Professional Documents

Culture Documents

Eact Tariff Policy1 046A01 PDF

Uploaded by

Alok KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eact Tariff Policy1 046A01 PDF

Uploaded by

Alok KumarCopyright:

Available Formats

Comments by Prayas (Energy Group) on

st

1 Draft of Discussion Paper on Tariff Policy by Ministry of Power

1. Context of Tariff Policy

Before going into the contents or process of Draft Tariff Policy, we wish to outline

the context of this proposed policy. The overarching framework of E-Act 2003 defines

this context. In practice, the E-Act is going to lead to segmentation of the society in four

parts. These are: (A) the large customers, which would be allowed to access new (low

cost) generation or put up their own captive plants. These customers would see a major

reduction in their tariff and largely be allowed not to shoulder the historical costs

(stranded costs), (B) urban small customers. Private players may be interested in taking

up Distribution (DisCom) for these areas. These private players may see these urban

customers as captive customers not just for distribution but also for their proposed

generation plants. Hence, these customers would remain under regulated monopoly for

quite some time to come. (C) The Rural small customers. These customers would also be

under regulated monopoly, which is likely to be under public ownership. These

customers are the largest in number and would be taking the largest brunt of tariff

increase. (D) The last section is the rural un-connected population, or prospective

customers. The actions for these customers under other policies are yet to be defined.

There is urgency to clearly spell out what will be done for these customers.

It needs to be recognized that the proposed Tariff Policy is largely for the captive

customers, under regulated monopoly (i.e. segment B and C). And these constitute

majority of customers getting electricity today.

2. Guiding Principles

From this perspective, it should become clear that the Tariff Policy should aim at

ensuring that investments are made to serve these captive customers, while protecting

their interests (i.e. investments are made in cost effective manner). Hence, regulatory

certainty (although important) should be a sub-part of this larger “public policy”

objective. In fact, the policy should address a number of other important issues too.

- Policy should lay a clear road map for future (not necessarily by specifying all

details). A good example of this is the section 5.8 (on co-generation and

renewable sources).

- Bring clarity, minimize confusion and contradictions. Reduce possibilities of

endless legal battles between utilities (which are substantial under the new Act).

Examples of areas that lack clarity in the E- Act; and have very large

implications on tariff and public interest include, issues related to second

licensee, Surcharge(s), and definition of Captive generation. All of these have

very significant implications for the sector as a whole.

Prayas (Energy Group) Comments on 1st Draft of Tariff Policy by MoP 1

- The policy has to make sure that the adverse tariff impacts on customers under

section B and C are minimized (are not unreasonable and are bearable to the

consumer and to the state subsidy capability).1

- Ensure that the benefits of competition are also maximized for these captive

customers (section B and C). This is discussed at length later.

- The policy should be aimed at avoiding old pitfalls, relating to lack of public

scrutiny and passing the existing costs to future.2

The policy should avoid investor focus and preoccupation with short-term objectives.

Section 7.1 “Broad Principles of Tariff setting”, for example, has no mention of

protecting consumer interests or improving efficiency.

At this stage, in our opinion, we should not aim at micro efficiency. Rather we should

focus on simple but clear and workable rules that would minimize the possibility of

creation of new mega inefficiencies. A road map for future, as mentioned earlier, should

clearly indicate the intent to move towards increased efficiency. An example of this

would be Transmission pricing based on simple principles of variants of “postage Stamp”

v/s highly involved principle of “distance travelled by energy transmitted”. This is

essential if we do a reality-check of our systems in terms of metering and other

infrastructure.

An example of areas where more clarity is urgently needed is regarding transmission.

How we expect regulators to tackle issue of commitment for use of transmission facility.

Do we expect generating companies to do a long-term contract of transmission capacity?

if not, how do we ensure that planning does not go astray?3

Last issue relates to the linkages in different policies. The National Electricity Policy

and Plan, Policy for stand-alone system, and for local distribution in rural areas etc., all

have inter-linkages. The set of policies actually need to be seen as a group, but for the

time being, the Tariff policy should clearly articulate the inter-linkages (that are

important). For example, the MNES is in the process of re-drafting its policy regarding

subsidy for Renewable energy sources. Last bullet of Sec. 6.4 exempts the RES from

Transmission surcharge. Such piece meal approach should be avoided.

