Professional Documents

Culture Documents

Reporting and Analyzing Liabilities: Learning Objectives

Uploaded by

azertyuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reporting and Analyzing Liabilities: Learning Objectives

Uploaded by

azertyuCopyright:

Available Formats

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

CHAPTER 10

REPORTING AND ANALYZING LIABILITIES

LEARNING OBJECTIVES

1. Account for current liabilities.

2. Account for instalment notes payable.

3. Identify the requirements for the financial statement presentation and analysis of

liabilities.

4. Account for bonds payable (Appendix 10A).

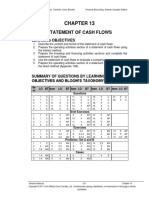

SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES

AND BLOOM’S TAXONOMY

Item LO BT Item LO BT Item LO BT Item LO BT Item LO BT

Questions

1. 1 K 5. 1 C 9. 2 C 13. 3 C 17. 4 C

2. 1 C 6. 1,2 C 10. 2 C 14. 3 C

3. 1 C 7. 2 K 11. 3 K 15. 3 C

4. 1 C 8. 2 C 12. 3 C 16. 4 K

Brief Exercises

1. 1 AP 5. 1 AN 9. 2 AP 13. 4 AP 17. 4 AP

2. 1 AP 6. 2 AN 10. 3 K 14. 4 AP

3. 1 AP 7. 2 AP 11. 3 AP 15. 4 AP

4. 1 AP 8. 2 AP 12. 3 AN 16. 4 AP

Exercises

1. 1 AN 4. 1 C 7. 2 AN 10. 3 AN 13. 4 AP

2. 1 AP 5. 2 AP 8. 3 AP 11. 4 AN 14. 4 AP

3. 1 AP 6. 2 AP 9. 3 AN 12. 4 AP

Problems: Set A and B

1. 1,3 AP 3. 2 AP 5. 2,3 AP 7. 3 AN 9. 4 AP

2. 1,3 AP 4. 2,3 AP 6. 1,3 K 8. 3 AN 10. 3,4 AP

Accounting Cycle Review

1. 1,3 AP

Cases

1. 3 AN 3. 3 S 5. 3 S 7. 2,3 AP

2. 3 AN 4. 3 S 6. 3 AN

Solutions Manual 10-1 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

Legend: The following abbreviations will appear throughout the solutions manual

file.

LO Learning objective

BT Bloom's Taxonomy

K Knowledge

C Comprehension

AP Application

AN Analysis

S Synthesis

E Evaluation

Difficulty: Level of difficulty

S Simple

M Moderate

C Complex

Time: Estimated time to prepare in minutes

AACSB Association to Advance Collegiate Schools of Business

Communication Communication

Ethics Ethics

Analytic Analytic

Tech. Technology

Diversity Diversity

Reflec. Thinking Reflective Thinking

CPA CM CPA Canada Competency

cpa-e001 Ethics Professional and Ethical Behaviour

cpa-e002 PS and DM Problem-Solving and Decision-Making

cpa-e003 Comm. Communication

cpa-e004 Self-Mgt. Self-Management

cpa-e005 Team & Lead Teamwork and Leadership

cpa-t001 Reporting Financial Reporting

cpa-t002 Stat. & Gov. Strategy and Governance

cpa-t003 Mgt. Accounting Management Accounting

cpa-t004 Audit Audit and Assurance

cpa-t005 Finance Finance

cpa-t006 Tax Taxation

Solutions Manual 10-2 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

ANSWERS TO QUESTIONS

1. Accounts payable and short-term notes payable are both forms of credit

used by a business to acquire the items or services they need to operate.

Both represent obligations of the business to repay amounts in the future

and are therefore considered to be liabilities. However, an account payable

is normally for a shorter period of time (e.g., 30, 60, 90 days) than a note

payable. A note payable usually provides for a longer period of time to

settle the amount owing.

A note payable involves a more formal arrangement than an account

payable. A note payable is an obligation in written form and will provide

documentation if legal action is required to collect the debt. As well, a note

payable often requires the payment of interest because it is generally used

when credit is to be granted for a longer period of time than for an account

payable.

LO 1 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

2. An operating line of credit, or credit facility, is used by a business to

overcome short-term cash demands or temporary cash shortfalls that

invariably happen during the operating cycle. It is not usually intended to be

a permanent type of financing and is generally used for operations. When

needed, the funds are used and then repaid as the liquidity improves and

cash becomes available from operations. Short-term bank loans are also

liabilities of the business and are often structured in such a way to deal with

short-term cash needs of the business. Short-term bank loans could be

used to finance inventory and accounts receivable. Bank loans are for

specific amounts that have structured terms for the repayment of the

principal.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 10-3 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

3. Disagree. The company only serves as a collection agent for the taxing

authority. It does not keep and report sales tax as revenue; it merely

forwards the amount paid by the customer to the government. Therefore,

until it is remitted to the government, sales tax is reported as a current

liability on the statement of financial position.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

4. Unearned revenue should be recognized when sales of gift cards are made

to customers. When a gift card is presented to pay for items or services

received by the customer, the unearned revenue is reduced and the sales

or service revenue increased. If there is a legally permissible expiration

date on the gift card, once that date is reached, any unused balances on

gift cards should be recognized as revenue and the related unearned

revenue eliminated.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

5. When determining whether an uncertain liability should be accrued as a

provision, management must first assess the level of uncertainty

concerning the outcome of a future event that will confirm either the

existence of the liability or the amount payable or both. Under IFRS, if the

outcome of a future event is probable and a reasonable estimate can be

made of the amount expected to be paid, the amount will appear as a

current liability on the statement of financial position. Probable, in this case

means “more likely than not” which is normally interpreted to mean that

there is more than a 50% probability of occurring.

The details of the reasons for the accrual will also be outlined in the

financial statement notes. If the outcome is not probable or if the amount

cannot be reasonably estimated, the details of the uncertain liability will be

disclosed in the notes to the financial statements. An uncertain liability that

is disclosed rather than recorded is known under IFRS as a contingent

liability. On the other hand, if the company is reporting under ASPE, the

probability needs to be “likely” ASPE does not use the term “provision”

Solutions Manual 10-4 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

Q 5 (continued)

If the liability is recorded it is referred to as a, contingent liability and there

is no special term for just having the contingency disclosed in a note to the

financial statements rather than recording it. This is a higher level of

probability that the standard used in IFRS.

