Professional Documents

Culture Documents

Calculation and Composition of Sensex and Nifty Stock Indices

Uploaded by

Nishi Sharma0 ratings0% found this document useful (0 votes)

17 views13 pagesThe document discusses the calculation of Sensex and Nifty stock market indices in India. Sensex is calculated using the weighted market capitalization of the top 30 companies by market cap. Nifty uses the top 50 companies. Both indices use free float market capitalization, which excludes shares that are locked in, held by promoters or acquired through foreign investment. The document also lists the constituent companies of Nifty and their respective weightages. It provides details on bull and bear markets and factors that affect stock market performance.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the calculation of Sensex and Nifty stock market indices in India. Sensex is calculated using the weighted market capitalization of the top 30 companies by market cap. Nifty uses the top 50 companies. Both indices use free float market capitalization, which excludes shares that are locked in, held by promoters or acquired through foreign investment. The document also lists the constituent companies of Nifty and their respective weightages. It provides details on bull and bear markets and factors that affect stock market performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views13 pagesCalculation and Composition of Sensex and Nifty Stock Indices

Uploaded by

Nishi SharmaThe document discusses the calculation of Sensex and Nifty stock market indices in India. Sensex is calculated using the weighted market capitalization of the top 30 companies by market cap. Nifty uses the top 50 companies. Both indices use free float market capitalization, which excludes shares that are locked in, held by promoters or acquired through foreign investment. The document also lists the constituent companies of Nifty and their respective weightages. It provides details on bull and bear markets and factors that affect stock market performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

Construction of Index

Calculation of Sensex (Index of BSE)

• Sensex is calculated using Weighted market capitalisation method.

• (Market Capitalisation = No. of outstanding(Floating) shares of

company * Current price per share

• Sensex comprises of stocks of top 30 companies. These companies

are selected on the basis of market cap.

• Free float market capitalisation of these 30 companies are

determined.

• Formula to calculate Sensex: (A*b/B)

Where A = Total free float market capitalisation (current market

value)

B = Base market capitalisation

b = base index value (for sensex it was 100)

Calculation of Nifty

• Nifty comprises of stock of 50 companies.

• Nifty value = (A*B/b)

Where A = Total free float market

capitalisation (current market value)

B = Base market capitalisation

b = base index value

Base index value of nifty is 1000

Full Float Methodology Vs. Free Float Methodology of

Market Capitalisation

• Market capitalization is nothing, but the outstanding number of shares,

multiplied by the current market price of a stock.

• For example, if a company has 2,00,000 outstanding shares and the price

of the share is Rs 10, we could say that the outstanding market cap of the

company is Rs 2 million.

• Free float market capitalization excludes: (i) Share which are locked in (ii)

Shares that are held by promoters (iii) Shares acquired by Foreign direct

investment (iv) Shares held by Government

• Whereas, in full float market capitalization all above category of shares

are considered.

• For calculation of sensex and Nifty free float capitalisation is considered.

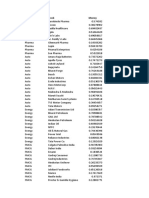

Securities to be included in NIFTY

Full List of Nifty 50 Companies

Industry Security Name Weightage

(%)