3. Some Specific Issues

3.1. Too Many Details

We feel that the policy should not be a tariff notification, as in the decade of

1990s. The Ministry should not dilute the authority given by Act to the

Regulatory commissions. We have a very bad track record of tariff notifications

1

This could only be done by doing an impact analysis – using case studies based on financial models.

2

Example of these include, excluding government companies from competitive bidding all together, and

allowing loop-hole of “Regulatory Assets” without any criterion / upper bound.

3

If the MoP feels that such issues are to be tackled by the regulatory commissions, the MoP policy can

indicate that.

Prayas (Energy Group) Comments on 1st Draft of Tariff Policy by MoP 2

by Ministry of Power. It was on this backdrop of unaccountable policy processes,

we have setup the regulatory commissions. And by and large the experience of

commissions is much better than that of the Ministry of Power (in the period of

IPP saga). We cannot and should not reverse this process.

The tariff policy seems to be concerned about the regulatory certainty. This is

justified. But notifying incentives and PLF is not a solution to this. A better

approach would be identify issues of possible regulatory uncertainty and suggest

mechanisms to handle them.

But on the other hand, some sections give rise to regulatory uncertainty. For

example, section 4.3 “Review of Operating Norms” does not clarify if it is

applicable only for wires business or whether the tariff implicit in new PPAs that

may be signed by Distribution companies would also be affected by Review of

Operating Norms (like PLF and availability).

3.2. Need to Bring Clarity in Roles

The policies by Ministry of Power should be aimed at bringing in more

clarity in the roles and responsibilities of various players such as CEA, CERC,

SERC and MoP. It should also help in better defining their authority and the

likely actions in near future. The roles of the new forums established by law also

need to be clarified by MoP.

In fact, if there are any conflicts with other agencies such as Competition

Commission, these need to be clarified by MoP.

3.3. Competition Issues (for Regulated Entities)

As mentioned in section 1 of this note, the Tariff Policy is largely applicable

for the ‘captive consumers’ of distribution utilities. These customers are going to

be worst hit due to E Act 2003. The commission and MoP should do all efforts to

ensure that these captive customers benefit from competition. The Tariff Policy

scores very low on this count, and needs major changes.

There should have been a clear mention that all power / capacity purchase by

distribution company should be in a transparent and competitive manner. It is

extremely important considering that cost of power purchase constitutes over 60%

in most cases. And the benefit of competition for captive customers (in category B

and C) would largely come from this aspect. In case a Distribution company

wants to construct a new plant, it should announce its avoided cost. If another

generating company offers power at a lower cost then the DisCo should purchase

power from that company. At most, the DisCo can be given an option to match

the cost of its competitor.4 The Regulatory Commission should oversee this

process to ensure that competition exists. The commission should approve the

4

This should be allowed only if, the tariff quoted by the lowest competing supplier is up to say 5% lower

than the “Avoided Cost” of DisCo. If the tariff quoted by competing supplier is more than 5% lower than

“Avoided Cost” of DisCo then it should be assumed that the DisCo cannot match that tariff. This method

appears fair for both, the DisCo and the possible competing generators.

Prayas (Energy Group) Comments on 1st Draft of Tariff Policy by MoP 3

capacity and the kind of plant (base / intermediate load or peaking). The location

of the plant should not be specified (rather an area where power is needed should

be specified). If the commission feels it a must, it may specify the fuel /

technology for the plant. The draft PPA and bid evaluation criteria should be part

of the bidding process.5

If the process is not competitive (for whatever reason) and fails to attract

sufficient number of bidders then the commission should evaluate the “Pudency”

of generation investment (of the DisCo) in a transparent manner. Without such

process the small (captive) customers would not get benefit of competition and it

would defeat the very purpose of the Act.

Rather than such an approach, the Tariff Policy takes a different route.