LO 1 BT: C Difficulty: C Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

6. Current liabilities include those payments that are going to be due for

payment in one year from the financial statement date. Non-current

liabilities are to be paid beyond that period. Included in current liabilities

would be the principal portion of any loans or debt that will be paid in the

next year. Consequently, care must be taken to disaggregate balances of

such non-current loans or mortgages to ensure that the current portion of

the debt is properly classified as a current liability.

LO 1,2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

7. Long-term instalment notes are similar to short-term notes in that they both

provide written documentation of a debtor’s obligation to the lender. The

main difference between the two types of notes is that long-term instalment

notes have maturities that extend beyond one year and have principal

repayments included in the periodic payments required by the note.

For both types of notes, interest expense is calculated by multiplying the

outstanding principal balance by the interest rate. However, because a

portion of the principal balance is usually repaid periodically throughout the

term of a long-term instalment note, the outstanding principal balance will

change (decrease). In contrast, the principal balance does not change

throughout the term of a short-term note.

LO 2 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 10-5 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

8. Instalment notes usually require the borrower to pay down a portion of the

principal through fixed periodic payments relating to the principal along with

any interest that was due at that time. Each time a payment is made, a

constant amount of principal repayment is deducted from the note. The

total payment amount will decline over time as the interest expense portion

decreases due to reductions in the principal amount of the note.

An instalment note with a blended principal and interest payment is

repayable in equal periodic amounts and results in changing amounts of

interest and principal being applied to the note. The total payment remains

the same over the life of the note but the portion applied to the principal

increases over time as the interest portion decreases due to reductions in

the principal amount of the note.

LO 2 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

9. (a) A student choosing the floating rate loan will initially pay a lower

interest rate, but if the prime lending rate changes so does the interest

rate that is charged on the balance of the loan. Since the loan

repayment typically takes several years, a floating interest rate

reduces the risk to the financial institution and provides a market return

on their loan to the student. With the fixed interest rate, the initial

interest rate paid is higher, but the rate does not change over the term

of the loan.

(b) If, in the view of the student, interest rates are expected to rise, the

fixed rate of interest is the better choice. On the other hand, if interest

rates are expected to remain steady or fall, the variable rate loan would

be the better choice.

LO 2 BT: C Difficulty: C Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 10-6 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

10. Doug is incorrect because the amount of interest paid each month will

decrease as payments are made and the outstanding (remaining) principal

balance decreases. The amount of interest is calculated as a percentage

of the outstanding principal amount. Because the monthly cash payment

remains constant, over time, greater portions of the payment will be applied

to the principal thereby more rapidly reducing the balance of the mortgage.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

11. (a) Current liabilities should be presented in the statement of financial

position with each major type shown separately. They are normally

listed in order of maturity, although other listing orders are also

possible. The notes to the financial statements should indicate the

terms, including interest rates, maturity dates, and other pertinent

information such as assets pledged as collateral.

(b) The nature and the amount of each non-current liability should be

presented in the statement of financial position or in schedules

included in the accompanying notes to the statements. The notes

should also indicate the interest rates, maturity dates, conversion

privileges, and assets pledged as collateral.

LO 3 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

12. Liquidity ratios measure the short-term ability of a company to repay its

maturing obligations. Ratios such as the current ratio, receivables turnover,

and inventory turnover can be used to assess liquidity. In all three ratios, an

increase in the ratio demonstrates an improvement.

Solvency ratios measure the ability of a company to repay its total debt and

survive over a long period of time. Ratios that are commonly used to

measure solvency include debt to total assets and times interest earned

ratios. In the case of debt to total assets ratio, an increase in the ratio is

often interpreted as a deterioration in solvency, while for the times interest

earned ratio, an increase demonstrates an improvement.

LO 3 BT: C Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 10-7 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

13. An operating line of credit, or credit facility, is used by a business to

overcome short-term cash demands that invariably happen during the

operating cycle. It is not usually intended to be a permanent type of

financing and is generally used for operations. When needed, the funds are

used and then repaid as the liquidity improves and cash becomes available

from operations. This type of financing is extremely flexible because interest

charges are only incurred for the actual amount of cash borrowed for the

needed period of time when there is a cash shortfall from daily operations.

As a consequence, the business does not incur the constant charge for

interest on a long-term bank debt or mortgages and can save on interest

costs. The liquidity issues of a business can therefore be effectively dealt

with using an operating line of credit.

LO 3 BT: C Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

14. A company’s debt to total asset ratio should be measured in terms of its

ability to manage its debt. A company may have a high debt to total asset

ratio but still be able to meet its interest payments because of high income.

Alternatively, a company with a low debt to total assets may find itself in

financial difficulty if it does not have sufficient net income to cover required

interest payments. Therefore, it is important to interpret these two ratios in

conjunction with one another.

LO 3 BT: C Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

15. A company with significant operating leases has obligations that are

reported in the notes to the financial statements rather than on the

statement of financial position. This is referred to as off-balance sheet

financing. The existence of these off-balance sheet forms of financing

highlights the importance of including the information contained in the notes

in any analysis of a company’s solvency. These notes also help the financial

statement user forecast the amount of the future cash outflows that will

occur to satisfy these lease commitments.

LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 10-8 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*16. (a) A bond is a form of a long-term note payable. They are similar in that

both have fixed maturity dates and pay interest. The most significant

difference between a note payable and a bond is that bonds are often

traded on publicly whereas few notes are. In addition, bonds tend to

be issued for much larger amounts than notes. Because of these

differences, generally only large companies use bonds as a form of

debt financing.

(b) When it comes to large sums of money, a business would consider

the issue of shares or bonds for obtaining the necessary cash. Both

would be traded publicly.. Bonds are classified as debt on the

statement of financial position and common shares are classified as

equity. Bonds require principal and interest payments; common

shares do not have to be repaid. The board of directors may choose

to pay dividends to the common shareholders, however.

LO 4 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

*17. (a) When a bond is sold at a discount, the proceeds received are less

than the face value of the bond because the stated rate of interest

that the bond offers is lower than the market interest rate. This has

made the bond less attractive to investors who will increase the return

they get from the bond by paying less than its face value. The bond

discount is considered to be an additional cost of borrowing. This

additional cost of borrowing should be recorded as additional interest

expense over the term of the bond through a process called

amortization. Initially, the discount is recorded by showing the Bond

Payable at an amount lower than its face value, but over time this

account is increased (credited) so that it will be equal to its face value

by the time it matures. The offsetting debit is made to interest

expense. This is the additional interest expense incurred by the

company for selling a bond at a discount. When interest is actually

paid, this amount is added to interest expense. So interest expense

will consist of a portion that is paid and a portion relating to the

amortization of the discount thereby making it greater than the cash

interest paid.

