Professional Documents

Culture Documents

Price Comparsion Kholpur M-Grade and Shamli RS/QTL: Sugar & Gur Weekly Research Report 20 Apr, 2020

Uploaded by

Steven JonathanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Price Comparsion Kholpur M-Grade and Shamli RS/QTL: Sugar & Gur Weekly Research Report 20 Apr, 2020

Uploaded by

Steven JonathanCopyright:

Available Formats

Sugar & Gur Weekly Research Report

20th Apr, 2020

Price Outlook:

The sugar market remained steady to low because of lower demand across the nation. The mills are facing

disruption in trade due to lack of labour and the problems faced by the truck drivers in the interstate movement.

Last week the market started with firmness in prices compared to the prices that were before the lockdown India.

The demand in sugar has shown no improvement since the last week and an average of only 30% is being sold

out the sales quota allotted in the April month in the domestic market. The prices in Vijayawada stood steady at

Rs.3820/q and Rs.3200/q in Kolhapur bench market whereas the prices in UP stood lower at Rs.3233/q against

last week.

Price Projection for the Next week

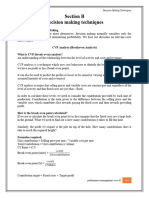

As per the Agriwatch estimate, spot sugar prices (M grade) in benchmark Kolhapur market are likely to range

higher next week between Rs.3100 -3300 per quintal for next week.

Domestic Sugar Market Summary

Average price for sugar ‘M’ grade in key Kolhapur market stood unchanged at Rs. 3200 per quintal, while spot

sugar prices for the same grade in Shamli district stood low at Rs. 3166 per quintal during the week.

Price comparsion Kholpur M- grade and Shamli

Rs/Qtl

3700

3500

3300

3100 Kolhapur M Grade

2900

Shamli M Grade

2700

Fundamental summary:

Factors Impact

2019-20 SS Production is estimated to be lower and estimated not more than 26.5 million Bullish

tonnes, according to ISMA

Indian Sugar Mills Association expects to export a record 6 million MT of sugar in 2019/20 to Bearish

reduce its huge stockpiles, up from 3 million MT in 2018/19

The reallocation of sugar export sales would help sugar mill to clear sugar stock piles in 2019- Bullish

20 season

The outbreak of coronavirus will affect the sales of sugar in domestic market as well as cause Bullish

disruption in sugar exports.

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

Domestic Market Highlights

Recent Updates:

According to ISMA, 247.8 lakh tonnes of sugar have been produced till 15 th April’20 across India down

by 20% as against 311.75 lakh tonnes produced in the same time last year. As on 15 th April’20, 139 mills were

operational while 172 sugar mills that were still crushing sugarcane on 15th April 2019 last year. In UP, sugar

mills have produced 108.25 LT of sugar compared to 105.55 LT of sugar with only 98 mills operational mills till

15th April’20 and 103 mills were operational last year. In Maharashtra, 136 mills have closed their operations

with only 10 mills operating at this time with producing 60.12 LT compared with 106.71LT produced year on

year. Similarly, this year Karnataka has also produced less sugar i.e., around 33.82 LT against 43.2 LT last

year till 15th April. All mills are closed so far in the state while 1 mill was in operation during the same time last

year. According to Agriwatch, Maharashtra is likely to produce around 60-61 LT followed by UP estimated

around 122 LT of sugar and around 34 LT of sugar in Karnataka.

The sugar mills are facing the sharp decline in sugar demand after the lockdown started. DFPD

allocated the 18LT of sales quota for the month April’20 and extended the sales quota of sugar for March’20 by

15 days. And so far only 20% of the allocated sugar quota for the month of April’20 has been sold in UP

because of poor demand. Similarly, in Maharashtra also the demand declined to an average of 30% and

remained stagnant for a while. As the demand from the bulk consumers fall sharply across the country but few

mills are expecting a slight surge in domestic demand in May due to the summers. It is expected that around

50-60% of the sales quota is going remain unsold in the April and could be carry forwarded to the next month

in May.

DFPD has asked the sugar mills to submit the quarterly report of sugar export by April 20 extended by

17 days which was supposed to be submitted by April 3 rd. The ministry also warned that if mills fail to export

the quota by 31st Mar’20, they would not be entitled for their claim for their quota of fourth quarter under the

MAEQ scheme and also for maintenance of buffer stock of 40 LT notified by DFPD earlier in the previous year.

