Professional Documents

Culture Documents

M&A Gillete Và P&G

Uploaded by

KankanNguyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M&A Gillete Và P&G

Uploaded by

KankanNguyenCopyright:

Available Formats

International Journal of Economics, Commerce and Management

United Kingdom Vol. VI, Issue 8, August 2018

http://ijecm.co.uk/ ISSN 2348 0386

MAJOR MERGER & ACQUISITIONS: PROCTER &

GAMBLE – GILLETTE DEAL. DID IT ACHIEVE ITS GOAL?

Papanikolaou Nikolaos

MBA, National Library of Greece

nkpap85@gmail.com

Abstract

The present paper examines the merger of Gillette and P&G in 2005. Based on this merger we

will describe the picture on the markets of both companies prior to the agreement, the terms and

the reasons that led to this move. Using the evaluation model by discounting the cash flows of

the Gillette Company, we will study the company’s value according to the data before and after

the agreement taking into account the benefits that will rise from this synergy.

Keywords: Merger & acquisitions, Procter &Gamble, Gilette Co., valuation, cash flows

INTRODUCTION: THE ACQUISITION OF GILLETTE BY PROCTER & GAMBLE - THE

TERMS OF THE AGREEMENT

In this section, we will seek to present and clarify the terms of the acquisition agreement of

Gillette by Procter & Gamble, initially by providing an overview of the company and the reasons

that led P&G to acquire Gillette.

The picture of the companies at the conclusion of the agreement

Procter and Gamble

Procter & Gamble has some of the best known brands in the world like Pampers, Tide, Ariel,

Always, Pantene, Crest, Head & Shoulders and Wella. In 2004 the company‟s profits reached

6.4 billion dollars of the total sales of 51.4 billion dollars. At that period the company‟s

employees amounted to 110,000 in 80 countries.

Licensed under Creative Common Page 498

International Journal of Economics, Commerce and Management, United Kingdom

Gillette profile

Gillette was clearly smaller in size but also had known brands, such as Mach3, Sensor, Venus,

Duracell, Oral-B, Braun, Silk-epil. In 2004 the company‟s sales amounted to 10.3 billion dollars

and the profits at 2.3 billion dollars. The company employed 30,000 workers and marketed its

products in more than 200 countries. Gillette‟s products and brands that after the takeover

passed to Procter & Gamble were the following:

1. Razors and Blades (Atra, Trac II, Good news, Sensor, Mach 3),

2. Shaving foams and deodorants (Foamy, Satin care, Gillette series),

3. Electric shavers (Braun syncho & flex, Silk epil),

4. Toothbrushes (Oral-B, Advantage),

5. Electric toothbrushes (Braun Oral-B),

6. Personal care products (Right guard, Series soft & Dri, Dri idea),

7. Batteries (Duracell)

From the above products, Atra, Trac II, Good news, Sensor and Mach3 had a very positive

sales results and profitability (37% of sales and 62% of profits) before the acquisition. Besides,

razors and blades were among the primary and most profitable products of the company and

especially in the U.S. since when the company was acquired was the industry leader with a

market share of 79%.

These products were essentially the golden cows for Gillette, which brought large profits

to the company. Their importance was so great and the support of their sales continued to be

supported after the acquisition by P&G. In addition, reminder ads were especially beneficial in

increasing the sales, as well as innovation through which Gillette could somehow renew

consumer preference and also differentiate its products from those of competitors, thus

maintaining the market share and attracting new customers.

A very positive point for the brand portfolio of Gillette was that its brands were either

golden cows with large market share and slow growth, or stars with large market share and

rapid growth. Thus, we could say that none of these products should be withdrawn even after

the process of acquisition. What would be considered preferable for Procter & Gamble after the

acquisition is to exploit the cash cow brands to promote, as far as possible, other brands by

taking advantage of both the financial resources flowing from them, and the recognition and

reputation of Gillette‟s shaving products.

In conclusion, one can say that P&G acquired a good and well balanced brand portfolio,

which could develop further synergies in order for the company to succeed a significant

increase in sales and thus profits (Thompson, & Strickland, 1996).

Licensed under Creative Common Page 499

© Papanikolaou

The terms of the agreement

The leader company in consumer products Procter & Gamble decided to acquire the 100% of

Gillette for $ 57 billion dollars. Procter & Gamble (P&G) signed an agreement in 2005 with

Gillette to acquire 100% of the last over 57 billion U.S. dollars.

This amount represents a premium of about 18% on the market value of Gillette. In order

for the agreement to be valid, it had to be approved by the shareholders of both companies and

the appropriate supervisory authorities. This acquisition resulted in the world‟s largest consumer

products company thus displacing Unilever that held the lead until then. The American investor

Warren Buffett, chairman of the investment company Berkshire Hathaway, had a 9% stock

share in Gillette and described the agreement as a «dream deal».

THE PREMIUM OFFER

The share price since 2001 until the date of the merger offer increased gradually, and after the

agreement the price increased with higher rates. On 26th January 2005 the share price of

Gillette was $45 while the share price of P&G was $55.04. P&G paid 0,975 over the share value

and hence $ 53.66 for each share of Gillette, therefore each share of Gillette received a

premium of $ 8.66 (53.66-45).

MOTIVES AND SYNERGIES OF THE AGREEMENT

Mergers and acquisitions are common business strategies for various reasons, such as:

1. Increase of the market share and greater operational efficiency.

2. Geographical expansion

3. Expansion into new product categories.

4. Access to new technologies.

5. Building new industries

The merger refers to the “equal” union of two or more companies and usually the resulting

company has a different name. The acquisition occurs when a company buys and incorporates

another company. The acquisition may be friendly (the acquired company agrees to be

acquired) or hostile (without the consent). These are called hostile takeovers.

In the case of P&G and Gillette the reasons that led to the acquisition seems to be that

there was an important, as it is called, strategic fit, between the two companies. This acquisition

was amicable and accepted by Gillette.

