Professional Documents

Culture Documents

Sa 200 "Overall Objectives of The Independent Auditor AND Conduct OF THE Audit IN Accordance With Sas

Uploaded by

Kisi Ka Dar NahiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sa 200 "Overall Objectives of The Independent Auditor AND Conduct OF THE Audit IN Accordance With Sas

Uploaded by

Kisi Ka Dar NahiCopyright:

Available Formats

SA 200 "OVERALL OBJECTIVES OF THE INDEPENDENT

AUDITOR AND CONDUCT OF THE AUDIT IN

ACCORDANCE WITH SAS

1.1 Overall Objectives of the Auditor

As per SA-200 "Overall Objectives of the Independent Auditor", in conducting an audit of

financial statements, the overall objectives of the auditor are:

a) To obtain reasonable assurance about whether the F. S. as a whole are free from

material misstatement, whether due to fraud or error, thereby enabling the auditor to

express an opinion on whether the F.S. are prepared, in all material respects, in

accordance with an applicable FRF, and

b) To report on the F.S. and communicate as required by the SAs, in accordance with

the auditor’s findings.

In all cases when reasonable assurance cannot be obtained and a qualified opinion

in the auditor’s report is insufficient, the SAs require that the auditor disclaim an

opinion or withdraw from the engagement.

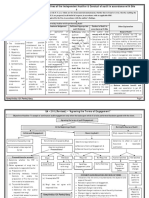

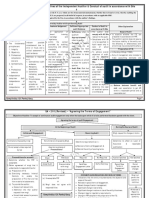

1.2 AUDITOR REQUIREMENT/RESPONSIBILITIES OF THE AUDITOR

Ethical Requirements Professional Professional Sufficient Appropriate

Relating to an Audit of Audit Risk

Judgment Audit Evidence

F.S. Skepticism

1. Compliance 1. Integrity;

1. Questioning mind, 1. Application of relevant

2. Objectivity; To obtain reasonable

2. Objectives 2. being alert to training, knowledge and risk that the auditor

assurance

3. Complying with 3. Professional onditions,may indicate experiencein planning and expresses an

competence and due performing an audit of 1. Reasonable Assurance: A inappropriate audit

relevant Requirements possible misstatement due

care; financial statements high, but not absolute, opinion

4. Failure to Achieve an to error or fraud

level of assurance.

Objective 4. Confidentiality; and 3. Reduces risk of 2. exercised throughout

Professional behaviour. the audit 2. Sufficient Appropriate

- Overlooking unusual Audit Evidence: Sufficiency

circumstances. 3. important when refers to quantum and

deciding about: Appropriateness refers to

- Over generalising when

drawing conclusions from - Materiality & audit risk. quality.

audit observations. - NTE of audit procedures.

- Using inappropriate - Evaluating sufficiency & -

assumptions in determining appropriateness of audit

N, T, E of audit procedures procedures.

- Evaluating management

judgment in applying

applicable FRF.

- Drawing conclusions

based on audit evidence.

This chart discussion & Question Answer video available

on YouTube - CA Kapil Goyal Audit Discussion

You might also like

- SA Flowcharts 2Document33 pagesSA Flowcharts 2partymonger71% (7)

- SA 200 & 210 Audit StandardsDocument86 pagesSA 200 & 210 Audit Standardssantosh pandeyNo ratings yet

- Chapter 4 - Controls: External Audit EngagementDocument9 pagesChapter 4 - Controls: External Audit EngagementSanjeev JayaratnaNo ratings yet

- Audit Charts FullDocument80 pagesAudit Charts FullsummaiyaNo ratings yet

- Auditing and Assurance 1Document247 pagesAuditing and Assurance 1All FreeNo ratings yet

- Auditing Principles OverviewDocument22 pagesAuditing Principles OverviewAngela Miles DizonNo ratings yet

- Auditing key concepts and audit cycleDocument2 pagesAuditing key concepts and audit cycleCharlize Natalie ReodicaNo ratings yet

- AUD 0 - (Compilation Report)Document21 pagesAUD 0 - (Compilation Report)Angela Miles DizonNo ratings yet

- Obtained by The Auditor in Arriving at The Conclusions On Which The Audit Opinion Is BaseDocument2 pagesObtained by The Auditor in Arriving at The Conclusions On Which The Audit Opinion Is BaseTech for lifeNo ratings yet

