Professional Documents

Culture Documents

Internal Control and Cash: Learning Objectives

Uploaded by

azertyuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal Control and Cash: Learning Objectives

Uploaded by

azertyuCopyright:

Available Formats

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

CHAPTER 7

INTERNAL CONTROL AND CASH

LEARNING OBJECTIVES

1. Explain the primary components of an internal control system, including its

control activities and limitations.

2. Apply the key control activities to cash receipts and payments.

3. Prepare a bank reconciliation.

4. Explain the reporting and management of cash.

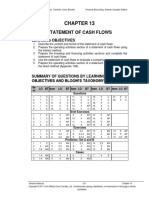

SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES

AND BLOOM’S TAXONOMY

Item LO BT Item LO BT Item LO BT Item LO BT Item LO BT

Questions

1. 1 C 6. 1 C 11. 2 C 16. 2,3 C 21. 3 K

2. 1 C 7. 1 C 12. 2 C 17. 3 C 22. 4 C

3. 1 C 8. 1 C 13. 2 C 18. 3 C 23. 4 C

4. 1 K 9. 1 C 14. 2 C 19. 3 C 24. 4 C

5. 1 C 10. 2 C 15. 2,3 C 20. 3 C 25. 4 C

Brief Exercises

1. 1 C 4. 1,2 K 7. 3 AN 10. 3 AP 13. 4 AP

2. 1 K 5. 3 C 8. 3 AN 11. 3 AP

3. 1,2 K 6. 3 AN 9. 3 AP 12. 4 C

Exercises

1. 1 C 4. 1,2 C 7. 3 AP 10. 4 AN

2. 1 C 5. 3 AP 8. 3 AP 11. 4 E

3. 1,2 C 6. 3 AP 9. 3 AP

Problems: Set A and B

1. 1,2 C 4. 1,2 AN 7. 3 AP 10. 4 C

2. 1,2 AN 5. 3 AP 8. 3 AP 11. 4 C

3. 1,2 AN 6. 3 AP 9. 4 AN

Accounting Cycle Review

1. 3,4 AP

Cases

1. 1 C 3. 1 C 5. 4 E

2. 4 C 4. 1,2 S 6. 1,2 C

Solutions Manual -1 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

Legend: The following abbreviations will appear throughout the solutions manual

file.

LO Learning objective

BT Bloom's Taxonomy

K Knowledge

C Comprehension

AP Application

AN Analysis

S Synthesis

E Evaluation

Difficulty: Level of difficulty

S Simple

M Moderate

C Complex

Time: Estimated time to prepare in minutes

AACSB Association to Advance Collegiate Schools of Business

Communication Communication

Ethics Ethics

Analytic Analytic

Tech. Technology

Diversity Diversity

Reflec. Thinking Reflective Thinking

CPA CM CPA Canada Competency

cpa-e001 Ethics Professional and Ethical Behaviour

cpa-e002 PS and DM Problem-Solving and Decision-Making

cpa-e003 Comm. Communication

cpa-e004 Self-Mgt. Self-Management

cpa-e005 Team & Lead Teamwork and Leadership

cpa-t001 Reporting Financial Reporting

cpa-t002 Stat. & Gov. Strategy and Governance

cpa-t003 Mgt. Accounting Management Accounting

cpa-t004 Audit Audit and Assurance

cpa-t005 Finance Finance

cpa-t006 Tax Taxation

Solutions Manual -2 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

ANSWERS TO QUESTIONS

1. The five primary components of a good internal control system include the

control environment, risk assessment, control activities, information and

communication, and monitoring.

A control environment encourages integrity and a high standard of ethical

behaviour. Risk assessment involves identification and management of key

business risks. Control activities are policies and procedures to help mitigate

the business risks. Information and communication ensures that the internal

control system captures and communicates the appropriate information to

internal and external users. Monitoring the internal control system for its

adequacy is a recurring process.

LO 1 BT: C Difficulty: S Time: 3 min. AACSB: None CPA: cpa-t001 CM: Reporting

2. Management is responsible for establishing a company’s control

environment. Since management is responsible for the preparation and

delivery of accurate and fair financial statements, it follows that management

should also be responsible for the internal control system that generates the

financial information communicated to the users of that information.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

3. When designing and explaining to all employees the system of internal

control of the company, management must be clear as to their expectations

concerning what actions all employees must take and the consequences of

not following management’s policies and procedures. Those individuals in

top management must set the correct tone by strictly adhering to the

company policies and procedures and providing a consistent example and

message to all employees. This conformance will demonstrate commitment

on the part of management to the importance of the internal control system

and environment for all concerned and the pledge to administer

consequences to anyone not following their lead.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -3 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

4. The five control activities that apply to most companies are assignment of

responsibility, segregation of duties, documentation, physical controls, and

review and reconciliation.

LO 1 BT: K Difficulty: S Time: 3 min. AACSB: None CPA: cpa-t001 CM: Reporting

5. Documentation procedures contribute to good internal control by providing

evidence of the occurrence of transactions and events and, when signatures

(or initials) are added, the documents establish responsibility for the

transactions. The prompt transmittal of documents to the accounting

department contributes to recording transactions in the proper period, and

the pre-numbering of documents helps to ensure that a transaction is

recorded only once.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

6. Independent review and reconciliation by internal auditors is necessary

because employees can forget to, or intentionally fail to, follow internal

controls, or they might become careless if there is no one to observe and

evaluate their performance. Segregating the physical custody of assets

from accounting record keeping is not enough to ensure that nothing has

been stolen or recorded incorrectly. A performance review still needs to be

done to ensure these controls were working effectively.

LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001, cpa-t004 CM: Reporting and Audit

7. External auditors are required to be independent of the organization they

audit. This independence provides the reassurance needed by external

users and owners of the organization about the financial condition and

performance of the business depicted in the financial statements.

