Professional Documents

Culture Documents

Reading 20

Reading 20

Uploaded by

Chulbul Pandey0 ratings0% found this document useful (0 votes)

12 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views8 pagesReading 20

Reading 20

Uploaded by

Chulbul PandeyCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

xX

R20 - Currency Exchange Rates Gdutors

READING 20

CURRENCY EXCHANGE RATES

Cited

Pee ea)

spot and forward exchange rates.

CES

cea a

a

‘An exchange rate is simply the price or cost of units of one currency in terms of

Exchange | another.

rate Interpretation of exchange rate of &/$ = 62

= This means that 1$=% 62 & 1% = 1/62$

Base and | $

= Price currency

Price

currency | Note: All decisions you take is from the perspective of base currency.

Nominal

& Real

exchange

rate

Spot

exchange | A spot exchange rate is the currency exchange rate for immediate delivery.

rate

A forward exchange rate isa currency exchange rate for an exchange to

be done in the future

2. A forwardis actually an agreement to exchange a specific amount of one

Forward currency for a specific amount of another on a future date specified in

exchange the forward agreement.

rate

Example: You agreed with SBI to pay @ 2/S = 62 for $ 1,100 payable to CFA

Institute in 6 months from now. By doing this agreement, you have technically

eliminated the currency risk.

‘outcome _| Describe functions of and participants in the foreign exchange ma

8

Foreign currency markets serve companies and individuals that purchase or sell

Role of

ole OF | foreign goods and services denominated in foreign currencies. An even larger

FOREN | market, however, exists for capital flows. Foreign currencies are needed to

purchase foreign physical assets as well as foreign financial securities.

By entering into a forward currency contract any firm can reduce or eliminate

ing | its foreign exchange risk associated with the transaction. When a firm takes a

Hedging " .

position in the foreign exchange market to reduce an existing risk, we say the

firm is hedging its risk.

€Edutors

vove, Ech & Empower

Speculation

CFA Level 1

8y Gourav Kabra

‘When a transaction in the foreign exchange markets increases currency risk, we

term ita speculative transaction or position. investors, companies, and financial

institutions, such as banks and investment funds, all regularly enter into

speculative foreign currency transactions.

Buy side &

Sell side

Buy side Primary dealers & large multinational banks

Sell side — Corporates, Investors etc.

Buy side

parties

pail Rea)

a

ney.

een ke ea

Corporations regularly engage in cross-border transactions, purchase

and sell foreign currencies as a result, and enter into FX forward

contracts to hedge the risk of expected future receipts and payments

denominated in foreign currencies.

Investment accounts of many types transact in foreign currencies, hold

foreign securities, and may both speculate and hedge with currency

derivatives, Real money accounts refer to mutual funds, pension funds,

insurance companies, and other institutional accounts that do not use

derivatives, Leveraged accounts refer to the various types of investment.

firms that do use derivatives, including hedge funds, firms that trade for

their own accounts, and other trading firms of various types.

Governments and government entities, including sovereign wealth

funds and pension funds, acquire foreign exchange for transactional

needs, investment, or speculation. Central banks sometimes engage in

FX transactions to affect exchange rates in the short term in accordance

with government policy.

The retail market refers to FX transactions by households and relatively

small institutions and may be for tourism, cross-border investment, or

speculative trading,

meen Cid

Note _| Always calculate % change of the base currency in a foreign exchange quotation,

What does a decrease in the USD/EUR exchange rate from 1.44 to 1.42

Mlustration

represent?

Outcome | Calculate and interpret currency cross-rates

Cross rate

The cross rate is the exchange rate between two currencies implied by their

‘exchange rates with a common third currency. Cross rates are necessary when

there is no active FX market in the currency pair.

7

dutors

R20 - Currency Exchange Rates

lf the MXN/USD quote is 12.3 and the USD/EUR quote is 1.45, then the MXN/EUR

Mustration cross rate is closest to?

