Professional Documents

Culture Documents

Template Portfolio Disclosure - February 2018-Derivative

Uploaded by

Reedos Lucknow0 ratings0% found this document useful (0 votes)

11 views1 pageOriginal Title

Template Portfolio Disclosure -February 2018-Derivative.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageTemplate Portfolio Disclosure - February 2018-Derivative

Uploaded by

Reedos LucknowCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

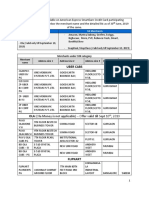

JM Arbitrage Advantage Fund (An Open-Ended Equity Oriented Scheme)

Name of the Instruments Industry/Rating Quantity Market Value % age to NAV

EQUITY & EQUITY RELATED

a) Listed/Awaiting Listing On Stock Exchange

Tata Global Beverages Ltd. Consumer Non Durables 3,465,000 9,546.08 2.46

JSW Steel Ltd. Ferrous Metals 2,691,000 8,401.30 2.16

Reliance Industries Ltd. Petroleum Products 844,000 8,056.40 2.07

Dewan Housing Finance Corporation Ltd. Finance 1,459,500 7,971.79 2.06

Tata Chemicals Ltd. Chemicals 810,000 5,707.67 1.48

IDFC Ltd. Finance 10,480,800 5,549.58 1.44

Bank of Baroda Banks 3,484,000 4,945.54 1.28

IDFC Bank Ltd. Banks 9,540,000 4,913.10 1.27

Dr. Reddy's Laboratories Ltd. Pharmaceuticals 214,250 4,793.31 1.24

Tata Motors Ltd. Auto 1,273,500 4,710.68 1.22

Jindal Steel & Power Ltd. Ferrous Metals 1,755,000 4,464.72 1.15

Reliance Capital Ltd. Finance 934,500 4,413.18 1.14

Sun Pharmaceutical Industries Ltd. Pharmaceuticals 803,000 4,298.86 1.11

Punjab National Bank Banks 4,212,000 4,270.97 1.10

Lupin Ltd. Pharmaceuticals 519,600 4,260.46 1.10

Fortis Healthcare Ltd. Healthcare Services 2,621,500 4,189.16 1.08

ITC Ltd. Consumer Non Durables 1,531,200 4,058.45 1.05

The South Indian Bank Ltd. Banks 15,112,296 4,019.87 1.04

Indiabulls Housing Finance Ltd. Finance 320,400 4,018.14 1.04

TV18 Broadcast Ltd. Media & Entertainment 6,222,000 3,898.08 1.01

Tata Communications Ltd. Telecom - Services 601,600 3,864.38 1.00

Multi Commodity Exchange of India Ltd. Finance 474,000 3,697.91 0.96

Reliance Infrastructure Ltd. Power 793,000 3,612.91 0.93

Jet Airways (India) Ltd. Transportation 422,400 3,151.53 0.82

CESC Ltd. Power 300,300 3,073.42 0.79

Bharat Financial Inclusion Ltd. Finance 292,000 2,996.21 0.77

Reliance Power Ltd. Power 6,552,000 2,928.74 0.76

State Bank of India Banks 1,092,000 2,926.56 0.76

The Karnataka Bank Ltd. Banks 2,139,400 2,891.40 0.75

Motherson Sumi Systems Ltd. Auto Ancillaries 872,000 2,877.60 0.74

United Spirits Ltd. Consumer Non Durables 85,750 2,822.85 0.73

KPIT Technologies Ltd. Software 1,264,500 2,732.58 0.71

Gujarat State Fertilizers & Chemicals Ltd. Fertilisers 2,088,000 2,675.77 0.69

Raymond Ltd. Textile Products 272,800 2,603.74 0.67

IRB Infrastructure Developers Ltd. Construction 1,125,000 2,571.75 0.67