From 2000 onwards, P&G started to enter more in the personal care product markets as

it is evident from the prior acquisition of Wella and Clairol. Thus, the acquisition of Gillette fitted

Licensed under Creative Common Page 500

International Journal of Economics, Commerce and Management, United Kingdom

with P&G‟s corporate strategy, since it widened the range of the company‟s product line with

similar products.

P&G knows marketing. It was, moreover, the company that introduced the terms brand

and brand management many decades ago. The annual advertising budget of P&G reaches the

amount of about $5.5 billion (a dream client for every advertising company) and most of the

targeted population are women.

On the other hand, Gillette was equally strong in marketing, the budget of which was as

high as $1 billion. The advertising activities of the two companies were also aiming in men,

which was an additional matching for the two companies. The huge total advertising budget (5.5

+ 1) that was available to the company after the acquisition of Gillette provided the new

company with a major bargaining power over the media.

The key word in this acquisition was the “scale”. P&G apparently believed that in order to

develop and exploit the opportunities offered by the globalization and the opening of new

markets, e.g. China, had to “increase its size”.

Apart from this, however, maximizing the company‟s size was also a counterbalance to

the increasing bargaining power of the retailers (meaning its clients) and especially Wal-Mart‟s

which is prevalent in the U.S. and famous for its hard bargains with the suppliers.

In other words, the acquisition reduced the bargaining power of P&G‟s clients. The same

applied for P&G‟s suppliers. The acquisition reduced their bargaining power, since P&G could

negotiate on better terms for the procurement of the raw materials etc.

Although the two companies were different in terms of the size, this was not translated,

as it often happens, in corporate culture differences. The corporate cultures of the two

companies were similar and this was very important for the future success of their agreement.

Company valuation

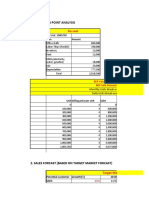

In order to calculate the value of Gillette we will use the model of discounted cash flows. The

forecasting horizon is five years, from 2005 to 2009, with the sales forecast to be based on the

historical data of the company. So, by studying the company‟s Income Statements of 2002-2004

we notice an increase in sales of 9.45% (from 2002 to 2003) and 13.24% (from 2003 to 2004). It

is assumed that the increase in sales for the next five years will be stable at 11% per year

(slightly below the average of the previous three years). The costs of the forecast period will be

calculated as a percentage of sales (based on average costs from 2002 to 2004 as a

percentage of sales).

Licensed under Creative Common Page 501

© Papanikolaou

Table 1. Expected profits of the company for the period 2005-2009

Cash Flow Statement

The Gillette Company PERIOD

Years Ended December 31,

(millions) average 2004 2005 2006 2007 2008 2009

Growth of sales 11% 11% 11% 11% 11%

Net Sales 100,00 10477 11629 12909 14329 15905 17654

Cost of Sales 42,14 4264 4901 5440 6038 6703 7440

Gross Profit 6213 6729 7469 8290 9202 10215

Selling, General and

Administrative Expenses 35,82 3748 4165 4624 5133 5697 6324

Profit from Operations 2465 2563 2845 3158 3505 3891

Interest 0,62 81 72 80 89 99 110

Earnings before taxes 2384 2491 2764 3068 3406 3781

Income Taxes (29,1%) 693 725 804 893 991 1100

Net Income 1691 1766 1960 2175 2415 2681

DEPRECIATION 5,61 588 652 724 804 892 990

Cash Flow 2418 2684 2979 3307 3671

From the financial statements of Gillette the long-term weighted average interest rates were

2.5% (Gillette, 2005) and the proportion of the shareholders‟ equity to the total equity with long-

term debt is 44%, while the corresponding proportion of debt is 56%. The tax rate is 29.1% and

the growth rate of the company is estimated at 5%. To calculate the cost of equity we consider

the risk-free interest rate of 4% (10 year bond), the market rate of 14% and beta 0,8. So based

on the CAPM model, the expected return on equity is re = rf + b*(rm-rf) = 0.04 + 0.8*(0.14-0.04) =

0.12 - 12%.

The weighted average cost of capital of the company is given by:

WACC= re *we + rd * wd *(1-T) = 0.12*0.44 + 0.025 * 0.56 *(1-0.291) = 0.0528 + 0.010 = 0.0628

– 6.28%, a percentage that will be used to discount the future cash flows.

To calculate the value of the company we use the discounted cash flows. The following table shows that

the terminal value is 39389 millions which is discounted to 29048 millions.

Licensed under Creative Common Page 502

International Journal of Economics, Commerce and Management, United Kingdom

Table 2. Valuation

WACC 6,28%

Constant growth rate 5%

Terminal

2004 2005 2006 2007 2008 2009 Value

Net Sales 10477 11629 12909 14329 15905 17654

Cost of Sales 4264 4901 5440 6038 6703 7440

Gross Profit 6213 6729 7469 8290 9202 10215

Selling, General and

Administrative

Expenses 3748 4165 4624 5133 5697 6324

Profit from Operations 2465 2563 2845 3158 3505 3891

Interest 81 72 80 89 99 110

Earnings before taxes 2384 2491 2764 3068 3406 3781

Income Taxes (29,1%) 693 725 804 893 991 1100

Net Income 1691 1766 1960 2175 2415 2681

DEPRECIATION 588 652 724 804 892 990

CAPITAL

EXPENDITURES 616 684 759 843 935 1038

Change in WC 5 5 6 6 7

Cash Flow 1730 1920 2131 2365 2626 39389

Discounting Factor 0,94 0,89 0,83 0,78 0,74 0,74

Discounted Cash Flows 1628 1700 1775 1854 1937 29048

Accomulated total 1628 3327 5102 6956 8893 37941

The total value of the company is 37941 millions, while excluding the value of long-term debt of

the company and add the cash it held on December 31 2004 we reach to the value of the

equity, so:

Firm‟s Present Value 37941

-Long-term Debt (31/12/2004) 3619

+ Cash 219

Firm Value 34541

If the value of the firm is divided by the number of the shares, we have the value of each share.

