Professional Documents

Culture Documents

LAS in Acounting 2 Week 1

Uploaded by

dorothytorino8Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LAS in Acounting 2 Week 1

Uploaded by

dorothytorino8Copyright:

Available Formats

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

LEARNING ACTIVITY SHEET IN FUNDAMENTALS OF ACCOUNTANCY,

BUSINESS AND MANGEMENT 2

Quarter 2 Week 1: BASIC DOCUMENTS AND TRANSACTIONS RELATED TO BANK

DEPOSITS

Objective: After going through this module, you are expected to:

1. Identify the difference between Savings from a Checking Account

2. Prepare bank deposit and withdrawal slips

3. Prepare checks

4. Identify and understand the contents of a bank statement.

Common Types of Bank Accounts

There are two common types of bank accounts maintained by a business. Let’s get to know some of

their characteristics.

Different Types of Investments and their Features:

SAVINGS CURRENT

•Purpose of opening a bank To save money Facilitate financial

account transactions

•Ideal use Employees/Personal Use Employer/Business

Interest rate offered by the bank Low None/lower than savings if

any

•Daily Maintaining Balance Low High

required by the bank

•Overdraft (bank service that Not allowed Allowed

allows an account holder to

withdraw a little more beyond

his/her balance

•Evidence of transactions Passbook, deposit and Deposit slips, Checks and

withdrawal slips Bank Statement

•Documents Required for ID, Proof of Address, Picture, ID, Proof of Address, Picture,

opening an account Reference of Existing account Proof of Business

holder

The services intended for savings account provide incentive for account holders to save and

earn minimal interest for keeping a minimum balance, while current account allows the convenience

of having multiple transactions, withdrawals and payments through checks suitable for businesses.

Because of its fast cash turnover, current accounts rarely earn interest except for hybrid

(combination of savings and current) accounts for premium deposits.

Although savings accounts are linked with a passbook (record of deposit, withdrawal and

earnings), a popularly used savings account nowadays is a Debit card or an ATM (Automated Teller

Machine) account wherein withdrawals can be made through designated machines. This also allow

the account holder to use the card to make cashless payments in various establishments.

Another type of bank account is the Time Deposit/ Certificate of Deposit. It is type of savings

account with a fixed-term and can only be withdrawn after the lapse of the agreed period and upon

giving notice to the bank.

• Fixed higher interest than the savings account

• It has a holding period and a maturity date.

• There is a penalty for premature withdrawals

Note, that the owner of a business can avail of both savings and current account in the same bank or in different

banks. Each account is covered by the Philippine Deposit Insurance Corporation for up to P500,000.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

Deposit and Withdrawal Slips

A. Deposit Slip - is used by the depositor to put money in the bank. Deposit slips are uniquely

designed for the specific need of each bank. However, the essential information required to

make a deposit are the same.

→For Cash Deposits -The breakdown of cash is listed

→For Check Deposits -The issuing bank, address of the issuing bank, date of the check and

the amount of the check are listed.

B. Withdrawal Slip - is a written order to the bank, used by account holders to get money from

his/her bank account. The information present in the withdrawal slip should include:

There may be occasions when the depositor cannot personally withdraw the funds, in this

case, he/she may authorize a representative by indicating the name of the representative in

the space provided where the representative must sign, and present his/her identification

card.

Identifying and Preparing Bank Checks

Steps in preparing a Check

1. Write the date.

2. Write the complete name of the payee.

→If the check is tended to be encashed by a person, write the person’s full name.

→If it is intended to be encashed by any person, write “cash” instead of a name.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

→If the recipient is an organization, write the complete name of the company.

3. Write the exact amount in figure right after the peso sign.

4. Write the amount in words followed by the word only, so that nothing can be written after.

Example: Seventy thousand Seventy thousand only –

5. Sign the check on the line at the bottom right corner.

Notes in handling checks.

A. Stale Check A check becomes invalid after 180days or 6 months from the date it was

issued. Ex. A check that is issued in January 1, 2020 may only be valid for transaction until

June of the same year.

B. Post-dated check A check that is dated at a future date. Ex. A check released in January 1,

2020, was dated as March 30, 2020. This check may be transacted only as soon as March 30,

2020 arrives.

C. Crossed check DRAWER PAYEE DRAWEE 5 1 2 3 4 8 This means that the check is

restricted for payees account and will only be accepted for deposit, thus, it cannot be

encashed over the counter. This is done by writing two parallel lines on the upper left corner

of the check

D. Bouncing check A check that cannot be honored by the bank because the drawer has no

sufficient funds to cover the amount of the check. Ex. If you have P10,000 in your bank

account, you can only issue checks below that amount.

