Professional Documents

Culture Documents

A III-5 F HUD 11711A - R S I F HUD 11711B - C A: Ppendix ORM Elease of Ecurity Nterest ORM Ertification and Greement

Uploaded by

perritoxx2Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A III-5 F HUD 11711A - R S I F HUD 11711B - C A: Ppendix ORM Elease of Ecurity Nterest ORM Ertification and Greement

Uploaded by

perritoxx2Copyright:

Available Formats

GINNIE MAE 5500.3, REV.

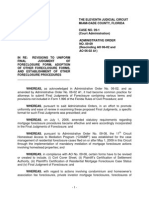

APPENDIX III-5

FORM HUD 11711A - RELEASE OF SECURITY INTEREST

FORM HUD 11711B - CERTIFICATION AND AGREEMENT

Form HUD 11711A - Release of Security Interest

Applicability: Ginnie Mae I MBS Program and Ginnie Mae II MBS Program.

Purpose: To provide for releases of security interests in the pooled mortgages by

prior secured institutions.

Prepared by: Interim financing institutions.

Prepared in: Original and any copies the issuer wishes to retain.

Distribution: Original to document custodian, along with other pool documents.

Completion

Instructions: The circled numbers on the illustrated form correspond with the numbers

listed below.

1. Pool number assigned by Ginnie Mae.

2. Name and address of interim lending (or other financing) institution.

3. Signature and title of individual signing on behalf of interim lender.

4. Date signed.

Date: 10/01/07 1 Appendix III-5

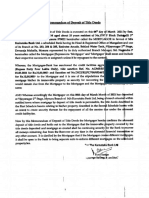

U.S. Department of Housing OMB Approval No. 2503-0033 (Exp. 10/31/2019)

Release of

and Urban Development

Security Interest Government National Mortgage Association

Public reporting for this information collection is estimated to average 3 minutes per response, including the time for reviewing instructions,

searching existing data sources, gathering and maintaining the data and completing and reviewing the collection of information. This agency may

not collect this information, and you are not required to complete this form, unless it displays a valid OMB control number.

Ginnie Mae is authorized to collect this information pursuant to Section 306(g) of the National Housing Act and/or by Ginnie Mae’s Handbook

5500.3, Rev. 1. The purpose of this collection is to provide for releases of security interests in the pooled mortgages by prior secured institutions.

The information collected will not be disclosed outside the Department except as required by law.

With respect to mortgages (loans) represented by Ginnie Mae Pool number:

The lending (or other financing) institution named below agrees to relinquish any and all right, title or interest it may have in mortgages to be placed

in this Ginnie Mae mortgage-backed securities pool or loan package (Pooled Mortgages) no later than the date and time of delivery of the securities

by Ginnie Mae or its agent. In the case of Home Equity Conversion Mortgage loans (HECMs), “Pooled Mortgages” shall include the mortgages,

Participations related to such mortgages and any amounts related to such mortgages that do not constitute participation interests.

Name of Lending (or Other Financing) Institution

Address

Authorized Signature Title of Individual Signing

Dat e

One or more releases per pool or loan package are required to be held by the document custodian to the extent necessary to encompass all

Pooled Mortgages.

form HUD-11711A (10/2007)

Previous edition is obsolete ref. Ginnie Mae Handbook 5500.3, Rev. 1

Form HUD 11711B - Certification and Agreement

Applicability: Ginnie Mae I MBS Program and Ginnie Mae II MBS Program.

Purpose: To provide for a certification by the issuer that the releases (forms HUD

11711A) provided to the document custodian encompass all mortgages in a pool or loan package.

Prepared by: Issuer.

Prepared in: Original and any copies the issuer wishes to retain.

Distribution: Original to document custodian, along with other pool documents.

Completion

Instructions: The circled numbers on the illustrated form correspond with the numbers

listed below.

