0% found this document useful (0 votes)

200 views12 pagesCalculate Internal Rate of Return (IRR)

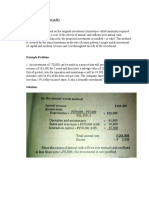

The document describes calculating the internal rate of return (IRR) for two investment proposals. For Proposal 1, the IRR is iteratively calculated starting from 15% until the point where the net present value is equal to 0, which occurs at 21.54%. For Proposal 2, the required discount rate is directly calculated to be the value where the present value factor equals the ratio of initial cost to annual return, determined to be 14.07%.

Uploaded by

PriYansh PaTelCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

200 views12 pagesCalculate Internal Rate of Return (IRR)

The document describes calculating the internal rate of return (IRR) for two investment proposals. For Proposal 1, the IRR is iteratively calculated starting from 15% until the point where the net present value is equal to 0, which occurs at 21.54%. For Proposal 2, the required discount rate is directly calculated to be the value where the present value factor equals the ratio of initial cost to annual return, determined to be 14.07%.

Uploaded by

PriYansh PaTelCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd