Professional Documents

Culture Documents

Shariah Pronouncement For Quantum Metal Sdn. Bhd. Gold Advance

Uploaded by

shahrimanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shariah Pronouncement For Quantum Metal Sdn. Bhd. Gold Advance

Uploaded by

shahrimanCopyright:

Available Formats

Ref. No.

: ISRA (IICSB)/QM/2020 (003)

Date : 15th July 2020

بسم هللا الرمحن الرحيم

All praise is due to the Almighty; prayers and peace be upon the last Prophet

Muhammad, and be upon his relatives and all his companions

SHARIAH PRONOUNCEMENT

FOR QUANTUM METAL SDN. BHD. GOLD ADVANCE

1. Background

1.1 Quantum Metal Sdn. Bhd. (hereinafter referred to as ‘QM’) is offering a product by the name of

Gold Advance (hereinafter referred to as ‘Product’) and seeks for Shariah compliance

certification from ISRA International Consulting Sdn. Bhd. (hereinafter referred to as ‘ISRA

Consulting’)

1.2 Through the Product, QM offers Tawarruq-based financing to the holders of Gold Saving

Account (GSA) that will enable the Customer who already owns certain amount of gold in his

GSA to obtain cash up to certain percentage of the gold’s value. Upon completion of the

transaction, the gold shall be pledged to QM as security against the indebtedness created

through the financing.

1.3 Pursuant to the above, ISRA Consulting has received and reviewed the Product’s Standard

Operating Procedure (‘the SOP’) as well as the Quantum Metal System (‘the System’), which is

the System provided by QM to manage all trading and operation transactions at branches and

departments.

2. Product Structure

2.1 The structure of the Product involves several steps, as follows:

Eligibility

a) The Product is offered to the holders of GSA only.1 For those who do not have GSA, they are

required to open a GSA account before they can apply for the financing through this Product.

1GSA has been endorsed as Shariah-compliant pursuant to ‘Shariah Pronouncement for Quantum Metal Sdn. Bhd. Gold Storage Account’ issued

by ISRA Consulting on 16 March 2020. The structure and operation procedures of GSA may be found in the same Pronouncement.

ISRA International Consulting Sdn. Bhd. (200701015420)

Lorong Universiti A, 59100 Kuala Lumpur, MALAYSIA

+603.7651.4252 | iicsb@isra.my

www.israconsulting.my

Financing

a) Upon approval of the application for financing, the Customer will appoint QM as his ‘agent to

purchase’ and ‘agent to sell’ and enter into a Tawarruq arrangement with QM. Via the Tawarruq

arrangement, QM, upon acquiring a Shariah-compliant commodity from a commodity trader on

‘Purchase Price’, sells the commodity to the Customer via QM (acting as his agent to purchase)

at ‘Selling Price’ (which comprises the Purchase Price and the profit) with deferred payment.

Subsequently, the Customer sells the commodity to a commodity trader via QM (acting as his

agent to sell) at a price equivalent to the Purchase Price with spot payment.

b) Upon completion of (a), the gold, which the Customer already owns in his GSA, shall be pledged

to QM as security against the debt the Customer owes to QM from the Tawarruq arrangement.2

The example below illustrates the flow of this financing:

Assuming that:

- 1g of gold = RM100.00;

- Selling price of 1g of gold = RM100.00 + 7% (gold spread) = RM107.00 (this will be the

QM’s Published Gold Price);

- The Customer owns 10g of gold = RM1,070.00

- The approved percentage of financing = 75% of the gold value; therefore

- The Tawarruq financing = RM802.50+ 3.5%, that is the profit rate i.e. RM28.09 =

RM830.59

- QM will buy the commodity from a commodity trader at RM802.50 and sells it

to the Customer at RM830.59 on deferred payment. The Customer then sells the

commodity to a commodity trader at RM802.50 on spot payment.

- He, therefore, obtains RM802.50 cash and is indebted RM830.59 to QM. All 10g

of his gold (100%) will be pledged as security to QM.

Settlement and Termination of Facility

a) The Customer is expected to make settlement of the financing within the stipulated tenure. In

the case where the Customer makes the settlement earlier than the maturity date of the

financing, QM shall grant rebate (Ibra’) on the unearned profit.

b) QM may also decide to terminate the facility in the event where the value of the gold (that is

pledged to QM for the purpose of security over the granted financing) falls below 13% as

compared to the London Metal Exchange (LME) purchase price. The following example

illustrates the situation:

2Based on the consent given by the Customer (pledgor), QM (pledgee) may utilise the charged gold (by charging it to any third party throughout

the tenure of the Tawarruq financing, for instance), as entailed by the Deeds of Charge agreed between QM and the Customer. In this, QM is

responsible to surrender gold with the same value and quality upon redemption made by the Customer.