1. Commitment number assigned by Ginnie Mae.

2. Check appropriate box.

3. Full legal name of issuer.

4. Signature and title of an authorized officer of the issuer as evidenced by Resolution of Board of

Directors and Certificate of Authorized Signatures, form HUD 11702 (Appendix I-2), previously

submitted to Ginnie Mae.

5. Enter issuer ID number that has been assigned by Ginnie Mae.

6. Date signed.

You might also like

- Prospectus Ginnie Mae I: Construction and Permanent Loan SecuritiesDocument10 pagesProspectus Ginnie Mae I: Construction and Permanent Loan SecuritiesAfzal ImamNo ratings yet

- Representations and Warranties Agreement: Government National Mortgage AssociationDocument2 pagesRepresentations and Warranties Agreement: Government National Mortgage AssociationA. CampbellNo ratings yet

- Forensic Mortgage Fraud Audit Report (MFI Miami) Echeverria, Et Al Vs Bank of America, Et Al.Document7 pagesForensic Mortgage Fraud Audit Report (MFI Miami) Echeverria, Et Al Vs Bank of America, Et Al.Isabel Santamaria100% (7)

- Third Party Financing Addendum (TREC No. 40-8) (Rev. 11 - 2019)Document2 pagesThird Party Financing Addendum (TREC No. 40-8) (Rev. 11 - 2019)Matt SimonNo ratings yet

- EDITED-FORM CA of Priti GeraDocument15 pagesEDITED-FORM CA of Priti GeraAmbience LegalNo ratings yet

- Third Division: Syllabus SyllabusDocument8 pagesThird Division: Syllabus SyllabusHannah TabundaNo ratings yet

- Directorate of Investment and Company Administration: Form H-1 - Registration of Mortgage or ChargeDocument2 pagesDirectorate of Investment and Company Administration: Form H-1 - Registration of Mortgage or ChargeNyi Nyi AungNo ratings yet

- Application Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Document5 pagesApplication Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Prabhu KnNo ratings yet

- Trust Deed Foreclosure ChecklistDocument40 pagesTrust Deed Foreclosure Checklistautumngrace100% (1)

- Final Payment Certif - TEMPLATEDocument1 pageFinal Payment Certif - TEMPLATEnoklit15No ratings yet

- Particulars of Claim - Shiraz Sethi - 637607503048561827Document8 pagesParticulars of Claim - Shiraz Sethi - 637607503048561827RollOnFridayNo ratings yet

- Perwira Habib Bank Malaysia BHD V Loo & Sons Realty SDN BHD (1996) 4 CLJ 171Document4 pagesPerwira Habib Bank Malaysia BHD V Loo & Sons Realty SDN BHD (1996) 4 CLJ 171Faizah Randeran100% (1)

- Schedule Ii Form D Proof of Claim by Financial CreditorsDocument3 pagesSchedule Ii Form D Proof of Claim by Financial Creditorssureshkumar reddyNo ratings yet

- William T. Whiting V Citimortgage IncDocument35 pagesWilliam T. Whiting V Citimortgage IncForeclosure FraudNo ratings yet

- Leos Investment Limited V Turyakira and Another (Civil Suit No 8 of 2020) 2022 UGHCLD 39 (3 March 2022)Document5 pagesLeos Investment Limited V Turyakira and Another (Civil Suit No 8 of 2020) 2022 UGHCLD 39 (3 March 2022)evasakankwatsa900No ratings yet

- US Internal Revenue Service: rr-98-34Document6 pagesUS Internal Revenue Service: rr-98-34IRSNo ratings yet

- Read, Sign and Return.: October 29, 2019Document31 pagesRead, Sign and Return.: October 29, 2019MIGUEL GOMEZNo ratings yet

- HUD Form 9887Document6 pagesHUD Form 9887DBHAAdminNo ratings yet

- Borrowers AuthDocument1 pageBorrowers Authapi-3850899No ratings yet

- Fax Cover Page 6 Pages: Attention: Robert GouletDocument6 pagesFax Cover Page 6 Pages: Attention: Robert Gouletrobert gouletNo ratings yet

