Professional Documents

Culture Documents

HBL Deposit Accounts Problem:: What Is Proper Documentation?

Uploaded by

aon aliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HBL Deposit Accounts Problem:: What Is Proper Documentation?

Uploaded by

aon aliCopyright:

Available Formats

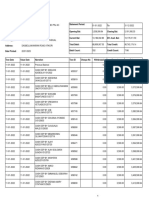

Hbl deposit Accounts Problem:

Hbl is the legendary and oldest bank in Pakistan. Main issue of hbl deposit accounts is Accounts

have been opened since the beginning ever since Pakistan was made approx. 73 years ago.

During a survey a sample of accounts raised by the state bank of Pakistan. It was found that most

of the accounts have no proper or complete documentation. They were weak in terms of

documentation required.

Most of the information available (for mostly older accounts) was partial. When went through

further scrutiny it was found that a lot of account holders passed away except from those which

were already reported by their heirs as deceased accounts.

There also a bunch of Un-claimed deposit accounts.

The issue of Benami Acocunts was also observed and had concerned the regulator to advise the

bank to go through a re-profiling activity, in-order to avoid money laundering issues.

What is Proper documentation?

C.N.I.C Proof Current, updated, which is on NADRA system and is biometrically verified.

Residential Proof as per C.N.I.C. IF not then customer should provide proof like utility bills in

either customer name or father or siblings name.

In case the customer lives on rent then customer must show tenancy agreement to verify the

address.

Income Proof. What is the source of income? Either customer earns himself (Salaried, Self-

employed or Sole-proprietor) or someone financially supports customer e.g. family siblings etc.

customer must provide these income proofs. Financial supporter’s income, their Valid ID and

Declaration having the amount through will he be supported

So there are thousands of accounts are exposed which do not have proper documentation like

there is one thing available on document and another was not. Something sends by the bank but

customer did not get OR customer does not live as per C.N.I.C address OR customer die etc.

there are various problems. Due to these problems it increases the risk of money laundering its

expose fake accounts like FALUDAY WALA , SABZI WALA, RIKSHA WALA etc.

On the other hand, there is no synchronize system like one person has accounts in different

branches and whoever used to come to the branch to open his account and branch will open his

account by the branch end. Due to this weakness the bank is facing various difficulties

Solution

1. HBL should update all the deposits accounts with proper documentation which is

outdated.

2. HBL must make a centralized system when the customer wants to open his

account, account will not open by the branch end.

3. When the customer comes into the branch to open his account then one person

shall input data in a branch and the second one will supervise but authorization

will done by the head office after reviewing all the documents, not by branch.

4. HBL should make a centralized system with customer information form with

customer number. When a customer whole data is on a customer information

form with customer number then bank will easily search how many accounts of a

same customer in different branches.

5. Documentation must be up to date. like C.N.I.C, Residential proof, Income proof.

Due to these solution we can easily solve these problems.

You might also like

- Bank Account CreationDocument10 pagesBank Account CreationJustin Patenaude100% (14)

- Types of Accounts BANKING LAWDocument99 pagesTypes of Accounts BANKING LAWTinashe MurindagomoNo ratings yet

- USAA Statement (Template)Document4 pagesUSAA Statement (Template)fehijan689No ratings yet

- How to Get a Business Loan for Commercial Real Estate: 2012 EditionFrom EverandHow to Get a Business Loan for Commercial Real Estate: 2012 EditionNo ratings yet

- Hand Out No 4 New Opening AccountsDocument12 pagesHand Out No 4 New Opening AccountsAbdul basit100% (1)

- View DocumentDocument6 pagesView Documentcss480% (1)

- Bank Reconciliation StatementDocument27 pagesBank Reconciliation Statementkimuli FreddieNo ratings yet

- Opening A Bank Account Can Seem IntimidatingDocument9 pagesOpening A Bank Account Can Seem IntimidatingtriratnacomNo ratings yet

