Professional Documents

Culture Documents

Cerro Verde and Ferreycorp Performance and Portfolio Analysis

Uploaded by

Anonymous bty2U5JryjOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cerro Verde and Ferreycorp Performance and Portfolio Analysis

Uploaded by

Anonymous bty2U5JryjCopyright:

Available Formats

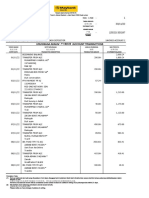

SCOTIA CERRO VERDE

Periodo Rendimiento Rendimiento

Jun-14 0.1375 0.000408163265306

Jul-14 0.05634 -0.01030927835052

Aug-14 0.01993 -0.05982905982906

Sep-14 0.00163 -0.05302325581395

Oct-14 -0.13791 0.001463414634146

Nov-14 -0.08987 0.099771167048055

Dec-14

0.08333 -0.04

Jan-15 -0.04669 -0.0125

Feb-15 0.006 -0.13793103448276

Mar-15 -0.04573 -0.12820512820513

Apr-15 -0.04641 -0.05823529411765

May-15 0.04425 0.029411764705882

Jun-15 -0.0314 -0.05714285714286

Jul-15 0.01277 -0.12121212121212

Aug-15 -0.13655 -0.02097902097902

Sep-15 -0.03148 0.203377902885292

Oct-15 0.025 0.192982456140351

Nov-15 0 -0.0095

Dec-15 0.20488 -0.0995

Jan-16 0.00887 0.028888888888889

Feb-16 0.16699 0.051212938005391

Mar-16 0.01667 -0.06043956043956

Apr-16 -0.02857 0.1

May-16 0.08613 -0.03466666666667

Jun-16 -0.03288 0.125

Jul-16 0.17671 -0.0562962962963

Aug-16 0.02389 0.15

Sep-16 0.00984 0.043478260869565

Oct-16 -0.03704 -0.10416666666667

Nov-16 0.14192 0.093023255813954

Dec-16 0.01013 -0.05652173913043

Jan-17 0.13712 -0.02347417840376

Feb-17 0.10254 0.085714285714286

Mar-17 -0.101 0.075555555555556

Apr-17 -0.02587 0.008403361344538

May-17 0.11448 0.166666666666667

Jun-17 -0.02189 -0.01485319516408

Jul-17 -0.01685 0.018867924528302

Aug-17 -0.03742 -0.02684563758389

Sep-17 0.03293 0.01551724137931

Oct-17 -0.03924 -0.00990099009901

Nov-17 -0.00029 -0.02068965517241

Dec-17 -0.05 -0.00711743772242

Jan-18 0.02857 -0.11636363636364

Feb-18 -0.01667 0.069958847736626

Mar-18 -0.00833 -0.0752

Apr-18 0.00704 0.036363636363636

May-18 0.00559 -0.13

Jun-18 0 0.046228710462287

Jul-18 -0.07978 -0.03703703703704

Aug-18 0.02394 -0.00480769230769

Sep-18 0 0.159420289855073

Oct-18 -0.01389 0.007142857142857

Nov-18 -0.05882 -0.02277432712215

Dec-18 -0.01563 -0.12775330396476

Jan-19 0.15625 0.0755

Feb-19 0.00658 -0.06555090655509

Mar-19 0.03628 -0.04040404040404

Apr-19 0.00126 -0.06493506493507

May-19 -0.01887 0.028

SCOTIA

Promedio historico (Men 1.1938000%

Promedio historico (Anu 15.3046592%

Desviación Estándar (Me 7.2443217%

Desviación Estándar (An 25.0950663%

SCOTIA

w 65.67%

Valores Obtenidos

E(Rp) 7.575%

Vp 0.003171122793

Vp 0.038053473516

Sp (Desv. Est. Port) 19.51%

Para el portafolio Scotiabank-Cerro Verde el riesgo del po

7.575%, con un rendimiento óptimo de 9.85% anual, invir

del capital en la empresa Scotiabank, y 34,33% del capital

Cerro Verde.