LIC Housing Finance Ltd. Finance 506,000 2,569.47 0.66

Asian Paints Ltd. Consumer Non Durables 219,000 2,447.87 0.63

Jain Irrigation Systems Ltd. Industrial Products 2,088,000 2,441.92 0.63

Steel Authority of India Ltd. Ferrous Metals 2,904,000 2,416.13 0.62

Maruti Suzuki India Ltd. Auto 26,175 2,316.74 0.60

Equitas Holdings Ltd. Finance 1,523,200 2,269.57 0.59

Jaiprakash Associates Ltd. Cement 12,580,000 2,226.66 0.58

L&T Finance Holdings Ltd Finance 1,363,500 2,212.96 0.57

The India Cements Ltd. Cement 1,386,000 2,207.21 0.57

Infosys Ltd. Software 187,200 2,195.11 0.57

Tata Motors Ltd. Auto 1,010,000 2,089.69 0.54

Glenmark Pharmaceuticals Ltd. Pharmaceuticals 368,100 2,004.49 0.52

Axis Bank Ltd. Banks 350,400 1,852.74 0.48

GMR Infrastructure Ltd. Construction Project 9,630,000 1,824.89 0.47

Tata Consultancy Services Ltd. Software 59,750 1,813.44 0.47

Jubilant Foodworks Ltd. Consumer Non Durables 84,000 1,708.56 0.44

Tata Elxsi Ltd. Software 161,600 1,702.05 0.44

Dish TV India Ltd. Media & Entertainment 2,275,000 1,674.40 0.43

Aurobindo Pharma Ltd. Pharmaceuticals 268,800 1,650.16 0.43

Titan Company Ltd. Consumer Durables 196,500 1,603.73 0.41

Bajaj Auto Ltd. Auto 50,500 1,525.40 0.39

Ujjivan Financial Services Ltd. Finance 403,200 1,517.04 0.39

Mahindra & Mahindra Financial Services Ltd. Finance 336,250 1,454.79 0.38

BEML Ltd. Industrial Capital Goods 117,300 1,448.77 0.37

Zee Entertainment Enterprises Ltd. Media & Entertainment 254,800 1,440.51 0.37

NBCC (INDIA) Ltd. Construction 732,000 1,437.65 0.37

Dabur India Ltd. Consumer Non Durables 425,000 1,381.46 0.36

UPL Ltd. Pesticides 187,200 1,364.22 0.35

Granules India Ltd. Pharmaceuticals 1,140,000 1,349.76 0.35

ICICI Prudential Life Insurance Company Ltd. Finance 325,000 1,341.60 0.35

Max Financial Services Ltd. Finance 270,000 1,337.72 0.35

Bajaj Finance Ltd. Finance 78,000 1,279.40 0.33

Adani Enterprises Ltd. Trading 616,000 1,253.87 0.32

Balrampur Chini Mills Ltd. Consumer Non Durables 1,036,000 1,240.61 0.32

Eicher Motors Ltd. Auto 4,450 1,220.98 0.32

Ashok Leyland Ltd. Auto 840,000 1,188.60 0.31

The Federal Bank Ltd. Banks 1,259,500 1,187.08 0.31

Godrej Industries Ltd. Consumer Non Durables 213,000 1,175.23 0.30

Grasim Industries Ltd. Cement 95,250 1,097.95 0.28

Strides Shasun Ltd. Pharmaceuticals 146,400 1,050.42 0.27

Tata Power Company Ltd. Power 1,215,000 1,026.68 0.27

Syndicate Bank Banks 1,638,000 1,000.82 0.26

Piramal Enterprises Ltd. Pharmaceuticals 38,195 986.40 0.26

Power Finance Corporation Ltd. Finance 918,000 964.82 0.25

Reliance Naval and Engineering Ltd. Industrial Capital Goods 2,322,000 938.09 0.24

HCL Technologies Ltd. Software 99,400 934.66 0.24

CEAT Ltd. Auto Ancillaries 56,350 902.98 0.23

Mangalore Refinery and Petrochemicals Ltd. Petroleum Products 738,000 880.07 0.23

