Professional Documents

Culture Documents

DLF LTD

DLF LTD

Uploaded by

ShanKar HunnurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DLF LTD

DLF LTD

Uploaded by

ShanKar HunnurCopyright:

Available Formats

1) COMPANY PROFILE

DLF Limited, together with its subsidiaries, engages in the business of

colonization and real estate development in India. Its activities include identification

and acquisition of land; and planning, execution, construction, and marketing of

projects. The company develops residential properties, such as plotted developments,

houses, and villas and apartments; and commercial and retail properties. It also

engages in the lease of developed office space, IT’s, and retail properties. In addition,

the company owns and operates The Lodhi hotel and the Hilton Garden Inn in New

Delhi. Further, it engages in the provision of maintenance services, and utilities and

facilities management services; generation and sale of power; and recreational

activities. DLF Limited was founded in 1946 and is based in Gurugram, India.

2) STATISTICS

1. Current P/E ratio

Price earnings ratio shows what the market is willing to pay for a stock based on its

current earnings.

The current P/E ratio of the DLF Limited is 22.43 as on 25/09/2019. The higher the

P/E ratio means that investors anticipate higher performance from and growth in the

future. This ratio is only useful in comparing like companies in same industry rather

than cross industrial comparison.

2. Profitability

Profitability is a business’s ability to produce a return on investment in comparative

with an alternative investment.

Operating Margin:

The operating margin gives a good look at how efficient a company is

to compare company’s returns to others in the industry because it

shows company’s ability to turn sales into pre-tax profits.

The operating margin (%) of Eicher Motors for fiscal year 2018-2019

is 36.93%

Gross Profit Margin:

The gross profit margin shows how much is business is earning, taking

into account the needed costs to produce its goods and service.

The gross profit margin (%) of Eicher Motors for fiscal year

2018-2019 is 33.14%

Net Profit Margin:

The net profit margin provides the final picture of how profitable a

company is after all expenses including interest and taxes have been

taken into account.

The net profit margin (%) of Eicher Motors for fiscal year 2018-2019

is 20.86%.

3. Management Effectiveness

Return on Asset

The return on asset(%) of Eicher Motors is 88.37 % which means that

the company approximately produces $1 of profit for every $5 it has

invested in its assets.

Therefore management is efficiently managing its assets to produce

profits.

Return on Equity

The return on Equity(%) of Eicher Motors is 24.69% which means

company is generating $ 0.2469 profit for every $1 of shareholders

equity.

Therefore the management is efficiently managing its shareholders

fund to generate profits.

3) Total Market Value Of Firm And Profit:

The total market value of the company is Rs. 38,565.36 Crore.

The profit for the fiscal year 2019 is Rs. 1961.85 Crore.

4) HOLDERS

1. Major Holders of Company’s Stock: 74.95%

Top mutual fund holders

Holder Shares Date reported % out Value

90,639,3 31 Mar 3.66 18,349,944,1

Invesco Oppenheimer Global Fund

88 2019 % 00

20,321,5 31 Mar 0.82 4,114,106,90

Invesco Oppenheimer V.I. Global Fund

95 2019 % 7

JNL Series Trust-JNL/Oppenheimer Global Growth 20,090,0 31 Mar 0.81 4,067,220,50

Fund 00 2019 % 0

Holder Shares Date reported % out Value

Voya Partners Inc.-VY Invesco Oppenheimer Global 12,243,5 30 Jun 0.49 2,308,522,86

Port 58 2019 % 0

9,587,28 31 Mar 0.39 1,940,946,05

Brighthouse Fds Tr I-Oppenheimer Global Equity Port

6 2019 % 0

Vanguard International Stock Index-Emerging Markets 7,063,11 31 Jan 0.29 1,164,354,83

Stk 7 2019 % 7

Vanguard International Stock Index-Total Intl Stock 6,471,70 31 Jan 0.26 1,066,859,74

Indx 0 2019 % 5

4,133,54 31 Jan 0.17

DFA Investment Dimensions-DFA Emerging Mkts Value 681,415,058

6 2019 %

3,283,50 31 Jan 0.13

DFA Emerging Markets Core Equity Portfolio 541,285,634

4 2019 %

First Tr Exchg Tr AlphaDEX Fd II-FT Emerging Markets 2,644,45 31 Mar 0.11

535,369,509

AlphaDex 3 2019 %

5) ANALYST OPINION:

1) Current Stock Price and Predicted Stock Price:

The stock is currently trading at INR 155.75 as on 25th September with EPS

88.37.

The predicted stock price is INR 167.45(high), 152.50(low) for 26th September

6) FINANCIALS

1. Total Assets at the End of previous Fiscal Year

Total assets at the end of FY 2019 is INR 15099.93 Crore.