Bajaj Auto Ltd. 0.74

Hero MotoCorp Ltd. 0.58

Eicher Motors Ltd. 0.51

Automobile

Mahindra & Mahindra Ltd. 0.76

Maruti Suzuki India Ltd. 1.59

Tata Motors Ltd. 0.36

Grasim Industries Ltd. 0.52

Cement Shree Cement Ltd. 0.65

UltraTech Cement Ltd. 1.05

Cigarettes ITC Ltd. 4.18

Hindustan Unilever Ltd. 4.59

Britannia Industries Ltd. 0.88

Consumer Goods Nestle India Ltd. 1.62

Titan Company Ltd. 1.09

Asian Paints Ltd. 2.1

Oil & Natural Gas Corporation Ltd. 0.7

NTPC Ltd. 1.14

Power Grid Corporation of India Ltd. 1.14

Energy Bharat Petroleum Corporation Ltd. 0.71

Indian Oil Corporation Ltd. 0.58

Reliance Industries Ltd. 10.06

GAIL (India) Ltd. 0.4

Engineering Larsen & Toubro Ltd. 2.79

Fertilizer UPL Ltd. 0.5

Axis Bank Ltd. 2.39

HDFC Bank Ltd. 10.42

ICICI Bank Ltd. 5.85

IndusInd Bank Ltd. 0.59

Financial Services Kotak Mahindra Bank Ltd. 4.85

State Bank of India 2.11

Bajaj Finance Ltd. 1.64

Bajaj Finserv Ltd. 0.78

Housing Development Finance Corporation Ltd. 7.88

HCL Technologies Ltd. 1.32

Infosys Ltd. 6.56

Information Technology Tata Consultancy Services Ltd. 5.36

Tech Mahindra Ltd. 0.98

Wipro Ltd. 0.82

Media & Entertainment Zee Entertainment Enterprises Ltd. 0.32

Hindalco Industries Ltd. 0.39

Vedanta Ltd. 0.33

Metals & Mining JSW Steel Ltd. 0.41

Tata Steel Ltd. 0.57

Coal India Ltd. 0.82

Cipla Ltd. 0.6

Pharma Dr. Reddy’s Laboratories Ltd. 1.06

Sun Pharmaceutical Industries Ltd. 1.06

Shipping Adani Ports and Special Economic Zone Ltd. 0.54

Telecom Bharti Infratel Ltd. 0.38

Stocks to be Included in Sensex

Last Mkt Cap

Company Name Industry Change %Chg

Price (Rs cr)

Asian Paints Paints 2,072.00 10.25 0.50 198,745.78

Axis Bank Bank - Private 488.80 16.55 3.50 149,580.67

Bajaj Auto Automobile - 2 & 3 Whee 3,038.35 -6.30 -0.21 87,919.83

lers

Bajaj Finance Finance - NBFC 3,218.80 -11.35 -0.35 193,960.81

Bajaj Finserv Finance - Investment 5,957.50 4.75 0.08 94,806.04

Bharti Airtel Telecommunication - Ser 396.75 -4.80 -1.20 216,449.24

vice Provider

HCL Tech IT Services & Consulting 846.00 18.90 2.29 229,576.07

HDFC Finance - Housing 2,028.00 67.95 3.47 364,189.44

HDFC Bank Bank - Private 1,207.10 8.10 0.68 664,352.13

HUL Household & Personal Pr 2,173.95 23.20 1.08 510,781.78

oducts

ICICI Bank Bank - Private 411.35 15.40 3.89 283,696.37

IndusInd Bank Bank - Private 622.25 14.20 2.34 47,070.21

Infosys IT Services & Consulting 1,120.95 -6.65 -0.59 477,458.79

ITC Cigarettes/Tobacco 167.20 1.45 0.87 205,740.21

Kotak Mahindra Bank - Private 1,365.30 28.75 2.15 270,246.72

Larsen Engineering & Constructi 891.20 -3.00 -0.34 125,127.59

on

M&M Automobile - Auto & Truc 602.50 -3.95 -0.65 74,902.35

k Manufacturers

Maruti Suzuki Automobile - Passenger C 6,856.85 -40.20 -0.58 207,131.77

ars

Nestle Consumer Food 15,742.00 307.80 1.99 151,777.62

NTPC Power Generation/Distri 80.90 0.55 0.68 80,046.97

bution

ONGC Oil Exploration and Produ 69.15 1.95 2.90 86,992.63

ction

Power Grid Corp Power Generation/Distri 160.20 1.25 0.79 83,810.07

bution

Reliance Oil Exploration and Produ 2,209.75 34.25 1.57 1,424,198.78

ction

SBI Bank - Public 200.65 4.85 2.48 179,072.33

Sun Pharma Pharmaceuticals & Drugs 485.10 -1.75 -0.36 116,391.74

Tata Steel Iron & Steel 395.65 1.80 0.46 44,569.56

TCS IT Services & Consulting 2,714.80 -47.70 -1.73 1,018,697.40

Tech Mahindra IT Services & Consulting 830.15 7.35 0.89 80,260.88

Titan Company Diamond & Jewellery 1,218.00 -5.10 -0.42 108,132.35

UltraTechCement Cement 4,515.80 36.05 0.80 130,339.34

Bull Market

• Bull markets are defined by the market going up

aggressively over a period of time. As the market starts

to rise, there becomes more and more greed in the

stock market.

• What Causes a Bull Market?

• Though a wide range of different factors contributes to a bull market, the two

largest are usually

• A strong economy

• High employment levels across the board

Bear Market

• The bear market definition is exactly the opposite of a bull

market. It’s a market where quarter after quarter the market is

moving down. That signals a bear market, and when that

happens people start to get really scared about putting money

into the stock market.