- Credit CardDocument23 pagesCredit Carddeepak kumarNo ratings yet

- One-Stop Account Opening Process Retail Ver 3Document7 pagesOne-Stop Account Opening Process Retail Ver 3ዝምታ ተሻለNo ratings yet

- An Overview of Kyc NormsDocument5 pagesAn Overview of Kyc NormsArsh AhmedNo ratings yet

- Steps of Loan ProcessDocument16 pagesSteps of Loan ProcessShraddha TiwariNo ratings yet

- Unit 3. Procedure For Opening & Operating of Deposit AccountDocument11 pagesUnit 3. Procedure For Opening & Operating of Deposit AccountBhagyesh ThakurNo ratings yet

- Types of Bank Accounts in IndiaDocument18 pagesTypes of Bank Accounts in IndiaPriya SharmaNo ratings yet

- Capital BudgetingDocument13 pagesCapital Budgetingaon aliNo ratings yet

- Money Laundering Notes (CAMS) : Page 1 of 63Document63 pagesMoney Laundering Notes (CAMS) : Page 1 of 63vickyNo ratings yet

- March 2019Document4 pagesMarch 2019sagar manghwaniNo ratings yet

- Final HDFC ProjectDocument45 pagesFinal HDFC ProjectAbhishek SainiNo ratings yet

- Lock Box in SAP ARDocument4 pagesLock Box in SAP ARNaveen KumarNo ratings yet

- Learning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Document13 pagesLearning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Yuri GalloNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® Best PracticesFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® Best PracticesNo ratings yet

- IGCSE Economics Self Assessment Chapter 16 AnswersDocument2 pagesIGCSE Economics Self Assessment Chapter 16 AnswersDesre100% (4)

- Organizational Structure of Bank of KhyberDocument11 pagesOrganizational Structure of Bank of Khybernyousufzai_150% (2)

- Fundamentals of Accountancy Business and Management 2Document20 pagesFundamentals of Accountancy Business and Management 2MOST SUBSCRIBER WITHOUT A VIDEO43% (7)

- Unit 3 TybbaDocument11 pagesUnit 3 TybbaChaitanya FulariNo ratings yet

- 1) - What Kind of Account You Offer and What Are The Details You Ask For Opening It?Document14 pages1) - What Kind of Account You Offer and What Are The Details You Ask For Opening It?Pawan Jaju100% (1)

- Unit 8-Bank Reconciliation StatementDocument20 pagesUnit 8-Bank Reconciliation Statementanamikarajendran441998No ratings yet

- Main Area of Focus For Audit of "Cash and Cash Equivalents"Document3 pagesMain Area of Focus For Audit of "Cash and Cash Equivalents"Mohit SainiNo ratings yet

- Watch Your Savings GrowDocument14 pagesWatch Your Savings GrowpratikjaiNo ratings yet

- Chapter 5 A ServicesDocument15 pagesChapter 5 A ServicesSeid KassawNo ratings yet

- Chapter - 02 Kyc & Aml Guidelines (Part - I)Document12 pagesChapter - 02 Kyc & Aml Guidelines (Part - I)anon_503407248No ratings yet

- Steps 4 Opening A.CDocument20 pagesSteps 4 Opening A.CBipinNo ratings yet

- Know Your Custimer PolicyDocument15 pagesKnow Your Custimer PolicyPrathmesh GharatNo ratings yet

- Cbo 2Document21 pagesCbo 2Jabed MansuriNo ratings yet

- CH 3 - BrsDocument0 pagesCH 3 - BrsHaseeb Ullah KhanNo ratings yet

- Quarter 2 Modified Module 2Document10 pagesQuarter 2 Modified Module 2erica lamsenNo ratings yet

- 12 Abm-E Florentino Lesson 5 Bank StatementDocument11 pages12 Abm-E Florentino Lesson 5 Bank StatementJan Paul de Alger ObeliaNo ratings yet

- Bank ReconciliationDocument5 pagesBank ReconciliationaizaNo ratings yet

- Funding Your COL Account PDFDocument11 pagesFunding Your COL Account PDFNAi IAnNo ratings yet