Calculate spot USD/GBP cross rate using the following information:

tmustration | 1 USO/EUR 1.5602

2. MXN/USD 2.0880

3. MxN/GBP 2.1097

PC er nn

Pa ec

‘A forward exchange rate quote typically differs from the spot quotation and is

expressed in terms of the difference between the spot exchange rate and the

Point:

oints | forward exchange rate. One way to indicate this is with points. The unit of points

is the last decimal place in the spot rate quote.

ttustration | Th¢ AUD/EUR spot exchange rate is 0.7313 with the 1-year forward rate quoted

at +3.5 points, What is the 1-year forward AUD/EUR exchange rate?

tustration | TR AUD/EUR spot rate is quoted at 0.7313, and the 120-day forward exchange

rate is given as ~0.062%. What is the 120-day forward AUD/EUR exchange rate?

Pree OURO eu SC COA Re Com UC Rod

aa

No arbitrage relation is also known as interest rate parity.

Cee eo eee

(discount)

Consider two currencies, the ABE and the DUB. The spot ABE/DUB exchange rate

is 4.5671, the 1-year riskless ABE rate is 5%, and the 1-year riskless DUB rate is

3%, What is the 1-year forward exchange rate that will prevent arbitrage profits?

Also calculate forward premium/discount.

Mlustration

Solution

y

dutors

vove, Ech & Empower

oo

CFA Level 1

8y Gourav Kabra

Pree ee te ecu ec Ce Rd

PE

llustration | To be done in class

Arbitrage

process

CRE ee ee ace

Countries

that do not

have their

own currency

Formal

A country can use the currency of another country (formal

doll in). The country cannot have its own monetary

policy, as it does not create money/currency.

‘Monetary union

A country can be a member of a monetary union in which

several countries use a common currency. Within the

European Union, for example, most countries use the euro.

‘While individual countries give up the ability to set domestic

monetary policy, they all participate in determining the

monetary policy of the European Central Bank,

Countries

that do not

have their

own currency

Currency board

arrangement

A currency board arrangement is an explicit commitment to

exchange domestic currency for a specified foreign currency

at a fixed exchange rate. A notable example of such an

arrangement is Hong Kong. In Hong Kong, currency is (and

may be} only issued when fully backed by holdings of an

‘equivalent amount of U.S. dollars. The Hong Kong Monetary

Authority can earn interest on its U.S. dollar balances. With

y

R20 - Currency Exchange Rates Edutors

Evoke, Eich & Empower

dollarization, there is no such income, as the income is

earned by the U.S. Federal Reserve when it buys interest-

bearing assets with the U.S. currency it issues. While the

monetary authority gives up the ability to conduct

independent monetary policy and essentially imports the

inflation rate of the outside currency, there may be some

latitude to affect interest rates over the short term.

Ina conventional fixed peg arrangement, a country pegs its

currency within margins of +19 versus another currency or a

basket that includes the currencies of its major trading or

financial partners. The monetary authority can maintain

exchange rates within the band by purchasing or selling

foreign currencies in the foreign exchange markets (direct

intervention). In addition, the country can use indirect

intervention, including changes in interest rate policy,

regulation of foreign exchange transactions, and convincing

people to constrain foreign exchange activity. The monetary

authority retains more flexibility to conduct monetary policy

than with dollarization, a monetary union, or a currency

board, However, changes in policy are constrained by the

requirements of the peg.

Conventional

fixed peg

arrangement

In a system of pegged exchange rates within horizontal

bands or a target zone, the permitted fluctuations in

currency value relative to another currency or basket of

currencies are wider (e.g., #2%). Compared to a conventional

eg, the monetary authority has more policy discretion

because the bands are wider.

Target zone

With a crawling peg the exchange rate is adjusted

periodically, typically to adjust for higher inflation versus the

currency used in the peg. This is termed a passive crawling

peg, as opposed to an active crawling peg in which a series

Countries

that donot | Cling peg | of exchange rate adjustments over time is announced and

fae atigte implemented. An active crawling peg can influence inflation

expectations, adding some predictability to domestic

own currency

inflation. Monetary policy is restricted in much the same way

itis with a fixed peg arrangement.

With management of exchange rates within crawling

bands, the width of the bands that identify permissible

Management of | exchange rates is increased over time. This method can be

exchange rates. | used to transition from a fixed peg to a floating rate when

within crawling | the monetary authority's lack of credibility makes an

bands immediate change to floating rates impractical. Again, the

degree of monetary policy flexibility increases with the width

of the bands,

€Edutors

vove, Ech & Empower

Countries

that do not

have their

own currency

Introduction

Cres

CFA Level 1

8y Gourav Kabra

With a system of managed floating exchange rates, the

monetary authority attempts to influence the exchange rate

in response to specific indicators such as the balance of

payments, inflation rates, or employment without any

specific target exchange rate or predetermined exchange

rate path. Intervention may be direct or indirect. Such

management of exchange rates may induce trading partners

to respond in ways that reduce stability.

