Professional Documents

Culture Documents

Income Tax Payment Challan: PSID #: 138384574

Uploaded by

naeem1990Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Payment Challan: PSID #: 138384574

Uploaded by

naeem1990Copyright:

Available Formats

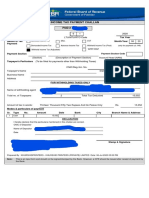

INCOME TAX PAYMENT CHALLAN

PSID # : 138384574

Corporate RTO Lahore 5 7 2020

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year 02 20

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 153(1)(a) Payment for Goods u/s 153(1)(a) (ATL @ 1% Payment Section Code 64060052

/ Non-ATL @ 2%)

(Section) (Description of Payment Section) Account Head (NAM) B01105

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

CNIC/Reg./Inc. No.

Taxpayer's Name Status

Business Name

Address

FOR WITHHOLDING TAXES ONLY

CNIC/Reg./Inc. No. 3509/20062007

Name of withholding agent MODERNO FABRICS

Total no. of Taxpayers 8 Total Tax Deducted 55,330

Amount of tax in words: Fifty Five Thousand Three Hundred Thirty Rupees And No Paisas Rs. 55,330

Only

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 ADC (e- 55,330 No Branch

payment)

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor 3509/20062007

Name of Depositor MODERNO FABRICS

Date

Stamp & Signature

PSID-IT-000093445537-022020

Prepared By : MODERNOFAB - MODERNO FABRICS Date: 22-Apr-2020 12:58 PM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

You might also like

- Bain - Company Test Example 2 Sem RespostaDocument10 pagesBain - Company Test Example 2 Sem RespostaCarina Janson OdfjellNo ratings yet

- Business Plan Auto Repairs and MaintenanceDocument38 pagesBusiness Plan Auto Repairs and MaintenanceJames Zachary100% (1)

- CCVODocument2 pagesCCVOAlonzoNo ratings yet

- Income Tax Payment Challan: PSID #: 138638394Document1 pageIncome Tax Payment Challan: PSID #: 138638394naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138458243Document1 pageIncome Tax Payment Challan: PSID #: 138458243naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138414509Document1 pageIncome Tax Payment Challan: PSID #: 138414509naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138458893Document1 pageIncome Tax Payment Challan: PSID #: 138458893naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138637167Document1 pageIncome Tax Payment Challan: PSID #: 138637167naeem1990No ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challannaeem1990No ratings yet

- It 000126799893 2023 08Document1 pageIt 000126799893 2023 08Anas KhanNo ratings yet

- Income Tax Payment Challan: PSID #: 141518891Document1 pageIncome Tax Payment Challan: PSID #: 141518891IkramNo ratings yet

- It 000126794858 2023 08Document1 pageIt 000126794858 2023 08Anas KhanNo ratings yet

- It 000142942160 2024 09Document1 pageIt 000142942160 2024 09tayyabNo ratings yet

- Income Tax Payment Challan: PSID #: 164056997Document1 pageIncome Tax Payment Challan: PSID #: 164056997M ZubairNo ratings yet

- Income Tax Payment Challan: PSID #: 35235957Document1 pageIncome Tax Payment Challan: PSID #: 35235957Ayan BNo ratings yet

- It 000136606018 2022 00Document1 pageIt 000136606018 2022 00Amazon wall streetNo ratings yet

- Income Tax Payment Challan: PSID #: 162486635Document1 pageIncome Tax Payment Challan: PSID #: 162486635samNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challangandapur khanNo ratings yet

- Income Tax Payment Challan: PSID #: 34336315Document1 pageIncome Tax Payment Challan: PSID #: 34336315kashif shahzadNo ratings yet

- It 000134579920 2022 00 PDFDocument1 pageIt 000134579920 2022 00 PDFMuhammad AslamNo ratings yet

- Abdul Ghaffar 14-10-19 PDFDocument1 pageAbdul Ghaffar 14-10-19 PDFAyan BNo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanUsman ArifNo ratings yet

- Income Tax Payment Challan: PSID #: 161602500Document1 pageIncome Tax Payment Challan: PSID #: 161602500Muhammad Asif BashirNo ratings yet

- It 000133172232 2023 01Document1 pageIt 000133172232 2023 01omer akhterNo ratings yet

- It 000133212268 2023 01Document1 pageIt 000133212268 2023 01omer akhterNo ratings yet

- It 000136658400 2023 04Document1 pageIt 000136658400 2023 04Talha ShaukatNo ratings yet

- Income Tax Payment Challan: PSID #: 57373338Document1 pageIncome Tax Payment Challan: PSID #: 57373338Kashif NiaziNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanWasimNo ratings yet

