Professional Documents

Culture Documents

Bangladesh Bank Circular

Uploaded by

tanviriubdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bangladesh Bank Circular

Uploaded by

tanviriubdCopyright:

Available Formats

Website: www.bb.org.

bd

Banking Regulation & Policy Department

Bangladesh Bank

Head Office

Dhaka

April 21, 2019

BRPD Circular No. 03 Date: ------------------------------

Baishakh 08, 1426

Managing Director/Chief Executive Officer

All Scheduled Banks in Bangladesh

Dear Sir,

Loan Classification and Provisioning

Please refer to BRPD Circular No.14 dated September 23, 2012, BRPD Circular No. 19 dated December

27, 2012 and BRPD Circular No.08 dated August 02, 2015 on the captioned subject.

2. For the purpose of facilitating the existing business environment and aligning with the economic cycle,

the following set of instructions shall have to be followed for the basis of loan classification under

objective criteria.

2.1. Any Continuous Loan if not repaid/renewed within the fixed expiry date for repayment or after the

demand by the bank will be treated as past due/overdue from the following day of the expiry date.

Any Demand Loan if not repaid within the fixed expiry date for repayment or after the demand by

the bank will be treated as past due/overdue from the following day of the expiry date. Whereas, In

case of any installment(s) or part of installment(s) of a Fixed Term Loan is not repaid within the

fixed expiry date, the amount of unpaid installment(s) will be treated as past due/overdue after six

months of the expiry date.

2.2. A Continuous Loan, Demand Loan, Fixed Term Loan or any installment(s)/part of installment(s) of

a Fixed Term Loan which will remain past due/overdue for a period of 03 (three) months or beyond

but less than 09 (nine) months, the entire loan will be put into the "Sub-standard (SS)".

2.3. A Continuous Loan, Demand Loan, Fixed Term Loan or any installment(s)/part of installment(s) of

a Fixed Term Loan which will remain past due/overdue for a period of 09 (nine) months or beyond

but less than 12 (twelve) months, the entire loan will be put into the "Doubtful (DF)".

2.4. A Continuous loan, Demand loan, Fixed Term Loan or any installment(s)/part of installment(s) of a

Fixed Term Loan which will remain past due/overdue for a period of 12 (twelve) months or beyond,

the entire loan will be put into the "Bad/Loss (B/L)".

2.5. Loans have to be treated as defaulted loan as per section 5(GaGa) of the Banking Companies Act,

1991 and to be reported accordingly as per formats given in BRPD Circular No.08 dated August 02,

2015. In this regard, a portion of the "Sub-standard (SS)" loans will be reported as defaulted loan.

3. All other instructions of BRPD Circular No.14 dated September 23, 2012 and its subsequent

modifications will remain unchanged. BRPD Circular No. 19 dated December 27, 2012, hereby stand

superseded by this circular.

This circular will come into force from 30 June 2019.

Yours sincerely,

(A.K.M. Amjad Hussain)

General Manager

Phone-9530252

You might also like

- Janus - Publicis Group Policies - 17 MayDocument304 pagesJanus - Publicis Group Policies - 17 MayPUSHKINNo ratings yet

- Holly FashionsDocument4 pagesHolly FashionsKhaled Darweesh100% (7)

- Literature Case Study on Bus Terminals DesignDocument12 pagesLiterature Case Study on Bus Terminals Designsumitbhatia10bac2676% (21)

- Cheapassignmenthelp Co UkDocument9 pagesCheapassignmenthelp Co UkOzPaper HelpNo ratings yet

- SECTION 303-01B: Engine - 4.6L and 5.4L 2000 F-150 Workshop Manual AssemblyDocument35 pagesSECTION 303-01B: Engine - 4.6L and 5.4L 2000 F-150 Workshop Manual AssemblyHassan Vela VenegasNo ratings yet

- BOC Facility Change Request FormDocument4 pagesBOC Facility Change Request FormDilum Alawatte100% (1)

- PSPLDocument13 pagesPSPLAswin KurupNo ratings yet

- Company Profile - AllDocument60 pagesCompany Profile - AllSaikrishna SangaNo ratings yet

- UserManual R45Document52 pagesUserManual R45miguel angel gracia ruizNo ratings yet

- Case DigestDocument4 pagesCase DigestSarabeth Silver MacapagaoNo ratings yet

- Lightcyber Behavioral AnalyticsDocument4 pagesLightcyber Behavioral AnalyticsasadaNo ratings yet

- Cheats Residet Evil 1 ps1Document6 pagesCheats Residet Evil 1 ps1Jose KurosakiNo ratings yet

- Quizzes - Topic 2Document6 pagesQuizzes - Topic 2LAN NGO HUONGNo ratings yet

- HKIA Journal 73Document143 pagesHKIA Journal 739 onNo ratings yet

- Chevrolet Corvette (C6)Document12 pagesChevrolet Corvette (C6)robertoNo ratings yet

- Channel Request Form: Tracker/ID No.: Branch CodeDocument2 pagesChannel Request Form: Tracker/ID No.: Branch CodeikmNo ratings yet

- PEDESTRIANIZATIONEVALUATIONTOOLVER220210614 FinalDocument21 pagesPEDESTRIANIZATIONEVALUATIONTOOLVER220210614 FinalAditi AiswaryaNo ratings yet

- Teklay ArayaDocument74 pagesTeklay Arayaendale yehualashetNo ratings yet

- U-Joint - Hardy SpicerDocument19 pagesU-Joint - Hardy SpicerCHEE SENG LEENo ratings yet

- SP14Q002 A1 HitachiDocument22 pagesSP14Q002 A1 HitachiNemesys TOFNo ratings yet

- Heromotocorp AR 2021Document309 pagesHeromotocorp AR 2021Mrigank MauliNo ratings yet

- National Geospatial Policy and ICICI-Videocon Fraud CaseDocument35 pagesNational Geospatial Policy and ICICI-Videocon Fraud CaseAnish GuptaNo ratings yet

- OpinionDocument15 pagesOpinionPat ThomasNo ratings yet

- Mh01aj5125 PDFDocument7 pagesMh01aj5125 PDFSELVEL SYNDICATENo ratings yet

- 4 Semana - Inglês - 9º Ano - (28-02 A 11-03-22)Document5 pages4 Semana - Inglês - 9º Ano - (28-02 A 11-03-22)Fernando LopesNo ratings yet

- Organic Gaseous FuelsDocument108 pagesOrganic Gaseous FuelsDHANUSH KARTHIK 20BME1003No ratings yet

- Adaptive Headlights System For Four Wheelers A ReviewDocument9 pagesAdaptive Headlights System For Four Wheelers A ReviewIJRASETPublicationsNo ratings yet

- 1596 - The Storage and Handling of LP GasDocument152 pages1596 - The Storage and Handling of LP GasVasko DrogriskiNo ratings yet

- HDFC Bank statement summary for Mr. Swarnjit SinghDocument4 pagesHDFC Bank statement summary for Mr. Swarnjit SinghSonu GoldyNo ratings yet

- BoschRexroth LMS Basic Setup ManualDocument83 pagesBoschRexroth LMS Basic Setup Manual케이홍No ratings yet

- Accounts & AdminDocument4 pagesAccounts & AdminJames JamesNo ratings yet

- On Screen Writing BookDocument61 pagesOn Screen Writing BookDada DadaNo ratings yet

- Se Srs Practical FileDocument22 pagesSe Srs Practical FileChintu kumarNo ratings yet

- Estimate Gadawara Power Plant NTPCDocument418 pagesEstimate Gadawara Power Plant NTPCSarin100% (1)

- Nuclear ChemistryDocument5 pagesNuclear ChemistryAletta Gregg CataloniaNo ratings yet

- VIVY'S WELDING AND FABRICATION BUSINESS PLANDocument8 pagesVIVY'S WELDING AND FABRICATION BUSINESS PLANBolt essays100% (1)

- Valkyrie 1500 C e CD 2002 Part NumberDocument159 pagesValkyrie 1500 C e CD 2002 Part NumberGeraldo FappiNo ratings yet

- 300+ REAL TIME E-Banking Objective Questions & AnswersDocument31 pages300+ REAL TIME E-Banking Objective Questions & Answersbarun vishwakarmaNo ratings yet

- JBL Basspro Car Active Subwoofer Rev.0Document18 pagesJBL Basspro Car Active Subwoofer Rev.0Edgar MamaniNo ratings yet

- Financial Analysis MIDHANIDocument14 pagesFinancial Analysis MIDHANIArghyadeep SinhaNo ratings yet

- CCL Products LTD.: Initiating Coverage Stock UpdateDocument8 pagesCCL Products LTD.: Initiating Coverage Stock Updateuma sankar vetsaNo ratings yet

- All India CW Pricelist Wef 01.08.2022Document6 pagesAll India CW Pricelist Wef 01.08.2022Bharath Raj SNo ratings yet

- Chimay-Mf1 FSM en Final 280219Document847 pagesChimay-Mf1 FSM en Final 280219Nikolaos MavridisNo ratings yet

- Presentation Refund InstructionsDocument12 pagesPresentation Refund InstructionsMilna JosephNo ratings yet

- Quickstart Hydrostar and Hypack Seabeam 3000 Rev - DDocument43 pagesQuickstart Hydrostar and Hypack Seabeam 3000 Rev - DloghanathanNo ratings yet

- CFA - Ethics - R56-60 Version 1211Document182 pagesCFA - Ethics - R56-60 Version 1211Thanh NguyễnNo ratings yet

- MagicDocument196 pagesMagicKamaldeep SinghNo ratings yet

- Senheiser MKH15 SMDocument53 pagesSenheiser MKH15 SMAndras Antal100% (1)

- ADDENDUM TO COC DBKL 230A (Rev.1-2010) PDFDocument3 pagesADDENDUM TO COC DBKL 230A (Rev.1-2010) PDFAbdul Aziz BurokNo ratings yet

- Guljari Lal Vs Kotak Mahindra Bank On 22 December 2022Document19 pagesGuljari Lal Vs Kotak Mahindra Bank On 22 December 2022Sahilkhan Pathan AdvocateNo ratings yet

- TuffStuff Hybrid Home Gym (SXT-550) Owner's ManualDocument60 pagesTuffStuff Hybrid Home Gym (SXT-550) Owner's ManualCharlieNo ratings yet

- Cyber Café and Xerox Lamination: Profile No.: 143 NIC Code: 63992Document11 pagesCyber Café and Xerox Lamination: Profile No.: 143 NIC Code: 63992Shivam SyalNo ratings yet

- GigaBlue 4K Box ManualDocument85 pagesGigaBlue 4K Box ManualWłodzimierz SurdackiNo ratings yet

- 01-06 Interface Management Commands PDFDocument68 pages01-06 Interface Management Commands PDFalan smithNo ratings yet

- Ipru Pension 10 Year X 2 LacDocument5 pagesIpru Pension 10 Year X 2 LacHK Option LearnNo ratings yet

- Baltra Catalogues 2022-23 FinalDocument44 pagesBaltra Catalogues 2022-23 FinalRohit KumarNo ratings yet

- 3 Is Learning Information Sheet in Technical Drafting Third Week 1Document11 pages3 Is Learning Information Sheet in Technical Drafting Third Week 1Cherie BalentozaNo ratings yet

- Brief Amicus Curiae of Pacific Legal Foundation, Baker v. City of McKinney, No. 22-40644 (5th Cir. Jan. 27, 2023)Document35 pagesBrief Amicus Curiae of Pacific Legal Foundation, Baker v. City of McKinney, No. 22-40644 (5th Cir. Jan. 27, 2023)RHTNo ratings yet

- Lab01 - Routing Concepts and Static RoutingDocument8 pagesLab01 - Routing Concepts and Static RoutingPham Van XuanNo ratings yet

- NM B471 ThinkPad - T480s ET481Document99 pagesNM B471 ThinkPad - T480s ET481Mike OtteNo ratings yet

- Finance Ca2 FinalDocument25 pagesFinance Ca2 Finalmasthan shaikNo ratings yet

- Cure MasterDocument64 pagesCure MasterSerkan Akşanlı100% (1)

- Installation Instruction Manual: Heat PumpDocument32 pagesInstallation Instruction Manual: Heat PumpAndrean SaputraNo ratings yet

- Bangladesh Bank Cottage Industry GuidelineDocument1 pageBangladesh Bank Cottage Industry GuidelineTanayNo ratings yet

- BRPD Circular No. 19 (2012)Document2 pagesBRPD Circular No. 19 (2012)Mohaiminul Islam ShuvraNo ratings yet

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Document15 pagesEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Sadhan RoyNo ratings yet

- Baina Deed - LandDocument11 pagesBaina Deed - LandtanviriubdNo ratings yet

- Passport MRP Online Form Fillup InstructionDocument14 pagesPassport MRP Online Form Fillup InstructionRahmatullah RonNo ratings yet

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Document15 pagesEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Sadhan RoyNo ratings yet

- Cwievi Mâqcî Μ‡Qi Dig: ‡Μzvi Mz¨Vwqz QweDocument2 pagesCwievi Mâqcî Μ‡Qi Dig: ‡Μzvi Mz¨Vwqz QweKazi HasanNo ratings yet

- Amortization SHBLDocument15 pagesAmortization SHBLtanviriubdNo ratings yet

- BASIC Bank Employee Certification LetterDocument2 pagesBASIC Bank Employee Certification LettertanviriubdNo ratings yet

- ALL Staff CPF From Basic BankDocument259 pagesALL Staff CPF From Basic BanktanviriubdNo ratings yet

- The Deputy General ManagerDocument3 pagesThe Deputy General ManagertanviriubdNo ratings yet

- HRM Practices in BangladeshDocument8 pagesHRM Practices in BangladeshtanviriubdNo ratings yet

- SL NoDocument1 pageSL NotanviriubdNo ratings yet

- CV Khalid FLFLDocument5 pagesCV Khalid FLFLtanviriubdNo ratings yet

- QuestionDocument6 pagesQuestiontanviriubdNo ratings yet

- Amortization SHBLDocument21 pagesAmortization SHBLtanviriubdNo ratings yet

- Professional Résumé: Official Contact Address: BASIC Bank Ltd. Gulshan Branch Permanent Contact AddressDocument6 pagesProfessional Résumé: Official Contact Address: BASIC Bank Ltd. Gulshan Branch Permanent Contact AddresstanviriubdNo ratings yet

- HRM Practices in BangladeshDocument8 pagesHRM Practices in BangladeshtanviriubdNo ratings yet

- Name of Co. Type Expiry Overdue Suspense DP% Sanctioned Limit Outstanding 31.07.15 Un-Applied Claim AmountDocument8 pagesName of Co. Type Expiry Overdue Suspense DP% Sanctioned Limit Outstanding 31.07.15 Un-Applied Claim AmounttanviriubdNo ratings yet

- Promotion TipsDocument81 pagesPromotion TipstanviriubdNo ratings yet

- Amortization TableDocument34 pagesAmortization TabletanviriubdNo ratings yet

- BASIC Bank Limited: Name: ID: Present AddressDocument1 pageBASIC Bank Limited: Name: ID: Present AddresstanviriubdNo ratings yet

- Model of Perfect CompetationDocument26 pagesModel of Perfect CompetationtanviriubdNo ratings yet

- BASIC Bank Limited: Deposit, Advance & Profit Achievement Against Target (Management)Document3 pagesBASIC Bank Limited: Deposit, Advance & Profit Achievement Against Target (Management)tanviriubdNo ratings yet

- Answers To Homework 5 Summer 2011Document8 pagesAnswers To Homework 5 Summer 2011tanviriubdNo ratings yet

- BASIC Bank document withDocument119 pagesBASIC Bank document withtanviriubdNo ratings yet

- Quick start guide for Samsung LCD TVDocument9 pagesQuick start guide for Samsung LCD TVtanviriubdNo ratings yet

- Contents Internship BASICDocument26 pagesContents Internship BASICtanviriubdNo ratings yet

- Transaction Type Account No./Glno/Suspense Account/Ep CodeDocument1 pageTransaction Type Account No./Glno/Suspense Account/Ep CodetanviriubdNo ratings yet

