Professional Documents

Culture Documents

Intermediate Accounting 3 Comprehensive Income Problems

Uploaded by

Darlyn Dalida San PedroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermediate Accounting 3 Comprehensive Income Problems

Uploaded by

Darlyn Dalida San PedroCopyright:

Available Formats

INTERMEDIATE ACCOUNTING 3

STATEMENT OF COMPREHENSIVE INCOME

PROBLEM 1

AKATSUKI COMPANY provided the following information for 2019:

Sales 7,500,000

Inventories - January 1

Raw materials 200,000

Goods in process 240,000

Finished goods 360,000

Inventories - December 31

Raw materials 280,000

Goods in process 170,000

Finished goods 300,000

Purchases 3,000,000

Direct labor 950,000

Indirect labor 250,000

Superintendence 210,000

Light, heat and power 320,000

Rent - factory building 120,000

Repair and maintenance - machinery 50,000

Factory supplies used 110,000

Sales salaries 400,000

Advertising 160,000

Depreciation - store equipment 70,000

Office salaries 150,000

Depreciation - office equipment 40,000

Depreciation - machinery 60,000

Sales returns and allowances 50,000

Interest income 10,000

Gain on sale of equipment 100,000

Delivery expenses 200,000

Accounting and legal fees 150,000

Office expenses 250,000

Earthquake loss 300,000

Gain from expropriation of asset 100,000

Income tax expense 320,000

Required:

a. Prepare a statement of Cost of Goods Manufactured.

b. Prepare an Income Statement using the "function of expense" method with supporting notes.

c. Prepare an Income Statement using the "nature of expense" method with supporting notes.

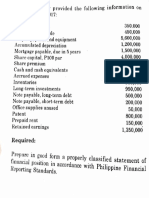

PROBLEM 2

The adjusted trial balance of ANBU COMPANY included the following accounts on December 31, 2019:

Sales 9,750,000

Share of profit of associate 150,000

Other income 300,000

Decrease in inventory of finished goods 250,000

Raw materials and consumables used 3,500,000

Employee benefit expense 1,500,000

Translation gain on foreign operation 300,000

Depreciation 450,000

Impairment loss on property 800,000

Finance costs 350,000

Other expenses 450,000

Income tax expense 900,000

Unealized gain on option contract designated as cash flow hedge 200,000

Required:

Prepare a single statement of comprehensive income for the year ended December 31, 2019.

You might also like

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- Chapter 6 Exercise Activity With AnswersDocument25 pagesChapter 6 Exercise Activity With Answers乙คckคrψ YTNo ratings yet

- Ronald Company 2019 Costs, Sales, IncomeDocument3 pagesRonald Company 2019 Costs, Sales, IncomeKean Brean GallosNo ratings yet

- Masay Company's Statement of Comprehensive IncomeDocument24 pagesMasay Company's Statement of Comprehensive Incomejake doinog88% (16)

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- Statement of Comprehensive Income - ExerciseDocument2 pagesStatement of Comprehensive Income - ExerciseMary Kate OrobiaNo ratings yet

- acctng-1-Quiz-FS Begino, Vanessa Jamila DDocument4 pagesacctng-1-Quiz-FS Begino, Vanessa Jamila DVanessa JamilaNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- Cost Sheet Problems for Manufacturing BusinessDocument1 pageCost Sheet Problems for Manufacturing BusinessK DIVYANo ratings yet

- Manuel L Quezon University SOAB Arts Integrated Review Statement of Financial Position Income StatementDocument5 pagesManuel L Quezon University SOAB Arts Integrated Review Statement of Financial Position Income StatementP De GuzmanNo ratings yet

- Cost of Gooods Manufactured 5,060,000Document5 pagesCost of Gooods Manufactured 5,060,000yayayaNo ratings yet

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- 162 003Document4 pages162 003Angelli LamiqueNo ratings yet

- Manufacturing Accounts - Extra Questions - A LevelDocument6 pagesManufacturing Accounts - Extra Questions - A LevelMUSTHARI KHANNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- Manufacturing Operations Overhead ScheduleDocument1 pageManufacturing Operations Overhead ScheduleArman DizonNo ratings yet

- Vanilla Food Processing Company Financial StatementsDocument1 pageVanilla Food Processing Company Financial StatementsMikko Gabrielle LangbidNo ratings yet

- Cost Sheet for Watkins and Company LimitedDocument13 pagesCost Sheet for Watkins and Company LimitedSoumendra RoyNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Chapter 4 - Ia3Document10 pagesChapter 4 - Ia3Xynith Nicole RamosNo ratings yet