ISRA International Consulting Sdn. Bhd. (200701015420)

Lorong Universiti A, 59100 Kuala Lumpur, MALAYSIA

+603.7651.4252 | iicsb@isra.my

www.israconsulting.my

Assuming that:

- The financing amount = RM839.59; and

The pledged gold original value = RM1,070.00; therefore

- RM1,070.00-13%= RM930.90

In this case, the pledged gold value drops from RM1000.00 to RM930.90 (by 13%) and

QM may decide to terminate the financing facility.

- For the sake of clarity, the termination of the facility shall necessitate the

Customer to make full settlement of his outstanding debt payment. In the event

where the Customer makes the full settlement, the pledged gold will be released

from any encumbrance. Should the Customer fail to make the full settlement, QM

may liquidate the pledged gold for the purpose of recovering the outstanding

debt amount. Subsequently, the balance amount from such liquidation, if any,

shall be returned to the Customer.

3. Shariah Opinion

Pursuant to the system run-through exercise as well as the review process on the SOP conducted by

us, we hereby are satisfied and of the view that the product structure, the SOP, and the system are

compliant with the principles of Shariah.

4. Disclaimer

4.1 This Pronouncement is strictly based on ‘the System’ and ‘the SOP’ provided to us. ISRA

Consulting shall not be held responsible for any variations made on both items after the

issuance of the Pronouncement. The scope of this Pronouncement only covers the Shariah

perspective of the Product documentation and does not include the Product’s day-to-day

operations.

4.2 It is also important to note that this Pronouncement does not include the Shariah-compliant

status of QM as the operator of the Product.

4.3 This Pronouncement is valid for ONE (1) renewable year from the signing date that it bears.

Nonetheless, any variation or additional features added in the reviewed documents within this

one year will necessitate supplementary endorsement by ISRA Consulting.

Thank you.

Sincerely yours,

Prof. Dr. Ashraf Md. Hashim

Chief Executive Officer

ISRA International Consulting Sdn. Bhd. (200701015420)

Lorong Universiti A, 59100 Kuala Lumpur, MALAYSIA

+603.7651.4252 | iicsb@isra.my

www.israconsulting.my

You might also like

- Quantum Metal FatwaDocument1 pageQuantum Metal FatwaTekashyukNo ratings yet

- 2020 TOPIC 3 - Authority of Advocates Solicitors 11 MarchDocument24 pages2020 TOPIC 3 - Authority of Advocates Solicitors 11 Marchمحمد خيرالدينNo ratings yet

- ZAHAREN HJ ZAKARIA v. REDMAX SDN BHD & OTHERDocument21 pagesZAHAREN HJ ZAKARIA v. REDMAX SDN BHD & OTHERJJNo ratings yet

- Kay Hian & Co (Pte) V Jon Phua Ooi Yong & orDocument10 pagesKay Hian & Co (Pte) V Jon Phua Ooi Yong & oranon_353612519No ratings yet

- MENAKA V LUM KUM CHUM - (1977) 1 MLJ 91 PDFDocument8 pagesMENAKA V LUM KUM CHUM - (1977) 1 MLJ 91 PDFzatikhairuddinNo ratings yet

- Tan Sri Khoo Teck Puat V Plenitude Holdings SDN BHDDocument19 pagesTan Sri Khoo Teck Puat V Plenitude Holdings SDN BHDAisyah RazakNo ratings yet

- Module Chapter 5 CSR 2021Document14 pagesModule Chapter 5 CSR 2021Kyle DTNo ratings yet

- Financial AssistanceDocument6 pagesFinancial AssistanceNajmi ArifNo ratings yet

- Land Law Case StudyDocument4 pagesLand Law Case StudyMorgan Phrasaddha Naidu PuspakaranNo ratings yet

- Kim Lin CaseDocument18 pagesKim Lin CaseJai Juet Phang100% (3)

- InvescorDocument30 pagesInvescorChin Kuen YeiNo ratings yet

- Overview of Financial Services Act 2013Document11 pagesOverview of Financial Services Act 2013FatehahNo ratings yet

- Law CasesDocument12 pagesLaw CasesTeohYeeThuanNo ratings yet

- Lecture 9 Hire Purchase LawDocument31 pagesLecture 9 Hire Purchase LawSyarah Syazwan SaturyNo ratings yet