- Mix Deposit NDocument1 pageMix Deposit NtanviriubdNo ratings yet

- BASIC Bank document withDocument119 pagesBASIC Bank document withtanviriubdNo ratings yet

- Ch1. Considering Materiality and RiskDocument47 pagesCh1. Considering Materiality and RiskAli AlbaqshiNo ratings yet

- Click The Link and Go To Link - Running Man Ep 145 Eng Sub Is Up 6Document46 pagesClick The Link and Go To Link - Running Man Ep 145 Eng Sub Is Up 6li mei fenNo ratings yet

- Joan L Cary: Please Remember, You Are Restricted From Using This Information ForDocument6 pagesJoan L Cary: Please Remember, You Are Restricted From Using This Information ForAliyaNo ratings yet

- Free Tuition Fee Application Form: University of Rizal SystemDocument2 pagesFree Tuition Fee Application Form: University of Rizal SystemCes ReyesNo ratings yet

- Summary National Policy Strategy For Infrastructure and Spatial PlanningDocument24 pagesSummary National Policy Strategy For Infrastructure and Spatial Planningandre turnerNo ratings yet

- The Main Departments in A HotelDocument20 pagesThe Main Departments in A HotelMichael GudoNo ratings yet

- Croatian Films of 2006 ExploredDocument80 pagesCroatian Films of 2006 ExploredCoockiNo ratings yet

- Nodalo - Medicard vs. CirDocument3 pagesNodalo - Medicard vs. CirGenebva Mica NodaloNo ratings yet

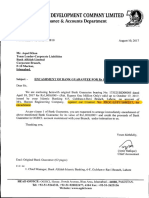

- Encashment of Bank Guarantee 2017-08-11Document4 pagesEncashment of Bank Guarantee 2017-08-11mc160403810 Usman AliNo ratings yet

- Case Digests On TrademarksDocument10 pagesCase Digests On Trademarkssei1davidNo ratings yet

- MUET@UiTM2020 - Food Poisoning - Analysis & SynthesisDocument15 pagesMUET@UiTM2020 - Food Poisoning - Analysis & SynthesisNURUL FARRAH LIEYANA BT SHAMSUL BAHARINo ratings yet

- What Is Gratitude and What Is Its Role in Positive PsychologyDocument19 pagesWhat Is Gratitude and What Is Its Role in Positive Psychologyakraam ullah100% (1)

- Hiv/Aids: Project BackgroundDocument1 pageHiv/Aids: Project BackgroundKristine JavierNo ratings yet

- Desperate HousewivesDocument15 pagesDesperate HousewivesIvanka ShtyfanenkoNo ratings yet

- 2009-05-28Document40 pages2009-05-28Southern Maryland OnlineNo ratings yet

- Prisoner of ZendaDocument27 pagesPrisoner of ZendaSauban AhmedNo ratings yet

- History of The Alphabet Sejarah AbjadDocument29 pagesHistory of The Alphabet Sejarah AbjadEmian MangaNo ratings yet

- UntitledDocument22 pagesUntitledArjun kumar ShresthaNo ratings yet

- Material For Upper Advanced and TOEFLDocument132 pagesMaterial For Upper Advanced and TOEFLNadia ChavezNo ratings yet

- Au L 1637113412 Poem Analysis of Matilda by Hilaire Belloc - Ver - 2Document5 pagesAu L 1637113412 Poem Analysis of Matilda by Hilaire Belloc - Ver - 2Manha abdellahNo ratings yet

- (UPDATED) BCC Semifinalist GuidebookDocument4 pages(UPDATED) BCC Semifinalist GuidebookYohanes StefanusNo ratings yet

- ALL Night Long: THE Architectural Jazz OF THE Texas RangersDocument8 pagesALL Night Long: THE Architectural Jazz OF THE Texas RangersBegüm EserNo ratings yet

- General Defences Shortest (Last Minute)Document23 pagesGeneral Defences Shortest (Last Minute)Raj DasNo ratings yet

- TSM 070 FormDocument8 pagesTSM 070 FormThapliyal SanjayNo ratings yet

- Et in Arcadia EgoDocument5 pagesEt in Arcadia Ego69telmah69No ratings yet