Professional Documents

Culture Documents

Bus 5110 Managerial Accounting Written Assignment Unit 47

Uploaded by

Emmanuel Gift BernardOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bus 5110 Managerial Accounting Written Assignment Unit 47

Uploaded by

Emmanuel Gift BernardCopyright:

Available Formats

lOMoARcPSD|5252336

BUS 5110- Managerial Accounting- Written Assignment Unit

4#7

managerial accounting (University of the People)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Emmanuel Gift Bernard (emmanuelgiftbernard@gmail.com)

lOMoARcPSD|5252336

BUS 5110: Managerial Accounting- Written Assignment Unit 4

Make or Buy

Written Assignment Unit 4

Managerial Accounting

Term 4 2020

BUS 5110

University of the People

May 2020

Downloaded by Emmanuel Gift Bernard (emmanuelgiftbernard@gmail.com)

lOMoARcPSD|5252336

BUS 5110: Managerial Accounting- Written Assignment Unit 4

Written Assignment

Submit a paper which is 2-3 pages in length (no more than 3-pages), exclusive of the

reference page. Paper should be double spaced in Times New Roman (or its equivalent) font

which is no greater than 12 points in size. The paper should cite at least two sources in APA

format. One source can be your textbook.

Please describe the circumstances of the following case study and recommend a course of

action. Explain your approach to the problem, perform relevant calculations and analysis, and

formulate a recommendation. Ensure your work and recommendation are thoroughly

supported.

Case Study:

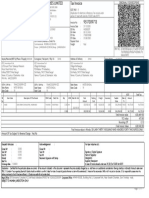

A vacuum manufacturer has prepared the following cost data for manufacturing one of its

engine components based on the annual production of 50,000 units.

Description Cost per

Month

Direct Materials $75,000

Direct Labor $100,000

Total $175,000

In addition, variable factory overhead is applied at $7.50 per unit. Fixed factory overhead is

applied at 150% of direct labor cost per unit. The vacuums sell for $150 each. A third party

has offered to make the engines for $60 per unit. 75% of fixed factory overhead, which

Downloaded by Emmanuel Gift Bernard (emmanuelgiftbernard@gmail.com)

lOMoARcPSD|5252336

BUS 5110: Managerial Accounting- Written Assignment Unit 4

represents executive salaries, rent, depreciation, and taxes, continue regardless of the

decision. Should the company make or buy the engines?

Superior papers will:

Perform all calculations correctly.

Articulate the approach to solving the problem, including which financial information

is relevant and not relevant.

Correctly conclude on whether the company should make or buy the engines.

Propose other factors that should be considered when making this decision and

elaborate on whether or not those factors do or do not support the decision.

Be sure to use APA formatting in your paper. Purdue University’s Online Writing LAB

(OWL) is a free website that provides excellent information and resources for understanding

and using the APA format and style. The OWL website can be accessed here:

http://owl.english.purdue.edu/owl/resource/560/01/

This assignment will be assessed using the BUS 5110 Unit 4 Written Assignment rubric

Introduction

Downloaded by Emmanuel Gift Bernard (emmanuelgiftbernard@gmail.com)

lOMoARcPSD|5252336

BUS 5110: Managerial Accounting- Written Assignment Unit 4

“A company may face stiff competition from its competitors and face the decision of

buying some parts of their production process rather than building the parts themselves. This

decision commonly known as make or buy decision involves performing a differential

analysis. Based on those calculations, managers may be able decide whether to make a given

product or buy the product instead of manufacturing the product.” (Osiemo, 2017)

In this assignment, I would judge whether the vacuum manufacturer should produce

the engine components internally or buy them from the third party by utilizing differential

analysis.

Analysis

In order to execute differential analysis to consider whether the company should buy

the engine components from the third party, firstly we need to list all the financial

information up for both patterns, alternative 1 (manufacturing internally) and alternative 2

(buy from outside). Therefore, I would consider if each item is relevant or irrelevant, and

compare the total manufacturing cost.

Table1

Financial comparison between alternative 1 and 2 in case of 50,000 units per year

Variable costs

Downloaded by Emmanuel Gift Bernard (emmanuelgiftbernard@gmail.com)

lOMoARcPSD|5252336

BUS 5110: Managerial Accounting- Written Assignment Unit 4

Direct materials, direct labor and manufacturing overhead are relevant, because if the

company buy products from third party they would no longer need to pay for these costs. On

the other hand, they need to pay for the third party to purchase goods.