→When writing a check carefully write the details and avoid erasures.

→When receiving checks make sure that the checks issued to you are free form errors.

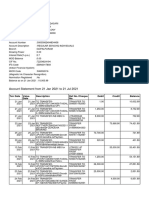

Bank Statement

The transactions involving savings account can easily be monitored as they are

reflected in the account holder’s passbook every time a transaction is made. Often, current

account holders have no passbooks and instead receive a detailed transaction history from

the bank released every month in the form of a Bank Statement that summarizes all the

activities made for the past thirty business days.

A bank statement contains relevant information including:

A. Customer’s information – identifies the name and location of the account holder. It is

important to make sure that this information is correctly stated without misspellings.

B. Bank’s information - the name, phone number and address of the bank.

C. Account information - this help identify the account number and the type of account that

is held by the account holder.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

D. Transactions: deposits made during the statement period, and withdrawals through

cheques, bill payments, ATM withdrawals, bank fees and debit purchases.

The beginning balance is carried over from the previous month’s ending balance. This

is added to the transactions that transpired within the current month, including deposits,

withdrawals, interest earned and other charges, to show how they have affected the account.

Understanding a Bank Statement

1. The Debit column represents all charges or deduction made by the bank to your account.

Examples of Debit transaction (DEBIT MEMO)

• Bank service charge - monthly fee charged by the bank for its services (Ex. cost of

printing checks writing funds to other locations and other fees)

• NSF - (Not Sufficient Fund) – Banks also use a debit memorandum when a deposited

check from a customer “bounces” because of insufficient funds. Bank refer to this as DAIF

(Drawn Against Insufficient Fund) or DAUD (Drawn Against Uncleared Deposits)

2. The Credit column represents the deposits or additions to your account that was made by

the bank. Examples of Credit transactions (CREDIT MEMO)

• Collection of cash proceeds from notes receivables.

• Interest income earned by the deposit.

3. The Balance column is the running balance after considering the effect of the transaction to

your account.

4. Transactions other than the deposits, withdraws/checks drawn come with codes beside

them. Transaction codes are normally a bank code for the transactions.

5. The ending balance of Tala Dry Goods is P185,950 after all transactions have been entered.

This balance will now be the beginning balance of the bank statement for the month of August

WRITTEN TASK:

TASK 1.

Types of Bank Accounts. Identify the bank account described by the statements.

a. Savings Account c. Time Deposit Account

b. Current Account d. ATM Account

_____1. An account where deposits can best be withdrawn at its maturity date.

_____ 2. It has a 24-hour banking facility for withdrawing money.

_____ 3. It offers higher interest upon maturity date.

_____ 4. It carries the convenience of withdrawing by checks.

_____ 5. Withdrawals and deposits are evidenced by a passbook.

TASK 2. Writing a Withdrawal Slip.

On January 1, 2017, Puppi’s Treats opened a current account with a CA# 0715-0010-36 at SunOne

Bank. In May 15, 2017 the owner of Puppi’s needed to withdraw P57,800 to pay Sunrise Miller in

cash for the flour delivered. Unfortunately, the owner cannot go to the bank and sent Leah Son (the

secretary) instead. Help fill out Puppi’s withdrawal slip.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

TASK 3. Reading Checks and Bank Statement. Read and analyze, then answer the questions that

comes after

1. Who does this check belong to? ________________________________________

2. To whom was the check written for? ___________________________________

3. What is the check number? ____________________________________________

4. How much is the check worth? _________________________________________

5. Can this check be encashed over the counter? Why? ____________________

1. What type of account does Tala have? _____________________________________

2. What was the balance in the account on June 30, 2015? ___________________

3. How much is the total amount deposited to the account in July? ___________

4. On what date was P 50 withdrawn from the account? ______________________

5. What is the reason for the decrease of P 7,000 in Tala’s balance? ___________

PERPORMANCE TASKS:

Preparing Bank Forms. Records show some transactions made by Produktong Local Merchandising for the month of

January 2019.

DATE TRANSACTION

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

Jan.1 Opened an account with SunOne Bank and was given a Current Account # 0848-0314-09

Jan.1 Made an initial deposit of P29,500

Jan.15 Issued a check to Pampanga Telephone Services to pay for telephone bills amounting to

P13,856.22.

Jan.21 Deposited cash collected from customers worth P115,000, for lanterns sold last month.

Required: →A. Help the company prepare needed bank documents to facilitate transactions.