Independence provides the proper environment to arrive at appropriate

accounting and disclosure conclusions, particularly when judgement is

involved. Internal auditors are not independent of the organization as they

are employees of the organization. Their role is to assist management in

their responsibility to provide a proper internal control system and

environment.

LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001, cpa-t004 CM: Reporting and Audit

Solutions Manual -4 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

8. A company’s system of internal control can only give reasonable

assurance that assets are properly safeguarded and that accounting

records are reliable because the cost of a perfect system outweighs its

benefits. For example, if a company wanted flawless accounting records,

they could double the number of accountants on staff and have the new

accountants check all of the work that was done by experienced

accountants but the benefit of this is outweighed by the costs. Absolute

assurance is too costly. Furthermore, even if cost was not a factor, human

error and collusion cannot be eliminated.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

9. Collusion occurs when two or more employees agree to circumvent

procedures or controls or get around control activities in an organization in

order to gain an advantage or to cover up theft or fraud. The internal control

activity that is most affected by collusion is the segregation of employees’

duties.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

10. Electronic funds transfers normally result in better internal control since no

cash or cheques are handled by employees, thereby limiting the possibility

of misappropriation. However, controls over EFT payments (and collections)

do need to be put in place.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

11. This is a violation of the assignment of responsibility control activity. Each

cash register should only be used by one employee and an independent

verification of the cash in each register at the end of each shift should be

compared to the total of the sales recorded in the cash register plus the float

(coins and paper currency for making change) in the register. If a

discrepancy arises, the employee responsible for that register can be held

responsible.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -5 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

12. Cash registers are visible to the customer. Thus, they prevent the sales clerk

from ringing up a lower amount for the price and pocketing the difference. In

addition, the customer receives an itemized receipt, and the cash register

tape is locked into the register for further verification. Having scanners

reduces the chance of error in entering the price of an item.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

13. This statement is true if the alternative to a cheque payment is a cash

payment. It is not always practical to make all payments by cheque, but

payment by cheque contributes to effective internal control over cash

disbursements as it provides a record of all payments. Also, having only

authorized individuals sign the cheques reduces the likelihood of payments

being made for unauthorized amounts or to unauthorized vendors.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

14. The receptionist has an opportunity to commit fraud. In the case of an

appointment where the customer pays cash, the cash can be pocketed by

the receptionist. The receptionist can then cancel the appointment, leaving

no trace in the accounting records of the revenue generated by the service.

This is a clear case of lack of segregation of duties.

LO 2 BT: C Difficulty: C Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

15. An employee who has no other responsibilities that relate to cash should

prepare the bank reconciliation. If a person had responsibility for handling

cash and also prepared the bank reconciliation, they could use the bank

reconciliation to hide fraud by falsifying the bank balance or misstating

reconciling items.

LO 2,3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

16. A bank contributes significantly to internal control over cash because it:

(1) safeguards cash on deposit, (2) minimizes the amount of cash that must

be kept on hand, and (3) provides another record of all bank transactions.

LO 2,3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -6 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

17. The lack of agreement between the cash balances may be due to either:

(1) Timing differences—caused by recording a transaction on the

company’s books in one month and the bank recording it another

month (example – outstanding cheque) or the bank recording a

transaction first which the company will record after completing the

bank reconciliation (example – a bank service charge, or an NSF

cheque).

(2) Errors—made by either the company or the bank. For example, a

cheque for $110 is recorded by the depositor at $101.

LO 3 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

18. (a) An NSF cheque is a cheque issued by a customer that was recorded

by the company when it was received and then deposited in the bank

only to discover later that the customer did not have the funds to cover

the cheque payment.

(b) An NSF cheque makes the bank balance lower than the book balance

and requires the book balance to be updated. Consequently, it is

deducted from the balance per books.

(c) An NSF cheque results in an entry in the company’s books, as a debit

to Accounts Receivable and a credit to Cash (assuming the cheque

deposited was a collection on account). The debit to Accounts

Receivable includes any additional charge that the bank may add for

their services with respect to the NSF cheque or the company may add

for late payment.

LO 3 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

19. Since the March cheque has still not cleared the bank at April 30, it must

be included in the April 30th bank reconciliation as an outstanding cheque.

LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -7 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

20. When performing a bank reconciliation, outstanding cheques are subtracted

from the bank balance to “move” that balance closer to the one recorded on

the company’s books. Since the bank balance is lower than the book

balance by the amount of this fraud, Sam will understate the amount of

outstanding cheques on the reconciliation. For example, if there was no

fraud, let’s assume that the bank balance would be $5,000 and that the

outstanding cheques were $3,000 so the book balance should be $2,000.

After the fraud, the book balance is still $2,000 but the bank balance is now

$3,300 instead of $5,000. When Sam prepares the reconciliation he has to

make sure that the $3,300 will reconcile to $2,000 so he will list the

outstanding cheques as only $1,300, thereby understating them by the

amount of cash he has stolen. The real outstanding cheques of $3,000 less

the stolen amount of $1,700, equals $1,300.

LO 3 BT: C Difficulty: C Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

21. Cash includes cash on hand and cash in bank accounts. Cash equivalents

include short-term, highly liquid held-for-trading investments less any bank

overdrafts. Together, these two amounts combine and are reported as cash

and cash equivalents in the current assets section of the statement of

financial position.

LO 3 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

22. Restricted cash is not available for general use, as it is restricted for a special

purpose. When the restricted purpose is of a long-term nature, the restricted

cash is reported as a non-current asset. If it is expected to be used within

one year of the statement of financial position date, it would be classified as

a current asset and disclosed in the financial statements. Compensating

balances are minimum cash balances which lenders specify that a borrower

must maintain in the borrower’s bank account to provide support for a loan.