(1) Policy paper does not make it mandatory that DisCo should undertake power

purchase only through Transparent and Competitive process. (2) Sec 5.2 among

other such sections dilute the Competitive bidding process. Even in case of

several controversial IPP projects the EPC contract (or procurement of major

blocks) was done through competitive bidding! (3) The government owned

companies are exempted from public scrutiny of cost for their generation

expansion. This should not be allowed at all. If a government company desires to

construct a ‘Merchant plant” to sell power in the market then there should be no

regulation on its investment. But if it wants to supply to a distribution company,

then it should only be one of the players (competitors) for supplying power. It

should also participate in the competitive bidding held for supplying power to

DisCo.

We understand that agencies such as World Bank have suggested that if there

is only one bidder - then even negotiated tariffs with that bidder should be treated

as "competitively bid tariffs"! Such a weird definition of competitive process is a

sure shot route to mega inefficiencies. And we will be taking the power sector

back to the regime of MoU based IPP projects. This is not the purpose of the act.

3.4. Removal of Information Asymmetry – a necessity for making competition work

It is well known that the information asymmetry is among the key reasons

for mega inefficiency. As yet, the MoP does not seem to have made concrete

efforts (to our knowledge) or indicated its intent to tackle this issue.

The tariff policy indicates that RCs should use “Pudency” tests. But the RCs

do not have backing of a solid database from which they can draw insights. It is

responsibility of the MoP and CEA to create the database. This may not be an

issue for the Tariff Policy, but as mentioned earlier, the MoP should clearly

indicate that it intends to do this.

5

With the vast experience of competitive bidding, it should now possible be possible to arrive at simple but

robust method of calling for bids. One method could be to ask bidders to quote only two sets of figures

Rs/U tariff for three different PLFs) and annual escalation in the same. Implying that fuel price and Forex

risk should be born by generator.

Prayas (Energy Group) Comments on 1st Draft of Tariff Policy by MoP 4

The database should contain information of ALL power plants (captive,

merchant plant or otherwise), trading contracts and even bi-lateral contracts

(between generation companies and consumers or DisCos). Filling information in

this public database should be a mandatory requirement. To limit the size of the

database, only plants more than 10 MW, trading and bilateral contracts for more

than 2 or 5 MW (and more than 15 days in a year) should be registered in the

database.

Such a database is essential to ensure that competition in generation is

efficient and the RCs ensure that regulated utility’s generation / power purchase

decisions are “prudent”.

3.5. Financial Principles

As per our suggestion, most contracts for power purchase (by DisCo) should

be through competitive bidding. In case this cannot materialize, the question of

regulated tariff would arise. In these limited cases, we believe that it is much

better to take ‘Cost of Capital’ approach.

Unless an area has two licensees, the wires business (distribution and

transmission) is a regulated monopoly, and all investments would need to be

regulated. And the concept of “Cost of Capital’ should be used.

The exact method to be used should be decided by the CERC. Probably a

range of values can be decided, depending on the strength and credit-worthiness

of the companies. It may be unfair to allow uniform values a utility in rural area

and another in say Delhi or Mumbai.

Any authority deciding this method should give due justification for the

numbers used / suggested by it (either for RoE or for Cost of Capital). In fact, it

should also indicate the implications of using suggested numbers and give a

translation (from RoE to Cost of Capital - for a given set of input conditions).

Use of Historic Cost

Use of historical cost for deciding tariff of old plants is inevitable, as we

want to limit the tariff impacts. But here a precaution needs to be taken by MoP.

Let us take an example. If for some old hydro generation, the tariff comes out to

be say Rs 0.25 /kWh. The state government then sells that plant at very low cost

(based on “revenue potential” as per E Act). The private party purchasing the

plant can make windfall profit by selling power in the competitive market. To

avoid this (improper business valuation), the MoP should find a way to bind these

old plants to the existing DisCo.

3.6. Cross-subsidy Surcharge

It is appropriate to include “potential” customers in the net for the surcharge.

