Professional Documents

Culture Documents

Mar. 31 Apr. 1 Assets

Uploaded by

amie honnagOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mar. 31 Apr. 1 Assets

Uploaded by

amie honnagCopyright:

Available Formats

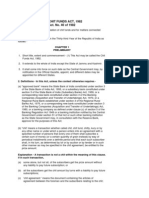

Problem- The following data is obtained from a single entry records kept by Mikko Tan, a

proprietor of a small hardware supply store:

Mar. 31 Apr. 1

Assets

Cash 88,600 76,000

Accounts Receivable 223,000 148,000

Notes Receivable (Trade) 24,000 15,000

Accrued Interest Receivable 3,400 2,600

Merchandise Inventory 138,000 103,000

Supplies on Hand 1,700 800

Prepaid Interest Expense 1,200 -

Furniture and Equipment 88,000 64,000

Accumulated Depreciation-Furniture and Equipment 28,000 20,000

Liabilities

Notes Payable 50,000 -

Accounts Payable 72,500 45,000

Accrued Salary Expense 1,900 1,600

Deferred Rent Revenue 3,200 2,700

An analysis of the store’s business papers showed the following supplementary data:

1. Sales returns and allowances amounting to P3,700 were credited to customers accounts.

2. Purchase discounts of P4,600 were received from trade creditors.

3. An old equipment was sold for P4,000, as recorded in cash receipts. The equipment was

50% depreciated at the time of its sale.

4. The cash receipts include the proceeds of bank loans for which notes of P80,000 were

issued. The interest of P3,500 had been deducted by the bank in advance.

5. Partial payment of P30,000 was made on the notes payable.

The cash records show the following:

Balance, April 1,2020 P76, 000

Receipts:

Cash Sales 39,000

On accounts and notes receivable arising from sales 325,000

From rental of office space 27,000

From interest revenue 800

From sale of equipment 4,000

From discounting own notes at bank 76,500

From additional investment 20,000 , 492,300

Total 568,300

Payments:

On accounts payable for purchases 303,000

For salaries 64,000

For supplies 3,200

For acquisition of new equipment 36,000

For miscellaneous expenses 8,500

To bank on notes payable 30,000

Proprietor’s withdrawal 35,000 , 479,700

Balance, March 31, 2021 88,600

Required:

1. Compute the profit under the single entry method.

2. Financial Statements under the accrual basis of accounting accompanied by

supporting computations.

You might also like

- Practice Set For Intermediate AccountingDocument2 pagesPractice Set For Intermediate AccountingmddddddNo ratings yet

- Dams Company Income Statement and Balance Sheet ProblemsDocument3 pagesDams Company Income Statement and Balance Sheet ProblemsHanjin Margaret ZaportezaNo ratings yet

- Handout - CADocument10 pagesHandout - CAArfeen ArifNo ratings yet

- Financial Statements With Notes To FsDocument2 pagesFinancial Statements With Notes To Fsdimpy dNo ratings yet

- Chapter 3. Exercises Income StatementDocument6 pagesChapter 3. Exercises Income StatementHECTOR ORTEGANo ratings yet

- AC3202 Corporate Accounting I Semester A 2022/23 Week 2 Questions Financial StatementsDocument9 pagesAC3202 Corporate Accounting I Semester A 2022/23 Week 2 Questions Financial StatementsLong LongNo ratings yet

- CH 3 In-Class ExercisesDocument2 pagesCH 3 In-Class ExercisesAbdullah alhamaadNo ratings yet

- Asawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueDocument22 pagesAsawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueLyka RoguelNo ratings yet

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- Global Corporation Liquidation Statement AnalysisDocument14 pagesGlobal Corporation Liquidation Statement AnalysisKez MaxNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- ADVANCED ACC - Revision ParkDocument20 pagesADVANCED ACC - Revision ParkTimothy KawumaNo ratings yet

- Baf 1201 Fa2Document3 pagesBaf 1201 Fa2ReginaNo ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- AssignmentDocument3 pagesAssignmentER ABHISHEK MISHRANo ratings yet

- Adjusting Entries From The Desk F JASDocument3 pagesAdjusting Entries From The Desk F JASMalik of ChakwalNo ratings yet

- Lecture 4 Part 2 - QuestionDocument4 pagesLecture 4 Part 2 - QuestionIsyraf Hatim Mohd TamizamNo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- 162 003Document4 pages162 003Angelli LamiqueNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- Tax ProbDocument3 pagesTax ProbJohn Paul Acebedo14% (7)