- It 000152818667 2023 00Document1 pageIt 000152818667 2023 00b3024345No ratings yet

- Income Tax Payment Challan: PSID #: 48471182Document1 pageIncome Tax Payment Challan: PSID #: 48471182Haseeb RazaNo ratings yet

- Income Tax Payment Challan: PSID #: 42079719Document1 pageIncome Tax Payment Challan: PSID #: 42079719gandapur khanNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- It 000145640626 2023 11Document1 pageIt 000145640626 2023 11pleasemakemefilerNo ratings yet

- Umair + Shahid PDFDocument1 pageUmair + Shahid PDFAyan BNo ratings yet

- Goga 2.5Document1 pageGoga 2.5advocateyaqootNo ratings yet

- Income Tax Payment Challan: PSID #: 41614961Document1 pageIncome Tax Payment Challan: PSID #: 41614961Zubair KhanNo ratings yet

- Income Tax Payment Challan: PSID #: 152672806Document1 pageIncome Tax Payment Challan: PSID #: 152672806JosephNo ratings yet

- Income Tax Payment Challan: PSID #: 57373755Document1 pageIncome Tax Payment Challan: PSID #: 57373755Kashif NiaziNo ratings yet

- Ali Hassan CC PDFDocument1 pageAli Hassan CC PDFAdv Ali Akbar Adv Ali AkbarNo ratings yet

- It 000135879998 2023 00Document1 pageIt 000135879998 2023 00Qavi UddinNo ratings yet

- Income Tax Payment Challan: PSID #: 144267713Document1 pageIncome Tax Payment Challan: PSID #: 144267713umar arshadNo ratings yet

- Mushtaq & IshfaqDocument1 pageMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNo ratings yet

- It 000095777126 2020 06Document1 pageIt 000095777126 2020 06Haroon ButtNo ratings yet

- Income Tax Payment Challan: PSID #: 148473407Document1 pageIncome Tax Payment Challan: PSID #: 148473407Haseeb RazaNo ratings yet

- Income Tax Payment Challan: PSID #: 165866345Document1 pageIncome Tax Payment Challan: PSID #: 165866345Ashok KumarNo ratings yet

- INCOME TAX PAYMENTDocument1 pageINCOME TAX PAYMENTSkjhkjhkjhNo ratings yet

- Income Tax PaymentDocument1 pageIncome Tax PaymentKashif NiaziNo ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- It 000139444749 2022 00Document1 pageIt 000139444749 2022 00WajehNo ratings yet

- Income Tax Payment Challan: PSID #: 50631682Document1 pageIncome Tax Payment Challan: PSID #: 50631682ZeeshanNo ratings yet

- Income Tax Payment Challan DetailsDocument1 pageIncome Tax Payment Challan DetailsHaseeb RazaNo ratings yet

- Income Tax Payment Challan: PSID #: 50454183Document1 pageIncome Tax Payment Challan: PSID #: 50454183Shehla FarooqNo ratings yet

- Income Tax Payment Challan: PSID #: 57372718Document1 pageIncome Tax Payment Challan: PSID #: 57372718Kashif NiaziNo ratings yet

- It 000130629196 2021 00Document1 pageIt 000130629196 2021 00muhammad faiqNo ratings yet

- It 000128980840 2021 00Document1 pageIt 000128980840 2021 00Salman GagaNo ratings yet

- DirectTaxesPaymentPSID UpdateNatureDocument1 pageDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanzeshanNo ratings yet

- Income Tax Payment Challan: PSID #: 148094666Document1 pageIncome Tax Payment Challan: PSID #: 148094666omer akhterNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanQazi zubairNo ratings yet

- It 000100418367 2020 11 PDFDocument1 pageIt 000100418367 2020 11 PDFMuhammad Qaisar LatifNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- WWW Scribd Com Document 293308167 A Research Study of Marketing Strategies of LAKMEDocument1 pageWWW Scribd Com Document 293308167 A Research Study of Marketing Strategies of LAKMEFrancis BaruahNo ratings yet

- Certificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) : Withholding AgentDocument9 pagesCertificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) : Withholding Agentnaeem1990No ratings yet

- ScribdDocument1 pageScribdnaeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Aps Jobs Details-01-2020Document2 pagesAps Jobs Details-01-2020MQ HaiderNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- A Study On Saving Function of Pakistan.Document45 pagesA Study On Saving Function of Pakistan.Sumiya ShahzadNo ratings yet

- GR Phase 1 2021-List of CasesDocument11 pagesGR Phase 1 2021-List of Caseskamal62747No ratings yet

- It 000087777830 2020 09Document1 pageIt 000087777830 2020 09naeem1990No ratings yet

