Professional Documents

Culture Documents

To Keep Inventory at Sufficiently High

Uploaded by

MokhlesurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

To Keep Inventory at Sufficiently High

Uploaded by

MokhlesurCopyright:

Available Formats

Define Working Capital: Explain the Factors determining the Explain the factors affecting working

Working capital is a financial metric need for working capital: capital requirement.

represents operating liquidity available to a The following factors determine the Main factors affecting the working

business, organization or other entity, need/requirement for working capital: capital are as follows:

including governmental entity. (1) Size of business; (2) Stage of 1) Nature of Business

development; (3) Time of production 2) Scale of Operations

(4) Rate of stock turnover ratio; (5)

Net working capital is calculated as current Buying and selling terms; (6) Seasonal

3) Business cycle

assets minus current liabilities. Positive consumption; (7) Profit level; (9) Growth 4) Production cycle

working capital is required to ensure that a and expansion; (10) Production cycle; (11) 5) Seasonal Factors

firm is able to continue its operations and General nature of business; (12) Business 6) Credit allowed

that it has sufficient funds to satisfy both cycle 7) Credit availed

maturing short-term debt and upcoming 8) Operating efficiency

operational expenses. Describe the motives for holding 9) Availability of Raw Material

cash in bank. 10) Growth Prospects

Management of Working Capital: Transaction Motive: Transaction 11) Level of Competition

Management will use a combination of motive refers to the holding of cash to 12) Inflation

policies and techniques for the meet anticipated obligations whose

management of working capital. The timing is not perfectly synchronized Explain different sources of

policies aim at managing the current assets with cash receipts. financing working capital.

and the short term financing that cash Precautionary Motive: Precautionary Common Sources of Working Capital

flows and returns are acceptable: motive implies the need to hold the Finance:

1. Cash management: Identify the cash cash to meet unpredictable Loans from Commercial Banks:

balance which allows for the business to obligations. Small scale industries can raise loans

meet day to day expenses but reduces cash Speculative Motive: It refers to the from the commercial banks with or

holding costs. desire of a firm to take advantage of without security. This method of

2. Inventory management: Identify the opportunities which present financing does not require any legal

level of inventory which allows for themselves at unexpected moments formality except that of creating a

uninterrupted production. and which are typically outside the mortgage on the assets.

3. Debtors management: Identify the normal course of business. Public Deposits: Often companies find

appropriate credit policy, i.e. credit terms Compensation Motive: Customers of it easy and convenient to raise, short-

which will attract customers. a bank are usually required to term funds by inviting shareholders,

4. Short term financing: Identify the maintain a minimum cash balance at employees and the general public to

appropriate source of financing, given the that bank for providing services to deposit their savings with the company.

cash conversion cycle. them. Since this balance cannot be Trade Credit: Just as the companies

utilized by the firms for transaction sell goods on credit, they also buy raw

Explain the difference between variable purposes, the bank themselves can use materials, components and other goods

working capital and permanent working the amount to earn a return. on credit from their suppliers.

capital. Factoring: Factoring is a financial

Working capital is a part of capital Explain the objectives of inventory service designed to help firms in

investment is used for running the business management. managing their book debts and

such like money which is used to buy The main objectives of inventory receivables in a better manner.

stock, pay expenses and finance credit. management is to maintain inventory at Discounting Bills of Exchange: When

Considering time as the basic of appropriate level to avoid excessive or goods are sold on credit, bills of

classification there are two types of shortage of inventory because both the exchange are generally drawn for

working capital: 1) Permanent working cases are undesirable for business. Thus, acceptance by the buyers of goods. The

capital; 2) Variable working capital; management is faced with the following bills are generally drawn for a period of

conflicting objectives: 3 to 6 months. In practice, the writer of

The difference between variable working (1) To keep inventory at sufficiently high the bill, instead of holding the bill till

capital and permanent working capital is as level to perform production and sales the date of maturity, prefers to discount

follows: activities smoothly. (2) To minimize them with commercial banks on

1) Permanent working capital is referred to investment in inventory at minimum level payment of a charge known as

finance to stock of finished goods, debtors to maximize profitability. (3) To ensure discount.

balances etc. Variable working capital is that the supply of raw material & finished Bank Overdraft and Cash Credit:

used to carry out day to day operations. goods will remain continuous so that Overdraft is a facility extended by the

2) Permanent working capital consists of production process is not halted and banks to their current account holders

stock of raw materials, stock of work-in- for a short-period generally a week.

demands of customers are duly met. (4)

process, stock of finished goods, debtors Advances from Customers: One way

balance, etc. Variable working capital To minimize carrying cost of of raising funds for short-term

consists of cash, marketable securities, inventory. (5) To keep investment in requirement is to demand for advance

account receivable, stock etc. inventory at optimum level. (6) To from one’s own customers.