Torrent Power Ltd. Power 321,000 849.53 0.22

Manappuram Finance Ltd. Finance 768,000 829.06 0.21

Canara Bank Banks 275,200 823.54 0.21

SREI Infrastructure Finance Ltd. Finance 965,000 820.25 0.21

IFCI Ltd. Finance 3,608,000 817.21 0.21

Arvind Ltd. Textile Products 190,000 797.91 0.21

Capital First Ltd. Finance 119,200 794.23 0.21

Hindustan Construction Company Ltd. Construction Project 2,340,000 793.26 0.21

Can Fin Homes Ltd. Finance 146,250 791.87 0.20

Wockhardt Ltd. Pharmaceuticals 94,500 774.99 0.20

Mahindra & Mahindra Ltd. Auto 104,000 757.48 0.20

Wipro Ltd. Software 256,800 751.91 0.19

IDBI Bank Ltd. Banks 980,000 730.59 0.19

Yes Bank Ltd. Banks 215,250 693.75 0.18

CG Power and Industrial Solutions Ltd. Industrial Capital Goods 816,000 681.36 0.18

Hindustan Unilever Ltd. Consumer Non Durables 51,600 679.96 0.18

Adani Power Ltd. Power 2,140,000 677.31 0.18

Suzlon Energy Ltd. Industrial Capital Goods 5,180,000 663.04 0.17

Amara Raja Batteries Ltd. Auto Ancillaries 78,400 644.64 0.17

Castrol India Ltd. Petroleum Products 299,600 605.04 0.16

Tech Mahindra Ltd. Software 92,400 566.09 0.15

National Aluminium Company Ltd. Non - Ferrous Metals 800,000 548.40 0.14

Infibeam Incorporation Ltd. Software 344,000 544.90 0.14

PVR Ltd. Media & Entertainment 41,200 544.03 0.14

DLF Ltd. Construction 235,000 531.69 0.14

Adani Ports and Special Economic Zone Ltd. Transportation 120,000 490.02 0.13

Justdial Ltd. Software 96,600 436.54 0.11

Housing Development and Infrastructure Ltd. Construction 846,000 422.15 0.11

PTC India Ltd. Power 408,000 419.22 0.11

Bharti Airtel Ltd. Telecom - Services 95,200 407.98 0.11

Ajanta Pharma Ltd. Pharmaceuticals 28,500 398.36 0.10

Union Bank of India Banks 360,000 379.98 0.10

Exide Industries Ltd. Auto Ancillaries 176,000 365.02 0.09

Shriram Transport Finance Company Ltd. Finance 25,200 336.13 0.09

Chennai Petroleum Corporation Ltd. Petroleum Products 84,000 306.35 0.08

Indraprastha Gas Ltd. Gas 96,250 293.27 0.08

Kaveri Seed Company Ltd. Consumer Non Durables 54,000 270.16 0.07

NCC Ltd. Construction Project 192,000 252.86 0.07

RBL Bank Ltd. Banks 49,000 240.20 0.06

Allahabad Bank Banks 450,000 236.93 0.06

Andhra Bank Banks 460,000 211.83 0.05

Bharat Electronics Ltd. Industrial Capital Goods 133,650 206.29 0.05

Godrej Consumer Products Ltd. Consumer Non Durables 19,200 205.53 0.05

Indian Bank Banks 60,000 198.66 0.05

Voltas Ltd. Construction Project 30,000 182.82 0.05

Hindalco Industries Ltd. Non - Ferrous Metals 63,000 154.60 0.04

Pidilite Industries Ltd. Chemicals 14,000 126.13 0.03

Kajaria Ceramics Ltd. Construction 18,400 105.74 0.03

NIIT Technologies Ltd. Software 12,000 100.14 0.03

Housing Development Finance Corporation Ltd. Finance 5,500 99.48 0.03

Godfrey Phillips India Ltd. Consumer Non Durables 10,500 91.68 0.02

Container Corporation of India Ltd. Transportation 6,875 89.66 0.02

Cadila Healthcare Ltd. Pharmaceuticals 20,800 84.26 0.02

Cipla Ltd. Pharmaceuticals 13,000 76.65 0.02

Havells India Ltd. Consumer Durables 14,000 71.07 0.02

Rural Electrification Corporation Ltd. Finance 48,000 69.26 0.02