Fixed costs

Not all but some of costs categorized as fixed factory overhead are recognized as

irrelevant. According to the prerequisites in this assignment, 75% of the fixed factory

overhead continue to be costed even if the company buy from third party.

Conclusion

According to the analysis above, we can summarize the result of outsourcing the

production as following (Heisinger, n.d.).

Table2

Result of Outsourcing Production of Engine Components in case of 50,000 units per

year

Here we can conclude the total manufacturing needed when they produce internally is

lower than when they buy from the third party. The difference is $75,000 if we assume the

company needs 50,000 units per year.

References

Downloaded by Emmanuel Gift Bernard (emmanuelgiftbernard@gmail.com)

lOMoARcPSD|5252336

BUS 5110: Managerial Accounting- Written Assignment Unit 4

Heisinger, K., & Hoyle, J. B. (n.d.). Accounting for Managers. Retrieved from

https://2012books.lardbucket.org/books/accounting-for-managers/index.html

Osiemo, J. (2017). Make or Buy Decisions. Retrieved from

http://www.managerialaccountingcourse.com/makebuy.php

Downloaded by Emmanuel Gift Bernard (emmanuelgiftbernard@gmail.com)

You might also like

- Managerial Accounting Qualitative FactorsDocument5 pagesManagerial Accounting Qualitative FactorsEmmanuel Gift Bernard100% (3)

- BUS 5110 Portfolio Activity Unit 5 BUS 5110 Portfolio Activity Unit 5Document5 pagesBUS 5110 Portfolio Activity Unit 5 BUS 5110 Portfolio Activity Unit 5ifeanyi ukachukwuNo ratings yet

- Bus 5110 Managerial Accounting Written Assignment Unit 62 PDFDocument14 pagesBus 5110 Managerial Accounting Written Assignment Unit 62 PDFEmmanuel Gift BernardNo ratings yet

- Bus 5110 Managerial Accounting Written Assignment Unit 74 PDFDocument10 pagesBus 5110 Managerial Accounting Written Assignment Unit 74 PDFEmmanuel Gift BernardNo ratings yet

- BUS 5110 Financial RatiosDocument3 pagesBUS 5110 Financial Ratioschristian allos100% (3)

- BUS 5110 - MANAGERIAL ACCOUNTING - Written Assignment Unit 4Document2 pagesBUS 5110 - MANAGERIAL ACCOUNTING - Written Assignment Unit 4Aravind Jp67% (3)

- BUS 5110 Assignment Unit 7Document7 pagesBUS 5110 Assignment Unit 7Charles Irikefe100% (1)

- Bus 5111 Discussion Assignment Unit 6Document2 pagesBus 5111 Discussion Assignment Unit 6Sheu Abdulkadir Basharu33% (3)

- Bus 5111 Discussion Assignment Unit 2Document2 pagesBus 5111 Discussion Assignment Unit 2Sheu Abdulkadir Basharu100% (1)

- This Study Resource Was: Portfolio Activity Unit 3Document5 pagesThis Study Resource Was: Portfolio Activity Unit 3klm klmNo ratings yet

- BUS 5110 Managerial Accounting Discussion Assignment Unit 6: Running Head: (Shortened Title Up To 50 Characters) 1Document5 pagesBUS 5110 Managerial Accounting Discussion Assignment Unit 6: Running Head: (Shortened Title Up To 50 Characters) 1Emmanuel Gift Bernard0% (1)

- BUS 5110 Written Assignment Unit 7 DoneDocument7 pagesBUS 5110 Written Assignment Unit 7 DoneSimran PannuNo ratings yet

- Discussion Assignment Unit-8 BUS 5110Document5 pagesDiscussion Assignment Unit-8 BUS 5110Djahan Rana100% (2)

- BUS 5110 - Managerial Accounting - Written Assignment Unit 4Document5 pagesBUS 5110 - Managerial Accounting - Written Assignment Unit 4Leslie100% (2)

- BUS 5110 - Assignment 3Document4 pagesBUS 5110 - Assignment 3michelleNo ratings yet