CUADRO DE COVARIANZA

CERRO

SCOTIA

VERDE

0.0069875% SCOTIA 0.0052480196231

0.0838824% CERRO VERDE 0.0002528966818

8.2077453%

28.4324639%

CERRO Riesgo Rendimiento

Suma Rendimiento Mensual

VERDE Optimo Anual

34.33% 100% 7.575% 0.7863144% 9.85%

btenidos

Anual

Mensual

Anual

Anual

erro Verde el riesgo del portafolio es de

timo de 9.85% anual, invirtiendo 65.67%

bank, y 34,33% del capital en la empresa

ANZA

CERRO

VERDE

0.0002528967

0.0067367083

FERREYCORP C.PACASMAYO

Periodo Rendimiento Rendimiento

Jun-14 0.1375 0.032258064516129

Jul-14 0.05634 0.006211180124224

Aug-14 0.01993 -0.05063291139241

Sep-14 0.00163 -0.00689655172414

Oct-14 -0.13791 -0.01398601398601

Nov-14 -0.08987 -0.02836879432624

Dec-14 0.08333 0.036231884057971

Jan-15 -0.04669 -0.00699300699301

Feb-15 0.006 -0.01438848920863

Mar-15 -0.04573 -0.05147058823529

Apr-15 -0.04641 -0.02325581395349

May-15 0.04425 0.09375

Jun-15 -0.0314 -0.10489510489511

Jul-15 0.01277 0.022727272727273

Aug-15 -0.13655 -0.08270676691729

Sep-15 -0.03148 0.111111111111111

Oct-15 0.025 0.130769230769231

Nov-15 0 0.186206896551724

Dec-15 0.20488 -0.02857142857143

Jan-16 0.00887 -0.08235294117647

Feb-16 0.16699 0.044871794871795

Mar-16 0.01667 0.01875

Apr-16 -0.02857 0.018518518518518

May-16 0.08613 0.018292682926829

Jun-16 -0.03288 0.036363636363636

Jul-16 0.17671 -0.01169590643275

Aug-16 0.02389 0.06508875739645

Sep-16 0.00984 0.021978021978022

Oct-16 -0.03704 0.096774193548387

Nov-16 0.14192 -0.08333333333333

Dec-16 0.01013 0.015544041450777

Jan-17 0.13712 -0.06217616580311

Feb-17 0.10254 -0.00552486187845

Mar-17 -0.101 0.037837837837838

Apr-17 -0.02587 0.097938144329897

May-17 0.11448 0.186915887850467

Jun-17 -0.02189 -0.02621722846442

Jul-17 -0.01685 -0.03409090909091

Aug-17 -0.03742 -0.00384615384615

Sep-17 0.03293 -0.02316602316602

Oct-17 -0.03924 0.01195219123506

Nov-17 -0.00029 0.039525691699605

Dec-17 -0.05 0.011406844106464

Jan-18 0.02857 -0.09961685823755

Feb-18 -0.01667 0

Mar-18 -0.00833 -0.02127659574468

Apr-18 0.00704 0.021739130434783

May-18 0.00559 -0.10970464135021

Jun-18 0 0.030837004405286

Jul-18 -0.07978 0.076271186440678

Aug-18 0.02394 0.028571428571429

Sep-18 0 -0.04651162790698

Oct-18 -0.01389 -0.00403225806452

Nov-18 -0.05882 0.004098360655738

Dec-18 -0.01563 -0.11065573770492

Jan-19 0.15625 0.071090047393365

Feb-19 0.00658 -0.06896551724138

Mar-19 0.03628 -0.04651162790698

Apr-19 0.00126 0.029268292682927

May-19 -0.01887 -0.00961538461538

SCOTIA FERREYCORP

Promedio historico (Mensual) 1.1938000% 0.5690668%

Promedio historico (Anual) 15.3046592% 7.0466410%

Desviación Estándar (Mensual) 7.2443217% 6.4317996%

Desviación Estándar (Anual) 25.0950663% 22.2804075%

SCOTIA FEREYCORP

w 45.74% 54.26%

Valores Obtenidos

E(Rp) 6.803% Anual

Vp 0.0025077905477 Mensual

Vp 0.0300934865723 Anual

Sp (Desv. Est. Port) 17.35% Anual

Para el portafolio Scotiabank-Ferreycorp el riesgo del portafolio es de 6.803%, con un

rendimiento óptimo de 10.75% anual, invirtiendo 45.74% del capital en la empresa

Scotiabank, y 54.26% del capital en la empresa Ferreycorp

En el presente portafolio se presenta el maximo rendimiento, siendo este de 10.75%

incluso con un menor riesgo.

De elegir un portafolio, eligiriamos el portafolio SCOTIABANK-CERROVERDE, debido a que

nos presenta el menor riego con el maximo rendimiento.

CUADRO DE COVARIANZAS

SCOTIA FERREYCORP

SCOTIA 0.005248019623051 0.0003865930716

FERREYCORP 0.000386593071602 0.00413680466003

Riesgo Rendimiento

Suma Rendimiento Mensual

Optimo Anual

100% 6.803% 0.8548159% 10.7540690%

s de 6.803%, con un

tal en la empresa

ndo este de 10.75%

ROVERDE, debido a que

CERRO FERREYCORP

Periodo Rendimiento Rendimiento

Jun-14 0.000408163265306 0.03225806451613

Jul-14 -0.010309278350516 0.00621118012422

Aug-14 -0.05982905982906 -0.0506329113924

Sep-14 -0.053023255813954 -0.0068965517241

Oct-14 0.001463414634146 -0.013986013986

Nov-14 0.099771167048055 -0.0283687943262

Dec-14 -0.04 0.03623188405797

Jan-15 -0.0125 -0.006993006993

Feb-15 -0.137931034482759 -0.0143884892086

Mar-15 -0.128205128205128 -0.0514705882353

Apr-15 -0.058235294117647 -0.0232558139535

May-15 0.029411764705882 0.09375

Jun-15 -0.057142857142857 -0.1048951048951

Jul-15 -0.121212121212121 0.02272727272727

Aug-15 -0.020979020979021 -0.0827067669173

Sep-15 0.203377902885292 0.11111111111111

Oct-15 0.192982456140351 0.13076923076923

Nov-15 -0.0095 0.18620689655173

Dec-15 -0.0995 -0.0285714285714

Jan-16 0.028888888888889 -0.0823529411765

Feb-16 0.051212938005391 0.04487179487179

Mar-16 -0.060439560439561 0.01875

Apr-16 0.1 0.01851851851852

May-16 -0.034666666666667 0.01829268292683

Jun-16 0.125 0.03636363636364

Jul-16 -0.056296296296296 -0.0116959064327

Aug-16 0.15 0.06508875739645

Sep-16 0.043478260869565 0.02197802197802

Oct-16 -0.104166666666667 0.09677419354839

Nov-16 0.093023255813954 -0.0833333333333

Dec-16 -0.056521739130435 0.01554404145078

Jan-17 -0.023474178403756 -0.0621761658031

Feb-17 0.085714285714286 -0.0055248618785

Mar-17 0.075555555555556 0.03783783783784

Apr-17 0.008403361344538 0.0979381443299

May-17 0.166666666666667 0.18691588785047

Jun-17 -0.014853195164076 -0.0262172284644

Jul-17 0.018867924528302 -0.0340909090909

Aug-17 -0.026845637583893 -0.0038461538462

Sep-17 0.01551724137931 -0.023166023166

Oct-17 -0.00990099009901 0.01195219123506

Nov-17 -0.020689655172414 0.0395256916996

Dec-17 -0.00711743772242 0.01140684410646

Jan-18 -0.116363636363636 -0.0996168582375

Feb-18 0.069958847736626 0

Mar-18 -0.0752 -0.0212765957447

Apr-18 0.036363636363636 0.02173913043478

May-18 -0.13 -0.1097046413502

Jun-18 0.046228710462287 0.03083700440529

Jul-18 -0.037037037037037 0.07627118644068

Aug-18 -0.004807692307692 0.02857142857143

Sep-18 0.159420289855073 -0.046511627907

Oct-18 0.007142857142857 -0.0040322580645

Nov-18 -0.022774327122153 0.00409836065574

Dec-18 -0.127753303964758 -0.1106557377049

Jan-19 0.0755 0.07109004739336

Feb-19 -0.065550906555091 -0.0689655172414

Mar-19 -0.040404040404041 -0.046511627907

Apr-19 -0.064935064935065 0.02926829268293

May-19 0.028 -0.0096153846154

CER VER FEREYCORP

Promedio historico ( 0.0069875% 0.5690668%

Promedio historico (A 0.0838824% 7.0466410%

Desviación Estándar 8.2699339% 6.4838424%

Desviación Estándar 28.6478914% 22.4606888%

CER VER FEREYCORP Suma

w 68.09% 31.91% 100%

Valores Obtenidos

E(Rp) 7.700% Anual

Vp 0.004651620188 Mensual

Vp 0.0558194422561 Anual

Sp (Desv. Est. Port) 23.63% Anual

Para el portafolio Cerro Verde-Ferreycorp el riesgo del portafolio es de 7.7%,

con un rendimiento óptimo de 2.26% anual, invirtiendo 68.09% del capital en

la empresa Scotiabank, y31.91% del capital en la empresa Ferreycorp

Como podemos observar, este portafolio es el que menor rendimiento anual

nos brinda, incluso teniendo un riesgo mayor

CUADRO DE COVARIANZA

CERRO VERDE FERREYCORP

CERRO VERDE 0.006839180659491 0.00242296213472

FERREYCORP 0.002422962134719 0.00420402118831

Riesgo

Rendimiento Mensual Rendimiento Anual

Optimo

7.700% 0.1863662% 2.26%

You might also like

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Britannia 1Document4 pagesBritannia 1Piyush FarsaiyaNo ratings yet

- Mes FT TT Fitt Error Error2 Proporción Por DemandaDocument27 pagesMes FT TT Fitt Error Error2 Proporción Por DemandaJuan SarmientoNo ratings yet

- AULA ANALYTICS PARA GESTAO DE RISCOS - Solucao 2024Document26 pagesAULA ANALYTICS PARA GESTAO DE RISCOS - Solucao 2024Marcos SilvaNo ratings yet

- Sales Forecast for 2017-2018Document12 pagesSales Forecast for 2017-2018Javi GalleNo ratings yet

- 02.09 Frontera EficienteDocument11 pages02.09 Frontera Eficientelaila89No ratings yet

- Long term investment trends in PakistanDocument11 pagesLong term investment trends in PakistanSYEDA MAHEENNo ratings yet

- Planilha Calculo Judiciario PequiDocument17 pagesPlanilha Calculo Judiciario PequiFilipeNo ratings yet

- MONTHLY RETURNSDocument17 pagesMONTHLY RETURNSFilipeNo ratings yet

- Medical Industry in India - The Evolving Landscape Oppurtunities and Challenges White PaperDocument9 pagesMedical Industry in India - The Evolving Landscape Oppurtunities and Challenges White Papermaxi1162No ratings yet

- Chart Title: X Y R NO Tanggal USD LiborDocument9 pagesChart Title: X Y R NO Tanggal USD Liborachmad bagusNo ratings yet

- Date Sale RP RP-RP' (RP-RP') 2 Semi Variance IndexDocument3 pagesDate Sale RP RP-RP' (RP-RP') 2 Semi Variance IndexAbdul NaveedNo ratings yet

- CapmDocument11 pagesCapmJose CevallosNo ratings yet

- Hands 6Document52 pagesHands 6Wilson SarmientoNo ratings yet

- 1 Year Beta Calculated Using Weekly DataDocument9 pages1 Year Beta Calculated Using Weekly Datatopeq100% (1)

- Kohinoor TextileDocument90 pagesKohinoor TextileRameen AliNo ratings yet

- Fecha N Venta Meta Pronóstico PEMA (% Error Medio Absoluto)Document3 pagesFecha N Venta Meta Pronóstico PEMA (% Error Medio Absoluto)ebasaezNo ratings yet

- Fin RatiosDocument7 pagesFin Ratiosakankshag_13No ratings yet

- Session 19-20 Cases RegressionDocument19 pagesSession 19-20 Cases RegressionSiddharthNo ratings yet

- IAPM Report 3 Calculations With Supporting Data For Portfolio and Benchmark Variance Calculations UpdatedDocument17 pagesIAPM Report 3 Calculations With Supporting Data For Portfolio and Benchmark Variance Calculations UpdatedAYUSHI NAGARNo ratings yet

- Year Jan Feb Mar Apr May Jun Jul AugDocument6 pagesYear Jan Feb Mar Apr May Jun Jul AugcristianoNo ratings yet

- Bank Alfala performance data and analyticsDocument17 pagesBank Alfala performance data and analyticssyed ali mujtabaNo ratings yet

- Bajaj AutoDocument8 pagesBajaj AutoAllwyn FlowNo ratings yet

- Ooredoo and Vodafone stock portfolio analysis under different allocation ratiosDocument5 pagesOoredoo and Vodafone stock portfolio analysis under different allocation ratiosFull StopNo ratings yet

- Forecasting Case - XlxsDocument8 pagesForecasting Case - Xlxsmayank.dce123No ratings yet

- Sismo El CentroDocument51 pagesSismo El Centrodavid rinconNo ratings yet

- Olah Data FarahDocument13 pagesOlah Data Farahnabilafarah442No ratings yet

- Company Name Stock Symbol Average Monthly Return (5 Years) Standard Deviation of Monthly ReturnsDocument8 pagesCompany Name Stock Symbol Average Monthly Return (5 Years) Standard Deviation of Monthly Returnsanon_764902750No ratings yet