- Accountancy Auditing 2018Document7 pagesAccountancy Auditing 2018Abdul basitNo ratings yet

- Quiz - Topic 5Document3 pagesQuiz - Topic 5mariakate LeeNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- Financial Accounting Manual 2023Document89 pagesFinancial Accounting Manual 2023Annel RamírezNo ratings yet

- Question 2 CashFlowDocument6 pagesQuestion 2 CashFlowsuraj lamaNo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- Final Acc Numericals1Document3 pagesFinal Acc Numericals1Asvag OndaNo ratings yet

- Integrated Accounting SystemDocument4 pagesIntegrated Accounting SystemKitty CattyNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- CPA Financial Accounting Exam PrepDocument10 pagesCPA Financial Accounting Exam PrepTuryamureeba JuliusNo ratings yet

- SFP and SCF - Practice QuestionsDocument3 pagesSFP and SCF - Practice QuestionsFazelah YakubNo ratings yet

- Accountancy-I Subjective PDFDocument4 pagesAccountancy-I Subjective PDFM Umar MughalNo ratings yet

- Accountancy and Auditing-2018Document6 pagesAccountancy and Auditing-2018Aisar Ud DinNo ratings yet

- Intermediate Accounting 3 Comprehensive Income ProblemsDocument2 pagesIntermediate Accounting 3 Comprehensive Income ProblemsDarlyn Dalida San PedroNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingXen XeonNo ratings yet

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- CH 3 In-Class Exercises SOLUTIONS CorrectedDocument2 pagesCH 3 In-Class Exercises SOLUTIONS CorrectedAbdullah alhamaadNo ratings yet

- Financial Reporting, Statement & Analysis - Assignment1Document5 pagesFinancial Reporting, Statement & Analysis - Assignment1sumanNo ratings yet

- Problem Set 3 Financial Statements BS SE S18Document8 pagesProblem Set 3 Financial Statements BS SE S18Nust Razi100% (1)

- Cielo Corp accounting adjustmentsDocument3 pagesCielo Corp accounting adjustmentsCarina Mae Valdez ValenciaNo ratings yet

- Practice Comptency Exam 124Document3 pagesPractice Comptency Exam 124Ivan Pacificar BioreNo ratings yet

- Solution - Problem 13-18Document45 pagesSolution - Problem 13-18Angelika Delosreyes VergaraNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Partnership Formation - Activity PDFDocument2 pagesPartnership Formation - Activity PDFWilliam TabuenaNo ratings yet

- M.B.A. (2013 Pattern) 2017 PDFDocument125 pagesM.B.A. (2013 Pattern) 2017 PDFAkdev 118No ratings yet

- ASSIGNMENTSDocument13 pagesASSIGNMENTSJpzelleNo ratings yet

- C 1Document10 pagesC 1biniamNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Income Statement & Closing Entries ProblemDocument1 pageIncome Statement & Closing Entries ProblemLiwliwa BrunoNo ratings yet

- CA Intermediate Accounting Test Paper Accounts from Incomplete RecordsDocument3 pagesCA Intermediate Accounting Test Paper Accounts from Incomplete RecordsAryan GuptaNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Ias 1 - Questions..Document8 pagesIas 1 - Questions..Timothy KawumaNo ratings yet

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Project 2nd Quarter AccountingDocument3 pagesProject 2nd Quarter AccountingRussell Von DomingoNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Dayag Prelims HO - BRDocument56 pagesDayag Prelims HO - BRamie honnagNo ratings yet

- mmw-1 1Document17 pagesmmw-1 1amie honnagNo ratings yet

- Cfe 104Document5 pagesCfe 104amie honnagNo ratings yet

- Stewart Ian Natures Numbers - The Unreal Reality PDFDocument179 pagesStewart Ian Natures Numbers - The Unreal Reality PDFAngel Carbonell100% (1)

- Lesson 2 - Self Test - The Global EconomyvDocument1 pageLesson 2 - Self Test - The Global Economyvamie honnagNo ratings yet

- Sales Finals ReviewerDocument30 pagesSales Finals Revieweramie honnagNo ratings yet

- Notes Obligations and Contracts - Compressed.2015Document29 pagesNotes Obligations and Contracts - Compressed.2015Angelo JavierNo ratings yet

- Question Final ExamDocument2 pagesQuestion Final ExamCaroline WijayaNo ratings yet

- HDFC Life AR 2020 - 260620 PDFDocument431 pagesHDFC Life AR 2020 - 260620 PDFasdNo ratings yet