Previous Updates

Government fixed the monthly sugar sales quota as 18 LT for April month to 545 mills lower by 3 LT

compared to the previous month that stood at 21 LT. In March, the sugar millers have reported that there

was weak demand due to the outbreak of coronavirus in India. The millers are not able to sell sugar because

of lack of availability of labour and transport, therefore, the government has extended the March sales quota till

15th April’20. Although the sugar demand has declined due to the closure of all hotels, restaurants, and

cafeterias, therefore, bulk buying has decreased. But the demand from the retail buyer has increased in the

last week because of panic buying by the consumers on the announcement of lockdown.

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

As sugar is the essential commodity, the government has announced that the trucks carrying the

essential raw material that come under Essential Commodities Act 1955 should not be stopped at the state

borders in the lockdown situation. Therefore, those mills across India which have not yet completed their

sugarcane crushing operations will continue to operate.

Across India, the mills are facing from the sharp drop in demand for ethanol from the OMCs due to the

significant decline in usage of petrol and diesel in the country because of lockdown in the country. Now, the

mills are having difficulties in storing the large amount of ethanol. The mills have requested the OMCs to

reallocate the ethanol in different depots so that all the ethanol contracted for in the year is supplied on time

without facing in storing the ethanol in the mills for which the OMCs have agreed upon.

Technical Analysis - Sugar (M grade) Spot Market at Kolhapur market

Sugar spot prices at benchmark Kolhapur market was closed same at Rs.3200/q.

Next resistance and support level for the next week is expected at Rs.3300 and Rs.3050 per quintal

respectively.

RSI is in the neutral region.

Technical Analysis - ChakuSukha-gur (fresh) at Spot (Muzaffarnagar) market.

Gur Market Scenario

Chaku variety of gur in key Muzaffarnagar market the prices stood slightly firm at Rs.2910/q with arrivals of

39000 quintals in one week.

RSI stood in the neutral region.

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

Domestic Sugar Market Technical Analysis (Future Market)

Commodity: Sugar Exchange: NCDEX

Contract: Sugar 1 M Con (Dec)

Strategy: Wait

Intraday Supports & Resistances S2 S1 PCP R1 R2

Sugar NCDEX Dec 2850 2900 2989 3200 3250

Intraday Trade Call Call Entry T1 T2 SL

Sugar NCDEX Dec Wait

* Do not carry-forward the position next day

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

Technical Commentary:

There is no trade volume in near month future contract. Market participants are advised to wait until trade

in volume starts.

In the daily chart the prices has gained but there is no bullish reversal pattern has evolved.

Seems that the prices are to consolidate in the range with good probability of touching the recent lows

again.

RSI showing some strength with prices remaining below 9 and 18 days EMA.

Sugar Domestic Balance Sheet

SUGAR BALNCE SHEET 2019-20(LT)

2016- 2017- 2018- 2019- Oct- Jan- Apr-

SUGAR BALNCE SHEET 2019-20(LT) 17 18 19 20* Dec Mar Jun Jul-Sep

Carry in stock 77 34.1 82.67 119.78 119.78 115.28 194.68 130.69

Estimated sugar production 202.85 321.96 331.61 262.76 77.95 154.05 26.66 4.10

Imports 4.46 2.85 0.00 0.00 0.00 0.00 0.00 0.00

Estimated sugar availability (A + B + C) 284.31 358.91 414.28 382.54 197.73 269.33 221.34 134.79

Exports 4.6 16.24 38.00 53.46 7.80 21.77 14.13 9.76

Availability for domestic consumption

(D - E) 279.71 342.67 376.28 329.08 189.93 247.56 207.21 125.03

Estimates sugar consumption 245.61 260 256.50 259.00 74.65 52.88 76.52 54.95

Carry out stock (F - G) 34.10 82.67 119.78 70.08 115.28 194.68 130.69 70.08

Source: Agriwatch and ISMA

Note: Indian sugar marketing year begins from October – September.

As per the Agriwatch latest estimate, India’s sugar production is expected to reach upto 331.61 LT in 2018/19

whereas the new season expects to decline by around 21% at 262.76 LT in 2019-20.

On the other hand, sugar domestic consumption is expected to decline to 256.5 lakh tonnes in 2018-19 (01st

October, 2018 – 30th September, 2019) whereas the consumption is estimated to increase to 259 LT in 2019-

20.

Although the production is estimated to decline, with an ending stock lower than the previous year at 70.08 LT

in 2019-20.

India exported around 38 LT against export target of 5.3 mln tonnes in 2018-19 but to clear the mounting sugar

stocks from 2018-19, government has released the sugar export incentives for 60LT target which could help

clear the stock as well as the arrears of cane farmers.

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

International Market Highlights

Recent Updates:

Brazilian sugar mills produced around 2.27 LT of sugar in the South-Central region in last two weeks of

March that allocated 29.33% of the cane to produce sugar in the period, compared to 20.5% at this time last

year. While the total sugar exports declined by 11% in Brazil year on year by producing 26.76 MMT of total

sugar, up by only around 1% this season.

The South-Central region produced 456 million liters of ethanol and allocated 70.67% of the cane for

ethanol during the same period. Exports of ethanol in March fell by 60% compared to the previous month due

to the lockdown in various countries amid covid-19 spread. The consumption and demand declined from the

exporting countries. Also, the Average ethanol prices at mills fell to 1.38 Brazilian real per liter from 2.16 real

per liter in February, when the COVID-19 epidemic had not yet affected the market. While, the total ethanol

exports increased by 5% year on year with the increase in total ethanol production of 33 billion liters in 2019-20

season up by 7.45% year on year.

The two major sugar producing mills in Philippines are shut down due to the increasing effects of

coronavirus in the country. The government announced a lockdown form 13th April to 26th April’20 to

minimize the spread of coronavirus. Both the mills together contributes around 16% of the country’s total

production and produce around 82% of sugar of Southern island region. After the closure of the mills, it could

lead to the shortage of sugar due to which the sugar prices might hike. The country is not a large importer but

when it does, it usually buys from Thailand.

Previous Updates

The world sugar exports has been hit after the outbreak of coronavirus in various countries since the

last two months. The supply declined especially when India has decided to lockdown for 21 days as many

countries were keeping an eye on Indian sugar and about 1 MMT of sugar has been sold but not shipped. The

demand and supply have been disrupted as all the countries have lockdown the cities and ports to avoid the

spread of the virus. Also the weakening of crude oil prices weighed on sugar prices and ethanol. Researcher

Czarnikow cut its global sugar consumption estimate for this year by 2.0 MMT, due to the collapse in demand

sugar consumption due to the closure of restaurants because of the coronavirus pandemic.

Thailand cane crush season has ended operations in March that usually ends in early May, with total

cane crushed down 43% on the year at 74.9 MMT by producing only 8.27 million tonnes of sugar this year

down by 43% against 14.58 MMT sugar produced during last year. The downfall is due to the severe drought

weather conditions faced by the country leading to slower cane development and a reduction in sugar yield.

Still the weather is not suitable for the sugarcane cultivation for the coming season 2020-21 as the drought is

still under pressure. The total sugar production in the country is estimated around 8.9 MMT for the 2020-21

season with slightly higher sugarcane crop of around 82.3 MMT.

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

Bullish and Bearish factors for International sugar market:

Factors Impact

Brazil 2020/21 sugar production will increase to 34 MMT from 26.4 MMT in the earlier season Bullish

Global 2019/20 sugar production likely to decline by -4.8% y/y to 166.7 MMT (ISO) in 2019/20 Bullish

The world sugar balance in 2019/20 will tighten to a -9.4 MMT deficit from the -6.2 MMT surplus in the Bullish

November estimate.

International Sugar Futures Price Projection

LIFFE (White Sugar Exchange) Future Market Sugar Scenario (May 20 Contract)

Technical Commentary

LIFFE future market was weak for the week.

Total volume & open interest decreased over a week.

Strategy: Buy at level 338, T1 350

International Sugar Futures Price Projection

Contract

Present Quote Expected Price level for next week

Month

LIFFE Sugar (US $/MT) May’20 340 330-360

ICE (Raw Sugar Exchange) Future Market Scenario (May’20 Contract)

Technical Commentary:

ICE raw sugar futures were bearish in the week.

Both total volume & open interest decreased.

Strategy: Buy at rate 9.8 Targeting 12.

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

International Sugar Futures Price Projection

Contract

Present Quote Expected Price level for next week

Month

ICE Sugar #11 (US Cent/lb) May’20 10.37 8-15

Spot Sugar Prices Scenario (Weekly) (Average)

Commodity Average Prices (Rs/Qtl)

10th

Centre Variety 3rd Apr'20 Change

Apr'20 to

Sugar to 9th

16th

Apr'20

Apr'20

Delhi M-Grade 3147 3185 -38

Delhi

Delhi S-Grade 3127 3165 -38

Khatauli M-Grade 3233 3242 -8

Ramala M-Grade 3127 3153 -27

Uttar Pradesh Dhampur M-Grade Ex-Mill 3164 3190 -26

Dhampur S-Grade Ex-Mill 3144 3170 -26

Dhampur L-Grade Ex-Mill 3214 3240 -26

Mumbai M-Grade 3600 3600 Unch

Mumbai S-Grade 3460 3400 60

Nagpur M-Grade 3325 3321 4

Maharashtra

Nagpur S-Grade 3225 3225 Unch

Kolhapur M-Grade 3200 3200 Unch

Kolhapur S-Grade 3100 3100 Unch

Assam Guhawati S-Grade 3410 3410 Unch

Meghalaya Shillong S-Grade 3420 3420 Unch

Vijayawada M-Grade 3820 3820 Unch

Andhra Pradesh

Vijayawada S-Grade 3760 3760 Unch

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

West Bengal Kolkata M-Grade 3750 3655 95

Chennai S-Grade 3783 3900 -117

Tamil Nadu Dindigul M-Grade 4127 4030 97

Coimbatore M-Grade 4020 3910 110

Chattisgarh Ambikapur M-Grade (Without Duty) 3600 3600 Unch

Sugar Prices are in INR/Quintal. (1 Quintal=100 kg)

Spot Jaggery(Gur) Prices Scenario (Weekly) (Average)

Commodity Prices (Rs/Qtl)

10th

Centre Variety 3rd Apr'20 Change

Apr'20 to

Jaggery(Gur) to 9th

16th

Apr'20

Apr'20

Muzaffarnagar Chaku Fresh 2742 2709 33

Muzaffarnagar Chaku(Arrival)(40kg Bag) 59000 20000 39000

Muzaffarnagar Khurpa (Fresh) 2660 2494 166

Uttar Pradesh Muzaffarnagar Laddoo (Fresh) 2916 2713 204

Muzaffarnagar Rascut (Fresh) 2454 2425 29

Hapur Chaursa 2558 2550 8

Hapur Balti 2490 NA -

Gold 5500 NA -

Andhra Pradesh Chittur White 5200 NA -

Black Closed NA -

Maharashtra Latur Lal Variety NA NA -

Bangalore Mudde (Average) NA NA -

Belgaum Mudde (Average) NA NA -

Belthangadi Yellow (Average) NA NA -

Bijapur Achhu NA NA -

Gulbarga Other (Average) NA NA -

Karnataka Mahalingapura Penti (Average) NA NA -

Mandya Achhu (Medium) NA NA -

Mandya Kurikatu (Medium) NA NA -

Mandya Other (Medium) NA NA -

Mandya Yellow (Medium) NA NA -

Shimoga Achhu (Average) NA NA -

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

Spot Sugar Prices Scenario (Weekly)

Commodity Today Week Ago Month Ago Year Ago

Centre Variety 20-Apr-

Sugar 13-Apr-20 21-Mar-20 22-Apr-19

20

Delhi M-Grade 3110 3150 3100 3250

Delhi

Delhi S-Grade 3090 3130 3080 3230

Khatauli M-Grade 3215 3245 3340 3330

Ramala M-Grade 3120 3120 3160 0

Uttar Pradesh Dhampur M-Grade Ex-Mill 3140 3160 3220 3150

Dhampur S-Grade Ex-Mill 3120 3140 3200 3130

Dhampur L-Grade Ex-Mill 3190 3210 3270 3200

Mumbai M-Grade 3450 Closed 3520 3346

Mumbai S-Grade 3380 Closed 3300 3216

Nagpur M-Grade 3325 3325 Closed 3225

Maharashtra

Nagpur S-Grade 3225 3225 Closed 3175

Kolhapur M-Grade 3200 3200 Closed 3100

Kolhapur S-Grade 3100 3100 Closed 3050

Assam Guhawati S-Grade 3410 3410 Closed 3360

Meghalaya Shillong S-Grade 3420 3420 Closed 3370

Vijayawada M-Grade 3820 3820 3660 3580

Andhra Pradesh

Vijayawada S-Grade 3760 3760 3600 3520

West Bengal Kolkata M-Grade 3750 3750 3560 3500

Chennai S-Grade 3800 3750 3600 3560

Tamil Nadu Dindigul M-Grade 4160 4160 3560 3580

Coimbatore M-Grade 4020 4020 3700 3520

Chattisgarh Ambikapur M-Grade (Without Duty) 3600 3600 4000 3400

Sugar Prices are in INR/Quintal. (1 Quintal=100 kg)