Solutions Manual 10-9 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

Q 17 (continued)

(b) When a bond is sold at a premium, the proceeds received are greater

than the face value of the bond because the stated rate of interest

that the bond offers is higher than the market interest rate. This has

made the bond very attractive to investors who will be prepared to pay

a higher price for the bond than its face value. The bond premium is

considered to be a reduction in interest. This benefit should be

recorded through reductions to interest expense over the term of the

bond through a process called amortization. Initially, the premium is

recorded by showing the Bond Payable at an amount higher than its

face value, but over time this account is decreased (debited) so that

it will be equal to its face value by the time it matures. The offsetting

credit is made to interest expense. This lowers interest expense to

reflect the benefit of the premium. When interest is actually paid, this

amount is added to interest expense. So interest expense will consist

of a portion that is paid minus a portion relating to the amortization of

the premium thereby making it lower than the interest paid.

LO 4 BT: C Difficulty: C Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-10 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 10-1

(a)

Oct. 1 Cash ($6,000 + $780)............................................. 6,780

Sales ............................................................. 6,000

Sales Tax Payable ($6,000 × 13%) ............... 780

(b)

Oct. 1 Cash ($6,000 + $899)............................................. 6,899

Sales ............................................................. 6,000

Sales Tax Payable [($6,000 × 5%) +

($6,000 × 9.975%)] ..................................... 899

LO 1 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 10-2

(a)

Apr. 30 Property Tax Expense ($36,000 ÷ 12 × 4) ................ 12,000

Property Tax Payable ........................................ 12,000

(b)

July 15 Property Tax Payable ................................................ 12,000

Property Tax Expense ($36,000 ÷ 12 × 2.5) ............. 7,500

Prepaid Property Tax ($36,000 ÷ 12 × 5.5) ............... 16,500

Cash.................................................................. 36,000

(c)

Dec. 31 Property Tax Expense ............................................... 16,500

Prepaid Property Tax ........................................ 16,500

LO 1 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-11 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 10-3

(a) Aug. 24 Salaries Expense ................................................... 15,000

Employee Income Tax Payable ..................... 6,258

CPP Payable ................................................. 743

EI Payable ..................................................... 282

Cash ($15,000 – $6,258 – $743 – $282) ....... 7,717

(b) Aug. 24 Employee Benefits Expense ................................... 1,138

CPP Payable ................................................. 743

EI Payable ..................................................... 395

(c) Sept. 3 Employee Income Tax Payable .............................. 6,258

CPP Payable ($743 + $743) ................................... 1,486

EI Payable ($282 + $395) ....................................... 677

Cash ($6,258 + $1,486 + $677) ..................... 8,421

LO 1 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 10-4

(a) July 1 Cash ...................................................................... 60,000

Bank Loan Payable ....................................... 60,000

(b) (1) Aug. 1 Interest Expense ($60,000 × 5% × 1/12) ................ 250

Cash .............................................................. 250

(2) Aug. 31 Interest Expense .................................................... 250

Interest Payable............................................. 250

(3) Sept. 1 Interest Payable ..................................................... 250

Cash .............................................................. 250

(4) Oct. 1 Interest Expense .................................................... 250

Cash .............................................................. 250

(c) Oct. 1 Bank Loan Payable ................................................ 60,000

Cash ............................................................. 60,000

LO 1 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-12 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 10-5

IFRS ASPE

a) Record and disclose a provision Record and disclose a contingent

(likely is a higher level of probability than probable,

liability, which in turn, is more likely than not)

b) Not recorded, disclose only Not recorded, disclose only

c) Not recorded nor disclosed Not recorded nor disclosed

d) Not recorded, disclose only Not recorded, disclose only

e) Not recorded, disclose only Not recorded, disclose only

LO 1 BT: AN Difficulty: C Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 10-6

a) The advantage of the fixed interest rate option is that the rate will not

change during the 10-year period, regardless of what happens to interest

rates in the future. One could view this feature as a disadvantage in that a

decline in interest rates will not result in a reduction of interest costs. In

order to lock in the interest rate for such a long period of time, the monthly

instalment payment and the amount of interest is higher.

The disadvantage of the fixed interest rate option becomes the advantage

of the floating interest rate option. When interest rates decline, the loan

interest and the monthly instalment payment are reduced. The

disadvantage is that if interest rates increase, the opposite will occur.

b) Students generally have limited income upon graduation and so the

additional risk of possible increases in instalment payments for student

loans should be avoided. The fixed interest rate is recommended.

Alternately, choosing the floating rate makes the initial monthly payments

smaller, during the time when earnings may be at their lowest. As long as

rates do not increase too much, it could be the less expensive alternative.

LO 2 BT: AN Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 10-13 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 10-7

(a) [1] $50,000 × 7% = $3,500

[2] $13,500 – $3,500 = $10,000

[3] $12,800 – $2,800 = $10,000 or same as [2] as fixed principal reduction

[4] $40,000 – $10,000 = $30,000 (or $2,100 ÷ 7% = $30,000)

[5] $10,000 fixed principal reduction [6] + $2,100 = $12,100

[6] $10,000 fixed principal reduction

[7] $30,000 [4] – $10,000 [6] = $20,000

[8] $11,400 – $1,400 = $10,000 fixed principal reduction or $20,000 [7] – $10,000

[9] $10,700 – $700 = $10,000 fixed principal reduction

[10] $10,000 – $10,000 = $0

(b) The current portion of the note at the end of period 3 is the amount of

principal reduction in the next year (period 4), which is $10,000. This leaves

$10,000 ($20,000 less current portion of $10,000) as the non-current

portion of the debt.

LO 2 BT: AP Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-14 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 10-8

(a) [1] $50,000 × 7% = $3,500

[2] $12,195 fixed cash payment

[3] $12,195 [2] – $2,891 = $9,304 or $41,305 – $32,001

[4] $12,195 fixed cash payment

[5] $12,195 [4] – $9,955 = $2,240 or $32,001 × 7%

[6] $32,001 – $9,955 = $22,046

[7] $12,195 fixed cash payment

[8] $12,195 [7] – $1,543 = $10,652 or $22,046 [6] – $11,394 = $10,652

[9] $12,195 fixed cash payment

[10] $11,394 – $11,394 = $0

(b) The current portion of the note at the end of period 3 is the amount of

principal reduction in the next year (period 4), which is $10,652 [8]. This

leaves $11,394 ($22,046 [6] less current portion of $10,652) as the non-

current portion of the debt.