3) Permanent working capital includes reduce the losses of theft, Accrual Accounts: Generally, there is

long term financial decisions. Variable obsolescence & wastage etc. (5) To a certain amount of time gap between a

working capital includes short term make arrangement for sale of slow income is earned and is actually

financing decisions. received or expenditure becomes due

moving items. (6) To minimize

4) Permanent working is mainly required and is actually paid. Salaries, wages

for operational activities. Variable working inventory ordering costs. and taxes.

capital is required for trading activities.

You might also like

- BCO 12 Block 04Document53 pagesBCO 12 Block 04crabhijt306No ratings yet

- WCM Imp - 091313Document14 pagesWCM Imp - 091313b46rrm45wvNo ratings yet

- Working Capital ManagementDocument62 pagesWorking Capital ManagementSuresh Dhanapal100% (1)

- Project On Study of Working Capital Management in Reliance Industries Ltd.Document96 pagesProject On Study of Working Capital Management in Reliance Industries Ltd.Shibayan Acharya62% (13)

- Introduction To Working CapitalDocument41 pagesIntroduction To Working CapitalVijeshNo ratings yet

- Module - 1 Working Capital Management: MeaningDocument30 pagesModule - 1 Working Capital Management: MeaningumeshrathoreNo ratings yet

- Shyam Prakash Project - Feb 12 2022Document71 pagesShyam Prakash Project - Feb 12 2022Sairam DasariNo ratings yet

- Working capital module 1Document30 pagesWorking capital module 1saurabhjain3455No ratings yet

- Working Capital Management ModuleDocument30 pagesWorking Capital Management ModulerababNo ratings yet

- Module 1-1Document6 pagesModule 1-1shejal naikNo ratings yet

- BF CH 5Document12 pagesBF CH 5IzHar YousafzaiNo ratings yet

- Working Capital ManagementDocument20 pagesWorking Capital Managementsmwanginet7No ratings yet

- Manage Working Capital EfficientlyDocument25 pagesManage Working Capital EfficientlyHitesh TejwaniNo ratings yet

- Working Capital Management ReportDocument26 pagesWorking Capital Management ReportAjay Singh PanwarNo ratings yet

- Working Capital IntroductionDocument18 pagesWorking Capital IntroductionShanmuka SreenivasNo ratings yet

- Working Capital ManagementDocument7 pagesWorking Capital ManagementrbkshuvoNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalSwati KunwarNo ratings yet

- Types of Working CapitalDocument44 pagesTypes of Working CapitalrajeevmbaNo ratings yet

- Cash Management and Working Capital ReviewerDocument2 pagesCash Management and Working Capital ReviewerAeris StrongNo ratings yet

- Module in Financial Management - 10Document8 pagesModule in Financial Management - 10Karla Mae GammadNo ratings yet

- 06 BSIS 2 Financial Management Week 12 13Document5 pages06 BSIS 2 Financial Management Week 12 13Ace San GabrielNo ratings yet

- Introduction of The TopicDocument13 pagesIntroduction of The TopicBharat ManochaNo ratings yet

- Conceptual Framework 1Document10 pagesConceptual Framework 1sampad DasNo ratings yet

- Working Capital ProjectDocument28 pagesWorking Capital ProjectPankaj PanjwaniNo ratings yet

- Finance in A Canadian SettingDocument27 pagesFinance in A Canadian SettingPianist CapuchinauticsNo ratings yet

- Workingcapitalmanagement-Lecture (Student)Document19 pagesWorkingcapitalmanagement-Lecture (Student)Christoper SalvinoNo ratings yet

- Chapter-1 Objective of The StudyDocument52 pagesChapter-1 Objective of The StudyShilpi JainNo ratings yet

- Types and Concepts of Working CapitalDocument3 pagesTypes and Concepts of Working CapitalSandipNo ratings yet

- FIN303_Chap 14Document49 pagesFIN303_Chap 14Hoang Thanh HangNo ratings yet

- Project Report - Working Capital ManagementDocument45 pagesProject Report - Working Capital ManagementSumit mukherjeeNo ratings yet

- Working Capital ManagementDocument15 pagesWorking Capital ManagementyosefNo ratings yet

- Introduction To Working Capital: 1.1 Objectives of The StudyDocument28 pagesIntroduction To Working Capital: 1.1 Objectives of The StudyalokpalNo ratings yet

- Working Capital RequirementsDocument32 pagesWorking Capital RequirementsPROFESSIONALS MARTNo ratings yet

- Financial Management in AgribusinessDocument10 pagesFinancial Management in AgribusinessNidhi NairNo ratings yet

- Management of Working CapitalDocument9 pagesManagement of Working CapitalKushal KaushikNo ratings yet

- WORKING CAPITAL - Meaning of Working CapitalDocument53 pagesWORKING CAPITAL - Meaning of Working CapitalvipinramtekeNo ratings yet

- Working Capital Management: A Guide to Optimizing Current AssetsDocument6 pagesWorking Capital Management: A Guide to Optimizing Current Assetsarchana_anuragiNo ratings yet

- 1 W C ChapDocument11 pages1 W C ChappoovarasnNo ratings yet

- Unit V MefaDocument24 pagesUnit V Mefashaikkhaderbasha2002No ratings yet

- Chapter Ii: Working Capital Management - A Conceptual OverviewDocument8 pagesChapter Ii: Working Capital Management - A Conceptual OverviewAnkit ShahNo ratings yet

- Vijay WC ConceptDocument26 pagesVijay WC ConceptVijay PkNo ratings yet

- O Variations in Accounting Methods o TimingDocument8 pagesO Variations in Accounting Methods o TimingAeris StrongNo ratings yet

- Dessertation AttachmentDocument59 pagesDessertation AttachmentBhavana thakurNo ratings yet

- GEC Elect 2 Module 6Document13 pagesGEC Elect 2 Module 6Aira Mae Quinones OrendainNo ratings yet

- WORKING CAPITAL - Meaning of Working CapitalDocument21 pagesWORKING CAPITAL - Meaning of Working CapitalDinesh KumarNo ratings yet

- Working Capital Management'Document16 pagesWorking Capital Management'Hardeep KaurNo ratings yet

- Final Project On WCMDocument51 pagesFinal Project On WCMAnup KulkarniNo ratings yet

- WORKING CAPITAL - Meaning of Working CapitalDocument33 pagesWORKING CAPITAL - Meaning of Working CapitalPriyesh KumarNo ratings yet

- Deven Final ProjectDocument84 pagesDeven Final ProjectviralNo ratings yet

- 2.3.1 Working Capital ConceptsDocument7 pages2.3.1 Working Capital Concepts이시연100% (1)

- Unit 5 Working Capital ManagementDocument20 pagesUnit 5 Working Capital ManagementMalde KhuntiNo ratings yet

- ProjectDocument62 pagesProjectvinodhknatrajanNo ratings yet

- Project Report - Working Capital Management Working Capital - Meaning of Working CapitalDocument6 pagesProject Report - Working Capital Management Working Capital - Meaning of Working CapitalAmartya Bodh TripathiNo ratings yet

- Learning Activity Sheet Business FinanceDocument9 pagesLearning Activity Sheet Business FinanceVon Violo BuenavidesNo ratings yet

- Jahan University Financial Management Lecture on Working CapitalDocument12 pagesJahan University Financial Management Lecture on Working CapitalMansour NiaziNo ratings yet

- Financial Management Unit 5Document15 pagesFinancial Management Unit 5Atish ArakkaNo ratings yet

- 1.1 Introduction of Working Capital Management: Chapter - 1Document67 pages1.1 Introduction of Working Capital Management: Chapter - 1raisNo ratings yet

- LeaseDocument2 pagesLeaseMokhlesurNo ratings yet

- Discuss The Techniques of Capital BudgetingDocument1 pageDiscuss The Techniques of Capital BudgetingMokhlesurNo ratings yet

- A Study On Temenos T24Document76 pagesA Study On Temenos T24Puja kumariNo ratings yet

- 2020 01 23 13 36 PDFDocument14 pages2020 01 23 13 36 PDFMokhlesurNo ratings yet

- A Study On Temenos T24Document76 pagesA Study On Temenos T24Puja kumariNo ratings yet

- Bangladesh Bank CircularDocument1 pageBangladesh Bank Circulartanviriubd100% (1)

- Bank Company Act, 1991 The Negotiable Instruments Act, 1881 The Bankers' Book Evidence Act, 1891Document3 pagesBank Company Act, 1991 The Negotiable Instruments Act, 1881 The Bankers' Book Evidence Act, 1891Mokhlesur100% (1)

- Financial Literacy SyllabusDocument4 pagesFinancial Literacy SyllabusVarun NandaNo ratings yet