→B. Compute for Produkto Local’s ending bank balance, if the bank added P15.75 interest and

subtracted P50.00 service charge in the company’s account.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

You might also like

- Monthly Budget Worksheet Exp 03-31-17Document1 pageMonthly Budget Worksheet Exp 03-31-17api-32901810850% (2)

- Adms 4551 PDFDocument50 pagesAdms 4551 PDFjorNo ratings yet

- Las-Business-Finance-Q1 Week 1Document16 pagesLas-Business-Finance-Q1 Week 1Kinn Jay100% (1)

- Final ModuleDocument3 pagesFinal ModuleAnnabelle MancoNo ratings yet

- Capslet: Capsulized Self - Learning Empowerment ToolkitDocument15 pagesCapslet: Capsulized Self - Learning Empowerment Toolkitun knownNo ratings yet

- Business Ethics Social Responsibility 12 q1 w1 FinalDocument16 pagesBusiness Ethics Social Responsibility 12 q1 w1 FinalVan DahuyagNo ratings yet

- Chapter 3: Preparation Financial StatementDocument20 pagesChapter 3: Preparation Financial StatementIan BucoyaNo ratings yet

- Chapter 3 Financial PlanningDocument25 pagesChapter 3 Financial PlanningChristopher Beltran CauanNo ratings yet

- (MKTG1 Lesson 1) PRINCIPLES OF MARKETINGDocument4 pages(MKTG1 Lesson 1) PRINCIPLES OF MARKETINGJeffrey Jazz BugashNo ratings yet

- LAS 1 Module 1 BESRDocument6 pagesLAS 1 Module 1 BESRAnna Jessica NallaNo ratings yet

- LM Business Finance Q3 WK 3 4 Module 6Document24 pagesLM Business Finance Q3 WK 3 4 Module 6Minimi LovelyNo ratings yet

- Fabm2 Quarter 1 Week 1 (Jenny Mae D. Otto Grade 12 Abm-Yen)Document2 pagesFabm2 Quarter 1 Week 1 (Jenny Mae D. Otto Grade 12 Abm-Yen)Jenny Mae OttoNo ratings yet

- AccountantsDocument15 pagesAccountantsJenny EvangelistaNo ratings yet

- Chapter 6Document6 pagesChapter 6Ellen Joy PenieroNo ratings yet

- Fabm2 Q2 M4 - 4 CsefDocument20 pagesFabm2 Q2 M4 - 4 CsefZeus MalicdemNo ratings yet

- Business Finance - Loan AmortizationDocument30 pagesBusiness Finance - Loan AmortizationJo HarahNo ratings yet

- Sdo Batangas: Department of EducationDocument10 pagesSdo Batangas: Department of EducationJomarie LagosNo ratings yet

- AccountingDocument26 pagesAccountingRheen Clarin0% (1)

- (FABM 2) Interactive Module Week 2Document12 pages(FABM 2) Interactive Module Week 2Krisha FernandezNo ratings yet

- Spreadsheet Exam ReviewDocument2 pagesSpreadsheet Exam Reviewapi-265873784No ratings yet

- Abm Fabm2 q2w2 Abcdwith AnswerkeyDocument10 pagesAbm Fabm2 q2w2 Abcdwith AnswerkeyElla Marie LagosNo ratings yet

- Lesson 1: The Current State of Ict Technologies: What Is It?Document6 pagesLesson 1: The Current State of Ict Technologies: What Is It?LC MoldezNo ratings yet

- Example For Chapter 2 (FABM2)Document10 pagesExample For Chapter 2 (FABM2)Althea BañaciaNo ratings yet

- Abm - 12 - Fabm2 - q1 - Clas2 - Prep of Sci - v8 - Rhea Ann NavillaDocument22 pagesAbm - 12 - Fabm2 - q1 - Clas2 - Prep of Sci - v8 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Fabm1 Completing The Accounting CycleDocument16 pagesFabm1 Completing The Accounting CycleVeniceNo ratings yet

- Accounting QuestionsDocument10 pagesAccounting QuestionsJhaycob Lance Del RosarioNo ratings yet

- Principles of Marketing WEEK 3 and 4Document6 pagesPrinciples of Marketing WEEK 3 and 4JayMoralesNo ratings yet

- Business Math Q1 M8Document12 pagesBusiness Math Q1 M8Fraeyo Barcoma DanceQ100% (1)

- Principles of Marketing GRADE 12/week 3 & 4Document6 pagesPrinciples of Marketing GRADE 12/week 3 & 4Master NistroNo ratings yet

