Professional Documents

Culture Documents

Priyanka Tungidwar - 21036

Uploaded by

Anonymous 5l219Y7Iu1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Priyanka Tungidwar - 21036

Uploaded by

Anonymous 5l219Y7Iu1Copyright:

Available Formats

GSTR 2

Name: Priyanka S Tungidwar

Roll No: 21036

GSTR-2 is a return containing details of all Who is required to file: To file the GSTR-2:

inward supplies. You must be a registered tax payer under the

Based on this return the Input Tax Credit that a GST with a 15 digit PAN-based GSTIN. You

taxpayer is eligible to avail is determined. must neither be a composition vendor nor have

After your suppliers file GSTR-1, the details of a Unique Identification Number (UIN). You

your inward supplies get auto-populated in should also not be one of those non-resident

GSTR-2A foreign tax payers.

Objective: GSTR-2 is a return containing Frequency of filing: Monthly

details of all inward supplies.

Based on this return the Input Tax Credit that a Details required while filing the said return

taxpayer is eligible to avail is determined. 1.GSTIN – Each taxpayer will be allotted a

After your suppliers file GSTR-1, the details of state-wise PAN-based 15-digit Goods and

your inward supplies get auto-populated in Services Taxpayer Identification Number

GSTR-2A (GSTIN). A format of proposed GSTIN has

Last date of filing: he last been shown in the image below. GSTIN of the

date for filing of GSTR-2 for the month of taxpayer will be auto-populated at the time of

July, 2017 is 31st October, 2017. The return filing.

competent authority has approved the 2. Name of the taxpayer

extension of filing of GSTR-2 for July, 2017 to 3.inward supplies received from a registered

30th November, 2017, for facilitation of person other than the supplies attracting

businesses and all taxpayers reverse change.

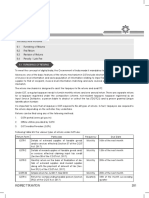

Process of filing the said return (can be 4. Inverse supplies on which tax is to be paid

shown through flow chart) on reverse charge.

5. Input/ capital good received from overseas

or from SEZ units on a bill of entry.

inward supplies

6.Amendments to details of inward supplies

www.gst.gov.in login

receives by taxpayer

furnished in returns for earlier tax periods in

Tables 3, 4 and 5 [including debit notes/credit

invoive details other details notes issued and their subsequent amendments]

7.supplies received from composition taxable

person and other exempt/ non rated/no gst

supplies received.

Generate GSTR 2

summary

8. ISD credit received.

9.TDS and TCS credit received.

10.Consolidate statement of advanced paid/

Submit

advances adjusted on account of receipt of

supplies

file GSTR 2 with file GSTR 2 with

DSC EVC 11.Inut tax credit reversal/ reclaim

12.Addition and reduction of amount in output

Consequences of late filing:

tax for mismatch and other reasons.

GSTR-2 Late fees and Penalty

13.HSN summaries of inward supplies.

A penalty of Rs. 100 per day is applicable in

case of late filing of GST return under both

CGST and SGST Act.

The penalty would be payable for the period in

which the taxpayer in case of failure to file the

return.

The maximum penalty would be up to Rs. 5000

You might also like

- 14-2001 - Requirements For Tax ExemptionDocument7 pages14-2001 - Requirements For Tax ExemptionArjam B. BonsucanNo ratings yet

- Deduction From The Gross EstateDocument6 pagesDeduction From The Gross EstateEmma Mariz GarciaNo ratings yet

- CFA Level I Formula SheetDocument27 pagesCFA Level I Formula SheetAnonymous P1xUTHstHT100% (4)

- GST Return FilingDocument9 pagesGST Return FilingSanthosh K SNo ratings yet

- AP Revised Standard Data 2017-18Document423 pagesAP Revised Standard Data 2017-18dee.angrau76% (25)

- 6.case Study On Input Tax Credit Under GSTDocument17 pages6.case Study On Input Tax Credit Under GSTSUNIL PUJARINo ratings yet

- Caps W 9Document4 pagesCaps W 9api-215255337No ratings yet

- GST Annual Return and AuditDocument10 pagesGST Annual Return and AuditRachit ChhedaNo ratings yet

- Commercial Invoice: Reset FormDocument3 pagesCommercial Invoice: Reset FormBen AliNo ratings yet

- HSC Economics: The Global Economy (Case Study: China)Document12 pagesHSC Economics: The Global Economy (Case Study: China)teresakypham100% (3)

- A Brief Economic History of The WorldDocument29 pagesA Brief Economic History of The Worlddzumbir100% (1)