Ultratech Cement Ltd. Cement 1,600 66.49 0.02

Muthoot Finance Ltd. Finance 15,000 58.77 0.02

Idea Cellular Ltd. Telecom - Services 56,000 46.98 0.01

Piramal Enterprises Ltd. - Rights Pharmaceuticals 1,669 43.10 0.01

Repco Home Finance Ltd. Finance 6,300 35.57 0.01

DCB Bank Ltd. Banks 13,500 22.14 0.01

Bharat Heavy Electricals Ltd. Industrial Capital Goods 22,500 20.23 0.01

Mahanagar Gas Ltd. Gas 600 6.26 ^

Sub Total: 252,410.61 65.26

b) Unlisted NIL NIL

Total: 252,410.61 65.26

TERM DEPOSITS (Placed as F & O Margin) No. of Days

IndusInd Bank Ltd. 92 25,000.00 6.47

IndusInd Bank Ltd. 123 10,000.00 2.59

IndusInd Bank Ltd. 125 7,000.00 1.81

HDFC Bank Ltd. 111 6,000.00 1.55

HDFC Bank Ltd. 92 2,500.00 0.65

IndusInd Bank Ltd. 109 2,500.00 0.65

HDFC Bank Ltd. 123 1,000.00 0.26

HDFC Bank Ltd. 118 1,000.00 0.26

Sub Total: 55,000.00 14.24

MONEY MARKET INSTRUMENTS

Certificate of Deposit (CD) / Commercial Paper (CP)

IVL Finance Ltd CP** BWR A1+ 4,000 19,939.59 5.16

Indiabulls Real Estate Co. Ltd CP** CARE A1+ (SO) 1,500 7,474.49 1.93

Capital First Ltd. CP** CARE A1+ 1,000 4,995.23 1.29

Kotak Mahindra Bank Ltd CD ** CRISIL A1+ 2,500 2,500.00 0.65

You might also like

- List Who GMPDocument126 pagesList Who GMPAnonymous 3LiDeGpOc100% (1)

- NRI List of Unclaimed Deposits AccountsDocument351 pagesNRI List of Unclaimed Deposits AccountsMovies OnlyNo ratings yet

- Top executives and contact details of major Indian companiesDocument36 pagesTop executives and contact details of major Indian companiesTom Master60% (5)

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- WHO GMP Manufacturers in IndiaDocument43 pagesWHO GMP Manufacturers in IndiaNAVNEET BAGGA100% (1)

- Contact Details of Major Indian CompaniesDocument1,197 pagesContact Details of Major Indian CompaniesGayathri75% (4)

- CMIE Express Annual Finance Standalone Report for Top Indian Telecom CompaniesDocument4,101 pagesCMIE Express Annual Finance Standalone Report for Top Indian Telecom CompaniesRia SharmaNo ratings yet

- HR Heads All India 16170Document2,026 pagesHR Heads All India 16170Tinku Chowdary Malempati0% (2)

- AGM UPDATEDocument8 pagesAGM UPDATEFICCI M PNo ratings yet

- ET 500 Companies ListDocument22 pagesET 500 Companies ListKunal SinghalNo ratings yet

- Directors and Companies Details ReportDocument420 pagesDirectors and Companies Details ReportNimesh C VarmaNo ratings yet

- Samples Hyd 2Document8 pagesSamples Hyd 2DATABASES LEADSNo ratings yet

- JM Midcap Oct 30Document1 pageJM Midcap Oct 30yugendhar janjiralaNo ratings yet

- Portfolio Icici GDocument2 pagesPortfolio Icici GdiscovertapasNo ratings yet

- Top 5 ELLSDocument11 pagesTop 5 ELLSvidyaNo ratings yet

- List of Companies of IndiaDocument18 pagesList of Companies of IndiaKiran SonarNo ratings yet

- Franklin India Bluechip Fund portfolio breakdownDocument1 pageFranklin India Bluechip Fund portfolio breakdownAatish TNo ratings yet

- Top Five Buys & Sells by Major MFs in January 2021Document32 pagesTop Five Buys & Sells by Major MFs in January 2021lakshmanNo ratings yet