Spot Jaggery(Gur) Prices Scenario (Weekly)

Commodity Today Week Ago Month Ago Year Ago

Centre Variety 20-Apr-

Jaggery(Gur) 13-Apr-20 21-Mar-20 22-Apr-19

20

Muzaffarnagar Chaku Sukha 2910 2718 2750 2938

Muzaffarnagar Chaku(Arrival)(40kg Bag) 10000 16000 12000 8000

Muzaffarnagar Khurpa 2563 2638 2538 2435

Uttar Pradesh Muzaffarnagar Laddoo 2878 2963 2528 2803

Muzaffarnagar Rascut 2413 2450 2338 2300

Hapur Chaursa Closed Closed 2440 Closed

Hapur Balti Closed Closed 2350 Closed

Andhra Pradesh Chittur Gold 4900 Closed 4800 4300

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

Sugar & Gur Weekly Research Report

20th Apr, 2020

White NA Closed 4300 3800

Black 4000 Closed 3700 3300

Maharashtra Latur Lal Variety NR 0 0 0

Bangalore Mudde (Average) NA NA 4900 4200

Belgaum Mudde (Average) NA NA NA 2800

Belthangadi Yellow (Average) NA NA NA 0

Bijapur Achhu NA NA NA 3100

Gulbarga Other (Average) NA NA NA NA

Karnataka Mahalingapura Penti (Average) NA NA NA 3094

Mandya Achhu (Medium) NA NA NA 3750

Mandya Kurikatu (Medium) NA NA NA 3450

Mandya Other (Medium) NA NA NA 3500

Mandya Yellow (Medium) NA NA NA 3750

Shimoga Achhu (Average) NA NA 3600 3850

International Sugar Prices (Weekly)

10th Apr'20

3rd Apr'20 to

Contract Month to 16th Change

9th Apr'20

Apr'20

20-May 1743 1770 -27.00

ICE Sugar #11 (US Cent/lb) 20-Jul 1766 1773 -7.00

20-Oct 1809 1809 Unch

20-May 2488 2458 30.00

LIFFE Sugar (US $/MT) 20-Aug 2621 2561 60.00

20-Oct 2540 2482 58.00

Disclaimer

The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy,

completeness and correctness. Use of data and information contained in this report is at your own risk. This document is not, and should not be construed as, an

offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for

any purpose without prior permission from the Company. IASL and its affiliates and/or their officers, directors and employees may have positions in any

commodities mentioned in this document (or in any related investment) and may from time to time add to or dispose of any such commodities (or investment).

Please see the detailed disclaimer at http://www.agriwatch.com/disclaimer.php © 2020 Indian Agribusiness Systems Ltd.

EMISPDF us-pwc-site from 111.95.42.5 on 2020-04-28 06:48:32 BST. DownloadPDF.

Downloaded by us-pwc-site from 111.95.42.5 at 2020-04-28 06:48:32 BST. EMIS. Unauthorized Distribution Prohibited.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Role of CounselorDocument74 pagesRole of Counselorrumi royNo ratings yet

- 2.1 Economic Systems: Igcse /O Level EconomicsDocument13 pages2.1 Economic Systems: Igcse /O Level EconomicsJoe Amirtham0% (1)

- Nike LawsuitDocument24 pagesNike LawsuitJ RohrlichNo ratings yet

- Critical Thinking Skills Developing Effective Anal... - (12 Critical Reflection)Document26 pagesCritical Thinking Skills Developing Effective Anal... - (12 Critical Reflection)Steven JonathanNo ratings yet

- Project Report On Corrugated Boxes (Automatic Plant)Document6 pagesProject Report On Corrugated Boxes (Automatic Plant)EIRI Board of Consultants and PublishersNo ratings yet

- Amazon Case StudyDocument26 pagesAmazon Case StudySteven JonathanNo ratings yet