- 001 200358166 CR8 117 5 PDFDocument1 page001 200358166 CR8 117 5 PDFnaeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax CPRDocument1 pageIncome Tax CPRnaeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document3 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document3 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document2 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document2 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- 149-Article Text-274-1-10-20200228 PDFDocument12 pages149-Article Text-274-1-10-20200228 PDFnaeem1990No ratings yet

- 8 2 PDFDocument16 pages8 2 PDFNintha JalanNo ratings yet

- LASTNAME AbstractDocument8 pagesLASTNAME Abstractnaeem1990No ratings yet

- Documento - MX Carlyn Cpa Encode PDFDocument10 pagesDocumento - MX Carlyn Cpa Encode PDFKeeiiiyyttt JoieNo ratings yet

- CIMA Case Study-IIT GuwahatiDocument24 pagesCIMA Case Study-IIT GuwahatiPrachi AgarwalNo ratings yet

- Understanding Business Activity: Business Studies Revision Booklet Indus International School 2014-15Document83 pagesUnderstanding Business Activity: Business Studies Revision Booklet Indus International School 2014-15A Random Person.No ratings yet

- Lesaca v. Lesaca, GR. No. L-3605, April 21, 1952Document1 pageLesaca v. Lesaca, GR. No. L-3605, April 21, 1952MonicaCelineCaroNo ratings yet

- Latihan Soal DirectDocument7 pagesLatihan Soal Directpadjajaran conferenceNo ratings yet

- "How Well Am I Doing?" Financial Statement Analysis: Mcgraw-Hill/IrwinDocument41 pages"How Well Am I Doing?" Financial Statement Analysis: Mcgraw-Hill/Irwinrayjoshua12No ratings yet

- Political Economy of International TradeDocument28 pagesPolitical Economy of International TradePradeepKumarNo ratings yet

- 2019 Annual Report ING Group NV PDFDocument449 pages2019 Annual Report ING Group NV PDFWilliam WatterstonNo ratings yet

- Auditing Inventory Management ProcessDocument51 pagesAuditing Inventory Management Processgilli1tr67% (3)

- 71480bos57500 p1Document33 pages71480bos57500 p1Lost OneNo ratings yet

- Fiscal Policy MCQDocument4 pagesFiscal Policy MCQCrystal Goh64% (14)

- T&P Magazine April 2018Document5 pagesT&P Magazine April 2018Trifirò Partners AvvocatiNo ratings yet

- Earnings Statementimportant - Keep For Your Records: E-MailDocument1 pageEarnings Statementimportant - Keep For Your Records: E-MailJuanNo ratings yet

- Model Project On Rice Milling: Prepared by NABARD Consultancy Services Private LimitedDocument13 pagesModel Project On Rice Milling: Prepared by NABARD Consultancy Services Private LimitedAnkush BajoriaNo ratings yet

- JFC LongverDocument4 pagesJFC LongverKirkNo ratings yet

- RRL Matrix - ToPIC 1 Effect of The New IFRS 15 Adoption - Revenue Recognition To Earnings Quality of FirmsDocument12 pagesRRL Matrix - ToPIC 1 Effect of The New IFRS 15 Adoption - Revenue Recognition To Earnings Quality of FirmsEuniceChungNo ratings yet

- Chapter 3 Analysis of TransactionsDocument70 pagesChapter 3 Analysis of TransactionsJessa Mae GomezNo ratings yet

- Dipad Vs OlivanDocument8 pagesDipad Vs OlivanFrancis De CastroNo ratings yet

- File1 - Laporan 5Document48 pagesFile1 - Laporan 5Bhaskoro AbdillahNo ratings yet

- Property Investment Analysis and ForecastingDocument23 pagesProperty Investment Analysis and Forecastingsam100% (1)

- Taxation 1 Case Analysis No. 1Document5 pagesTaxation 1 Case Analysis No. 1PJ OrtizNo ratings yet

- Far AnswersDocument2 pagesFar AnswersMikhail Ayman MasturaNo ratings yet

- Modified Pag-Ibig Ii Enrollment FormDocument2 pagesModified Pag-Ibig Ii Enrollment FormNimrod Sobremisana AdaptarNo ratings yet

- Peacock Co Trial Balance Fire Loss ProblemDocument2 pagesPeacock Co Trial Balance Fire Loss ProblemmhikeedelantarNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- Boq PraneenDocument2 pagesBoq Praneenlkovijay100% (1)

- BUS 402 - Assignment 4 - Supply Chain Management and Financial Plan - Course HeroDocument6 pagesBUS 402 - Assignment 4 - Supply Chain Management and Financial Plan - Course Herowriter topNo ratings yet