- March 30 2011 CasesDocument16 pagesMarch 30 2011 CasesBruce WayneNo ratings yet

- JV AgreementDocument14 pagesJV AgreementRizky RachmatNo ratings yet

- Philippine National Bank v. Gateway PropertyDocument10 pagesPhilippine National Bank v. Gateway PropertyChantal Sue PalerNo ratings yet

- Honeywell - Garrett Motion - Plan Support Deal in Chapter 11Document97 pagesHoneywell - Garrett Motion - Plan Support Deal in Chapter 11Kirk HartleyNo ratings yet

- 131 Windser GreensDocument22 pages131 Windser Greens100abhayNo ratings yet

- Conveyancing Rough Draft 2Document23 pagesConveyancing Rough Draft 2Sylvia G.No ratings yet

- Case DigestDocument29 pagesCase Digestangela erillaNo ratings yet

- Reimbursement ProcedureDocument6 pagesReimbursement ProcedureLam TranNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 342, Docket 93-7370Document14 pagesUnited States Court of Appeals, Second Circuit.: No. 342, Docket 93-7370Scribd Government DocsNo ratings yet

- Loan ApplicationDocument5 pagesLoan Applicationkhalid khayNo ratings yet

- Week 2 - Credit Transactions (Mutuum) Full-TextDocument44 pagesWeek 2 - Credit Transactions (Mutuum) Full-TextMaestro LazaroNo ratings yet

- First Fil-Sin Lending Corp. v. PadilloDocument1 pageFirst Fil-Sin Lending Corp. v. PadilloiwamawiNo ratings yet

- DHLF - Loan Sanction LetterDocument2 pagesDHLF - Loan Sanction LetterRaju BhaiNo ratings yet

- Bayport Tanzania Template Payroll Terms and Conditions Revsied 2020Document14 pagesBayport Tanzania Template Payroll Terms and Conditions Revsied 2020Haason RamadhanNo ratings yet

- CASE Stakeholder Toh Theam HockDocument5 pagesCASE Stakeholder Toh Theam HockIqram MeonNo ratings yet

- United States Court of Appeals, Third CircuitDocument15 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Pag-Ibig How To - PhilippinesDocument14 pagesPag-Ibig How To - PhilippinesSteffanie Jorj EspirituNo ratings yet

- Mortgagee Letter 2005-30Document13 pagesMortgagee Letter 2005-30Storm BradfordNo ratings yet

- Frias V San Diego SisonDocument5 pagesFrias V San Diego Sisonbrida athenaNo ratings yet

- Agreement TwoWheelerLoanDocument18 pagesAgreement TwoWheelerLoanygrjnb5kcqNo ratings yet

- Cir. 294 - Amended Guidelines On Foreclosure of Real Estate MortgageDocument12 pagesCir. 294 - Amended Guidelines On Foreclosure of Real Estate MortgageRey John Ren PachoNo ratings yet

- HBMT 2005-3 Bear Stearns Derivative AgreementDocument98 pagesHBMT 2005-3 Bear Stearns Derivative AgreementcsgaddisNo ratings yet

- Guidance For Preparation of Funding Documents v2Document17 pagesGuidance For Preparation of Funding Documents v2AtulNo ratings yet

- Addedum To The Contract of LeaseDocument3 pagesAddedum To The Contract of LeaseUndo ValenzuelaNo ratings yet

- HUD FHA Mortgagee Letter ML 2012-02Document4 pagesHUD FHA Mortgagee Letter ML 2012-02Enforcement DefenseNo ratings yet

- YaVaughnie Wilkins BankruptcyDocument8 pagesYaVaughnie Wilkins BankruptcyCalifornia Public Access100% (1)

- Property Purchase Form PDFDocument2 pagesProperty Purchase Form PDFSamarendra JenaNo ratings yet

- Garcia POC Including Note 1 - No EndorsementDocument31 pagesGarcia POC Including Note 1 - No EndorsementAC FieldNo ratings yet