Managed

floating

exchange rates

‘When a currency is independently floating, the exchange

rate is market determined, and foreign exchange market

intervention is used only to slow the rate of change and

reduce short-term fluctuations, not to keep exchange rates

ata target level.

Independently

floating

in the effects of exchange rates on countries’ international trade and capital

X-M=(S-1) +(T-G)

When XM <0; there could be two possibilities:

1. S0

where:

W.= proportion of total trade that is exports

Wa= proportion of total trade that is imports

x= price elasticity of demand for exports

m= price elasticity of demand for imports

In the case where import expenditures and export revenues are equal, Wx= Wa,

this condition reduces to ex + em > 1, which is most often cited as the classic

‘Marshall-Lerner condition.

y

R20 - Currency Exchange Rates Edutors

Evoke, Eich & Empower

CONCLUSION

The elasticities approach tells us that currency depreciation will result in a

greater improvement in the trade deficit when either import or export demand

is elastic. For this reason, the compositions of export goods and import goods

are an important determinant of the success of currency depreciation in

reducing trade deficit.

Note: in general, elasticity of demand is greater for goods with close substitutes,

‘g00ds that represent a high proportion of consumer spending, and luxury goods

in general. Goods that are necessities, have few or no good substitutes, or

represent a small proportion of overall expenditures tend to have less elastic

demand. Thus, currency depreciation will have a greater effect on the balance

of trade when import or export goods are primarily luxury goods, goods with

close substitutes, and goods that represent a large proportion of overall

spending.

The J-Curve

Because import and export contracts for the delivery of goods most often

require delivery and payment in the future, import and export quantities may be

relatively insensitive to currency depreciation in the short run. This means that

a currency depreciation may worsen a trade deficit initially thereafter the

Marshall-Lerner conditions take effect and the currency depreciation begins to

improve the trade balance. This short-term increase in the deficit followed by a

decrease when the Marshall-Lerner condition is met is referred to as the J-curve.

‘SHORTCOMING OF ELASTICITIES APPROACH

‘One shortcoming of the elasticities approach is that it only considers the

microeconomic relationship between exchange rates and trade balances. It

ignores capital flows, which must also change as a result of a currency

depreciation that improves the balance of trade.

‘ABSORPTION APPROACH

The absorption approach is a macroeconomic technique that focuses on the

capital account and can be represented as:

The BT=Y-E

Absorption | where:

Approach jomestic production of goods and services or national income

E = domestic absorption of goods and services, which is total expenditure

BT= balance of trade

Viewed in this way, we can see that income relative to expenditure must

increase (domestic absorption must fall) for the balance of trade to improve in

response to a currency depreciation. For the balance of trade to improve,

domestic saving must increase relative to domestic investment in physical

capital (which is a component of £}. Thus, for a depreciation of the domestic

currency to improve the balance of trade towards surplus, it must increase

national income relative to expenditure, We can also view this as a requirement

that national saving increase relative to domestic investment in physical capital.

xy

dutors rv tev

Evove, Ench & Empower FA Level

y Gourav Kabra

EFFECT OF CURRENCY DEPRECIATION

Less than Full employment:

‘When an economy is operating at less than full employment, the currency

depreciation makes domestic goods and assets relatively more attractive than

foreign goods and assets. Resultantly, both expenditures and income will

increase but national income will increase more than total expenditure,

improving the balance of trade.

