Professional Documents

Culture Documents

Chapter 13 Intacc

Uploaded by

Jhuliane Ralph0 ratings0% found this document useful (0 votes)

29 views2 pagesOriginal Title

CHAPTER 13 INTACC.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views2 pagesChapter 13 Intacc

Uploaded by

Jhuliane RalphCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

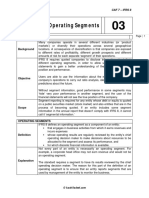

Chapter 13

SEGMENT REPORTING- CORE PRINCIPLE NOT necessarily a manager with a

specific title.

Overview

Function- allocate resources to the

The core principle of the standard on segment segments and assess their

reporting (PFRS 8) emphasises the importance of performance.

segment disclosures that enables users of the

financial statements to evaluate the nature and IDENTIFYING OPERATING SEGMENT

financial effects of the operations, and the

economic environment in which an entity Management Approach

operates.

Identified through the basis of internal

SEGMENT REPORTING- disclosure of certain reports that are regularly viewed by the

financial information about the products and CODM

services an entity produces and the geographical For internal management relating

areas in which an entity operates. purposes

PURPOSE- to enable investors and

users make better assessment of IDENTIFICATION OF REPORTABLE

each business activity leading to the SEGMENTS

understanding of the

PERFORMANCE of the entity as a Once an operating segment has been identified

WHOLE. the entity needs to report segment information if

the segment meets any of the following

SCOPE

quantitative thresholds:

PFRS 8 applies to the separate or individual

1. its reported revenue (external and inter-

financial statements of an entity (and to the

consolidated financial statements of a group with segment) is 10% or more of the combined

a parent): revenue, internal and external, of all

a. Whose debt or equity instruments are operating segments

traded in a public market 2. its reported profit or loss is 10% or more of

b. That files, or is in the process of filing, its the greater, in absolute amount, of

(consolidated) financial statements with a a. the combined profit of all operating

securities commission or other regulatory

segments that did not report a loss

organisation for the purpose of issuing any

class of instruments in a public market. and

b. the combined loss of all operating

IDENTIFICATION OF OPERATING SEGMENTS segments that reported a loss or

3. its assets are 10% or more of the combined

PFRS 8 defines an operating segment as a assets of all operating segments.

component of an entity:

that engages in business activities OVERALL SIZE TEST- 75% THRESHOLD

from which it may earn revenues

and incur expenses (including PFRS 8 states that if the total external turnover

revenues and expenses relating to reported by the operating segments identified by

transactions with other components the size criteria is less than 75% of total entity

of the same entity)

revenue then additional segments need to be

whose operating results are

reviewed regularly by the entity's reported on until the 75% level is reached.

chief operating decision maker to

make decisions about resources to AGGREGATION OF SEGMENTS

be allocated to the segment and

assess its performance and Two or more operating segments may be

for which discrete financial combined into a single operating segment if:

information is available Aggregation is consistent with the core

principle of this standard, to allow users of the

CHIEF OPERATING DECISION MAKER ( CODM)

financial statements make informed decisions o Measurement of these amounts

based on the financial statements. shall be on the same basis as

The segments have similar economic reported to chief operating decision

characteristics and are similar in each of the maker;

following areas: o On top of the total amounts of profit

nature of the products and services or loss, assets and liabilities, the

nature of the production process entity shall present the information

type or class of customer for their products about specified revenues and

and services expenses (revenues from external

methods used to distribute their products customers, internal revenues,

or provide their services, and depreciation and others);

if applicable, the nature of the regulatory o Entity should provide the

environment, for example, banking insurance or explanation of the measurement

public utilities. basis, including the explanation of

nature of differences between the

LIMIT TO THE NUMBER OF SEGMENT amounts reported per segments and

total entity's amounts

if the number of reportable segment 3. Reconciliations

exceeds 10- information become too The entity should reconcile total amount

detailed and consequently lose its per operating segments with total amount

usefulness. reported in the entity's financial

statements for:

SEGMENT NO LONGER REPORTABLE o Revenues;

o Profit or loss;

shall continue to be reported separately in o Assets;

the current period even if it no longer o Liabilities;

meets any of the 10% quantitative o Other material information.

threshold for reportability. 4. Entity-wide information- additional

information.

o Information about products and

SEGMENT BECOMING REPORTABLE services;

segment data for a prior period presented Revenue from external

for comparative purposes shall be customers for each product

RESTATED to reflect the newly reportable and service

segment even if that segment did not o Information about geographical

satisfy any of the quantitative threshold in areas, namely:

Revenues from external

the prior period.

customers (in the country of

NOT BE RESTATED if the necessary domicile and in foreign

information is NOT available and the cost countries;

to develop it would be excessive. Certain non-current assets(in

the country of domicile and in

INFORMATION TO BE DISCLOSED FOR EACH foreign countries;

SEGMENT o Information about major customers

Total amount

What information to disclose? Identity of segment.