- CFAS_QUIZ_Santiago CityDocument1 pageCFAS_QUIZ_Santiago CityMikaella SaduralNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- QUIZ 2-PART 2Document1 pageQUIZ 2-PART 2Jaypee BignoNo ratings yet

- Ia3 Quiz 3Document5 pagesIa3 Quiz 3Magdaraog LutzNo ratings yet

- Laboratory Exercise 1 - Intermediate Accounting 3Document1 pageLaboratory Exercise 1 - Intermediate Accounting 3Zeniah LouiseNo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- Cost Sheet CalculationsDocument2 pagesCost Sheet CalculationsKajal YadavNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- 2.manufacturing Accounts IllustrationDocument2 pages2.manufacturing Accounts Illustrationdaniel.maina2005No ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- Cost Sheet - CWDocument16 pagesCost Sheet - CWkushgarg627No ratings yet

- Cfas ActivitiesDocument10 pagesCfas ActivitiesAntonNo ratings yet

- Module 2 - Problems On Cost SheetDocument8 pagesModule 2 - Problems On Cost SheetSupreetha100% (1)

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Hasan Yaseen 9990Document3 pagesHasan Yaseen 9990Haris KhanNo ratings yet

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnNo ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Cost Sheet 1Document4 pagesCost Sheet 1Bhavya GroverNo ratings yet

- Audit Bond Interest Income and Advertising Expense AdjustmentsDocument4 pagesAudit Bond Interest Income and Advertising Expense AdjustmentsJoody CatacutanNo ratings yet

- Assignment On TaxationDocument2 pagesAssignment On TaxationKal KalNo ratings yet

- Statement of Comprehensive Income - PROBLEMSDocument20 pagesStatement of Comprehensive Income - PROBLEMSSarah GNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Statement of Comprehensive Income - Ia3Document16 pagesStatement of Comprehensive Income - Ia3SharjaaahNo ratings yet

- Manufacturing Costs and COGSDocument4 pagesManufacturing Costs and COGSNia BranzuelaNo ratings yet

- 121 Class Project Financials and Accounts ProblemsDocument2 pages121 Class Project Financials and Accounts ProblemsJames Darwin TehNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Managerial Accounting - ExercisesDocument60 pagesManagerial Accounting - ExercisesNúmero CuatroNo ratings yet

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- Group 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Document31 pagesGroup 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Carla TalanganNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- l2 VolleyballDocument67 pagesl2 VolleyballDarlyn Dalida San PedroNo ratings yet

- Accounting Policies, Change in Acct Estimate and ErrorDocument4 pagesAccounting Policies, Change in Acct Estimate and ErrorDarlyn Dalida San PedroNo ratings yet

- AUDIT OF SHAREHOLDER.docx PART 1Document2 pagesAUDIT OF SHAREHOLDER.docx PART 1Darlyn Dalida San PedroNo ratings yet

- L1 VolleyballDocument33 pagesL1 VolleyballRockheart 18No ratings yet

- Financial Reporting Objectives and ConceptsDocument14 pagesFinancial Reporting Objectives and ConceptsDarlyn Dalida San PedroNo ratings yet

- Activity 1 - Teams SportsDocument1 pageActivity 1 - Teams SportsDarlyn Dalida San PedroNo ratings yet

- Intermediate Accounting 3 Comprehensive Income ProblemsDocument2 pagesIntermediate Accounting 3 Comprehensive Income ProblemsDarlyn Dalida San PedroNo ratings yet

- Statement of Comprehensive Income LessonsDocument2 pagesStatement of Comprehensive Income LessonsDarlyn Dalida San PedroNo ratings yet

- Corp Gov Chapter 3 New UpdatedDocument10 pagesCorp Gov Chapter 3 New UpdatedDarlyn Dalida San PedroNo ratings yet

- Business Taxation 2 Lesson 1Document5 pagesBusiness Taxation 2 Lesson 1Darlyn Dalida San PedroNo ratings yet

- Activity 2. Effective Oral Communication San PedroDocument2 pagesActivity 2. Effective Oral Communication San PedroDarlyn Dalida San PedroNo ratings yet

- Statement of Comprehensive Income LessonsDocument2 pagesStatement of Comprehensive Income LessonsDarlyn Dalida San PedroNo ratings yet

- Activity 2. Effective Oral CommunicationDocument1 pageActivity 2. Effective Oral CommunicationDarlyn Dalida San PedroNo ratings yet