LO 2 BT: AP Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-15 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 10-9

(a) Fixed principal payment

(B) (C)

(A) Interest Reduction of (D)

Monthly Cash Expense Principal Principal

Interest Payment (D) × 4% ÷ ($300,000 ÷ Balance

Period (B) + (C) 12 months 120) (D) ̶ (C)

Nov. 30, 2017 $300,000

Dec. 31, 2017 $3,500 $1,000 $2,500 297,500

Jan. 31, 2018 3,492 992 2,500 295,000

2017

Nov. 30 Cash ......................................................................... 300,000

Mortgage Payable ............................................ 300,000

Dec. 31 Interest Expense ....................................................... 1,000

Mortgage Payable ..................................................... 2,500

Cash................................................................. 3,500

2018

Jan. 31 Interest Expense ....................................................... 992

Mortgage Payable ..................................................... 2,500

Cash................................................................. 3,492

Solutions Manual 10-16 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 10-9 (CONTINUED)

(b) Blended principal and interest payment

(B)

Interest (C) (D)

Monthly (A) Expense Reduction Principal

Interest Cash (D) × 4% ÷ of Principal Balance

Period Payment 12 mos. (A) – (B) (D) – (C)

Nov. 30, 2017 $300,000

Dec. 31, 2017 $3,037 $1,000 $2,037 297,963

Jan. 31, 2018 3,037 993 2,044 295,919

01476.73 22,000

2017

Nov. 30 Cash .................................................................. 300,000

Mortgage Payable ..................................... 300,000

Dec. 31 Interest Expense ................................................ 1,000

Mortgage Payable .............................................. 2,037

Cash.......................................................... 3,037

2018

Jan. 31 Interest Expense ................................................ 993

Mortgage Payable .............................................. 2,044

Cash.......................................................... 3,037

LO 2 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-17 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 10-10

a. Non-current liability

b. Current liability

c. Current liability

d. Neither – any unused portion is not a liability and no balance is outstanding

but line of credit limits should be disclosed in the notes to the financial

statements

e. Current liability

f. Neither – obligations are reported in the notes to the financial statements

g. Non-current liability

h. Current liability

i. Neither – current asset

j. Current liability for the $5,000 due next year. The remaining $70,000

balance is a non-current liability.

k. Neither – because the outcome has a remote probability, it is neither

recorded nor disclosed

LO 3 BT: K Difficulty: S Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 10-11

(in $ millions)

(a) Current ratio

$443

= 1.0:1

$423

(b) Debt to total $1,014

= = 64.9%

assets $1,563

$76 + $19 + $28

(c) Times interest earned = = 6.5 times

$19

LO 3 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 10-18 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 10-12

(a) Debt to total assets Improvement

Times interest earned Deterioration

(b) Although Fromage’s debt to total assets ratio improved in 2018, its times

interest earned ratio deteriorated. Fromage’s overall solvency appears to

have deteriorated because even though liabilities relative to assets has

fallen, the company is generating less income before income tax and

interest relative to its interest expense than it did in the prior year.

LO 3 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

*BRIEF EXERCISE 10-13

(a) The proceeds received from the issue of the bonds = face value of the

bonds X price.

$200,000 x 96 = $192,000

(b) Interest expense on the first semi-annual interest payment = bond carrying

amount x effective interest rate x 6/12

$192,000 x 7% x 6/12 = $6,720

(c) The semi-annual interest payment based on the coupon rate of 6% x face

value of the bonds x 6/12 = $200,000 x 6% x 6/12 = $6,000

The amortization of the bond discount is $6,720 less $6,000 or $720

The amortization of the bond discount is added to the bond carrying

amount of $192,000 making the carrying amount after the first interest

payment $192,720.

LO 4 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-19 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*BRIEF EXERCISE 10-14

(a) The proceeds received from the issue of the bonds = face value of the

bonds X price.

$100,000 x 109 = $109,000

(b) Interest expense on the first semi-annual interest payment = bond carrying

amount x effective interest rate x 6/12

$109,000 x 3% x 6/12 = $1,635

(c) The semi-annual interest payment based on the coupon rate of 5% x face

value of the bonds x 6/12 = $100,000 x 5% x 6/12 = $2,500

The amortization of the bond premium is $2,500 less $1,635 or $865

The amortization of the bond premium is deducted from the bond carrying

amount of $109,000 making the carrying amount after the first interest

payment $108,135.

LO 4 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-20 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*BRIEF EXERCISE 10-15

(a) Key inputs: Future value (FV) = $500,000

Market interest rate (i) = 2.5% (5% × 6/12)

Interest payment (PMT) = $15,000 ($500,000 × 6% × 6/12)

Number of semi-annual periods (n) = 10 (5 years × 2)

Present value of $500,000 received in 10 periods

($500,000 × 0.78120) (n = 10, i = 2.5%) $390,600

Present value of $15,000 received each of 10 periods

($500,000 × 3% × 8.75206) (n = 10, i = 2.5%) 131,281

Present value (issue price) of the bonds $521,881

(b) Key inputs: Future value (FV) = $500,000

Market interest rate (i) = 3% (6% × 6/12)

Interest payment (PMT) = $15,000 ($500,000 × 6% × 6/12)

Number of semi-annual periods (n) = 10 (5 years × 2)

Present value of $500,000 received in 10 periods

($500,000 × 0.74409) (n = 10, i = 3%) $372,045

Present value of $15,000 received each of 10 periods

($500,000 × 3% × 8.53020) (n = 10, i = 3%) 127,953

Present value (issue price) of the bonds (rounded to $500,000) $500,000

This is rounded because we know that there would be no

discount or premium because the market and stated rate are equal

(c) Key inputs: Future value (FV) = $500,000

Market interest rate (i) = 3.5% (7% × 6/12)

Interest payment (PMT) = $15,000 ($500,000 × 6% × 6/12)

Number of semi-annual periods (n) = 10 (5 years × 2)

Present value of $500,000 received in 10 periods

($500,000 × 0. 70892) (n = 10, i = 3.5%) $354,460

Present value of $15,000 received each of 10 periods

($500,000 × 3% × 8.31661) (n = 10, i = 3.5%) 124,749

Present value (issue price) of the bonds $479,209

Note to the instructor: Rounding discrepancies may arise depending on whether

present value tables, calculators, or spreadsheet programs are used to determine

the present value.

