Professional Documents

Culture Documents

Assignment On Taxation

Uploaded by

Kal KalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment On Taxation

Uploaded by

Kal KalCopyright:

Available Formats

1.

The following data is given to ABC Business for the year ended Sene 30, 2010

Date Description Cost

January Balance 1000@60

February Purchase 800@62

March Purchase 600@62

April Purchase 400@64

May Purchase 700@64

June Purchase 500@68

July Purchase 300@68

August Purchase 900@70

September Purchase 200@70

October Purchase 1,100@74

November Purchase 800@74

December Purchase 700@76

No Plant Asset Original Additions Disposal Accumulated

cost Depreciation

1 Building 1,200,000 80,000 - 200,000

2 Equipment 120,000 40,000 10,000 20,000

3 Computer& accessories 100,000 40,000 12,000 30,000

Physical count indicates that there were 1,800 units on hand

Total revenue amounts to br. 2,000,000

Prepaid insurance that amounts to br. 12,000 for the period that covers 3 years

Interest on borrowed funds amounted to br. 400,000(National Bank of Ethiopia interest

rate is br. 10%)

Uncollectible accounts expense amounts to br. 15,000 where the tax auditor accepts only

60% of it

The cost of goods sold included an inventory amounting br. 20,000 covered by insurance

ABC Business

Income statement

For the year ended Sene 30, 2010

Descriptions For Financial Reporting For Income Tax

Sales 1,500,000

Less cost of goods sold 500,000

Gross profit 1,000,000

Operating expenses

Basic salary expenses 160,000

Provident fund contributions (20%) 32,000

Utility expense 5,000

Donations

To Makedonia 15,000

To Adama Foot Ball Club 10,000

Depreciation Expense- Building 54,000

Depreciation Expense-Equipment 32,000

Depreciation Expense- Computer 24,500

Repair and Maintenance Expense 50,000

Interest Expense 64,000

Dividend payable 12,000

Additional Investment 5,000

Uncollectible Accounts Expense 15,000

Prepaid Insurance 12,000

Personal consumption expense 4,000

Total Operating expense 494,500

Income before income taxes 505,000

Income tax expense(505,000 x 35% -18000) 158,925

Net income 346,075

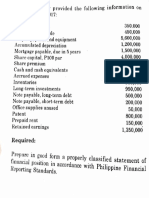

Required

Based on the data given above fill the table with an appropriate amount as per the tax proclamation

You might also like

- Sample Persuasive Speech OutlineDocument5 pagesSample Persuasive Speech OutlineShahDanny100% (3)

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Cash Flow Statement QuizDocument7 pagesCash Flow Statement QuizAngelo HilomaNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Siebel Order Management Guide PDFDocument414 pagesSiebel Order Management Guide PDFDebjyoti RakshitNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Sample of A Project Proposal - Provision of Farm Inputs (Production of Palay, Corn, Mongo, Peanut and Camote)Document13 pagesSample of A Project Proposal - Provision of Farm Inputs (Production of Palay, Corn, Mongo, Peanut and Camote)rolandtrojas93% (182)

- IPDA Lookback FinalDocument9 pagesIPDA Lookback Finalmessaoudi05ff100% (1)

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Ia3 Quiz 3Document5 pagesIa3 Quiz 3Magdaraog LutzNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Intermediate Accounting 3 Comprehensive Income ProblemsDocument2 pagesIntermediate Accounting 3 Comprehensive Income ProblemsDarlyn Dalida San PedroNo ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- 162 003Document4 pages162 003Angelli LamiqueNo ratings yet

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Statement of Comprehensive Income - ExerciseDocument2 pagesStatement of Comprehensive Income - ExerciseMary Kate OrobiaNo ratings yet

- Statements in AccountingDocument7 pagesStatements in AccountingIrianne MendolaNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Frias Activity 6Document6 pagesFrias Activity 6Lars FriasNo ratings yet

- M.B.A. (2013 Pattern) 2017 PDFDocument125 pagesM.B.A. (2013 Pattern) 2017 PDFAkdev 118No ratings yet