A compensating balance should be reported as a non-current asset and the

details of the loan conditions should be disclosed in the notes to the financial

statements.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -8 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

23. The line of credit facility of $16 million does not represent a liability until

Brandon Corporation borrows (or draws) money under the line of credit. In

the notes to the financial statements, the terms of the line of credit and its

available limit of $16 million should be reported to demonstrate how the

business is well positioned to deal with future cash flow demands or to take

advantage of investment opportunities.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

24. The basic principles of cash management are: (1) increase the speed of

collection on receivables, (2) keep inventory levels low, (3) delay payment

of liabilities, (4) plan the timing of major expenditures, (5) invest idle cash,

and (6) prepare a cash budget. The first three principles are ways to

increase cash on hand. The last three principles focus on making sure

management understands when cash balances will be high so that

investment income can be earned from idle cash and when cash balances

will be low so that bank loans or other financing can be obtained.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

25. Having too much cash on hand may hinder a business’ performance if the

cash cannot be used effectively and therefore not give a proper return to

the shareholders. Effective uses of cash can include upgrading existing

property, plant, and equipment, expanding the business, paying down

debt, repurchasing shares, or paying dividends.

LO 4 BT: C Difficulty: C Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -9 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 7-1

Control Activity Example

Assignment of Responsibility One person operates the cash register at the exit

of the parking garage.

Segregation of duties Tickets are provided to those entering the

garage by an automated machine. This ticket is

given to the attendant on exiting the parking

garage. In this way, the attendant does not

authorize the parking and collect the cash.

Documentation The time on the ticket is entered into a machine

to determine the amount owed, which is keyed

into the cash register before the gate will open.

In this way the total time in the parking garage is

recorded.

Physical controls Cash is kept in a cash register.

Review and reconciliation If a customer is overcharged, they will complain.

Review to make sure parking gate is not being

raised prior to payment being received.

Reconcile the number of parking tickets issued

to the amount of cash received.

LO 1 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -10 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 7-2

(a) 3 All transactions should include original, detailed receipts.

(b) 4 Undeposited cash should be stored in the company safe.

(c) 5 Surprise cash counts are performed by internal audit.

(d) 1 Responsibility for related activities should be assigned to specific

employees.

(e) 2 Cheque signers are not allowed to record cash transactions

LO 1 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7-3

1. Documentation and physical controls

2. Review and reconciliation

3. Segregation of duties

4. Assignment of responsibility

5. Physical controls

LO 1,2 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7-4

1. Documentation

2. Review and reconciliation

3. Physical controls

4. Assignment of responsibility

5. Segregation of duties

6. Physical controls

LO 1,2 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -11 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 7-5

1. Bank – 7. Book +

2. NA 8. Bank –

3. Bank + 9. Book –

4. Book – 10. Book –

5. Bank + 11. Bank –

6. Book – 12. Book +

LO 3 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7-6

January deposits in transit:

Deposits in transit at beginning of month ........................................... $ 0

Add: Deposits recorded in company books this month ...................... 5,000

Less: Deposits recorded on this month’s bank statement ................. 4,000

Deposits in transit at end of month .................................................... $1,000

February deposits in transit:

Deposits in transit at beginning of month ........................................... $1,000

Add: Deposits recorded in company books this month ...................... 5,600

Less: Deposits recorded on this month’s bank statement ................. 4,600

Deposits in transit at end of month .................................................... $2,000

LO 3 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -12 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 7-7

November outstanding cheques:

Outstanding cheques at beginning of month ..................................... $ 0

Add: Cheques recorded in company books this month ..................... 27,100

Less: Cheques recorded on this month’s bank statement ................. 25,900

Outstanding cheques at end of month ............................................... $ 1,200

December outstanding cheques:

Outstanding cheques at beginning of month ..................................... $1,200

Add: Cheques recorded in company books this month ..................... 23,200

Less: Cheques recorded on this month’s bank statement ................. 19,700

Outstanding cheques at end of month ............................................... $ 4,700

LO 3 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7-8

(a) Kashechewan should correct its books for the error in recording the cheque

by reducing cash by $90 ($659 – $569).

The cheque in the amount of $415 mistakenly deducted by the bank should

be added back to the bank balance since it is the bank’s error.

(b) Accounts Payable ..................................................................... 90

Cash ........................................................................... 90

No entry is necessary for the cheque mistakenly deducted by the bank,

although the bank should be notified of this error.

LO 3 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -13 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 7-9

June 30, reconciled cash balance per bank reconciliation ......... $18,920

Add: Cash receipts in July ......................................................... 21,700

Less: Cash disbursements in July ............................................. 24,300

July 31, unreconciled cash balance ........................................... $16,320

LO 3 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7-10

Cash balance per bank $19,260

Add: Deposits in transit 1,450

20,710

Less: Outstanding cheques 3,630

Reconciled cash balance per bank $17,080

Cash balance per books (as per BE7-9) $16,320

Add: EFT collections on account 2,170

18,490

Less: Bank service charge $ 90

NSF cheque and fee ($1,270 + $50) 1,320

1,410

Reconciled cash balance per books $17,080

LO 3 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -14 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 7-11

July 31 Cash ......................................................................... 2,170

Accounts Receivable ......................................... 2,170

Bank Charges Expense ............................................ 90

Cash .................................................................. 90

Accounts Receivable ................................................ 1,320

Cash .................................................................. 1,320

LO 3 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7-12

Ouellette Ltée should report the cash in the bank, the payroll bank account, and

the cash register floats as cash. The held-for-trading investments would be

reported as cash equivalents because they mature within 90 days. Cash and cash

equivalents are recorded as a current asset. Assuming the restricted cash is not

expected to be used during the next year, the restricted cash for the plant

expansion should be reported as a non-current asset. The compensating balance

should also be reported as a non-current asset and disclosed in the notes.