The number of shares of Gillette Common Stock outstanding as of January 31, 2005, was

991,326,243. Consequently, each share of Gillette worth 34.84

Licensed under Creative Common Page 503

© Papanikolaou

Actions developed by the company after the acquisition

Policy, Structure and Culture

After the acquisition P&G had to respond to the growing demands of the market, and make a

series of strategic actions, with qualitative among other transformations to its structure. The end

user had to be the focus of the effort. So, the company had to be renovated in accordance to

the market needs. The result of all this was a new structure aimed at achieving dynamic sales

and generally to promote products, so as to increase the work volume and their results and to

expand the market share.

What P&G did after the acquisition was to exploit the strengths of Gillette (economies of

scale, reputation, experience, product quality, high market shares, diversification, innovation)

and to address some weaknesses (introversion, fall of share price, high costs, reduction in

profits, lack of sales growth and falling operating margins, reduced advertising costs as a

percentage of sales, increased general costs for sales and increased administrative costs due

to its organizational structure).

The new organizational structure of P&G relied on customer-focused principles, meaning

the creation of units with the responsibility of an inclusive service of the target markets and

development of products that will cover all the needs and the responsible and effective

management of human resources through processes, systems and practices that would

optimize performance to achieve company objectives (Jain, 2002).

Through lower-cost procedures and the concentration of the support services, the

company aimed at reducing the operating costs in order to focus on new operations. Also, there

was a rationalization in the allocation of human resources based on objective criteria and focus

of a significant proportion of the staff in the sales department, which assisted in improving the

overall financial situation (Hill and Jones, 1995).

Particular importance was given after the acquisition to the education of the Gillette

employees through an organized training center based on the operating facts of P&G. Through

training, the new company could make the most of the staff to achieve the change needed for

their better adaptation to the new conditions. Besides, training in new subjects was a key

element in the career of every employee for the development of new skills after the acquisition.

The promotion system was supported internally and this meant supporting and

developing prospects for the already existing resources. The staff was motivated through the

promotion of executives, who gained a moral satisfaction from the recognition of their efforts.

After the acquisition Gillette entered a transition period between the certainty of

yesterday and the reality of today, the need for greater efficiency and the intense

competitiveness. It is interesting at this point to mention that the company needed to escape

Licensed under Creative Common Page 504

International Journal of Economics, Commerce and Management, United Kingdom

from the persistence to the culture and leadership of the past and meet the changes in the

environment (Mintzberg, Quinn, and Ghosal, 1998).

Since we examined the strategic position of the new company after the acquisition, we

will proceed in describing how the company achieved the competitive advantage. This can be

accomplished through the department of research and development, which developed new

products that could not be imitated at least not fast enough, from the competing companies in

the industry.

More specifically, through this section small or major innovations were found, which had

as their ultimate goal the most possible efficiency in meeting the needs of the consumers. In

general, the characteristics that can contribute in creating a competitive advantage on behalf of

P&G were the significant product differentiation, the increased usefulness to buyers and

therefore the increased benefits for the customer.

P&G‟s products after the acquisition could be distinguished among those of the

competitors due to some features. These features included the quality of the materials, the

stylish design, the increased safety and anything else that could make the products stand out

from the competition and to differentiate.

Strategy

Regarding the strategy after the acquisition, P&G was able to gain significant market advantage

and cope with the competition dynamically through the horizontal integration strategy. The

benefits obtained were as follows (Mintzberg, Quinn, and Ghosal, 1998):

Economies of scale from the increased size of the new company.

Economies of scope and new specialized and highly differentiated products.

Combination and integration of the resources of the two companies

Increased market share and strength of the company, due to the larger size of the new

one. Thus, P&G will be able to compete with greater confidence.

Increased market dynamics. The acquisition of a firm was a good method for P&G to

dynamically expand at this time.

Reduced time and cost for developing new products. It is possible to say that the

acquisition substituted the company‟s need for innovation. This is because many times

the company has limited resources, which are not easily made available to invest in new

product development. The strategy of horizontal integration was and is for the P&G

relatively harmless and could provide benefits through innovation.

Increased diversification. When a company wants to diversify greatly encounters many

difficulties. The acquisition of Gillette was therefore a safe way of diversification. The

Licensed under Creative Common Page 505

© Papanikolaou

access to the existing knowledge of the management of the target company was an

additional advantage.

Avoid excess competition. Because of the expansion, P&G was able to reduce its

dependence on the markets already operating, where the competition was very strong

especially from the Unilever

Synergy Results

From the merger Gillette is expected to become stronger in the market and the rate of its sales

to increase to at least 15% per year, so based on this differentiation the calculation of the value

of the shares is shown in the following table.

Table 3. The calculation of the value of the shares

VALUATION

WACC 6,28%

Constant growth rate 5%

Terminal

2004 2005 2006 2007 2008 2009 Value

Net Sales 10477 12049 13856 15934 18324 21073

Cost of Sales 4264 4901 5440 6038 6703 7440

Gross Profit 6213 7148 8416 9896 11622 13633

Selling, General and

Administrative Expenses 3748 4165 4624 5133 5697 6324

Profit from Operations 2465 2982 3792 4763 5925 7310

Interest 81 72 80 89 99 110

Earnings before taxes 2384 2910 3711 4674 5826 7200

Income Taxes (29,1%) 693 847 1080 1360 1695 2095

Net Income 1691 2063 2631 3314 4130 5105

DEPRECIATION 588 676 777 894 1028 1182

CAPITAL

EXPENDITURES 616 708 815 937 1077 1239

Change in WC 6 7 9 10 11

Cash Flow 2024 2587 3262 4071 5036 75547

Discounting Factor 0,94 0,89 0,83 0,78 0,74 0,74

Discounted Cash Flows 1905 2290 2717 3191 3714 55713

Accomulated total 1905 4195 6912 10103 13817 69530

Licensed under Creative Common Page 506

International Journal of Economics, Commerce and Management, United Kingdom

Firm‟s Present Value 69530

-Long-term Debt (31/12/2004) 3619

+ Cash 219

Firm Value 66130

So the value of each share of Gillette from this synergy will be $66.71. From the following

sensitivity analysis it is observed that the value of the Gillette‟s share and by extension the

overall value of the firm is strongly influenced by changes in growth rate. With low growth the

share value will be $ 53.39, while by achieving a high growth rate of around 7%, the share value

will skyrocket to $90.69.