- TLKM. Olah Data BaruDocument5 pagesTLKM. Olah Data Barusyahrul oikosNo ratings yet

- Y Cosx - 0,1xDocument7 pagesY Cosx - 0,1xИлья ТапковичNo ratings yet

- Beta, CAPM, RF CalculationsDocument8 pagesBeta, CAPM, RF CalculationsPradeesh MenomadathilNo ratings yet

- Coprate FinanceDocument114 pagesCoprate FinanceHrishita AnandNo ratings yet

- March Day # Price Diff. Entry Price # of Contracts Position Opened)Document6 pagesMarch Day # Price Diff. Entry Price # of Contracts Position Opened)RoNo ratings yet

- Date Calcul Licenta 1Document13 pagesDate Calcul Licenta 1Andreea DobrescuNo ratings yet

- Trabajo 30 06Document3 pagesTrabajo 30 06Irene Monja Camizan100% (1)

- Company Name Colgate-Palmolive (India) LTDDocument46 pagesCompany Name Colgate-Palmolive (India) LTDPremNo ratings yet

- Trips Details Report 17072019 - 165454Document3 pagesTrips Details Report 17072019 - 165454ingricharNo ratings yet

- Assig BetaDocument9 pagesAssig BetaGan Huey Ling100% (1)

- Sno Date Amount Rs Rate RS/LTR Gap Between Fillings Quantity LtrsDocument16 pagesSno Date Amount Rs Rate RS/LTR Gap Between Fillings Quantity LtrsBishanjit Singh GrewalNo ratings yet

- PF Charge As On 15Document3 pagesPF Charge As On 15sayem biswasNo ratings yet

- Chart TitleDocument28 pagesChart TitleGabrielLesneanuNo ratings yet

- Chương 3 - Financial ModelingDocument6 pagesChương 3 - Financial ModelingHUONG NGUYEN THINo ratings yet

- ChartsDocument11 pagesChartsRadhika SarawagiNo ratings yet

- Buckley-Leverett model parameters and calculations for an oil reservoirDocument12 pagesBuckley-Leverett model parameters and calculations for an oil reservoirJuan Diego Medina MedinaNo ratings yet

- SRF LTDDocument36 pagesSRF LTDDhagash SanghaviNo ratings yet

- Colegio de Bachilleres Del Estado de YucatánDocument10 pagesColegio de Bachilleres Del Estado de YucatánluisNo ratings yet

- Ancash earthquake acceleration dataDocument5,941 pagesAncash earthquake acceleration dataLuis Fernando Vergaray AstupiñaNo ratings yet

- Vibracion Libre AmortiguadaDocument1 pageVibracion Libre AmortiguadaUriel BenitoNo ratings yet

- Nifty 500 Data Set-1Document1 pageNifty 500 Data Set-1rohitNo ratings yet

- Acciones ColcapDocument25 pagesAcciones ColcapAndry OrtizNo ratings yet

- AWT Investments Limited: Validity Date Navs Navs Return KSE Kse RetuenDocument4 pagesAWT Investments Limited: Validity Date Navs Navs Return KSE Kse RetuenHamxa SajjadNo ratings yet

- Futures and Stocks AnalysisDocument4 pagesFutures and Stocks Analysisniharika sharma sharmaNo ratings yet

- Fecha Coca Cola Ko IBM Precio Acción Precio AcciónDocument3 pagesFecha Coca Cola Ko IBM Precio Acción Precio AcciónBelu RodriguezNo ratings yet

- RIO1 Streamflow for Selected Nodes and ReachesDocument56 pagesRIO1 Streamflow for Selected Nodes and ReachesAndrea FanoNo ratings yet

- 1990 Beer Figures and ForecastsDocument8 pages1990 Beer Figures and ForecastsRitika SharmaNo ratings yet

- CM1B TemplateDocument12 pagesCM1B TemplateRahul IyerNo ratings yet

- Ects1 Buzea Stefania GeorgianaDocument82 pagesEcts1 Buzea Stefania GeorgianaPirtac Vladut-MihaiNo ratings yet

- BERK iNAĞDocument31 pagesBERK iNAĞHaydar Eren UyanikerNo ratings yet

- Excel DikiDocument6 pagesExcel DikiVianSaefullahNo ratings yet

- Date VTI BND VEA Ret - VTI Ret - BND Ret - VEA $1 - VTI $1 - BND $1 - VEADocument12 pagesDate VTI BND VEA Ret - VTI Ret - BND Ret - VEA $1 - VTI $1 - BND $1 - VEAM Thahir ShahNo ratings yet

