Environmental Aspects Register (Iso 14001)Document11 pagesEnvironmental Aspects Register (Iso 14001)hunain zafarNo ratings yet

- SWOT ANALYSIS For ISO Context of The OrganizationDocument1 pageSWOT ANALYSIS For ISO Context of The OrganizationZach JavelonaNo ratings yet

- Risk RegisterDocument20 pagesRisk Registerzayzan100% (2)

- Opportunity and Risk MGMTDocument24 pagesOpportunity and Risk MGMTCharu Modi100% (3)

- Risk Register AllLevelsDocument5 pagesRisk Register AllLevelsriyaz10100% (4)

- Context of The OrganizationDocument23 pagesContext of The OrganizationIbrahim SirpiNo ratings yet

- Appointment of Management Representative For IMSDocument3 pagesAppointment of Management Representative For IMSbudi_alamsyahNo ratings yet

- OHS Risk Register-OldDocument24 pagesOHS Risk Register-OldMohamed Rizwan100% (1)

- Environmental Impacts and Aspects Register EngDocument9 pagesEnvironmental Impacts and Aspects Register EngsjmpakNo ratings yet

- EOHSP 07 Communication Consultation Participation PDFDocument5 pagesEOHSP 07 Communication Consultation Participation PDFSyafiq KhalilNo ratings yet

- Proposed Six Story Building For Community Concern Society - Risk RegistryDocument2 pagesProposed Six Story Building For Community Concern Society - Risk Registryjmaasa83% (6)

- EMS & OHSMS Internal Audit ChecklistDocument44 pagesEMS & OHSMS Internal Audit ChecklistRaajha Munibathiran92% (13)

- ISO 9001:2015 Key Concepts Series: Context of The Organization and Interested Parties An Implementation ApproachDocument13 pagesISO 9001:2015 Key Concepts Series: Context of The Organization and Interested Parties An Implementation Approachqualiman1100% (1)

- 02 Procedure For Context of The OrganizationDocument3 pages02 Procedure For Context of The OrganizationQualtic Certifications50% (4)

- Aspects & Impacts Register v8.2 January 2015: S I G N I F I C A N C eDocument5 pagesAspects & Impacts Register v8.2 January 2015: S I G N I F I C A N C eShashank SaxenaNo ratings yet

- Environmental Legal RegisterDocument13 pagesEnvironmental Legal Registermuthuswamy77No ratings yet

- Context of Organization Interested Parties, Issues, Needs and Expectation ListsDocument1 pageContext of Organization Interested Parties, Issues, Needs and Expectation Listsabdelmutalab100% (5)

- Risk register for construction projectDocument4 pagesRisk register for construction projectSreekumarNo ratings yet

- Risk Assessment RegisterDocument8 pagesRisk Assessment RegisterFareeha Waqar100% (10)

- Register of Legal & Other RequirementsDocument10 pagesRegister of Legal & Other RequirementsFairulhidayahNo ratings yet

- Risk Assessment and Method Statement Coronavirus Pandemic Control MeasuresDocument8 pagesRisk Assessment and Method Statement Coronavirus Pandemic Control MeasuresSubin JoseNo ratings yet

- Risk assessment and mitigation worksheetDocument4 pagesRisk assessment and mitigation worksheetkapil ajmaniNo ratings yet

- Ilo Osh 2001Document23 pagesIlo Osh 2001Armand LiviuNo ratings yet

- Guide to Selecting Product EPIsDocument40 pagesGuide to Selecting Product EPIsArmand LiviuNo ratings yet

- CSSM ManualDocument63 pagesCSSM ManualArmand LiviuNo ratings yet

- IAF TC Meeting Minutes DraftDocument46 pagesIAF TC Meeting Minutes DraftArmand LiviuNo ratings yet

- Ex. Risk Assessment Form For NRADocument1 pageEx. Risk Assessment Form For NRAArmand LiviuNo ratings yet

- Audit Assessment QuestionnaireDocument31 pagesAudit Assessment QuestionnaireArmand LiviuNo ratings yet

- FAQ AS9101-2016 (Mar. 2018) PDFDocument6 pagesFAQ AS9101-2016 (Mar. 2018) PDFArmand LiviuNo ratings yet

- Ea/Cc Faqs: Certification CommitteeDocument31 pagesEa/Cc Faqs: Certification CommitteeArmand LiviuNo ratings yet

- Activities, Environmental Impacts & AspectsDocument47 pagesActivities, Environmental Impacts & AspectsArunNo ratings yet

- Printable Ring Sizer: OPTION 1: String TestDocument1 pagePrintable Ring Sizer: OPTION 1: String TestArmand LiviuNo ratings yet

- Competence requirements for OH&S management system auditorsDocument6 pagesCompetence requirements for OH&S management system auditorsArmand LiviuNo ratings yet

- BTD Quality System Policy ManualDocument19 pagesBTD Quality System Policy ManualPinaki DasNo ratings yet

- Clarification of Intent of Iso 14001Document24 pagesClarification of Intent of Iso 14001Armand LiviuNo ratings yet

- ISO 9001 - 2015 - Managing - ChangeDocument3 pagesISO 9001 - 2015 - Managing - ChangeArmand LiviuNo ratings yet

- Dual White Bulb User - InstructionDocument2 pagesDual White Bulb User - InstructionArmand LiviuNo ratings yet

- Dual White Bulb User - InstructionDocument2 pagesDual White Bulb User - InstructionArmand LiviuNo ratings yet

- AS9100D Revision 2016 Key ChangesDocument67 pagesAS9100D Revision 2016 Key ChangesArmand LiviuNo ratings yet

- ISO-9001:2015 Transition GuideDocument25 pagesISO-9001:2015 Transition GuideChong CongNo ratings yet