Table 4. SENSITIVITY ANALYSIS

growth rate 0.3 0.4 0.5 0.6 0.7

value per share 53,39 59,22 66,71 76,7 90,69

INDUSTRY CHARACTERISTICS – COMPETITORS AND EXTERNAL ENVIRONMENT

The analysis of the microenvironment is necessary for the determination of the acquisition. In

the analysis of the sectoral (micro) environment the five forces framework of the structural

market analysis is very useful. This is known as the Porter‟s model and provides the way to

determine the nature of competition in the industry. The competition environment is defined by

the following forces (Porter, 1985):

Level of Competition

The war to increase the market share in the sector of retail products is very intense, and the

need to achieve economies of scale is great. This is completely normal since the fixed costs are

very high and the division in most units is beneficial. The introduction of new competitors in the

industry in recent years contributes to the development of competition. Thus, the level of

competition between existing firms can be classified as high.

Bargaining Power of Suppliers

The bargaining power of Gillette‟s and P&G‟s suppliers could be classified as low due to the

high bargaining power of the two companies and the large quantities they procure. This implies

that companies could also negotiate discounted prices. In addition, suppliers were not able to

„threaten‟ the companies after the acquisition with vertical integration because of its size

(Papadakis, 1999).

Licensed under Creative Common Page 507

© Papanikolaou

Bargaining Power of Buyers

The bargaining power of buyers is low and after the acquisition even lower, as their number is

large and the purchase quantities are small. Certainly consumers have at their disposal a wide

range of products from any company in the industry which leads them to seek the best quality.

In this contributes the fact that today‟s consumers are more deeply informed and thus more

mature than ever. On the other hand, the major buyers-companies like Wal-mart, Target,

Costco and Carrefour have great power and seek to constantly buy from P&G at the lowest

possible prices. In this of course contributes the huge volume of the purchases made by these

companies.

Threat of Substitute Products

In general, P&G‟s products have their substitutes that are sold at lower prices with which

consumers can also meet their needs equally. Therefore this threat existed and will always

exist.

Threat of New Entrants

The threat of new firms entering the industry is not great and that‟s why there are many

obstacles that prevent the operation of new companies. This happens because there are

economies of scale on the side of the powerful, and there is a very strong competition among

companies already active. The largest companies account for a large part of the market and of

course any other company that operates in retail will face war prices.

In addition, companies that are already active have created a customer base, which is a

result of long efforts and advertising campaigns. Finally, innovation is also a difficult task for any

newcomers, as it is most likely that they will not have the necessary funds for research and

development (Papadakis, 2002). Finally, the possible response of the major players in the

industry is also a discouraging factor for any newcomers.

DISCUSSIONS

Based on the above it was found that the agreement worked energetically for both companies.

On the one hand, Gillette‟s shareholders exploited in financial terms the positive and stable

course of Gillette in all the previous years and on the other, Procter & Gamble benefited at a

very large degree from the acquisition thus reinforcing its position in the market. In summary,

the actions that were instrumental in the success of P&G‟s project were the following:

1. Ensure management support

2. Fair treatment for all employees

Licensed under Creative Common Page 508

International Journal of Economics, Commerce and Management, United Kingdom

3. Active participation of the personnel

4. Qualitative communication

5. Provision of adequate training

6. Development of implementation teams

7. Focus on changing attitudes / skills

8. Reward success

The six most difficult problems that the company had to face were:

1. Shortage of available resources

2. Lack of necessary knowledge and skills

3. Size and complexity of systems

4. Communication

5. Employees‟ Response

6. Network size

The actions from P&G‟s side that helped to the better development of the changes after the

acquisition were as follows:

P&G communicated through specific information about how the change will affect

customer satisfaction, service quality, market shares, sales or productivity.

Employees are usually left in the darkness regarding the business reasons for the

change attempts. Top management can spend countless hours studying the problems

and analyzing data, but the staff usually does not share this information. It was very

important to have the employees of both companies to know about the various options

and why some, like this one that was being implemented without their consent, are

better than others. The explanation of the apparent contradictions was essential. The

contradictions that remain without clarification undermine the credibility of all messages.

It was natural for some classes of workers in Gillette to be influenced by the changes

more than others. And this led them to fear and anticipate „evils‟. But, fear and

uncertainty could stall the agreement. In this case, only the events could reduce it. The

things that wouldn‟t change were also described.

There was a clear evaluation and assessment of this acquisition‟s aims, so that

employees would know what was going to happen in the near future.

P&G repeated several times the purpose of the change and the planned actions. If the

initial announcement caused no questions, it does not mean that employees accepted

the need for change. They might have just been surprised, puzzled or in shock.

Therefore, the first announcement meeting was accompanied by other meetings with

Licensed under Creative Common Page 509

© Papanikolaou

specific communication actions that informed the personnel about the specific aspects of

the acquisition program.

Successful change programs integrate communication into their model by using specific

newsletters, emails, events or presentations to inform employees and to create a feeling

of belonging. In P&G the communication was attempted with multiple means: large and

small meetings, memos and newspapers, formal and informal exchange of views. All

these were effective for transmitting the vision. The communication was always honest

(Chitiris, 1996).

Based on the SWOT analysis model we will evaluate the strategic move of the P&G

Company. Specifically, the data that frame this evaluation process are as follows (Kotler

and Armstrong, 2001):

Strengths:

1. Strengthened company position in the market against Unilevel, with stronger product

portfolio, enhanced profits, enhanced position compared to suppliers and buyers.

2. Improved promotional processes that boosted the brand name of the company in all its

markets actions.

3. Fostering innovation through the strengthening of research within P&G, after the

acquisition of Gillette and hence the merger of their research departments.