LO 4 BT: C Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -15 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 7-13

(a)

Cash in savings account $22,000

Less compensating balance 5,000 $17,000

Cash on hand 1,700

Cash in chequing account 14,000

Cash reported as a current asset $32,700

(b)

Compensating balance reported as non-current asset

and disclosed in the notes. 5,000

Income tax refund, current assets: Income Tax Receivable 2,000

Postdated cheques received from customers of $1,000 are not yet valid and

represent underlying current assets of accounts receivable.

LO 4 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -16 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 7-1

(a) (b)

Control Strength or Weakness Suggested Improvements

1. No establishment of responsibility over the cash The employees should use separate cash

– weakness drawers.

Cash counts not performed independently – Cash counts should be performed by a

weakness supervisor at the end of the shift and the

totals compared to the cash register

reading.

2. By shredding the receipts there is no record Retain supporting information until all

maintained of sales for independent internal or independent verification is complete

external verification – weakness (a comparison of the receipts to the sales

recorded in the accounting records). Shred

the receipts only after the verification is

complete.

3. Cash receipts procedures appear to illustrate NA

good internal control – the segregation of duties

between receiving, recording, and depositing

cash greatly reduces the likelihood of cash

being stolen or recorded incorrectly – strength

4. Improper segregation of duties could result in Different individuals should receive cash,

the misappropriation of cash and the ability to record cash receipts, and deposit the cash.

misstate the accounting records to cover up the

misappropriation – weakness In a small business this may be impossible;

therefore, it is imperative that management

take an active role in the operations and

supervision of the business to enable

detection of any accounting irregularities.

5. The procedures in place to conduct the physical NA

inventory count appear to be reasonable –

strength

LO 1 BT: C Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -17 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-2

1. (a) It is possible to detect this type of fraud by comparing the amount of

inventory consumed during the evening with the sales that were

recorded in cash registers.

(b) This fraud can be prevented by segregating the duties of those

individuals handling the drinks to those individuals having access to

the cash register. If additional staff is not available, the floor

supervisor should keep a close eye on the bartender or inventory

could be counted once a day.

2. (a) It is possible to detect this type of fraud as the bottles of liquor sold to

establishments are not the same as those sold at a liquor store. A

special label is attached, which can be detected at the end of the shift.

As well, if the additional empty bottles are on hand at the end of the

shift, when the inventory consumed (including the bartender’s bottle)

at the end of the bartender’s shift is compared to sales, a discrepancy

will be noticed.

(b) This fraud can be prevented by segregating the duties of those

individuals handling the drinks to those individuals having access to

the cash register. If additional staff is not available, the floor

supervisor should keep a close eye on the bartender and do a bottle

count at the end of the shift.

3. (a) It is possible to detect this type of fraud if someone notices that the

number of appointments and services given by the spa does not

reconcile to the revenue deposited in the bank account for the day.

Most businesses of this nature will have someone comparing the bank

deposit slips with the appointment schedule (often the schedule will

be printed off a day or two prior to the scheduled date).

(b) This fraud can be prevented by segregating the duties of those

individuals handling the appointments, to those handing the cash, and

again to those individuals making the bank deposit. If additional staff

is not available, the owner of the spa should at least make the bank

deposit and require that the scheduling software not allow

appointment changes on the day of the appointment.

Solutions Manual -18 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-2 (CONTINUED)

4. (a) It is possible to detect this type of fraud but likely only after the first

instance of fraud. The individual in charge of approving the bank

reconciliation could insist on looking at the cheques returned by the

bank and detect the unauthorized cheque.

(b) This fraud can be prevented by segregating the duties of those

individuals handling the cheques with the individual preparing the

bank reconciliation, and by being vigilant in scrutinizing the bank

reconciliation and its supporting documents.

LO 1 BT: C Difficulty: C Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -19 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-3

(a) (b)

Recommended

Weakness Control Activity Improvement

1. Inability to fix responsibility Assignment of There should be separate

for cash to a specific clerk. responsibility cash drawers and register

pass codes for each clerk.

2. Cash is not adequately Physical controls Cash should be stored in a

protected from theft. locked safe until it is

deposited in the bank.

3. Cash is not independently Review and A cashier office supervisor

counted. reconciliation should count cash and

reconcile the amount of cash

received to the cash register

reading.

4. The accountant should not Segregation of duties An employee not otherwise

handle cash and record cash handling cash or the

transactions. accounting records should

make the deposits.

5. Some sales will not be Documentation and All sales should be entered in

recorded so that they can be physical controls the cash register to provide

independently verified later; evidence the transaction has

cash is not adequately occurred. In addition, the

protected from theft. loose change box should be

locked to keep it safe until the

funds are deposited.

LO 1,2 BT: C Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -20 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-4

(a) (b)

Recommended

Weakness Control Activity Improvement

1. Cheques are not Physical controls Cheques should be stored in a safe or

stored in a secure locked file drawer.

area.

2. The approval of and Assignment of The purchasing manager should not

payment to suppliers responsibility and approve bills for payment nor should this

is done by the wrong segregation of manager have signing authority. An

employee. duties employee, other than one involved with

purchasing, who is aware of delivery of

goods and services, should be

authorizing the payment and another

member of senior management should be

assigned cheque signing duties.

3. Blank cheques are Assignment of Establish a second signing authority with

signed. responsibility the bank.

4. Cheques are not Documentation Cheques should be prenumbered and

prenumbered. their serial continuity subsequently tested

for completeness.

5. The bank Review and A person independent of the accountant

reconciliation is not reconciliation should prepare the bank reconciliation. If

independently this is not possible, then the accountant

prepared. can prepare the reconciliation but the

owner, not the store manager (because

they can access cash) should approve it.

LO 1,2 BT: C Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -21 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-5

(a)

August 31 reconciled cash balance per bank reconciliation ............. $ 34,780

Add: (4) Cash deposits in September ............................................. 199,680

Less: (1) Cheques issued ................................................ $176,978

(2) Salaries deposited to employee accounts ......... 39,170

(3) Monthly EFT payment for rent ........................... 2,600 218,748

September, unreconciled cash balance ............................................ $ 15,712

(b) None of the above items would be included in the bank reconciliation as

they are included in the starting (unreconciled) cash balance and already

have been recorded by the company.