- World Rank Company Industry Revenue (Billion $) Profits (Billion $) Assets (Billion $) Market Value (Billion $)Document13 pagesWorld Rank Company Industry Revenue (Billion $) Profits (Billion $) Assets (Billion $) Market Value (Billion $)Pankaj SinhaNo ratings yet

- Constituents of Nifty 50 Index and their WeightageDocument2 pagesConstituents of Nifty 50 Index and their WeightagenomihNo ratings yet

- Bse Listed List of CompanyDocument1 pageBse Listed List of Companyfuturetechcafe88No ratings yet

- Common Stocks Across MF Schemes ReportDocument4 pagesCommon Stocks Across MF Schemes Reportbidar007No ratings yet

- PPFAS Monthly Portfolio Report February 28 2023Document44 pagesPPFAS Monthly Portfolio Report February 28 2023DevendraNo ratings yet

- Calculation and Composition of Sensex and Nifty Stock IndicesDocument13 pagesCalculation and Composition of Sensex and Nifty Stock IndicesNishi SharmaNo ratings yet

- NIFTY 50 Nov2020Document2 pagesNIFTY 50 Nov2020Games ZoneNo ratings yet

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000No ratings yet

- L&T Tax Advantage Fund Portfolio 31st Aug 22Document1 pageL&T Tax Advantage Fund Portfolio 31st Aug 22srinivas krishnaNo ratings yet

- Tracing Missing ShareholdersDocument19 pagesTracing Missing Shareholdersmrpatel121152No ratings yet

- SBI-MultiCap-Fund 2Document9 pagesSBI-MultiCap-Fund 2garvitaneja477No ratings yet

- Mid Cap Growth FundDocument1 pageMid Cap Growth FundChromoNo ratings yet

- PPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)Document13 pagesPPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)TunirNo ratings yet

- Baroda BNP Paribas Large & Mid Cap Fund PortfolioDocument11 pagesBaroda BNP Paribas Large & Mid Cap Fund PortfolioJahangir ChohanNo ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- Group 11 CF-2 Assignment (24-3-23)Document6 pagesGroup 11 CF-2 Assignment (24-3-23)Ankit RajNo ratings yet

- April 30, 2020: Constituents of NIFTY Smallcap 100Document4 pagesApril 30, 2020: Constituents of NIFTY Smallcap 100amitNo ratings yet

- PPFAS Monthly Portfolio Report January 31 2024Document64 pagesPPFAS Monthly Portfolio Report January 31 2024Pratik HingeNo ratings yet

- Isha Excel Anand 123Document162 pagesIsha Excel Anand 123ISHA AGGARWALNo ratings yet

- Sbi Magnum Children S Benefit Fund - Investment PlanDocument9 pagesSbi Magnum Children S Benefit Fund - Investment PlanManoja ManivasagamNo ratings yet

- 01-04-2020 Bse 200 52LDocument18 pages01-04-2020 Bse 200 52LSach PaNo ratings yet

- Fiscf Franklin India Smaller Companies Fund: PortfolioDocument1 pageFiscf Franklin India Smaller Companies Fund: PortfolioRtsu PtNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- NIFTY Next 50 Apr2020Document2 pagesNIFTY Next 50 Apr2020amitNo ratings yet

- MFDocument380 pagesMFjayram 8080100% (1)

- April 30, 2020: Constituents of NIFTY Services SectorDocument2 pagesApril 30, 2020: Constituents of NIFTY Services SectoramitNo ratings yet

- April 30, 2020: Constituents of NIFTY 50Document2 pagesApril 30, 2020: Constituents of NIFTY 50amitNo ratings yet

- Nifty Next 50 Jan2022Document2 pagesNifty Next 50 Jan2022Arati DubeyNo ratings yet

- Sbi Blue Chip Fund June 2023Document9 pagesSbi Blue Chip Fund June 2023varipe1667No ratings yet

- Top Indian companies by revenue and profitsDocument3 pagesTop Indian companies by revenue and profitsriyathakurNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- NIFTY Smallcap 50 Jan2022Document2 pagesNIFTY Smallcap 50 Jan2022Arati DubeyNo ratings yet