- Bidding Documents - 20Document29 pagesBidding Documents - 20madz heussafNo ratings yet

- Notice of Sale of Estate Property: United States Bankruptcy Court Central District of CaliforniaDocument12 pagesNotice of Sale of Estate Property: United States Bankruptcy Court Central District of CaliforniaChapter 11 DocketsNo ratings yet

- PartnershipDocument7 pagesPartnershipJohn Paul Dumaguin CastroNo ratings yet

- Case Digests Agner To RicarzeDocument97 pagesCase Digests Agner To RicarzePatrick Alvin AlcantaraNo ratings yet

- Loan Agreement: Transaction Details ScheduleDocument13 pagesLoan Agreement: Transaction Details ScheduleNaren Singh TanwarNo ratings yet

- Surety Bond Guarantee Agreement Terms and Conditions of Agreement On Page 2Document2 pagesSurety Bond Guarantee Agreement Terms and Conditions of Agreement On Page 2Paul SteveNo ratings yet

- Standard Clauses: Reinz Book ofDocument24 pagesStandard Clauses: Reinz Book ofBob SmithNo ratings yet

- Truth in Lending Act CASE DIGESTSDocument5 pagesTruth in Lending Act CASE DIGESTSkeouhNo ratings yet

- VICEDocument92 pagesVICEVerónica SilveriNo ratings yet

- ContractDocument13 pagesContractAli khanNo ratings yet

- Most Important Terms and ConditionDocument6 pagesMost Important Terms and ConditionAtish NayarNo ratings yet

- Magic Chef Washer Manual Model Mcstcw21w2.Document39 pagesMagic Chef Washer Manual Model Mcstcw21w2.perritoxx2No ratings yet

- Electrical Jobs Requiring PermitsDocument9 pagesElectrical Jobs Requiring Permitsperritoxx2No ratings yet

- Midfirst Bank Linda Green VPDocument2 pagesMidfirst Bank Linda Green VPperritoxx2No ratings yet

- 1-09-09-Revision Uniform Final Judgment Foreclosure and ProceduresDocument11 pages1-09-09-Revision Uniform Final Judgment Foreclosure and Proceduresperritoxx2No ratings yet

- FHFA V Credit SuisseDocument122 pagesFHFA V Credit SuisseStephen DibertNo ratings yet

- Ibm t43 ManualDocument222 pagesIbm t43 ManualAlexandru ClambaNo ratings yet

- Manual JL50QT 18Document180 pagesManual JL50QT 18perritoxx2No ratings yet

- JPMorgan Reaches FHFA Settlement - Business InsiderDocument4 pagesJPMorgan Reaches FHFA Settlement - Business Insiderperritoxx2No ratings yet

- Nortel CICS Installer Guide 6.1 PDFDocument390 pagesNortel CICS Installer Guide 6.1 PDFperritoxx2No ratings yet

- FHFA V Deutsche Bank PDFDocument112 pagesFHFA V Deutsche Bank PDFperritoxx2No ratings yet

- Letter-Requesting-Depublication Glanski V Bank of America PDFDocument7 pagesLetter-Requesting-Depublication Glanski V Bank of America PDFperritoxx2No ratings yet

- Salom Brothers Prepayment ModelDocument42 pagesSalom Brothers Prepayment Modelsouravroy.sr5989100% (1)

- California Qui Tam False Claims Recording FeesDocument18 pagesCalifornia Qui Tam False Claims Recording Feesthorne1022No ratings yet

- QuestionsDocument4 pagesQuestionsSohad ElnagarNo ratings yet

- Mortgage Assumption Agreement (Original Mortgage Holder Released From Further Obligations)Document2 pagesMortgage Assumption Agreement (Original Mortgage Holder Released From Further Obligations)Legal Forms100% (1)