- Adobe India Benefits SummaryDocument3 pagesAdobe India Benefits SummaryShobhita SoodNo ratings yet

- PRACTICE-SET-IN-BASIC-ACCOUNTING-converted (Repaired)Document33 pagesPRACTICE-SET-IN-BASIC-ACCOUNTING-converted (Repaired)mary josefaNo ratings yet

- IOS Sums PDFDocument2 pagesIOS Sums PDFBeing HumaneNo ratings yet

- Math 1050 - Credit Card AssignmentDocument3 pagesMath 1050 - Credit Card Assignmentapi-501149352No ratings yet

- Capital StructureDocument13 pagesCapital StructureRam SharmaNo ratings yet

- FinalDocument2 pagesFinalSherna Jinayon100% (1)

- Form 207 See Rule 23 Challan (Under The Gujarat Value Added Tax Act, 2003)Document1 pageForm 207 See Rule 23 Challan (Under The Gujarat Value Added Tax Act, 2003)Anand KatariyaNo ratings yet

- Assignment of Lease Option AgreementDocument3 pagesAssignment of Lease Option AgreementAlberta Real Estate100% (1)

- Scrip Code Scrip NameDocument5 pagesScrip Code Scrip NamenitmemberNo ratings yet

- Manish Negi A1412020004 Interest Certificate 2015-16Document1 pageManish Negi A1412020004 Interest Certificate 2015-16VIKAS GARG100% (1)

- Brokers, Auctioneers, Del Credere Agents, Persons Entrusted With Money For Obtaining Sales and Insurance AgentsDocument3 pagesBrokers, Auctioneers, Del Credere Agents, Persons Entrusted With Money For Obtaining Sales and Insurance AgentsRanga HkNo ratings yet

- The Chit Funds ActDocument5 pagesThe Chit Funds ActGuru RamanathanNo ratings yet

- Financial Planning of Financial InstitutionsDocument3 pagesFinancial Planning of Financial InstitutionsSoniya Omir VijanNo ratings yet

- SBI Life eShield protects families affordablyDocument6 pagesSBI Life eShield protects families affordablyAnkit VyasNo ratings yet

- Court Rules Memorandum Checks Fall Under Bouncing Check LawDocument2 pagesCourt Rules Memorandum Checks Fall Under Bouncing Check LawRon Jacob AlmaizNo ratings yet

- Mini Practice Set 6 QuickBooks GuideDocument3 pagesMini Practice Set 6 QuickBooks GuideJoseph SalidoNo ratings yet

- Sps. Lambino v. Hon. Presiding JudgeDocument3 pagesSps. Lambino v. Hon. Presiding JudgeKobe Lawrence Veneracion100% (1)

- SBI Life QuestionnaireDocument7 pagesSBI Life QuestionnaireShubham Patil0% (1)

- Expectations Investing: Analyzing Stock Prices to Anticipate Expectations RevisionsDocument35 pagesExpectations Investing: Analyzing Stock Prices to Anticipate Expectations RevisionsThanh Tuấn100% (2)

- Reliance General Insurance Company LimitedDocument15 pagesReliance General Insurance Company LimitedSakshi DamwaniNo ratings yet

- Liabilities Deferred TaxDocument3 pagesLiabilities Deferred TaxHikari0% (1)

- Tax Deductions and Credits for Individuals and CorporationsDocument9 pagesTax Deductions and Credits for Individuals and CorporationsNhajNo ratings yet

- LAW 240 - Hire PurchaseDocument1 pageLAW 240 - Hire Purchaseshafika azmanNo ratings yet

- SOBREJUANITE v. ASB DEVELOPMENT CORPORATION ruling on corporate rehabilitation suspensionDocument1 pageSOBREJUANITE v. ASB DEVELOPMENT CORPORATION ruling on corporate rehabilitation suspensionFrancis PunoNo ratings yet

- Revenue Regulations On Retirement Benefit Plans PDFDocument15 pagesRevenue Regulations On Retirement Benefit Plans PDFJadeNo ratings yet

- Your TM Bill: Page 1 of 5 Level 51, Menara TM, 50672 Kuala Lumpur ST ID: W10-1808-31001554Document5 pagesYour TM Bill: Page 1 of 5 Level 51, Menara TM, 50672 Kuala Lumpur ST ID: W10-1808-31001554lemNo ratings yet

- Moodys Charter School RiskDocument12 pagesMoodys Charter School Risksmf 4LAKidsNo ratings yet

- General Banking Activities (CBS)Document15 pagesGeneral Banking Activities (CBS)Ifrat SnigdhaNo ratings yet