- Types of Audits: Audit - An OverviewDocument31 pagesTypes of Audits: Audit - An OverviewRanel Clark D. TabiosNo ratings yet

- Auditing NotesDocument4 pagesAuditing NotesJust AlexNo ratings yet

- Audit Objectives and ConductDocument52 pagesAudit Objectives and ConductarifNo ratings yet

- 1 - Overview of AuditingDocument13 pages1 - Overview of AuditingZooeyNo ratings yet

- AT.3203 Audit Responsibilities and ObjectivesDocument5 pagesAT.3203 Audit Responsibilities and ObjectivesNancy Jane LaurelNo ratings yet

- Auditing ReviewerDocument2 pagesAuditing ReviewerQueenie de BorjaNo ratings yet

- Intro. To Auditing: "Your Online Partner To Get Your Title"Document6 pagesIntro. To Auditing: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Sa Fastrack NotesDocument36 pagesSa Fastrack Noteskunika bachhasNo ratings yet

- Psa 200: Overall Objectives of The Independent Auditor and The Conduct of AuditDocument3 pagesPsa 200: Overall Objectives of The Independent Auditor and The Conduct of AuditDaren Dame Jodi RentasidaNo ratings yet

- Notes For Audit by ChaptersDocument7 pagesNotes For Audit by ChaptersFarah KhattabNo ratings yet

- Tips Membuat Audit ProgramDocument29 pagesTips Membuat Audit Programbungsu anisaNo ratings yet

- AT.3403 - Risk-Based FS Audit ProcessDocument5 pagesAT.3403 - Risk-Based FS Audit ProcessMonica GarciaNo ratings yet

- Chap 1 Overview of An AuditDocument19 pagesChap 1 Overview of An AuditeaeNo ratings yet

- 10 General Accepted Auditing StandardsDocument7 pages10 General Accepted Auditing StandardsAureen TabamoNo ratings yet

- Auditing Exam Revision Notes SummaryDocument3 pagesAuditing Exam Revision Notes SummaryJonalyn GabrilloNo ratings yet

- 74938bos60526-Cp5 UnlockedDocument38 pages74938bos60526-Cp5 Unlockedhrudaya boysNo ratings yet

- 09_26_2023Document7 pages09_26_2023Christen HerceNo ratings yet

- Chapter 6Document2 pagesChapter 6Blessed OrtegaNo ratings yet

- University of Luzon Assurance CourseDocument11 pagesUniversity of Luzon Assurance CourseYae'kult VIpincepe QuilabNo ratings yet

- Chapter 4Document3 pagesChapter 4Gerrelle Cap-atanNo ratings yet

- Chapter 5 - AuditingDocument4 pagesChapter 5 - AuditingRaymond GuillartesNo ratings yet

- Standards by Sanidhya Saraf Serial 1 5Document85 pagesStandards by Sanidhya Saraf Serial 1 5rahul gobburiNo ratings yet

- Aa 3101Document3 pagesAa 3101Lance UrichNo ratings yet

- CA SANIDHYA SARAF'S NOTES ON STANDARDS OF AUDITINGDocument86 pagesCA SANIDHYA SARAF'S NOTES ON STANDARDS OF AUDITINGmaulesh bhattNo ratings yet

- Focus NotesDocument3 pagesFocus NotesJean Ysrael Marquez100% (1)

- AudTheo NoteDocument2 pagesAudTheo NoteJorelyn Rose BaronNo ratings yet

- Audit SolutionsDocument82 pagesAudit SolutionsFlow RiyaNo ratings yet

- At 03 - Fundamentals of Assurance ServicesDocument2 pagesAt 03 - Fundamentals of Assurance ServicesPrincess LajumNo ratings yet

- ACAUD 3149 TOPIC 1 Overview of The Audit ProcessDocument2 pagesACAUD 3149 TOPIC 1 Overview of The Audit ProcessCazia Mei JoverNo ratings yet

- SA Chart FullDocument37 pagesSA Chart FullJinal SanghviNo ratings yet

- Fundamentals of Auditing and Assurance ServicesDocument41 pagesFundamentals of Auditing and Assurance Servicesnotchu latteNo ratings yet

- Understanding Audit Standards and TypesDocument3 pagesUnderstanding Audit Standards and TypesKendall JennerNo ratings yet

- Audit Procedures and Risk ResponseDocument7 pagesAudit Procedures and Risk ResponseJwyneth Royce DenolanNo ratings yet