2. Total Revenue and Profit After Tax

Total Revenue of the company for the FY 2018-2019 stood at INR 9,75,10,400

and Profit After Tax stood at INR 2,20,27,300.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Charles Shephard - Gann Cycles - A Time and Price Cycle Analysis PDFDocument147 pagesCharles Shephard - Gann Cycles - A Time and Price Cycle Analysis PDFxg1792% (12)

- AmbushDocument25 pagesAmbushDave Foo100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Final Draft The Last Resort (1) NAZARDocument58 pagesFinal Draft The Last Resort (1) NAZARShanKar HunnurNo ratings yet

- List of Publications: Dr. R.Sethumadhavan Assistant ProfessorDocument4 pagesList of Publications: Dr. R.Sethumadhavan Assistant ProfessorShanKar HunnurNo ratings yet

- AC - Sales JDDocument2 pagesAC - Sales JDShanKar HunnurNo ratings yet

- MS Access AssignmentsDocument1 pageMS Access AssignmentsShanKar HunnurNo ratings yet

- An Article On How To Cultivate An Attitude of Gratitude at The WorkplaceDocument2 pagesAn Article On How To Cultivate An Attitude of Gratitude at The WorkplaceShanKar HunnurNo ratings yet

- Shubhi Singhal: EducationDocument2 pagesShubhi Singhal: EducationShanKar HunnurNo ratings yet

- ICICI Prudential: Mutual FundsDocument28 pagesICICI Prudential: Mutual FundsRonduckNo ratings yet

- Chapter07 PDFDocument26 pagesChapter07 PDFBabuM ACC FIN ECONo ratings yet

- Evsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Document52 pagesEvsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1shakibalamNo ratings yet

- Harshad Mehta ScamDocument9 pagesHarshad Mehta ScamMashboob R.MNo ratings yet

- FRM Mcq'sDocument69 pagesFRM Mcq'sAakash Kathuria0% (3)

- Chapter 5Document34 pagesChapter 5Jyoti PaiNo ratings yet

- Project Report On Factors Affecting Investors Preference For Investment in Mutual FundsDocument89 pagesProject Report On Factors Affecting Investors Preference For Investment in Mutual FundsAnkit Singh71% (14)

- Quality Ranking Whitepaper FinalDocument38 pagesQuality Ranking Whitepaper Finalpeter990xNo ratings yet

- TRADING STRATEGIES - The Prop TraderDocument4 pagesTRADING STRATEGIES - The Prop TraderDatom Manuel0% (1)

- BKM Chapter 3 SlidesDocument41 pagesBKM Chapter 3 SlidesIshaNo ratings yet

- Wayne A. Thorp - The MACD A Combo of Indicators For The Best of Both Worlds PDFDocument5 pagesWayne A. Thorp - The MACD A Combo of Indicators For The Best of Both Worlds PDFTruong Minh HuyNo ratings yet

- BF2207 Chapter 05 - Blades Case - Use of Currency Derivative InstrumentsDocument3 pagesBF2207 Chapter 05 - Blades Case - Use of Currency Derivative InstrumentsAaron CheongNo ratings yet

- Here Is What Was Behind The - Largest VIX Buy Order in History - Zero HedgeDocument7 pagesHere Is What Was Behind The - Largest VIX Buy Order in History - Zero HedgeeliforuNo ratings yet

- More Mcqs Set 21Document3 pagesMore Mcqs Set 21Aaki SharmaNo ratings yet

- Good Hope School - 11 16 1A Ch.4 Percentages I CQDocument3 pagesGood Hope School - 11 16 1A Ch.4 Percentages I CQhlc230013No ratings yet

- Presentation - USD LIBOR Final StepsDocument36 pagesPresentation - USD LIBOR Final Stepspatrick chauNo ratings yet

- bms6.6 E 2Document2 pagesbms6.6 E 224vaishuNo ratings yet

- Arbitrage Pricing ModelDocument11 pagesArbitrage Pricing ModelAmit SinhaNo ratings yet

- 08 Zero Sum Game PDFDocument9 pages08 Zero Sum Game PDFAdnan KamalNo ratings yet

- GBM - MKT - Units 1 and 2Document19 pagesGBM - MKT - Units 1 and 2Santiago CzopNo ratings yet

- The Determinants of Stock Market Development The Case For The Nairobi Stock ExchangeDocument17 pagesThe Determinants of Stock Market Development The Case For The Nairobi Stock ExchangeGhulam Mustafa SialNo ratings yet

- Hold-To-Collect' Business Model 10 The SPPI' Contractual Cash Flow Characteristics Test 12Document2 pagesHold-To-Collect' Business Model 10 The SPPI' Contractual Cash Flow Characteristics Test 12Marjo KaciNo ratings yet

- Case: Ravi Bose, An NSU Business Graduate With Few Years' Experience As An Equities Analyst, Was Recently Brought in As Assistant To TheDocument13 pagesCase: Ravi Bose, An NSU Business Graduate With Few Years' Experience As An Equities Analyst, Was Recently Brought in As Assistant To TheAtik MahbubNo ratings yet

- Direct Lending: Benefits, Risks and Opportunities: OaktreeDocument13 pagesDirect Lending: Benefits, Risks and Opportunities: OaktreeIshan ShuklaNo ratings yet

- Case Study of Insider TradingDocument5 pagesCase Study of Insider TradingAnkit Dua50% (2)

- Talha Farooqi - Assignment 01 - Overview of Bond Sectors and Instruments - Fixed Income Analysis PDFDocument4 pagesTalha Farooqi - Assignment 01 - Overview of Bond Sectors and Instruments - Fixed Income Analysis PDFMohammad TalhaNo ratings yet

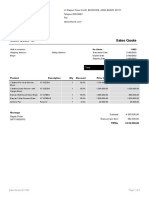

- Sales Quote-11623 Bapak Rolan - 230221 - 142946Document3 pagesSales Quote-11623 Bapak Rolan - 230221 - 142946srt droneNo ratings yet

- PAA 2M SA TPD 1M ADD LCB 36k ApeDocument10 pagesPAA 2M SA TPD 1M ADD LCB 36k ApeRey Christopher CastilloNo ratings yet