LO 3 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -22 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-6

Bank Books Journal

Not

Item Add Deduct Add Deduct Entry

Appli-

(Credit) (Debit) (Debit) (Credit) Required

cable

1. Deposits in transit at No

the end of April

2. Deposits in transit at

the beginning of April No

that cleared the bank

in April

3. Outstanding cheques

at the beginning of No

April that cleared the

bank in April

4. Outstanding cheques No

at the end of April

5. Bank service charges Yes

6. Deposit of $400 made

in error by the bank to No

the company’s

account

7. Cheque written for

$250 recorded in error Yes

as $520 on the books

8. NSF cheque received Yes

from customer

9. EFT collection on Yes

account not previously

recorded by company

10. Interest earned on Yes

bank account

LO 3 BT: AP Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -23 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-7

(a) Deposits in transit: July 31

Deposits in transit, June 30 .................................................. $ 2,000

Add: Deposits recorded in company books in July .............. 14,750

Less: Deposits recorded on bank statement in July............. 15,820

Deposits in transit, July 31 .................................................... $ 930

Deposits in transit: August 31

Deposits in transit, July 31 .................................................... $ 930

Add: Deposits per books in company books in August ........ 22,900

Less: Deposits recorded on bank statement in August ........ 22,500

Deposits in transit, August 31 ............................................... $ 1,330

(b) Outstanding cheques: July 31

Outstanding cheques, June 30 ............................................. $ 570

Add: Cheques recorded in company books in July ............... 18,200

Less: Cheques recorded on July bank statement ................. 17,200

Outstanding cheques, July 31............................................... $ 1,570

Outstanding cheques: August 31

Outstanding cheques, July 31............................................... $ 1,570

Add: Cheques recorded in company books in August .......... 22,700

Less: Cheques recorded on August bank statement ............ 23,520

Outstanding cheques, August 31 .......................................... $ 750

LO 3 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -24 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-8

(a)

NEOPOLITAN LTD.

Bank Reconciliation

July 31

Cash balance per bank statement $10,670

Add: Deposits in transit 1,968

12,638

Less: Outstanding cheques 2,359

Reconciled cash balance per bank $10,279

Cash balance per books $ 8,953

Add: Cheque No. 373 error ($980 – $890) 90

EFT deposits 1,276

10,319

Less: Bank service charges 40

Reconciled cash balance per books $10,279

(b) July 31 Cash ................................................................. 90

Office Supplies ............................................ 90

Cash ................................................................. 1,276

Accounts Receivable ................................... 1,276

31 Bank Charges Expense .................................... 40

Cash ............................................................ 40

LO 3 BT: AP Difficulty: M Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -25 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-9

(a) Outstanding deposit of May 31 $ 7,820

(b) Outstanding Cheques:

Cheque No. 003 – March 14 $1,675

Cheque No. 005 – March 18 360

Cheque No. 007 – March 22 2,130

Cheque No. 008 – March 23 525 $ 4,690

(c) Returned cheque – NSF S. Gillis – deduct 1,350

NSF fee – deduct 25

Bank service charges – deduct 40 $ 1,415

(d) May1, beginning balance ........................................................ $ 0

Add: Cash receipts in May ...................................................... 37,470

Less: Cash disbursements in May .......................................... 26,819

May 31, unreconciled cash balance........................................ $10,651

(e)

SHARP MANUFACTURING LTD.

Bank Reconciliation

May 31

Cash balance per bank statement $6,106

Add: Deposits in transit 7,820

13,926

Less: Outstanding cheques 4,690

Reconciled cash balance per bank $9,236

Cash balance per books $ 10,651

Less: Returned cheque – NSF S. Gillis 1,350

NSF fee 25

Bank service charges 40 1,415

Reconciled cash balance per books $9,236

LO 3 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -26 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-10

(a) Items that are considered cash but not cash equivalents would include:

1. Currency and coin $ 123

2. Royal Bank chequing account 4,325

3. Royal Bank savings account 5,000

5. Undeposited April customer cheques 750

7. Over-the-counter receipts ($1,735 + $1,230) 2,965

9. Cash register floats 500

Total cash $13,663

(b) 4. The $25,000 government treasury bill is considered a cash equivalent

because it matures within 90 days and the value at which it will mature

at is certain.

(c) Cash and cash equivalents = $13,663 [from (a)] + $25,000 = $38,663

(d) 6. Post-dated cheque—Accounts Receivable; Statement of Financial Position

8. IOU from company receptionist—Advances to Employees; Statement

of Financial Position

LO 4 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -27 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 7-11

Suggestions to improve cash management practices for Tory, Hachey, and

Wedunn:

1. Prepare a cash budget.

2. Adopt a time docketing accounting system that will track work performed on

files for individual clients.

3. Invoice clients monthly as work progresses, using the accounting records

established for docketing time.

4. To the extent practicable, ask clients for retainers before work on files

begins. Use the retainers received to apply payments for monthly invoices

sent to clients.

5. When retainers are used up, request additional retainers until the case is

completed.

6. Establish an operating line of credit with the bank for day-to-day operations.

7. Arrange a non-current loan for renovations and equipment with repayment

terms structured to coincide with expected future cash inflows.

8. Negotiate terms with suppliers that allow for delayed payments.

9. To the extent necessary, obtain additional investments from the three

lawyers to ensure payment to suppliers and employees are made on time.

LO 4 BT: E Difficulty: C Time: 25 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -28 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 7-1A

(a) Control Activities Application to Cash Receipts

Assignment of responsibility Only cashiers are authorized to sell tickets.

Only the manager and cashier can handle cash.

Only ushers authorize entrance.

Segregation of duties The duties of receiving cash and admitting

customers are assigned to the cashier and to the

doorperson. The manager maintains custody of

the cash, and the company accountant records

the cash.

Documentation Tickets are prenumbered. Cash count sheets are

prepared and initialled. Deposit slips are prepared.

Physical controls Cash is deposited in a bank vault nightly.

Prenumbered tickets are locked into the machine

by the manager and the machine is used to issue

tickets.

Review and reconciliation Cash counts are made by the manager at the end

of each cashier’s shift. Daily comparisons are

made by the head cashier and accounting

department of cash received, deposited, and

recorded.

(b) Actions by the usher and cashier to collaborate to misappropriate cash

include:

1. Instead of tearing the tickets, the usher could return the tickets to the

cashier who could resell them, and the two could divide the cash.

2. The cashier could issue a lower priced ticket than paid for and the usher

would admit the customer. The difference between the ticket issued and

the cash received could be divided between the usher and cashier.

LO 1,2 BT: C Difficulty: M Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -29 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-2A

(a) Control Weaknesses (b) Improvements

Fred or Asmaa can order goods John or Rehana should take on

(assignment of responsibility) and the responsibility for the

approve invoices for payment (up to purchase of goods.

$20,000 for Fred and up to $5,000 for

Asmaa). Fred is the sole signer of

cheques less than $20,000. Fred could

purchase items for personal use or create

and pay invoices to companies that he

owns.

Fred signs cheques and prepares the Someone who does not record

bank reconciliation. Fred could write a cash transactions or has access

cheque to himself and cover it up in the to cash and cheques should

bank reconciliation and/or through journal prepare the bank reconciliation.

entries. If this is not possible, then one of

the owners should either

prepare or at least review and

approve the reconciliation.

One person can sign cheques At least two individuals should

sign each cheque to prevent

inappropriate expenditures.

LO 1,2 BT: AN Difficulty: C Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -30 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-3A

(a) Control Weaknesses (b) Recommendations

1. No segregation of duties between receiving the cash The duties of receiving cash and

and admitting students to the lessons. The instructor admitting students should be

could admit students for free or charge extra and assigned to separate individuals.

pocket the difference or report fewer students and

pocket the extra money.

2. There is no segregation of duties in the accounting An independent person should

function. The general manager could prepare approve the invoices for payment

fictitious invoices for payment or write cheques to and prepare the bank

himself and not be detected because the general reconciliations.

manager also prepares the bank reconciliation.

3. Each salesperson is responsible for determining An independent and experienced

credit policies and they receive a commission based person should be responsible for

on sales. They could provide credit to customers setting credit limits for customers.

who should not receive credit in order to earn the Credit limit criteria should be

commission on the sale. determined by the company and

consistently applied.

4. All programmers have access to the accounting Access to the accounting records

software which could provide unauthorized changes should be restricted and protected

to the accounting records (such as wage rates). with password or biometric

restrictions.

5. Eliminating receiving reports and purchase orders Receiving reports and purchase

causes problems when invoices from suppliers are orders should be reinstated.

received. Accountants will not be able to verify if the

invoice pertains to items that have actually been

received or approved. Incorrect or fictitious invoices

may be paid or unauthorized orders made.

LO 1,2 BT: AN Difficulty: M Time: 40 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -31 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-4A

(a) Control Weaknesses (b) Improvements

The tickets were unnumbered so there is Tickets should be prenumbered so

no way of knowing if duplicates were that the students could be held more

made and sold. accountable for the tickets and a

final reconciliation could be

performed between cash receipts

and sales.

No record was kept of which students Roger should have kept a record of

took tickets to sell or how many they took which tickets were issued to each

so there is no way of knowing if tickets student for resale. (Note: This

were given away for free and how many problem could have been largely

tickets were actually sold. avoided if the tickets had been sold

at the door on the day of the dance.)

There was no control over unsold tickets. Students should have been required

This deficiency made it possible for to return the unsold tickets to Roger

students to sell tickets, keep the cash, as well as the cash. In each case,

and tell Roger that they had disposed of the students should have been

the unsold tickets. issued a receipt for the cash they

turned in and the tickets they

returned.

Did not receive a receipt from Obnoxious A receipt should have been obtained

Al. Without a receipt, there is no way to from Obnoxious Al.

verify how much Obnoxious Al was

actually paid. For example, it is possible

that he was only paid $100 and that

Roger took the rest.

Solutions Manual -32 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-4A (CONTINUED)

(a) and (b) (continued)

(a) Control Weaknesses (b) Improvements

Inadequate control over the cash box. Only Roger should have had

access to the key and disbursed

funds when necessary for

purchases.

Praveen Patel counted the funds, made Roger should have counted the

out the deposit slip, and took the funds to funds, with someone observing

the bank. Praveen could have taken him. Then he could have made out

some of the money. the deposit slip and had Praveen

deposit the funds.

Students taking money for decorations Roger should reimburse each

were not required to have a receipt and student when a receipt is provided.

had unrestricted access to the cash box to

pay for their purchases.

Sara Wu was collecting tickets and There should have been one

receiving cash for additional tickets sold. person selling tickets at the door

and a second person collecting

tickets. The tickets collected times

the price per ticket could then be

compared to the cash collected.

Net cash receipts were less than A final reconciliation should have

anticipated. been performed between cash on

hand, ticket sales, and purchase

receipts.

LO 1,2 BT: AN Difficulty: C Time: 50 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -33 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-5A

(a) BEAUPRÉ LTD.

Bank Reconciliation

July 31

Cash balance per bank statement .............................................. $21,722

Less: Outstanding cheques ($2,738 – $2,162) ............................ $ 576

Deposit incorrectly posted by bank ................................. 3,100 3,676

Reconciled cash balance per bank ............................................. $18,046

Cash balance per books ............................................................. $12,934

Add: EFT collections ................................................................ 5,230

18,164

Less: Bank service charges ....................................................... 118

Reconciled cash balance per books ........................................... $18,046

The salaries are not a reconciling item because they were recorded by both

the bank and the company.