Factors affecting Stock market

• Supply and Demand

• Company related factors

• Investors Sentiment (Bullish & Bearish )

• Interest Rates (Interest Rate Increases Market

Goes down and Vice versa)

• Political Factor

• Natural Calamities

• Exchange Rate (Domestic currency depreciates,

the stock market tends to go down)

You might also like

- Tata Nano Case (Questions Answers)Document4 pagesTata Nano Case (Questions Answers)erfan441790100% (4)

- Basic EconomicsDocument11 pagesBasic EconomicsKevin AycockNo ratings yet

- Top Indian Companies by Nifty 50 WeightageDocument1 pageTop Indian Companies by Nifty 50 WeightageMadhavesh Kulkarni100% (4)

- Interwood MobelDocument32 pagesInterwood MobelHSNo ratings yet

- Samir Amin-The Liberal Virus Permanent War and The Americanization of The World - Aakar Books (2006)Document120 pagesSamir Amin-The Liberal Virus Permanent War and The Americanization of The World - Aakar Books (2006)PericoiNo ratings yet

- SR - No. Company Name Sector WeightageDocument2 pagesSR - No. Company Name Sector WeightageChellapandiNo ratings yet

- Common Stocks Across MF Schemes ReportDocument4 pagesCommon Stocks Across MF Schemes Reportbidar007No ratings yet

- MGT436 Security Analysis and Portfolio ManagementDocument3 pagesMGT436 Security Analysis and Portfolio ManagementSuraj ApexNo ratings yet

- SL No Name of The Company Industry The Weightage (%)Document2 pagesSL No Name of The Company Industry The Weightage (%)Ishleen KaurNo ratings yet

- Isha Excel Anand 123Document162 pagesIsha Excel Anand 123ISHA AGGARWALNo ratings yet

- Nifty and BankNifty Constituents and WeightageDocument5 pagesNifty and BankNifty Constituents and WeightageDavid JosephNo ratings yet

- Nifty 50 Stocks ListDocument2 pagesNifty 50 Stocks ListNaveen ShivegowdaNo ratings yet

- Top Holdings of Principal Emerging Bluechip Fund (GDocument11 pagesTop Holdings of Principal Emerging Bluechip Fund (GPahe LambNo ratings yet

- Equity Fund (ULIF001100105EQUITY FND111) : Issuer Name % To AUM Issuer Name % To AUM Equity 89.73%Document1 pageEquity Fund (ULIF001100105EQUITY FND111) : Issuer Name % To AUM Issuer Name % To AUM Equity 89.73%Ram KumarNo ratings yet

- WEIGHTAGE CHART - Sheet1Document1 pageWEIGHTAGE CHART - Sheet1Jot DhillonNo ratings yet

- Nifty 50 Stocks Weightage 2020Document2 pagesNifty 50 Stocks Weightage 2020raajiNo ratings yet

- Nifty 50 Stocks Weightage: SR - No. Company Name Sector WeightageDocument2 pagesNifty 50 Stocks Weightage: SR - No. Company Name Sector WeightageJennifer NievesNo ratings yet

- Security Name Industry Weightage %Document5 pagesSecurity Name Industry Weightage %Reshika BagariaNo ratings yet

- Round 2 Moolyankan2021Document2 pagesRound 2 Moolyankan2021Mahek MallNo ratings yet

- Nifty 50 Stock List For 2022 and Their WeightageDocument3 pagesNifty 50 Stock List For 2022 and Their WeightageVikas KarandeNo ratings yet

- April 30, 2020: Constituents of NIFTY 50Document2 pagesApril 30, 2020: Constituents of NIFTY 50amitNo ratings yet

- NIFTY 50 Nov2020Document2 pagesNIFTY 50 Nov2020Games ZoneNo ratings yet

- Nifty 50 Share by WeightedDocument2 pagesNifty 50 Share by WeightedsaurabhsarafNo ratings yet

- Aditya Birla Sun Life Equity FundDocument8 pagesAditya Birla Sun Life Equity FundManmohan TiwariNo ratings yet

- Constituents of Nifty 50 Index and their WeightageDocument2 pagesConstituents of Nifty 50 Index and their WeightagenomihNo ratings yet