- HALIJAH V MORAD & ORS - (1972) 2 MLJ 166Document4 pagesHALIJAH V MORAD & ORS - (1972) 2 MLJ 166NuraniNo ratings yet

- Infographic EthicDocument5 pagesInfographic EthicFitriah RabihahNo ratings yet

- LAW299 Part A & BDocument49 pagesLAW299 Part A & BIyad Ameen100% (1)

- Mohd. Latiff Bin Shah Mohd. & 2 Ors. v. Tengku Abdullah Ibni Sultan Abu Bakar & 8 Ors. & 2 Other CasesDocument25 pagesMohd. Latiff Bin Shah Mohd. & 2 Ors. v. Tengku Abdullah Ibni Sultan Abu Bakar & 8 Ors. & 2 Other CasesWai Chong KhuanNo ratings yet

- Kevin Peter Schmider V Nadja Geb Schmider Poignee & AnorDocument29 pagesKevin Peter Schmider V Nadja Geb Schmider Poignee & AnorJoanne LauNo ratings yet

- How Does The Court System of Malaysia WorkDocument5 pagesHow Does The Court System of Malaysia WorkADIL25No ratings yet

- RHB Bank Berhad V Malaysia Pacific Corporation Berhad and Another AppealDocument10 pagesRHB Bank Berhad V Malaysia Pacific Corporation Berhad and Another AppealartanebehenxolNo ratings yet

- Legal Issues Relating To Jual Janji - MalaysiaDocument44 pagesLegal Issues Relating To Jual Janji - MalaysiaAinul Jaria MaidinNo ratings yet

- Guidelines Islamic Negotiable InstrumentsDocument27 pagesGuidelines Islamic Negotiable Instrumentskarim meddebNo ratings yet

- Case-Section 3 (1) Partnership Act 1961 Malayan Law Journal UnreportedDocument16 pagesCase-Section 3 (1) Partnership Act 1961 Malayan Law Journal UnreportedAZLINANo ratings yet

- Part 1 Sale of GoodsDocument24 pagesPart 1 Sale of GoodsChen HongNo ratings yet

- Petrodar Operating Co LTD V Nam Fatt Corp BDocument19 pagesPetrodar Operating Co LTD V Nam Fatt Corp Bf.dnNo ratings yet

- Perwira Habib Bank Malaysia BHD V Viswanathan SoDocument9 pagesPerwira Habib Bank Malaysia BHD V Viswanathan SoAmelda Mohd Yusof100% (1)

- Fin 358 - June 2019Document2 pagesFin 358 - June 2019aisyah syazwaniNo ratings yet

- Topic2 - 1 Sole Proprietorship and Partnership 2017Document84 pagesTopic2 - 1 Sole Proprietorship and Partnership 2017顺兴No ratings yet

- Kasus Pasar Modal Di MalaysiaDocument12 pagesKasus Pasar Modal Di MalaysiaArsip KerjaNo ratings yet

- East Union Malaysia V Gov of Johor & MalaysiaDocument2 pagesEast Union Malaysia V Gov of Johor & MalaysiaMiauGoddessNo ratings yet

- Sukhinderjit Singh Muker V Arumugam Deva RajDocument15 pagesSukhinderjit Singh Muker V Arumugam Deva RajNik Nur FatehahNo ratings yet

- Tutorial 5 Company LawDocument7 pagesTutorial 5 Company LawWei Weng ChanNo ratings yet

- Assignment Far 110 UitmDocument56 pagesAssignment Far 110 UitmFarah HusnaNo ratings yet

- Name: Soon Woan ChyiDocument8 pagesName: Soon Woan ChyiSoon Woan ChyiNo ratings yet

- LAWS2301 Take Home AssignmentDocument6 pagesLAWS2301 Take Home AssignmenthenryshaoNo ratings yet

- Contract Ii Case Review (Per & CC)Document37 pagesContract Ii Case Review (Per & CC)khairiah tsamNo ratings yet

- Lec 10 TakeooverDocument12 pagesLec 10 TakeooverTee You WenNo ratings yet

- Lee Gee Pheng v. RHB Bank BHDDocument3 pagesLee Gee Pheng v. RHB Bank BHDNur AliahNo ratings yet

- Interpleader Proceedings Order 17 ROC 2012Document2 pagesInterpleader Proceedings Order 17 ROC 2012Raider50% (2)

- Application of Ju Alah in Multi-Level Marketing (MLM)Document11 pagesApplication of Ju Alah in Multi-Level Marketing (MLM)AimifdzirulNo ratings yet

- Soga Presentation Group 4Document11 pagesSoga Presentation Group 4vivek1119No ratings yet