- SL Company Sector Market Cap (Rs - CR) Long Term Debt (Rs - CR) Debt Minus Cash (Rs - CR.) Debt Equity Ratio (D/E)Document2 pagesSL Company Sector Market Cap (Rs - CR) Long Term Debt (Rs - CR) Debt Minus Cash (Rs - CR.) Debt Equity Ratio (D/E)kiransunkuNo ratings yet

- NIFTY Next 50 Nov2020Document2 pagesNIFTY Next 50 Nov2020Games ZoneNo ratings yet

- Fund ComparisionDocument14 pagesFund ComparisionAmit PatelNo ratings yet

- UlipDocument1 pageUlipsanu091No ratings yet

- IndustryDocument20 pagesIndustry121prashantNo ratings yet

- NIFTY Smallcap 50 Apr2020Document2 pagesNIFTY Smallcap 50 Apr2020amitNo ratings yet

- Form 4 Sep21Document1 pageForm 4 Sep21rohan.explorerNo ratings yet

- Company Name Cluster Group: Market CapDocument4 pagesCompany Name Cluster Group: Market CapAkash VijayNo ratings yet

- ET 500 Companies List 2022Document2 pagesET 500 Companies List 20220000000000000000No ratings yet

- April 30, 2020: Constituents of NIFTY 100Document4 pagesApril 30, 2020: Constituents of NIFTY 100amitNo ratings yet

- Candidate Arrived/Transferred/Remote from January - June 2022 ReportDocument2 pagesCandidate Arrived/Transferred/Remote from January - June 2022 Reportayaz akhtarNo ratings yet

- Latest Market Prices of Indian Companies by SectorDocument16 pagesLatest Market Prices of Indian Companies by SectorNitesh TripathiNo ratings yet

- 11 - Chapter 5 PDFDocument48 pages11 - Chapter 5 PDFXyzNo ratings yet

- NIFTY Dividend Opportunities 50 Apr2020Document2 pagesNIFTY Dividend Opportunities 50 Apr2020amitNo ratings yet

- Rank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCADocument6 pagesRank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCA0000000000000000No ratings yet

- What Are Small Cap Funds Buying - Oct. 2023Document5 pagesWhat Are Small Cap Funds Buying - Oct. 2023aishazerodhaNo ratings yet

- HDFC Equity Fund Outperforms Benchmark ReturnsDocument8 pagesHDFC Equity Fund Outperforms Benchmark Returnsshreedhar mohtaNo ratings yet

- Sr. No. Symbol Company Name Market Capitalisation (In Lakhs)Document23 pagesSr. No. Symbol Company Name Market Capitalisation (In Lakhs)bhagvat saseNo ratings yet

- Book 1Document64 pagesBook 1poojaguptainida1No ratings yet

- Sr. No. Symbol Company Name Market Capitalisation (In Lakhs)Document12 pagesSr. No. Symbol Company Name Market Capitalisation (In Lakhs)Anish ShahNo ratings yet

- Monthly Scheme SGDocument14 pagesMonthly Scheme SGvarunstuffNo ratings yet

- Sbi 1Document1,104 pagesSbi 1Reedos LucknowNo ratings yet

- Inter-Scheme/ Off Market Trade/Market Trade S.No Name of The Securiisin Scheme Name Maturity Date Residusettle Trade DateDocument2 pagesInter-Scheme/ Off Market Trade/Market Trade S.No Name of The Securiisin Scheme Name Maturity Date Residusettle Trade DateReedos LucknowNo ratings yet

- CBLO, Repo and Fixed Deposit Trades Are Not ConsideredDocument4 pagesCBLO, Repo and Fixed Deposit Trades Are Not ConsideredReedos LucknowNo ratings yet

- CBLO, Repo and Fixed Deposit Trades Are Not ConsideredDocument4 pagesCBLO, Repo and Fixed Deposit Trades Are Not ConsideredReedos LucknowNo ratings yet

- TransactionDetails 06022018Document2 pagesTransactionDetails 06022018Reedos LucknowNo ratings yet