- NIFTY Dividend Opportunities 50 Apr2020Document2 pagesNIFTY Dividend Opportunities 50 Apr2020amitNo ratings yet

- ICICI Prudential Long Term Equity Fund (Tax Saving)Document17 pagesICICI Prudential Long Term Equity Fund (Tax Saving)purvi jainNo ratings yet

- Franklin India Bluechip Fund portfolio breakdownDocument1 pageFranklin India Bluechip Fund portfolio breakdownAatish TNo ratings yet

- PMS Entire Portfolios 30 June 2022Document14 pagesPMS Entire Portfolios 30 June 2022Deepak GoyalNo ratings yet

- List of Companies of IndiaDocument18 pagesList of Companies of IndiaKiran SonarNo ratings yet

- ESG Funding IndiaDocument14 pagesESG Funding IndiaJoel SamuelNo ratings yet

- Template Portfolio Disclosure - February 2018-DerivativeDocument1 pageTemplate Portfolio Disclosure - February 2018-DerivativeReedos LucknowNo ratings yet

- Ector Constituents Cigarettes PharmaceuticalsDocument4 pagesEctor Constituents Cigarettes PharmaceuticalsBalasanthosh SountharajanNo ratings yet

- World Rank Company Industry Revenue (Billion $) Profits (Billion $) Assets (Billion $) Market Value (Billion $)Document13 pagesWorld Rank Company Industry Revenue (Billion $) Profits (Billion $) Assets (Billion $) Market Value (Billion $)Pankaj SinhaNo ratings yet

- CMIE Beta values for companies listed on BSE/NSEDocument735 pagesCMIE Beta values for companies listed on BSE/NSEAjay VaswaniNo ratings yet

- BNP Paribas Equity Fund (Portfolio Holdings) : CompanyDocument15 pagesBNP Paribas Equity Fund (Portfolio Holdings) : CompanyPahe LambNo ratings yet

- Nippon India Index Funds - Lower Cost Index InvestingDocument48 pagesNippon India Index Funds - Lower Cost Index InvestingNiks MystryNo ratings yet

- Ethical Fun9Document1 pageEthical Fun9Nitish KumarNo ratings yet

- NIFTY Next 50 Apr2020Document2 pagesNIFTY Next 50 Apr2020amitNo ratings yet

- Group 11 CF-2 Assignment (24-3-23)Document6 pagesGroup 11 CF-2 Assignment (24-3-23)Ankit RajNo ratings yet

- Bse Nse Secotr RepresentationDocument3 pagesBse Nse Secotr RepresentationritausasinghNo ratings yet

- Equity FundDocument1 pageEquity FundPradeep KumarNo ratings yet

- Top Indian companies by sectorDocument288 pagesTop Indian companies by sectorM Stags100% (1)

- Equity FundDocument1 pageEquity FundPradeep KumarNo ratings yet

- Fund ComparisionDocument14 pagesFund ComparisionAmit PatelNo ratings yet

- Midcap FundDocument1 pageMidcap FundSureshKavaliNo ratings yet

- Basicsofsharemarket 170327071022 PDFDocument33 pagesBasicsofsharemarket 170327071022 PDFHEROKNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- April 30, 2020: Constituents of NIFTY 100Document4 pagesApril 30, 2020: Constituents of NIFTY 100amitNo ratings yet

- Company Name P/E P/BDocument309 pagesCompany Name P/E P/BAchilles AkhilNo ratings yet

- Money FlowDocument6 pagesMoney FlowsachinNo ratings yet

- Equity FundDocument1 pageEquity FundANKIT SINGHNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Price of Top 25 CompaniesDocument2 pagesPrice of Top 25 Companiesleyacow919No ratings yet

- Debt Free CompaniesDocument43 pagesDebt Free CompaniesWajid KNo ratings yet

- Investing Feb27Document160 pagesInvesting Feb27mdyakubhnk85No ratings yet

- Midcap FundDocument1 pageMidcap FundAnurag NahataNo ratings yet

- April 30, 2020: Constituents of NIFTY Services SectorDocument2 pagesApril 30, 2020: Constituents of NIFTY Services SectoramitNo ratings yet

- JM Midcap Oct 30Document1 pageJM Midcap Oct 30yugendhar janjiralaNo ratings yet