- Business Finance: Time Value of MoneyDocument15 pagesBusiness Finance: Time Value of MoneyAngelica Paras100% (1)

- Fundamentals of Accounting and Business Management 2: Statement of Financial Position Account FormDocument6 pagesFundamentals of Accounting and Business Management 2: Statement of Financial Position Account Formmarcjann dialinoNo ratings yet

- FABM Week 8 - Bank Accounts, Transactions and DocumentsDocument26 pagesFABM Week 8 - Bank Accounts, Transactions and Documentsvmin친구No ratings yet

- 02 Teaching Guide - Business Math - Decimals - TEDocument19 pages02 Teaching Guide - Business Math - Decimals - TEAhrcelie FranciscoNo ratings yet

- SFP WK 1Document6 pagesSFP WK 1Alma Dimaranan-Acuña0% (1)

- LM Business Finance Q3 W5 Module 7Document16 pagesLM Business Finance Q3 W5 Module 7Minimi LovelyNo ratings yet

- Accounting 2 Week 1-2Document6 pagesAccounting 2 Week 1-2Ace LincolnNo ratings yet

- Marketing Chapter4Document27 pagesMarketing Chapter4Angel Bengan100% (1)

- Balance Sheet Only-Agatha TradingDocument1 pageBalance Sheet Only-Agatha TradingJasmine Acta0% (1)

- Labasbas SummativeDocument3 pagesLabasbas SummativeAlexidaniel LabasbasNo ratings yet

- Selection 3Document10 pagesSelection 3Pillos Jr., ElimarNo ratings yet

- Businessfinance12 - q3 - Mod6.2 - Basic Long Term Financial Concepts - Loan AmortizationDocument22 pagesBusinessfinance12 - q3 - Mod6.2 - Basic Long Term Financial Concepts - Loan AmortizationBernadette MendozaNo ratings yet

- Kan Taxes and Accounting ServicesDocument28 pagesKan Taxes and Accounting Servicessean.lloyd1124No ratings yet

- Fabm2 Q1mod1 Statement of Financial Position Denver Aliwana Bgo v1Document28 pagesFabm2 Q1mod1 Statement of Financial Position Denver Aliwana Bgo v1Pedana RañolaNo ratings yet

- Fabm1 Quarter1 Module 6.2 Week 6Document22 pagesFabm1 Quarter1 Module 6.2 Week 6Danny BulacsoNo ratings yet

- Lesson 1 PDFDocument30 pagesLesson 1 PDFJanna GunioNo ratings yet

- Media and Information Literacy: ST NDDocument6 pagesMedia and Information Literacy: ST NDRence PazNo ratings yet

- FAR Assignment 1Document3 pagesFAR Assignment 1The Psycho100% (1)

- Las Eapp 1stq RamosDocument70 pagesLas Eapp 1stq RamosSarah Jane VallarNo ratings yet

- ABM1 - 11-Module Jan11-29Document12 pagesABM1 - 11-Module Jan11-29Roz Ada100% (1)

- G12 Fabm2 Week2Document16 pagesG12 Fabm2 Week2Whyljyne Glasanay100% (1)

- Q1 WK 7 Las Fabm 2 Ma. Cristina R. JamonDocument8 pagesQ1 WK 7 Las Fabm 2 Ma. Cristina R. JamonFunji BuhatNo ratings yet

- ABM FABM1 AIRs LM Q3 W5 M5Document20 pagesABM FABM1 AIRs LM Q3 W5 M5Trisha Mae DuatNo ratings yet

- Module 9 - Fabm 1: Fundamentals of Accountancy, Business and Management 1Document12 pagesModule 9 - Fabm 1: Fundamentals of Accountancy, Business and Management 1Richard Rhamil Carganillo Garcia Jr.No ratings yet

- FABM 11 1stQDocument80 pagesFABM 11 1stQNiña Gloria Acuin Zaspa100% (1)

- Problem #3 SciDocument2 pagesProblem #3 SciJhazz Kyll100% (1)

- Chapter V. Types of Business According To ActivitiesDocument1 pageChapter V. Types of Business According To Activitiesmarissa casareno almueteNo ratings yet

- Lesson 7.4Document7 pagesLesson 7.4crisjay ramosNo ratings yet

- FABM2 - Q1 - Module 3 - Statement of Changes in EquityDocument23 pagesFABM2 - Q1 - Module 3 - Statement of Changes in EquityHanzel NietesNo ratings yet

- FABM 2 Worksheet 1 Q4Document4 pagesFABM 2 Worksheet 1 Q4Darwin MenesesNo ratings yet