- KYC Portability InfosysDocument5 pagesKYC Portability InfosysNadeemNo ratings yet

- Askari Commercial Bank Limited: Internship ReportDocument72 pagesAskari Commercial Bank Limited: Internship ReportMaham ButtNo ratings yet

- Material 2Document45 pagesMaterial 2Rocky BassigNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationDenishNo ratings yet

- Procedure of Account OpeningDocument11 pagesProcedure of Account OpeningSky WalkerNo ratings yet

- Account Opening GuidelinesDocument11 pagesAccount Opening GuidelinesGraphic MasterNo ratings yet

- A 2 B T & P T B S P B S B O I: Ssingment-Anking Heory Ractices Opic: Anking Ervices Rovided Y Tate ANK F NdiaDocument20 pagesA 2 B T & P T B S P B S B O I: Ssingment-Anking Heory Ractices Opic: Anking Ervices Rovided Y Tate ANK F NdiaarunanayarNo ratings yet

- Customers Account With BankerDocument11 pagesCustomers Account With Bankerrkrakib073No ratings yet

- Kokan BankDocument20 pagesKokan BankramshaNo ratings yet

- Ann 2Document2 pagesAnn 2Kedriner LabanNo ratings yet

- Policy On Unclaimed Deposits (2018-19)Document5 pagesPolicy On Unclaimed Deposits (2018-19)Puran Singh LabanaNo ratings yet

- Binayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurDocument8 pagesBinayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurkunjapNo ratings yet

- Aml CFT Quiz Ans (1) 20211116212832Document205 pagesAml CFT Quiz Ans (1) 20211116212832Uday GopalNo ratings yet

- KYC Officers Master KeyDocument100 pagesKYC Officers Master KeyTarang100% (1)

- Intermidiate FA I ChapterDocument28 pagesIntermidiate FA I Chapteryiberta69No ratings yet

- Opening A Savings Account: Step OneDocument3 pagesOpening A Savings Account: Step OneAlexander CorvinusNo ratings yet

- KYC - Know Your CustomerDocument2 pagesKYC - Know Your CustomerRatnadeep Mitra0% (1)

- Bank Reconcilation Knowledge Aptitude TestDocument4 pagesBank Reconcilation Knowledge Aptitude TestBirender SinghNo ratings yet

- COL Account Opening FAQs (2022 - 02 - 06 14 - 14 - 27 UTC)Document11 pagesCOL Account Opening FAQs (2022 - 02 - 06 14 - 14 - 27 UTC)Rey Coroña NardoNo ratings yet

- Internship Report NiB BankDocument10 pagesInternship Report NiB BankAbdul WaheedNo ratings yet

- Cbo 2Document46 pagesCbo 2CHARLIENo ratings yet

- Master Circular Savings Bank AccountDocument35 pagesMaster Circular Savings Bank Accountamanjain28820No ratings yet

- Fabm 2Document3 pagesFabm 2John Calvin GerolaoNo ratings yet

- Citizenship Charter of DBDocument13 pagesCitizenship Charter of DBPrathyusha KothaNo ratings yet

- Customer's Account With The BankerDocument7 pagesCustomer's Account With The BankerShuktarai Nil JosnaiNo ratings yet

- LAS in Acounting 2 Week 1Document8 pagesLAS in Acounting 2 Week 1dorothytorino8No ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJenny Pearl Dominguez CalizarNo ratings yet

- Kyc (Know Your Customer) Information For Customers Intending To Open Bank Accounts With UsDocument5 pagesKyc (Know Your Customer) Information For Customers Intending To Open Bank Accounts With UsAshok GaikwadNo ratings yet

- Pakistan PDFDocument2 pagesPakistan PDFaon aliNo ratings yet

- Financial Risk Management Course OutlineDocument3 pagesFinancial Risk Management Course Outlineaon aliNo ratings yet

- Strategic Negotiations OutlineDocument2 pagesStrategic Negotiations Outlineaon aliNo ratings yet