Once the segment has been identified as

reportable, the entity must disclose the following

information:

1. General information:

o Factors used to identify reportable

operating segments;

o Judgements used in applying the

aggregation criteria;

o Types of products and services

generating revenues.

2. Information about profit or loss, assets

and liabilities

You might also like

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- Chapter 13Document2 pagesChapter 13Fatima Nicetas Rabang AlonzoNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- PFRS 8 - Operating SegmentsDocument11 pagesPFRS 8 - Operating SegmentseiraNo ratings yet

- Ifrs 8: Operating SegmentsDocument15 pagesIfrs 8: Operating SegmentsAANo ratings yet

- Ifrs 8: Operating SegmentsDocument15 pagesIfrs 8: Operating SegmentsMohammad BaratNo ratings yet

- Ifrs at A Glance IFRS 8 Operating Segments: WWW - Bdo.globalDocument4 pagesIfrs at A Glance IFRS 8 Operating Segments: WWW - Bdo.globalMiladanica Barcelona BarracaNo ratings yet

- Accountancy For Managers (DONE)Document10 pagesAccountancy For Managers (DONE)Gouri mattadNo ratings yet

- 31 Pfrs 8 - Operating Segments: Scope 1. What Is The Scope of The Standards?Document6 pages31 Pfrs 8 - Operating Segments: Scope 1. What Is The Scope of The Standards?Chris Sevilla BurhamNo ratings yet

- PFRS 8Document2 pagesPFRS 8Ella MaeNo ratings yet

- Operating SegmentsDocument17 pagesOperating SegmentsAbby NavarroNo ratings yet

- Kings College of The PhilippinesDocument6 pagesKings College of The PhilippinesIzza Mae Rivera KarimNo ratings yet

- Operating Segment: Pfrs 8Document28 pagesOperating Segment: Pfrs 8Giellay OyaoNo ratings yet

- Module 6Document5 pagesModule 6Karen GarciaNo ratings yet

- 8.0 NFRS 8 - SetPasswordDocument8 pages8.0 NFRS 8 - SetPasswordDhruba AdhikariNo ratings yet

- 07 Segment ReportingDocument5 pages07 Segment ReportingHaris IshaqNo ratings yet

- Operating Segment Reporting Key Financial DataDocument19 pagesOperating Segment Reporting Key Financial DataRainNo ratings yet

- 07 Segment Reporting 1Document4 pages07 Segment Reporting 1Irtiza AbbasNo ratings yet

- Operating Segments: International Financial Reporting Standard 8Document10 pagesOperating Segments: International Financial Reporting Standard 8Tanvir PrantoNo ratings yet

- 11 IFRS 8, IAS 24 & Ethical IssuesDocument20 pages11 IFRS 8, IAS 24 & Ethical IssuespesseNo ratings yet

- #6 PFRS 8Document2 pages#6 PFRS 8Shara Joy B. ParaynoNo ratings yet

- Operating SegmentsDocument3 pagesOperating SegmentsPaula De RuedaNo ratings yet

- Operating SegmentDocument1 pageOperating Segmenthipax95801No ratings yet

- Ifrs 8 Operating Segments: BackgroundDocument4 pagesIfrs 8 Operating Segments: Backgroundmusic niNo ratings yet

- IPPTChap 013Document51 pagesIPPTChap 013LegnaNo ratings yet

- Adv - Chap 8Document7 pagesAdv - Chap 8Melody LisaNo ratings yet

- 11. Operating SegmentsDocument39 pages11. Operating Segmentslascona.christinerheaNo ratings yet

- PFRS 8 - Operating SegmentsDocument12 pagesPFRS 8 - Operating SegmentsHannah TaduranNo ratings yet

- Chapter-08-Ideas On Operating SegmentsDocument12 pagesChapter-08-Ideas On Operating Segmentsmdrifathossain835No ratings yet

- Operating SegmentsDocument10 pagesOperating SegmentsUdit JindalNo ratings yet

- SEGMENT REPORTING AS 17 Presentation DuDocument18 pagesSEGMENT REPORTING AS 17 Presentation DuNamit AroraNo ratings yet