- Broadband Remains Growth Focus: Ksa Telecom SectorDocument14 pagesBroadband Remains Growth Focus: Ksa Telecom Sectorapi-192935904No ratings yet

- Payment Options: Aesm - Instructions For Online Test Payment and Seat BookingDocument8 pagesPayment Options: Aesm - Instructions For Online Test Payment and Seat BookingSombir AhlawatNo ratings yet

- OID Demystified (Somewhat)Document6 pagesOID Demystified (Somewhat)Reznick Group NMTC PracticeNo ratings yet

- 4th Ans BookDocument248 pages4th Ans BookPriyanka BaluNo ratings yet

- Payment SystemDocument24 pagesPayment SystemiramanwarNo ratings yet

- 235+ MCQ - Financial Awareness by Ashish Gautam Ga GuruDocument27 pages235+ MCQ - Financial Awareness by Ashish Gautam Ga Gurumahesh kumar100% (1)

- Factors Affecting Money SupplyDocument3 pagesFactors Affecting Money Supplyananya50% (2)

- An LSOC Tutorial: A New Customer Protection Model For Cleared Swaps BeginsDocument3 pagesAn LSOC Tutorial: A New Customer Protection Model For Cleared Swaps BeginsMarketsWikiNo ratings yet

- 3 - 1-Asset Liability Management PDFDocument26 pages3 - 1-Asset Liability Management PDFAlaga ZelkanovićNo ratings yet

- Chapter 4 Recording of TransactiosDocument24 pagesChapter 4 Recording of TransactiosJohn Mark MaligaligNo ratings yet

- KPN Travels: Bangalore To ChennaiDocument2 pagesKPN Travels: Bangalore To Chennaiவினோத் குமார் சேகர்No ratings yet

- List of Life Insurance PDFDocument51 pagesList of Life Insurance PDFChet KNo ratings yet

- Reliance IndustriesDocument28 pagesReliance Industriesyudhishther0% (1)

- Weekender - GEI Industrial Systems - 05-08-11 PDFDocument5 pagesWeekender - GEI Industrial Systems - 05-08-11 PDFSwarupa DateNo ratings yet

- Financial Planning For HNI ClientsDocument42 pagesFinancial Planning For HNI ClientsNirav Mistry50% (2)

- Research Proposal On BankingDocument23 pagesResearch Proposal On Bankingrujuta88% (8)

- HomeworkDocument8 pagesHomeworkK59 Do Man NghiNo ratings yet

- FM 1-Financial Management: Our Lady of The Pillar College-San Manuel IncDocument7 pagesFM 1-Financial Management: Our Lady of The Pillar College-San Manuel Incrosalyn mauricioNo ratings yet

- Chapter 7 Posting To The LedgerDocument11 pagesChapter 7 Posting To The LedgerMa. Concepcion Desepeda100% (2)

- Ibs Bahau 1Document4 pagesIbs Bahau 1Khairul AzimNo ratings yet

- Journalizing TransactionsDocument38 pagesJournalizing TransactionsPratyush mishraNo ratings yet

- 1530450884495Document20 pages1530450884495ManuSugathanNo ratings yet

- Business Chapter 1 - 24 4 2018Document14 pagesBusiness Chapter 1 - 24 4 2018Aishani ToolseeNo ratings yet

- HSBC v Aldanese surety liabilityDocument1 pageHSBC v Aldanese surety liabilityLouie RaotraotNo ratings yet

- Cheap Air Tickets Online, International Flights To India, Cheap International Flight Deals - SpiceJet Airlines PDFDocument2 pagesCheap Air Tickets Online, International Flights To India, Cheap International Flight Deals - SpiceJet Airlines PDFprince_rahul_159No ratings yet

- Online Banking of Sunrise Bank Limited.: A Project Work ReportDocument28 pagesOnline Banking of Sunrise Bank Limited.: A Project Work ReportSachin JhaNo ratings yet

- 2 - Complete Presentation - 11.13.2018Document140 pages2 - Complete Presentation - 11.13.2018wnicoloffNo ratings yet

- Electronic Payment SystemsDocument8 pagesElectronic Payment SystemsAbhishek NayakNo ratings yet

- Company Finance - Group 9Document20 pagesCompany Finance - Group 9TumwesigyeNo ratings yet

- Credit Rating Report of JP MorganDocument6 pagesCredit Rating Report of JP MorganPOOONIASAUMYANo ratings yet