- FINANCIAL AUDIT (Final Exam - Portions) : RelevanceDocument5 pagesFINANCIAL AUDIT (Final Exam - Portions) : RelevanceSoniea DianiNo ratings yet

- Module 1 - Overview of The AuditingDocument13 pagesModule 1 - Overview of The AuditingJesievelle Villafuerte NapaoNo ratings yet

- Audit PrelimsDocument10 pagesAudit PrelimsMane NessyNo ratings yet

- Chapter14 - Auditing IT Controls Part 1 - BSA2ADocument10 pagesChapter14 - Auditing IT Controls Part 1 - BSA2AjejelaNo ratings yet

- Auditor Responsibility & Professional StandardsDocument6 pagesAuditor Responsibility & Professional Standards03LJNo ratings yet

- Isa 330 PDFDocument27 pagesIsa 330 PDFMarcos ViníciusNo ratings yet

- Introduction To Auditing and Overview of The Audit 1Document17 pagesIntroduction To Auditing and Overview of The Audit 1ogayon.annamarieNo ratings yet

- CA Inter Audit Assurance Scope Nature ObjectiveDocument58 pagesCA Inter Audit Assurance Scope Nature Objectivecharul kapuriyaNo ratings yet

- AuditDocument1 pageAuditshivangiNo ratings yet

- Kort Notes ISA'sDocument49 pagesKort Notes ISA'skateNo ratings yet

- CA Inter Audit SA Revision Book @CA - Study - NotesDocument62 pagesCA Inter Audit SA Revision Book @CA - Study - Notessantosh pandeyNo ratings yet

- A3 - Topic 1Document7 pagesA3 - Topic 1jgames777No ratings yet

- Audit Cheat SheetDocument2 pagesAudit Cheat Sheetdea.shafa29No ratings yet

- Objectives and Requirements of Independent AuditDocument142 pagesObjectives and Requirements of Independent AuditSri PavanNo ratings yet

- AUDITING IN CIS ENVIRONMENT Reviewer Chap 1 3Document11 pagesAUDITING IN CIS ENVIRONMENT Reviewer Chap 1 3Michaela De guzmanNo ratings yet

- Risk Based Audit (1) FINALDocument68 pagesRisk Based Audit (1) FINALSamiah Manggis MampaoNo ratings yet

- F8 Revision Notes Table of ContentsDocument169 pagesF8 Revision Notes Table of ContentsArbab JhangirNo ratings yet

- 01-QNET Vihaan - Policy and Procedures PDFDocument27 pages01-QNET Vihaan - Policy and Procedures PDFAtul Vats100% (1)

- Vihaan Direct Selling (India) PVT LTD - RegistrationDocument4 pagesVihaan Direct Selling (India) PVT LTD - RegistrationKisi Ka Dar NahiNo ratings yet

- Vihaan Direct Selling (India) PVT LTD - ReceiptDocument2 pagesVihaan Direct Selling (India) PVT LTD - ReceiptKisi Ka Dar NahiNo ratings yet

- Vihaan Direct Selling (India) PVT LTD - ProductsDocument4 pagesVihaan Direct Selling (India) PVT LTD - ProductsKisi Ka Dar NahiNo ratings yet

- HMRC Chat Print PDFDocument6 pagesHMRC Chat Print PDFKisi Ka Dar NahiNo ratings yet

- Accounting Standard 34Document34 pagesAccounting Standard 34Kisi Ka Dar NahiNo ratings yet

- IPCC Accounts Chapter 2Document52 pagesIPCC Accounts Chapter 2Kisi Ka Dar NahiNo ratings yet

- English Law Week 2017 Thursday 23 November PresentationsDocument5 pagesEnglish Law Week 2017 Thursday 23 November PresentationsZviagin & CoNo ratings yet

- Tarlac State University (Tsu) College of Law Course Syllabus: Taxation Law Review (2 UNITS) 2017-2018 (2 Semester)Document5 pagesTarlac State University (Tsu) College of Law Course Syllabus: Taxation Law Review (2 UNITS) 2017-2018 (2 Semester)ronaldNo ratings yet

- YOGESH JAIN V SUMESH CHADHADocument7 pagesYOGESH JAIN V SUMESH CHADHASubrat TripathiNo ratings yet