- Returns GSTDocument25 pagesReturns GSTRahul RockzzNo ratings yet

- GST ReturnDocument7 pagesGST ReturnJCGCFGCGNo ratings yet

- Assignmen GST 5Document10 pagesAssignmen GST 5BhavnaNo ratings yet

- Unit 2 - Part III - Returns Under GST - 30!07!2021Document4 pagesUnit 2 - Part III - Returns Under GST - 30!07!2021Milan ChandaranaNo ratings yet

- GST Returns NotesDocument5 pagesGST Returns NotesvishnureachmeNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument29 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- Latest Updation in GSTN PortalDocument47 pagesLatest Updation in GSTN PortalVenkat BalaNo ratings yet

- Gstr-2A: TH TH THDocument1 pageGstr-2A: TH TH THTejaswi J DamerlaNo ratings yet

- Indirect Tax Laws 1Document10 pagesIndirect Tax Laws 1GunjanNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- Day 6 & 7Document23 pagesDay 6 & 7PrasanthNo ratings yet

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- Circular CGST 131 NewDocument5 pagesCircular CGST 131 NewSanjeev BorgohainNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

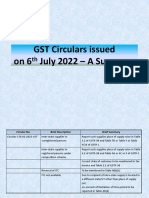

- GST Circulars Issued On 6th July - A SummaryDocument8 pagesGST Circulars Issued On 6th July - A SummaryVijaya ChandNo ratings yet

- GST Return & FilingDocument14 pagesGST Return & Filingjibin samuelNo ratings yet

- FORM GSTR-2B - Advisory (Available Under "Advisory" Tab of GSTR-2B) Terms UsedDocument4 pagesFORM GSTR-2B - Advisory (Available Under "Advisory" Tab of GSTR-2B) Terms UsedSachin KNNo ratings yet

- GST Returns Assessment and Penal ProvisionsDocument9 pagesGST Returns Assessment and Penal ProvisionsAishuNo ratings yet

- GST Returns and FormsDocument46 pagesGST Returns and FormsSachin KhapareNo ratings yet

- Presentation 09.03.2017 CA - Shivani ShahDocument29 pagesPresentation 09.03.2017 CA - Shivani ShahPARESH KUVADIYANo ratings yet

- GST Pratical ApproachDocument20 pagesGST Pratical ApproachSanthoshNo ratings yet

- Record Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Document16 pagesRecord Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Sha dowNo ratings yet

- Advisory 2710 2Document20 pagesAdvisory 2710 2Pushpraj SinghNo ratings yet

- Concept of Input Tax Credit: © Indirect Taxes Committee, ICAIDocument35 pagesConcept of Input Tax Credit: © Indirect Taxes Committee, ICAIyennamNo ratings yet

- Returns in Goods and Services Tax: Section 37-47 of CGST Act, 2017Document73 pagesReturns in Goods and Services Tax: Section 37-47 of CGST Act, 2017Nikhil PahariaNo ratings yet

- ReturnsDocument12 pagesReturnsPriya DasNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument28 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of Indiaatanu karmakarNo ratings yet

- Circular CGST 123Document4 pagesCircular CGST 123AKSHATANo ratings yet

- GST Registration Process and ReturnsDocument7 pagesGST Registration Process and ReturnsAkshay KumarNo ratings yet

- Faqs Viewing Form Gstr-2B Form Gstr-2B: TH TH TH THDocument5 pagesFaqs Viewing Form Gstr-2B Form Gstr-2B: TH TH TH THAsh WNo ratings yet

- Circular No.60Document4 pagesCircular No.60Hr legaladviserNo ratings yet

- Certification DraftDocument47 pagesCertification DraftndNo ratings yet

- GST Returns: BackgroundDocument3 pagesGST Returns: BackgroundPrakash PalanisamyNo ratings yet

- DR - MGR E & RI - Chennai - 28.05.2021-1Document21 pagesDR - MGR E & RI - Chennai - 28.05.2021-1Sha dowNo ratings yet

- Chapter IX of CGST Act Read With CGST Rules, 2017 & Notifications PrescribedDocument26 pagesChapter IX of CGST Act Read With CGST Rules, 2017 & Notifications PrescribedManali PingaleNo ratings yet

- Mygov 1445315831190667 PDFDocument72 pagesMygov 1445315831190667 PDFjitendraktNo ratings yet

- GST - V2 - May 2023Document326 pagesGST - V2 - May 2023FhfhhNo ratings yet

- Chapter 13 - Returns Under GSTDocument11 pagesChapter 13 - Returns Under GSTJay PawarNo ratings yet

- Export of Services in GST RegimeDocument5 pagesExport of Services in GST RegimeNM JHANWAR & ASSOCIATESNo ratings yet