- Unit 3: Indian Accounting Standard 108: Operating SegmentsDocument25 pagesUnit 3: Indian Accounting Standard 108: Operating SegmentsgauravNo ratings yet

- Segment and Interim Reporting: Mcgraw-Hill/IrwinDocument47 pagesSegment and Interim Reporting: Mcgraw-Hill/IrwinSamah Refa'tNo ratings yet

- 108 Operating SegmentsDocument39 pages108 Operating SegmentsbinuNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions ManualDocument32 pagesAdvanced Accounting 13th Edition Hoyle Solutions ManualKatieElliswcze100% (35)

- Pfrs 8 - Operating Segment Pas 34 - Interim Financial ReportingDocument1 pagePfrs 8 - Operating Segment Pas 34 - Interim Financial ReportingKent Raysil PamaongNo ratings yet

- Ind As 108Document6 pagesInd As 108Khushi SoniNo ratings yet

- IFRS-8 Operating Segments: 1. Core PrincipleDocument11 pagesIFRS-8 Operating Segments: 1. Core PrincipleNATIONAL SAVINGSNo ratings yet

- Pfrs 8 Operating SegmentsDocument2 pagesPfrs 8 Operating SegmentsJimuel ImbuidoNo ratings yet

- Segment Reporting Flashcards - 2Document3 pagesSegment Reporting Flashcards - 2SeanNo ratings yet

- Segment Reporting RequirementsDocument4 pagesSegment Reporting RequirementsSHIENA TECSONNo ratings yet

- Unit 3: Indian Accounting Standard 108: Operating SegmentsDocument25 pagesUnit 3: Indian Accounting Standard 108: Operating SegmentsRobie SalujaNo ratings yet

- Operating Segments: International Financial Reporting Standard 8Document9 pagesOperating Segments: International Financial Reporting Standard 8Imran MustafaNo ratings yet

- Unit 3: Indian Accounting Standard 108: Operating SegmentsDocument31 pagesUnit 3: Indian Accounting Standard 108: Operating SegmentsJoyitaNo ratings yet

- Advanced Accounting Hoyle 12th Edition Solutions ManualDocument33 pagesAdvanced Accounting Hoyle 12th Edition Solutions ManualBrentBrowncgwzm100% (90)

- Operating SegmentDocument6 pagesOperating SegmentsubupooNo ratings yet

- 9 - Segment ReportingDocument4 pages9 - Segment ReportingCathNo ratings yet

- 3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionDocument15 pages3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionRITZ BROWNNo ratings yet

- FA Vol.3 Operating SegmentsDocument7 pagesFA Vol.3 Operating SegmentsRyan SanitaNo ratings yet

- Operating Segment: Intermediate Accounting 3Document51 pagesOperating Segment: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- AcFN 3151 CH, 7 Segment Reporting and Interim Reporting IFRS 8 andDocument42 pagesAcFN 3151 CH, 7 Segment Reporting and Interim Reporting IFRS 8 andbethelhemNo ratings yet

- Reporting For Segments and For Interim Financial Periods: Advanced Accounting, Fifth EditionDocument42 pagesReporting For Segments and For Interim Financial Periods: Advanced Accounting, Fifth EditionHeaven NamjoonNo ratings yet

- NFRS 8 - Operating SegmentsDocument14 pagesNFRS 8 - Operating SegmentsNareshNo ratings yet

- Segment Reporting: Hazel Chinique - ACC 312Document13 pagesSegment Reporting: Hazel Chinique - ACC 312HazelNo ratings yet

- Ca - Bharat Bhushan B-Com, ACA: Presented byDocument23 pagesCa - Bharat Bhushan B-Com, ACA: Presented byEshetieNo ratings yet

- PFRS 8-Operating SegmentsDocument20 pagesPFRS 8-Operating Segmentsrena chavezNo ratings yet

- Ifrs 8: Operating SegmentsDocument12 pagesIfrs 8: Operating SegmentsGere TassewNo ratings yet

- Ifrs 8 and Ias 34-Operating Segments & Interim ReportingDocument46 pagesIfrs 8 and Ias 34-Operating Segments & Interim Reportingesulawyer2001No ratings yet

- Chapter 8Document7 pagesChapter 8suleymantesfaye10No ratings yet

- Welcome To The Presentation On: IFRS 8 - Operating SegmentsDocument21 pagesWelcome To The Presentation On: IFRS 8 - Operating SegmentsMaruf MahadiNo ratings yet