- Top 500 MNCDocument10 pagesTop 500 MNCATUL KUMARNo ratings yet

- 11 - Chapter 5 PDFDocument48 pages11 - Chapter 5 PDFXyzNo ratings yet

- Sr. No. Symbol Company Name Market Capitalisation (In Lakhs)Document12 pagesSr. No. Symbol Company Name Market Capitalisation (In Lakhs)Anish ShahNo ratings yet

- Top 5 Indian Companies: Presented By: Mohit Sharma MBA (IT-Operations) 50801043Document18 pagesTop 5 Indian Companies: Presented By: Mohit Sharma MBA (IT-Operations) 50801043Manu SharmaNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Industrial Visit Report Coca Cola: Institute of Management Sciences LucknowDocument29 pagesIndustrial Visit Report Coca Cola: Institute of Management Sciences Lucknowvishal kasaudhanNo ratings yet

- Working Capital Management at NALCO: Analysis and RecommendationsDocument11 pagesWorking Capital Management at NALCO: Analysis and RecommendationsAniket JaggiNo ratings yet

- Chapter - 12 Manufacturing Account - MCQDocument3 pagesChapter - 12 Manufacturing Account - MCQNRKNo ratings yet

- Avenue E-Commerce Limited: 00009595951004031712 Crate IdDocument2 pagesAvenue E-Commerce Limited: 00009595951004031712 Crate IdAbhishek LodhaNo ratings yet

- GODFREY PHILLIPS INDIA LTD - CompanyAnalysis2934234Document5 pagesGODFREY PHILLIPS INDIA LTD - CompanyAnalysis2934234yaiyajieNo ratings yet

- Manufacture Company DetailsDocument23 pagesManufacture Company Detailsums 3vikram0% (1)

- MCX Options - Hedging Instruments for Bullion & Jewellery industryDocument29 pagesMCX Options - Hedging Instruments for Bullion & Jewellery industryOlivia JacksonNo ratings yet

- List of Media Orgs With HK GIS AccessDocument5 pagesList of Media Orgs With HK GIS AccessHKFPNo ratings yet

- 3.1 Money and Finance: Igcse /O Level EconomicsDocument17 pages3.1 Money and Finance: Igcse /O Level EconomicszainNo ratings yet

- 048-2014 Farm To Market RoadsDocument2 pages048-2014 Farm To Market RoadsSbGuinobatan100% (2)

- Position Paper About Federalism in The PHDocument4 pagesPosition Paper About Federalism in The PHRuru ShiNo ratings yet

- SssssDocument19 pagesSssssHaura Latifa YumnaNo ratings yet

- Financial Engineering I Syllabus JohnsonDocument3 pagesFinancial Engineering I Syllabus JohnsonDaniel ChuiNo ratings yet

- Company contact list for Pune areaDocument5 pagesCompany contact list for Pune areaSunnyNo ratings yet

- EC2301 International Economics - Re-Exam 190827 PDFDocument3 pagesEC2301 International Economics - Re-Exam 190827 PDFgulzira3amirovnaNo ratings yet

- Warren BuffetDocument8 pagesWarren BuffetRinkesh JainNo ratings yet

- Liza Case AnalysisDocument2 pagesLiza Case AnalysismarybernadithNo ratings yet

- Euro DisneyDocument2 pagesEuro DisneySourav DattaNo ratings yet

- Instruction On Installation of EM2817 Series Main Drain: Models: EM2817V (A1) EM2817V (A2)Document2 pagesInstruction On Installation of EM2817 Series Main Drain: Models: EM2817V (A1) EM2817V (A2)sin sombathNo ratings yet

- Full Thread CatalogDocument5 pagesFull Thread CatalogZahin BasriNo ratings yet

- Test Bank For Contemporary Labor Economics 10th Edition by McconnellDocument3 pagesTest Bank For Contemporary Labor Economics 10th Edition by McconnellJustin Zeches100% (28)

- Newspaper Stratergy (Good)Document50 pagesNewspaper Stratergy (Good)Alan Chan Tee SiongNo ratings yet

- E StatementDocument1 pageE Statementmuzamilshah1234asNo ratings yet

- City Project and Public Space (Urban and Landscape Perspectives) PDFDocument315 pagesCity Project and Public Space (Urban and Landscape Perspectives) PDFAnna OdroboNo ratings yet

- Internal Auditors Are Business PartnerDocument2 pagesInternal Auditors Are Business PartnerValuers NagpurNo ratings yet

- Jetty and Mining Project Cost EstimatesDocument2 pagesJetty and Mining Project Cost EstimatesJonas Arifin0% (1)