LO 4 BT: AP Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-21 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*BRIEF EXERCISE 10-16

(a) CARVEL CORP.

Bond Premium Amortization

(A) (B) (C) (D) (E)

Semi- Interest Interest Premium Unamor- Bond

annual Payment Expense Amor- tized Carrying

Interest (6% × (5% × 6/12 tization Premium Amount

Periods 6/12 = = 2.5%) (A) – (B) (D) – (C) ($500,000 + D)

3%)

Jan. 1/18 $21,881 $521,881

July 1/18 $15,000 $13,047 $1,953 19,928 519,928

Jan. 1/19 15,000 12,998 2,002 17,926 517,926

(b) CARVEL CORP.

Interest Interest Bond

Semi- Payment Expense Carrying

annual (6% × (6% × 6/12 Amount

Interest 6/12 = = 3%) ($500,000)

Periods 3%)

Jan. 1/18 $500,000

July 1/18 $15,000 $15,000 500,000

Jan. 1/19 15,000 15,000 500,000

Solutions Manual 10-22 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 10-16 (CONTINUED)

(c) CARVEL CORP.

Bond Discount Amortization

(A) (B) (E)

Semi- (C) (D)

Interest to Be Interest Bond

annual Discount Unamortized

Paid Expense Carrying

Interest Amortization Discount

(6% × 6/12 = (7% × 6/12 Amount

Periods (A) – (B) (D) – (C)

3%) = 3.5%) ($500,000 – D)

Jan. 1/18 $20,791 $479,209

July 1/18 $15,000 $16,772 $1,772 19,019 480,981

Jan. 1/19 15,000 16,834 1,834 17,185 482,815

LO 4 BT: AP Difficulty: C Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-23 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*BRIEF EXERCISE 10-17

(a)

Jan. 1 Cash ........................................................... 521,881

Bonds Payable ................................... 521,881

July 1 Interest Expense ......................................... 13,047

Bonds Payable ............................................ 1,953

Cash ................................................... 15,000

Dec. 31 Interest Expense ......................................... 12,998

Bonds Payable ............................................ 2,002

Interest Payable.................................. 15,000

(b)

Jan. 1 Cash ........................................................... 500,000

Bonds Payable ................................... 500,000

July 1 Interest Expense ......................................... 15,000

Cash ................................................... 15,000

Dec. 31 Interest Expense ......................................... 15,000

Interest Payable.................................. 15,000

(c)

Jan. 1 Cash ........................................................... 479,209

Bonds Payable ................................... 479,209

July 1 Interest Expense ......................................... 16,772

Bonds Payable ................................... 1,772

Cash ................................................... 15,000

Dec. 31 Interest Expense ......................................... 16,834

Bonds Payable ................................... 1,834

Interest Payable.................................. 15,000

LO 4 BT: AP Difficulty: C Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-24 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 10-1

Shareholders’ Net

Assets Liabilities Revenues Expenses

Equity Income

1. + + NE NE NE NE

2. NE NE NE NE NE NE

3. NE + - NE + -

4. - - NE NE NE NE

5. + + + + NE +

6. - + - NE + -

7. NE + - NE + -

8. NE + - NE + -

9. + + NE NE NE NE

10. NE - + + NE +

LO 1 BT: AN Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 10-25 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-2

(a)

Mar. 17 Cash ............................................................ 56,000

Sales .................................................... 50,000

Sales Tax Payable ($2,500 + $3,500).. 6,000

May 1 Property Tax Expense ($52,800 ÷ 12 × 4) ... 17,600

Property Tax Payable .......................... 17,600

July 1 Property Tax Expense ($52,800 ÷ 12 × 2) ... 8,800

Prepaid Property Tax ($52,800 ÷ 12 × 6) ..... 26,400

Property Tax Payable .................................. 17,600

Cash .................................................... 52,800

Aug. 15 Salaries Expense ......................................... 81,000

CPP Payable ....................................... 4,010

EI Payable ........................................... 1,523

Employee Income Tax Payable ........... 16,020

Pension Payable .................................. 6,400

Cash .................................................... 53,047

15 Employee Benefits Expense ........................ 6,142

CPP Payable ....................................... 4,010

EI Payable ........................................... 2,132

22 CPP Payable ($4,010 + $4,010) .................. 8,020

EI Payable ($1,523 + $2,132) ...................... 3,655

Employee Income Tax Payable ................... 16,020

Cash .................................................... 27,695

Oct. 1 Cash ............................................................ 100,000

Bank Loan Payable .............................. 100,000

Solutions Manual 10-26 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-3 (CONTINUED)

(b)

Dec. 31 Property Tax Expense ................................. 26,400

Prepaid Property Tax ........................... 26,400

31 Interest Expense ($100,000 × 4% × 3/12) .. 1,000

Interest Payable .................................. 1,000

(c)

April 1 Bank Loan Payable........................................... 100,000

Interest Payable ................................................ 1,000

Interest Expense ............................................... 1,000

Cash ........................................................ 102,000

LO 1 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-27 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-3

(a) Dougald Construction

(1) Oct. 1, 2017 Cash ........................................................ 250,000

Bank Loan Payable ........................... 250,000

(2) Dec. 31, 2017 Interest Expense ...................................... 3,125

Interest Payable ................................ 3,125

($250,000 × 5% × 3/12)

(3) July 1, 2018 Interest Expense ($250,000 × 5% × 6/12) 6,250

Interest Payable ................................ 6,250

Bank Loan Payable .................................. 250,000

Interest Payable ($3,125 + $6,250).......... 9,375

Cash .................................................. 259,375

(b) TD Bank

(1) Oct. 1, 2017 Notes Receivable ..................................... 250,000

Cash .................................................. 250,000

(2) Dec. 31, 2017 Interest Receivable .................................. 3,125

Interest Revenue ............................... 3,125

($250,000 × 5% × 3/12)

(3) July 1, 2018 Interest Receivable ($250,000 × 5% × 6/12) 6,250

Interest Revenue .............................. 6,250

Cash ........................................................ 259,375

Interest Receivable ($3,125 + $6,250) 9,375

Notes Receivable .............................. 250,000

LO 1 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-28 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-4

(a) Since the obligation for providing maintenance on the aircraft exists at the

time of signing the lease, the provision must be recorded at that time.

When the provision is established (by crediting that account), the offsetting

debit is recorded as an asset that is amortized over the period of the lease.

(b) The provision for aircraft maintenance is based on estimates of the costs

that are expected to be incurred when the maintenance work will be

performed in the future. Consequently, the amount estimated is subject to

change. In the case of accounts payable, the amounts owed are fixed and

determinable.

LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 10-29 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-5

(a) and (b)

(1) Fixed principal payment

(B) (C)

(A) Interest Reduction (D)

Semi-annual Cash Expense of Principal Principal

Interest Payment (D) × 5% × ($150,000 ÷ Balance

Period (B) + (C) 6/12 20) (D) – (C)

Dec. 31, 2017 $150,000

June 30, 2018 $11,250 $3,750 $7,500 142,500

Dec. 31, 2018 11,063 3,3,,53,563 7,500 135,000

01 01476.73 22,000

Issue of Mortgage

2017 Dec. 31 Cash ................................................... 150,000

Mortgage Payable ...................... 150,000

First Instalment Payment

2018 June 30 Interest Expense ($150,000 × 5% × 6/12) 3,750

Mortgage Payable ............................... 7,500

Cash ........................................... 11,250

Second Instalment Payment

Dec. 31 Interest Expense

[($150,000 – $7,500) × 5% × 6/12] 3,563

Mortgage Payable ............................... 7,500

Cash ........................................... 11,063

LO 2 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-30 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-5 (CONTINUED)

(a) and (b) (continued)

(2) Blended principal and interest payment

(B)

Interest (C) (D)

Semi-annual (A) Expense Reduction Principal

Interest Cash (D) × 5% × of Principal Balance

Period Payment 6/12 (A) – (B) (D) – (C)

Dec. 31, 2017 $150,000

June 30, 2018 $9,622 $3,750 $5,872 144,128

Dec. 31, 2018 9,622 3,603 6,019 138,109

01 0 01476.73 22,000

Issue of Mortgage

2017 Dec. 31 Cash ................................................... 150,000

Mortgage Payable ...................... 150,000

First Instalment Payment

2018 June 30 Interest Expense

($150,000 × 5% × 6/12) ................... 3,750

Mortgage Payable ............................... 5,872

Cash ........................................... 9,622

Second Instalment Payment

Dec. 31 Interest Expense [($150,000

– $5,872) × 5% × 6/12] ................... 3,603

Mortgage Payable ............................. 6,019

Cash ......................................... 9,622

(c) Interest expense for the six-month period ended June 30, 2018 is the same

amount of $3,750 whether the payment is blended or based on fixed

principal payments because for this first period, the amount of the principal

balance of the loan is the same, at the initial amount of $150,000. Once

the six-month period is completed, the principal balance of the mortgage

payable on which interest charges are applied changes by a different

amount based on whether the principal payment is fixed or is blended with

interest, based on the repayment terms of the loan. Thereafter, the interest

expense will differ under the two approaches.

LO 2 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-31 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-6

(a)

(B) (C) (D)

Annual (A) Interest Reduction Principal

Interest Cash Expense of Principal Balance

Period Payment (D) × 4% (A) – (B) (D) – (C)

July 1, 2017 $15,000

June 30, 2018 $7,953 $600 $7,353 7,647

June 30, 2019 7,953 306 7,647 0

(b) 2017

(1) July 1 Cash ........................................................... 15,000

Notes Payable .................................... 15,000

(2) Dec. 31 Interest Expense ($600 × 6/12) .................. 300

Interest Payable ................................. 300

(3) 2018

June 30 Interest Expense......................................... 300

Interest Payable ......................................... 300

Notes Payable ............................................ 7,353

Cash ................................................... 7,953

(c) On December 31, 2018 another accrual for interest expense would be made

as follows:

Dec. 31 Interest Expense ($306 × 6/12) .................. 153

Interest Payable ................................. 153

After making the above entry the company would have two current liabilities

relating to the note as follows:

Current liability

Interest payable $153

Note payable 7,647

LO 2 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-32 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-7

(a) This is a blended principal and interest payment schedule, as the cash

payment is constant at $23,097.48 each year.

(b) The interest rate is 5% ($5,000 ÷ $100,000).

(c) Interest Expense .................................................... 5,000.00

Bank Loan Payable ................................................ 18,097.48

Cash ............................................................. 23,097.48

(d) Current portion = $19,952.47

Non-current portion = $20,950.10 + $21,997.60 = $42,947.70

LO 2 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

EXERCISE 10-8

(a) Current liabilities would likely include:

Accounts payable and accrued liabilities

Current portion of long-term debt

Income taxes payable

Dividends payable

Deferred (unearned) tenant deposits

Non-current liabilities would likely include:

Long-term debt

Deferred income taxes

Finance lease obligations

Depending on when the liability will become due, some items listed above

under non-current could instead be current; an example: finance lease

obligations. As well, some items listed above as current could be non-

current or portions of the balances could be non-current; an example:

deferred (unearned) tenant deposits.

Solutions Manual 10-33 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-8 (CONTINUED)

(b)

DOLLARAMA INC.

Statement of Financial Position (partial)

February 1, 2015

(in thousands)

Current liabilities

Accounts payable and accrued liabilities ................. $ 175,739

Dividends payable ................................................... 10,480

Income taxes payable .............................................. 25,427

Deferred (unearned) tenant deposits ....................... 60,475

Current portion of long-term debt ............................. 3,846

Total current liabilities .................................. 275,967

Non-current liabilities

Long-term debt ........................................................ 560,641

Deferred income taxes ............................................. 122,184

Finance lease obligations ........................................ 1,566

Total non-current liabilities ........................... 684,391

Total liabilities ............................................................................... $960,358

LO 3 BT: AP Difficulty: S Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-34 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-9

($ in thousands)

(a) Current ratio

2018: $4,744 = 1.6:1 2017: $4,298 = 1.4:1

$3,011 $2,989

(1) Based only on the current ratio, Fruition’s liquidity is improving in

2018. There are proportionately more current assets to pay the

current liabilities.

(2) To make a proper assessment, information concerning the due dates

for the liabilities and the type of current assets that make up the

remaining assets would need to be scrutinized. For example, if current

assets consisted mainly of cash rather than inventory, we would

conclude that the company had greater liquidity. Knowing the quality

of receivables and the turnover of the inventory would be useful.

(b) Current ratio for 2018:

Before:

$4,744

= 1.6:1

$3,011

After:

$4,744 - $1,000

= 1.9:1

$3,011 - $1,000

Paying off the $1 million improves Fruition’s current ratio from 1.6:1 to

1.9:1. This is because $1 million represents a greater percentage of the

denominator than it does the numerator. The greater percentage decrease

to the denominator makes the ratio rise.

Solutions Manual 10-35 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-9 (CONTINUED)

(c) Having access to an operating line of credit means that cash is available

on a short-term basis and therefore the assessment of the company’s

short-term liquidity is better than it first appeared. Although the ability to

access cash improves the liquidity position, it does not necessarily mean

that drawing down the operating line of credit will improve the current ratio.

If the unused line of credit were to be fully drawn down, Fruition’s current

assets would increase by the addition of $4 million of cash. At the same

time, the current liabilities would increase by the addition of a $4 million

bank loan payable. As is demonstrated in the calculation below, the current

ratio would deteriorate to 1.2:1.

$4,744 + $4,000

= 1.2:1

$3,011 + $4,000

LO 3 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 10-36 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 10-10

($ in millions)

(a)

2014

$2,258

Debt to total assets = = 57.9%

$3,900

$218 + $58 + $28

Times interest earned = = 10.9 times

$28

2015

$2,559

Debt to total assets = = 58.3%

$4,388

$234 + $32 + $55

Times interest earned = = 5.8 times

$55

Open Text Corporation’s debt to total assets ratio deteriorated slightly in

2015, with the increase from 57.9% to 58.3%. The company’s times

interest earned ratio decreased significantly from 10.9 times in 2014 to 5.8

times in 2015. This reveals a deterioration in Open Text’s solvency.

(b) Having access to an operating line of credit means that cash is available

on a short-term basis. None of the total line of credit available in the amount

of $300 million has been drawn down at the date of the financial

statements. Since no liability exists at the end of the year, only a note

disclosure of the available operating line of credit will be needed.

LO 3 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-37 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*EXERCISE 10-11

(a) The Province of Manitoba bonds are trading at a discount.

(b) The Loblaw Companies Limited bonds are trading at a premium.

(c) Cash (0.999 × $100,000) ............................................ 99,900

Bonds Payable ........................................................ 99,900

Cash (1.4409 × $100,000) .......................................... 144,090

Bonds Payable ..................................................... 144,090

(d) When initially issued, both Loblaws and the Province of Manitoba would

have an understanding of the rate of interest demanded by the market, for

equivalent risk, and would consequently set the coupon rate of interest on

their bonds at a level that would be very close to the market interest rate at

that time. When the market rate and the coupon rate are the same, the

bonds are issued at par or 100% of the face value of the bond. When

issued at par, there are is no premiums or discounts to amortize.

(e) The major reason for the change in the price of the bonds since they were

issued is the market rate changes that have occurred since the date of

issuance. If the market rate (yield demanded by bondholders) increases,

the price of the bonds will fall and they will trade at a discount. If the market

rate decreases, the price of the bonds will rise and they will trade at a

premium.

LO 4 BT: AN Difficulty: C Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-38 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*EXERCISE 10-12

(a) 2018

1. Oct. 1 Cash ......................................................... 800,000

Bonds Payable ................................ 800,000

2. Dec. 31 Interest Expense ($800,000 × 5% × 3/12) 10,000

Interest Payable................................ 10,000

2019

3. Apr. 1 Interest Expense ($800,000 × 5% × 3/12) 10,000

Interest Payable ........................................ 10,000

Cash ($800,000 × 5% × 6/12) .......... 20,000

(b)

December 31, 2018

Current liabilities

Interest payable .................................................... $ 10,000

Non-current liabilities

Bonds payable, due 2028 .................................... 800,000

LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-39 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*EXERCISE 10-13

(a) [1] $25,000 + $2,768 = $27,768

[2] $74,387 – $2,768 = $71,619

[3] $27,851 – $25,000 = $2,851

[4] $928,381 + $2,851[3] = $931,232 or $1,000,000 – $68,768

[5] $25,000 same as previous semi-annual payments

[6] $27,937 – $25,000 = $2,937

[7] $68,768 – $2,937 [6] = $65,831

(b) $1,000,000 face value ($925,613 carrying amount plus unamortized

discount $74,387 at issue date)

(c) The bonds were issued at a discount as the carrying amount of $925,613

is lower than the $1,000,000 face value of the bond at the issue date.

(d) Coupon interest rate: Semi-annual payments are $25,000 × 2 divided by

the face value $1,000,000 = 5% per year

Market interest rate: Interest expense April 30 (item [1] of part (a) $27,768)

divided by carrying amount at issue date $925,613 × 2 = 3% × 2 = annual

rate of 6%

(e) The effective rate of interest of 6% is greater than the coupon rate. Interest

expense is calculated using the market rate of interest and cash interest

paid is calculated using the coupon rate. Therefore, interest expense is

greater than cash interest paid.

(f) Interest expense is calculated by multiplying the carrying value of the

bonds by the market rate of interest. With each semi-annual payment, the

carrying amount of the bonds increases, from the semi-annual amortization

of the discount, and consequently, the amount of interest expense

increases.

(g) The carrying amount of the bonds will be equal to the face value of the

bonds of $1,000,000 as the entire amount of the discount will have been

amortized.

LO 4 BT: AP Difficulty: C Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-40 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*EXERCISE 10-14

(a) Jan. 1 Cash ......................................................................... 925,617

Bonds Payable.................................................. 925,617

(b) July 1 Interest Expense ($925,617× 6% × 6/12) ................. 27,769

Bonds Payable ($27,769 – $25,000) ................ 2,769

Cash ($1,000,000 × 5% × 6/12) ........................ 25,000

(c) Dec. 31 Interest Expense [($925,617 + $2,769) × 6% × 6/12] 27,852

Bonds Payable ($27,852 – $25,000) ................ 2,852

Interest Payable ($1,000,000 × 5% × 6/12) ...... 25,000

(d) Key inputs: Future value (FV) = $1,000,000

Market interest rate (i) = 3% (6% × 6/12)

Interest payment (PMT) = $25,000 ($1,000,000 × 5% × 6/12)

Number of semi-annual periods (n) = 20 (10 years × 2)

Present value of $1,000,000 received in 20 periods

($1,000,000 × 0.55368) (n = 20, i = 3%) $553,680

Present value of $25,000 received each of 20 periods

($1,000,000 × 2.5% × 14.87747 (n = 20, i = 3%) 371,937

Present value (issue price) of the bonds $925,617

One year later, December 31, 2019, the carrying amount of the bond is

$925,617 + $2,769 + $2,852 = $931,238

Key inputs: Future value (FV) = $1,000,000

Market interest rate (i) = 3% (6% × 6/12)

Interest payment (PMT) = $25,000 ($1,000,000 × 5% × 6/12)

Number of semi-annual periods (n) = 18 (9 years × 2)

Present value of $1,000,000 received in 18 periods

($1,000,000 × 0.58739) (n = 18, i = 3%) $587,390

Present value of $25,000 received each of 18 periods

($1,000,000 × 2.5% × 13.75351 (n = 18, i = 3%) 343,838

Present value (issue price) of the bonds $931,228

Note to the instructor: Rounding discrepancies may arise depending on

whether present value tables, calculators, or a spreadsheet programs are

used to determine the present value.