- Developed Countries (15) Developing Countries (23) Less Developed CountriesDocument1 pageDeveloped Countries (15) Developing Countries (23) Less Developed CountriesJhuliane RalphNo ratings yet

- Jane Paula C. Cerdeñola: Objective EducationDocument1 pageJane Paula C. Cerdeñola: Objective EducationJhuliane RalphNo ratings yet

- Pecha Pucha ReviseD WORDSDocument5 pagesPecha Pucha ReviseD WORDSJhuliane RalphNo ratings yet

- Prayer 1Document1 pagePrayer 1Jhuliane RalphNo ratings yet

- SLU Business Communication Exam PrepDocument3 pagesSLU Business Communication Exam PrepJhuliane RalphNo ratings yet

- The Political Economy of Hegemonic TransitionDocument5 pagesThe Political Economy of Hegemonic TransitionJhuliane RalphNo ratings yet

- Master indoor volleyball hand signals guideDocument8 pagesMaster indoor volleyball hand signals guideJhuliane RalphNo ratings yet

- Vertebrates Fertilization Development Scales Turtles Tuatara Lizards Snakes Crocodiles Birds Archosauria BirdDocument8 pagesVertebrates Fertilization Development Scales Turtles Tuatara Lizards Snakes Crocodiles Birds Archosauria BirdJhuliane RalphNo ratings yet

- Advocy For The Env. Gpcom SemifinalDocument20 pagesAdvocy For The Env. Gpcom SemifinalJhuliane RalphNo ratings yet

- English Entrance Exam GuideDocument12 pagesEnglish Entrance Exam GuidestaceyNo ratings yet

- 10 Unusual Laws From Around The WorldDocument4 pages10 Unusual Laws From Around The WorldJhuliane RalphNo ratings yet

- T104 - TranscribeMe Style Guide Version 3.1 20200708 PDFDocument23 pagesT104 - TranscribeMe Style Guide Version 3.1 20200708 PDFsantosh tripathyNo ratings yet

- BasketballDocument1 pageBasketballJhuliane RalphNo ratings yet

- Meet Zhang YimingDocument5 pagesMeet Zhang YimingJhuliane RalphNo ratings yet

- CalculatorDocument2 pagesCalculatorJhuliane RalphNo ratings yet

- VolleyballDocument5 pagesVolleyballKarlo DreyesNo ratings yet

- How Is Paper MadeDocument10 pagesHow Is Paper MadeJhuliane RalphNo ratings yet

- Best Countries To Travel AloneDocument10 pagesBest Countries To Travel AloneJhuliane RalphNo ratings yet

- How Bluetooth Works: A Guide to Wireless ConnectivityDocument5 pagesHow Bluetooth Works: A Guide to Wireless ConnectivityJhuliane RalphNo ratings yet

- How Does A Ball Point Pen WorkDocument3 pagesHow Does A Ball Point Pen WorkJhuliane RalphNo ratings yet

- How Do FishDocument2 pagesHow Do FishJhuliane RalphNo ratings yet

- How Wi-Fi Works: A Guide to Wireless ConnectivityDocument2 pagesHow Wi-Fi Works: A Guide to Wireless ConnectivityJhuliane RalphNo ratings yet

- Find Out How Solar Power WorksDocument2 pagesFind Out How Solar Power WorksJhuliane RalphNo ratings yet

- How Bluetooth Works: A Guide to Wireless ConnectivityDocument5 pagesHow Bluetooth Works: A Guide to Wireless ConnectivityJhuliane RalphNo ratings yet

- How Do Insulated Tumblers WorkDocument1 pageHow Do Insulated Tumblers WorkJhuliane RalphNo ratings yet

- How Wi-Fi Works: A Guide to Wireless ConnectivityDocument2 pagesHow Wi-Fi Works: A Guide to Wireless ConnectivityJhuliane RalphNo ratings yet

- How Do Insulated Tumblers WorkDocument1 pageHow Do Insulated Tumblers WorkJhuliane RalphNo ratings yet

- How Does A Ball Point Pen WorkDocument3 pagesHow Does A Ball Point Pen WorkJhuliane RalphNo ratings yet

- Find Out How Solar Power WorksDocument2 pagesFind Out How Solar Power WorksJhuliane RalphNo ratings yet

- How Is Paper MadeDocument10 pagesHow Is Paper MadeJhuliane RalphNo ratings yet

- Fin464 Final ReportDocument10 pagesFin464 Final ReportTakia KhanNo ratings yet

- Sample Document For Practical Training ReportDocument32 pagesSample Document For Practical Training ReportChai Yung Ken100% (1)