- SPC GST (TDS TCS)Document12 pagesSPC GST (TDS TCS)Aritra BanerjeeNo ratings yet

- Action For Difference in ITC Between 3B and 2ADocument46 pagesAction For Difference in ITC Between 3B and 2Aphani raja kumarNo ratings yet

- Tax Law 2 ProjectDocument16 pagesTax Law 2 Projectrelangi jashwanthNo ratings yet

- Return FormatsDocument56 pagesReturn Formatspuran1234567890No ratings yet

- GST TDS Mechanism - 21062017Document3 pagesGST TDS Mechanism - 21062017Deepak WadhwaNo ratings yet

- Changes in Input Tax Credit Rule 36 (4) in GSTDocument4 pagesChanges in Input Tax Credit Rule 36 (4) in GSTKanhaiya RAthiNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- Goods and Services Tax Council Standing Committee On Capacity Building and FacilitationDocument61 pagesGoods and Services Tax Council Standing Committee On Capacity Building and FacilitationJeyakar PrabakarNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- Guidance Note-Claim of ITC As Per GSTR 2B - Taxguru - inDocument4 pagesGuidance Note-Claim of ITC As Per GSTR 2B - Taxguru - inpradeepkumarsnairNo ratings yet

- New Presentation 2Document126 pagesNew Presentation 2prasadtanishquekumarNo ratings yet

- Eturns: After Studying This Chapter, You Will Be Able ToDocument70 pagesEturns: After Studying This Chapter, You Will Be Able ToChandan ganapathi HcNo ratings yet

- Unit 3FDocument21 pagesUnit 3Fbasavaraj nayakNo ratings yet

- Calculation of Tax Liability Assignment: Rishabh KaushikDocument22 pagesCalculation of Tax Liability Assignment: Rishabh KaushikLkNo ratings yet

- Ineligible ITCDocument51 pagesIneligible ITCj84806126No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- ODC Module4 Group7Document26 pagesODC Module4 Group7utkarsh chaudharyNo ratings yet

- Notes For MBA 2Document254 pagesNotes For MBA 2Pramod Vasudev100% (1)

- Croma Juicer WarrantyDocument2 pagesCroma Juicer WarrantyHimanshu YadavNo ratings yet

- Nepal Budget Highlights 2078Document36 pagesNepal Budget Highlights 2078shankarNo ratings yet

- FIN 242 Individual ReportDocument23 pagesFIN 242 Individual ReportNUR SYAMILA MOHD SUKRINo ratings yet

- Exam ReviewDocument87 pagesExam ReviewAdamNo ratings yet

- Audit Under FiscalDocument108 pagesAudit Under FiscalAjay PanwarNo ratings yet

- Materials Management in Voluntary HospitalsDocument20 pagesMaterials Management in Voluntary HospitalsPham PhongNo ratings yet

- Annaprasadam Donor Application 2018 PDFDocument2 pagesAnnaprasadam Donor Application 2018 PDFsureshNo ratings yet

- OCCSTT Short Course - UWI Open Campus SUMMER Online 2021Document26 pagesOCCSTT Short Course - UWI Open Campus SUMMER Online 2021Shamena Hosein0% (1)

- Gross Income 07.01.21Document1 pageGross Income 07.01.21BeaNo ratings yet

- JKT PTI Form For Assets and Liabilities 30 June 2013Document4 pagesJKT PTI Form For Assets and Liabilities 30 June 2013PTI Official100% (4)

- Advanced Taxation - United Kingdom (ATX-UK) : Syllabus and Study GuideDocument26 pagesAdvanced Taxation - United Kingdom (ATX-UK) : Syllabus and Study GuideJonathan GillNo ratings yet

- Mba 3 Sem Tax Planning and Management Kmbfm02 2020Document2 pagesMba 3 Sem Tax Planning and Management Kmbfm02 2020Vinod GuptaNo ratings yet

- Template of Offer LetterDocument2 pagesTemplate of Offer LetterRaj PrasadNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoicearihantjha36No ratings yet

- Agra Final TableDocument4 pagesAgra Final TableJohn Patrick IsraelNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Praveen PujerNo ratings yet

- First Planters Pawnshop v. CIR, G.R. No. 174134, July 30, 2008Document8 pagesFirst Planters Pawnshop v. CIR, G.R. No. 174134, July 30, 2008Emerson NunezNo ratings yet

- Capital Deductions and Value Added Tax 2Document26 pagesCapital Deductions and Value Added Tax 2Nilufar RustamNo ratings yet

- Chapter 07Document27 pagesChapter 07Rollon NinaNo ratings yet

- Holding and SubsidiaryDocument2 pagesHolding and SubsidiaryRizwana BegumNo ratings yet