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- AaaaDocument11 pagesAaaaJessica JaroNo ratings yet

- Balance Sheet As On 1st April 2018 Liabilities Amt Assets AmtDocument10 pagesBalance Sheet As On 1st April 2018 Liabilities Amt Assets Amtwork acNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- 105 - Activity 1 - Cash FlowDocument11 pages105 - Activity 1 - Cash FlowElla DavisNo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- Ronald Company 2019 Costs, Sales, IncomeDocument3 pagesRonald Company 2019 Costs, Sales, IncomeKean Brean GallosNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- Quiz 1 - Limited CompaniesDocument2 pagesQuiz 1 - Limited CompaniesELIZABETH MARGARETHANo ratings yet

- Accountancy and Auditing-2018Document6 pagesAccountancy and Auditing-2018Aisar Ud DinNo ratings yet

- Accountancy-I Subjective PDFDocument4 pagesAccountancy-I Subjective PDFM Umar MughalNo ratings yet

- Soal UAS 2015.2016 KajianDocument4 pagesSoal UAS 2015.2016 Kajiansyafaatun munajahNo ratings yet

- Tutorial 23 Financial Statement 1 2 Management SkillsDocument4 pagesTutorial 23 Financial Statement 1 2 Management SkillsOkgar Myint SoeNo ratings yet

- 6728 Statement of Comprehensive IncomeDocument4 pages6728 Statement of Comprehensive IncomeJane ValenciaNo ratings yet

- C 1Document10 pagesC 1biniamNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- Accountancy Auditing 2018Document7 pagesAccountancy Auditing 2018Abdul basitNo ratings yet

- Balance Sheet IAS 1Document3 pagesBalance Sheet IAS 1briankuria21No ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Practice Comptency Exam 124Document3 pagesPractice Comptency Exam 124Ivan Pacificar BioreNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- MZM Grocery Income StatementDocument7 pagesMZM Grocery Income StatementIphegenia DipoNo ratings yet

- RequiredDocument15 pagesRequiredCheska Anne Mikka RoxasNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAlliah Mae ArbastoNo ratings yet

- Asynchronous Statement of Financial Position XYZ CompanyDocument5 pagesAsynchronous Statement of Financial Position XYZ CompanyDiana Fernandez MagnoNo ratings yet

- Paw & Saw Downstream ConsolidationDocument3 pagesPaw & Saw Downstream ConsolidationLorie Roncal JimenezNo ratings yet

- STATEMENT-OF-CASH-FLOWS-Larosa, Trinashin U.Document11 pagesSTATEMENT-OF-CASH-FLOWS-Larosa, Trinashin U.Trinashin Umapas LarosaNo ratings yet

- Question 2 CashFlowDocument6 pagesQuestion 2 CashFlowsuraj lamaNo ratings yet

- Statement of Comprehensive Income - Ia3Document16 pagesStatement of Comprehensive Income - Ia3SharjaaahNo ratings yet

- Comparative and Common Size StatementsDocument10 pagesComparative and Common Size Statementsvanshikagoswami25No ratings yet

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- Accounting Excel SheetsDocument8 pagesAccounting Excel Sheetskokila amarasingheNo ratings yet

- Act 202 - Financial Accounting QDocument3 pagesAct 202 - Financial Accounting QShebgatul MursalinNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Case Study 8 WTO LawDocument7 pagesCase Study 8 WTO LawVy Tô Tường100% (1)

- Current Affair Questions On Lagos StateDocument43 pagesCurrent Affair Questions On Lagos Statealphatrade500No ratings yet

- Group-IV General Merit List of PHC Backlog Recruitment F.Y 2020-21Document123 pagesGroup-IV General Merit List of PHC Backlog Recruitment F.Y 2020-21Ganesh VallepuNo ratings yet

- Vol-3 CA-04RDocument191 pagesVol-3 CA-04Rmayank007aggarwalNo ratings yet

- Accounting for Investments under AS 13Document6 pagesAccounting for Investments under AS 13anshNo ratings yet