- Contract Ii Case Review (Condition)Document9 pagesContract Ii Case Review (Condition)khairiah tsamNo ratings yet

- LiabilityDocument4 pagesLiabilityNor Karmila Roslan0% (1)

- LIPUTAN SIMFONI SDN BHD v. PEMBANGUNANDocument41 pagesLIPUTAN SIMFONI SDN BHD v. PEMBANGUNANEaster0% (1)

- Nature of A PartnershipDocument27 pagesNature of A PartnershipschafieqahNo ratings yet

- Q&A PartnershipDocument24 pagesQ&A PartnershipLoveLyzaNo ratings yet

- Case Analysis of Syed Jaafar Vs Maju MeharDocument4 pagesCase Analysis of Syed Jaafar Vs Maju MeharNur Syahira50% (2)

- The Sales ContractDocument24 pagesThe Sales ContractasrialiNo ratings yet

- Chap 12 MecibDocument3 pagesChap 12 MecibHe's Rasta She's Purple50% (2)

- Theories of Muamalat ContractsDocument5 pagesTheories of Muamalat Contractssyifa aina0% (1)

- AuditorsDocument34 pagesAuditorsLim Yew TongNo ratings yet

- Project and Group ProfileDocument48 pagesProject and Group ProfileNoureen MushtaqNo ratings yet

- Protecting Intellectual PropertyDocument4 pagesProtecting Intellectual PropertyZami SaidNo ratings yet

- CLBG ChecklistDocument23 pagesCLBG ChecklistDaryl ChongNo ratings yet

- Case Kopeks Holdings SDN BHD Vs Bank Islam Malaysia Berhad. S-02-1480-2009Document14 pagesCase Kopeks Holdings SDN BHD Vs Bank Islam Malaysia Berhad. S-02-1480-2009Cindy Iqbalini Fortuna100% (1)

- Separate Legal EntityDocument18 pagesSeparate Legal EntityJagdesh SinghNo ratings yet

- PDS - Ar Rahnu Facility-IDocument4 pagesPDS - Ar Rahnu Facility-IAen FarahNo ratings yet

- F97.1 MOHD FAHIM - Offer 31 Dec 2023Document1 pageF97.1 MOHD FAHIM - Offer 31 Dec 2023Fahim AkhtarNo ratings yet

- Undertaking To Pay Facilitator Service Fee (Commission)Document2 pagesUndertaking To Pay Facilitator Service Fee (Commission)shanizam ariffinNo ratings yet

- Ojsadmin, AJISS 14-2-5 Book ReviewsDocument4 pagesOjsadmin, AJISS 14-2-5 Book ReviewsshahrimanNo ratings yet

- Project ManagerDocument1 pageProject ManagershahrimanNo ratings yet

- Buletin QSlink 2020Document60 pagesBuletin QSlink 2020shahrimanNo ratings yet

- Project ManagerDocument1 pageProject ManagershahrimanNo ratings yet

- Long Intl Construction Contract Notice LettersDocument21 pagesLong Intl Construction Contract Notice Lettersjose miguel lagumbayNo ratings yet

- Sigmacover 850 Sigmashield 880 HSDocument6 pagesSigmacover 850 Sigmashield 880 HSshahrimanNo ratings yet

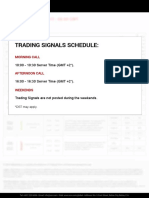

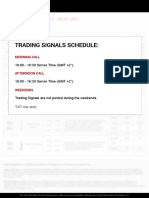

- Trading-Signals Price PDFDocument1 pageTrading-Signals Price PDFshahrimanNo ratings yet

- Qsprincipalsdialogue PDFDocument31 pagesQsprincipalsdialogue PDFshahrimanNo ratings yet

- Trading Signals PDFDocument1 pageTrading Signals PDFshahrimanNo ratings yet

- Guidelines For Hard Material Rock Excavation Nota Teknik Jalan 24 05 PDFDocument16 pagesGuidelines For Hard Material Rock Excavation Nota Teknik Jalan 24 05 PDFshahrimanNo ratings yet

- SMM2Document139 pagesSMM2Shazwan Taib0% (1)

- COC 203A (20102007) Amended 16 3 2012Document43 pagesCOC 203A (20102007) Amended 16 3 2012Abd Aziz MohamedNo ratings yet

- COC 203A (20102007) Amended 16 3 2012Document43 pagesCOC 203A (20102007) Amended 16 3 2012Abd Aziz MohamedNo ratings yet