- General Terms and Conditions On Gem 4.0 (Version 1.2) Dt5 July 2022Document44 pagesGeneral Terms and Conditions On Gem 4.0 (Version 1.2) Dt5 July 2022Study WayNo ratings yet

- Gurbax Singh Pabla and Co. vs. Reyes 11111Document2 pagesGurbax Singh Pabla and Co. vs. Reyes 11111Mary Dorothy TalidroNo ratings yet

- I-Iib (E) 2015 11 13Document33 pagesI-Iib (E) 2015 11 13Manimekala ViswanathanNo ratings yet

- Document 1Document33 pagesDocument 1viktor samuel fontanillaNo ratings yet

- LIST OF LICENSED INSURANCE BROKERSDocument44 pagesLIST OF LICENSED INSURANCE BROKERSarbaz khanNo ratings yet

- Solved Schlosser Entered Into An Agreement To Purchase A Cooperative APDocument1 pageSolved Schlosser Entered Into An Agreement To Purchase A Cooperative APAnbu jaromiaNo ratings yet

- HGC vs. Manpalaz (January 2021) - Civil Law Contract To Sell PD 957Document25 pagesHGC vs. Manpalaz (January 2021) - Civil Law Contract To Sell PD 957jansen nacarNo ratings yet

- Score:: Points %Document45 pagesScore:: Points %Eliverta FifoNo ratings yet

- CIVICS-80 MarksDocument3 pagesCIVICS-80 MarksDaksh MandaveNo ratings yet

- Public Corporation Mid-Term Examination IDocument1 pagePublic Corporation Mid-Term Examination ICedrick Contado Susi BocoNo ratings yet

- Human Rights of Hijras in Bangladesh: An Analysis: Arobia KhanamDocument28 pagesHuman Rights of Hijras in Bangladesh: An Analysis: Arobia KhanamShabbir AhmedNo ratings yet

- Applywing Two-Sided Market Theory - The Mastercard and American Express DecisionsDocument29 pagesApplywing Two-Sided Market Theory - The Mastercard and American Express DecisionsFrancisca Lobos CNo ratings yet

- PM&DC Experience Recognition FormDocument4 pagesPM&DC Experience Recognition FormFurqan H. Khattak25% (4)

- Declaration of Secrecy & Independence: DTTL Member FirmDocument2 pagesDeclaration of Secrecy & Independence: DTTL Member FirmJOhnNo ratings yet

- Petition For Settlement of EstateDocument6 pagesPetition For Settlement of EstateKim InocNo ratings yet

- Format Extension of Stay OrderDocument1 pageFormat Extension of Stay OrderAshmika Raj0% (1)

- S7 Edge Invoice PDFDocument1 pageS7 Edge Invoice PDFRajesh KumarNo ratings yet

- IBC Knowledge Capsule on Framework for Personal GuarantorsDocument8 pagesIBC Knowledge Capsule on Framework for Personal GuarantorsprdyumnNo ratings yet

- MIZORAM PUBLIC SERVICE COMMISSION DEPARTMENTAL EXAMINATIONS FOR SUB-INSPECTORDocument3 pagesMIZORAM PUBLIC SERVICE COMMISSION DEPARTMENTAL EXAMINATIONS FOR SUB-INSPECTORNeeraj KumarNo ratings yet

- Chapter 1Document22 pagesChapter 1Rodnie Cyrus De LeonNo ratings yet

- 2024 Lhc 1392Document5 pages2024 Lhc 1392usmandatariNo ratings yet

- DSWD SB GF 097 - Rev 00 - Application Form For Accreditation of SWDDocument8 pagesDSWD SB GF 097 - Rev 00 - Application Form For Accreditation of SWDtagamjodielynNo ratings yet

- 036 - Rights of Legitimatized Children Under Hindu Law (466-471)Document6 pages036 - Rights of Legitimatized Children Under Hindu Law (466-471)PRANOY GOSWAMINo ratings yet

- LASC Case #LC105743 Minute OrderDocument1 pageLASC Case #LC105743 Minute OrderProSe AdvocateNo ratings yet

- Barnuevo vs. FusterDocument5 pagesBarnuevo vs. FusterChristiane Marie BajadaNo ratings yet

- FOSFA Contract No 33 PDFDocument2 pagesFOSFA Contract No 33 PDFNasty100% (1)

- Conference BrochureDocument7 pagesConference BrochureSubodh AsthanaNo ratings yet