- BUS 5111 Discussion Forum Unit 1Document3 pagesBUS 5111 Discussion Forum Unit 1Djahan RanaNo ratings yet

- SSA BUS 5111 Financial Management Unit 1 Written Assignment 1Document6 pagesSSA BUS 5111 Financial Management Unit 1 Written Assignment 1Charles Irikefe100% (2)

- Managerial Accounting Case Study on Vacuum Engine Component CostsDocument3 pagesManagerial Accounting Case Study on Vacuum Engine Component Costsकुनाल सिंहNo ratings yet

- BUS 5110 - PA Unit 6Document6 pagesBUS 5110 - PA Unit 6christian allosNo ratings yet

- BUS 5113 Group Assignment - Group 0001A - Global Washer and Dryer Manufacturer Case StudyDocument12 pagesBUS 5113 Group Assignment - Group 0001A - Global Washer and Dryer Manufacturer Case StudyPaw Akou-edi100% (2)

- Unit 2 Second PortfolioDocument3 pagesUnit 2 Second PortfolioSimran PannuNo ratings yet

- Portfolio Activity Unit 5 University of The PeopleDocument5 pagesPortfolio Activity Unit 5 University of The Peoplechristian allosNo ratings yet

- Case Study Unit 5Document4 pagesCase Study Unit 5Hilkiah MusNo ratings yet

- Writting Assignement Unit 7Document2 pagesWritting Assignement Unit 7Paw Akou-ediNo ratings yet

- Written Assignment Solution Unit 6Document6 pagesWritten Assignment Solution Unit 6Emmanuel Gift Bernard100% (1)

- Written Assignment Unit 6Document8 pagesWritten Assignment Unit 6rony alexander75% (4)

- Written Assignment Week 4Document5 pagesWritten Assignment Week 4Thai50% (2)

- Bus 5111 Portfolio Assignment Unit 4Document4 pagesBus 5111 Portfolio Assignment Unit 4Sheu Abdulkadir Basharu100% (1)

- Bus 5112 Unit 8 Portfolio ActivityDocument3 pagesBus 5112 Unit 8 Portfolio ActivityChidinma AndrewNo ratings yet

- Learning Guide Unit 2Document11 pagesLearning Guide Unit 2lebog0% (1)

- Unit 3 Discussion PostDocument3 pagesUnit 3 Discussion PostSimran PannuNo ratings yet

- Week 6 Portfolio AssignmentDocument4 pagesWeek 6 Portfolio AssignmentjmNo ratings yet

- Bus 5110 Managerial Accounting Written Assignment Unit 75 PDFDocument8 pagesBus 5110 Managerial Accounting Written Assignment Unit 75 PDFEmmanuel Gift BernardNo ratings yet

- Written Assignment Unit 7Document5 pagesWritten Assignment Unit 7rony alexander100% (3)

- BUS 5110 - Written Assignment - Unit 5 - MADocument5 pagesBUS 5110 - Written Assignment - Unit 5 - MAAliyazahra Kamila100% (1)

- BUS 5110 - Assignment 1Document6 pagesBUS 5110 - Assignment 1michelle100% (1)

- Case Study - Fashion Forward Vs Dream DesignDocument6 pagesCase Study - Fashion Forward Vs Dream DesignmynalawalNo ratings yet

- Unit 6 Written Assignment BUS 5110Document5 pagesUnit 6 Written Assignment BUS 5110luiza100% (6)

- Managerial Accounting Case Study RecommendationDocument7 pagesManagerial Accounting Case Study RecommendationEmmanuel Gift BernardNo ratings yet

- TBUS 5116 UNIT 1 WA FINAL The Case of BMWDocument6 pagesTBUS 5116 UNIT 1 WA FINAL The Case of BMWPyaihsone AungNo ratings yet

- Written Assign 3 - CVP ANALYSISDocument5 pagesWritten Assign 3 - CVP ANALYSISFrank Kendoh100% (1)

- Portfolio Activity Unit 8Document7 pagesPortfolio Activity Unit 8Gregory Pilar100% (1)

- CALCULATING BREAK-EVEN POINT AND PROFITABILITY FOR WASHER AND DRYER PRODUCTSDocument11 pagesCALCULATING BREAK-EVEN POINT AND PROFITABILITY FOR WASHER AND DRYER PRODUCTSchristian allos100% (14)