4. Targeting in most market segments which resulted in an increase in profits of P&G and

better treatment of competitors per division.

Weaknesses:

1. Difficulties related to the diffusion of change within the organization, which will initially

affect the operation of P&G.

2. Following the acquisition, the company was forced to annex the weakest products of

Gillette, to cover its debts and generally make a large financial exposure that would not

be easy to be covered in a short time.

3. Possible difficulty in managing departments that P&G didn‟t know well and that this

would force P&G to keep the entire staff of Gillette, which meant increased costs.

Threats:

1. Possible internal conflicts that would weaken the company in the future.

2. The economic crisis has led the market to shrink and the customers to switch to cheaper

products. This may affect future sales of P&G.

Licensed under Creative Common Page 510

International Journal of Economics, Commerce and Management, United Kingdom

3. Before the acquisition, Gillette showed downward trends that after the acquisition were

annexed by P&G, with the possibility to influence the near future.

Opportunities:

1. Gillette strengthened through its products P&G‟s portfolio thus providing the room to sell

cheaply priced products helping to keep up with the consumer trends and the economic

crisis.

2. Internationalization is a great opportunity for companies like P&G. The acquisition

enables future openings in other markets worldwide.

3. Finally, by calculating the value of the firm, based on the method of discounted cash

flows after the synergy of the two companies, it is noted that with the increasing of the

percentage of the sales the value of each share is $ 66.71. From this merger, the

shareholders of both companies gain profits. On the one hand Gillette‟s shareholders

acquired a premium of $8.66 and P&G‟s are expected to benefit after the merger since

this will solidify Gillette in the market and the company‟s value will increase significantly

in the future.

CONCLUSIONS

Apparently the movement of the two companies was good and had many chances to achieve

the ultimate goal of any company that was none other than the increase in shareholder value.

However, most mergers and acquisitions do not achieve their goals in general. The attempt to

reconcile the two companies, especially if they are large, often stumbles into conflicts between

managers, conflicts on management style to be applied and overall corporate culture as well as

general problems of integration.

As mentioned above, the corporate culture is a very important factor for success in these

cases. There are many examples of mergers and acquisitions that when announced were

considered by experts and not, as great ideas, but actually destroyed rather than increase, as

intended, the value of the business.

For example, Daimler-Benz and Chrysler, now DaimlerChrysler. This merger was

advertized as a “merger of equals”. Until proved through some memo that the Germans did not

take into account the Americans and the agreement was in fact more of an acquisition than a

merger.

AOL and Time Warner, the “New Economy” was here. A company of the “New

Economy” acquires essentially a giant of the “old” economy. The idea was the legendary

Licensed under Creative Common Page 511

© Papanikolaou

convergence of technologies and the distribution of content over the Internet. The strategic

rationale behind the move of P&G and Gillette was and is solid.

This paper is designed to serve as a foundation for the future research work which will

analyze further what makes a merger successful in the long term. How would a “big player”

react in a pressure situation where sales would slow down or drop? After all, we should take into

account that we live in a sluggish world economy since the Great Recession.

REFERENCES

Papadakis M.V., (2002), “Corporate Strategy-Greek and International Experience”, Case Studies (vol. II), Benos,

Athens

Papadakis M.V., (1999), “Corporate Strategy-Greek and international experience”, Benos, Athens

Chitiris S. L., (1996), Organizational Behavior, Part 6, Change Management, Interbooks, Athens

Gillette, 10-K, available from http://google.brand.edgar-online.com/displayfilinginfo.aspx?FilingID=3534766-472786-

734545&type=sect&TabIndex=2&companyid=10029&ppu=%252fDefault.aspx%253fcompanyid%253d10029%2526a

mp%253bformtypeID%253d7

Jain,S. (2002), Strategic marketing planning, Ellin publications

Thompson, A. & Strickland, A., (1996), Strategic Management Concepts and cases, 9th Edition, Irwin.

Dess G. and Miller A., (1993), Strategic Management, 1st edition, McGraw-Hill

Hill C. W. L. and Jones G., (1995), Strategic Management: An Integrated Approach, Boston, Houghton Mifflin, 3rd

edition

Kotler, P., Armstrong, G.(2001), Marketing Principles, Gkiourdas

Mintzberg, H., Quinn, J. and Ghosal, S., (1998), The Strategy process: Concepts, contexts and cases, 4th edition,

Prentice Hall

Porter M., (1985), Competitive Advantage: Creating and Sustaining Superior Performance, New York, Free Press

Licensed under Creative Common Page 512

You might also like

- Acquisition of Gillette by P&G (2004-2005) : Case StudyDocument11 pagesAcquisition of Gillette by P&G (2004-2005) : Case StudySajib KarNo ratings yet

- Running Head: Gillette Company Case 1Document23 pagesRunning Head: Gillette Company Case 1Aneela Jabeen100% (1)

- Submission1 - P&G Acquisition of GilletteDocument9 pagesSubmission1 - P&G Acquisition of GilletteAryan AnandNo ratings yet

- M&A P&G GiletteDocument12 pagesM&A P&G Gilettepg12rajiv_g100% (2)

- CaseDocument7 pagesCasekrisNo ratings yet

- Will The Gillette Acquisition Ever Pay Off For Proctor and GambleDocument4 pagesWill The Gillette Acquisition Ever Pay Off For Proctor and Gamblesita deliyana FirmialyNo ratings yet

- Procter and Gamble India LimitedDocument68 pagesProcter and Gamble India Limitedten_ishan88No ratings yet

- Group03 - SectionA - M&A - Project - P&G Acquisition GilletteDocument7 pagesGroup03 - SectionA - M&A - Project - P&G Acquisition Gillettesili coreNo ratings yet

- Gillette and P&GDocument8 pagesGillette and P&GSiddhi MirnaalNo ratings yet

- Assignment (Group) Autumn 2015Document2 pagesAssignment (Group) Autumn 2015Dao DuongNo ratings yet

- GilletteDocument18 pagesGilletteManish SharmaNo ratings yet

- The Best Deal Gillette Could GetDocument1 pageThe Best Deal Gillette Could Get连文琪No ratings yet