But it may be noticed that with the present definition the HT industry may get a

Prayas (Energy Group) Comments on 1st Draft of Tariff Policy by MoP 5

tariff reduction (if it opts for open access) of around 20% (assuming T and back-

up charges up to Rs 0.4/unit in addition to Surcharge as defined in the Tariff

Policy). While, the likely surcharge is going to be small for most states.

Another issue relates with use of Marginal cost v/s use of Average cost for

supply for computing Surcharge. Strictly speaking, the cost of reduced / avoided

purchase because of HT industry opting out has to be considered for the

calculation of Surcharge. The badly negotiated PPAs cannot be considered for this

calculations for two reasons, (1) these PPAs need to be seen as exception, and

(2) they do not constitute the reduced / avoided purchase.

3.7. Additional Surcharge (section 7.2.10)

This additional surcharge on the wheeling charge is to be applicable to

compensate the utility for costs associated with “obligation to serve”. The policy

argues that in case of shortages this cost is insignificant. Look at this from the

perspective of small consumers (section B and C) with an example of a 30 MW

consuming industry. Assume that this large industrial consumer opts out and starts

purchasing power from an outside generator. One fine day, its contract with the

outside generator goes sore. The industrial consumer demands power from the

DisCo. Now the DisCo has no option but to do additional load shedding and give

power to this large industry! Why should a large number of small consumers be

on a tender hook and suffer load shedding for the convenience of the large

industry?

We need to discourage large customers from opting out of the grid without a

reliable supplier and then coming back at will, which will cause a major

uncertainty for the grid operations.6

In fact, in case of shortages – high Additional Surcharge (corresponding to

Scarcity value of power) should be charged. This is an example of Industry and

investor bias of the policy. Similar is the next example.

3.8. Limiting chargeable T (& D) losses (section 6.6)

Limiting chargable T (& D) losses in Transmission costs or wheeling costs to

the normative losses (presumably technical losses) at respective voltage levels is a

major decision. It implies that large consumers (from segment A) opting out – for

open access are exempt from the Stranded costs of high T & D losses. This is

incorrect. The costs should be shared by all consumers that use the grid (a

common infrastructure). Else, as a next step, even the metered consumers may

argue that they are not liable to pay the excess (above the nominal) T & D losses -

this will leave only government to pay for it (or the distribution / transmission

company).

Say in case of (prospective) Maharashtra Transmission utility - the T losses

are about 3% higher than the losses arrived at by load flow studies. If this is

6

It needs to be remembered that the Act expects that the corss-subsidy will be removed in near future. And

then the large customers should not have any preferential treatment.

Prayas (Energy Group) Comments on 1st Draft of Tariff Policy by MoP 6

directly disallowed it implies a cost of Rs 430 Cr (against a much lower profit).

So the Transmission company in Maharashtra will make operating loss, which

will have to be paid by government (tax payers). In case of DisCo the inefficiency

will be loaded on small (captive) consumers while large consumers will be

exempt from this.

Chargable T (or D) losses should be declining in tandem with the T&D loss

reduction target applicable for DisCo or TransCo in general.

3.9. AT&C Loss

The paper argues that AT&C loss method is essential to reduce data

uncertainty. This is difficult to understand. The data uncertainty is mainly in the

context of energy billed (not in energy available for sale, amount of Rs billed or

even money received, which are the other variables in the formula). Even in the

AT&C method, the key parameter that leads to uncertainty still remains. Hence,

the AT&C would only put the cost of inefficiency of bill collection on to the

consumers. Whereas the present expectation is that utility recovers all bills.

In addition to this, the draft policy also allows the "Bad Debt" to be

considered in the tariff calculations. This appears to be double counting.