- Guatemala Case Study FV 21AUG2015Document62 pagesGuatemala Case Study FV 21AUG2015Denia Eunice Del ValleNo ratings yet

- DP Unit Planner Grade 11 - 2012-Unit 6-ItgsDocument4 pagesDP Unit Planner Grade 11 - 2012-Unit 6-Itgsapi-196482229No ratings yet

- Bangladesh Leasing Industry OverviewDocument22 pagesBangladesh Leasing Industry OverviewAyesha SiddikaNo ratings yet

- AB 1385 Fact SheetDocument1 pageAB 1385 Fact SheetThe Press-Enterprise / pressenterprise.comNo ratings yet

- Instagram Commerce in The Time of Influenced Purchase Decision - Kirtika ChhetiaDocument2 pagesInstagram Commerce in The Time of Influenced Purchase Decision - Kirtika ChhetiaKirtika ChetiaNo ratings yet

- Land Form18 Lease or Sub Lease Offer by DLBDocument2 pagesLand Form18 Lease or Sub Lease Offer by DLBSepuuya AlexNo ratings yet

- Research ProjectDocument31 pagesResearch Projectakash sharmaNo ratings yet

- Mutual Fund: Securities Exchange Act of 1934Document2 pagesMutual Fund: Securities Exchange Act of 1934Vienvenido DalaguitNo ratings yet

- Unit - III Lesson 7 Holding Companies - IDocument51 pagesUnit - III Lesson 7 Holding Companies - IVandana SharmaNo ratings yet

- Cemon Industries Workmen Unon v State of Gujarat and Cemon IndustriesDocument3 pagesCemon Industries Workmen Unon v State of Gujarat and Cemon IndustriesRanish AliaNo ratings yet

- Analytical Report On The Status of The China GHG Voluntary Emission Reduction ProgramDocument14 pagesAnalytical Report On The Status of The China GHG Voluntary Emission Reduction ProgramEnvironmental Defense Fund (Documents)No ratings yet

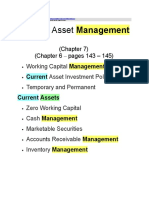

- Current Asset Management Chapter SummaryDocument14 pagesCurrent Asset Management Chapter SummaryLokamNo ratings yet

- Final Assignment: Mct1074 Business Intelligence and AnalyticsDocument28 pagesFinal Assignment: Mct1074 Business Intelligence and AnalyticsAhmad Shahir NohNo ratings yet

- Otm On CloudDocument4 pagesOtm On CloudiamrameceNo ratings yet

- A New Way Shop, Meet Rise: To andDocument8 pagesA New Way Shop, Meet Rise: To andAmit GolaNo ratings yet

- Email: Address: 26 Elmer Avenue, Toronto, ON M4L 3R7: Operations Process Specialist-Project & Document ManagementDocument3 pagesEmail: Address: 26 Elmer Avenue, Toronto, ON M4L 3R7: Operations Process Specialist-Project & Document Managementsh tangriNo ratings yet

- SYAD Prefinal ExamsDocument2 pagesSYAD Prefinal ExamsBien Joshua Martinez PamintuanNo ratings yet

- Pilatus PC-12 Assembly Line: Industrialization, Manufacturing and Process ImprovementDocument8 pagesPilatus PC-12 Assembly Line: Industrialization, Manufacturing and Process ImprovementTGTrindadeNo ratings yet

- Manitou Telescopic Loader Mlt627 Turbo Repair ManualDocument22 pagesManitou Telescopic Loader Mlt627 Turbo Repair Manualkevinhawkins080584xij100% (113)

- CPA CV Seeking Accounting PositionDocument2 pagesCPA CV Seeking Accounting Positionsamy njorogeNo ratings yet

- International Trade Law: SEMESTER IX - B.A. LL.B. (Hons.) Syllabus (Session: July-December 2022)Document13 pagesInternational Trade Law: SEMESTER IX - B.A. LL.B. (Hons.) Syllabus (Session: July-December 2022)shiviNo ratings yet