- A Project On Merger and Acquisition of Vodafone and HutchDocument7 pagesA Project On Merger and Acquisition of Vodafone and HutchiamsourabhcNo ratings yet

- The Merger of Tata TetleyDocument25 pagesThe Merger of Tata TetleyNimeel MehtaNo ratings yet

- Acquisition of Tetley by TataDocument3 pagesAcquisition of Tetley by TataANUSHRI MAYEKARNo ratings yet

- Koito Case UploadDocument11 pagesKoito Case UploadJurjen van der WerfNo ratings yet

- DSCM Cia 1Document62 pagesDSCM Cia 1Albert Davis 2027916No ratings yet

- 2G Robotics Casesummary Group7Document2 pages2G Robotics Casesummary Group7Ishika RatnamNo ratings yet

- Gillette International BusinessDocument19 pagesGillette International BusinessAzwad Saad100% (1)

- Grasim ReportDocument44 pagesGrasim ReportRahul PatilNo ratings yet

- P&G v1Document4 pagesP&G v1Kiran Kumar Reddy RayaNo ratings yet

- A Study On Leveraged Buyout's in IndiaDocument60 pagesA Study On Leveraged Buyout's in Indiavinodab150% (2)

- Boeings Assignment MaterialDocument4 pagesBoeings Assignment MaterialMingNo ratings yet

- Penetration Pricing Strategy 2 Wal-MartDocument6 pagesPenetration Pricing Strategy 2 Wal-MartYogesh SharmaNo ratings yet

- MP Sec A, B, C & D PGDM Case 2021Document8 pagesMP Sec A, B, C & D PGDM Case 2021Saksham DhamaNo ratings yet

- Koito Case Questions 2,3,4Document2 pagesKoito Case Questions 2,3,4Simo RajyNo ratings yet

- DR Reddy CaseDocument3 pagesDR Reddy Casesubhendu maharanaNo ratings yet

- P&G AnalysisDocument21 pagesP&G AnalysisThảo PhanNo ratings yet

- Merger of Bharti Airtel With ZainDocument4 pagesMerger of Bharti Airtel With ZainDarshan VaghelaNo ratings yet

- Whirlpool Corporation S Global StrategyDocument26 pagesWhirlpool Corporation S Global StrategyGhumonto Safiur0% (1)

- SWOT Analysis GilletteDocument1 pageSWOT Analysis GilletteKarthik RajaNo ratings yet

- Corp Reconstruction Sem 10 FLIPKART-MYNTRA A STATEGIC DEAL PDFDocument24 pagesCorp Reconstruction Sem 10 FLIPKART-MYNTRA A STATEGIC DEAL PDFdurgesh kumar gandharveNo ratings yet

- IntroductionDocument18 pagesIntroductionprasanthNo ratings yet

- WWTDocument6 pagesWWTAnshul GuptaNo ratings yet

- Case Analysis 3Document2 pagesCase Analysis 3Gracie VillarrealNo ratings yet

- The Gillette Company: Dry Idea Advertising Case Analysis: Integrated Marketing CommunicationDocument5 pagesThe Gillette Company: Dry Idea Advertising Case Analysis: Integrated Marketing CommunicationShachin ShibiNo ratings yet

- Case Study GilletteDocument6 pagesCase Study GilletteNomi SiekoNo ratings yet

- Motorola RAZR - Case PDFDocument8 pagesMotorola RAZR - Case PDFSergio AlejandroNo ratings yet

- Sun Life Financial and Indian Economic Surge: Case Analysis - International BusinessDocument9 pagesSun Life Financial and Indian Economic Surge: Case Analysis - International Businessgurubhai24No ratings yet

- P&GDocument34 pagesP&GPankaj SachanNo ratings yet

- Jain Irrigation System Limited (JISL)Document16 pagesJain Irrigation System Limited (JISL)Sushil KumarNo ratings yet

- Analysis of Working Capital of Ambuja and ACC Cement Final ReportDocument13 pagesAnalysis of Working Capital of Ambuja and ACC Cement Final ReportAnuj GoelNo ratings yet

- P&G and GilletteDocument13 pagesP&G and GilletteHimanshu Shekhar100% (1)

- Marico LTD.: ME Final Project PresentationDocument28 pagesMarico LTD.: ME Final Project PresentationSaumitra AmbegaokarNo ratings yet

- TCI PackagingDocument25 pagesTCI PackagingShreyas HN0% (1)

- Garry Halper PDFDocument17 pagesGarry Halper PDFRahul KashyapNo ratings yet

- Dabur Case StudyDocument19 pagesDabur Case StudyMrunal MehtaNo ratings yet

- Marketingmixoffevicolcompany 130922022932 Phpapp01Document125 pagesMarketingmixoffevicolcompany 130922022932 Phpapp01karan bhiakaNo ratings yet

- Thermo Fisher To Acquire Life Technologies IR PresentationDocument13 pagesThermo Fisher To Acquire Life Technologies IR PresentationTariq MotiwalaNo ratings yet

- Gillette and Its Market Share in IndiaDocument8 pagesGillette and Its Market Share in IndiaArsalan QaziNo ratings yet

- Pb-Mba Mobile VersionDocument16 pagesPb-Mba Mobile Versionapi-266822504No ratings yet

- Ankit Synopsis Sem 2Document73 pagesAnkit Synopsis Sem 2Ankit SharmaNo ratings yet

- Group 5 DM17132-R. PRASHANTHI Dm17138-Rohith Das Dm17159 - Vishnu V Unni Dm17244 - Sai Vishnu M NDocument9 pagesGroup 5 DM17132-R. PRASHANTHI Dm17138-Rohith Das Dm17159 - Vishnu V Unni Dm17244 - Sai Vishnu M NSai VishnuNo ratings yet

- MM Project FinalDocument64 pagesMM Project FinalAnkita KothariNo ratings yet

- Group 10 - Sec D - MM ProjectDocument12 pagesGroup 10 - Sec D - MM ProjectRahul ChatterjeeNo ratings yet