To reduce the data uncertainty the paper suggests that sample metering of

DTs should be done (most RCs are following this method) for estimation of

Agricultural consumption. We have been arguing that proper sampling is the key

for making this method successful. Thorough census of all IP sets in the state

along with information on crops taken, area irrigated and water source (and depth)

is a pre-requisite for this; which unfortunately no state utility has completed. In

absence of such an approach, just random sampling (using DTs chosen by SEB) is

likely to be problematic. Analysis of MSEB’s monthly Distribution loss and

agricultural consumption estimates clearly prove this point. The distribution loss

comes down radically in the monsoon where as the agricultural consumption

estimates remain more or less same as in other non-monsoon months (see page 26

Vol. II MSEB tariff proposal for year 2003-04). This implies that the agricultural

sampling is wrong.

3.10. Regulatory Asset:

The E Act 2003 has several hard provisions to ensure that the corss-subsidy

is removed rapidly (Captive, Open access etc.). It also aims at achieving financial

discipline by mandating that the state governments pay subsidy in advance.

Where as, an un-qualified provision for allowing regulatory asset seems a U turn.

This can become a dangerous way of pushing present burden in future. In our

opinion, the regulatory assets should be allowed only in case the tariff shock

(average tariff increase) is more than say 20%. It should also be accompanied

with a well-articulated plan to recover the money in future. Without such

provision, it is possible that commissions may be tempted to avoid tough

decisions and push the costs in future to an un-sustainable level.

Prayas (Energy Group) Comments on 1st Draft of Tariff Policy by MoP 7

In general, the regulatory asset should be applicable only in case of un-

foreseen costs arising out of factors such as natural calamity and other such

Force-Majeure events. This is because; a prudent regulatory oversight is expected

to avoid the need for such a tariff shock.

3.11. Miscellaneous Issues

The Tax liability: Section 4.5.1 says 16% RoE is pre-tax and it is said to give

incentive for good tax management. But 5.1 adds tax (at actual) in the fixed cost!

This appears confusing.

Hydro: In 1 in 10 years when the water availability is low (generation below

design energy) the hydro stations would get full Fixed cost. And in 9 of 10 years

when water availability is more than design (and generation is more) it would get

incentive. This may be fine if the incentive is only a small part. But it does not

become clear, as the "Primary Energy Charge" is not defined in the document.

Working Capital seems high: for generation stations it is nearly equal to sum

of 2 month bill and fuel cost for two months. One wonders whether the generating

company gets any credit from coal suppliers and if not what is the reasonable

quantum for working capital?

It is good that the working capital as defined in section 7.2.4 given a clear

incentive for reducing arrears for the distribution utility.

Above comments are without prejudice to our stand that MoP should not get into such

micro details. MoP should try and concentrate on removing confusion and lay down

direction and leave it to the RC’s to fill in the detail.

4. The Process for Making Tariff Policy

We strongly feel that the process of making ‘Tariff policy’ (or any such policy) needs

substantial improvements. The process should be seen as transparent and accountable –

especially when MoP is leading the power sector in a new era – wherein transparency and

accountability have to be the corner stones of decision-making.

To achieve this, (a) the plan of action should be outlined (such as whether drat 2 will

be a draft policy or a discussion paper and whether it would be follow by policy). This

will facilitate groups having limited resources to optimally focus their inputs. While

making comments we have assumed that Draft 1 is only an outline. We would appreciate

if clarity can be brought as regards to stage at which final decisions would be taken.

In the new document, the changes made in draft document should be clearly

articulated and a covering note outlining changes should be circulated along with new

draft. Else, it would be like the several Drafts of E-Bill. By the time small groups (with

limited resources) could obtain a copy and read the draft, the newer draft was available.

This undermines the meaningful public participation in the process.

Prayas (Energy Group) Comments on 1st Draft of Tariff Policy by MoP 8

The comments received from all stakeholders should be put up on the web or should

be made available to public in some form. This would help improve the transparency in

the process.

Another major lacuna in the current process is the lack of supporting analysis based

on concrete data and sensitivity analysis. The tariff impact analysis should be included

with any discussion paper. Without such supporting data and impact analysis, the

exercise remains only academic discussion for most stakeholders. The impact of different

provisions and changes should be explained with help of numbers. We urge the ministry

to remove this important lacuna in future drafts.

Ideally the draft policy should be preceded with a review of preset tariff policy(ies),

discussing the good practices and shortcomings. The MoP may still consider bring out

such a paper.