- Interim ReviewerDocument5 pagesInterim ReviewerDarlyn Dalida San PedroNo ratings yet

- Taxation Income Tax for IndividualsDocument12 pagesTaxation Income Tax for IndividualsDarlyn Dalida San PedroNo ratings yet

- FAR 3 PPT - Effective Interest Method - Discount and Serial BondsDocument7 pagesFAR 3 PPT - Effective Interest Method - Discount and Serial BondsErica CadagoNo ratings yet

- Vietnam Local Charges Service Fees May2023Document2 pagesVietnam Local Charges Service Fees May2023Mỹ Nhật NguyễnNo ratings yet

- In Voice 8077122617129115647Document2 pagesIn Voice 8077122617129115647Vibrant PixelsNo ratings yet

- Quotation Export PT Nas ChittagongDocument1 pageQuotation Export PT Nas Chittagongachmadrefani55No ratings yet

- Budimpestanska Konvencija o Prevozu Robe Unutrasnjim Vodnim PutevimaDocument31 pagesBudimpestanska Konvencija o Prevozu Robe Unutrasnjim Vodnim PutevimaMaja HadzicNo ratings yet

- Business Finance For Video Module 4Document9 pagesBusiness Finance For Video Module 4Bai NiloNo ratings yet

- BCG New Business Models For A New Global LandscapeDocument9 pagesBCG New Business Models For A New Global LandscapefdoaguayoNo ratings yet

- 10A. HDFC Jan 2021 EstatementDocument10 pages10A. HDFC Jan 2021 EstatementNanu PatelNo ratings yet

- MM Module 3 NotesDocument9 pagesMM Module 3 NotesJase JbmNo ratings yet

- SAMALA - DISCUSSION 6 (Audit of Statement of Cash Flow)Document2 pagesSAMALA - DISCUSSION 6 (Audit of Statement of Cash Flow)Jessalyn DaneNo ratings yet

- Indo Swiss Chemicals LTDDocument1 pageIndo Swiss Chemicals LTDX Legend GamerzNo ratings yet

- Chapter 7 Financial EvaluationDocument16 pagesChapter 7 Financial EvaluationMersha KassayeNo ratings yet

- International Business: The New Realities: Fifth EditionDocument51 pagesInternational Business: The New Realities: Fifth EditionEswari PerisamyNo ratings yet

- Propiedad Intelectual 2019Document134 pagesPropiedad Intelectual 2019Javier Alejandro SolanoNo ratings yet

- Feenstra and Taylor International Trade PDFDocument2 pagesFeenstra and Taylor International Trade PDFLouis0% (24)

- International Trade Theories: Course Pack - Unit II - IBEDocument29 pagesInternational Trade Theories: Course Pack - Unit II - IBESagar BhardwajNo ratings yet

- International Financial ManagementDocument6 pagesInternational Financial ManagementChristophe MathieuNo ratings yet

- Bab 3 Materi Keu InterDocument10 pagesBab 3 Materi Keu InterMaya MorukNo ratings yet

- Inventory Valuation Work Sheet 2023Document5 pagesInventory Valuation Work Sheet 2023Risha OsfordNo ratings yet

- Lesson 6 Contworld With ActivitiesDocument8 pagesLesson 6 Contworld With ActivitiesAngelyn MortelNo ratings yet

- HyperFund Standard Presentation 1 Oct 2021 Final-1Document35 pagesHyperFund Standard Presentation 1 Oct 2021 Final-1Rb BNo ratings yet

- Foreign Trade Policy: Ministry of Commerce and Industry Government of IndiaDocument70 pagesForeign Trade Policy: Ministry of Commerce and Industry Government of Indiavarun_bathulaNo ratings yet

- STATEMENT SUMMARYDocument7 pagesSTATEMENT SUMMARYDeeptimayee SahooNo ratings yet

- Supermarkets in The PhilippinesDocument8 pagesSupermarkets in The PhilippinesAngel Alejo Acoba100% (1)

- Ch.33. Aggregate Demand and Aggregate SupplyDocument28 pagesCh.33. Aggregate Demand and Aggregate Supplynguyenthinhuquynh2000mxNo ratings yet

- Document TypeDocument1 pageDocument TypeAdam JurekNo ratings yet

- Abigail 1Document1 pageAbigail 1AdebisiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Selvapriya LazerNo ratings yet

- TCW ReviewerDocument9 pagesTCW ReviewerMeghan OpenaNo ratings yet

- R10 Currency Exchange Rates SlidesDocument59 pagesR10 Currency Exchange Rates SlidesKalpesh PatilNo ratings yet