(b) July 31 Cash ....................................................................... 5,230

Accounts Receivable ..................................... 5,230

31 Bank Charges Expense .......................................... 118

Cash .............................................................. 118

LO 3 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -34 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-6A

(a) HIRJI HOLDINGS LTD.

Bank Reconciliation

October 31

Cash balance per bank statement ........................ $16,780

Add: Outstanding deposits ................................... 6,300

................................... 23,080

Less: Outstanding cheques .................................. 2,650

Reconciled cash balance per bank ....................... $20,430

Cash balance per books ....................................... $19,070

Add: Note receivable collection ........................... $ 2,000

Interest receivable collection on note..................... 180 2,180

................................................................. 21,250

Less: NSF cheque ............................................... $ 575

Cheque #3421 error ($860 - $680) .............. 180

Bank service charges .................................. 65 820

Reconciled cash balance per books ...................... $20,430

(b) Oct. 31 Cash ................................................... 2,180

Notes Receivable ..................... 2,000

Interest Receivable ................... 180

31 Accounts Receivable .......................... 575

Cash .......................................... 575

31 Utilities Expense ................................. 180

Cash .......................................... 180

31 Bank Charges Expense ...................... 65

Cash .......................................... 65

LO 3 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -35 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-7A

(a) February 28, reconciled cash balance per bank reconciliation $17,029

Add: Cash receipts in March.................................................... 9,249

Less: Cash disbursements in March ........................................ 7,912

March 31, unreconciled cash balance ..................................... $18,366

(b) Deposits in transit: $4,012 (dated March 31).

(c) Outstanding cheques: #3473 for $4,947 (dated March 29).

(d)

YAP LTD.

Bank Reconciliation

March 31

Balance per bank statement .......................................... $17,163

Add: Deposits in transit [from (b)] .............................. $4,012

Error in recording cheque #3472

($1,823 – $1,283) ......................................... 540 4,552

21,715

Less: Outstanding cheques

No. 3473 [from (c)] ........................................... 4,947

Reconciled cash balance per bank ............................... $16,768

Balance per books [from (a)] ........................................ $18,366

Add: EFT collection—Boudreault ............................. 610

18,976

Less: Service charges ................................................ $ 89

NSF cheque and fee—Mustafa ($870 + $35) ... 905

EFT loan payment ............................................ 1,214 2,208

Reconciled cash balance per books .............................. $16,768

Solutions Manual -36 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-7A (CONTINUED)

(e) Mar. 31 Cash ....................................................... 610

Accounts Receivable ...................... 610

31 Bank Charges Expense .......................... 89

Cash ............................................... 89

31 Accounts Receivable .............................. 905

Cash ............................................... 905

31 Bank Loan Payable ................................ 1,130

Interest Expense..................................... 84

Cash ............................................... 1,214

LO 3 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -37 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-8A

(a)

October 31, reconciled cash balance per bank reconciliation ....... $23,812

Add: Cash receipts in November .................................................. 21,438

Less: Cash disbursements in November ...................................... 30,968

November 30, unreconciled cash balance .................................... $14,282

(b) HAMPTONS LIMITED

Bank Reconciliation

November 30

Balance per bank statement ......................................... $18,958

Add: Deposits in transit (Nov. 30 cash receipt) ........... 2,676

21,634

Less: Outstanding cheques

No. 2474 ........................................................ $1,008

No. 2480 ........................................................ 1,224

No. 2482 ........................................................ 1,660 3,892

Reconciled cash balance per bank ............................... $17,742

Balance per books [from (a)] ........................................ $14,282

Add: EFT collection .................................................. 5,008

19,290

Less: NSF cheque and fee ($500 + $80) ................... $580

Bank service charges ....................................... 50

Error in recording cheque No. 2476

($4,760 – $5,660) ............................................ 900

Error in Nov. 20 deposit ($5,908 – $5,890) ...... 18 1,548

Reconciled cash balance per books ............................. $17,742

Solutions Manual -38 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-8A (CONTINUED)

(c) Nov. 30 Cash ..................................................................... 5,008

Notes Receivable ........................................ 4,400

Interest Revenue .......................................... 608

30 Bank Charges Expense ........................................ 50

Cash ............................................................. 50

30 Accounts Receivable (Giasson Developments) .... 580

Cash ........................................ 580

30 Accounts Payable ................................................. 900

Cash ........................................ 900

30 Accounts Receivable............................................. 18

Cash ........................................ 18

LO 3 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -39 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-9A

(a) and (b) Cash and cash equivalents (reported in Current Assets section)

Cash:

1. Cash on hand ............................................................... $ 2,920

2. Commercial bank savings account ............................... 57,800

Commercial bank chequing account ............................ 25,000

U.S. bank account (Canadian equivalent) .................... 27,000

Total cash ............................................................................... 112,720

Cash equivalents:

5. Government of Canada Bond....................................... 50,000

Total cash and cash equivalents ............................................. $162,720

(c) 3. Restricted cash would be reported as a current or non-current asset,

depending on the timing of the equipment replacement.

4. Amounts due from employees (travel advances) of $8,700 would be

classified as other receivables in an account called Advances to

Employees.

5. Held-for-trading investments would be listed separately in the

current assets section of the statement of financial position and

would include the term deposit that matures in 120 days (to be a

cash equivalent it would have to mature in 90 days or less) and the

shares of Loblaw Companies Limited. The classification of the

shares could also be non-current depending on management’s

intentions for holding the shares.

6. NSF cheques would be included in Accounts Receivable, assuming

the company expects collection. If collection is doubtful, they might

have been provided for as part of Bad Debts Expense and related

Allowance for Doubtful Accounts or written off as uncollectible.

7. This amount would be reported as restricted cash in the non-current

assets section of the statement of financial position.

LO 4 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual -40 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-10A

(a) Cash includes cash on hand, and money in bank accounts.

Cash equivalents are short-term, highly liquid (easily sold) trading

investments that are subject to insignificant risk of changes in value less

any bank overdrafts. Examples of trading investments that would be

classified as cash equivalents include debt investments such as

government treasury bills (T-bills) that mature in 90 days or less, money

market funds, and 90-day bank term deposits.

These two categories are often combined as they are the cash either

currently available or the cash that is readily available for use by the

company.

(b) Restricted cash will most likely be reported in the non-current assets

section of the statement of financial position as it can likely not be used to

meet current liabilities.

(c) It is necessary to report restricted cash separately because the cash

cannot be used for regular operations and has been set aside for a specific

purpose. As such, it is not available for use. Separate classification assists

users of the statement of financial position in assessing the flexibility

available to the business in managing its cash and obligations to pay cash.

LO 4 BT: AN Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -41 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-11A

Accelerating collection of receivables

- currently only a minimal deposit of $50 is received from the customers.

Increase the deposit to cover cost of decorations so that this money is

received up front

- have final payment due immediately following the function

- both of these will improve cash flow as cash receipts will be accelerated

- Bev will have to check with other decorating companies to see what their

terms are in order to remain competitive

- if final payment cannot be received immediately due to competitive

pressures, Bev must monitor collections better and actively contact

customers whose payments are overdue so that cash can be collected

more promptly

Delay payment of liabilities

- Bev can apply for credit which will delay payment by 30 days, giving her

use of this cash for 30 more days

LO 4 BT: C Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -42 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-1B

Control Activities Application to Cash Payments

Assignment of responsibility Only the controller and assistant controller are

authorized to sign cheques. Invoices are approved by

the purchasing agent and goods received are

approved by the receiving department supervisor.

Segregation of duties The purchasing agent has only an approval function

and does not work in the receiving or accounting

areas. The receiving department supervisor has

access to the assets but does not order or record

purchases. Payment can only be made by the

controller or assistant controller, and the cheque

signers do not record the cash disbursement

transactions. The bank reconciliation is not done by

someone who records payments.

Documentation Cheques are prenumbered.

Following payment, the invoices are stamped “PAID”.

Physical controls Blank cheques are kept in a safe in the controller’s

office. Only the controller and assistant controller have

access to the safe. A computer is used for printing

cheques.

Review and reconciliation The cheque signer compares the cheque with the

approved invoice prior to issue. A staff accountant

reconciles the bank and book balances monthly.

LO 1,2 BT: C Difficulty: M Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -43 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-2B

(a) The weaknesses in control activities in the handling of collections include:

• Each usher could take cash from the collection plates en route to the

basement office.

• The head usher counts the cash alone so no one would ever know if

the head usher stole cash.

• The head usher’s notation of the count is left in the safe with the cash

so no one other than the financial secretary will know if the cash placed

in the safe was ever deposited.

• The financial secretary recounts the cash alone.

• The financial secretary withholds $200 per week – this is an unapproved

payment.

• The cash is vulnerable to robbery when kept in the unlocked safe

overnight.

• Cheques are made payable to “Cash” so anyone can cash them.

• The financial secretary has custody of the cash, maintains church

records, and prepares the bank reconciliation.

• No annual audits of cash receipts procedures are performed.

(b) The improvements should include the following:

(1) Head usher

• The head usher and a finance committee member should take the cash

to the office. The cash should be counted by the head usher and the

financial secretary in the presence of the finance committee member.

The amount counted should be written down on a cash count sheet and

copies kept by the secretary and finance committee member.

(2) Ushers

• The ushers should transfer their cash collections to a cash pouch (or

bag) held by the head usher. The transfer should be witnessed by a

member of the finance committee.

Solutions Manual -44 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-2B (CONTINUED)

(b) (continued)

(3) Financial Secretary

• Following the count, the financial secretary should prepare a deposit

slip in duplicate for the total cash received, and the secretary should

immediately deposit the cash in the bank’s night deposit vault. A copy

of the deposit slip should be given to a finance committee member.

• A “petty” or small cash fund should be established for the financial

secretary to be used for weekly cash expenditures and requests for

replenishment of the fund should be sent to the chairperson of the

finance committee for approval. Receipts for items paid from this fund

along with the unused cash should be kept in a locked cash box.

Periodic counts of the cash box should be performed by a finance

committee member to ensure that the cash on hand plus receipts for

cash expenditures total the limit (for example, $200) established for the

fund.

(4) Finance Committee

• A reconciliation of the cash count sheet and the bank deposit slip should

be done every time a deposit is made to ensure all cash counted was

actually deposited.

• Members should make their cheques payable to the church, and not to

cash.

• At the end of each month, a member of the finance committee should

prepare the bank reconciliation.

• Annual audits should be performed.

LO 1,2 BT: AN Difficulty: C Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual -45 Chapter 7

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 7-3B

(a) Control Weaknesses (b) Recommendations

1. Cash is collected and kept in the car. Cash should be deposited in the bank

This could result in theft. each day.

2. The person purchasing the merchandise is An independent person should verify the

the same person that verifies receipt of the receipt of goods. The purchaser should

goods and approves invoices for payment. approve bills for payment by the

Because this person is responsible for all controller.

activities related to purchasing, errors and

theft could occur.

3. All three cashiers use the same cash drawer. Each employee should use a separate

This could result in difficulty establishing cash drawer.

responsibility for errors.

4. The office manager opens the mail, deposits Mail should be opened by someone not

the cash and cheques, and posts the entry responsible for making the bank deposit.

in the accounting records. This could result The bank deposit slip should be

in the office manager depositing cheques reconciled to the accounting records (and

into his/her own account, taking the cash, perhaps a list of cheques kept by the mail

and not posting the entry for accounting room) on a daily basis to ensure all cash

purposes or posting a debit to an expense received was deposited and recorded.