On the whole, we request the MoP to substantially rework the policy as well as the

approach it is taking in terms of defining such policies.

20th Sept 2003

~ 0 ~

Prayas (Energy Group) Comments on 1st Draft of Tariff Policy by MoP 9

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Welding ElectrodesDocument13 pagesWelding ElectrodesArimoro Cyril ObuseNo ratings yet

- Abb RmuDocument88 pagesAbb RmumarkfoyNo ratings yet

- Legal Tech India 1581617090882Document10 pagesLegal Tech India 1581617090882Alok KumarNo ratings yet

- Why Buildings Fall Down How Structures FailDocument60 pagesWhy Buildings Fall Down How Structures FaillyeshiunNo ratings yet

- Discussion & Conclusion Dry Fractionation MuzDocument4 pagesDiscussion & Conclusion Dry Fractionation MuzAhmad MuzammilNo ratings yet

- LMTD CalculatorDocument2 pagesLMTD CalculatorSATISH PAWARNo ratings yet

- Coal Handling SystemDocument56 pagesCoal Handling SystemPrudhvi RajNo ratings yet

- Legal Positivism Human RightsDocument5 pagesLegal Positivism Human RightsAlok KumarNo ratings yet

- Active Passive LessonDocument13 pagesActive Passive LessonAlok KumarNo ratings yet

- Buy Back of Shares-Overview: Specified SecuritiesDocument2 pagesBuy Back of Shares-Overview: Specified SecuritiesAlok KumarNo ratings yet

- Currency Wars Yesterday and Today PDFDocument6 pagesCurrency Wars Yesterday and Today PDFAlok KumarNo ratings yet

- What Is The Time Value of Money 1549613254102Document2 pagesWhat Is The Time Value of Money 1549613254102Alok KumarNo ratings yet

- How Credit Rating Agencies Work: 1. Credit Rating Information Services of India Limited (Crisil)Document3 pagesHow Credit Rating Agencies Work: 1. Credit Rating Information Services of India Limited (Crisil)Alok KumarNo ratings yet

- TRIPS and Public Health (DOHA Declaration)Document4 pagesTRIPS and Public Health (DOHA Declaration)Alok KumarNo ratings yet

- Editor'S Note: in This IssueDocument13 pagesEditor'S Note: in This IssueAlok KumarNo ratings yet

- European Court of Human RightsDocument2 pagesEuropean Court of Human RightsAlok KumarNo ratings yet

- Arbitration Notes - KAMKUS PDFDocument83 pagesArbitration Notes - KAMKUS PDFAlok Kumar80% (5)

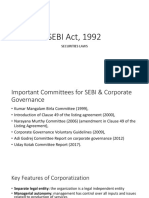

- SEBI Act, 1992: Securities LawsDocument25 pagesSEBI Act, 1992: Securities LawsAlok KumarNo ratings yet

- I Csi Capital Market and Securite SlawDocument45 pagesI Csi Capital Market and Securite SlawAlok KumarNo ratings yet

- 2 Code of Civil ProcedureDocument2 pages2 Code of Civil ProcedureAlok KumarNo ratings yet

- Nanoscience & Nanotechnolog Y File: ProjectDocument3 pagesNanoscience & Nanotechnolog Y File: ProjectAlok KumarNo ratings yet

- Cbse - Joint Entrance Examination (Main) - 2015Document1 pageCbse - Joint Entrance Examination (Main) - 2015Alok KumarNo ratings yet

- Aalok Business Env...Document11 pagesAalok Business Env...Alok KumarNo ratings yet

- Catalogo DynapacDocument36 pagesCatalogo DynapacblaktionNo ratings yet

- Tunisia - Nawara Southern Tunisian Gas Pipeline - ESIA Executive SummaryDocument28 pagesTunisia - Nawara Southern Tunisian Gas Pipeline - ESIA Executive SummaryodeinatusNo ratings yet

- 1957 The Spectral Emissivity and Optical Properties of TungstenDocument88 pages1957 The Spectral Emissivity and Optical Properties of TungstenpresledovatelNo ratings yet