- Nikitha Assignment 6 CompletedDocument6 pagesNikitha Assignment 6 CompletedNikki JainNo ratings yet

- ADocument46 pagesAalfiyaNo ratings yet

- Gr-2 Case Study AssignmentDocument5 pagesGr-2 Case Study AssignmentjaludaxNo ratings yet

- Conglomerate Merger - P&G GilletteDocument5 pagesConglomerate Merger - P&G GilletteSharmaine Altezo CarranzaNo ratings yet

- 1986), With The Result Indicates That: 69% of Students Cheat at Colleges With Low CommunityDocument1 page1986), With The Result Indicates That: 69% of Students Cheat at Colleges With Low CommunityKankanNguyenNo ratings yet

- Identify Main Point Find Key Points, Reasons and Evidence Supporting Main PointDocument6 pagesIdentify Main Point Find Key Points, Reasons and Evidence Supporting Main PointKankanNguyenNo ratings yet

- 05 - Straub PDFDocument6 pages05 - Straub PDFKankanNguyenNo ratings yet

- 12 - Paraphrasing ActivityDocument2 pages12 - Paraphrasing ActivityKankanNguyenNo ratings yet

- From Identifying Claims To Analyzing ArgumentsDocument28 pagesFrom Identifying Claims To Analyzing ArgumentsKankanNguyen100% (1)

- 09 - From Identifying Issues To Forming Questions Chapter 4Document32 pages09 - From Identifying Issues To Forming Questions Chapter 4KankanNguyenNo ratings yet

- Studies Explore Whether The Internet Makes Students Better WritersDocument6 pagesStudies Explore Whether The Internet Makes Students Better WritersKankanNguyenNo ratings yet

- Basic Argument StructureDocument41 pagesBasic Argument StructureKankanNguyenNo ratings yet

- Basic Argument StructureDocument41 pagesBasic Argument StructureKankanNguyenNo ratings yet

- From Identifying Claims To Analyzing ArgumentsDocument28 pagesFrom Identifying Claims To Analyzing ArgumentsKankanNguyen100% (1)

- Rhetorical SituationDocument40 pagesRhetorical SituationKankanNguyenNo ratings yet

- Walking Food Tour (Updated 18 - 04 - 2020)Document2 pagesWalking Food Tour (Updated 18 - 04 - 2020)KankanNguyenNo ratings yet

- From Reading As A Writer To Writing As A ReaderDocument23 pagesFrom Reading As A Writer To Writing As A ReaderKankanNguyen100% (1)

- Motorbike City Tour - 1 (Updated 18 - 04 - 2020)Document2 pagesMotorbike City Tour - 1 (Updated 18 - 04 - 2020)KankanNguyenNo ratings yet

- Milk Tea (Bubble Tea) Demand in Vietnam: Asia Plus IncDocument30 pagesMilk Tea (Bubble Tea) Demand in Vietnam: Asia Plus IncKankanNguyenNo ratings yet

- The Story of Tide Is A Lesson in Surviving DisruptionDocument4 pagesThe Story of Tide Is A Lesson in Surviving DisruptionKankanNguyenNo ratings yet

- Câu hỏi - 100 Metres OlympicDocument5 pagesCâu hỏi - 100 Metres OlympicKankanNguyenNo ratings yet

- Section 3-Homework AssignmentsDocument6 pagesSection 3-Homework AssignmentsKankanNguyenNo ratings yet

- Volcano: Types of Volcanoes Reason For VolcanoDocument2 pagesVolcano: Types of Volcanoes Reason For VolcanoKankanNguyenNo ratings yet

- HR Career Roadmap-Roles: Entry Level Middle Level Management Level Senior Management LevelDocument2 pagesHR Career Roadmap-Roles: Entry Level Middle Level Management Level Senior Management LevelKankanNguyenNo ratings yet

- Summary - Nguyễn Khánh Linh - 1815520193Document3 pagesSummary - Nguyễn Khánh Linh - 1815520193KankanNguyenNo ratings yet

- Breakeven Point Analysis: Fix CostDocument7 pagesBreakeven Point Analysis: Fix CostKankanNguyenNo ratings yet

- Dulux Trade Paints SWOT AnalysisDocument8 pagesDulux Trade Paints SWOT AnalysisMuhammad Ammar GhaniNo ratings yet

- Cover Sheet: Business Name, Address, Phone Number, Principals Executive Summary or Statement of PurposeDocument6 pagesCover Sheet: Business Name, Address, Phone Number, Principals Executive Summary or Statement of PurposePiojo TheodoreNo ratings yet

- The Attempted Merger Between General Electric and Honeywell A Case Study of Transatlantic ConflictDocument53 pagesThe Attempted Merger Between General Electric and Honeywell A Case Study of Transatlantic ConflictuswahulNo ratings yet

- Chapter 02 Evans BermanDocument19 pagesChapter 02 Evans BermanthesimpleNo ratings yet

- Ozdem, M. I. 2009. Government Agencies in Commercial Diplomacy Seeking The Optimal Agency Structure For Foreign Trade PolicyDocument33 pagesOzdem, M. I. 2009. Government Agencies in Commercial Diplomacy Seeking The Optimal Agency Structure For Foreign Trade PolicymiozdemNo ratings yet

- Business Plan in A DayDocument9 pagesBusiness Plan in A DayIvan100% (1)

- LO3 Discuss The Process Required To CommercialiseDocument35 pagesLO3 Discuss The Process Required To CommercialiseLucio StefanoNo ratings yet

- Further Topics in Industry and Competition AnalysisDocument17 pagesFurther Topics in Industry and Competition AnalysisSamridh AgarwalNo ratings yet

- New Microsoft PowerPoint PresentationDocument21 pagesNew Microsoft PowerPoint PresentationTmesibmcs MandviNo ratings yet

- 5 Market Segmentation Targeting and PosiDocument24 pages5 Market Segmentation Targeting and PosiLong Dong Mido100% (1)