- Setting Customer Expectation in Service Delivery - An Itegrated Marketing-Operations PerspectiveDocument11 pagesSetting Customer Expectation in Service Delivery - An Itegrated Marketing-Operations PerspectiveSteven JonathanNo ratings yet

- NR 000627 GAP Service QualityDocument32 pagesNR 000627 GAP Service QualitySteven JonathanNo ratings yet

- Service Quality Models A ReviewDocument38 pagesService Quality Models A ReviewSteven JonathanNo ratings yet

- Capital Structure of FlipkartDocument7 pagesCapital Structure of FlipkartAkriti PandeyNo ratings yet

- Six Brand Prism CacharelDocument24 pagesSix Brand Prism CacharelDeta DetadeNo ratings yet

- COA Nitric Acid 68Document1 pageCOA Nitric Acid 68Noviyanti Violita Hamisi100% (1)

- s2 Entrepreneurship Notes 3Document10 pagess2 Entrepreneurship Notes 3ismumenaNo ratings yet

- R3 Pricelist Normal Units Fifty Seven PromenadeDocument1 pageR3 Pricelist Normal Units Fifty Seven PromenadeRani RdsNo ratings yet

- IMC Assignment - JL20PG036 - Ayush TiwariDocument5 pagesIMC Assignment - JL20PG036 - Ayush TiwariBhumika KewlaniNo ratings yet

- Price List 2013 - Hospec: Hospital EquipmentDocument20 pagesPrice List 2013 - Hospec: Hospital EquipmentHoang Vu HungNo ratings yet

- AVSY - Task 2 - 2 - B13 - Assessment - BookDocument7 pagesAVSY - Task 2 - 2 - B13 - Assessment - BookJonathan MerksNo ratings yet

- Iso 9001 - 1994Document16 pagesIso 9001 - 1994David KingNo ratings yet

- MGE303 Social Entrepreneurship 2024Document4 pagesMGE303 Social Entrepreneurship 2024El DeeNo ratings yet

- Accounting AssistantDocument2 pagesAccounting AssistantBobot EscoteNo ratings yet

- United The Business of A Better WorldDocument39 pagesUnited The Business of A Better WorldAndrés Barquero RodríguezNo ratings yet

- Psu Vision: The Leading University in Geology, Bio-Resource Science and Environmental Management in The Bicol RegionDocument14 pagesPsu Vision: The Leading University in Geology, Bio-Resource Science and Environmental Management in The Bicol RegionBykiel NatielNo ratings yet

- This Study Resource Was: Philippine School of Business AdministrationDocument6 pagesThis Study Resource Was: Philippine School of Business AdministrationGab IgnacioNo ratings yet

- Presentasi Sempro Bahasa InggrisDocument11 pagesPresentasi Sempro Bahasa InggrishermawanNo ratings yet

- EC202 Exam Question Paper S1 2023 (May 1st 2023)Document5 pagesEC202 Exam Question Paper S1 2023 (May 1st 2023)R and R wweNo ratings yet

- Section B. Decision Making Techniques - TutorDocument73 pagesSection B. Decision Making Techniques - TutorNirmal ShresthaNo ratings yet

- How To Lead in The Stakeholder EraDocument9 pagesHow To Lead in The Stakeholder EraHuicai MaiNo ratings yet

- The Economic Base of Accra Ghana PDFDocument16 pagesThe Economic Base of Accra Ghana PDFfornaraNo ratings yet

- CHAP 3-5 OMT BooksDocument16 pagesCHAP 3-5 OMT Booksbae joohyunNo ratings yet

- Category 1 MessagesDocument17 pagesCategory 1 MessagesSun City TVNo ratings yet

- GIZ Manual On IHWM IndexDocument42 pagesGIZ Manual On IHWM IndexAlberto CamachoNo ratings yet

- (VER. 3) TLE-IA6 - q0 - Mod3 - Simple Survey Using Technology - v3Document30 pages(VER. 3) TLE-IA6 - q0 - Mod3 - Simple Survey Using Technology - v3PAUL JIMENEZNo ratings yet

- Retail Store Solution BrochureDocument3 pagesRetail Store Solution BrochureAnanda Agung PrasetyoNo ratings yet

- Terex Genie Rl4000 Parts ManualDocument5 pagesTerex Genie Rl4000 Parts Manualwesley100% (30)

- Polutry Production Business PlanDocument18 pagesPolutry Production Business PlanBerhe HarguyNo ratings yet