- Cabluri Monofilare Fara Manta Unsheathed Single-Core Cables: Test Voltage: 3 KV, 50 HZ, 5 Minutes in WaterDocument2 pagesCabluri Monofilare Fara Manta Unsheathed Single-Core Cables: Test Voltage: 3 KV, 50 HZ, 5 Minutes in WaterCirtiu SandaNo ratings yet

- Product Manual IS 9283Document7 pagesProduct Manual IS 9283North EastNo ratings yet

- E&T1350 Electronics Chapter 4 Special Purpose DiodesDocument16 pagesE&T1350 Electronics Chapter 4 Special Purpose DiodesRMK BrothersNo ratings yet

- Chapter-1 Physical WorldDocument7 pagesChapter-1 Physical WorldAbhi AdiNo ratings yet

- 2013 04Document110 pages2013 04Jose Emmanuel Martinez CordovaNo ratings yet

- Information & Operations Manual For Bavaria Cruiser 37Document37 pagesInformation & Operations Manual For Bavaria Cruiser 37RDNo ratings yet

- Materials & Their Materials & Their Behavior in Welding Behavior in WeldingDocument56 pagesMaterials & Their Materials & Their Behavior in Welding Behavior in WeldingWahyu Tirta Nugraha100% (1)

- Gas Turbine Lease Engine, Ruston TB5000, Ruston TB5400, Siemens SGT100, Siemens SGT200Document3 pagesGas Turbine Lease Engine, Ruston TB5000, Ruston TB5400, Siemens SGT100, Siemens SGT200sink or swimNo ratings yet

- Analysis of Commercial Proanthocyanidins. Part 1 The Chemical Composition of Quebracho (Schinopsis Lorentzii and Schinopsis Balansae) Heartwood Extract 2012 Phytochemistry 1Document11 pagesAnalysis of Commercial Proanthocyanidins. Part 1 The Chemical Composition of Quebracho (Schinopsis Lorentzii and Schinopsis Balansae) Heartwood Extract 2012 Phytochemistry 1Eric FernandoNo ratings yet

- 2026 - 1 Specification For Power Trfo - Part 1Document46 pages2026 - 1 Specification For Power Trfo - Part 1Balamurugan ArumugamNo ratings yet

- Chp15notes Part 2Document32 pagesChp15notes Part 2api-255402590No ratings yet

- Transmission Lines and NetworksDocument18 pagesTransmission Lines and NetworkszgxfsbjbnNo ratings yet

- 520-540 Watt: Key FeaturesDocument2 pages520-540 Watt: Key FeaturesCH MOHAMMAD ATTIR KHAYYAMNo ratings yet

- 6120-A - Electric Motors Rated Up To 150KWDocument7 pages6120-A - Electric Motors Rated Up To 150KWharmlesdragonNo ratings yet

- Mohammad Shadab Khan - Field OperatorDocument6 pagesMohammad Shadab Khan - Field OperatorDonNo ratings yet

- MJ0320335ENN enDocument487 pagesMJ0320335ENN ennickybudauNo ratings yet

- Renewable and Sustainable Energy Reviews: MD Maruf Hossain, Mohd. Hasan AliDocument9 pagesRenewable and Sustainable Energy Reviews: MD Maruf Hossain, Mohd. Hasan AliJuan MNo ratings yet

- Lecture 25Document4 pagesLecture 25216435964No ratings yet

- Axial Flux Permanent Magnet Generators For Pico-HydropowerDocument8 pagesAxial Flux Permanent Magnet Generators For Pico-HydropowerEngineers Without Borders UKNo ratings yet

- Boe (Boiler Operation Engineer) Short Type Question Answer For Examination - AskpowerplantDocument15 pagesBoe (Boiler Operation Engineer) Short Type Question Answer For Examination - AskpowerplantRaju MaityNo ratings yet

- Wheat Corn Soybean SorghumDocument8 pagesWheat Corn Soybean SorghumNoelNo ratings yet