- CAPMDocument77 pagesCAPMaon aliNo ratings yet

- Guidelines For BRP FRP IS Thesis V3Document37 pagesGuidelines For BRP FRP IS Thesis V3aon aliNo ratings yet

- v3 SP19 Guidelines Business Project (BBA & MBAP)Document19 pagesv3 SP19 Guidelines Business Project (BBA & MBAP)aon aliNo ratings yet

- History of HBLDocument2 pagesHistory of HBLaon aliNo ratings yet

- v3 SP19 Guidelines Business Project (BBA & MBAP)Document19 pagesv3 SP19 Guidelines Business Project (BBA & MBAP)aon aliNo ratings yet

- Demo Rapidminer New Data April 5Document6 pagesDemo Rapidminer New Data April 5Mohit SainiNo ratings yet

- 281 Rediscounting LineDocument4 pages281 Rediscounting LineLawrence T. BullandayNo ratings yet

- 2013 14 Unclaimed Dividend Account Shareholders DetailsDocument17 pages2013 14 Unclaimed Dividend Account Shareholders Detailsgurpreet06No ratings yet

- Vouchar 2024-27Document1 pageVouchar 2024-27Muhammad Azhar LashariNo ratings yet

- PQ5Document5 pagesPQ5Swastik MohapatraNo ratings yet

- Group Assignment: Name Student Id CourseDocument30 pagesGroup Assignment: Name Student Id CourseGONG HUEY WEN MoeNo ratings yet

- First Texas Savings Association, and First Gibraltar Savings Association, FSB, Intervening v. Reliance Insurance Co., 950 F.2d 1171, 1st Cir. (1992)Document13 pagesFirst Texas Savings Association, and First Gibraltar Savings Association, FSB, Intervening v. Reliance Insurance Co., 950 F.2d 1171, 1st Cir. (1992)Scribd Government DocsNo ratings yet

- Appendix 32 BrgyDocument4 pagesAppendix 32 BrgyJovelyn SeseNo ratings yet

- List of Accounts Team 1Document9 pagesList of Accounts Team 1Tintin LorenzoNo ratings yet

- Statement 2020 06 25 090643681Document7 pagesStatement 2020 06 25 090643681selfNo ratings yet

- Namma Kalvi 9th STD Mathematics TM Sample Materials 2019Document101 pagesNamma Kalvi 9th STD Mathematics TM Sample Materials 2019xx xaNo ratings yet

- A Research Report ON: Consumer Attitude Towards Education Loan in India Provided by Indian BankDocument28 pagesA Research Report ON: Consumer Attitude Towards Education Loan in India Provided by Indian BankKavindra SahuNo ratings yet

- PGVCL HowtoapplyDocument3 pagesPGVCL HowtoapplyDhaval PatelNo ratings yet

- Banking Reviewer - HMPDocument15 pagesBanking Reviewer - HMPjieNo ratings yet

- Office AsistantDocument1 pageOffice AsistantSantosh SahuNo ratings yet

- Ibs Kuantan Main 1 31/03/20Document16 pagesIbs Kuantan Main 1 31/03/20Hamierul MohamadNo ratings yet

- UntitledDocument485 pagesUntitledTowolawi AkeemNo ratings yet

- Saraswat Bank Annual Report 2014 15 PDFDocument92 pagesSaraswat Bank Annual Report 2014 15 PDFvishalNo ratings yet

- Santander's Acquisition of Abbey: Banking Across BordersDocument29 pagesSantander's Acquisition of Abbey: Banking Across BordersJawad FarisiNo ratings yet

- Lecture Notes MTH5124: Actuarial Mathematics IDocument117 pagesLecture Notes MTH5124: Actuarial Mathematics IRishi KumarNo ratings yet

- StatementDocument4 pagesStatementoliversmith6990No ratings yet

- Risk Management in Indian Banking SectorDocument3 pagesRisk Management in Indian Banking Sectorsplender2008No ratings yet

- FinMan InterestDocument3 pagesFinMan InterestJennifer RasonabeNo ratings yet