- Case Discussion MC Donalds: Is China Lovin ItDocument6 pagesCase Discussion MC Donalds: Is China Lovin ItBernatd Bernadus SetiawanNo ratings yet

- Amazondrones Schematicreport Final 170301010100Document13 pagesAmazondrones Schematicreport Final 170301010100humayriNo ratings yet

- Introduction About Tata CromaDocument6 pagesIntroduction About Tata CromaAmit PrakashNo ratings yet

- PSAP ALAM 2019 MechanicsDocument31 pagesPSAP ALAM 2019 MechanicsAileen Morillo Retiza-CasisonNo ratings yet

- Nasty Gal Project FullDocument59 pagesNasty Gal Project FullrenNo ratings yet

- FmegDocument64 pagesFmegShiny SNo ratings yet

- Introduction To International MarketingDocument53 pagesIntroduction To International MarketingshailuNo ratings yet

- Introduction Round Red Master (Semana 01)Document22 pagesIntroduction Round Red Master (Semana 01)Jorge CastillaNo ratings yet

- Business Case Analysis: The Body Shop InternationalDocument12 pagesBusiness Case Analysis: The Body Shop Internationaljoyce_ann_mayo100% (5)

- Chapter 2MMDocument47 pagesChapter 2MMMegbaru MisikirNo ratings yet

- Advertising 2Document9 pagesAdvertising 2Jellivie ManansalaNo ratings yet

- Strategy Course Notes PDFDocument27 pagesStrategy Course Notes PDFTodayClass CenterNo ratings yet

- Antitrust Laws: A Glance at The Philippine Competition Act: Who or What Is Covered by The PCA?Document6 pagesAntitrust Laws: A Glance at The Philippine Competition Act: Who or What Is Covered by The PCA?Bai NiloNo ratings yet

- Zale Corp CaseStudyDocument15 pagesZale Corp CaseStudyPaulina Naranjo100% (1)

- The Fashion ChannelDocument11 pagesThe Fashion ChannelMuzamil Naeem100% (3)

- Product Life Cycle TheoryDocument12 pagesProduct Life Cycle TheoryMrunalR.DhavaleNo ratings yet

- Supply Chain Strategies Which One Hits The MarkDocument11 pagesSupply Chain Strategies Which One Hits The MarkFaried Putra SandiantoNo ratings yet

- Enviropreneurial Marketing StrategyDocument10 pagesEnviropreneurial Marketing StrategyMadhu Mitha100% (1)

- Avantika KumariDocument64 pagesAvantika KumariDhiraj Ranjan RayNo ratings yet

- Strategy& PwC Booz Casebook Consulting Case Interview Book思略特 - 博斯 - 普华永道咨询案例面试Document14 pagesStrategy& PwC Booz Casebook Consulting Case Interview Book思略特 - 博斯 - 普华永道咨询案例面试issac li100% (3)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (3)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- HBR's 10 Must Reads on AI, Analytics, and the New Machine AgeFrom EverandHBR's 10 Must Reads on AI, Analytics, and the New Machine AgeRating: 4.5 out of 5 stars4.5/5 (69)

- Strategic Analytics: The Insights You Need from Harvard Business ReviewFrom EverandStrategic Analytics: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (46)

- Systems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessFrom EverandSystems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessRating: 4.5 out of 5 stars4.5/5 (80)

- Sales Pitch: How to Craft a Story to Stand Out and WinFrom EverandSales Pitch: How to Craft a Story to Stand Out and WinRating: 4.5 out of 5 stars4.5/5 (2)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Rating: 5 out of 5 stars5/5 (2)

- Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantFrom EverandBlue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantRating: 4 out of 5 stars4/5 (387)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffFrom EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffRating: 4 out of 5 stars4/5 (1)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (11)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffFrom EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffRating: 5 out of 5 stars5/5 (62)

- A New Way to Think: Your Guide to Superior Management EffectivenessFrom EverandA New Way to Think: Your Guide to Superior Management EffectivenessRating: 5 out of 5 stars5/5 (18)

- The 10X Rule: The Only Difference Between Success and FailureFrom EverandThe 10X Rule: The Only Difference Between Success and FailureRating: 4.5 out of 5 stars4.5/5 (289)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)

- The Prosperity Paradox: How Innovation Can Lift Nations Out of PovertyFrom EverandThe Prosperity Paradox: How Innovation Can Lift Nations Out of PovertyRating: 4.5 out of 5 stars4.5/5 (5)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Play Bigger: How Pirates, Dreamers, and Innovators Create and Dominate MarketsFrom EverandPlay Bigger: How Pirates, Dreamers, and Innovators Create and Dominate MarketsRating: 4.5 out of 5 stars4.5/5 (73)

- Harvard Business Review Project Management Handbook: How to Launch, Lead, and Sponsor Successful ProjectsFrom EverandHarvard Business Review Project Management Handbook: How to Launch, Lead, and Sponsor Successful ProjectsRating: 4.5 out of 5 stars4.5/5 (16)

- 7 Powers: The Foundations of Business StrategyFrom Everand7 Powers: The Foundations of Business StrategyRating: 5 out of 5 stars5/5 (5)

- HBR at 100: The Most Influential and Innovative Articles from Harvard Business Review's First CenturyFrom EverandHBR at 100: The Most Influential and Innovative Articles from Harvard Business Review's First CenturyRating: 3.5 out of 5 stars3.5/5 (6)

- Choose Your Enemies Wisely by Patrick Bet-David: key Takeaways, Summary & AnalysisFrom EverandChoose Your Enemies Wisely by Patrick Bet-David: key Takeaways, Summary & AnalysisNo ratings yet

- HBR Guide to Setting Your StrategyFrom EverandHBR Guide to Setting Your StrategyRating: 4.5 out of 5 stars4.5/5 (18)

- Competing in the Age of AI: Strategy and Leadership When Algorithms and Networks Run the WorldFrom EverandCompeting in the Age of AI: Strategy and Leadership When Algorithms and Networks Run the WorldRating: 4.5 out of 5 stars4.5/5 (21)