- Revenue Regulations On Retirement Benefit Plans PDFDocument15 pagesRevenue Regulations On Retirement Benefit Plans PDFJadeNo ratings yet

- Handout No. 2Document4 pagesHandout No. 2Gertim CondezNo ratings yet

- Business Transfer TaxDocument5 pagesBusiness Transfer TaxFrincess Go Porazo100% (3)

- Income Taxation ReviewerDocument65 pagesIncome Taxation ReviewerShiela100% (10)

- Tax Deductions and Credits for Individuals and CorporationsDocument9 pagesTax Deductions and Credits for Individuals and CorporationsNhajNo ratings yet

- Document 806977650 PDFDocument17 pagesDocument 806977650 PDFshortmycdsNo ratings yet

- IDBI Bank Project: Analysis of Products, Services, Financials and Customer SatisfactionDocument49 pagesIDBI Bank Project: Analysis of Products, Services, Financials and Customer Satisfactionshweta GuptaNo ratings yet

- HDFC Life AR 2020 - 260620 PDFDocument431 pagesHDFC Life AR 2020 - 260620 PDFasdNo ratings yet

- Stamp Duty-MalaysiaDocument30 pagesStamp Duty-Malaysiazarfarie aron100% (9)

- PFG CardsDocument1 pagePFG Cardsapi-435582182No ratings yet

- San Fernando Rural Bank, Inc. V. Pampanga Omnibus Development Corporation and Dominic G. Aquino FactsDocument2 pagesSan Fernando Rural Bank, Inc. V. Pampanga Omnibus Development Corporation and Dominic G. Aquino FactsRamon Khalil Erum IVNo ratings yet

- Islamic Laws and Contracts (UMT Sample)Document8 pagesIslamic Laws and Contracts (UMT Sample)AbdulAzeemNo ratings yet

- Difference Between OPC and SPDocument2 pagesDifference Between OPC and SPrahulkapur87No ratings yet

- Financing Details: Cik Syazwani Binti Aziz Financing Account 06028080069448 MYR MYR 85,000.00Document1 pageFinancing Details: Cik Syazwani Binti Aziz Financing Account 06028080069448 MYR MYR 85,000.00GINTAMAGINTOKINo ratings yet

- Acco 400 Final NotesDocument53 pagesAcco 400 Final NotesMichael Di MonacoNo ratings yet

- Accounting For Electricity Company (IPCC)Document10 pagesAccounting For Electricity Company (IPCC)Rahul Prasad75% (4)

- Financing Small and Medium Business Enterprises by Janata Bank LTDDocument74 pagesFinancing Small and Medium Business Enterprises by Janata Bank LTDShowkatul IslamNo ratings yet

- Cost & Management Accounting - MGT402 McqsDocument19 pagesCost & Management Accounting - MGT402 McqsArsh UllahNo ratings yet

- Assignment On:: Cox's Bazar International UniversityDocument13 pagesAssignment On:: Cox's Bazar International UniversityJamil UddinNo ratings yet

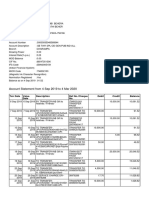

- Account Statement From 4 Sep 2019 To 4 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument6 pagesAccount Statement From 4 Sep 2019 To 4 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChiranjibi Behera ChiruNo ratings yet

- Finance Quiz 2Document4 pagesFinance Quiz 2studentNo ratings yet

- Scrip Code Scrip NameDocument5 pagesScrip Code Scrip NamenitmemberNo ratings yet

- Compare Old Jeevan Anand Plan No 149 To New Jeevan Anand Plan No 815 - New LIC Plans in 2014 - LIC Plans & PoliciesDocument3 pagesCompare Old Jeevan Anand Plan No 149 To New Jeevan Anand Plan No 815 - New LIC Plans in 2014 - LIC Plans & Policiesu4rishiNo ratings yet

- Chapter 5 SolutionsDocument21 pagesChapter 5 SolutionsIzu EvansNo ratings yet

- National Moot Court Competition Moot PropositionDocument8 pagesNational Moot Court Competition Moot Propositionrashmi narayanNo ratings yet

- 1040-SR Tax Return for SeniorsDocument2 pages1040-SR Tax Return for SeniorsRemyan RNo ratings yet

- Texas Rental ApplicationDocument5 pagesTexas Rental ApplicationKimberly JaéNo ratings yet

- Averting The Old Age CrisisDocument436 pagesAverting The Old Age CrisisJeonghee Lee100% (1)

- Wi Application FormDocument2 pagesWi Application Formippon_osotoNo ratings yet