- Lenovo Desktop A740 DatasheetDocument2 pagesLenovo Desktop A740 DatasheetArmand LiviuNo ratings yet

- Wi Fi HDD Web User Guide en 1Document34 pagesWi Fi HDD Web User Guide en 1Armand LiviuNo ratings yet

- Lenovo Desktop A740 DatasheetDocument2 pagesLenovo Desktop A740 DatasheetArmand LiviuNo ratings yet

- Adding Value - Zone 1Document1 pageAdding Value - Zone 1Armand LiviuNo ratings yet

- Regulatory Risk AnalysisDocument2 pagesRegulatory Risk AnalysisArmand LiviuNo ratings yet

- Organizational Maturity LevelsDocument1 pageOrganizational Maturity LevelsArmand LiviuNo ratings yet

- ONLY Context Process Tabs Feb18Document2 pagesONLY Context Process Tabs Feb18Armand LiviuNo ratings yet

- Interested Parties & Needs-Expectations - As Per Iatf 16949 - 2016Document4 pagesInterested Parties & Needs-Expectations - As Per Iatf 16949 - 2016suresh kumar95% (38)

- Blank Risk Matrix, Updated On 31.01.2017.Document9 pagesBlank Risk Matrix, Updated On 31.01.2017.Madhavaram SVNo ratings yet

- Printable Ring Sizer: OPTION 1: String TestDocument1 pagePrintable Ring Sizer: OPTION 1: String TestArmand LiviuNo ratings yet

- Register Environmental ImpactsDocument7 pagesRegister Environmental ImpactsArmand LiviuNo ratings yet

- HR Human Targets Kens 5 Reports On Texan Tis Tortured in Houses of Horrors PDFDocument3 pagesHR Human Targets Kens 5 Reports On Texan Tis Tortured in Houses of Horrors PDFBozo ZarubicaNo ratings yet

- Discover Your Body's Needs with Intuitive MovementDocument2 pagesDiscover Your Body's Needs with Intuitive MovementLaura Bauman100% (1)

- Harrods Development PlansDocument8 pagesHarrods Development PlansAsghar AbbasNo ratings yet

- MELC Household ServicesDocument3 pagesMELC Household ServicesVincent Bayona92% (52)

- Rigger Level IIDocument5 pagesRigger Level IISulaman Nazir JuttNo ratings yet

- Social Dimensions of EducationDocument89 pagesSocial Dimensions of EducationJewel OrtizNo ratings yet

- Marketing Strategy Project FullDocument63 pagesMarketing Strategy Project FullAYYAPPAN1883% (46)

- A Synthesis, ESPDocument36 pagesA Synthesis, ESPReyNo ratings yet

- Enhancing Highway Traffic Safety Through Intelligent CarDocument9 pagesEnhancing Highway Traffic Safety Through Intelligent CarijdpsNo ratings yet

- Weekly Learning Plan for English Grade 10 at Gordon Heights National High SchoolDocument2 pagesWeekly Learning Plan for English Grade 10 at Gordon Heights National High SchoolAlwin AsuncionNo ratings yet

- Analysis of Play ScenarioDocument7 pagesAnalysis of Play Scenarioapi-537450355No ratings yet

- M5 Assignment-Gap IncDocument5 pagesM5 Assignment-Gap Incwalter chahweta100% (1)

- Brooks Kubik - The Dinosaur Training ManualDocument161 pagesBrooks Kubik - The Dinosaur Training ManualStephanie Clayton100% (12)

- Dixon Ticonderoga Case StudyDocument4 pagesDixon Ticonderoga Case StudyVineet SinghNo ratings yet

- Access to Justice IssuesDocument17 pagesAccess to Justice IssuesaddieNo ratings yet

- Theories of Retailing, Retail Life Cycle: Dr. Parveen NagpalDocument20 pagesTheories of Retailing, Retail Life Cycle: Dr. Parveen NagpalMisbah UllahNo ratings yet

- Teaching Social Studies MethodsDocument10 pagesTeaching Social Studies MethodsMedalle Roy67% (3)

- Vikas Saini BELDocument10 pagesVikas Saini BELVikas SainiNo ratings yet

- Interactive ReadingDocument3 pagesInteractive Readingapi-490016955No ratings yet

- AC DC Motor RewindingDocument6 pagesAC DC Motor RewindingJames Adrian Abalde Sabo100% (1)

- Mini Critique: by Galo and CasiñoDocument9 pagesMini Critique: by Galo and CasiñoAngela GaloNo ratings yet

- Sogo CSR ActivityDocument7 pagesSogo CSR ActivityLuthfi Mochammad ZakyNo ratings yet

- Librarian at LargeDocument279 pagesLibrarian at LargeSCPNo ratings yet

- COMMUNICATE EFFECTIVELY IN THE WORKPLACEDocument123 pagesCOMMUNICATE EFFECTIVELY IN THE WORKPLACEPaul BautistaNo ratings yet

- DIASS Q3 Module1Document25 pagesDIASS Q3 Module1Sherlyn MahinayNo ratings yet

- It Case StudyDocument14 pagesIt Case StudySameer ShujaNo ratings yet

- LP MathDocument5 pagesLP MathNUÑEZ, BIANCA G.No ratings yet

- Judges Grant Ontario Stay in Toronto Council FightDocument13 pagesJudges Grant Ontario Stay in Toronto Council FightCTV NewsNo ratings yet

- Copy of CSTP 2 Individual Induction Plan TemplateDocument3 pagesCopy of CSTP 2 Individual Induction Plan Templateapi-269928551No ratings yet

- Resumen Pelicula Historias CruzadasDocument2 pagesResumen Pelicula Historias CruzadasNatalia VaronNo ratings yet