- TransactionDetails 01022018Document2 pagesTransactionDetails 01022018Reedos LucknowNo ratings yet

- Portfolio 28022018-09-March-2018-1160956717Document54 pagesPortfolio 28022018-09-March-2018-1160956717Reedos LucknowNo ratings yet

- TransactionDetails 06022018Document2 pagesTransactionDetails 06022018Reedos LucknowNo ratings yet

- TransactionDetails 01022018Document2 pagesTransactionDetails 01022018Reedos LucknowNo ratings yet

- EDEL - Portfolio Monthly 31-Mar-2020 - 10042020 - 073716 - PMDocument190 pagesEDEL - Portfolio Monthly 31-Mar-2020 - 10042020 - 073716 - PMReedos LucknowNo ratings yet

- Portfolio Disclosure - February 2018Document28 pagesPortfolio Disclosure - February 2018Reedos LucknowNo ratings yet

- 090320181611MONTHLY PORTFOLIO REPORT-Feb-18Document157 pages090320181611MONTHLY PORTFOLIO REPORT-Feb-18Reedos LucknowNo ratings yet

- Debt Redeemed-20.06.2016Document830 pagesDebt Redeemed-20.06.2016Reedos LucknowNo ratings yet

- EDEL - Portfolio Monthly 31-Mar-2020 - 10042020 - 073716 - PMDocument190 pagesEDEL - Portfolio Monthly 31-Mar-2020 - 10042020 - 073716 - PMReedos LucknowNo ratings yet

- Edelweiss March 2020Document146 pagesEdelweiss March 2020Reedos LucknowNo ratings yet

- Edelweiss March 2020Document146 pagesEdelweiss March 2020Reedos LucknowNo ratings yet

- State Power 6-1Document135 pagesState Power 6-1Gopal PNo ratings yet

- Acct Statement - XX6738 - 27102022Document10 pagesAcct Statement - XX6738 - 27102022Aloke KumarNo ratings yet

- Enquiry KSRTCDocument2 pagesEnquiry KSRTCacumen3004No ratings yet

- Imax and PlfsDocument7 pagesImax and PlfsAdithya adhiNo ratings yet

- BSE Group A and B Companies ListingDocument281 pagesBSE Group A and B Companies ListingHemanta majhiNo ratings yet

- Custodian CodesDocument6 pagesCustodian CodesjohnNo ratings yet

- Patient Records with Dates, Names, UHIDs and Insurance DetailsDocument15 pagesPatient Records with Dates, Names, UHIDs and Insurance DetailsSaurabh Upadhyay0% (1)

- Family Planning AllowanceDocument1 pageFamily Planning AllowanceJTO-IT Manipur SSANo ratings yet

- SLBCDocument1 pageSLBCyogesh shingareNo ratings yet

- Corporate Scoreboard IndexDocument3 pagesCorporate Scoreboard IndexKAJAL BALASAHEB PATILNo ratings yet

- 3 Page - DiwaliPicks 2021-22Document3 pages3 Page - DiwaliPicks 2021-22Rick DasNo ratings yet

- Approved List 101109Document16 pagesApproved List 101109tudaya_rajNo ratings yet

- Placements BrochureDocument17 pagesPlacements Brochure142545No ratings yet

- Merchantlist PDFDocument201 pagesMerchantlist PDFrahulNo ratings yet

- A Study On Customers' Satisfaction Towards: Lakmé Cosmetics at Ambegaon, PuneDocument25 pagesA Study On Customers' Satisfaction Towards: Lakmé Cosmetics at Ambegaon, PuneMome SinhaNo ratings yet

- Short Term Breakouts, Technical Analysis ScannerDocument2 pagesShort Term Breakouts, Technical Analysis ScannerKhaleel RahmanNo ratings yet

- GST No Party Name As Per Books IgstDocument19 pagesGST No Party Name As Per Books IgstHarneet SinghNo ratings yet

- Task StatusDocument80 pagesTask StatusAmit KumarNo ratings yet

- Billionaries 1Document1 pageBillionaries 1ashishch4No ratings yet