- (Web24.Vn) Danh Sach Dien Dan Va Website Rao VatDocument12 pages(Web24.Vn) Danh Sach Dien Dan Va Website Rao VatLee Truwowfng PhaNo ratings yet

- Accounting For Decision Making and Control 8th Edition Zimmerman Solutions ManualDocument48 pagesAccounting For Decision Making and Control 8th Edition Zimmerman Solutions Manualflorabinhxuq100% (23)

- Cost Accounting Notes For StudentsDocument41 pagesCost Accounting Notes For StudentsDipak K. SahNo ratings yet

- Reliance Petroleum Project ReportDocument52 pagesReliance Petroleum Project ReportDNYANKUMAR SHENDENo ratings yet

- Chapter 3 CreditDocument2 pagesChapter 3 Creditcoleen100% (2)

- Issues and Challenges in Managing Halal and Toyyib Business for Nz Crunchies Snack ProductDocument20 pagesIssues and Challenges in Managing Halal and Toyyib Business for Nz Crunchies Snack Productikmal hakimNo ratings yet

- Financial Accounting Chapter 12 - Business Decisions and Financial Accounting Solutions Answers To Mini-Exercises M1-1 Abbreviation Full DesignationDocument31 pagesFinancial Accounting Chapter 12 - Business Decisions and Financial Accounting Solutions Answers To Mini-Exercises M1-1 Abbreviation Full DesignationChiến Cao DuyNo ratings yet

- 1 D 1 DF 41 D 6 F 8 C 8 G 5Document5 pages1 D 1 DF 41 D 6 F 8 C 8 G 5Kia PottsNo ratings yet

- Revenue Receivables Cash Cycle MCQsDocument48 pagesRevenue Receivables Cash Cycle MCQsYukiNo ratings yet

- Roto Pumps Annual Report 2017-18Document127 pagesRoto Pumps Annual Report 2017-18Puneet367No ratings yet

- VAT Problems SolvedDocument3 pagesVAT Problems Solvedtisha10rahman50% (4)

- David Facter's ResumeDocument2 pagesDavid Facter's Resumeapi-78742526No ratings yet

- FIN 242 Individual ReportDocument23 pagesFIN 242 Individual ReportNUR SYAMILA MOHD SUKRINo ratings yet

- AC Sample Paper 3 Unsolved-1Document10 pagesAC Sample Paper 3 Unsolved-1Appharnha Rs0% (1)

- SYLLBS2023Document6 pagesSYLLBS2023AMBenedicto - MCCNo ratings yet

- Basic Settings and Configuration in SAP Controlling (CODocument10 pagesBasic Settings and Configuration in SAP Controlling (COSATYANARAYANA MOTAMARRINo ratings yet

- POA1-Assignment - Chapter 5 - QDocument5 pagesPOA1-Assignment - Chapter 5 - QAuora Bianca100% (1)

- CUET 2023 SyllabusDocument113 pagesCUET 2023 SyllabusDivyanshi PareekNo ratings yet

- Ford Company ProfileDocument7 pagesFord Company ProfileBeth DeLucaNo ratings yet

- Ratio Analysis Part 1Document27 pagesRatio Analysis Part 1RAVI KUMARNo ratings yet

- 10 31 Fabm QS 2Document10 pages10 31 Fabm QS 2Fat AjummaNo ratings yet

- Chapter 8 Homework MADocument13 pagesChapter 8 Homework MAErvin Jello Rosete RagonotNo ratings yet

- Accounting For Pensions and Post Retirement BenefitsDocument54 pagesAccounting For Pensions and Post Retirement BenefitsAlverdo RicardoNo ratings yet

- Albrecht CH 13 SM FinalDocument49 pagesAlbrecht CH 13 SM FinalJessie jorgeNo ratings yet

- MANACO 2 Questions and ProblemsDocument6 pagesMANACO 2 Questions and ProblemsKenneth Bryan Tegerero Tegio100% (1)

- FS ANALYSIS AND CVP ANALYSIS KEY FINANCIAL CONCEPTSDocument9 pagesFS ANALYSIS AND CVP ANALYSIS KEY FINANCIAL CONCEPTSChristian Rey Sandoval DelgadoNo ratings yet

- Physical Fitness Gym Business PlanDocument28 pagesPhysical Fitness Gym Business Planabasyn_university83% (6)

- Ap A1Document23 pagesAp A1Liên ĐỗNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)