LO 4 BT: AP Difficulty: C Time: 20 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 10-41 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 10-1A

(a) Mar. 2 Accounts Payable .................................... 10,000

Notes Payable .................................. 10,000

5 Cash ......................................................... 45,200

Sales ................................................ 40,000

Sales Tax Payable ($40,000 × 13%) 5,200

Cost of Goods Sold .................................. 24,000

Inventory .......................................... 24,000

9 Property Tax Expense ($18,000 × 3/12) .. 4,500

Property Tax Payable ....................... 4,500

As we are now in the third month, expense 3 months of property taxes.

12 Unearned Revenue .................................. 11,300

Service Revenue .............................. 10,000

Sales Tax Payable ($11,300 ÷ 1.13 × 13%) . 1,300

13 Sales Tax Payable ................................... 5,800

Cash................................................. 5,800

16 CPP Payable ($1,340 + $1,340) .............. 2,680

EI Payable ($468 + $655) ........................ 1,123

Income Tax Payable ................................ 5,515

Cash................................................. 9,318

27 Accounts Payable ..................................... 30,000

Cash................................................. 30,000

Solutions Manual 10-42 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 10-1A (CONTINUED)

(a) (continued)

Mar. 30 Salaries Expense ....................................... 16,000

CPP Payable ..................................... 792

EI Payable ......................................... 301

Employee Income Tax Payable......... 5,870

Cash..................................................

9,037

30 Employee Benefits Expense ..................... 1,213

CPP Payable ..................................... 792

EI Payable ......................................... 421

(b) Mar. 31 Interest Expense ....................................... 50

Interest Payable .................................... 50

($10,000 × 6% × 1/12)

(c)

MOLEGA LTD.

Statement of Financial Position (partial)

March 31, 2018

Current liabilities

Accounts payable ($42,500 – $10,000 – $30,000) ................. $ 2,500

Notes payable ......................................................................... 10,000

Unearned revenue ($15,000 – $11,300) ................................. 3,700

Employee income tax payable ($5,515 – $5,515 + $5,870) .... 5,870

Property tax payable ............................................................... 4,500

Sales tax payable ($5,800 + $5,200 + $1,300 - $5,800) ......... 6,500

CPP payable ($2,680 – $2,680 + $792 + $792) ...................... 1,584

EI payable ($1,123 – $1,123 + $301 + $421).......................... 722

Interest payable ...................................................................... 50

Total current liabilities ................................................. $35,426

LO 1,3 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-43 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 10-2A

(a) Sept. 1 Inventory ................................................. 15,000

Accounts Payable .......................... 15,000

30 Bank Loan Payable ................................. 12,000

Interest Expense ($12,000 × 3% × 3/12) 90

Cash............................................... 12,090

Oct. 1 Accounts Payable ................................... 15,000

Notes Payable ................................ 15,000

2 Buildings ................................................. 25,000

Bank Loan Payable ........................ 25,000

Nov. 1 Interest Expense ($15,000 × 4% × 1/12) 50

Cash............................................... 50

1 Interest Expense ($25,000 × 3% × 1/12) 63

Cash............................................... 63

Dec. 1 Interest Expense ($15,000 × 4% × 1/12) 50

Cash............................................... 50

1 Interest Expense ($25,000 × 3% × 1/12) 63

Cash............................................... 63

3 Vehicles .................................................. 28,000

Bank Loan Payable ........................ 20,000

Cash............................................... 8,000

31 Interest Expense ($50* + $63** + $50***) 163

Interest Payable ............................. 163

* $15,000 × 4% × 1/12 = $50

** $25,000 × 3% × 1/12 = $63

*** $20,000 × 3% × 1/12 = $50

Solutions Manual 10-44 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 10-2A (CONTINUED)

(b)

Interest Expense

Sept. 1 Bal. 0 Notes Payable

Sept. 30 90 Sept. 1 Bal. 0

Nov. 1 50 Oct.1 15,000

Nov. 1 63 Dec. 31Bal. 15,000

Dec. 1 50

Dec. 1 63

Dec. 31 163 Bank Loans Payable

Dec.31 Bal. 479 Sept. 1 Bal. 12,000

Sept. 30 12,000 Oct. 2 25,000

Interest Payable Dec. 3 20,000

Sept. 1 Bal. 0 Dec. 31Bal. 45,000

Dec. 31 163

Dec. 31Bal. 163

(c)

CLING-ON LTD.

Income Statement (partial)

Year Ended December 31, 2018

Other revenues and expenses

Interest expense ......................................................................... $479

(d)

CLING-ON LTD.

Statement of Financial Position (partial)

December 31, 2018

Current liabilities

Bank loans payable .................................................................... $45,000

Notes payable ............................................................................. 15,000

Interest payable .......................................................................... 163

LO 1,3 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 10-45 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 10-3A

(a) Table not required but source for detailed calculations

Interest

Quarterly Cash Expense Reduction of Principal

Interest Period Payment 4% × 3/12 Principal Balance

Sept. 30, 2017 $1,000,000

Dec. 31, 2017 $93,333 $10,000 $83,333 916,667

Mar. 31, 2018 92,500 9,167 83,333 833,334

June 30, 2018 91,666 8,333 83,333 750,001

2017

Sept. 30 Equipment .................................................. 1,100,000

Cash .................................................. 100,000

Bank Loan Payable ........................... 1,000,000

(b) 2017

Nov. 30 Interest Expense ($10,000 × 2/3) ............... 6,667

Interest payable................................. 6,667

(c) 2017

Dec. 31 Interest Payable ......................................... 6,667

Interest Expense ........................................ 3,333

Bank Loan Payable .................................... 83,333

Cash .................................................. 93,333

2018

Mar. 31 Interest Expense ...................................... 9,167

Bank Loan Payable .................................. 83,333

Cash ................................................ 92,500

Solutions Manual 10-46 Chapter 10

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

PROBLEM 10-3A (CONTINUED)

(d) Table not required but source for detailed calculations

Interest