Professional Documents

Culture Documents

BUS 5110 - Written Assignment Unit 5 University of The People

BUS 5110 - Written Assignment Unit 5 University of The People

Uploaded by

christian allosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BUS 5110 - Written Assignment Unit 5 University of The People

BUS 5110 - Written Assignment Unit 5 University of The People

Uploaded by

christian allosCopyright:

Available Formats

BUS 5110 - Written Assignment Unit 5

University of the People

To Answer I will like to break them down step by step:

1.Standard Cost:

Fruit: 200,000/20,000 = 10/carton

Packaging: 10,000/20,000 = 0.5/carton

Labor: 90,000/20,000 = 4.5

Standard Cost = 15/carton (10 + 0.5 + 4.5)

2.Actual cost per unit:

Fruit: 244,200/20,000 = 12.21/Carton

Packaging: 11,000/20,000 = 0.55/carton

Labor: 150,000/20,000 = 7.5/carton

Actual cost per carton = 20.26/carton

3.Direct Materials Price Variance: indicates the difference between the actual cost

of direct materials and the standard cost of direct materials[ CITATION Accnd1 \l

1033 ].

Standard cost of direct materials: Fruit + Packaging: (200,000 x 1) + (11,000 x 0.50)

(standard cost x actual quantity)

Actual amount spent on direct materials Fruit + Packaging: (200,000 x 1.221) +

(11,000 x 1) (Actual price x actual quantity)

Variance: 255,200 - 205,500 = 49,700 unfavorable

Workings-1: (The information will be used for material price & usage variance)

Fruit:

Standard cost: 20,000 x 10 = 200,000 Pounds; 200,000 Pounds x 1 = $200,000

Standard cost = 1

Standard quantity = 200,000

Actual cost: 20,000 x 10 = 200,000 Pounds; 200,000 x 1.221 = $244,200

Actual cost = 1.221

Actual quantity = 200,000

Packaging:

Standard cost: 20,000 x 1 = 20,000 Pounds x 0.5 = 10,000

Standard rate = 0.5;

Standard quantity = 20,000

Actual cost: 20,000 x 0.55 = 11,000 Pounds x 1 = 11,000

Actual rate = 1

Actual Quantity = 11,000

The variance is unfavorable because the actual spent on purchasing the material is

higher than the standard price of direct materials. The purchase department should be

consulted in order to determine the reason of unfavorable variance.

4.Direct material usage variance: indicates the difference between the standard cost

of direct materials that should have been used (standard quantity times standard cost)

for the good output and the actual quantity of direct materials used at their standard

cost[ CITATION Accnd2 \l 1033 ].

It is calculated as: (Standard Usage - Actual usage) x Standard cost per unit.

Actual usage: 11,000

Standard Usage: 20,000

Standard price: 0.50

Variance: (20,000 - 11,000) x 0.50 = $4,500 favorable

The usage variance is favorable as actual usage is lower than standard usage, this

means that production department is working efficiently and a good quality of

packaging in bought by the purchasing department. There is no usage variance in fruit

usage as 10 pounds per carton is used under budgeted and actual.

5.Direct Labor rate variance: It is difference between the standard cost of direct

labor for standards hours and the standards cost of actual hours. It is calculated as:

Actual Hours x Standard rate: 15,000 x 9 = 135,000

Actual Hours x Actual rate: 15,000 x 10 = 150,000

Variance: 15,000 unfavorable

Standards hours x standard rate:

Production department (usually production supervisor) is to concerned for the

inquiries about labor rate variance.

Workings-2: (Will be used for labor rate & efficiency variance)

Standard cost: 20,000 x 0.50 = 10,000 hours; 10,000 x 9 = 90,000

Standard rate = 9/hr.

Standard Hours = 10,000

Actual Cost: 20,000 x 0.75 = 15,000 hours; 15,000 x 10 = 150,000

Actual rate = 10/hour

Actual hours = 15,000

6.Direct labor efficiency variance: It is calculated as Actual hours less standard hours

multiplied by standard rate.

(Actual Hours - Standard Hours) x standard rate: (15,000 - 10,000) x 9 = 45,000

unfavorable

As ore hours are spent therefore it is an unfavorable variance. The production

manager should be contacted in order to determine the reason of the unfavorable

variance. Furthermore, the purchase department (usually purchase manager) should

also be asked about the quality of material as poor material might take more time.

Conclusion: The labor efficiency variance and direct material variances are the

highest variances. The management should look into the production department as

both these variances are pointing towards the inefficiency of production department.

The management should also inquire about the material quality that is being

purchased as poor quality material will affect labor as well as material efficiency. The

labor rate unfavorable variance shows another inefficiency of the production

department. To conclude, management should take measures to check the quality of

the materials purchased and efficiency of the production department; the machinery

involved in production should also be checked.

References

Accountingcoach. (n.d.). direct materials price variance definition. Retrieved Mar 4,

2020, from Accountingcoach: https://www.accountingcoach.com/terms/D/direct-

materials-price-variance

Accountingcoach. (n.d.). direct materials usage variance definition. Retrieved 2020,

from Accountingcoach: https://www.accountingcoach.com/terms/D/direct-

materials-usage-variance

You might also like

- Group Activity: University of People BUS 5110 Group Activity Case StudyDocument11 pagesGroup Activity: University of People BUS 5110 Group Activity Case Studychristian allos100% (15)

- Case Study Unit 5Document4 pagesCase Study Unit 5Hilkiah MusNo ratings yet

- BUS 5113 Group Assignment - Group 0001A - Global Washer and Dryer Manufacturer Case StudyDocument12 pagesBUS 5113 Group Assignment - Group 0001A - Global Washer and Dryer Manufacturer Case StudyPaw Akou-edi100% (2)

- UNIT 1-Written Assignment-BUS 5110Document5 pagesUNIT 1-Written Assignment-BUS 5110Aliyazahra Kamila100% (1)

- BUS 5110 Portfolio Activity Unit-4 BUS 5110 Portfolio Activity Unit-4Document5 pagesBUS 5110 Portfolio Activity Unit-4 BUS 5110 Portfolio Activity Unit-4Emmanuel Gift Bernard100% (3)

- Discussion Assignment Unit-8 BUS 5110Document5 pagesDiscussion Assignment Unit-8 BUS 5110Djahan Rana100% (2)

- Written Assignment Unit 4Document3 pagesWritten Assignment Unit 4कुनाल सिंहNo ratings yet

- Writting - Unit - 5 - Papaya Case Study 1 PDFDocument4 pagesWritting - Unit - 5 - Papaya Case Study 1 PDFFrancis Desoliviers Winner-BluheartNo ratings yet

- Bus 5110 Managerial Accounting Written Assignment Unit 47Document7 pagesBus 5110 Managerial Accounting Written Assignment Unit 47Emmanuel Gift Bernard100% (2)

- Written Assignment Unit 7 Business Law 5115Document7 pagesWritten Assignment Unit 7 Business Law 5115Ola leahNo ratings yet

- Bus 5110 Written Assignment Unit 7Document7 pagesBus 5110 Written Assignment Unit 7KonanRogerKouakouNo ratings yet

- BUS 5110 - Written Assignment - Unit 5 - MADocument5 pagesBUS 5110 - Written Assignment - Unit 5 - MAAliyazahra Kamila100% (1)

- BUS 5110 - Written Assignment - Unit 6Document5 pagesBUS 5110 - Written Assignment - Unit 6Aliyazahra KamilaNo ratings yet

- Unit 1 Written Assignment - Updated VersionDocument6 pagesUnit 1 Written Assignment - Updated VersionSimran Pannu100% (1)

- 5111 Written Assignment Unit 7Document6 pages5111 Written Assignment Unit 7Rachell Ann UsonNo ratings yet

- Written Assignment Unit 5 BUS 5110Document6 pagesWritten Assignment Unit 5 BUS 5110nefelikokNo ratings yet

- Written Assignment Unit 1 - Polly's Pet ProductsDocument3 pagesWritten Assignment Unit 1 - Polly's Pet ProductsJheralene Apple VistroNo ratings yet

- Bus 5111 Financial Management Written Assignment Unit 48Document8 pagesBus 5111 Financial Management Written Assignment Unit 48dinesh kumarNo ratings yet

- BUS 5115 - Unit 2 - Written AssignmentDocument5 pagesBUS 5115 - Unit 2 - Written AssignmentNitesh Shrestha50% (2)

- Bus 5110 Unit 2 AssignmentDocument5 pagesBus 5110 Unit 2 Assignmentwonnetta nicholson0% (1)

- BUS 5115 - PF Unit 4Document5 pagesBUS 5115 - PF Unit 4christian allos100% (3)

- Written Assignment Unit 2 - AANSUDocument6 pagesWritten Assignment Unit 2 - AANSUSamer Sowidan100% (1)

- Written Assignment Unit 6Document8 pagesWritten Assignment Unit 6rony alexander75% (4)

- Bus 5115 Unit 1 Written AssignmentDocument7 pagesBus 5115 Unit 1 Written Assignmentchristian allosNo ratings yet

- Bus 5115 Unit 1 Written AssignmentDocument7 pagesBus 5115 Unit 1 Written Assignmentchristian allosNo ratings yet

- BUS 5115 - PF Unit 4Document5 pagesBUS 5115 - PF Unit 4christian allos100% (3)

- MicroeconomicsDocument1 pageMicroeconomicsJoy Angelique JavierNo ratings yet

- Bus 5110 - Managerial Accounting - Unit 2 - Written AssignmentDocument5 pagesBus 5110 - Managerial Accounting - Unit 2 - Written AssignmentLeslie100% (1)

- Polly's Pet ProductsDocument7 pagesPolly's Pet Productsseles23734No ratings yet

- BUS 5110 Managerial Accounting - Written Assignment Unit 7Document7 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 7LaVida LocaNo ratings yet

- Bus 5110-WK 4-Written AssignmentDocument3 pagesBus 5110-WK 4-Written Assignmentdavid olayiwolaNo ratings yet

- Bus 5110 Discussion Forum Unit 5 SubmissionDocument3 pagesBus 5110 Discussion Forum Unit 5 SubmissionAhmad Hafez100% (1)

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- BUS 5110 Managerial Accounting Discussion Assignment Unit 6: Running Head: (Shortened Title Up To 50 Characters) 1Document5 pagesBUS 5110 Managerial Accounting Discussion Assignment Unit 6: Running Head: (Shortened Title Up To 50 Characters) 1Emmanuel Gift Bernard0% (1)

- BUS 5110 - Managerial Accounting - Written Assignment Unit 4Document5 pagesBUS 5110 - Managerial Accounting - Written Assignment Unit 4Leslie100% (2)

- Bus 5111 Discussion Assignment Unit 2Document2 pagesBus 5111 Discussion Assignment Unit 2Sheu Abdulkadir Basharu100% (1)

- Written Assignment Unit01Document6 pagesWritten Assignment Unit01Michael Aboelkhair100% (1)

- BUS 5115 Unit 4 Portfolio Activity - Docx-SampleDocument5 pagesBUS 5115 Unit 4 Portfolio Activity - Docx-SampleRamy ahmed0% (1)

- BUS 5110 Portfolio Activity Unit 5 BUS 5110 Portfolio Activity Unit 5Document5 pagesBUS 5110 Portfolio Activity Unit 5 BUS 5110 Portfolio Activity Unit 5ifeanyi ukachukwuNo ratings yet

- Income, Cash Flow, and Balance Sheet For Polly's Pet ProductsDocument3 pagesIncome, Cash Flow, and Balance Sheet For Polly's Pet ProductskashNo ratings yet

- Unit 2 Second PortfolioDocument3 pagesUnit 2 Second PortfolioSimran PannuNo ratings yet

- Written Assignment - BUS 5115 - Week 4Document8 pagesWritten Assignment - BUS 5115 - Week 4christian allos100% (1)

- BUS 5110 Written Assignment Unit 7 DoneDocument7 pagesBUS 5110 Written Assignment Unit 7 DoneSimran PannuNo ratings yet

- Written Assignment Unit 3 BUS 5115-01Document7 pagesWritten Assignment Unit 3 BUS 5115-01modar KhNo ratings yet

- Written Assignment Unit 2-Bus5110Document4 pagesWritten Assignment Unit 2-Bus5110Franklyn Doh-Nani100% (1)

- Portfolio Activity Unit 5 University of The PeopleDocument5 pagesPortfolio Activity Unit 5 University of The Peoplechristian allosNo ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 4Document5 pagesBUS 5111 - Financial Management - Written Assignment Unit 4LaVida LocaNo ratings yet

- BUS 5110 - Assignment 1Document6 pagesBUS 5110 - Assignment 1michelle100% (1)

- BUS 5110 Assignment Unit 7Document7 pagesBUS 5110 Assignment Unit 7Charles Irikefe100% (1)

- Bus 5110 Managerial Accounting Written Assignment Unit 74 PDFDocument10 pagesBus 5110 Managerial Accounting Written Assignment Unit 74 PDFEmmanuel Gift BernardNo ratings yet

- BUS 5110 Port. Act Unit 7Document3 pagesBUS 5110 Port. Act Unit 7christian allos100% (3)

- Writting Assignement Unit 7Document2 pagesWritting Assignement Unit 7Paw Akou-ediNo ratings yet

- Bus 5113 - Unit 4 BREAKTHROUGH IMPROVEMENT PLAN CASEDocument4 pagesBus 5113 - Unit 4 BREAKTHROUGH IMPROVEMENT PLAN CASEmynalawal50% (2)

- Bus 5111 Discussion Assignment Unit 6Document2 pagesBus 5111 Discussion Assignment Unit 6Sheu Abdulkadir Basharu33% (3)

- Assignment 5Document3 pagesAssignment 5Hilkiah MusNo ratings yet

- University of The People: BUS 5110 Managerial Accounting Portfolio Assignment 6Document4 pagesUniversity of The People: BUS 5110 Managerial Accounting Portfolio Assignment 6Emmanuel Gift BernardNo ratings yet

- BUS 5113 Group 46C Activity Project (Hiring Selection Case) - Draft 2Document13 pagesBUS 5113 Group 46C Activity Project (Hiring Selection Case) - Draft 2Khadijat SmileNo ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 3Document5 pagesBUS 5111 - Financial Management - Written Assignment Unit 3LaVida LocaNo ratings yet

- BUS 5115 - WK 3 - Written AssignmentDocument4 pagesBUS 5115 - WK 3 - Written AssignmentEzekiel Patrick100% (1)

- Bus 5111 Discussion Assignment Unit 7 18Document8 pagesBus 5111 Discussion Assignment Unit 7 18ifeanyi ukachukwu100% (1)

- Written Assignment Unit 3Document6 pagesWritten Assignment Unit 3Aby ZuñigaNo ratings yet

- BUS 5110 Managerial Accounting - Written Assignment Unit 5Document5 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 5LaVida LocaNo ratings yet

- BUS 5110 - Written Assignment Unit 5Document5 pagesBUS 5110 - Written Assignment Unit 5Yusuf Gbenga AyodeleNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Written Assignment Unit 1Document6 pagesWritten Assignment Unit 1christian allosNo ratings yet

- Written Assignment - BUS 5115 - Week 4Document8 pagesWritten Assignment - BUS 5115 - Week 4christian allos100% (1)

- Ethics in Finance: University of PeopleDocument5 pagesEthics in Finance: University of Peoplechristian allosNo ratings yet

- Portfolio Activity Unit 5 University of The PeopleDocument5 pagesPortfolio Activity Unit 5 University of The Peoplechristian allosNo ratings yet

- BUS 5110 Port. Act Unit 7Document3 pagesBUS 5110 Port. Act Unit 7christian allos100% (3)

- Bus 5115 - Discussion Forum Unit 1 University of The PeopleDocument5 pagesBus 5115 - Discussion Forum Unit 1 University of The Peoplechristian allosNo ratings yet

- BUS 5110 - PA Unit 6Document6 pagesBUS 5110 - PA Unit 6christian allosNo ratings yet

- BUS 5110 Port. Act Unit 7Document3 pagesBUS 5110 Port. Act Unit 7christian allos100% (3)

- Quadratic Equations - MathigonDocument4 pagesQuadratic Equations - MathigonJemeraldNo ratings yet

- Drug Supply Management-Participants ManualDocument153 pagesDrug Supply Management-Participants ManualClara Undap100% (1)

- MKTG1025 Week8 TutorialDocument31 pagesMKTG1025 Week8 TutorialMagedaNo ratings yet

- Road Construction DUPADocument277 pagesRoad Construction DUPARhodwillNo ratings yet

- Do Global Factors Impact Bitcoin PricesDocument39 pagesDo Global Factors Impact Bitcoin Pricesnannous1986No ratings yet

- Tesla Capital RaiseDocument89 pagesTesla Capital RaiseFred LamertNo ratings yet

- Tender 2388Document93 pagesTender 2388atulchurchaNo ratings yet

- Cambridge Assessment International Education: EconomicsDocument21 pagesCambridge Assessment International Education: Economicsganza.dorian.sNo ratings yet

- Chapter 5Document26 pagesChapter 5Deep ShahNo ratings yet

- Compensation Plan: RomaniaDocument11 pagesCompensation Plan: RomaniaAlex VimanNo ratings yet

- DIEDRICHSEN-On Surplus Value in ArtDocument18 pagesDIEDRICHSEN-On Surplus Value in ArtramblingunitNo ratings yet

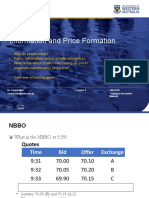

- Information and Price FormationDocument36 pagesInformation and Price FormationDylan AdrianNo ratings yet

- Ib Economics GlossaryDocument10 pagesIb Economics GlossaryValeriia IvanovaNo ratings yet

- Ebay Consumer BehaviorDocument13 pagesEbay Consumer BehaviordharitridalviNo ratings yet

- Dana - 1Document47 pagesDana - 1Dana Denisse RicaplazaNo ratings yet

- Preview: Walden UniversityDocument24 pagesPreview: Walden UniversityHodan HaruriNo ratings yet

- Practiceproblem1 23839Document3 pagesPracticeproblem1 23839Karamveer SinghNo ratings yet

- International Business - Who Make The Apple's IphoneDocument2 pagesInternational Business - Who Make The Apple's IphoneTito R. GarcíaNo ratings yet

- SBI3Document31 pagesSBI3bhaskarrao01No ratings yet

- Case Study Analysis: Team: Zeus ThunderboltDocument3 pagesCase Study Analysis: Team: Zeus ThunderboltSIDDHANT SWAIN100% (1)

- Managerial Economics AssignmentDocument17 pagesManagerial Economics AssignmentDeepshikha Gupta50% (2)

- Market Equilibrium AnswersDocument35 pagesMarket Equilibrium Answerschandanays323No ratings yet

- Cec 004 NotesDocument4 pagesCec 004 NotesChastity LoveNo ratings yet

- The Implementation of Target Costing in The United States: Theory Versus PracticeDocument14 pagesThe Implementation of Target Costing in The United States: Theory Versus PracticeAldi SBPNo ratings yet

- Kanpur Confectionaries BP0268A PDFDocument7 pagesKanpur Confectionaries BP0268A PDFAditya MehraNo ratings yet

- Relevance of Economics in LawDocument30 pagesRelevance of Economics in LawsamNo ratings yet

- Chips & Chicken GuideDocument28 pagesChips & Chicken GuideMatata MuthokaNo ratings yet

- Quiz No. 1 Discount SeriesDocument2 pagesQuiz No. 1 Discount SeriesAngelicaHermoParas100% (1)

- Latihan Bab 9Document2 pagesLatihan Bab 9Lanang TanuNo ratings yet