- Eligibility MatrixDocument9 pagesEligibility Matrixsports9696No ratings yet

- FinancingDocument40 pagesFinancingdwrighte1No ratings yet

- Spouses Jonsay v. Solidbank Corporation, G.R. No. 206459, April 6, 2016Document15 pagesSpouses Jonsay v. Solidbank Corporation, G.R. No. 206459, April 6, 2016noemi alvarezNo ratings yet

- Max Gardner's Top 200 Signs You've Got A False Document As Published by The Florida Bar in 2008Document18 pagesMax Gardner's Top 200 Signs You've Got A False Document As Published by The Florida Bar in 2008lizinsarasota100% (2)

- DPC IiDocument13 pagesDPC Iishailesh latkarNo ratings yet

- Extrajudicial ForeclosureDocument5 pagesExtrajudicial ForeclosureNORABBE L. MERCADERNo ratings yet

- Reg MDTDDocument5 pagesReg MDTDvandv printsNo ratings yet

- Analysis of CMBS Bubble PDFDocument36 pagesAnalysis of CMBS Bubble PDFCooperNo ratings yet

- Affidavit of Good Faith Chattel Mortgage PDFDocument1 pageAffidavit of Good Faith Chattel Mortgage PDFArianneParalisanNo ratings yet

- Nelson Mckee Has Been Filing Agent For 908 Registrants Such As Jpmac, Deutsche, PHH, Lehman, Thornburg, HarborviewDocument23 pagesNelson Mckee Has Been Filing Agent For 908 Registrants Such As Jpmac, Deutsche, PHH, Lehman, Thornburg, Harborview83jjmackNo ratings yet

- Foreclosure List ReportDocument1 pageForeclosure List Reportapi-26867167No ratings yet

- Amortization Homework HelpDocument4 pagesAmortization Homework Helpnyjunutybuj2100% (1)

- Andhra Pradesh Records of Rights in Land and Pattadar Pass Books PDFDocument15 pagesAndhra Pradesh Records of Rights in Land and Pattadar Pass Books PDFLatest Laws TeamNo ratings yet

- Deed of Real Estate MortgageDocument2 pagesDeed of Real Estate MortgageKristian Paolo De CastroNo ratings yet

- Echeverria Motion For Proof of AuthorityDocument13 pagesEcheverria Motion For Proof of AuthorityIsabel SantamariaNo ratings yet

- Bad Faith in Foreclosure MotionDocument20 pagesBad Faith in Foreclosure MotionNancy O'BrienNo ratings yet

- Mortgages For DummiesDocument2 pagesMortgages For DummiesramondoniakNo ratings yet

- Bank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 2014Document2 pagesBank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 201483jjmackNo ratings yet

- 2020 IvyZelman Fairway PresentationDocument41 pages2020 IvyZelman Fairway PresentationpharssNo ratings yet

- Affidavit of Consolidation - Pascual IIDocument2 pagesAffidavit of Consolidation - Pascual IITricia Maria M. CastroNo ratings yet

- Quiz Regulatory Framework and Legal Issues in BusinessDocument8 pagesQuiz Regulatory Framework and Legal Issues in Businessqrrzyz7whgNo ratings yet

- Extra Judicial ForeclosureDocument3 pagesExtra Judicial ForeclosureANGIE BERNALNo ratings yet

- Office of The Punong Barangay: Agreement To PayDocument4 pagesOffice of The Punong Barangay: Agreement To PayBarangay CatoNo ratings yet

- Mortgage Loan Excel SheetDocument4 pagesMortgage Loan Excel Sheetsumbul imranNo ratings yet

- Proof Submission User Manual 2023-24 1Document28 pagesProof Submission User Manual 2023-24 1Arun APNo ratings yet

- The New Math of Reverse Mortgages For Retirees - WSJ (June 2022)Document5 pagesThe New Math of Reverse Mortgages For Retirees - WSJ (June 2022)ejbejbejbNo ratings yet

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- The Synergy Solution: How Companies Win the Mergers and Acquisitions GameFrom EverandThe Synergy Solution: How Companies Win the Mergers and Acquisitions GameNo ratings yet

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet