Professional Documents

Culture Documents

Pricing Schedule

Pricing Schedule

Uploaded by

Stas Oskin0 ratings0% found this document useful (0 votes)

48 views3 pagesThis document provides pricing information for various banking and custody services offered by SEBA, including:

- Account opening and onboarding fees ranging from free to CHF 2,500 depending on client type.

- Monthly account fees starting at CHF 40-50 for individual clients and CHF 110-125 for corporate clients, plus additional fees for extra accounts or currencies.

- Annual custody storage fees ranging from 0.10-0.40% depending on asset amount and storage type (hot, cold, deep cold).

- Transaction fees for transfers, payments, deposits and withdrawals ranging from free to CHF 5,000 depending on asset, amount, and storage type.

- Trading commissions for

Original Description:

Pricing Schedule

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides pricing information for various banking and custody services offered by SEBA, including:

- Account opening and onboarding fees ranging from free to CHF 2,500 depending on client type.

- Monthly account fees starting at CHF 40-50 for individual clients and CHF 110-125 for corporate clients, plus additional fees for extra accounts or currencies.

- Annual custody storage fees ranging from 0.10-0.40% depending on asset amount and storage type (hot, cold, deep cold).

- Transaction fees for transfers, payments, deposits and withdrawals ranging from free to CHF 5,000 depending on asset, amount, and storage type.

- Trading commissions for

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

48 views3 pagesPricing Schedule

Pricing Schedule

Uploaded by

Stas OskinThis document provides pricing information for various banking and custody services offered by SEBA, including:

- Account opening and onboarding fees ranging from free to CHF 2,500 depending on client type.

- Monthly account fees starting at CHF 40-50 for individual clients and CHF 110-125 for corporate clients, plus additional fees for extra accounts or currencies.

- Annual custody storage fees ranging from 0.10-0.40% depending on asset amount and storage type (hot, cold, deep cold).

- Transaction fees for transfers, payments, deposits and withdrawals ranging from free to CHF 5,000 depending on asset, amount, and storage type.

- Trading commissions for

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

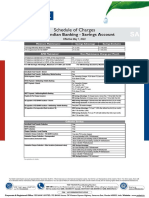

Pricing Schedule December 2019

Swiss International Swiss International

Clients

Individual2 Individual2 Corporate2 Corporate2

Opening Fees1

Pre-screening - one-off Free CHF 2’500

Onboarding3 - one-off Free CHF 2’500

Account Fees1,4

Basic package; monthly

Included in price:

1st currency account, CHF 40 CHF 50 CHF 110 CHF 125

1st crypto account,

hot custody storage,

1st SEBA card.

Each additional currency

account - monthly CHF 10 CHF 20

Each additional crypto

account incl. hot custody CHF 20 CHF 30

storage - monthly

Custody Storage Setup Fees

Setup for all custody

Free for all crypto currencies

storages

Custody Storage Fees1,5

Up to CHF 1m: 0.40%

Crypto account and hot CHF 1m - CHF 10m: 0.30%

custody storage - annual CHF 10m - CHF 100m: 0.25%

Above CHF 100m: 0.20%

Cold custody storage and Up to CHF 1m: 0.25%

traditional securities

CHF 1m - CHF 10m: 0.20%

custody - annual

CHF 10m - CHF 100m: 0.18%

Minimum CHF 125 per

month per crypto currency Above CHF 100m: 0.15%

Deep cold custody storage;

annual

Up to CHF 10m: 0.15%

Minimum CHF 1’000 per

month per crypto currency CHF 10m - CHF 100m: 0.12%

and for a minimum of 6

Above CHF 100m: 0.10%

months, or

Long-term fee (optional)13

Version: 1912191556 1/3

Transfer, Deposit, Withdrawal and Payment Fees

Blockchain fees - mining,

Charged for requested custody storage changes as incurred

gas, etc. per transfer

From crypto currency account and hot custody storage: Free

Crypto transfer fees -

per custody storage From cold custody storage: CHF 500

transfer

From deep cold custody storage: CHF 5’000

Crypto deposit and Any crypto currency deposit into SEBA: 0.20%

withdrawal fees - minimum CHF 500

per custody storage

transfer14 Withdrawal out of SEBA: CHF 500

Outgoing payments for

corporate clients9 are only

Automatic domestic:7 Free

made to an account in the

Currency payments Manual domestic:7, 8 CHF 5 same name as the client itself:

fees for individual clients apply

(additional external fees for Automatic CHF/EUR

international payments are international: CHF 5 Manual domestic7 payments

charged) for crypto companies: Free

All other payments: CHF 15

All other payments:

same fees as for individual

clients apply

Crypto Trading Commission and Traditional Securities Brokerage Fees1, 10, 11

Crypto currency trading;

No commission15

per transaction

Switzerland equity and all bonds:

Up to CHF 0.25m: 0.80%

CHF 0.25m - CHF 1m: 0.40%

Traditional securities

brokerage fees - CHF 1m - CHF 10m: 0.30%

per transaction CHF 10m - CHF 100m: 0.20%

Above CHF100m: 0.10%

Minimum Fees

Western Europe/ North America & Asia (main markets) equity:

Minimum CHF 250

Up to CHF 0.25m: 1.20%

CHF 0.25m - CHF 1m: 0.60%

Orders placed on SEBA

Digital Banking CHF 1m - CHF 10m: 0.45%

50% discount on all fees CHF 10m - CHF 100m: 0.30%

Minimum CHF 125 (for Above CHF 100m: 0.15%

“Other equity markets”:

Minimum CHF 125 Other equity markets:

respectively 0.80%)

Up to CHF 0.25m: 2.40%

CHF 0.25m - CHF 1m: 1.20%

Above CHF 1m: 1.00%

Credit Fees1, 12

Set-up – / one-off Lombard credit: CHF 500

administration fees For applicable interest rates, please consult SEBA

Version: 1912191556 2/3

Remarks

All prices are excluding VAT and potential external fees (e.g. stock exchange fees, stamp duties).

Fees are always cumulative (see however footnote 5), e.g. a storage change fee is charged on top of a trading or

transfer fee.

SEBA reserves the right to adjust and amend this pricing schedule at any time, including changes in market conditions,

as stated in Art. 5 GTC/Art. 20 Custody Regulations.

Certain products and services are subject to legal restrictions and cannot be offered worldwide on an unrestricted

basis. Nothing in this pricing schedule should be construed as a solicitation, offer or recommendation.

Crypto currencies currently offered: BTC, LTC, ETH, ETC, XLM. For offering and pricing of other Digital Assets, please

consult SEBA.

Currencies currently offered: CHF, EUR, GBP, HKD, JPY, SGD, USD.

1) Fees are charged at the end of each quarter in arrears. Fees based on the value of assets in custody are charged

on the asset valuation on the last day of the quarter.

2) Minimum CHF 100’000 assets to be deposited.

3) Additional costs may be charged for non-standard onboarding circumstances according to the actual effort

involved. Correspondingly the fee may be waived.

4) Each crypto currency requires a crypto currency account and hot custody storage. Additional custody storage

fees apply on top of the basic package.

A) Cards: Switzerland domiciled individuals only (international domiciled individuals to be serviced soon).

Additional cards CHF 100 p.a./card. Issue new PIN, replacement and blocking of card CHF 50. Card

transactions in non-reference currencies are charged with 1.00% on top of the MasterCard rate.

B) Securities accounts for professional clients only.

C) Investment deposit accounts: Priced as additional fiat account.

5) Custody minimum fees are non-cumulative across storage solutions. For each custody solution fees are charged

individually per step, not per the highest tier (stepped, not tiered, e.g. for CHF 50m in cold storage: 0.25% on the

first 1m, 0.20% on 9m, 0.18% on the remaining 40m). Additional fees are charged for non-standard setups. Sub-

custody will be priced on a stand-alone basis, please consult SEBA.

6) Deliveries into or out of SEBA are only possible to a wallet in the name of the client. The minimum fee is charged

only once for multiple transfers within one week.

7) Domestic payments are payments within Switzerland.

8) No fee is charged for manual domestic payments for employees of crypto companies.

9) Crypto companies have the possibility of fiat payments to third party accounts.

10) Delivery out per security: CHF 100. In exceptional cases where securities require additional manual custody

efforts, such additional efforts are charged with CHF 100 per security.

11) Please contact SEBA for a list of included markets and exchanges.

12) For Lombard credits (CHF100k minimum credit line and for selective countries only) please contact SEBA.

Unauthorized overdrafts -9.50% for CHF, all others -12.50%.

13) For amounts up to CHF 10m and a term of 3 years, an upfront payment of 25k can be applied instead of monthly

deep cold custody storage fees.

14) Multiple deposits and withdrawals from/ to the same wallet within a short timeframe will be charged as one

transaction.

15) See client form “Special Terms and Conditions for Trading in Foreign Currencies and Crypto Currencies” for more

information.

Version: 1912191556 3/3

You might also like

- MCQ Chap 4Document6 pagesMCQ Chap 4Diệu QuỳnhNo ratings yet

- Buffer Stock Essay (OCR)Document3 pagesBuffer Stock Essay (OCR)naqqi abbasNo ratings yet

- H. Kevin Byun's Q4 2013 Denali Investors LetterDocument4 pagesH. Kevin Byun's Q4 2013 Denali Investors LetterValueInvestingGuy100% (1)

- Effects of Mergers and Acquisitions On Financial Performance of Oil Companies in KenyaDocument69 pagesEffects of Mergers and Acquisitions On Financial Performance of Oil Companies in KenyaAnaNo ratings yet

- Creating A Business NameDocument5 pagesCreating A Business NameNader MehdawiNo ratings yet

- Sensitivity AnalysisDocument2 pagesSensitivity AnalysisDrzvvk Zxjkk100% (1)

- Tutorial QuestionsDocument66 pagesTutorial QuestionsKim Chi100% (1)

- Forex Trading Machine EbookDocument0 pagesForex Trading Machine EbookMahadi MahmodNo ratings yet

- Zahlung Firmenkunden Web enDocument6 pagesZahlung Firmenkunden Web enGarrett NelsonNo ratings yet

- Overview of Range of Accounts: Payments Savings Retirement ProvisionDocument2 pagesOverview of Range of Accounts: Payments Savings Retirement ProvisiondwdNo ratings yet

- Schedule of ChargeDocument4 pagesSchedule of Chargebana44244No ratings yet

- Pricing: Banking ServicesDocument3 pagesPricing: Banking ServiceshamoNo ratings yet

- Bitwala Pricing enDocument2 pagesBitwala Pricing entitoNo ratings yet

- Advance Easy GuideDocument9 pagesAdvance Easy GuideCode JonNo ratings yet

- PI Premium Commission Payments 2017 April v3 PDFDocument2 pagesPI Premium Commission Payments 2017 April v3 PDFOlsion HysaNo ratings yet

- Unicredit vs. IngDocument3 pagesUnicredit vs. IngAlina AndrioaeNo ratings yet

- VMBS 2017-2018 FEE GUIDE - Members - 1 August 2017 - Post June 16 RevDocument5 pagesVMBS 2017-2018 FEE GUIDE - Members - 1 August 2017 - Post June 16 RevtereveNo ratings yet

- Personal and Corporate Account FeesDocument2 pagesPersonal and Corporate Account Feesandres torresNo ratings yet

- Commission On Share CFDsDocument2 pagesCommission On Share CFDsSohaib ElabidiNo ratings yet

- Gib Savings Account Wef 01may2022Document3 pagesGib Savings Account Wef 01may2022Ankur VermaNo ratings yet

- Actual Table To Comissions Int 95fdf2abe8Document6 pagesActual Table To Comissions Int 95fdf2abe8House GardenNo ratings yet

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BNo ratings yet

- Actual Table To Comissions Int 95fdf2abe8Document6 pagesActual Table To Comissions Int 95fdf2abe8House GardenNo ratings yet

- Wealth and Investments: Pricing Guide 1 July 2019 - 30 June 2020Document18 pagesWealth and Investments: Pricing Guide 1 July 2019 - 30 June 2020Mark JacobsNo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- Easy Equities Cost ProfileDocument5 pagesEasy Equities Cost ProfileKaka KuxNo ratings yet

- Access Bank Tariff Guide Booklet - 2021Document16 pagesAccess Bank Tariff Guide Booklet - 2021Adu SamuelNo ratings yet

- Foreign Exchange (FX) and Precious Metal (PM) Spot, Forward & SwapsDocument1 pageForeign Exchange (FX) and Precious Metal (PM) Spot, Forward & SwapsAdrian TurionNo ratings yet

- Charges 2007Document1 pageCharges 2007ajbryceNo ratings yet

- GFCBJJVDFBKKDocument1 pageGFCBJJVDFBKKHare KrishnaNo ratings yet

- Regular Savings SOC 2023Document2 pagesRegular Savings SOC 2023megha90909No ratings yet

- Tariff Guide Updated April 2022Document9 pagesTariff Guide Updated April 2022Antwi Adjei EmmanuelNo ratings yet

- UBA Tarrifs and FeesDocument7 pagesUBA Tarrifs and Feesedward mpangileNo ratings yet

- Hatton National BankDocument1 pageHatton National Bankerica jayasunderaNo ratings yet

- Everyday Banking Fees 2023Document31 pagesEveryday Banking Fees 2023José Geraldo De Souza SilvaNo ratings yet

- Nedbank Transactor Account Schedule of FeesDocument4 pagesNedbank Transactor Account Schedule of FeesdlndlaminiNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Standard Fees ChargesDocument1 pageStandard Fees ChargesShirleyNo ratings yet

- Produs Structurat Denominat in USD Cu Randament de 10.25%Document3 pagesProdus Structurat Denominat in USD Cu Randament de 10.25%Ciocoiu Vlad AndreiNo ratings yet

- WHAT Subscription Purchase OrderDocument2 pagesWHAT Subscription Purchase OrderAM- BLOGSNo ratings yet

- MDB Schedule of Charges Foreign Trade NRB Banking 2015Document8 pagesMDB Schedule of Charges Foreign Trade NRB Banking 2015Mohammad Ariful Hoque ShuhanNo ratings yet

- Charges and Fees enDocument2 pagesCharges and Fees enVikas MadhanNo ratings yet

- SOC DCB Classic Current AccountDocument4 pagesSOC DCB Classic Current AccountpanditipabmaNo ratings yet

- Crypto Tax Switzerland 2023 Guide KoinlyDocument21 pagesCrypto Tax Switzerland 2023 Guide KoinlyataaataNo ratings yet

- Axis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)Document2 pagesAxis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)venkatesh19701100% (1)

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Business Essential AccountDocument4 pagesBusiness Essential Accountshekharsap284No ratings yet

- Everyday Banking Fees 2024Document33 pagesEveryday Banking Fees 2024sxgemysticNo ratings yet

- Schedule of Charges - Inward Remittances: (A) Wire Transfers (SWIFT)Document1 pageSchedule of Charges - Inward Remittances: (A) Wire Transfers (SWIFT)anubalanNo ratings yet

- Standard Bank Elite Banking 2020Document7 pagesStandard Bank Elite Banking 2020BusinessTechNo ratings yet

- PriceDocument2 pagesPricemeicassiedongNo ratings yet

- List of Conditions Effective From 01-04-2017Document13 pagesList of Conditions Effective From 01-04-2017omidreza tabrizianNo ratings yet

- Service Fees and Price Guide: Current Accounts Savings AccountsDocument4 pagesService Fees and Price Guide: Current Accounts Savings AccountsObi MogboNo ratings yet

- Nedbank Credit Cards Pricing Guide 2023Document8 pagesNedbank Credit Cards Pricing Guide 2023Mr ProtonNo ratings yet

- Private Accounts: Fast and Flexible BankingDocument2 pagesPrivate Accounts: Fast and Flexible BankingWiskurnain AhmadNo ratings yet

- Schedule of International Transaction ChargesDocument28 pagesSchedule of International Transaction Chargesaiss.ay.moussNo ratings yet

- Current AccountsDocument3 pagesCurrent Accountssyllahassane01No ratings yet

- Invoice - 0001Document1 pageInvoice - 0001Alvyn D'chipmunk FasuyiNo ratings yet

- Service Charges and FeeDocument10 pagesService Charges and Feehgfh hgfNo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- Service Charges and FeeDocument10 pagesService Charges and FeeShanNo ratings yet

- Wealth CA Schedule of ChargesDocument6 pagesWealth CA Schedule of ChargesSayan Kumar PatiNo ratings yet

- Commissions and Interests SMEDocument12 pagesCommissions and Interests SMEAamir KhanNo ratings yet

- 2020 FCA TarrifsDocument6 pages2020 FCA TarrifsmunasheNo ratings yet

- Migoals Pricing Guide 2023Document10 pagesMigoals Pricing Guide 2023MpumeleloNo ratings yet

- GTB Trade TarrifsDocument5 pagesGTB Trade TarrifsarunsundariaNo ratings yet

- 2918 Stanbic August TarrifsDocument1 page2918 Stanbic August TarrifsNyamutatanga MakombeNo ratings yet

- Draft Parking Policy in DelhiDocument40 pagesDraft Parking Policy in DelhiOjas ShettyNo ratings yet

- Abp #1Document6 pagesAbp #1Molly StolzNo ratings yet

- Assets of The Government Agencies: ACCT 1133 Accounting For Government and Non-for-Profit OrganizationDocument23 pagesAssets of The Government Agencies: ACCT 1133 Accounting For Government and Non-for-Profit OrganizationMark Angelo BustosNo ratings yet

- Tata Power-Ddl DSM Case Study Ceo&MdDocument4 pagesTata Power-Ddl DSM Case Study Ceo&MdPraveen KumarNo ratings yet

- Vora and CompanyDocument9 pagesVora and CompanyAditya SaxenaNo ratings yet

- Stream#2 - Assignment Submission Week 12 - Net Present ValueDocument10 pagesStream#2 - Assignment Submission Week 12 - Net Present ValueSergant PororoNo ratings yet

- Lecture 11 - Financial Derivatives and Forex HedgingDocument33 pagesLecture 11 - Financial Derivatives and Forex HedgingAlice LowNo ratings yet

- DSCLDocument28 pagesDSCLanshumanximbNo ratings yet

- Understanding The Tool: Porter's Five Forces ModelDocument10 pagesUnderstanding The Tool: Porter's Five Forces ModelsherdarazNo ratings yet

- 2022-11-22 - Howard Marks Memo - What-Really-MattersDocument14 pages2022-11-22 - Howard Marks Memo - What-Really-MattersappujisNo ratings yet

- Tax Notes On Capital GainsDocument15 pagesTax Notes On Capital GainsGarima GarimaNo ratings yet

- Levi'sDocument16 pagesLevi'sPeter ThomasNo ratings yet

- Unit Rate WorksheetDocument2 pagesUnit Rate WorksheetRizky Hermawan100% (1)

- Creative Shock 2018 Preliminary Case StudyDocument13 pagesCreative Shock 2018 Preliminary Case StudyRishabh Agrawal0% (1)

- Costing - What Would It Cost To Build A 2bedroom Flat in NigeriaDocument5 pagesCosting - What Would It Cost To Build A 2bedroom Flat in Nigeriaikperha jomafuvweNo ratings yet

- Valuation and Reporting of Fixed and Intangible AssetsDocument11 pagesValuation and Reporting of Fixed and Intangible AssetsBoby PodderNo ratings yet

- Ce40 E01 CPR1 ChuaDocument5 pagesCe40 E01 CPR1 ChuaChantal Noelle Victoria ChuaNo ratings yet

- Chapter 10Document7 pagesChapter 10Harry G WilliamsNo ratings yet

- SBD Dts 3 Badami KerurDocument191 pagesSBD Dts 3 Badami KerurNaveen NagisettiNo ratings yet

- EconomicsDocument55 pagesEconomicsFrancis LewahNo ratings yet

- BK013 Principles of Economics 1 Quiz - July 2017/2018Document2 pagesBK013 Principles of Economics 1 Quiz - July 2017/2018GopikaGopiNo ratings yet

- United Spirits Report - MotilalDocument12 pagesUnited Spirits Report - Motilalzaheen_1No ratings yet