- Part - 2Document46 pagesPart - 2Seid AragawNo ratings yet

- Study 101Document2 pagesStudy 101ROBIN BACCAYNo ratings yet

- Chapter 1 TestbankDocument7 pagesChapter 1 TestbankpraktekalNo ratings yet

- Classless SocietyDocument5 pagesClassless SocietyA Butterfly ProductionNo ratings yet

- Appadurai The Thing ItselfDocument8 pagesAppadurai The Thing ItselfMikolaj KostyrkoNo ratings yet

- Demand AnalysisDocument31 pagesDemand AnalysisMuteeb RainaNo ratings yet

- SET-A-1 (5 Files Merged)Document15 pagesSET-A-1 (5 Files Merged)David MakangeNo ratings yet

- Analyzing "At The Auction of The Ruby Slippers"Document10 pagesAnalyzing "At The Auction of The Ruby Slippers"simone_mottaNo ratings yet

- Extension Unit 6Document123 pagesExtension Unit 6Mann PandyaNo ratings yet

- Sieber and MarxDocument278 pagesSieber and MarxritopoultNo ratings yet

- B2B Marketing: by Professor Preeti KaushikDocument18 pagesB2B Marketing: by Professor Preeti KaushiksanmukhNo ratings yet

- Class Exercise - Five Forces ModelDocument9 pagesClass Exercise - Five Forces Modelchungjerry94No ratings yet

- MUH. AFDAL - E061211105 - International RelationsDocument6 pagesMUH. AFDAL - E061211105 - International RelationsMuhammad AfdalNo ratings yet

- GTI - Rice AnalysisDocument7 pagesGTI - Rice AnalysisGlenn Jalbuena100% (1)

- 6 (1) .Principle of Reciprocal DemandDocument39 pages6 (1) .Principle of Reciprocal Demand05550100% (1)

- The Vampire, The Wandering Jew, and A False Critique of CapitalismDocument11 pagesThe Vampire, The Wandering Jew, and A False Critique of CapitalismVictor SherazeeNo ratings yet

- NZF Zakat Guide Business Owners R4Document11 pagesNZF Zakat Guide Business Owners R4Asif MullaNo ratings yet

- Adam Smith Abso Theory - PDF Swati AgarwalDocument3 pagesAdam Smith Abso Theory - PDF Swati AgarwalSagarNo ratings yet

- BBA - Study On Gold As A Safer Investment CommodityDocument94 pagesBBA - Study On Gold As A Safer Investment CommoditySANJU GNo ratings yet

- How Society Works NotesDocument116 pagesHow Society Works NotesPeter Georges67% (3)

- NumericalReasoningTest13 SolutionsDocument12 pagesNumericalReasoningTest13 SolutionsSnow SnowNo ratings yet

- (Consumption and Public Life) Daniel Cook - Lived Experiences of Public Consumption - Studies of Culture and Value in International Market Places (2008, Palgrave Macmillan)Document268 pages(Consumption and Public Life) Daniel Cook - Lived Experiences of Public Consumption - Studies of Culture and Value in International Market Places (2008, Palgrave Macmillan)Marcello SenaNo ratings yet

- Chapter 3 CUSTOMER PERCEPTION DRIVEN PRICINGDocument15 pagesChapter 3 CUSTOMER PERCEPTION DRIVEN PRICINGjoyce serraNo ratings yet

- Managerial EconomicsDocument26 pagesManagerial EconomicsMr BhanushaliNo ratings yet

- Navjot (Internship Proposal Report)Document9 pagesNavjot (Internship Proposal Report)Navjot singhNo ratings yet

- Fundamental & Technical Analysis of Selected Commodities (Gold & Silver)Document4 pagesFundamental & Technical Analysis of Selected Commodities (Gold & Silver)Raghava PrusomulaNo ratings yet

- Energy AccountingDocument11 pagesEnergy AccountingshubhamNo ratings yet

- Jane Hutton Reciprocal Landscapes - Stories of Material Movements Routledge - 2019Document344 pagesJane Hutton Reciprocal Landscapes - Stories of Material Movements Routledge - 2019Guilherme Tedesco100% (1)

- CTRM Briefing Note - EKA - Digital CM Platform Applications (Apps)Document3 pagesCTRM Briefing Note - EKA - Digital CM Platform Applications (Apps)CTRM CenterNo ratings yet

- CISI - Financial Products, Markets & Services: Topic - Derivatives (6.5) Derivatives and Commodity MarketsDocument9 pagesCISI - Financial Products, Markets & Services: Topic - Derivatives (6.5) Derivatives and Commodity MarketsSaurabh SharmaNo ratings yet