- Bus 5111 Discussion Assignment Unit 7 18Document8 pagesBus 5111 Discussion Assignment Unit 7 18ifeanyi ukachukwu100% (1)

- Bus 5115 Unit 1 Written AssignmentDocument7 pagesBus 5115 Unit 1 Written Assignmentchristian allosNo ratings yet

- BUS 5113 Case StudyDocument4 pagesBUS 5113 Case Studymynalawal50% (2)

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- Unit 1 Written Assignment - Updated VersionDocument6 pagesUnit 1 Written Assignment - Updated VersionSimran Pannu100% (1)

- BUS 5110 - Portfolio Activity WK 1Document4 pagesBUS 5110 - Portfolio Activity WK 1Ezekiel Patrick100% (1)

- Written Assignment Unit 2-Bus5110Document4 pagesWritten Assignment Unit 2-Bus5110Franklyn Doh-Nani100% (1)

- Insider info dilemma at North ManufacturingDocument8 pagesInsider info dilemma at North Manufacturingchristian allos100% (1)

- BUS 5113 Group 46C Activity Project (Hiring Selection Case) - Draft 2Document13 pagesBUS 5113 Group 46C Activity Project (Hiring Selection Case) - Draft 2Khadijat SmileNo ratings yet

- Financial Analysis for Washer Dryer Manufacturer Break-EvenDocument15 pagesFinancial Analysis for Washer Dryer Manufacturer Break-EvenmohamedNo ratings yet

- BUS 5110 Group 4B Project v2.0Document14 pagesBUS 5110 Group 4B Project v2.0SAM100% (1)

- BUS 5110 - Written Assignment Unit 5 University of The PeopleDocument5 pagesBUS 5110 - Written Assignment Unit 5 University of The Peoplechristian allosNo ratings yet

- Bus 5111 Discussion Assignment Unit 7 5Document6 pagesBus 5111 Discussion Assignment Unit 7 5ifeanyi ukachukwuNo ratings yet

- BUS 5112 Group Assignment 21ADocument12 pagesBUS 5112 Group Assignment 21AAravind JpNo ratings yet

- Learning Guide Unit 4Document14 pagesLearning Guide Unit 4lebogNo ratings yet

- 5110 Written Assignment Unit 4Document4 pages5110 Written Assignment Unit 4fisehadekamo02No ratings yet

- BUS 5110 Unit 4 AssignmentDocument5 pagesBUS 5110 Unit 4 AssignmentAdilNo ratings yet

- University of The People: BUS 5110 Managerial Accounting Portfolio Assignment 6Document4 pagesUniversity of The People: BUS 5110 Managerial Accounting Portfolio Assignment 6Emmanuel Gift BernardNo ratings yet

- BUS 5110 Managerial Accounting Discussion Assignment Unit 6: Running Head: (Shortened Title Up To 50 Characters) 1Document5 pagesBUS 5110 Managerial Accounting Discussion Assignment Unit 6: Running Head: (Shortened Title Up To 50 Characters) 1Emmanuel Gift Bernard0% (1)

- University of The People: BUS 5110 Managerial Accounting Portfolio Assignment 6Document4 pagesUniversity of The People: BUS 5110 Managerial Accounting Portfolio Assignment 6Emmanuel Gift BernardNo ratings yet

- Written Assignment Solution Unit 6Document6 pagesWritten Assignment Solution Unit 6Emmanuel Gift Bernard100% (1)

- Bus 5110 Managerial Accounting Written Assignment Unit 71 PDFDocument10 pagesBus 5110 Managerial Accounting Written Assignment Unit 71 PDFEmmanuel Gift Bernard100% (1)

- Managerial Accounting Case Study RecommendationDocument7 pagesManagerial Accounting Case Study RecommendationEmmanuel Gift BernardNo ratings yet

- Bus 5110 Managerial Accounting Written Assignment Unit 75 PDFDocument8 pagesBus 5110 Managerial Accounting Written Assignment Unit 75 PDFEmmanuel Gift BernardNo ratings yet

- BUS 5110 Discussion Forum Unit-4 BUS 5110 Discussion Forum Unit-4Document3 pagesBUS 5110 Discussion Forum Unit-4 BUS 5110 Discussion Forum Unit-4Emmanuel Gift Bernard100% (1)

- Managerial Accounting Break-Even AnalysisDocument3 pagesManagerial Accounting Break-Even AnalysisEmmanuel Gift Bernard100% (1)

- Astrology Setup GuideLinesDocument15 pagesAstrology Setup GuideLinesVipul JujarNo ratings yet

- Course Code:8503 Unit # 08: EntrepreneurshipDocument11 pagesCourse Code:8503 Unit # 08: EntrepreneurshipSalaha AbdullahNo ratings yet

- Determinants of Forward and Futures PricesDocument24 pagesDeterminants of Forward and Futures PricesSHUBHAM SRIVASTAVANo ratings yet

- Asn 2 736 FinalDocument23 pagesAsn 2 736 Finalqh11022003No ratings yet

- Compilation of Partnership CasesDocument13 pagesCompilation of Partnership CasesJanet FabiNo ratings yet

- Problems On Contract CostingDocument11 pagesProblems On Contract CostingRoguewolfx VFX50% (2)

- Cost of Capital Optimization ModelingDocument71 pagesCost of Capital Optimization ModelingAhmed Mostafa ElmowafyNo ratings yet

- Mallness Pitch Deck - JuneDocument19 pagesMallness Pitch Deck - JuneFrans HasiholanNo ratings yet

- Partnership Formation AccountingDocument6 pagesPartnership Formation AccountingHelena MontgomeryNo ratings yet

- Internal Analysis: Resources, Capabilities, and Core CompetenciesDocument40 pagesInternal Analysis: Resources, Capabilities, and Core Competenciesmuhammad omerNo ratings yet

- HR Practices Comparison of Two OrganizationsDocument9 pagesHR Practices Comparison of Two OrganizationsROhit NagPalNo ratings yet

- Haris HRMDocument11 pagesHaris HRMM.K.J M.K.JNo ratings yet

- BDAP2203 Management AccountingDocument7 pagesBDAP2203 Management Accountingdicky chongNo ratings yet

- Cosmetics Business PlanDocument46 pagesCosmetics Business PlanLaica LagulaoNo ratings yet

- Customer Complaint HandlingDocument7 pagesCustomer Complaint HandlingpapplionNo ratings yet

- Delcevo Eng PDFDocument74 pagesDelcevo Eng PDFLaleNo ratings yet

- National Model Clinical Governance FrameworkDocument44 pagesNational Model Clinical Governance Frameworkwenhal100% (1)

- DEPOSITSLIP#192792#1Document1 pageDEPOSITSLIP#192792#1AsadNo ratings yet

- Twitter Musk LawsuitDocument62 pagesTwitter Musk LawsuitTechCrunchNo ratings yet

- Activity Based BillingDocument34 pagesActivity Based BillingArun Minnasandran100% (1)

- Bianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreDocument50 pagesBianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreJOJONo ratings yet

- Group Project - AuditDocument25 pagesGroup Project - AuditARMIZAWANI BINTI MOHAMED BUANG BMNo ratings yet

- Tax Invoice for ACSR ZEBRA CONDUCTOR, UNGREASED from APAR INDUSTRIES LIMITED to KEC International LtdDocument1 pageTax Invoice for ACSR ZEBRA CONDUCTOR, UNGREASED from APAR INDUSTRIES LIMITED to KEC International LtdDoita Dutta ChoudhuryNo ratings yet

- AssignmentDocument94 pagesAssignmentJanheshNo ratings yet

- Business Plan For Startup BusinessDocument26 pagesBusiness Plan For Startup BusinessPuneet Kashyap100% (1)

- Report On Project AppraisalDocument99 pagesReport On Project Appraisalswapnil2288No ratings yet

- Arthan Finance - HR TraineeDocument2 pagesArthan Finance - HR TraineePriyadharshini RamamurthyNo ratings yet

- Terms of Audit EngagementsDocument1 pageTerms of Audit EngagementsA R AdIL100% (1)

- Training Needs Assessment of LGUs On The Project Management of Local Infrastructure - FinalDocument6 pagesTraining Needs Assessment of LGUs On The Project Management of Local Infrastructure - Finalaeron antonioNo ratings yet

- Analysis of Credit Appraisal at Bank of IndiaDocument127 pagesAnalysis of Credit Appraisal at Bank of IndiaGaurav Narang82% (11)