- Business Math Module 7Document5 pagesBusiness Math Module 7CJ WATTPADNo ratings yet

- Content No. 06 Basic Documents and Transactions Related To Bank DepositsDocument3 pagesContent No. 06 Basic Documents and Transactions Related To Bank DepositsAway To PonderNo ratings yet

- ATA Contract Virtual OfficeDocument6 pagesATA Contract Virtual OfficeGuo YanmingNo ratings yet

- Topic 7 - Presentation of FS (IAS 1) - SVDocument51 pagesTopic 7 - Presentation of FS (IAS 1) - SVHONG NGUYEN THI KIMNo ratings yet

- Relationships Between Inflation, Interest Rates, and Exchange RatesDocument33 pagesRelationships Between Inflation, Interest Rates, and Exchange RatessajjadNo ratings yet

- Pas 7Document11 pagesPas 7Princess Jullyn ClaudioNo ratings yet

- INTACC 1 - PPE ReviewerDocument2 pagesINTACC 1 - PPE ReviewerRandom VidsNo ratings yet

- Money MarketDocument20 pagesMoney Marketramankaurrinky100% (1)

- Project Manager Inc. Real Estate DevelopmentDocument13 pagesProject Manager Inc. Real Estate DevelopmentinventionjournalsNo ratings yet

- BBDC Elearning PDFDocument100 pagesBBDC Elearning PDFlakshmipathihsr64246100% (1)

- MRTP ActDocument29 pagesMRTP ActawasarevinayakNo ratings yet

- Harvard Risk Management Career OpportunityDocument7 pagesHarvard Risk Management Career OpportunityLeo Kolbert100% (1)

- P DZupavm Hy TCBJG 4Document6 pagesP DZupavm Hy TCBJG 4sandeepNo ratings yet

- Public Finance and BudgetingDocument15 pagesPublic Finance and BudgetingNdichu WanjiruNo ratings yet

- Lecture Session 9 - Forecasting Exchange RatesDocument10 pagesLecture Session 9 - Forecasting Exchange Ratesapi-19974928No ratings yet

- Corporate Finance Current Papers of Final Term PDFDocument35 pagesCorporate Finance Current Papers of Final Term PDFZahid UsmanNo ratings yet

- Asset Pricing and Welfare Analysis With Bounded Rational InvestorsDocument15 pagesAsset Pricing and Welfare Analysis With Bounded Rational InvestorsZasha RanaNo ratings yet

- Corporate Governance: Accountants and AuditorsDocument22 pagesCorporate Governance: Accountants and AuditorsVam EnzioNo ratings yet

- Wassim Zhani KrogerDocument13 pagesWassim Zhani Krogerwassim zhaniNo ratings yet

- Starbucks Corporation - FinancialsDocument3 pagesStarbucks Corporation - FinancialsAtish GoolaupNo ratings yet

- 1.0 Sub: Finalisation of Tender Documents For Open/press TendersDocument378 pages1.0 Sub: Finalisation of Tender Documents For Open/press TenderssubrajuNo ratings yet

- Solved Jim and Andrea Kerslake Want To Open A Restaurant inDocument1 pageSolved Jim and Andrea Kerslake Want To Open A Restaurant inAnbu jaromiaNo ratings yet

- MARSHALL-WS2 Problem Document Chapters 5 6 7Document18 pagesMARSHALL-WS2 Problem Document Chapters 5 6 7Nik Nur Azmina AzharNo ratings yet

- Internal Control and Cash: Learning ObjectivesDocument75 pagesInternal Control and Cash: Learning ObjectivesazertyuNo ratings yet

- David WintersDocument8 pagesDavid WintersRui BárbaraNo ratings yet

- Wall Street Courier Services, Inc. PayslipDocument1 pageWall Street Courier Services, Inc. PayslipAimee TorresNo ratings yet

- Pledge Real Mortgage Chattel Mortgage AntichresisDocument12 pagesPledge Real Mortgage Chattel Mortgage AntichresisKATHERINEMARIE DIMAUNAHANNo ratings yet

- Enge 1013 Week 2Document19 pagesEnge 1013 Week 2Denise Magdangal0% (1)

- Audit of Receivables: Cebu Cpar Center, IncDocument10 pagesAudit of Receivables: Cebu Cpar Center, IncEvita Ayne TapitNo ratings yet

- Shariah Pronouncement For Quantum Metal Sdn. Bhd. Gold AdvanceDocument3 pagesShariah Pronouncement For Quantum Metal Sdn. Bhd. Gold AdvanceshahrimanNo ratings yet