Full employment:

Ina situation where the economy is operating at full employment (capacity), an

increase in domestic spending will translate to higher domestic prices, which can

reverse the relative price changes of the currency depreciation, resulting ina

return to the previous deficit in the balance of trade.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Valuation Approaches and MethodsDocument11 pagesValuation Approaches and MethodsChulbul PandeyNo ratings yet

- LWS Lite Guide V 2.0Document17 pagesLWS Lite Guide V 2.0Chulbul PandeyNo ratings yet

- PB Fintech Limited, Q3 2024 Earnings Call, Jan 30, 2024Document26 pagesPB Fintech Limited, Q3 2024 Earnings Call, Jan 30, 2024Chulbul PandeyNo ratings yet

- 409A Training 2023Document41 pages409A Training 2023Chulbul PandeyNo ratings yet

- Ctryprem July 20Document171 pagesCtryprem July 20Chulbul PandeyNo ratings yet

- Equity & Liabilities Audited Provisional DifferenceDocument10 pagesEquity & Liabilities Audited Provisional DifferenceChulbul PandeyNo ratings yet

- Introduction To Accounting and Finance Unit Code Aaf005-1 Main Exam Semester 3 2020/21Document7 pagesIntroduction To Accounting and Finance Unit Code Aaf005-1 Main Exam Semester 3 2020/21Chulbul PandeyNo ratings yet

- Icmai Rvo: Continuing Education ProgrammeDocument37 pagesIcmai Rvo: Continuing Education ProgrammeChulbul PandeyNo ratings yet

- Joint Share Exchange Ratio ReportDocument15 pagesJoint Share Exchange Ratio ReportChulbul PandeyNo ratings yet

- A Part of Your: Fine Organic Industries LimitedDocument185 pagesA Part of Your: Fine Organic Industries LimitedChulbul PandeyNo ratings yet

- Box IPO Financial ModelDocument40 pagesBox IPO Financial ModelChulbul PandeyNo ratings yet

- Daaj Hotels Workings 2Document23 pagesDaaj Hotels Workings 2Chulbul PandeyNo ratings yet

- MNGPL & Sharnagat - 18-19Document67 pagesMNGPL & Sharnagat - 18-19Chulbul PandeyNo ratings yet

- DCFValuation JKTyre1Document195 pagesDCFValuation JKTyre1Chulbul PandeyNo ratings yet

- 2.2 Security Deposit With AgeingDocument238 pages2.2 Security Deposit With AgeingChulbul PandeyNo ratings yet

- 3.1 Ledger SGL TwoDocument5 pages3.1 Ledger SGL TwoChulbul PandeyNo ratings yet

- Sanwariya Gas LTD: ReceivablesDocument8 pagesSanwariya Gas LTD: ReceivablesChulbul PandeyNo ratings yet

- Debtor Ageing As On 31.03.2019 - RevisedDocument131 pagesDebtor Ageing As On 31.03.2019 - RevisedChulbul PandeyNo ratings yet

- Nitesh Bhadani: ExperienceDocument2 pagesNitesh Bhadani: ExperienceChulbul PandeyNo ratings yet

- Revenue From Sale of Products: ParticularsDocument12 pagesRevenue From Sale of Products: ParticularsChulbul PandeyNo ratings yet

- Fixed Income Investing: Joydeep Sen April 2020Document46 pagesFixed Income Investing: Joydeep Sen April 2020Chulbul PandeyNo ratings yet

- Indian Life Insurance Sector-3 April 2019 PDFDocument91 pagesIndian Life Insurance Sector-3 April 2019 PDFChulbul PandeyNo ratings yet

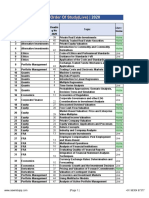

- Cfa L2 - 2020: Order of Study (Video)Document2 pagesCfa L2 - 2020: Order of Study (Video)Chulbul PandeyNo ratings yet

- Standard IDocument18 pagesStandard IChulbul PandeyNo ratings yet

- Cfa L2 - 2020: Order of Study (Live)Document2 pagesCfa L2 - 2020: Order of Study (Live)Chulbul PandeyNo ratings yet

- Regulations & Compliance: Presented byDocument25 pagesRegulations & Compliance: Presented byChulbul PandeyNo ratings yet

- 0 20200411110104fixed Income-Chapter 1 PDFDocument14 pages0 20200411110104fixed Income-Chapter 1 PDFChulbul PandeyNo ratings yet

- Chapter 2 - Fixed Income Instruments and Return ComputationDocument9 pagesChapter 2 - Fixed Income Instruments and Return ComputationChulbul PandeyNo ratings yet

- Intrinsic Valuation: The Constant Growth ModelDocument4 pagesIntrinsic Valuation: The Constant Growth ModelChulbul PandeyNo ratings yet